by Terry Weiss, MoneyMorning:

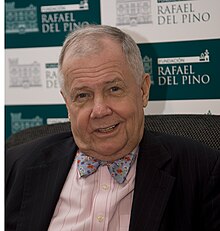

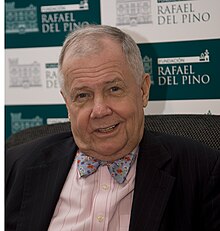

In a riveting interview on CNBC, legendary investor Jim Rogers warned Americans to prepare for “Financial Armageddon,” saying he fully expects the economy to implode after the U.S. election.

Rogers, who for years has been an outspoken critic of the Feds policies of “Quantitative Easing,” says the world is “drowning in too much debt.” He put the blame squarely on U.S. and European governments for abusing their “license to print money.” In the U.S. alone, the national debt has surged to nearly $16 trillion, that’s more than $50,000 for every American man, woman and child.

“[They] need to stop spending money they don’t have,” Rogers said. “The solution to too much debt is not more debt… What would make me very excited is if a few people [in the government] went bankrupt…” Rogers added.

Rogers also charged Obama and German Chancellor Angela Merkel with promoting dangerous policies that create the illusion the economy is stable… but are really only intended to buy time before their upcoming elections.

Read More @ MoneyMorning.com

In a riveting interview on CNBC, legendary investor Jim Rogers warned Americans to prepare for “Financial Armageddon,” saying he fully expects the economy to implode after the U.S. election.

Rogers, who for years has been an outspoken critic of the Feds policies of “Quantitative Easing,” says the world is “drowning in too much debt.” He put the blame squarely on U.S. and European governments for abusing their “license to print money.” In the U.S. alone, the national debt has surged to nearly $16 trillion, that’s more than $50,000 for every American man, woman and child.

“[They] need to stop spending money they don’t have,” Rogers said. “The solution to too much debt is not more debt… What would make me very excited is if a few people [in the government] went bankrupt…” Rogers added.

Rogers also charged Obama and German Chancellor Angela Merkel with promoting dangerous policies that create the illusion the economy is stable… but are really only intended to buy time before their upcoming elections.

Read More @ MoneyMorning.com

Jim Sinclair’s Commentary

Is not Motors the great accomplishment of the present administration’s business sense? "As Motors goes so does the USA" is a very old axiom.

General Motors may hit bankruptcy again!

We are in June 1, 2009. At approximately 8:00 am EST General Motors fills for Chapter 11 reorganization in the Manhattan New York federal bankruptcy court.

The filing reported US$82.29 billion in assets and US$172.81 billion in debt. Is the fourth-largest filing in U.S. history after Lehman Brothers Holdings Inc., Washington Mutual and WorldCom Inc.

Shortly after, Obama administration is announcing that the Government will invest an additional $30.1 billion in General Motors(GM) to finance its bankruptcy reorganization – this after the U.S. government provided $20 billion in aid.

And GM is becoming the new GM – without Hummer, Saturn, Saab and many more operations…

So mission accomplished. Right? Wrong!

GM’s boat is once again taking water, writes Louis Woodhill at Forbes.

The US still owns 26% of the company and would need about $53 a share to break even, a far cry from the current price of $20. That adds up to a current “unrealized loss of $16.4 billion,” writes Woodhill.

“GM is unlikely to hit the wall before the election, but, given current trends, the company could easily do so again before the end of a second Obama term.”

Woodhill goes on to note that the government’s (read: taxpayers’) GM stock is worth about 39% less than it was on November 17, 2010, when the company went public—49% less relative to the Dow Jones Industrial Average, which has risen by almost 20% during the intervening period.

The main problem here is that GM is unable to compete – to create competitive vehicles. In 1960, General Motors averaged a 48.3% share of the U.S. car and truck market. For the first 7 months of 2012, their market share was 18.0%, down from 20.0% for the same period in 2011.

More…

Jim Sinclair’s Commentary

This is just another way to short risk free, and then follow the devil’s mantra of "Short and Distort."

How many commentators of financial TV have had a good word for Facebook?

And Now Facebook’s Bankers Are Divvying Up The $100 Million They Made Shorting Facebook’s Stock Henry Blodget

Boy it doesn’t suck to be a banker.

Every time I forget how much it doesn’t suck, I’m reminded of some other magical cash-printing tool I had forgotten about that allows Wall Street to coin money no matter what.

And this latest one is a beauty.

Remember the Facebook IPO? Yes, it was one of the biggest IPOs ever. It has also now become a colossal disaster that has vaporized half of investors’ capital in three months.

Wall Street bankers were paid extremely handsomely to sell the $16 billion of stock they sold on the Facebook IPO. Specifically, they were paid $176 million in fees.

(Investors who bought Facebook’s stock on the IPO, meanwhile, have since lost $8 billion).

But that was only the beginning.

More…

Jim Sinclair’s Commentary

The Banksters, our financial leaders, and their ass-kissing minions

run everything we are financially interested in. Recognizing danger is

more important now than ever before.

How to spot a sociopath – 10 red flags that could save you from being swept under the influence of a charismatic nut job by Mike Adams, the Health Ranger, NaturalNews Editor

(NaturalNews) One of the more offensive duties of being an investigative journalist is taking out the trash — exposing liars, fraudsters, con artists and scammers for the people they truly are. Each time we investigate a sociopath, we find that they always have a little cult group following of spellbound worshippers who consider that particular sociopath to be a "guru" or "prophet."

Sociopaths are masters at influence and deception. Very little of what they say actually checks out in terms of facts or reality, but they’re extremely skillful at making the things they say sound believable, even if they’re just making them up out of thin air. Here, I’m going to present quotes and videos of some legendary sociopaths who convinced everyday people to participate in mass suicides. And then I’m going to demonstrate how and why similar sociopaths are operating right now… today.

Why cover this subject? I’ve seen a lot of people get hoodwinked, scammed or even harmed by sociopaths, and it bewilders me that people are so easily sucked into their destructive influence. I want to share with NaturalNews readers the warning signs of sociopaths so that you can spot them, avoid them, and save yourself the trouble of being unduly influenced by them.

Much of this information is derived from the fascinating book, The Sociopath Next Door (http://www.amazon.com/Sociopath-Next-Door-Martha-Stout/dp/0767915828), which says that 4% of the population are sociopaths. The book is a fascinating read.

More…

Jim Sinclair’s Commentary

Look at what the Chinese are doing while the West slumbers away. We

are more interested in high frequency trading and OTC derivatives.

China is putting the corner on major base and strategic metals plus gold production

Sunny skies: China’s gold ambitions August 17, 2012 12:11 pm by Robert Cookson

China’s largest gold producer is already a force to be reckoned with. But if the visionary head of China National Gold Corporation gets his way, it’s going to be much, much bigger.

As the FT reported on Friday, the state-owned group is in talks to buy a majority stake in African Barrick Gold from its parent Barrick Gold, the world’s top gold miner.

For anyone seeking an insight into the thinking behind the deal, beyondbrics has translated a fascinating article by Sun Zhaoxue [pictured], president of China National.

The article appeared this month in Qiushi magazine, the main academic journal of the Chinese Communist Party’s Central Committee. The publication is responsible for disseminating communist ideology to officials.

Given the timing of the article and the standing of its author, its contents should not be taken lightly.

More…

Jim Sinclair’s Commentary

Every small step forward is a major advance toward honest money, also known as Gold.

CME Clearing Europe to Accept Gold as Collateral on Demand By Nandini Sukumar and Nicholas Larkin – Aug 17, 2012 8:41 AM ET

CME Clearing Europe will accept physical gold as collateral, extending the list of assets it’s prepared to receive as regulators globally push more derivatives trading through clearing houses.

CME Group Inc. (CME)’s European clearing house, based in London, appointed Deutsche Bank AG (DBK), HSBC Holdings Plc and JPMorgan Chase & Co. as gold depositaries. There will be a 15 percent charge on the market value of gold deposits and a limit of $200 million or 20 percent of the overall initial margin requirement per clearing member based on whichever is lower, Andrew Lamb, chief executive officer of CME Clearing Europe, said today.

“We started with a narrow range of government securities and are now extending that,” Lamb said in an interview today. “We recognize there will be a massive demand for collateral as a result of the clearing mandate. This is part of our attempt to maintain the risk management standard and to offer greater flexibility to clearing members and end clients.”

CME Clearing Europe, which started on May 6 last year, plans to offer interest-rate swaps and more commodities later this year, he said. In the U.S., the Dodd-Frank Act means more derivatives than ever will be processed at a clearing house while the European Markets Infrastructure Regulation is doing the same in the region. JPMorgan in February last year said it will allow gold to be used as collateral for trading, following similar moves by CME Group and Intercontinental Exchange Inc.

Investors and central banks are expanding gold holdings on demand for a protection of wealth and alternative to currencies. Gold held in bullion-backed exchange-traded products reached a record 2,417.3 metric tons on Aug. 10, data compiled by Bloomberg show. Central banks bought 254.2 tons in the first half of 2012 and may add close to 500 tons for the year as a whole, the London-based World Gold Council said yesterday.

More…

Jim Sinclair’s Commentary

Every step forward, large or smal,l is a step closer to Gold as honest Money.

Big Changes Ahead: Gold Just Became Money Again Doug Hornig, Senior Editor

August 17, 2012 10:15am GMT

On June 18, the Federal Reserve and FDIC circulated a letter to banks that proposes to harmonize US regulatory capital rules with Basel III.

BASEL III is an accord that tells a bank how much capital it must hold to safeguard its solvency and overall economic stability.

It’s a global standard on bank capital adequacy, stress testing, and market liquidity risk.

Here’s the important bit:

At the top of the proposed changes is the new list of "zero-percent risk weighted items," which now includes "gold bullion," right after "cash."

That’s the part to take notice of.

If the proposals are approved by regulators – and that seems likely since adoption of Basel III will be– then this is a momentous change for the gold market.

Now banks will be allowed to hold bullion in their vaults and count it among their Tier 1 assets – in other words, the least risky assets.

That by itself would be bullish for the gold price, as banks that recognize gold’s unique characteristics seek to stockpile more of it.

More…

Jim Sinclair’s Commentary

It is everywhere you look. This is the age of you do the crime but

not the time if you steal enough for good counsel or contacts.

Made any good internet investments lately?

Officials Freeze Assets Of Online Company Described As $600 Million Ponzi Scheme Aug. 18, 2012, 6:58 AM

RALEIGH, N.C. (AP) — Federal securities regulators have filed fraud charges and an emergency order to freeze the assets of a North Carolina company officials say operated a $600 million Ponzi scheme that is on the verge of collapse.

The action by the Securities and Exchange Commission Friday is intended to help investors recoup money and avoid devastating losses.

Online marketer Paul Burks of Lexington, N.C., is accused in a federal complaint of raising money from more than 1 million customers through ZeekRewards.com, a website in operation less than two years.

Burks could not immediately be reached for comment Friday and the website has been taken down.

Clifton Jolley, a Texas-based communications consultant representing the website’s parent company, Rex Venture Group, said Burks had agreed to settle the SEC charges but that he has neither admitted nor denied the allegations against him. Jolley said Burks will cooperate with federal officials and a court-appointed receiver.

More…

Jim Sinclair’s Commentary

Now here is one of the dumbest of economic stimulants as it is

unsustainable because at least now the Labor department has no means of

printing money. How does anyone really believe the softness in

employment is just a passing cloud?

Labor Dept. Attempts to Stop Layoffs by Giving $100 Million to States to Subsidize Payrolls By Penny Starr

August 15, 2012

(CNSNews.com) – The Labor Department announced on Monday that it will be awarding almost $100 million in grant funding to states to prevent layoffs by allowing businesses to pay employees as part-time workers and the federal government will pick up the tab for the cost of a full-time paycheck.

The “work-sharing” program was passed as part of a Republican-led bill in the House, H.R. 3630, and Senate Amendment 1465 to extend the payroll tax deduction and unemployment benefits. In February 2012, President Barack Obama signed the bill into law, which included the $100 million in funding.

"Establishing or expanding work-sharing programs nationwide will help business owners better weather hard economic times by temporarily reducing their labor costs while still keeping their existing skilled employees," Labor Secretary Hilda L. Solis said in the press release announcing the grants. "This program is a win-win for businesses and employees alike."

The work-sharing programs “allows employees to keep their jobs and helps employers to avoid laying off their trained workforces during economic downturns by reducing the hours of work for an entire group of affected workers,” according to the Labor Department.

The grants will be given to states that apply and meet certain requirements, including having short-term compensation programs in place that meet federal guidelines. Workers will have “wages compensated with a portion of their weekly unemployment compensation payments,” according to the Labor Department.

More…

Dear Jim,

My impression is that virtually no one understands the issues here and doesn’t see the oncoming headlights. I guess I shouldn’t be surprised and no doubt you aren’t either by the total ignorance people have over issues of systemic risk. If these are the proposals to help us being made by those whose job is to protect us, we are screwed. That should be news to no one.

Thanks for all you do to educate your readers,

CIGA Rich G

Dear Richard,

There is no question that your summation is correct. We are all royally screwed.

Regards,

Jim

Jim

Jean-Claude

Juncker, leader of the eurozone finance ministers’ group, said he

believes Greece will not leave the single currency as he prepares for

talks in Athens next week.

by Nathalie Thomas and agencies, The Telegraph:

Mr Juncker, also Prime Minister of Luxembourg, told an Austrian newspaper that a Greek exit from the eurozone “won’t happen” as he is confident the country will “redouble its efforts” to meet austerity targets.

The Eurogroup chief will meet Greek Prime Minister Antonis Samaras in Athens on Wednesday amid speculation that Greece will seek more time to implement austerity cuts.

“It won’t happen,” Mr Juncker told Austria’s Tiroler Tageszeitung, when he was asked about the likelihood of a Greek exit from eurozone.

Read More @ Telegraph.co.uk

by Nathalie Thomas and agencies, The Telegraph:

Mr Juncker, also Prime Minister of Luxembourg, told an Austrian newspaper that a Greek exit from the eurozone “won’t happen” as he is confident the country will “redouble its efforts” to meet austerity targets.

The Eurogroup chief will meet Greek Prime Minister Antonis Samaras in Athens on Wednesday amid speculation that Greece will seek more time to implement austerity cuts.

“It won’t happen,” Mr Juncker told Austria’s Tiroler Tageszeitung, when he was asked about the likelihood of a Greek exit from eurozone.

Read More @ Telegraph.co.uk

America's Demographic Cliff: The Real Issue In The Coming, And All Future Presidential Elections

In four months the debate over America's Fiscal cliff will come to a crescendo, and if Goldman is correct (and

in this case it likely is), it will probably be resolved in some sort

of compromise, but not before the market swoons in a replica of the

August 2011 pre- and post-debt ceiling fiasco: after all politicians

only act when they (and their more influential, read richer, voters and

lobbyists) see one or two 0's in their 401(k)s get chopped off. But

while the Fiscal cliff is unlikely to be a key point of contention far

past December, another cliff is only starting to be appreciated, let

alone priced in: America's Demographic cliff, which in a decade or two will put Japan's ongoing demographic crunch to shame, and with barely 2 US workers for every retired person in 2035,

we can see why both presidential candidates are doing their darnedest

to skirt around the key issue that is at stake not only now, be every

day hence.

In four months the debate over America's Fiscal cliff will come to a crescendo, and if Goldman is correct (and

in this case it likely is), it will probably be resolved in some sort

of compromise, but not before the market swoons in a replica of the

August 2011 pre- and post-debt ceiling fiasco: after all politicians

only act when they (and their more influential, read richer, voters and

lobbyists) see one or two 0's in their 401(k)s get chopped off. But

while the Fiscal cliff is unlikely to be a key point of contention far

past December, another cliff is only starting to be appreciated, let

alone priced in: America's Demographic cliff, which in a decade or two will put Japan's ongoing demographic crunch to shame, and with barely 2 US workers for every retired person in 2035,

we can see why both presidential candidates are doing their darnedest

to skirt around the key issue that is at stake not only now, be every

day hence.

We The Sheeplez... is intended to reflect

excellence in effort and content. Donations will help maintain this goal

and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

I'm PayPal VerifiedThe US Money Markets And The Price Of Gold

What

do USD money markets have to do with gold? Money market funds invest

in short-term highly rated securities, like US Treasury bills

(sovereign risk) and commercial paper (corporate credit). But who

supplies such securities to these funds? For the purpose of our

discussion, participants in the futures markets, who look for secured

funding. They sell their US Treasury bills, under repurchase agreements,

to money market funds. These repurchase transactions, of course, take

place in the so-called repo market. The repo market supplies money

market funds with the securities they invest in. Now… what do

participants in the futures markets do, with the cash obtained against

T-bills? They, for instance, fund the margins to obtain leverage and

invest in the commodity futures markets. In summary: There are people

(and companies) who exchange their cash for units in money market

funds. These funds use that cash to buy – under repurchase agreements -

US Treasury bills from players in the futures markets. And the players

in the futures markets use that cash to fund the margins, obtain

leverage, and buy positions. What if these positions (financed with the

cash provided by the money market funds) are short positions in gold

(or other commodities)? Now, we can see what USD money markets have to

do with gold! Let’s propose a few potential scenarios, to understand

how USD money markets and gold are connected...

What

do USD money markets have to do with gold? Money market funds invest

in short-term highly rated securities, like US Treasury bills

(sovereign risk) and commercial paper (corporate credit). But who

supplies such securities to these funds? For the purpose of our

discussion, participants in the futures markets, who look for secured

funding. They sell their US Treasury bills, under repurchase agreements,

to money market funds. These repurchase transactions, of course, take

place in the so-called repo market. The repo market supplies money

market funds with the securities they invest in. Now… what do

participants in the futures markets do, with the cash obtained against

T-bills? They, for instance, fund the margins to obtain leverage and

invest in the commodity futures markets. In summary: There are people

(and companies) who exchange their cash for units in money market

funds. These funds use that cash to buy – under repurchase agreements -

US Treasury bills from players in the futures markets. And the players

in the futures markets use that cash to fund the margins, obtain

leverage, and buy positions. What if these positions (financed with the

cash provided by the money market funds) are short positions in gold

(or other commodities)? Now, we can see what USD money markets have to

do with gold! Let’s propose a few potential scenarios, to understand

how USD money markets and gold are connected...BTFD...Keep Stacking...It Really Is That Easy...

Invest In Something You Know A Lot About

Admin at Jim Rogers Blog - 6 hours ago

Investors should be investing in and owning things they know about. If you

don’t know what you’re doing or don’t have something you think is going to

be a good investment, you should do nothing.

The problem these days is even if you put your money in cash, what kind of

cash? Some cash is better than others. But even if you don’t know any

better, just put your money in U.S. dollars in the bank and wait until you

find something you know a lot about. - *excerpt form The Coming Fiscal

Catastrophe*

*Jim Rogers is an author, financial commentator and successful

international investor. He... more »

Massive Yet Discrete Accumulation in Gold

Eric De Groot at Eric De Groot - 9 hours ago

A surge in the GLD total assets WA stochastic reveals massive yet

discrete accumulation in gold (chart). Chart: London PM Fixed Gold and GLD

(ETF) Total Assets WA Stochastic I know many readers and community

members are saying "BFD (Big F-ing deal), I've heard this story endless

times only to see nothing happen in gold." All I can say is that the...

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]]

Trader Dan on King World News Markets and Metals Wrap

Trader Dan at Trader Dan's Market Views - 15 hours ago

Please click on the following link to listen in to my regular weekly radio

interview with Eric King on the KWN Markets and Metals Wrap.

*http://tinyurl.com/c7e9o6y*

**

Spanish bad loans increase dramatically/Spain to issue increasing levels of debt/

Harvey Organ at Harvey Organ's - The Daily Gold and Silver Report - 16 hours ago

Good

morning Ladies and Gentlemen:

Gold closed up today by 40 cents to $1616.50. Silver fell by 21 cents

to $28.00 in the rather lacklustre day. The only big news of the day

came from Spain where it announced an increase in bad banks loans. It

also said it will probably increase it's offerings through sovereign

auctions.We will see these and other stories but first....

Let us now proceed toWhen Darwin Failed: "Fishing For Perfect Markets"

Perhaps

the biggest affront to the natural order of things set in motion by

central planners' intervention in capital markets of all varieties, is

that through sheer brute force (of a printer, of posturing, and of

outright politicized pandering), several academics in a low-lit room

can suppress, for a brief period of time, the Darwinian survival of the

fittest. Key word here is "brief" because in the end nature always

gets even, and usually with a vengeance. In the meantime, however, epic

distortions in what are already indefinitely irrational markets,

which however always eventually regress to a

rational mean (in popular jargon a process better known as "crash"),

succeed in driving out legacy traders who no longer can navigate the

chaos unleashed by the authoritarian ambitions oh the kind that

ultimately resulted in the collapse of the Soviet Union, and every

other centrally-planned establishment, when abused on a long-enough

timeline... For a vivid example of what happens "when Darwinism fails"

we go to a parable from a just released letter to client by the

English hedge fund Toscafund, which looks at modern day trading from

the perspective of fishing in the Polynesian seas, which also does an

admirable job in explaining why being lucky is almost always more

important than being good (sadly, one can not sell "luck" in newsletter

format for $29.95/ month).

Perhaps

the biggest affront to the natural order of things set in motion by

central planners' intervention in capital markets of all varieties, is

that through sheer brute force (of a printer, of posturing, and of

outright politicized pandering), several academics in a low-lit room

can suppress, for a brief period of time, the Darwinian survival of the

fittest. Key word here is "brief" because in the end nature always

gets even, and usually with a vengeance. In the meantime, however, epic

distortions in what are already indefinitely irrational markets,

which however always eventually regress to a

rational mean (in popular jargon a process better known as "crash"),

succeed in driving out legacy traders who no longer can navigate the

chaos unleashed by the authoritarian ambitions oh the kind that

ultimately resulted in the collapse of the Soviet Union, and every

other centrally-planned establishment, when abused on a long-enough

timeline... For a vivid example of what happens "when Darwinism fails"

we go to a parable from a just released letter to client by the

English hedge fund Toscafund, which looks at modern day trading from

the perspective of fishing in the Polynesian seas, which also does an

admirable job in explaining why being lucky is almost always more

important than being good (sadly, one can not sell "luck" in newsletter

format for $29.95/ month).Sanctions Force Iranian Retreat from Global Stage

The Organization of Petroleum Economies, in its August report, said Iranian crude oil production in part led to a decline in overall output from the Vienna-based cartel. OPEC said crude oil production for its members, not including Iraq, was reported at 28.1 million barrels per day in July, a decline of 270,000 bpd compared with the previous month. The decline in OPEC oil production in part was led by Iran, which saw its export options curtailed by sanctions imposed by the U.S. and European governments. Tehran announced it still had a viable consumer base in China, however, which received about 12 percent of its oil needs from Iran. The Indian government, meanwhile, said it would circumvent EU sanctions by extending government-backed insurance to tankers carrying Iranian crude because of the "definite need" for oil.Why Goldman Refuses To Raise Its S&P 1250 Year End Forecast

The S&P 500 is at its 2012 highs, and rapidly approaching all time highs, even as nothing has

changed over the biggest near-term challenge facing America: the

fiscal cliff. Ironically, with every tick higher in the market, the

probability that Congress will come to a consensus over what would be a

haircut of up to 4% to next year's GDP as soon as January 1 2013 gets

smaller. Why - the same reason that Spain is unlikely to demand a

bailout now that its 10 Year bond is back to the mid 6% range

(ironically on expectations it will demand a bailout!): complacency - both by investors, and by politicians.

After all, it's is all a matter of perception, and the market is seen

to be "perceiving" an all clear signal. It means that the impetus to do

something constructive simply does not exist, as we explained recently in

the case of Spain (and Italy). It also means that Congress has no

reason to be proactive about the biggest threat facing the economy: just

look at the S&P - it sure isn't worried, and the

market is supposed to be far more efficient than elected politicians.

At least on paper. This line of thinking is also the reason why

Goldman's head of equity strategy David Kostin (not to be confused with

the person he replaced: permabull A Joseph Cohen, who off the record

sees the S&P rising to 1600 or more) refuses to raise his year end

forecast for the S&P, which has remained firmly at 1250 for the

entire year. More muppetry, more dodecatuple reverse psychology, or is

Goldman telling the truth? You decide.

The S&P 500 is at its 2012 highs, and rapidly approaching all time highs, even as nothing has

changed over the biggest near-term challenge facing America: the

fiscal cliff. Ironically, with every tick higher in the market, the

probability that Congress will come to a consensus over what would be a

haircut of up to 4% to next year's GDP as soon as January 1 2013 gets

smaller. Why - the same reason that Spain is unlikely to demand a

bailout now that its 10 Year bond is back to the mid 6% range

(ironically on expectations it will demand a bailout!): complacency - both by investors, and by politicians.

After all, it's is all a matter of perception, and the market is seen

to be "perceiving" an all clear signal. It means that the impetus to do

something constructive simply does not exist, as we explained recently in

the case of Spain (and Italy). It also means that Congress has no

reason to be proactive about the biggest threat facing the economy: just

look at the S&P - it sure isn't worried, and the

market is supposed to be far more efficient than elected politicians.

At least on paper. This line of thinking is also the reason why

Goldman's head of equity strategy David Kostin (not to be confused with

the person he replaced: permabull A Joseph Cohen, who off the record

sees the S&P rising to 1600 or more) refuses to raise his year end

forecast for the S&P, which has remained firmly at 1250 for the

entire year. More muppetry, more dodecatuple reverse psychology, or is

Goldman telling the truth? You decide.Will The Bernank Save The Equity Markets?

How far is the Fed from reaching the bottom of its ammunition box? Well, both Mario Draghi and Ben Bernanke said no to yet more monetary stimulus recently. Wall Street unsurprisingly was disappointed. Wall Street expected more stimulus, as institutional investors are analyzing monetary policy from their own perspective rather than the central bank's viewpoint – understandable, but a big mistake. Wall Street's Conundrum: with the S&P 500 up less than 7% in 2012, the year is almost over, and the investment firms have little to show for it."The Euro Crisis May Last 20 Years" - The European Headlines Are Back

In Europe, the "no news" vacation for the past month was great news. The news is back... As is Merkel.- "The Euro Crisis May Last 20 Years" - Welt

- German finmin: no new aid programme for Greece - Reuters

- Westerwelle Opposes Relaxing Greek Aid Terms: Tagesspiegel

- Euro Countries Plan Strategies to Prevent Break-Up: Sueddeutsche (via Bloomberg)

- Deutsche Bank Among Four Said to Be in U.S. Laundering Probe - Bloomberg

- Bundesbank Vice-Head Opposes Schaeuble’s Banking Proposal: WiWo (via Bloomberg)

- Westerwelle Opposes Relaxing Greek Aid Terms: Tagesspiegel

- German Industry Group Head says No Place In Greece For Eurozone: WiWo (via Bloomberg)

- German Taxpayer Association Head Criticises ESM: Euro am Sonntag (via Bloomberg)

- Spain says there must be no limit set on ECB bond buying - RTRS

- France Favors Greece Rescue Package, Opposing Germany: Welt (via Bloomberg)

ATP Oil And Gas Files For Bankruptcy, CEO Blames Obama

Now

that the "alternative energy" industry is in shambles following one

after another solar company bankruptcy, as the realization that at

current prices, alternative energy business models are still just too

unsustainable, no matter how much public equity is pumped into them,

more "traditional" companies have resumed circling the drain. First, it

was Patriot Coal, which finally succumbed to reality a month ago. Now it is the turn of ATP Oil and Gas, which filed Chapter 11 in Texas last night.

And sure enough, in a world in which nobody is to blame, and

everything is someone else's fault, the CEO promptly made a case that

he is blameless and it is all Obama's fault. According to Forbes: "The

founder and chairman of [ATP Paul Bulmahn] wants the world to know that

the Obama Administration—and its illegal ban on deepwater drilling in

the wake of the BP disaster—is to blame for the implosion of his

company. Not him. “It is all directly attributable to what the government did to us,” he rails. “This Administration has gone out of its way to create problems for my company, the company that I formed from scratch.”

Now

that the "alternative energy" industry is in shambles following one

after another solar company bankruptcy, as the realization that at

current prices, alternative energy business models are still just too

unsustainable, no matter how much public equity is pumped into them,

more "traditional" companies have resumed circling the drain. First, it

was Patriot Coal, which finally succumbed to reality a month ago. Now it is the turn of ATP Oil and Gas, which filed Chapter 11 in Texas last night.

And sure enough, in a world in which nobody is to blame, and

everything is someone else's fault, the CEO promptly made a case that

he is blameless and it is all Obama's fault. According to Forbes: "The

founder and chairman of [ATP Paul Bulmahn] wants the world to know that

the Obama Administration—and its illegal ban on deepwater drilling in

the wake of the BP disaster—is to blame for the implosion of his

company. Not him. “It is all directly attributable to what the government did to us,” he rails. “This Administration has gone out of its way to create problems for my company, the company that I formed from scratch.”

from TheHealthRanger:

Gun Control is Genocide. Why? Because throughout history, citizen disarmament has always been a precursor of mass genocide carried out by government gone bad. The term for it is “democide.”

Gun Control is Genocide. Why? Because throughout history, citizen disarmament has always been a precursor of mass genocide carried out by government gone bad. The term for it is “democide.”

from Testosterone Pit.com:

“That amount of radium found to date cannot be explained by gauges, deck markers, and decontamination activities,” wrote

Stephen Woods, an environmental cleanup manager at the California

Department of Public Health, about Treasure Island, the rectilinear

speck of land in the San Francisco Bay two-and-a-half miles of white

caps from our kitchen window. It summed up decades of US Government

efforts to bury nuclear sins under layers of ignorance.

“That amount of radium found to date cannot be explained by gauges, deck markers, and decontamination activities,” wrote

Stephen Woods, an environmental cleanup manager at the California

Department of Public Health, about Treasure Island, the rectilinear

speck of land in the San Francisco Bay two-and-a-half miles of white

caps from our kitchen window. It summed up decades of US Government

efforts to bury nuclear sins under layers of ignorance.

The US Government created Treasure Island from fill in 1937 and connected it to Yerba Buena Island, the overgrown rock in the middle of the Bay Bridge. After the Golden Gate International Exposition in 1939/1940, it became a naval base. In 1993, the Navy started the process of cleaning up the island so that the City of San Francisco, which had agreed to buy it for $105 million, would accept it—pending approval by state health officials.

Meanwhile, 2,800 people, oblivious to what was buried on the island, moved into the housing units they rented from the Navy. Developers are scheduled to break ground on a high-rise complex next year. The population could eventually swell to 20,000. Alas, in an excellent piece of reporting, The Bay Citizen, a nonprofit news organization, reveals a homegrown nuclear debacle kept out of public view by decades of deception.

Read More @ TestosteronePit.com

“That amount of radium found to date cannot be explained by gauges, deck markers, and decontamination activities,” wrote

Stephen Woods, an environmental cleanup manager at the California

Department of Public Health, about Treasure Island, the rectilinear

speck of land in the San Francisco Bay two-and-a-half miles of white

caps from our kitchen window. It summed up decades of US Government

efforts to bury nuclear sins under layers of ignorance.

“That amount of radium found to date cannot be explained by gauges, deck markers, and decontamination activities,” wrote

Stephen Woods, an environmental cleanup manager at the California

Department of Public Health, about Treasure Island, the rectilinear

speck of land in the San Francisco Bay two-and-a-half miles of white

caps from our kitchen window. It summed up decades of US Government

efforts to bury nuclear sins under layers of ignorance.The US Government created Treasure Island from fill in 1937 and connected it to Yerba Buena Island, the overgrown rock in the middle of the Bay Bridge. After the Golden Gate International Exposition in 1939/1940, it became a naval base. In 1993, the Navy started the process of cleaning up the island so that the City of San Francisco, which had agreed to buy it for $105 million, would accept it—pending approval by state health officials.

Meanwhile, 2,800 people, oblivious to what was buried on the island, moved into the housing units they rented from the Navy. Developers are scheduled to break ground on a high-rise complex next year. The population could eventually swell to 20,000. Alas, in an excellent piece of reporting, The Bay Citizen, a nonprofit news organization, reveals a homegrown nuclear debacle kept out of public view by decades of deception.

Read More @ TestosteronePit.com

by Byron Tau and Dylan Byers, Politico:

President Barack Obama has been taking a lot of questions in the two

months since his last press conference or national news interview. He’s

just been doing them with ESPN, Entertainment Tonight, People Magazine and FM radio stations around the country, mostly to talk local sports and regional cuisine.

President Barack Obama has been taking a lot of questions in the two

months since his last press conference or national news interview. He’s

just been doing them with ESPN, Entertainment Tonight, People Magazine and FM radio stations around the country, mostly to talk local sports and regional cuisine.

This isn’t a mistake. Even at the height of a campaign in which they’ve been firing hard at Mitt Romney and trying to keep hold of the news cycle, Obama’s reelection staffers are pretty sure most voters aren’t tuning in.

“People get their news in many different ways,” Obama campaign spokeswoman Jen Psaki told POLITICO. “Sometimes it’s turning on ‘Entertainment Tonight’ and seeing what the latest news is out there.”

Psaki said the president will be doing a variety of media appearances in the coming weeks with both national and local outlets, but for now, “We’re reaching an audience that may not be paying attention to the day-to-day political back and forth.”

Read More @ Politico

President Barack Obama has been taking a lot of questions in the two

months since his last press conference or national news interview. He’s

just been doing them with ESPN, Entertainment Tonight, People Magazine and FM radio stations around the country, mostly to talk local sports and regional cuisine.

President Barack Obama has been taking a lot of questions in the two

months since his last press conference or national news interview. He’s

just been doing them with ESPN, Entertainment Tonight, People Magazine and FM radio stations around the country, mostly to talk local sports and regional cuisine.This isn’t a mistake. Even at the height of a campaign in which they’ve been firing hard at Mitt Romney and trying to keep hold of the news cycle, Obama’s reelection staffers are pretty sure most voters aren’t tuning in.

“People get their news in many different ways,” Obama campaign spokeswoman Jen Psaki told POLITICO. “Sometimes it’s turning on ‘Entertainment Tonight’ and seeing what the latest news is out there.”

Psaki said the president will be doing a variety of media appearances in the coming weeks with both national and local outlets, but for now, “We’re reaching an audience that may not be paying attention to the day-to-day political back and forth.”

Read More @ Politico

by Nicholas Larkin, Bullion Street:

Gold traders are the most bullish in six weeks as investors boosted

their bullion holdings to a record on concern that economic growth is

slowing and after billionaires John Paulson and George Soros bought more

metal. Fourteen of 26 analysts surveyed by Bloomberg expect prices to

rise next week and six were bearish.

Gold traders are the most bullish in six weeks as investors boosted

their bullion holdings to a record on concern that economic growth is

slowing and after billionaires John Paulson and George Soros bought more

metal. Fourteen of 26 analysts surveyed by Bloomberg expect prices to

rise next week and six were bearish.

A further six were neutral, making the proportion of bulls the highest since July 6. Paulson raised his stake in the SPDR Gold Trust, the biggest gold-backed exchange-traded product, by 26% in the second quarter and Soros more than doubled his holding, U.S. Securities and Exchange Commission filings showed August 14. Global holdings reached a record on August 10, data compiled by Bloomberg show.

The euro-area contracted in the second quarter after the worsening debt crisis forced at least six nations into recessions, European Union data showed August 14. gold bar and coin purchases jumped 15% in Europe in the period, the World Gold Council said.

Read More @ BullionStreet.com

Gold traders are the most bullish in six weeks as investors boosted

their bullion holdings to a record on concern that economic growth is

slowing and after billionaires John Paulson and George Soros bought more

metal. Fourteen of 26 analysts surveyed by Bloomberg expect prices to

rise next week and six were bearish.

Gold traders are the most bullish in six weeks as investors boosted

their bullion holdings to a record on concern that economic growth is

slowing and after billionaires John Paulson and George Soros bought more

metal. Fourteen of 26 analysts surveyed by Bloomberg expect prices to

rise next week and six were bearish.A further six were neutral, making the proportion of bulls the highest since July 6. Paulson raised his stake in the SPDR Gold Trust, the biggest gold-backed exchange-traded product, by 26% in the second quarter and Soros more than doubled his holding, U.S. Securities and Exchange Commission filings showed August 14. Global holdings reached a record on August 10, data compiled by Bloomberg show.

The euro-area contracted in the second quarter after the worsening debt crisis forced at least six nations into recessions, European Union data showed August 14. gold bar and coin purchases jumped 15% in Europe in the period, the World Gold Council said.

Read More @ BullionStreet.com

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment