Pimco Increases Gold Allocation From 10.5% To 11.5% In Commodity Fund

Moments

ago, the FOMC members formalized their opinion on where inflation is

heading: "Most members continued to anticipate that, with longer-term

inflation expectations stable and the existing slack in resource

utilization being taken up very gradually, inflation would run over the medium term at a rate at or below the Committee’s objective of 2 percent."

The only conclusion one can derive from this is that since the

perpetually wrong FOMC committee, which has never accurately predicted

any one thing in its entire history, sees little to no inflation,

inflation is most likely about to soar. A convenient independent

confirmation of this assumption comes from none other than bond manager

PIMCO which moments ago announce that it was adding to its gold

holdings "on inflation concerns...as it bets that global inflation

rates will pick up over the next three to five years." Specifically,

"The Pimco Commodity Real Return Strategy Fund, which has about $20

billion in assets, has increased its gold holdings to 11.5% of

total assets recently, from 10.5% two months ago, and has been adding

to the position when gold prices dipped toward $1,500 a troy ounce,

says Nic Johnson, the fund's co-portfolio manager." And with

global asset managers allocating about 1% of their AUM to the precious

metal, should the majority of them copycat PIMCO in this move, then

gold would cross the psychological $2,000 barrier in minutes. The irony

is that for a bond manager, which Pimco just happens to be the biggest

in the world, inflation is your worst friend. So acknowledging its

imminent creep, is hardly "talking one's book."

Moments

ago, the FOMC members formalized their opinion on where inflation is

heading: "Most members continued to anticipate that, with longer-term

inflation expectations stable and the existing slack in resource

utilization being taken up very gradually, inflation would run over the medium term at a rate at or below the Committee’s objective of 2 percent."

The only conclusion one can derive from this is that since the

perpetually wrong FOMC committee, which has never accurately predicted

any one thing in its entire history, sees little to no inflation,

inflation is most likely about to soar. A convenient independent

confirmation of this assumption comes from none other than bond manager

PIMCO which moments ago announce that it was adding to its gold

holdings "on inflation concerns...as it bets that global inflation

rates will pick up over the next three to five years." Specifically,

"The Pimco Commodity Real Return Strategy Fund, which has about $20

billion in assets, has increased its gold holdings to 11.5% of

total assets recently, from 10.5% two months ago, and has been adding

to the position when gold prices dipped toward $1,500 a troy ounce,

says Nic Johnson, the fund's co-portfolio manager." And with

global asset managers allocating about 1% of their AUM to the precious

metal, should the majority of them copycat PIMCO in this move, then

gold would cross the psychological $2,000 barrier in minutes. The irony

is that for a bond manager, which Pimco just happens to be the biggest

in the world, inflation is your worst friend. So acknowledging its

imminent creep, is hardly "talking one's book."

UPDATE: Friends, I just received this note from our friend and mortgage fraud expert Vermont Trotter regarding this story:

“The trusts are all empty. The master loan doc contractually

allows for the hypothecation and re-hypothecation of the assets.

Hypothecation is a legal term meaning to pledge, but not deliver an

asset. To hypothecate means there is no true sale of the asset. To

re-hypothecate means it can be pledged multiple times and, again, never

have a true sale. No one owns anything.” – V. Trotterfrom Foreclosuredefensenationwide:

August 21, 2012

August 21, 2012Confirming, under oath and in print what we already suspected: there is no schedule of mortgage loans evidencing what JPM allegedly “purchased” from the FDIC in connection with the failure of WaMu. This is from the sworn deposition testimony of Lawrence Nardi, the operations unit manager and a mortgage officer for JPM, who was previously with WaMu and was picked up by JPM after WaMu’s failure. The 330 page deposition was taken by counsel for the homeowner on May 9, 2012 in the matter of JPMorgan Chase Bank, N.A. as successor in interest to Washington Mutual Bank v. Waisome, Florida 5th Judicial Circuit Case No. 2009-CA-005717. Read More…

by Mac Slavo, SHTFPlan:

As the election season heats up, the White House Insider is keeping details of activity from within the Obama administration flowing. Having been well ahead of breaking news stories like Fast & Furious, the Solyndra scandal and a host of other D.C. goings on, Insider is advising that something is amiss with the Vice President’s latest trip to Florida.

Reports from top national news wires indicate Vice President Biden will be in town during the GOP convention so that he can “look his opponents in the eyes next week when he campaigns in Tampa.” Other than this limited campaign information, few additional details about Joe Biden’s trip have been released to the media.

But according to The Ulsterman Report’s source inside the White House, this is no typical campaign trip. It’s to take place in the midst of the Republican National Convention and it just doesn’t make sense from a political standpoint, especially since Secret Service reportedly had no protocols in place for protective details until just 72 hours ago.

As the election season heats up, the White House Insider is keeping details of activity from within the Obama administration flowing. Having been well ahead of breaking news stories like Fast & Furious, the Solyndra scandal and a host of other D.C. goings on, Insider is advising that something is amiss with the Vice President’s latest trip to Florida.

Reports from top national news wires indicate Vice President Biden will be in town during the GOP convention so that he can “look his opponents in the eyes next week when he campaigns in Tampa.” Other than this limited campaign information, few additional details about Joe Biden’s trip have been released to the media.

But according to The Ulsterman Report’s source inside the White House, this is no typical campaign trip. It’s to take place in the midst of the Republican National Convention and it just doesn’t make sense from a political standpoint, especially since Secret Service reportedly had no protocols in place for protective details until just 72 hours ago.

That Biden visit to Tampa got my wheels spinning. What the hell are they up to? How far is Biden willing to go to remain relevant? To stay on the ticket? So I put some feelers out to the WH. Got lots of people willing to talk and share these days.

Read More @ SHTFPlan.com

Citi Sees Greek Exit As Soon As September

"Prolonged

economic weakness will persist - especially in the peripheral

countries - with further periods of intense financial market stress" is

how Citi's Willem Buiter's economics team sees the future in Europe.

While they continue to believe that the probability of a Greece exit

from the Euro is around 90% in the next 12-18 months; but more

critically it is increasingly likely in the next six months - conceivably as soon as September/October depending on the TROIKA report.

There is a crucial series of meetings and events in coming weeks and

while they believe that the ECB's conditional bond-buying (and ESM/EFSF)

may help avoid a 'Lehman moment' around the GRExit, they believe that

there will still be considerably capital flight out of periphery assets

should it occur. The reason being simply that even if funding costs

were reduced, the current mix of fiscal austerity and

supply-side reform will not return any periphery country to a

sustainable fiscal path in coming years.

"Prolonged

economic weakness will persist - especially in the peripheral

countries - with further periods of intense financial market stress" is

how Citi's Willem Buiter's economics team sees the future in Europe.

While they continue to believe that the probability of a Greece exit

from the Euro is around 90% in the next 12-18 months; but more

critically it is increasingly likely in the next six months - conceivably as soon as September/October depending on the TROIKA report.

There is a crucial series of meetings and events in coming weeks and

while they believe that the ECB's conditional bond-buying (and ESM/EFSF)

may help avoid a 'Lehman moment' around the GRExit, they believe that

there will still be considerably capital flight out of periphery assets

should it occur. The reason being simply that even if funding costs

were reduced, the current mix of fiscal austerity and

supply-side reform will not return any periphery country to a

sustainable fiscal path in coming years.Behold The "New Normal" Buyers Of First, Last And Only Resort

In a "new normal" "market" that has long since given up discounting fundamental news, and merely reacts to how any given central planner banker blinks, coughs, sneezes, or otherwise hints on future monetary injection plans at any given moment, it is useful to know the only market players that matter. Courtesy of Guggenheim, they are listed out below - these are no longer the major TBTF banks, Jamie Dimon and Lloyd Blankfein ambitions to rule the world notwithstanding; they are now the world's central banks, whose assets are rapidly approaching their host sovereign GDPs even as their overall leverage is increasing by leaps and bounds on a daily basis, putting such recent Investment Bank overlevered behemoths to shame. It is in this playing field where the price of any one "risk asset" is no longer indicative of anything more than monetary, and in a world in which politicians have long been made obsolete by the central planners, fiscal policies. It also means that capital markets are only whatever the various central bankers want to make them... and nothing else.

Gold (and silver) Is Getting Ready For Big Move

Dave in Denver at The Golden Truth - 25 minutes ago

*The bottom line here is that these large, well-financed entities are now

anticipating inflation for the foreseeable future. This means the ‘risk

on’ trade is back in vogue, and we should see higher prices for gold and

silver going forward. I would also add that there is a great deal of money

on the sidelines and this means we will see some violent action as these

markets move to the upside* *- *Dan Norcini from King World News LINK

The price of gold has been in a massive consolidation phase for about a

year. With or without help from another round of QE, the world's oldest ... more »

PIMCO Buying Gold

Trader Dan at Trader Dan's Market Views - 3 hours ago

Dow Jones is reporting this morning that PIMCO's Commodity Real Return

Strategy Fund, with about $20 billion in assets, has raised its gold

holdings to 11.5% of it total assets from 10.5% two months ago. The

position was apparently taken when gold dipped towards $1500 according to

comments from Nic Johnson, its co-portfolio manager.

Their concern is a triple one - loose monetary policy, high levels of

sovereign debt and rising commodity prices are going to fuel an inflation

outbreak as we move ahead.

Sounds familiar doesn't it?

Here is the point - the chart in gold showed tremendou... more »

Video: How To Protect Yourself From Debased Currencies

Admin at Jim Rogers Blog - 4 hours ago

Related: iShares Silver Trust (ETF) (NYSE:SLV), SPDR Gold Trust (ETF)

(NYSE:GLD), United States Oil Fund LP (ETF) (NYSE:USO), PowerShares DB

Agriculture Fund (NYSE:DBA)

*

**Jim Rogers is an author, financial commentator and successful

international investor. He has been frequently featured in Time, The New

York Times, Barron’s, Forbes, Fortune, The Wall Street Journal, The

Financial Times and is a regular guest on Bloomberg and CNBC.*Are The "Many FOMC Members" Looking At The Same Economy?

The

FOMC minutes were full of doom and gloom: if things get worse then

we'll save the day; the economy is deteriorating; growth is not great

etc. All of which for one glorious moment raised speculation that the

'many' may get their way on the committee sooner than some think.

However, a funny thing happened since their last meeting - US Economic

Data has improved dramatically relative to expectations. As the chart

below shows, the rise in Citi's economic surprise index in the last four weeks is nearly record-breaking since the crisis began. Perhaps, the 'many' could explain which economy they are looking at and just what their economic projections look like now?

The

FOMC minutes were full of doom and gloom: if things get worse then

we'll save the day; the economy is deteriorating; growth is not great

etc. All of which for one glorious moment raised speculation that the

'many' may get their way on the committee sooner than some think.

However, a funny thing happened since their last meeting - US Economic

Data has improved dramatically relative to expectations. As the chart

below shows, the rise in Citi's economic surprise index in the last four weeks is nearly record-breaking since the crisis began. Perhaps, the 'many' could explain which economy they are looking at and just what their economic projections look like now?

We The Sheeplez... is intended to reflect

excellence in effort and content. Donations will help maintain this goal

and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

I'm PayPal VerifiedFOMC Minutes Indicate No Shift In Fed's Views, Even As Many Members See More Easing Likely Warranted

The thoughts of the FOMC from a mere three weeks ago - before a 30bps rise in 10Y yields (40bps in 30Y), 5% rise in the NASDAQ, 8.5% rise in AAPL, and 85bps compression in Spanish bond spreads - are out. It appears little has changed in their muddle-through, always at-the-ready, wish-it-were-better view of the world. Via Bloomberg,- *FOMC PARTICIPANTS SAW ECONOMY DECELERATING AFTER JUNE MEETING

- *MANY FOMC PARTICIPANTS SAID MANUFACTURING WAS SLOW OR FALLING

- *FOMC PARTICIPANTS DISCUSSED QE, EXTENDING 2014 FORECAST ON RATE

- *FED STAFF SAID MARKETS HAVE LARGE CAPACITY TO HANDLE MORE QE

- *MANY FOMC PARTICIPANTS SAW NEW QE AS BOLSTERING U.S. RECOVERY

- *MANY ON FOMC FAVORED EASING SOON IF NO SUSTAINED GROWTH PICKUP

Europe's Inverted Rally

As

European markets have rallied - just like in the US - forward earnings

estimates have inched down, leading to a significant multiple

(eurhopia) re-rating. As we noted last week, this multiple expansion is dramatically 'rich' compared to sovereign risk changes and is now at the top-end of the euro-zone crisis range. Meanwhile, sentiment has become palpably positive - put/call ratios near lows (highs in complacency; and at the same time European cash equity trading volumes have plunged to 12-year lows (with no high-priced AAPL to 'defend' this with); while fundamentally earnings momentum among cyclical stocks has continued to deteriorate since May 2012. But apart from that, it's all good...

As

European markets have rallied - just like in the US - forward earnings

estimates have inched down, leading to a significant multiple

(eurhopia) re-rating. As we noted last week, this multiple expansion is dramatically 'rich' compared to sovereign risk changes and is now at the top-end of the euro-zone crisis range. Meanwhile, sentiment has become palpably positive - put/call ratios near lows (highs in complacency; and at the same time European cash equity trading volumes have plunged to 12-year lows (with no high-priced AAPL to 'defend' this with); while fundamentally earnings momentum among cyclical stocks has continued to deteriorate since May 2012. But apart from that, it's all good...Romney/Ryan And The Fiscal Cliff

Romney's

selection of Paul Ryan as his veep clarifies the policy debate

(forcing typically middle-of-the-road voters to become more polarized to

the size of government) into the November election and materially

changes the odds of the fiscal cliff's resolution. As Morgan Stanley's

Vince Reinhart notes, "by tying one side to an explicit plan for fiscal

consolidation, the Ryan selection makes it much more likely that the

campaign will focus on the appropriate role of the government. That is,

the debate will be about the right level of federal

expenditure relative to national income, the progressivity of the tax

system, and the extent to which family incomes are protected on the

downside by Washington, DC." Although theoretically the Ryan

pick raises the chance of a benign, before-the-election resolution to

the fiscal cliff 'issue', it also worsens the likely outcome if the legislative stand-off continues into 2013 - which the odds suggest is the case.

Romney's

selection of Paul Ryan as his veep clarifies the policy debate

(forcing typically middle-of-the-road voters to become more polarized to

the size of government) into the November election and materially

changes the odds of the fiscal cliff's resolution. As Morgan Stanley's

Vince Reinhart notes, "by tying one side to an explicit plan for fiscal

consolidation, the Ryan selection makes it much more likely that the

campaign will focus on the appropriate role of the government. That is,

the debate will be about the right level of federal

expenditure relative to national income, the progressivity of the tax

system, and the extent to which family incomes are protected on the

downside by Washington, DC." Although theoretically the Ryan

pick raises the chance of a benign, before-the-election resolution to

the fiscal cliff 'issue', it also worsens the likely outcome if the legislative stand-off continues into 2013 - which the odds suggest is the case.The Truth Behind Juncker's Lies: In The Second Largest Greek City, 1250 Companies Have Shuttered In 2012

European viceroy of various neo-colonial territories Jean-Claude Juncker, best known for being a self-professed pathological liar, just concluded a press conference in which he did what he does best: lie. Here is a sampling of the soundbites along with our commentary:- EU'S JUNCKER SAYS TRUTH IS GREECE SUFFERS CREDIBILITY CRISIS - coming from a pathological liar, this one is our favorite

- EU'S JUNCKER SAYS CONVINCED GOVERNMENT WILL TAKE ALL MEASURES. "all measures" = "all gold"

- EU'S JUNCKER: FULLY CONFIDENT GOVERNMENT TO TAKE ALL EFFORTS "all efforts" = "all gold"

- EU'S JUNCKER SAYS GREECE MUST OPEN UP CLOSED PROFESSIONS. Chimneysweep? Bootblack? Telegraph Operator? Tax Collector? Prosecutor? Uncorrupted muppet?

- EU'S JUNCKER SAYS BALL IS IN GREEK COURT; IS LAST CHANCE. The ball will be repoed to the ECB shortly

- EU'S JUNCKER SAYS NOT SAYING THERE WON'T EVER BE A 3RD PROGRAM or 33rd program

- EU'S JUNCKER SAYS GREEK EURO EXIT WOULD BE RISK TO EURO AREA and Obama's reelections

- EU'S JUNCKER SAYS BALL IS IN GREEK COURT; not for long: ball will soon be repoed to the ECB

by J. D. Heyes, Natural News:

You buy health insurance, car insurance and homeowners insurance. You

buy life insurance as well, but Rep. Roscoe Bartlett, the senior

Republican congressman from Maryland, has a different take on what life insurance really means.

You buy health insurance, car insurance and homeowners insurance. You

buy life insurance as well, but Rep. Roscoe Bartlett, the senior

Republican congressman from Maryland, has a different take on what life insurance really means.“There are a number of events that could create a situation in the cities where civil unrest would be a very high probability,” Bartlett – one of the country’s most vocal advocates of preparing for the worst possible domestic situations – says in a new documentary called “Urban Danger,” where he takes viewers on a tour of a cabin he maintains in rural West Virginia – a structure that is powered by the sun and by the wind.

Far from actually predicting that Doomsday is just over the horizon, Bartlett merely suggests being prepared for any eventuality. He’s not so much a “survivalist,” as many call him; he’s a realist.

Read More @ NaturalNews.com

Already the No. 2 grossing documentary of the year, “2016: Obama’s America” expands nationwide this weekend

by Pamela McClintock, Hollywood Reporter:

An anti-Obama documentary based on conservative author Dinesh D’Souza’s book The Roots of Obama’s Rage

will expand nationwide this weekend after doing notable business in

select markets across the country — including in liberally minded New

York City.

An anti-Obama documentary based on conservative author Dinesh D’Souza’s book The Roots of Obama’s Rage

will expand nationwide this weekend after doing notable business in

select markets across the country — including in liberally minded New

York City.

Overall, 2016: Obama’s America grossed an impressive $1.2 million last weekend as it upped its theater count from 61 to 169 for a total gross of $2 million, the second-best showing of the year for a documentary after Bully ($3.2 million). That doesn’t include nature documentaries Chimpanzee ($29 million) and To the Arctic ($7.6 million).

It’s already the No. 12 political documentary of all time — a market that Michael Moore has cornered — as well as the No. 2 conservative documentary after Expelled: No Intelligence Allowed ($7.7 million).

On Friday, Obama’s America, co-directed by D’Souza and John Sullivan, will be playing in 1,075 theaters in an aggressive expansion that comes on the eve of the Republican National Convention in Tampa, Fla., which gets underway Aug. 27.

Read More @ HollywoodReporter.com

It is impossible to make up a fantasy tale that rivals the

manifestations of the outlandish MF Global scandal. The evaporation of

customer’s monies into an intentional offshore stash is tragic enough,

but the indignity of allowing “no consequences” for a horrific crime

against all investors is inexcusable. Jon S. Corzine is a fraudster that

screams out for the gallows of justice.

It is impossible to make up a fantasy tale that rivals the

manifestations of the outlandish MF Global scandal. The evaporation of

customer’s monies into an intentional offshore stash is tragic enough,

but the indignity of allowing “no consequences” for a horrific crime

against all investors is inexcusable. Jon S. Corzine is a fraudster that

screams out for the gallows of justice.

The manner of fleecing the public by Wall Street crooks has a clear distinction. Corzine walks while Madoff serves time. The original “Magical Mystery Tour” was a precursor of today’s reality TV shows. Corzine’s version is more a “House of Horrors”.

The lack of definitive disclosure in the MF Global investigation is hampered at every turn. The stonewalling and cover-up is business as usual in the world of special selective prosecution. The frustration shows as Judicial Watch sues SEC, CFTC for Corzine, MF Global docs.

Read More @ Activist Post

by Pamela McClintock, Hollywood Reporter:

An anti-Obama documentary based on conservative author Dinesh D’Souza’s book The Roots of Obama’s Rage

will expand nationwide this weekend after doing notable business in

select markets across the country — including in liberally minded New

York City.

An anti-Obama documentary based on conservative author Dinesh D’Souza’s book The Roots of Obama’s Rage

will expand nationwide this weekend after doing notable business in

select markets across the country — including in liberally minded New

York City.Overall, 2016: Obama’s America grossed an impressive $1.2 million last weekend as it upped its theater count from 61 to 169 for a total gross of $2 million, the second-best showing of the year for a documentary after Bully ($3.2 million). That doesn’t include nature documentaries Chimpanzee ($29 million) and To the Arctic ($7.6 million).

It’s already the No. 12 political documentary of all time — a market that Michael Moore has cornered — as well as the No. 2 conservative documentary after Expelled: No Intelligence Allowed ($7.7 million).

On Friday, Obama’s America, co-directed by D’Souza and John Sullivan, will be playing in 1,075 theaters in an aggressive expansion that comes on the eve of the Republican National Convention in Tampa, Fla., which gets underway Aug. 27.

Read More @ HollywoodReporter.com

by James Hall, Activist Post

It is impossible to make up a fantasy tale that rivals the

manifestations of the outlandish MF Global scandal. The evaporation of

customer’s monies into an intentional offshore stash is tragic enough,

but the indignity of allowing “no consequences” for a horrific crime

against all investors is inexcusable. Jon S. Corzine is a fraudster that

screams out for the gallows of justice.

It is impossible to make up a fantasy tale that rivals the

manifestations of the outlandish MF Global scandal. The evaporation of

customer’s monies into an intentional offshore stash is tragic enough,

but the indignity of allowing “no consequences” for a horrific crime

against all investors is inexcusable. Jon S. Corzine is a fraudster that

screams out for the gallows of justice.The manner of fleecing the public by Wall Street crooks has a clear distinction. Corzine walks while Madoff serves time. The original “Magical Mystery Tour” was a precursor of today’s reality TV shows. Corzine’s version is more a “House of Horrors”.

The lack of definitive disclosure in the MF Global investigation is hampered at every turn. The stonewalling and cover-up is business as usual in the world of special selective prosecution. The frustration shows as Judicial Watch sues SEC, CFTC for Corzine, MF Global docs.

Read More @ Activist Post

by Gary North, Lew Rockwell:

The media are filled with stories claiming that the Obama vs. Romney

race is all about class warfare. I have my doubts. Here is why.

The media are filled with stories claiming that the Obama vs. Romney

race is all about class warfare. I have my doubts. Here is why.

Karl Marx and Frederick Engels, in their then-anonymous tract, The Manifesto of the Communist Party (1848), began chapter 1 with these words: “The history of all hitherto existing society is the history of class struggles.”

You would be hard-pressed to find any theory of history more wrong-headed than this one.

To prove their case, they should have defined “class.” They never did. In the unpublished third volume of Das Kapital, Marx wrote this: “The first question to he answered is this: What constitutes a class? – I see. The first question. This appears in Chapter 52. Three paragraphs later, the manuscript broke off.

This was written around 1865. He died in 1883. He never wrote another book. It appeared in 1895. Engels edited it. It would have helped if Marx had told us what a class is. In The Manifesto, he followed sentence one with this:

Freeman and slave, patrician and plebeian, lord and serf, guild-master and journeyman, in a word, oppressor and oppressed, stood in constant opposition to one another, carried on an uninterrupted, now hidden, now open fight, a fight that each time ended, either in a revolutionary reconstitution of society at large, or in the common ruin of the contending classes.

Read More @ LewRockwell.com

The media are filled with stories claiming that the Obama vs. Romney

race is all about class warfare. I have my doubts. Here is why.

The media are filled with stories claiming that the Obama vs. Romney

race is all about class warfare. I have my doubts. Here is why.Karl Marx and Frederick Engels, in their then-anonymous tract, The Manifesto of the Communist Party (1848), began chapter 1 with these words: “The history of all hitherto existing society is the history of class struggles.”

You would be hard-pressed to find any theory of history more wrong-headed than this one.

To prove their case, they should have defined “class.” They never did. In the unpublished third volume of Das Kapital, Marx wrote this: “The first question to he answered is this: What constitutes a class? – I see. The first question. This appears in Chapter 52. Three paragraphs later, the manuscript broke off.

This was written around 1865. He died in 1883. He never wrote another book. It appeared in 1895. Engels edited it. It would have helped if Marx had told us what a class is. In The Manifesto, he followed sentence one with this:

Freeman and slave, patrician and plebeian, lord and serf, guild-master and journeyman, in a word, oppressor and oppressed, stood in constant opposition to one another, carried on an uninterrupted, now hidden, now open fight, a fight that each time ended, either in a revolutionary reconstitution of society at large, or in the common ruin of the contending classes.

Read More @ LewRockwell.com

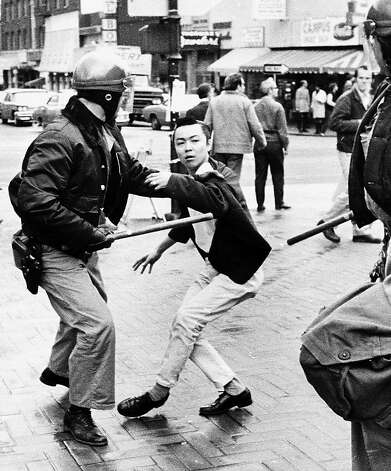

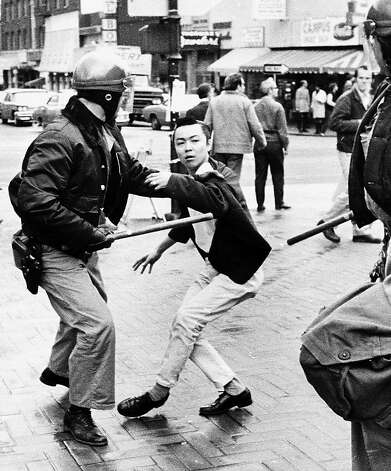

by Kurt Nimmo, Info Wars:

Over the past few years, Infowars.com has provided ample evidence that

the FBI is intimately involved in creating radical and violent political

groups that are used as propaganda by the government to push for

further implementation of a police state.

Over the past few years, Infowars.com has provided ample evidence that

the FBI is intimately involved in creating radical and violent political

groups that are used as propaganda by the government to push for

further implementation of a police state.

We have consistently underscored the fact that a post-COINTELPRO effort is operating in the United States and is being used to demonize legitimate and constitutionally protected opposition to the government. From supposed white supremacist Hal Turner operating for years as a prized national security asset and provocateur to a long line of Muslim patsies manipulated in ludicrous terror stings subsequently exploited to hype the government’s increasingly repressive war on terror, we have documented without a doubt that COINTELPRO is alive and well, despite the FBI claiming it put the illegal program to rest back in the 1970s.

Read More @ InfoWars.com

Over the past few years, Infowars.com has provided ample evidence that

the FBI is intimately involved in creating radical and violent political

groups that are used as propaganda by the government to push for

further implementation of a police state.

Over the past few years, Infowars.com has provided ample evidence that

the FBI is intimately involved in creating radical and violent political

groups that are used as propaganda by the government to push for

further implementation of a police state.We have consistently underscored the fact that a post-COINTELPRO effort is operating in the United States and is being used to demonize legitimate and constitutionally protected opposition to the government. From supposed white supremacist Hal Turner operating for years as a prized national security asset and provocateur to a long line of Muslim patsies manipulated in ludicrous terror stings subsequently exploited to hype the government’s increasingly repressive war on terror, we have documented without a doubt that COINTELPRO is alive and well, despite the FBI claiming it put the illegal program to rest back in the 1970s.

Read More @ InfoWars.com

by Ben Traynor, Gold Seek:

SPOT MARKET

prices to buy silver rose to their highest level in two months Tuesday,

hitting $29.09 per ounce– 3.5% up on last week’s close – after

extending gains from yesterday’s trading.

SPOT MARKET

prices to buy silver rose to their highest level in two months Tuesday,

hitting $29.09 per ounce– 3.5% up on last week’s close – after

extending gains from yesterday’s trading.

“This changes [silver's] posture to bullish,” says the latest technical analysis note from bullion bank Scotia Mocatta.

“There was congestion in the $28.00 area and this should provide some support, while the next target is the $29.90 high from June.”

Dollar gold prices meantime climbed to their highest level so far this month this morning, hitting $1626 per ounce. By contrast, the gold price in Euros traded lower, falling to €42,069 per kilo (€1308 per ounce), just below last week’s close, as the Euro extended gains against the Dollar to breach $1.24.

Stocks and commodities also traded higher, while US, UK and German government bond prices fell, following fresh reports that Eurozone policymakers are looking at ways of limiting the borrowing costs faced by struggling single currency members.

European Central Bank president Mario Draghi has received the backing of fellow ECB Executive Board member Joerg Asmussen, who tells Germany’s Frankfurter Rundschau that a new program to buy Eurozone government bonds will be “better designed” than previous ECB interventions.

Read More @ GoldSeek.com

SPOT MARKET

prices to buy silver rose to their highest level in two months Tuesday,

hitting $29.09 per ounce– 3.5% up on last week’s close – after

extending gains from yesterday’s trading.

SPOT MARKET

prices to buy silver rose to their highest level in two months Tuesday,

hitting $29.09 per ounce– 3.5% up on last week’s close – after

extending gains from yesterday’s trading.“This changes [silver's] posture to bullish,” says the latest technical analysis note from bullion bank Scotia Mocatta.

“There was congestion in the $28.00 area and this should provide some support, while the next target is the $29.90 high from June.”

Dollar gold prices meantime climbed to their highest level so far this month this morning, hitting $1626 per ounce. By contrast, the gold price in Euros traded lower, falling to €42,069 per kilo (€1308 per ounce), just below last week’s close, as the Euro extended gains against the Dollar to breach $1.24.

Stocks and commodities also traded higher, while US, UK and German government bond prices fell, following fresh reports that Eurozone policymakers are looking at ways of limiting the borrowing costs faced by struggling single currency members.

European Central Bank president Mario Draghi has received the backing of fellow ECB Executive Board member Joerg Asmussen, who tells Germany’s Frankfurter Rundschau that a new program to buy Eurozone government bonds will be “better designed” than previous ECB interventions.

Read More @ GoldSeek.com

by Jim Karger, Dollar Vigilante:

“I simply do not know where the money is, or why the accounts have not

been reconciled to date. I do not know which accounts are unreconciled

or whether the unreconciled accounts were or were not subject to the

segregation rules.” — John Corzine

“I simply do not know where the money is, or why the accounts have not

been reconciled to date. I do not know which accounts are unreconciled

or whether the unreconciled accounts were or were not subject to the

segregation rules.” — John Corzine

Jon Corzine is a contemporary Richard Nixon: a low rent thief, liar, and American success story.

Corzine, you may recall, bet $6.3 billion on the wrong side of European sovereign debt, a wager his own risk department at MF Global told him was nuts, and a wager so big and so wrong that it wiped out the entire firm.

After the news hit the wire and blood hit the water MF’s customers started jumping ship and that is when MF deliberately took customer money as its own to keep its head above water. It was too little, too late. The company filed for bankruptcy protection and Corzine resigned.

Over $1 billion in customer funds remain missing in action.

Read More @ DollarVigilante.com

“I simply do not know where the money is, or why the accounts have not

been reconciled to date. I do not know which accounts are unreconciled

or whether the unreconciled accounts were or were not subject to the

segregation rules.” — John Corzine

“I simply do not know where the money is, or why the accounts have not

been reconciled to date. I do not know which accounts are unreconciled

or whether the unreconciled accounts were or were not subject to the

segregation rules.” — John CorzineJon Corzine is a contemporary Richard Nixon: a low rent thief, liar, and American success story.

Corzine, you may recall, bet $6.3 billion on the wrong side of European sovereign debt, a wager his own risk department at MF Global told him was nuts, and a wager so big and so wrong that it wiped out the entire firm.

After the news hit the wire and blood hit the water MF’s customers started jumping ship and that is when MF deliberately took customer money as its own to keep its head above water. It was too little, too late. The company filed for bankruptcy protection and Corzine resigned.

Over $1 billion in customer funds remain missing in action.

Read More @ DollarVigilante.com

by Bill Bonner, Daily Reckoning.com.au:

We’re in those lazy, crazy, hazy days of summer… with little action in the markets…

We’re in those lazy, crazy, hazy days of summer… with little action in the markets…

Not many of the players seem to want to play.

For example, Goldman Sachs‘ chief US equity man says it’s time to get out of stocks before they fall off the ‘fiscal cliff’. CBNC:

David Kostin vehemently defends his year-end S&P target of 1250 despite the benchmark’s recent rise to above 1400. The strategist still sees a 12 percent drop ahead, believing that Congress will fail to address the fiscal cliff before the election, and maybe even before the end of the year.

The worst case scenario this year is that a lame duck Congress does absolutely nothing after the election — not even kick the can down the road by voting in a short extension of the tax breaks and spending plans. Under that scenario, 2013 GDP would actually contract, according to Goldman Sachs economists.

The big banks are taking no chances either. They’re keeping their money in Treasuries. Here’s Bloomberg on that story:

Read More @ DailyReckoning.com.au

I'm PayPal Verified

We’re in those lazy, crazy, hazy days of summer… with little action in the markets…

We’re in those lazy, crazy, hazy days of summer… with little action in the markets…Not many of the players seem to want to play.

For example, Goldman Sachs‘ chief US equity man says it’s time to get out of stocks before they fall off the ‘fiscal cliff’. CBNC:

David Kostin vehemently defends his year-end S&P target of 1250 despite the benchmark’s recent rise to above 1400. The strategist still sees a 12 percent drop ahead, believing that Congress will fail to address the fiscal cliff before the election, and maybe even before the end of the year.

The worst case scenario this year is that a lame duck Congress does absolutely nothing after the election — not even kick the can down the road by voting in a short extension of the tax breaks and spending plans. Under that scenario, 2013 GDP would actually contract, according to Goldman Sachs economists.

The big banks are taking no chances either. They’re keeping their money in Treasuries. Here’s Bloomberg on that story:

Read More @ DailyReckoning.com.au

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment