by Angela Monaghan, The Telegraph:

The Bank of England is poised to sharply downgrade growth and inflation forecasts amid a weak economy hit by the eurozone crisis and slowing domestic demand.

The Bank is expected to say in its August Inflation Report that the British economy

will come to a standstill this year with virtually zero growth in 2012

as a whole, opening the door to more stimulus in the coming months.

The Bank is expected to say in its August Inflation Report that the British economy

will come to a standstill this year with virtually zero growth in 2012

as a whole, opening the door to more stimulus in the coming months.Just three months ago it was forecasting growth of around 0.7pc this year, as was the Government’s independent fiscal watchdog, the Office for Budget Responsibility.

The new forecasts, to be presented by the Bank’s Governor Sir Mervyn King on Wednesday, are also expected to show a sharp downgrade of growth prospects for 2013, to about 1.5pc, down from more than 2pc in May.

The Bank’s move is set to be the latest in a series of downgrades since the beginning of the year. Sir Mervyn is likely to highlight the risk to the UK economy posed by the eurozone’s crisis.

“The Bank of England started the year with a glass half-full – looking for the economy to grow by more than 1pc on average,” said Alan Clarke, economist at Scotiabank.

Read More @ Telegraph.co.uk

From Knight To Schrödinger Cat: Brokerage Scrambles Half-Alive, Half-Dead

Knight Capital is scrambling: it has a few hours to convince any potential suitors that it is worth some $300 million more alive than having its carcass picked off at a cost of $0.01 over its debt (which itself will likely be materially impaired) in a Chapter 11 Stalking Horse sale. If the Sunday before the Lehman, and MF Global, bankruptcy filings is any indication, the third time will not be the charm for the company whose 1400 employees may have no place to call work at 9am tomorrow. Sadly, in a world in which entire countries and continents have taken on the patina of Schrödingerian felinism, constantly shifting between alive and dead states depending on who is looking, we would take the under on the probability that the firm's lawyers will not be visiting 1 Bowling Green at some point in the next 16 hours. mockery of stock trading."Did Somebody Repeal The Laws Of Mathematics?"

Remember late-2010? When Spain wasn’t a problem, but merely a potential problem? I do. Back then, the general opinion was that if the contagion spread to Spain the game was over because there wasn’t enough money with which to bail out an economy the size of The Kingdom of Spain. I’m not sure exactly what happened— maybe I wasn’t paying attention—but suddenly, almost two years on and in an environment where even the rich nations of Europe are seeing an undeniable slide towards recession, there is no talk about Spain being ‘too-big-to-bail’ anymore.Did somebody repeal the laws of mathematics?

What Democracy?

Rather

than give the people a voice, democracy allows for the choking of life

by men and women of state authority. When Occupy protestors were

chanting “this is what democracy looks like” last fall, they wrongly

saw the power of government as the best means to alleviate poverty.

What modern day democracy really looks like is endless bailouts,

special privileges, and imperial warfare all paid for on the back of

the common man. None of this is to suggest that a transition to real

democracy is the answer. The popular adage of democracy being “two

wolves and lamb voting on what’s for lunch” is undeniably accurate. A

system where one group of people can vote its hands into another’s

pockets is not economically sustainable. Democracy’s pitting of

individuals against each other leads to moral degeneration and impairs

capital accumulation. It is no panacea for the rottenness that follows

from centers of power. True human liberty with respect to property

rights is the only foundation from which civilization can grow and

thrive.

Rather

than give the people a voice, democracy allows for the choking of life

by men and women of state authority. When Occupy protestors were

chanting “this is what democracy looks like” last fall, they wrongly

saw the power of government as the best means to alleviate poverty.

What modern day democracy really looks like is endless bailouts,

special privileges, and imperial warfare all paid for on the back of

the common man. None of this is to suggest that a transition to real

democracy is the answer. The popular adage of democracy being “two

wolves and lamb voting on what’s for lunch” is undeniably accurate. A

system where one group of people can vote its hands into another’s

pockets is not economically sustainable. Democracy’s pitting of

individuals against each other leads to moral degeneration and impairs

capital accumulation. It is no panacea for the rottenness that follows

from centers of power. True human liberty with respect to property

rights is the only foundation from which civilization can grow and

thrive.On This Day In 2016

For

a presidential election taking place when the US debt/GDP has for the

first time in 70 years crossed above 100%, in which over 50 million

Americans collect food stamps and disability, in which M2 just crossed

$10 trillion, in which total US debt is about to pass $16 trillion, and

when total nonfarm employees in America (133,235,000) are the same as

they were in April of 2005, it is quite surprising that economics has

not taken on a more decisive role in the electoral debate. But while

both candidates may, for their own particular reasons, not want to bring

up the slow motion trainwreck that is the US economy now, in 4 years

whoever is running for president will not be so lucky, because as the US

debt clock shows, assuming current rates of progression, things are

about to get far, far worse.

For

a presidential election taking place when the US debt/GDP has for the

first time in 70 years crossed above 100%, in which over 50 million

Americans collect food stamps and disability, in which M2 just crossed

$10 trillion, in which total US debt is about to pass $16 trillion, and

when total nonfarm employees in America (133,235,000) are the same as

they were in April of 2005, it is quite surprising that economics has

not taken on a more decisive role in the electoral debate. But while

both candidates may, for their own particular reasons, not want to bring

up the slow motion trainwreck that is the US economy now, in 4 years

whoever is running for president will not be so lucky, because as the US

debt clock shows, assuming current rates of progression, things are

about to get far, far worse.On The One Year Anniversary Of The US Downgrade

A year ago, the budget “deal” concocted between Mr Obama and his Congress was ballyhooing a “plan” to cut $US 1.2 TRILLION off annual budget deficits over a DECADE. Now, the projection for the 2012 budget is that the US government will add that amount to the funded debt of the US Treasury over ONE YEAR. This would be hilariously funny if it wasn’t so tragic. What is even funnier - and more tragic - is that the entire world is “depending” on the people who concoct this stuff.

By Nickolai Hubble, Daily Reckoning.com.au:

It’s been a busy couple of weeks for central bankers. They’ve been doing nothing, causing all sorts of kerfuffles.

European Central Bank President Draghi stole the spotlight from his American counterpart Bernanke by talking the talk last week. Like some sort of Winston Churchill quote, his words will never be forgotten:

‘Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough.’Cue decision time yesterday and Mario Draghi, like Ben Bernanke, did nothing. This disappointed the markets, to say the least. There was carnage in the foreign exchange market, the stock market and the crucially important European bond market. Our favourite part was this move in bond yields, pointed out by Zerohedge.com:

‘Spanish sovereign bond spreads blew almost 60bps wider today — that is the single-largest absolute move in spreads on record. Almost the entire gain in bonds post-Draghi ‘Believe’ speech from last week has been retraced in a mere few hours. Swiss, German, and Dutch short-dated bond yields all dropped to new record low rates.’

Read More @ DailyReckoning.com.au

from Naked Capitalism:

While everyone from Tony Blair to Nouriel Roubini is debating whether or not bankers should be hung, the Wall Street Journal and Bloomberg provide some fascinating historical context.

While everyone from Tony Blair to Nouriel Roubini is debating whether or not bankers should be hung, the Wall Street Journal and Bloomberg provide some fascinating historical context.The journal’s Jason Zweig reports:

Financial criminals throughout history have been beaten, tortured and even put to death, with little evidence that severe punishments have consistently deterred people from misconduct that could make them rich.

The history of drastic punishment for financial crimes may be nearly as old as wealth itself.

The Code of Hammurabi, more than 3,700 years ago, stipulated that any Mesopotamian who violated the terms of a financial contract – including the futures contracts that were commonly used in commodities trading in Babylon – “shall be put to death as a thief.” The severe penalty doesn’t seem to have eradicated such cheating, however.

In medieval Catalonia, a banker who went bust wasn’t merely humiliated by town criers who declaimed his failure in public squares throughout the land; he had to live on nothing but bread and water until he paid off his depositors in full. If, after a year, he was unable to repay, he would be executed – as in the case of banker Francesch Castello, who was beheaded in 1360. Bankers who lied about their books could also be subject to the death penalty.

Read More @ NakedCapitalism.com

We The Sheeplez... is intended to reflect

excellence in effort and content. Donations will help maintain this goal

and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

I'm PayPal Verified

[Ed. Note:

We failed to properly celebrate the fact that the draconian and

tyrannical 'cyber security' bill - and the gun magazine ban buried

within that bill - was defeated! However all celebrating is postponed as

further attacks on the people's Liberty appear imminent. To wit, the

criminal in the White House may simply sign an Executive Order:]

by Brendan Sasso, The Hill:

Senate Republicans recently blocked cybersecurity legislation, but the issue might not be dead after all.

Senate Republicans recently blocked cybersecurity legislation, but the issue might not be dead after all.

The White House hasn’t ruled out issuing an executive order to strengthen the nation’s defenses against cyber attacks if Congress refuses to act.

“In the wake of Congressional inaction and Republican stall tactics, unfortunately, we will continue to be hamstrung by outdated and inadequate statutory authorities that the legislation would have fixed,” White House Press Secretary Jay Carney said in an emailed response to whether the president is considering a cybersecurity order.

“Moving forward, the President is determined to do absolutely everything we can to better protect our nation against today’s cyber threats and we will do that,” Carney said.

The White House has emphasized that better protecting vital computer systems is a top priority.

Read More @ TheHill.com

Dear Friend of GATA and Gold:

Dear Friend of GATA and Gold:

The Los Angeles Times reported yesterday that the U.S. Treasury Department is “auditing” the gold vaulted at the Federal Reserve Bank of New York, most of which is held in custody for other countries, but only to the extent of confirming the gold content of the bars kept there, and not touching on issues of ownership impairment, like swapping and leasing, the issues raised by GATA and others aggrieved by manipulation of the gold market.

Indeed, the “audit” seems intended to dispel “conspiracy theories” without actually having to disclose anything about the U.S. government’s gold market intervention policy, the issue at the heart of GATA’s freedom-of-information lawsuit against the Fed in U.S. District Court for the District of Columbia, a lawsuit that was decided more or less in GATA’s favor last year and revealed that the Fed has secret gold swap arrangements with foreign banks as well as many other gold-related records that are being kept secret:

http://www.gata.org/node/9917

Responding to the L.A. Times story, Zero Hedge quickly explained why the Treasury’s “audit” of the New York Fed’s gold is a fraud. “What the ‘conspiracy theorists’ allege,” Zero Hedge notes, “is that claims existing in paper format on the physical gold held under Liberty 33 are orders of magnitude greater than the actual physical gold these claims supposedly have recourse to”:

Read More @ GoldSeek.com

from PastorDowell:

by Brendan Sasso, The Hill:

The White House hasn’t ruled out issuing an executive order to strengthen the nation’s defenses against cyber attacks if Congress refuses to act.

“In the wake of Congressional inaction and Republican stall tactics, unfortunately, we will continue to be hamstrung by outdated and inadequate statutory authorities that the legislation would have fixed,” White House Press Secretary Jay Carney said in an emailed response to whether the president is considering a cybersecurity order.

“Moving forward, the President is determined to do absolutely everything we can to better protect our nation against today’s cyber threats and we will do that,” Carney said.

The White House has emphasized that better protecting vital computer systems is a top priority.

Read More @ TheHill.com

by Chris Powell, Secretary/Treasurer, GATA, Gold Seek:

Dear Friend of GATA and Gold:

Dear Friend of GATA and Gold:The Los Angeles Times reported yesterday that the U.S. Treasury Department is “auditing” the gold vaulted at the Federal Reserve Bank of New York, most of which is held in custody for other countries, but only to the extent of confirming the gold content of the bars kept there, and not touching on issues of ownership impairment, like swapping and leasing, the issues raised by GATA and others aggrieved by manipulation of the gold market.

Indeed, the “audit” seems intended to dispel “conspiracy theories” without actually having to disclose anything about the U.S. government’s gold market intervention policy, the issue at the heart of GATA’s freedom-of-information lawsuit against the Fed in U.S. District Court for the District of Columbia, a lawsuit that was decided more or less in GATA’s favor last year and revealed that the Fed has secret gold swap arrangements with foreign banks as well as many other gold-related records that are being kept secret:

http://www.gata.org/node/9917

Responding to the L.A. Times story, Zero Hedge quickly explained why the Treasury’s “audit” of the New York Fed’s gold is a fraud. “What the ‘conspiracy theorists’ allege,” Zero Hedge notes, “is that claims existing in paper format on the physical gold held under Liberty 33 are orders of magnitude greater than the actual physical gold these claims supposedly have recourse to”:

Read More @ GoldSeek.com

from PastorDowell:

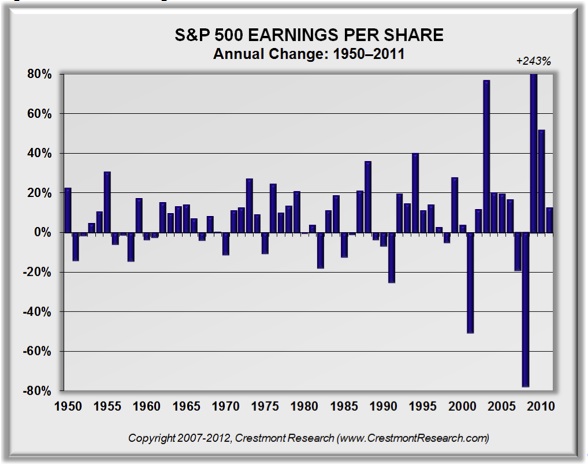

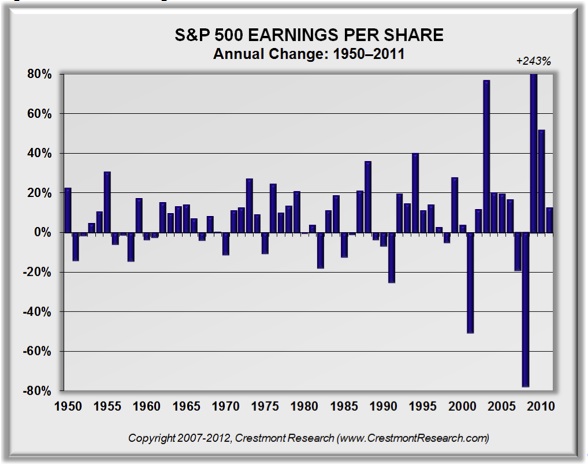

by John Mauldin, The Market Oracle:

A few weeks ago, Ed Easterling and I updated the work we published

almost ten years ago about secular bear and bull markets. This week I am

in Maine at the annual Shadow Fed fishing trip (for those of us whose

invitation to Jackson Hole keeps getting lost in the mail). Ed has

graciously agreed to do another piece with me on the earnings, or

business, cycle, which is different in timing than the secular stock

market cycle but is part of the total warp and woof of the markets. When

you combine them, you get a much clearer picture of the markets.

A few weeks ago, Ed Easterling and I updated the work we published

almost ten years ago about secular bear and bull markets. This week I am

in Maine at the annual Shadow Fed fishing trip (for those of us whose

invitation to Jackson Hole keeps getting lost in the mail). Ed has

graciously agreed to do another piece with me on the earnings, or

business, cycle, which is different in timing than the secular stock

market cycle but is part of the total warp and woof of the markets. When

you combine them, you get a much clearer picture of the markets.

Earnings are a topic of great debate. At any given time, you can hear someone on TV talking about how “cheap” the market is, while the person on the next channel goes on about how expensive the market is. Today we look at the cycle of earnings, rather than a specific point in time. Let me give you a little preview. In terms of time, this earnings cycle is already longer than average, and in terms of magnitude it is projected to go to all-time highs. Which makes one want to think about whether current projections are realistic. So let’s jump right in. (Note: This letter sets the Thoughts from the Frontline record for the number of charts, so it will print longer than usual, but the number of words is about average.)

Time to Row, or Sail?

Read More @ TheMarketOracle.co.uk

Gold to Rally Above $1,900 by End 2012: HSBC Published: Friday, 3 Aug 2012 | 6:31 AM ET  A few weeks ago, Ed Easterling and I updated the work we published

almost ten years ago about secular bear and bull markets. This week I am

in Maine at the annual Shadow Fed fishing trip (for those of us whose

invitation to Jackson Hole keeps getting lost in the mail). Ed has

graciously agreed to do another piece with me on the earnings, or

business, cycle, which is different in timing than the secular stock

market cycle but is part of the total warp and woof of the markets. When

you combine them, you get a much clearer picture of the markets.

A few weeks ago, Ed Easterling and I updated the work we published

almost ten years ago about secular bear and bull markets. This week I am

in Maine at the annual Shadow Fed fishing trip (for those of us whose

invitation to Jackson Hole keeps getting lost in the mail). Ed has

graciously agreed to do another piece with me on the earnings, or

business, cycle, which is different in timing than the secular stock

market cycle but is part of the total warp and woof of the markets. When

you combine them, you get a much clearer picture of the markets.Earnings are a topic of great debate. At any given time, you can hear someone on TV talking about how “cheap” the market is, while the person on the next channel goes on about how expensive the market is. Today we look at the cycle of earnings, rather than a specific point in time. Let me give you a little preview. In terms of time, this earnings cycle is already longer than average, and in terms of magnitude it is projected to go to all-time highs. Which makes one want to think about whether current projections are realistic. So let’s jump right in. (Note: This letter sets the Thoughts from the Frontline record for the number of charts, so it will print longer than usual, but the number of words is about average.)

Time to Row, or Sail?

Read More @ TheMarketOracle.co.uk

by Bruce Krasting, Bruce Krasting Blog:

Edward De Marco is the acting head of the FHFA. He is responsible for

what happens at Fannie and Freddie. A lot of people hate this guy and

want to see him sacked. I like him. I think he is one a few people in D.C. who actually gives a damn about taxpayer losses at the mortgage agencies.

Edward De Marco is the acting head of the FHFA. He is responsible for

what happens at Fannie and Freddie. A lot of people hate this guy and

want to see him sacked. I like him. I think he is one a few people in D.C. who actually gives a damn about taxpayer losses at the mortgage agencies.

As per usual in America, this is a matter between left and right. Democrats hate De Marco. The Republicans are standing behind him.

The latest saga in this love-hate story is a letter that De Marco wrote to Senators Richard Shelby (R -AL) and Tim Johnson (D – SD). (Link) The issue is whether Fan and Fred should write down the principal on mortgages they own. De Marco said flat, “no”. The following is the critical sentence. Note that De Marco uses “I” when he says who made the decision. I give him an “A” for putting his head on the line.

I have concluded that Fannie Mae and Freddie Mac’s adoption of HAM PPRA would not make a meaningful improvement in reducing foreclosures in a cost effective way for taxpayers.

Read More @ BruceKrasting.blogspot.com

Jim Sinclair’s Commentary

This is a spoof, but you should listen to it.

It has worked so perfectly that I doubt our intelligence service could have invented it. However, what a great gift to the entire international intelligence world.

Edward De Marco is the acting head of the FHFA. He is responsible for

what happens at Fannie and Freddie. A lot of people hate this guy and

want to see him sacked. I like him. I think he is one a few people in D.C. who actually gives a damn about taxpayer losses at the mortgage agencies.

Edward De Marco is the acting head of the FHFA. He is responsible for

what happens at Fannie and Freddie. A lot of people hate this guy and

want to see him sacked. I like him. I think he is one a few people in D.C. who actually gives a damn about taxpayer losses at the mortgage agencies.As per usual in America, this is a matter between left and right. Democrats hate De Marco. The Republicans are standing behind him.

The latest saga in this love-hate story is a letter that De Marco wrote to Senators Richard Shelby (R -AL) and Tim Johnson (D – SD). (Link) The issue is whether Fan and Fred should write down the principal on mortgages they own. De Marco said flat, “no”. The following is the critical sentence. Note that De Marco uses “I” when he says who made the decision. I give him an “A” for putting his head on the line.

I have concluded that Fannie Mae and Freddie Mac’s adoption of HAM PPRA would not make a meaningful improvement in reducing foreclosures in a cost effective way for taxpayers.

Read More @ BruceKrasting.blogspot.com

Jim Sinclair’s Commentary

This is a spoof, but you should listen to it.

It has worked so perfectly that I doubt our intelligence service could have invented it. However, what a great gift to the entire international intelligence world.

By: Holly Ellyatt

Gold could be one of the few assets to profit from the political and economic turbulence in the United States as the “fiscal cliff” approaches, potentially creating a rally in the precious metal later in 2012 for it to reach $1,900 per ounce by the end of the year, analysts at HSBC said.

“Economic uncertainty, geopolitical tensions and the uncertainty of the U.S. November elections are theoretically gold-bullish,” and gold should perform better later in the year “when U.S. growth is poor and the dollar is weak,” a new HSBC report said. “We expect prices to rally to above $1,900/oz by the end of the year. Patience is the most important commodity.”

HSBC recommends holding onto gold as an asset that will gain in value as investors fear the future of the euro and dollar, with governments and central banks expected to intervene to shore up their currencies’ strength.

According to commodities’ analysts at the bank, the outlook on gold is positive for the second half of the year despite the current stall in the gold rally due to a rise in supply, lack of demand in the jewelry sector and uncertainty about the European financial crisis and U.S. “fiscal cliff” approaching at the end of 2012, when the U.S. government must decide whether or not to increase taxes and introduce spending cuts, which could risk a slowdown similar to Europe’s.

More…

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment