from Rense:

Asia

opens loud and proud and announces itself with a subtle

'buy-every-single-contract-in-the-stack-coz-I-am-desperate' algo

grabbing 7000 contracts in S&P 500 e-mini futures (ES). Nothing else

moved, just ES. Now a few things are reacting but the total lack of

news and sheer ignorance of unloading that much into an illiquid thin

market at this time of day suggests this market is more broken than we

suspected. Also, since the move is identical to what a certain Bruno

Iksil would have done back in March with IG9, when he would sell through

all the bids, only this time in reverse with equities, we wonder if

the "water walking" Frenchman may not have already found his next port

of call.

Asia

opens loud and proud and announces itself with a subtle

'buy-every-single-contract-in-the-stack-coz-I-am-desperate' algo

grabbing 7000 contracts in S&P 500 e-mini futures (ES). Nothing else

moved, just ES. Now a few things are reacting but the total lack of

news and sheer ignorance of unloading that much into an illiquid thin

market at this time of day suggests this market is more broken than we

suspected. Also, since the move is identical to what a certain Bruno

Iksil would have done back in March with IG9, when he would sell through

all the bids, only this time in reverse with equities, we wonder if

the "water walking" Frenchman may not have already found his next port

of call.

As I remember...Correct me if I'm wrong...

Didn't klinton and al gore go to China and have a fund raiser... and then suddenly we sold super computers to China so they could make the calculations so their nukes could hit the U. S.... oops I mean satellites to go into orbit...

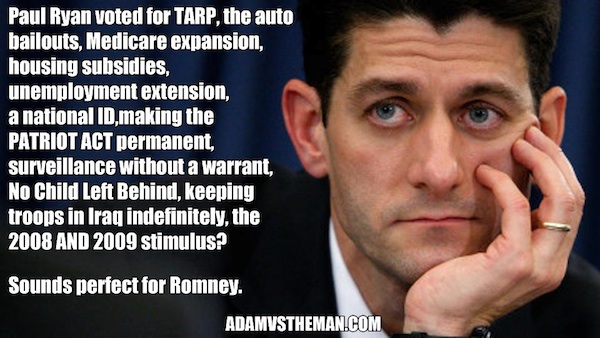

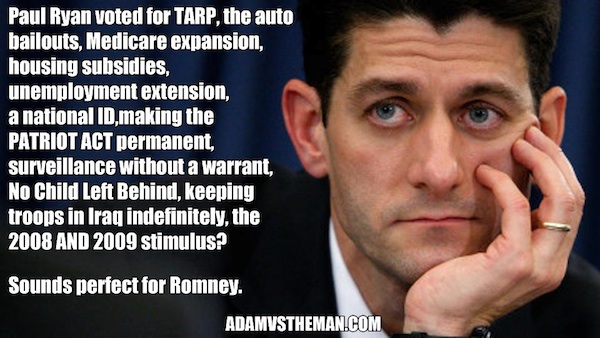

Mitt Romney, Paul Ryan, Barack Obama, Joe Biden – America’s Status Quo Apartheid

The propaganda machine has launched its final blitz before the Republican Convention with Mitt Romney and Paul Ryan on tour. The crowds that have accumulated consist of every neo-con that could be ordered into service. But check this out. This is all of them. These are the people who will vote for Mitt Romney and their numbers are so minute as to be laughable.NDAA: The Most Important Lawsuit in American History that No One is Talking About

Despite a mainstream media blackout on the topic, the alternative media is abuzz with this week’s hearing on the constitutionality of the clearly unconstitutional NDAA. In case you don’t remember, section 1021 of the NDAA, which Obama signed into law on December 31 of last year, allows the government to lock up U.S. citizens indefinitely without a trial.S&P Futures Gap Up 0.5% -- That Is All

Asia

opens loud and proud and announces itself with a subtle

'buy-every-single-contract-in-the-stack-coz-I-am-desperate' algo

grabbing 7000 contracts in S&P 500 e-mini futures (ES). Nothing else

moved, just ES. Now a few things are reacting but the total lack of

news and sheer ignorance of unloading that much into an illiquid thin

market at this time of day suggests this market is more broken than we

suspected. Also, since the move is identical to what a certain Bruno

Iksil would have done back in March with IG9, when he would sell through

all the bids, only this time in reverse with equities, we wonder if

the "water walking" Frenchman may not have already found his next port

of call.

Asia

opens loud and proud and announces itself with a subtle

'buy-every-single-contract-in-the-stack-coz-I-am-desperate' algo

grabbing 7000 contracts in S&P 500 e-mini futures (ES). Nothing else

moved, just ES. Now a few things are reacting but the total lack of

news and sheer ignorance of unloading that much into an illiquid thin

market at this time of day suggests this market is more broken than we

suspected. Also, since the move is identical to what a certain Bruno

Iksil would have done back in March with IG9, when he would sell through

all the bids, only this time in reverse with equities, we wonder if

the "water walking" Frenchman may not have already found his next port

of call.

The Obama False Flag Attack That Would Suspend 2012 ElectionsKelly Keisling, Tennessee state Representative, is concerned that the Obama administration and the Department of Homeland Security (DHS) are planning events that will lead to “martial law”.Mega-Banks Plan for Collapse with Contingency Plans and Private Police ForceBank of America, Goldman Sachs and other technocrats have secretly crafted worst-case scenarios in which they can continue to thrive during a full-blown domestic monetary crisis.Europe: From the Subprime to the BreakdownThe outbreak of the subprime mortgage crisis in the U.S. arrives to its fifth year with a legacy that includes a global economic crisis that seems endless: the almost certain breakdown of the euro, and in the case of Greece, Spain, and most likely France, Portugal and Italy , among others, the need to seek bailouts from the European Union.False Terror IEDocy Ramps UpThere hasn’t been a noteworthy incident since the mother of all deceptions on 9/11. And now bombs are everywhere, just waiting for us to accidentally detonate them? Or suddenly massive repeats of the false flag Oklahoma City government sponsored bombing? |

As I remember...Correct me if I'm wrong...

Didn't klinton and al gore go to China and have a fund raiser... and then suddenly we sold super computers to China so they could make the calculations so their nukes could hit the U. S.... oops I mean satellites to go into orbit...

Mitt Romney is facing prosecution for holding election fundraisers in London and Israel in violation of US Law.

by G. Duff. via, Alexander Higgins:

No other American presidential candidate has ever left the US to garner campaign contributions from foreign citizens.

No other American presidential candidate has ever left the US to garner campaign contributions from foreign citizens.

There is a reason for this, one that Romney and his staff seem oblivious to and the mainstream media had ignored until just recently.

Using foreign contributions in any American election is a felony. Hello Romney campaign…is anybody home, hello?

Below, Fox News identifies illegal fundraising in both Israel and in London, no donor is identified, no records are kept. Gosh, does that look like someone might be trying to circumvent the law?

Read More @ AlexanderHiggins.com

by G. Duff. via, Alexander Higgins:

No other American presidential candidate has ever left the US to garner campaign contributions from foreign citizens.

No other American presidential candidate has ever left the US to garner campaign contributions from foreign citizens. There is a reason for this, one that Romney and his staff seem oblivious to and the mainstream media had ignored until just recently.

Using foreign contributions in any American election is a felony. Hello Romney campaign…is anybody home, hello?

Below, Fox News identifies illegal fundraising in both Israel and in London, no donor is identified, no records are kept. Gosh, does that look like someone might be trying to circumvent the law?

Read More @ AlexanderHiggins.com

by Bruce Krasting, Bruce Krasting Blog:

I’m amazed that Japan has not yet hit an economic reef. At over 230+%,

the country’s debt to GDP is so far out of whack that I keep thinking

that something has to give. I’ve been wrong for years.

I’m amazed that Japan has not yet hit an economic reef. At over 230+%,

the country’s debt to GDP is so far out of whack that I keep thinking

that something has to give. I’ve been wrong for years.

The trend lines for Japan are awful. A decline in total population coupled with a rapidly aging society is a recipe for slow or no growth. Japan is the world leader in these critical statistics. I don’t think there is anything that Japan can do to reverse its social/economic future. Projections on the critical variables for at least the next ten-years continue to head south.

It’s not as if the Japanese are unaware that they are headed for a debt train wreck. They have just passed new tax legislation that could make a meaningful contribution towards stabilizing Japan’s debt to GDP problem. But the new law is a sham. The new taxes will never get paid.

Japan has a consumption tax today of 5%. The new laws will raise the tax to 8% in 2014 and 10% in 2015. Moody’s thought this was a great idea, and said this about the tax hikes: (Link)

Read More @ BruceKrasting.blogspot.com

I'm PayPal Verified

I’m amazed that Japan has not yet hit an economic reef. At over 230+%,

the country’s debt to GDP is so far out of whack that I keep thinking

that something has to give. I’ve been wrong for years.

I’m amazed that Japan has not yet hit an economic reef. At over 230+%,

the country’s debt to GDP is so far out of whack that I keep thinking

that something has to give. I’ve been wrong for years.The trend lines for Japan are awful. A decline in total population coupled with a rapidly aging society is a recipe for slow or no growth. Japan is the world leader in these critical statistics. I don’t think there is anything that Japan can do to reverse its social/economic future. Projections on the critical variables for at least the next ten-years continue to head south.

It’s not as if the Japanese are unaware that they are headed for a debt train wreck. They have just passed new tax legislation that could make a meaningful contribution towards stabilizing Japan’s debt to GDP problem. But the new law is a sham. The new taxes will never get paid.

Japan has a consumption tax today of 5%. The new laws will raise the tax to 8% in 2014 and 10% in 2015. Moody’s thought this was a great idea, and said this about the tax hikes: (Link)

Read More @ BruceKrasting.blogspot.com

We The Sheeplez... is intended to reflect

excellence in effort and content. Donations will help maintain this goal

and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

I'm PayPal Verified

from FinancialSurvivalNetwork.com:

Ranting Andy Hoffman the ace observer of gold price manipulation and a

perpetual thorn in the cartel’s backside joined us for the Monday Rant.

While we were watching, gold got hammered and at one point was over $12

in the red. As a wise man said, we no longer have markets, just a

series of ongoing governmental interventions. And if you don’t believe

it, just look at the price charts. They tell the whole story and it’s

not a pretty one at that. In the Elite’s effort to prop up the markets

and give the appearance of normalcy, they regularly manipulate the

markets, all in the name of economic stability. But what we will wind up

with is far from stability. Instead, they will cause the mother of all

crashes. And us average Americans will be left to pick up the pieces and

pay the piper.

Ranting Andy Hoffman the ace observer of gold price manipulation and a

perpetual thorn in the cartel’s backside joined us for the Monday Rant.

While we were watching, gold got hammered and at one point was over $12

in the red. As a wise man said, we no longer have markets, just a

series of ongoing governmental interventions. And if you don’t believe

it, just look at the price charts. They tell the whole story and it’s

not a pretty one at that. In the Elite’s effort to prop up the markets

and give the appearance of normalcy, they regularly manipulate the

markets, all in the name of economic stability. But what we will wind up

with is far from stability. Instead, they will cause the mother of all

crashes. And us average Americans will be left to pick up the pieces and

pay the piper.

CLICK HERE TO LISTEN TO AUDIO

Evening Laugh...

[Ed. Note: King of fiat satire Billy Joe is back. 'nuff said.]

from HouseOfTheMoon:

Ranting Andy Hoffman the ace observer of gold price manipulation and a

perpetual thorn in the cartel’s backside joined us for the Monday Rant.

While we were watching, gold got hammered and at one point was over $12

in the red. As a wise man said, we no longer have markets, just a

series of ongoing governmental interventions. And if you don’t believe

it, just look at the price charts. They tell the whole story and it’s

not a pretty one at that. In the Elite’s effort to prop up the markets

and give the appearance of normalcy, they regularly manipulate the

markets, all in the name of economic stability. But what we will wind up

with is far from stability. Instead, they will cause the mother of all

crashes. And us average Americans will be left to pick up the pieces and

pay the piper.

Ranting Andy Hoffman the ace observer of gold price manipulation and a

perpetual thorn in the cartel’s backside joined us for the Monday Rant.

While we were watching, gold got hammered and at one point was over $12

in the red. As a wise man said, we no longer have markets, just a

series of ongoing governmental interventions. And if you don’t believe

it, just look at the price charts. They tell the whole story and it’s

not a pretty one at that. In the Elite’s effort to prop up the markets

and give the appearance of normalcy, they regularly manipulate the

markets, all in the name of economic stability. But what we will wind up

with is far from stability. Instead, they will cause the mother of all

crashes. And us average Americans will be left to pick up the pieces and

pay the piper.CLICK HERE TO LISTEN TO AUDIO

Evening Laugh...

[Ed. Note: King of fiat satire Billy Joe is back. 'nuff said.]

from HouseOfTheMoon:

from Azizonomics:

Apparently, this badly.

Apparently, this badly.

But this is chickenshit money — it doesn’t even add up to Lloyd Blankfein’s 2007 bonus. Let’s see where the real money is going.

The S&P is still well up during Obama’s presidency. So does Wall Street really want a Romney Presidency? Or could Wall Street not care less, because they know that both sides will gladly do their bidding? After all it’s not like Obama has tried to jail corrupt bankers — Corzine who after raiding segregated accounts is surely up there with the most corrupt guys on Wall Street, has been bundling for Obama as recently as April.

Ignore the chickenshit donations. If markets fall significantly between now and November — 1300, 1200, 1100, 1000 — the powers that be on Wall Street want a Romney presidency. After all, it’s not only possible but extremely easy to deliberately crash the market when you have at your disposal algorithmic trading programs that can buy the spike and sell the dip 40 times a second (that’s 2400 times a minutes, 144,000 times an hour). No market crash? They’re happy to stick with Obama.

Read More @ Azizonomics.com

I'm PayPal Verified

Apparently, this badly.

Apparently, this badly.But this is chickenshit money — it doesn’t even add up to Lloyd Blankfein’s 2007 bonus. Let’s see where the real money is going.

The S&P is still well up during Obama’s presidency. So does Wall Street really want a Romney Presidency? Or could Wall Street not care less, because they know that both sides will gladly do their bidding? After all it’s not like Obama has tried to jail corrupt bankers — Corzine who after raiding segregated accounts is surely up there with the most corrupt guys on Wall Street, has been bundling for Obama as recently as April.

Ignore the chickenshit donations. If markets fall significantly between now and November — 1300, 1200, 1100, 1000 — the powers that be on Wall Street want a Romney presidency. After all, it’s not only possible but extremely easy to deliberately crash the market when you have at your disposal algorithmic trading programs that can buy the spike and sell the dip 40 times a second (that’s 2400 times a minutes, 144,000 times an hour). No market crash? They’re happy to stick with Obama.

Read More @ Azizonomics.com

by Joe Duarte, Financial Sense:

The financial markets seem to be equally betting on whether the Federal Reserve and the European Central Bank (ECB) will decide to unleash the printing presses at any time in the near future and what the consequences of this actually happening or not may be for the future of the global economy. What’s the answer? Well, the Fed and the ECB could tell this story to the public. After all it’s the truth. They, of course, would have to explain how their policies, along with those of the governments’ that they serve helped to set up the mess in the first place. And, that, of course, could have some serious consequences.

The alternative is to turn the printing presses on to ELEVEN, as if they were a stack of Marshall amps at a metal concert, close their eyes, and hope that it works.

The central banks know that they are in a big pickle. They don’t want to implement the Marshall amp plan because they are afraid of inflation. So, they’re hoping to jawbone the markets into moving higher so that people feel good about life again.

Read More @ Financial Sense.com

Jim Sinclair’s Commentary

World powers weigh emergency meeting on food prices By Gus Trompiz

PARIS | Mon Aug 13, 2012 11:18am EDT

(Reuters) – Leading members of the Group of 20 nations are prepared to trigger an emergency meeting to tackle soaring grain prices caused by the worst U.S. drought in half a century and poor crops from the Black Sea bread basket.

France, the United States and G20 president Mexico will hold a conference call at the end of August to discuss whether an emergency international meeting is required, aiming to avoid a repeat of the 2007/08 food price spike that triggered riots in poorer countries in 2008.

Analysts had little hope of concrete action, although there could be further calls for the United States to change its biofuels policy in response to the crisis while Russia will be encouraged not to impose an export ban.

The United States uses 40 percent of its corn crop to produce biofuel ethanol, drawing criticism from some groups which argue against the use of food for fuel when hunger is widespread in some poorer countries.

"They might talk about the U.S. ethanol mandate requirements but I don’t seem them making any massive responses at the moment. They don’t have a lot of tools at their disposal," said analyst Muktadir Ur Rahman Of Capital Economics

More…

Jim Sinclair’s Commentary

MAP: Here Are All Of The Big Chinese Investments In Africa Since 2010 by Mamta Badkar Aug 13, 2012

by Mamta Badkar Aug 13, 2012

Chinese investments in Africa have raised many eyebrows, as competitors like the U.S. argue that it’s motivated by Beijing’s desire to exploit the continent’s resources.

Earlier this year China promised $20 billion in investments to various African countries, and U.S. secretary of state Hilary Clinton said in a speech that African countries should consider partnerships with more responsible countries as against countries that exploit resources in a veiled reference to China.

This prompted Chinese state news-agency Xinhua (via the Guardian) to write "Whether Clinton was ignorant of the facts on the ground or chose to disregard them, her implication that China has been extracting Africa’s wealth for itself is utterly wide of the truth.

Given the recent debate we drew on this map from Stratfor to highlight Chinese investments offers in Africa since 2010. From Stratfor:

"While China has proposed $750 million for agriculture and general development aid and about $50 million to support small- and medium-sized business development in addition to the aforementioned projects, it has been criticized for the extractive nature of its relationship with many African countries, as well as the poor quality of some of its construction work.

However, since many African countries lack the indigenous engineering capability to construct these large-scale projects or the capital to undertake them,African governments with limited resources welcome Chinese investments enthusiastically. These foreign investment projects are also a boon for Beijing, since China needs African resources to sustain its domestic economy, and the projects in Africa provide a destination for excess Chinese labor."

More…

Jim Sinclair’s Commentary

Israel’s Dollar Reserves a Weapon Against Iranian War Disaster

Gloom and doomers warn that war with Iran could cripple the economy, but Israel has a weapon: $70 billion in dollar reserves. By Tzvi Ben Gedalyahu

First Publish: 8/13/2012, 4:42 PM

Gloom and doomers warn that war with Iran could cripple the economy, but Israel has a weapon: $70 billion in dollar reserves.

Many international financial wizards scoffed at Bank of Israel Governor Stanley Fischer three years when he bought billions of dollars, ostensibly to keep the then-mighty shekel from growing even stronger. Israeli exporters were suffering from low revenue due to a lower shekel rate for the dollar and the euro.

Globes reported that a senior Bank of Israel official said, “We have $76 billion in foreign currency reserves, which says it all. It does not conceal the fact that some of the reasons for its accumulation of foreign currencies over the past four years, from $27 billion to $76 billion, have been due to Israel’s geopolitical challenges.”

Whether intentional or not – and some say that Fischer saw the future – that hoard of dollars may be Israel’s saving grace if any military attack on Iran plunges the Israeli economy into a deep recession.

If a war between Israel and Iran were to cause a panic among foreign investors selling shekel investments, the local currency could plummet. Fischer then could come to the rescue, using the hoard of dollars to buy up shekels and prevent the collapse of the currency.

More…

Jim Sinclair’s Commentary

IMF Says Bailouts Iceland-Style Hold Lessons for Crisis Nations

Iceland holds some key lessons for nations trying to survive bailouts after the island’s approach to its rescue led to a “surprisingly” strong recovery, the International Monetary Fund’s mission chief to the country said.

Iceland’s commitment to its program, a decision to push losses on to bondholders instead of taxpayers and the safeguarding of a welfare system that shielded the unemployed from penury helped propel the nation from collapse toward recovery, according to the Washington-based fund.

“Iceland has made significant achievements since the crisis,” Daria V. Zakharova, IMF mission chief to the island, said in an interview. “We have a very positive outlook on growth, especially for this year and next year because it appears to us that the growth is broad based.”

Iceland refused to protect creditors in its banks, which failed in 2008 after their debts bloated to 10 times the size of the economy. The island’s subsequent decision to shield itself from a capital outflow by restricting currency movements allowed the government to ward off a speculative attack, cauterizing the economy’s hemorrhaging. That helped the authorities focus on supporting households and businesses.

“The fact that Iceland managed to preserve the social welfare system in the face of a very sizeable fiscal consolidation is one of the major achievements under the program and of the Icelandic government,” Zakharova said. The program benefited from “strong implementation, reflecting ownership on the part of the authorities,” she said.

More…

The financial markets seem to be equally betting on whether the Federal Reserve and the European Central Bank (ECB) will decide to unleash the printing presses at any time in the near future and what the consequences of this actually happening or not may be for the future of the global economy. What’s the answer? Well, the Fed and the ECB could tell this story to the public. After all it’s the truth. They, of course, would have to explain how their policies, along with those of the governments’ that they serve helped to set up the mess in the first place. And, that, of course, could have some serious consequences.

The alternative is to turn the printing presses on to ELEVEN, as if they were a stack of Marshall amps at a metal concert, close their eyes, and hope that it works.

The central banks know that they are in a big pickle. They don’t want to implement the Marshall amp plan because they are afraid of inflation. So, they’re hoping to jawbone the markets into moving higher so that people feel good about life again.

Read More @ Financial Sense.com

Jim Sinclair’s Commentary

This was not a subject important enough to the cost of living that the Fed Chairman might have commented on it.

World powers weigh emergency meeting on food prices By Gus Trompiz

PARIS | Mon Aug 13, 2012 11:18am EDT

(Reuters) – Leading members of the Group of 20 nations are prepared to trigger an emergency meeting to tackle soaring grain prices caused by the worst U.S. drought in half a century and poor crops from the Black Sea bread basket.

France, the United States and G20 president Mexico will hold a conference call at the end of August to discuss whether an emergency international meeting is required, aiming to avoid a repeat of the 2007/08 food price spike that triggered riots in poorer countries in 2008.

Analysts had little hope of concrete action, although there could be further calls for the United States to change its biofuels policy in response to the crisis while Russia will be encouraged not to impose an export ban.

The United States uses 40 percent of its corn crop to produce biofuel ethanol, drawing criticism from some groups which argue against the use of food for fuel when hunger is widespread in some poorer countries.

"They might talk about the U.S. ethanol mandate requirements but I don’t seem them making any massive responses at the moment. They don’t have a lot of tools at their disposal," said analyst Muktadir Ur Rahman Of Capital Economics

More…

Jim Sinclair’s Commentary

The West throws trillions at the Banksters while China throws billions at raw materials. When will the West learn?

MAP: Here Are All Of The Big Chinese Investments In Africa Since 2010

Chinese investments in Africa have raised many eyebrows, as competitors like the U.S. argue that it’s motivated by Beijing’s desire to exploit the continent’s resources.

Earlier this year China promised $20 billion in investments to various African countries, and U.S. secretary of state Hilary Clinton said in a speech that African countries should consider partnerships with more responsible countries as against countries that exploit resources in a veiled reference to China.

This prompted Chinese state news-agency Xinhua (via the Guardian) to write "Whether Clinton was ignorant of the facts on the ground or chose to disregard them, her implication that China has been extracting Africa’s wealth for itself is utterly wide of the truth.

Given the recent debate we drew on this map from Stratfor to highlight Chinese investments offers in Africa since 2010. From Stratfor:

"While China has proposed $750 million for agriculture and general development aid and about $50 million to support small- and medium-sized business development in addition to the aforementioned projects, it has been criticized for the extractive nature of its relationship with many African countries, as well as the poor quality of some of its construction work.

However, since many African countries lack the indigenous engineering capability to construct these large-scale projects or the capital to undertake them,African governments with limited resources welcome Chinese investments enthusiastically. These foreign investment projects are also a boon for Beijing, since China needs African resources to sustain its domestic economy, and the projects in Africa provide a destination for excess Chinese labor."

More…

Jim Sinclair’s Commentary

76 billion in a war chest? You can blow that in week number one.

Israel’s Dollar Reserves a Weapon Against Iranian War Disaster

Gloom and doomers warn that war with Iran could cripple the economy, but Israel has a weapon: $70 billion in dollar reserves. By Tzvi Ben Gedalyahu

First Publish: 8/13/2012, 4:42 PM

Gloom and doomers warn that war with Iran could cripple the economy, but Israel has a weapon: $70 billion in dollar reserves.

Many international financial wizards scoffed at Bank of Israel Governor Stanley Fischer three years when he bought billions of dollars, ostensibly to keep the then-mighty shekel from growing even stronger. Israeli exporters were suffering from low revenue due to a lower shekel rate for the dollar and the euro.

Globes reported that a senior Bank of Israel official said, “We have $76 billion in foreign currency reserves, which says it all. It does not conceal the fact that some of the reasons for its accumulation of foreign currencies over the past four years, from $27 billion to $76 billion, have been due to Israel’s geopolitical challenges.”

Whether intentional or not – and some say that Fischer saw the future – that hoard of dollars may be Israel’s saving grace if any military attack on Iran plunges the Israeli economy into a deep recession.

If a war between Israel and Iran were to cause a panic among foreign investors selling shekel investments, the local currency could plummet. Fischer then could come to the rescue, using the hoard of dollars to buy up shekels and prevent the collapse of the currency.

More…

Jim Sinclair’s Commentary

I imagine that the IMF in this article is hinting that imprisonment of bank’s management is a good idea.

IMF Says Bailouts Iceland-Style Hold Lessons for Crisis Nations

Iceland holds some key lessons for nations trying to survive bailouts after the island’s approach to its rescue led to a “surprisingly” strong recovery, the International Monetary Fund’s mission chief to the country said.

Iceland’s commitment to its program, a decision to push losses on to bondholders instead of taxpayers and the safeguarding of a welfare system that shielded the unemployed from penury helped propel the nation from collapse toward recovery, according to the Washington-based fund.

“Iceland has made significant achievements since the crisis,” Daria V. Zakharova, IMF mission chief to the island, said in an interview. “We have a very positive outlook on growth, especially for this year and next year because it appears to us that the growth is broad based.”

Iceland refused to protect creditors in its banks, which failed in 2008 after their debts bloated to 10 times the size of the economy. The island’s subsequent decision to shield itself from a capital outflow by restricting currency movements allowed the government to ward off a speculative attack, cauterizing the economy’s hemorrhaging. That helped the authorities focus on supporting households and businesses.

“The fact that Iceland managed to preserve the social welfare system in the face of a very sizeable fiscal consolidation is one of the major achievements under the program and of the Icelandic government,” Zakharova said. The program benefited from “strong implementation, reflecting ownership on the part of the authorities,” she said.

More…

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment