from KingWorldNews:

Today acclaimed commodity trader Dan Norcini told KWN, “… we have a

combination of bullish indicators that may very well signal that the

gold bears are going to be crushed and overrun.” Norcini also said, “We

could very well see silver ignite.”

Today acclaimed commodity trader Dan Norcini told KWN, “… we have a

combination of bullish indicators that may very well signal that the

gold bears are going to be crushed and overrun.” Norcini also said, “We

could very well see silver ignite.”

Here is what Norcini had to say: “We have a surge in crude oil and gasoline. At the wholesale level, gasoline has already surged more than 20% higher. WTI Crude oil is up near $95 a barrel, and Brent crude is significantly higher. Not only do we have energy on the move, but we also have grains on the move as well.”

“Soybean prices are making record highs, corn is making record highs, and wheat has soared. The impact of these higher grain prices is going to be with us for quite some time. So you have rising food, rising energy, and now we are seeing a breakdown in the bond market.

Bonds have made a low going all the way back to May. So we are definitely seeing a very important and major shift here….

Dan Norcini continues @ KingWorldNews.com

Today acclaimed commodity trader Dan Norcini told KWN, “… we have a

combination of bullish indicators that may very well signal that the

gold bears are going to be crushed and overrun.” Norcini also said, “We

could very well see silver ignite.”

Today acclaimed commodity trader Dan Norcini told KWN, “… we have a

combination of bullish indicators that may very well signal that the

gold bears are going to be crushed and overrun.” Norcini also said, “We

could very well see silver ignite.” Here is what Norcini had to say: “We have a surge in crude oil and gasoline. At the wholesale level, gasoline has already surged more than 20% higher. WTI Crude oil is up near $95 a barrel, and Brent crude is significantly higher. Not only do we have energy on the move, but we also have grains on the move as well.”

“Soybean prices are making record highs, corn is making record highs, and wheat has soared. The impact of these higher grain prices is going to be with us for quite some time. So you have rising food, rising energy, and now we are seeing a breakdown in the bond market.

Bonds have made a low going all the way back to May. So we are definitely seeing a very important and major shift here….

Dan Norcini continues @ KingWorldNews.com

What To Do When Every Market Is Manipulated...

What do the following have in common? LIBOR, Bernie Madoff, MF

Global, Peregrine Financial, zero-percent interest rates, the Social

Security and Medicare entitlement funds, many state and municipal

pension funds, mark-to-model asset values, quote stuffing and high

frequency trading (HFT), and debt-based money? The answer is that

every single thing in that list is an example of market rigging, fraud,

or both. How are we supposed to make decisions in today’s rigged and

often fraudulent market environment? Where should you put your money if

you don’t know where the risks lie? How does one control risk when control fraud

runs rampant? Unfortunately, there are no perfect answers to these

questions. Instead, the task is to recognize what sort of world we

happen to live in today and adjust one’s actions to the realities as

they happen to be. The purpose of this report is not to stir up

resentment or anger -- although those are perfectly valid responses to

the abuses we are forced to live with -- but to simply acknowledge the

landscape as it is so that we can make informed decisions.

Europe Since LTRO2 - A Little Context

As

Twitter and CNBC come alive with European banks ripping higher

(short-sale-ban and trading a pennies will do that), Spanish and Italian

equity markets ramping (to recent swing highs and the top of a

four-month range on de minimus volume), while EGBs basically stagnate;

we thought a little cooling reality on this white-hot exuberance was

necessary. Without really wanting to steal the jam out of Draghi's

donut, since LTRO2, Spain and Italy 10Y are 175bps and 71bps

wider; Europe's VIX is unchanged at 23%, France's CAC and Germany's DAX

equity indices are +1-2%; and Spain's IBEX and Italy's MIB equity

indices are -13% and 8.5% respectively. Recency bias, summer

doldrums, and an incessant hope that the status quo can really re-emerge

(be printed back into existence) among what is increasingly a global

balance-sheet-recession (and shadow-banking collapse) among advanced

economies is indeed a powerful driver but context is key.

As

Twitter and CNBC come alive with European banks ripping higher

(short-sale-ban and trading a pennies will do that), Spanish and Italian

equity markets ramping (to recent swing highs and the top of a

four-month range on de minimus volume), while EGBs basically stagnate;

we thought a little cooling reality on this white-hot exuberance was

necessary. Without really wanting to steal the jam out of Draghi's

donut, since LTRO2, Spain and Italy 10Y are 175bps and 71bps

wider; Europe's VIX is unchanged at 23%, France's CAC and Germany's DAX

equity indices are +1-2%; and Spain's IBEX and Italy's MIB equity

indices are -13% and 8.5% respectively. Recency bias, summer

doldrums, and an incessant hope that the status quo can really re-emerge

(be printed back into existence) among what is increasingly a global

balance-sheet-recession (and shadow-banking collapse) among advanced

economies is indeed a powerful driver but context is key.Treasuries Got Bernank'd: 3 Years Gone In 3 Weeks

Over

the last three weeks, 10-year US government bond yields increased from

under 1.4% to over 1.81% while 30-year went up from 2.44% to 2.96%.

The 20+ year Treasury bond ETF (TLT) declined 8.2% from the top. That's more than three years worth of interest, gone in just three weeks.

Yes, there is a flip side to central bankers artificially depressing

bond yields. And you thought you were smart, not falling for Bernanke’s

siren songs to push you into "risky" investments.

Over

the last three weeks, 10-year US government bond yields increased from

under 1.4% to over 1.81% while 30-year went up from 2.44% to 2.96%.

The 20+ year Treasury bond ETF (TLT) declined 8.2% from the top. That's more than three years worth of interest, gone in just three weeks.

Yes, there is a flip side to central bankers artificially depressing

bond yields. And you thought you were smart, not falling for Bernanke’s

siren songs to push you into "risky" investments.The Truth About How The Fed Has Destroyed The Housing Market

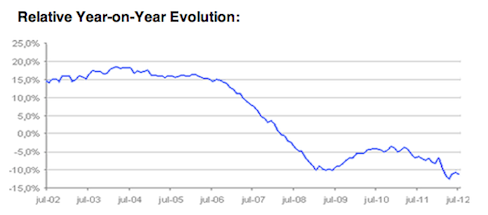

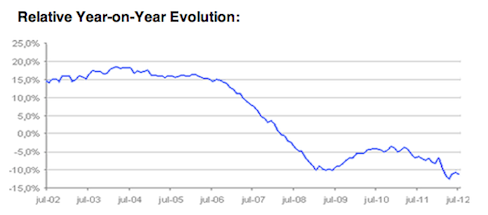

When

observing the trends in the housing market, one has two choices: i)

listen to the bulls who keep repeating that "housing has bottomed", a

common refrain which has been repeated every single year for

the past four, or ii) look at the facts. We touched briefly on the facts

earlier today when we presented the latest housing starts

data:construction of single family residences remains 46 percent below

the long-term trend; the more volatile multifamily houses is 15 percent

below trend and demand for new homes 47 percent below. This is

indicative of reluctance by households to make long-term investments due

to fear of another downturn in housing prices. Bloomberg summarizes

this succinctly: "This historically weak demand for new homes is

inhibiting the recovery of demand for construction workers as well,

about 2.3 million of whom remain without work." But the best visual

representation of the housing "non-bottom" comes courtesy of the

following chart of homes in negative or near-negative equity, which via

Bloomberg Brief, is soared in Q4, and is now back to Q1 2010 level at

over 13.5 million. What this means is that the foreclosure backlog and

the shadow inventory of houses on the market could be as large as 13.5

million in the future, which translates into one simple word: supply.

When

observing the trends in the housing market, one has two choices: i)

listen to the bulls who keep repeating that "housing has bottomed", a

common refrain which has been repeated every single year for

the past four, or ii) look at the facts. We touched briefly on the facts

earlier today when we presented the latest housing starts

data:construction of single family residences remains 46 percent below

the long-term trend; the more volatile multifamily houses is 15 percent

below trend and demand for new homes 47 percent below. This is

indicative of reluctance by households to make long-term investments due

to fear of another downturn in housing prices. Bloomberg summarizes

this succinctly: "This historically weak demand for new homes is

inhibiting the recovery of demand for construction workers as well,

about 2.3 million of whom remain without work." But the best visual

representation of the housing "non-bottom" comes courtesy of the

following chart of homes in negative or near-negative equity, which via

Bloomberg Brief, is soared in Q4, and is now back to Q1 2010 level at

over 13.5 million. What this means is that the foreclosure backlog and

the shadow inventory of houses on the market could be as large as 13.5

million in the future, which translates into one simple word: supply.The World Will Continue To Change

Admin at Jim Rogers Blog - 39 seconds ago

“Not one country in existence today has had the same borders and government

for as long as two hundred years. The world will continue changing.” - in A

Gift to My Children: A Father's Lessons for Life and Investing

*Jim Rogers is an author, financial commentator and successful

international investor. He has been frequently featured in Time, The New

York Times, Barron’s, Forbes, Fortune, The Wall Street Journal, The

Financial Times and is a regular guest on Bloomberg and CNBC.*

Americans Are Strapped For Cash But Denial Is Easier

Eric De Groot at Eric De Groot - 1 hour ago

"The paycheck cycle remains pronounced, and there continues to be a lot of

uncertainty in the global economy,'' Chief Financial Officer Charles Holley

said in a recorded message on Thursday. When Wal Mal characterizes the

paycheck cycle remains “pronounced”, they’re saying that the bulk of their

customers do their shopping around the paycheck cycle at the beginning of

the month. This uneven...

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]]

Mailbox - Correlation of Gold and Bonds

Eric De Groot at Eric De Groot - 2 hours ago

Corporate (LTCBTRI) and government (LTGBTRI) bond total return indices show

a strong positive correlative to gold. I would not recommend arguing this

point to a room full of hardcore gold enthusiast. The capital appreciation

index (LTGBCAI) which excludes interest income shows the expected inverse

correlation. Table: Correlation Matrix Eric: In your...

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]]

CNBC Video: I Do Not Think Romney Will Be Elected

Admin at Marc Faber Blog - 3 hours ago

In this "Fast Money" excerpt, investor Marc Faber explains why he thinks

the stock market is rooting for President Obama's re-election in November.

*Marc Faber is an international investor known for his uncanny predictions

of the stock market and futures markets around the world.*Europe's Energy Costs See Biggest Two Month Jump Ever

Between

a weaker EUR and Middle-East tensions, Europe faces a very significant

(and real) drag on its economic performance. Forget the 'grow our way

out of it' or 'believe-me' memes, the crude reality (that we warned

about last week) is that the cost of buying spot Brent Crude in

Euros is very close to record highs, above 2008 highs and most

worryingly, has seen the biggest rise on record in the last two months.

For those wondering what the trade-off is to Mario Monti's pointless

blustering and scorched-earth hostage tactics at the June 29 Summit,

just look at the 'Total' line item, the next time you gas up.

Between

a weaker EUR and Middle-East tensions, Europe faces a very significant

(and real) drag on its economic performance. Forget the 'grow our way

out of it' or 'believe-me' memes, the crude reality (that we warned

about last week) is that the cost of buying spot Brent Crude in

Euros is very close to record highs, above 2008 highs and most

worryingly, has seen the biggest rise on record in the last two months.

For those wondering what the trade-off is to Mario Monti's pointless

blustering and scorched-earth hostage tactics at the June 29 Summit,

just look at the 'Total' line item, the next time you gas up.The Broken Market Chronicles: Nat Gas Explodes As Man United Implodes

The market is so beyond broken. No point in commenting any more. Here is what happened with Natgas in slow motion animation courtesy of Nanex... And here is what just happened to recently public Manchester United on no news as the $14.00 IPO price defense finally failed:

by J. D. Heyes, Natural News:

A huge, foul-smelling and potentially radioactive sinkhole has gulped

an entire acre of cypress trees south of Baton Rouge, forcing the

evacuations of about 150 homes and leading affected residents to file a

class-action lawsuit against the Texas Brine Co. for its alleged

responsibility.

A huge, foul-smelling and potentially radioactive sinkhole has gulped

an entire acre of cypress trees south of Baton Rouge, forcing the

evacuations of about 150 homes and leading affected residents to file a

class-action lawsuit against the Texas Brine Co. for its alleged

responsibility.“On Friday, August 3, 2012, a sinkhole, 422 feet deep and 372 feet wide emerged releasing a foul diesel odor and created salt-water slurry, which contains diesel fuel,” the suit begins.

Lisa LeBlanc, the lead plaintiff in the case, and others affected by the sinkhole reside in Assumption Parish, which is about 60 miles east of New Orleans. According to the federal complaint, a salt cavern being utilized by Texas Brine to store radioactive materials that are byproducts of the drilling industry failed.

The complaint accuses Texas Brine of being complicit, saying the company knew the cavern walls were at risk of failing as early as January 2011 but did not provide any advance warning to the public.

Read More @ NaturalNews.com

by David McWilliams, David McWilliams:

Now that the Olym-pics are over, let’s focus on the original home of

the Olym-pics, Greece, against the background of data released yesterday

showing that the eurozone economy is slowing rapidly ahead of the

troika’s return to Athens in September.

Now that the Olym-pics are over, let’s focus on the original home of

the Olym-pics, Greece, against the background of data released yesterday

showing that the eurozone economy is slowing rapidly ahead of the

troika’s return to Athens in September.The troika will be there to see if it will release additional tranches of funding to Greece. If the troika decides to cut the taps off — unlikely, but not out of the question — then Greece would default and move to exit the eurozone.

Greek industrial output is down 27pc since the depression began, youth unemployment is above 50pc and the economy is cratering. This can’t go on for much longer.

After years of crises, leaving the euro may be in the best interests of both the Greek economy and its people. One way of looking at the debate about the currency is to see who wins and who loses when a weak economy adopts a hard currency and what happens when this is reversed.

History tells us that whenever a weak country adopts a strong currency, the weak country is made weaker, not stronger. Its manufacturing base can’t compete and those who pay themselves in the hard currency without earning it, such as the public sector, get paid in a currency they have no ability to earn.

Read More @ DavidMcWilliams.ie

by Dr. Paul Craig Roberts, PaulCraigRoberts.org:

The morons who rule the american sheeple are not only dumb and blind,

they are deaf as well. The ears of the american “superpower” only work

when the Israeli prime minister, the crazed Netanyahu, speaks. Then

Washington hears everything and rushes to comply.

The morons who rule the american sheeple are not only dumb and blind,

they are deaf as well. The ears of the american “superpower” only work

when the Israeli prime minister, the crazed Netanyahu, speaks. Then

Washington hears everything and rushes to comply.

Israel is a tiny insignificant state, created by the careless British and the stupid americans. It has no power except what its american protector provides. Yet, despite Israel’s insignificance, it rules Washington.

When a resolution introduced by the Israel Lobby is delivered to Congress, it passes unanimously. If Israel wants war, Israel gets its wish. When Israel commits war crimes against Palestinians and Lebanon and is damned by the hundred plus UN resolutions passed against Israel’s criminal actions, the US bails Israel out of trouble with its veto.

The power that tiny Israel exercises over the “worlds’s only superpower” is unique in history. Tens of millions of “christians” bow down to this power, reinforcing it, moved by the exhortations of their “christian” ministers.

Netanyahu lusts for war against Iran. He strikes out against all who oppose his war lust. Recently, he called Israel’s top generals “pussies” for warning against a war with Iran. He regards former Israeli prime ministers and former heads of the Israeli intelligence service as traitors for opposing his determination to attack Iran.

Read More @ PaulCraigRoberts.org

The morons who rule the american sheeple are not only dumb and blind,

they are deaf as well. The ears of the american “superpower” only work

when the Israeli prime minister, the crazed Netanyahu, speaks. Then

Washington hears everything and rushes to comply.

The morons who rule the american sheeple are not only dumb and blind,

they are deaf as well. The ears of the american “superpower” only work

when the Israeli prime minister, the crazed Netanyahu, speaks. Then

Washington hears everything and rushes to comply.Israel is a tiny insignificant state, created by the careless British and the stupid americans. It has no power except what its american protector provides. Yet, despite Israel’s insignificance, it rules Washington.

When a resolution introduced by the Israel Lobby is delivered to Congress, it passes unanimously. If Israel wants war, Israel gets its wish. When Israel commits war crimes against Palestinians and Lebanon and is damned by the hundred plus UN resolutions passed against Israel’s criminal actions, the US bails Israel out of trouble with its veto.

The power that tiny Israel exercises over the “worlds’s only superpower” is unique in history. Tens of millions of “christians” bow down to this power, reinforcing it, moved by the exhortations of their “christian” ministers.

Netanyahu lusts for war against Iran. He strikes out against all who oppose his war lust. Recently, he called Israel’s top generals “pussies” for warning against a war with Iran. He regards former Israeli prime ministers and former heads of the Israeli intelligence service as traitors for opposing his determination to attack Iran.

Read More @ PaulCraigRoberts.org

by Andrew Hoffman, MilesFranklin.com:

On last week’s round table podcast with Elijah Johnson of Unconventional Finance, Bix Weir made a comment regarding how overt market manipulations have become. And not just the blatancy of

stock, bond, currency, and PM interventions – per the rote machinations

I discuss EVERY DAY. I believe he used the term “official

manipulation,” which gave me the idea for this RANT…

On last week’s round table podcast with Elijah Johnson of Unconventional Finance, Bix Weir made a comment regarding how overt market manipulations have become. And not just the blatancy of

stock, bond, currency, and PM interventions – per the rote machinations

I discuss EVERY DAY. I believe he used the term “official

manipulation,” which gave me the idea for this RANT…

Four Part Round Table Podcast – Ranting Andy, Bill Murphy, and Bix Weir

It is public record that the “President’s Working Group on Financial Markets” is charged with supporting U.S. stocks; the Fed with purchasing Treasury bonds via “QE”, “OPERATION TWIST,” and “ZIRP”; and the “Exchange Stabilization Fund” with gold and currency intervention; not to mention, equivalent organizations in nearly ALL sovereign nations. However, even after the past four years’ market CHAOS – following Global Meltdown I – the investment world and MSM have largely kept their heads in the sand, pretending markets were freely-traded and hoping – for instance – that the “DOW JONES PROPAGANDA AVERAGE’s” strong performance “signaled” good times ahead.

Read more @ MilesFranklin.com

I'm PayPal Verified

On last week’s round table podcast with Elijah Johnson of Unconventional Finance, Bix Weir made a comment regarding how overt market manipulations have become. And not just the blatancy of

stock, bond, currency, and PM interventions – per the rote machinations

I discuss EVERY DAY. I believe he used the term “official

manipulation,” which gave me the idea for this RANT…

On last week’s round table podcast with Elijah Johnson of Unconventional Finance, Bix Weir made a comment regarding how overt market manipulations have become. And not just the blatancy of

stock, bond, currency, and PM interventions – per the rote machinations

I discuss EVERY DAY. I believe he used the term “official

manipulation,” which gave me the idea for this RANT…Four Part Round Table Podcast – Ranting Andy, Bill Murphy, and Bix Weir

It is public record that the “President’s Working Group on Financial Markets” is charged with supporting U.S. stocks; the Fed with purchasing Treasury bonds via “QE”, “OPERATION TWIST,” and “ZIRP”; and the “Exchange Stabilization Fund” with gold and currency intervention; not to mention, equivalent organizations in nearly ALL sovereign nations. However, even after the past four years’ market CHAOS – following Global Meltdown I – the investment world and MSM have largely kept their heads in the sand, pretending markets were freely-traded and hoping – for instance – that the “DOW JONES PROPAGANDA AVERAGE’s” strong performance “signaled” good times ahead.

Read more @ MilesFranklin.com

We The Sheeplez... is intended to reflect

excellence in effort and content. Donations will help maintain this goal

and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

I'm PayPal Verified

by Charles Hugh Smith, Of Two Minds:

We are in the latter stages of financialization’s self-destruct sequence.

We are in the latter stages of financialization’s self-destruct sequence.

Like all systems that follow an S-curve of growth and decay, financialization cannot return to its growth phase. I addressed the impossibility of reflating asset and credit bubbles in Let’s Pretend Financialization Hasn’t Killed the Economy (March 8, 2012).

But there is another dynamic at play: a self-destruct sequence triggered by central bank and Central State efforts to reflate asset and credit/leverage bubbles. All central bank and State policies aimed at driving capital into risk assets boil down to reflating phantom assets purchased with debt by issuing more debt that is based on newly issued phantom assets.

Phantom assets purchased with debt cannot be reflated by issuing more debt that is based on newly issued phantom assets. Piling more debt/leverage on a sandpile of phantom assets (CDS, bonds that cannot possibly be paid back, empty condos in the middle of nowhere, etc.) only heightens the probability that the unstable pile will collapse.

The implicit Central Planning campaign to trigger “mild” inflation is part of the self-destruct sequence. Central planners metaphorically fight the last war, or at best the last two wars, and so they remain blind to any dynamics that did not exist in their case studies.

Read More @ OfTwoMinds.com

We are in the latter stages of financialization’s self-destruct sequence.

We are in the latter stages of financialization’s self-destruct sequence.Like all systems that follow an S-curve of growth and decay, financialization cannot return to its growth phase. I addressed the impossibility of reflating asset and credit bubbles in Let’s Pretend Financialization Hasn’t Killed the Economy (March 8, 2012).

But there is another dynamic at play: a self-destruct sequence triggered by central bank and Central State efforts to reflate asset and credit/leverage bubbles. All central bank and State policies aimed at driving capital into risk assets boil down to reflating phantom assets purchased with debt by issuing more debt that is based on newly issued phantom assets.

Phantom assets purchased with debt cannot be reflated by issuing more debt that is based on newly issued phantom assets. Piling more debt/leverage on a sandpile of phantom assets (CDS, bonds that cannot possibly be paid back, empty condos in the middle of nowhere, etc.) only heightens the probability that the unstable pile will collapse.

The implicit Central Planning campaign to trigger “mild” inflation is part of the self-destruct sequence. Central planners metaphorically fight the last war, or at best the last two wars, and so they remain blind to any dynamics that did not exist in their case studies.

Read More @ OfTwoMinds.com

by Yves Smith, via Naked Capitalism:

Yves here. We’ve flagged in earlier posts how the Spanish banking

crisis has the potential to become destabilizing politically, as if

Yves here. We’ve flagged in earlier posts how the Spanish banking

crisis has the potential to become destabilizing politically, as if Spain

wasn’t already at considerable risk of upheaval. Spanish depositors

were pushed to convert their deposits into preference shares, which they

were told were just as safe. This was a simple desperation move by the

banks to save their own skins, customers be damned, by raising equity

from the most unsophisticated source to which they had access. And now

that that gambit failed, these shareholders are due to have those

investments wiped out unless the Spanish authorities can cut a deal to

spare them. Don’t hold your breath.

By Delusional Economics, who is horrified at the state of economic commentary in Australia and is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness

I mentioned back in early July that Spain had a serious political problem brewing because the draft Memorandum of Understanding for the Spanish bankingsystem

clearly stated that:

Read More @ NakedCapitalism.com

Yves here. We’ve flagged in earlier posts how the Spanish banking

crisis has the potential to become destabilizing politically, as if

Yves here. We’ve flagged in earlier posts how the Spanish banking

crisis has the potential to become destabilizing politically, as if

By Delusional Economics, who is horrified at the state of economic commentary in Australia and is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness

I mentioned back in early July that Spain had a serious political problem brewing because the draft Memorandum of Understanding for the Spanish banking

Read More @ NakedCapitalism.com

by Susanne Posel, Occupy Corporatism:

The

US government, under the leadership of the globalist puppet, Barack

Obama, knows that the general American public is waking up to the

tyranny that is being forced upon them. The divide and conquer

ideal purveyed by the mainstream media (MSM) in America may be the

second false flag that coerces us into having a “civil war” before the

November 2012 elections.

The

US government, under the leadership of the globalist puppet, Barack

Obama, knows that the general American public is waking up to the

tyranny that is being forced upon them. The divide and conquer

ideal purveyed by the mainstream media (MSM) in America may be the

second false flag that coerces us into having a “civil war” before the

November 2012 elections.

Obama has amassed a “legion of lawyers” to flood the court system with support should problems arise from the voting process. The preparatory process alludes to the fact that they anticipate a problem with the voting.

The electronic voting booths are being pushed in time for the 2012 presidential election season as a way to answer to potential issues brought on my mail-in ballots by overseas Americans and US armed forces service members.

Read More @ OccupyCorporatism.com

The

US government, under the leadership of the globalist puppet, Barack

Obama, knows that the general American public is waking up to the

tyranny that is being forced upon them. The divide and conquer

ideal purveyed by the mainstream media (MSM) in America may be the

second false flag that coerces us into having a “civil war” before the

November 2012 elections.

The

US government, under the leadership of the globalist puppet, Barack

Obama, knows that the general American public is waking up to the

tyranny that is being forced upon them. The divide and conquer

ideal purveyed by the mainstream media (MSM) in America may be the

second false flag that coerces us into having a “civil war” before the

November 2012 elections.Obama has amassed a “legion of lawyers” to flood the court system with support should problems arise from the voting process. The preparatory process alludes to the fact that they anticipate a problem with the voting.

The electronic voting booths are being pushed in time for the 2012 presidential election season as a way to answer to potential issues brought on my mail-in ballots by overseas Americans and US armed forces service members.

Read More @ OccupyCorporatism.com

by Lawrence Williams, MineWeb.com

Latest figures from the World Gold Council show that global gold demand fell back in Q2 2012 compared with a year ago, but Central Bank buying rose to a new record level.

In its latest Gold Demand Trends report, the World Gold Council

estimates, on figures provided by Thomson Reuters GFMS, that global

gold demand in Q2 2012 was 990.0 tonnes, down 7% from the 1,065.8 tonnes

in Q2 2011. The organisation does point out though that demand in Q2

2011 was exceptionally high.

In its latest Gold Demand Trends report, the World Gold Council

estimates, on figures provided by Thomson Reuters GFMS, that global

gold demand in Q2 2012 was 990.0 tonnes, down 7% from the 1,065.8 tonnes

in Q2 2011. The organisation does point out though that demand in Q2

2011 was exceptionally high.

However perhaps one of the most interesting findings of this latest analysis is that gold buying by the world’s Central Banks hit a new record of 157.5 tonnes , more than double the level of Q2 2011 and accounting for 16% of overall global demand. This, by our reckoning is also around 22.5% of total gold supply over the period extrapolating from the WGC’s own annual figures for 2011. Central banks that significantly bolstered their holdings during the quarter included the National Bank of Kazakhstan, and the central banks of the Philippines, Russia and Ukraine.

Overall the WGC notes that if the Central Bank buying continues at the current rate where they have bought 254 tonnes against 200 tonnes H1 2011 this could be a record year, for Central Bank buying.

Read More @ MineWeb.com

Latest figures from the World Gold Council show that global gold demand fell back in Q2 2012 compared with a year ago, but Central Bank buying rose to a new record level.

In its latest Gold Demand Trends report, the World Gold Council

estimates, on figures provided by Thomson Reuters GFMS, that global

gold demand in Q2 2012 was 990.0 tonnes, down 7% from the 1,065.8 tonnes

in Q2 2011. The organisation does point out though that demand in Q2

2011 was exceptionally high.

In its latest Gold Demand Trends report, the World Gold Council

estimates, on figures provided by Thomson Reuters GFMS, that global

gold demand in Q2 2012 was 990.0 tonnes, down 7% from the 1,065.8 tonnes

in Q2 2011. The organisation does point out though that demand in Q2

2011 was exceptionally high.However perhaps one of the most interesting findings of this latest analysis is that gold buying by the world’s Central Banks hit a new record of 157.5 tonnes , more than double the level of Q2 2011 and accounting for 16% of overall global demand. This, by our reckoning is also around 22.5% of total gold supply over the period extrapolating from the WGC’s own annual figures for 2011. Central banks that significantly bolstered their holdings during the quarter included the National Bank of Kazakhstan, and the central banks of the Philippines, Russia and Ukraine.

Overall the WGC notes that if the Central Bank buying continues at the current rate where they have bought 254 tonnes against 200 tonnes H1 2011 this could be a record year, for Central Bank buying.

Read More @ MineWeb.com

by Jennifer Martinez, The Hill:

Sen. Jay Rockefeller (D-W.Va.) urged President Obama on Monday to

issue an executive order that would establish a program in which

companies operating critical infrastructure would take steps to bolster

the security of their computer systems from a cyberattack.

Sen. Jay Rockefeller (D-W.Va.) urged President Obama on Monday to

issue an executive order that would establish a program in which

companies operating critical infrastructure would take steps to bolster

the security of their computer systems from a cyberattack.

Before Congress left for its August recess, Senate Republicans blocked a similar measure in a cybersecurity bill Rockefeller had co-sponsored.

He said Obama could issue an executive order to implement a section of that bill that would have encouraged operators of critical systems to adopt tighter security standards.

“[B]ecause it is very unclear whether the Senate will come to agreement on cybersecurity legislation in the near future, I urge you to explore and employ every lever of executive power that you possess to protect this country from the cyber threat,” Rockefeller wrote in a letter to Obama on Monday. “We must act to address our cyber vulnerabilities as soon as possible and many components of the Cybersecurity Act are amenable to implementation via executive order, normal regulatory processes, or other executive action under the authorities of the Homeland Security Act.”

Read More @ TheHill.com

Sen. Jay Rockefeller (D-W.Va.) urged President Obama on Monday to

issue an executive order that would establish a program in which

companies operating critical infrastructure would take steps to bolster

the security of their computer systems from a cyberattack.

Sen. Jay Rockefeller (D-W.Va.) urged President Obama on Monday to

issue an executive order that would establish a program in which

companies operating critical infrastructure would take steps to bolster

the security of their computer systems from a cyberattack.Before Congress left for its August recess, Senate Republicans blocked a similar measure in a cybersecurity bill Rockefeller had co-sponsored.

He said Obama could issue an executive order to implement a section of that bill that would have encouraged operators of critical systems to adopt tighter security standards.

“[B]ecause it is very unclear whether the Senate will come to agreement on cybersecurity legislation in the near future, I urge you to explore and employ every lever of executive power that you possess to protect this country from the cyber threat,” Rockefeller wrote in a letter to Obama on Monday. “We must act to address our cyber vulnerabilities as soon as possible and many components of the Cybersecurity Act are amenable to implementation via executive order, normal regulatory processes, or other executive action under the authorities of the Homeland Security Act.”

Read More @ TheHill.com

from Brandon Smith, Activist Post

Rule #1: Stop Waiting For Others To Fight The Battle For You

Rule #1: Stop Waiting For Others To Fight The Battle For You

If you want to put an end to totalitarianism, you can’t sit around waiting for other people to solve the problem for you. The greatest downfall of any political campaign (even when led by a liberty minded candidate) is the centralization of popular focus on a single man. There is no knight in shining armor coming to lead the Liberty Movement to the promised land. These unrealistic expectations will only end in disappointment and nihilism. The solution starts not with others, but with YOU. Where do you contribute to freedom? What actions have you taken? Who have you inspired? What ideas have you offered? What project have you organized, struggled for, sweat for? Take the reigns of your own destiny and finally join the fight instead of perusing the internet longing for a guru to hand you a mission.

Rule #2: Believe In Something Greater Than Yourself – Abandon Childish Cynicism

Cynics do not make history, or change a country for the better. They are the forgotten dust wafting about in the wayward attics of time.

Read More @ Activist Post

I'm PayPal Verified

Rule #1: Stop Waiting For Others To Fight The Battle For You

Rule #1: Stop Waiting For Others To Fight The Battle For YouIf you want to put an end to totalitarianism, you can’t sit around waiting for other people to solve the problem for you. The greatest downfall of any political campaign (even when led by a liberty minded candidate) is the centralization of popular focus on a single man. There is no knight in shining armor coming to lead the Liberty Movement to the promised land. These unrealistic expectations will only end in disappointment and nihilism. The solution starts not with others, but with YOU. Where do you contribute to freedom? What actions have you taken? Who have you inspired? What ideas have you offered? What project have you organized, struggled for, sweat for? Take the reigns of your own destiny and finally join the fight instead of perusing the internet longing for a guru to hand you a mission.

Rule #2: Believe In Something Greater Than Yourself – Abandon Childish Cynicism

Cynics do not make history, or change a country for the better. They are the forgotten dust wafting about in the wayward attics of time.

Read More @ Activist Post

from End of the American Dream:

What a depressing choice the American people are being presented with

this year. We are at a point in our history where we desperately need a

change of direction in the White House, and we are guaranteed that we

are not going to get it. The Democrats are running the worst president

in American history, and the Republicans are running a guy who is almost

a carbon copy of him. The fact that about half the country is still

supporting Barack Obama shows how incredibly stupid and corrupt the

American people have become. No American should have ever cast a single

vote for Barack Obama for any political office under any circumstances.

He should never have even been the assistant superintendent in charge

of janitorial supplies, much less the president of the United States.

The truth is that Barack Obama has done such a horrible job that he

should immediately resign along with his entire cabinet. But instead of

giving us a clear choice, the Republicans nominated the Republican that

was running that was most similar to Barack Obama. In fact, I don’t

think we have ever had two candidates for president that are so similar.

Yes, there are a few minor differences between them, but the truth is

that we are heading into Obama’s second term no matter which one of them

gets elected. The mainstream media makes it sound like Obama and

Romney are bitter ideological rivals but that is a giant lie. Yeah,

they are slinging lots of mud at each other, but they both play for the

same team and the losers are going to be the American people.

What a depressing choice the American people are being presented with

this year. We are at a point in our history where we desperately need a

change of direction in the White House, and we are guaranteed that we

are not going to get it. The Democrats are running the worst president

in American history, and the Republicans are running a guy who is almost

a carbon copy of him. The fact that about half the country is still

supporting Barack Obama shows how incredibly stupid and corrupt the

American people have become. No American should have ever cast a single

vote for Barack Obama for any political office under any circumstances.

He should never have even been the assistant superintendent in charge

of janitorial supplies, much less the president of the United States.

The truth is that Barack Obama has done such a horrible job that he

should immediately resign along with his entire cabinet. But instead of

giving us a clear choice, the Republicans nominated the Republican that

was running that was most similar to Barack Obama. In fact, I don’t

think we have ever had two candidates for president that are so similar.

Yes, there are a few minor differences between them, but the truth is

that we are heading into Obama’s second term no matter which one of them

gets elected. The mainstream media makes it sound like Obama and

Romney are bitter ideological rivals but that is a giant lie. Yeah,

they are slinging lots of mud at each other, but they both play for the

same team and the losers are going to be the American people.

Read More @ EndoftheAmericanDream.com

Today’s Items:

Finally, please prepare now for the escalating economic and social unrest. Good Day!

What a depressing choice the American people are being presented with

this year. We are at a point in our history where we desperately need a

change of direction in the White House, and we are guaranteed that we

are not going to get it. The Democrats are running the worst president

in American history, and the Republicans are running a guy who is almost

a carbon copy of him. The fact that about half the country is still

supporting Barack Obama shows how incredibly stupid and corrupt the

American people have become. No American should have ever cast a single

vote for Barack Obama for any political office under any circumstances.

He should never have even been the assistant superintendent in charge

of janitorial supplies, much less the president of the United States.

The truth is that Barack Obama has done such a horrible job that he

should immediately resign along with his entire cabinet. But instead of

giving us a clear choice, the Republicans nominated the Republican that

was running that was most similar to Barack Obama. In fact, I don’t

think we have ever had two candidates for president that are so similar.

Yes, there are a few minor differences between them, but the truth is

that we are heading into Obama’s second term no matter which one of them

gets elected. The mainstream media makes it sound like Obama and

Romney are bitter ideological rivals but that is a giant lie. Yeah,

they are slinging lots of mud at each other, but they both play for the

same team and the losers are going to be the American people.

What a depressing choice the American people are being presented with

this year. We are at a point in our history where we desperately need a

change of direction in the White House, and we are guaranteed that we

are not going to get it. The Democrats are running the worst president

in American history, and the Republicans are running a guy who is almost

a carbon copy of him. The fact that about half the country is still

supporting Barack Obama shows how incredibly stupid and corrupt the

American people have become. No American should have ever cast a single

vote for Barack Obama for any political office under any circumstances.

He should never have even been the assistant superintendent in charge

of janitorial supplies, much less the president of the United States.

The truth is that Barack Obama has done such a horrible job that he

should immediately resign along with his entire cabinet. But instead of

giving us a clear choice, the Republicans nominated the Republican that

was running that was most similar to Barack Obama. In fact, I don’t

think we have ever had two candidates for president that are so similar.

Yes, there are a few minor differences between them, but the truth is

that we are heading into Obama’s second term no matter which one of them

gets elected. The mainstream media makes it sound like Obama and

Romney are bitter ideological rivals but that is a giant lie. Yeah,

they are slinging lots of mud at each other, but they both play for the

same team and the losers are going to be the American people. Read More @ EndoftheAmericanDream.com

Today’s Items:

Another day, another prediction of a Greek

exit from the euro zone. Next month there may be the ratification of

the ESM in Germany; thus, a situation that forces Greece leaves the euro

next month. Of course, Greece’s exit will allow for Spain and Italy a

better opportunity at the German supported money trough… Unless the

whole thing collapses.

Due to inflation, zinc, that makes up the

penny, is no longer an option. Last year, it took 2.4 cents to make

each penny. In addition, nickels, which are 75% copper, cost twice as

much to produce as they’re worth. From 2006 to 2011, production of the

cent and nickel generated losses of $359.80 million. In short, after

preparing, if you cannot afford silver and gold, keep stacking those

nickels.

The Central Bank Cabal may believe they

control the world economy; however, according to Bill Fleckenstein,

financial gravity will take over when the markets dictate the value of

the currency printed by Central Banks. Make no mistake, bubbles pop

and the Fed officially or unofficially printing currency, believing

there are no repercussions, is definitely going to eventually produce an

implosion event that will cause people to get the hell out Dodge.

If you are holding your gold and silver in

the form of ETF’s or other paper instruments, you may be in for a real

surprise in the near future. This market cannot even be compared to a

casino since casino’s at least follow some form of rules when taking

your money. It is far better to be holding onto physical gold and

silver; however, what ever you do, avoid storing it in bank safety

deposit boxes.

Bank of America, in the latest act of

crimes, has purposely and deliberately drilled open and removed private

property from customer’s safety deposit boxes. What was the reason?

They claim that they could not find the safety deposit box owners social

security numbers; which was clearly on the application for those safety

deposit boxes. At least the bank notified the owners of the theft.

Believe it or not, there are careers out

there that are literally booming. For example, Al-Qaeda has posted

“suicide bombers wanted” ads in internet forums. The main

qualification for this job is that you must be utterly committed to

completing your mission. Sorry, there will be no trainings,

healthcare benefits of any kind, and you can forget about any retirement

benefits. Only serious applicants should immediately contact the

Department of Homeland Insecurity for this explosive job opportunity.

Bill Gates, who is certainly demonstrated

that he is full of it, has decided to go from windows to the toilet.

How fitting. His claim is that the flush toilets that we use today

are impractical and impossible for many people in the world. Well,

what ever the new toilet will be, you can be sure he is a fan of Sheyl Crow’s proposed limitation of a single toilet tissue square.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment