Marc Faber On Keynesian Folly, The 'Missing' Inflation, And Bubble-Blowing

In

as-comprehensive-an-explanation-as-we-have-seen of the monetary

malfeasance and misunderstanding of the standard Keynesian

central-banker, Gloom-Boom-Doom's Marc Faber addressed an instutional

audience in the Middle East earlier this year. Faber begins by

explaining his (correct) view that 'Keynesian' intervention into the

free-market or capitalistic society (with fiscal and monetary measures),

in order to 'smooth' the business cycle, has in fact created a more violent business cycle

- as they attempt to address long-term structural problems with

short-term fixes (or bubbles). His lecture expands from his insight that

in 1970 not a single investment bank was public - they were

all private partnerships (implicitly playing with their own money as

opposed to other-people's - dramatically impacting the risk

profile in the world) to the notion that central bank money printing

(pushing dollars out the door) does have inflationary symptoms - but

they do not necessarily have to show up in wages or CPI in the US (think

Chinese wage inflation, or commodity price rises, or Aussie housing

bubbles). Central bankers can determine the quantity of money but they cannot determine what we do with those USD bills. Must watch.

In

as-comprehensive-an-explanation-as-we-have-seen of the monetary

malfeasance and misunderstanding of the standard Keynesian

central-banker, Gloom-Boom-Doom's Marc Faber addressed an instutional

audience in the Middle East earlier this year. Faber begins by

explaining his (correct) view that 'Keynesian' intervention into the

free-market or capitalistic society (with fiscal and monetary measures),

in order to 'smooth' the business cycle, has in fact created a more violent business cycle

- as they attempt to address long-term structural problems with

short-term fixes (or bubbles). His lecture expands from his insight that

in 1970 not a single investment bank was public - they were

all private partnerships (implicitly playing with their own money as

opposed to other-people's - dramatically impacting the risk

profile in the world) to the notion that central bank money printing

(pushing dollars out the door) does have inflationary symptoms - but

they do not necessarily have to show up in wages or CPI in the US (think

Chinese wage inflation, or commodity price rises, or Aussie housing

bubbles). Central bankers can determine the quantity of money but they cannot determine what we do with those USD bills. Must watch.

by Staff Report, The Daily Bell:

The debate about shrinking government is mostly wishful thinking … With the selection of Paul Ryan

as the Republican vice-presidential candidate, it is clear both

political parties agree that the central issue in the coming

presidential election will be the scale and scope of government

involvement in the U.S. economy. There will be disagreement over what

constituted “normal” levels of spending in the past and indeed over what

constitutes “spending.” But there is a widespread view in both parties

that it is feasible and desirable that in the future the federal

government will be no larger as a share of the overall economy than it

has been historically. Unfortunately, this aspiration is unlikely to be

achieved. Even preserving the amount of government functions the U.S.

had before the financial crisis will require substantial increases in

the share of the economy devoted to the public sector. This is the case

for several structural reasons. – Reuters/Lawrence H. Summers

The debate about shrinking government is mostly wishful thinking … With the selection of Paul Ryan

as the Republican vice-presidential candidate, it is clear both

political parties agree that the central issue in the coming

presidential election will be the scale and scope of government

involvement in the U.S. economy. There will be disagreement over what

constituted “normal” levels of spending in the past and indeed over what

constitutes “spending.” But there is a widespread view in both parties

that it is feasible and desirable that in the future the federal

government will be no larger as a share of the overall economy than it

has been historically. Unfortunately, this aspiration is unlikely to be

achieved. Even preserving the amount of government functions the U.S.

had before the financial crisis will require substantial increases in

the share of the economy devoted to the public sector. This is the case

for several structural reasons. – Reuters/Lawrence H. Summers

Dominant Social Theme: The path we are on toward larger government and more federal expenditures in the US (and the West) is an inevitable one. We have no choice other than to live this way and discuss what (helpful) services we will disallow.

Free-Market Analysis: Here comes Lawrence H. Summers to tell us that shrinking the US federal Leviathan is at least improbable. Summers is very good at this kind of thing. After Milton Friedman passed away, he wrote an article entitled, “We’re all Friedmanites Now.”

Read More @ TheDailyBell.com

The debate about shrinking government is mostly wishful thinking … With the selection of Paul Ryan

as the Republican vice-presidential candidate, it is clear both

political parties agree that the central issue in the coming

presidential election will be the scale and scope of government

involvement in the U.S. economy. There will be disagreement over what

constituted “normal” levels of spending in the past and indeed over what

constitutes “spending.” But there is a widespread view in both parties

that it is feasible and desirable that in the future the federal

government will be no larger as a share of the overall economy than it

has been historically. Unfortunately, this aspiration is unlikely to be

achieved. Even preserving the amount of government functions the U.S.

had before the financial crisis will require substantial increases in

the share of the economy devoted to the public sector. This is the case

for several structural reasons. – Reuters/Lawrence H. Summers

The debate about shrinking government is mostly wishful thinking … With the selection of Paul Ryan

as the Republican vice-presidential candidate, it is clear both

political parties agree that the central issue in the coming

presidential election will be the scale and scope of government

involvement in the U.S. economy. There will be disagreement over what

constituted “normal” levels of spending in the past and indeed over what

constitutes “spending.” But there is a widespread view in both parties

that it is feasible and desirable that in the future the federal

government will be no larger as a share of the overall economy than it

has been historically. Unfortunately, this aspiration is unlikely to be

achieved. Even preserving the amount of government functions the U.S.

had before the financial crisis will require substantial increases in

the share of the economy devoted to the public sector. This is the case

for several structural reasons. – Reuters/Lawrence H. SummersDominant Social Theme: The path we are on toward larger government and more federal expenditures in the US (and the West) is an inevitable one. We have no choice other than to live this way and discuss what (helpful) services we will disallow.

Free-Market Analysis: Here comes Lawrence H. Summers to tell us that shrinking the US federal Leviathan is at least improbable. Summers is very good at this kind of thing. After Milton Friedman passed away, he wrote an article entitled, “We’re all Friedmanites Now.”

Read More @ TheDailyBell.com

China Flash PMI Plummets As New Export Orders Collapse To Lehman Lows

It

was the best of times (US equities); it was the worst of times (the

world's growth engine - China). HSBC-Markit just announced the Flash PMI

for August and it's not pretty - printing at a nine-month low (47.8 vs 49.3 in July). Of course, China's own version remains in the Schrodinger-like >50-expansion state for now but with all 11 sub-indices in this evening's data pointing to weakness, we suspect not even the Chinese can sell that data for much longer. So what next - RRR? Massive stimulus? - don't hold your breath

given the recent reverse repos and the already creeping-inflation in

food and energy prices. The piece-de-resistance of the data-dump though

has to be (in line with Japan's trade data last night) is the New Export Orders slumped to 44.7 - lowest since March 2009 when trade finance collapsed post-Lehman.

It

was the best of times (US equities); it was the worst of times (the

world's growth engine - China). HSBC-Markit just announced the Flash PMI

for August and it's not pretty - printing at a nine-month low (47.8 vs 49.3 in July). Of course, China's own version remains in the Schrodinger-like >50-expansion state for now but with all 11 sub-indices in this evening's data pointing to weakness, we suspect not even the Chinese can sell that data for much longer. So what next - RRR? Massive stimulus? - don't hold your breath

given the recent reverse repos and the already creeping-inflation in

food and energy prices. The piece-de-resistance of the data-dump though

has to be (in line with Japan's trade data last night) is the New Export Orders slumped to 44.7 - lowest since March 2009 when trade finance collapsed post-Lehman.Silver Breakout Leads to Gold Breakout

Trader Dan at Trader Dan's Market Views - 2 hours ago

Gold put in a very strong showing in today's session the instant the FOMC

press release hit the market. All that was necessary was the fact that a

few words were changed from "some" to "many" and to "fairly soon". Once

traders saw those words, it was off to the races and no looking back.

Traders interpretted this change of wording as evidence that the committee

was now largely leaning to a new round of bond buying should future

economic data releases confirm the slowdown in growth.

We have noted for some time that Silver would underperform gold during a

time in which deflationary or... more »

by Lawrence Williams, MineWeb.com

Gold seems to be beginning to find some stability at or above the $1,640 level and silver around $29.50, but can this be considered preliminary signs of a significant breakout from the recent flat trading range?

Wednesday , 22 Aug 2012

Wednesday , 22 Aug 2012

LONDON (Mineweb) –

Gold has broken up through $1640 this morning – seen as a resistance level by some technical analysts – and silver remains well above $29, but in the words of former global pop group Queen’s Bohemian Rhapsody – “Is this the real life? Is this just fantasy?” As usual only time will tell, but we are coming towards the end of the northern summer doldrums period and the precious metals do seem to be at last breaking out of their recent very tight trading range.

Recent news that mega investors George Soros and John Paulson have been climbing back into the GLD gold ETF may have given things a fillip, as had an appearance of a little more stability in the Eurozone situation (but don’t bank on the latter to continue) and the prospect of more Chinese monetary easing.

Comex gold futures have been rising for the past few days while markets in general have been pretty flat and with the dollar retreating – perhaps largely on the temporarily better Eurozone perception – commodities in general have also been rising. As London precious metals dealer Sharps Pixley puts it in a commentary this morning: “The risky external markets, commodities and gold are all having a tear. The sentiment on commodities has turned positive owing to traders’ expectations of further monetary easing in China, and better U.S. growth prospects. China’s Premier Wen said there would be room for more monetary operation, while the U.S. consumers’ confidence in August and July’s leading indicators both turned out better than expected.”

Read More @ MineWeb.com

Gold seems to be beginning to find some stability at or above the $1,640 level and silver around $29.50, but can this be considered preliminary signs of a significant breakout from the recent flat trading range?

LONDON (Mineweb) –

Gold has broken up through $1640 this morning – seen as a resistance level by some technical analysts – and silver remains well above $29, but in the words of former global pop group Queen’s Bohemian Rhapsody – “Is this the real life? Is this just fantasy?” As usual only time will tell, but we are coming towards the end of the northern summer doldrums period and the precious metals do seem to be at last breaking out of their recent very tight trading range.

Recent news that mega investors George Soros and John Paulson have been climbing back into the GLD gold ETF may have given things a fillip, as had an appearance of a little more stability in the Eurozone situation (but don’t bank on the latter to continue) and the prospect of more Chinese monetary easing.

Comex gold futures have been rising for the past few days while markets in general have been pretty flat and with the dollar retreating – perhaps largely on the temporarily better Eurozone perception – commodities in general have also been rising. As London precious metals dealer Sharps Pixley puts it in a commentary this morning: “The risky external markets, commodities and gold are all having a tear. The sentiment on commodities has turned positive owing to traders’ expectations of further monetary easing in China, and better U.S. growth prospects. China’s Premier Wen said there would be room for more monetary operation, while the U.S. consumers’ confidence in August and July’s leading indicators both turned out better than expected.”

Read More @ MineWeb.com

In the face of growing fears of a renewed global plunge into economic depression and a climate of low apparent price inflation, investors might expect commodities and precious metals to be falling in price. Instead, gold continues to hover around a relatively high $1,640 an ounce and silver at $29. At the same time, central banks – including those of the ever more important China, Russia and India – continue aggressively to buy gold.

At a time when very complex financial instruments allow for the seemingly effective hedging of all manner of risks, why should precious metals, which ostensibly involve considerable downside risk, continue to be attractive? Simply, investors in precious metals see traditional risk management instruments as too dependent upon the challenged financial markets that they fail to represent true and ultimate insurance.

The 2008 financial crisis was rooted in a property bubble, but was magnified when reckless risks were often passed on to unknowing, conservative third-parties. This was accomplished by means of increasingly sophisticated and deceptive financial instruments. When the unthinkable happened and property prices turned down, the highly interconnected Western financial world was awash with toxic assets and so-called hedge instruments, including derivatives. At one stage, total financial collapse threatened, so governments stepped in to absorb these toxic assets or pass them off to more solvent banks.

Read More @ GoldSeek.com

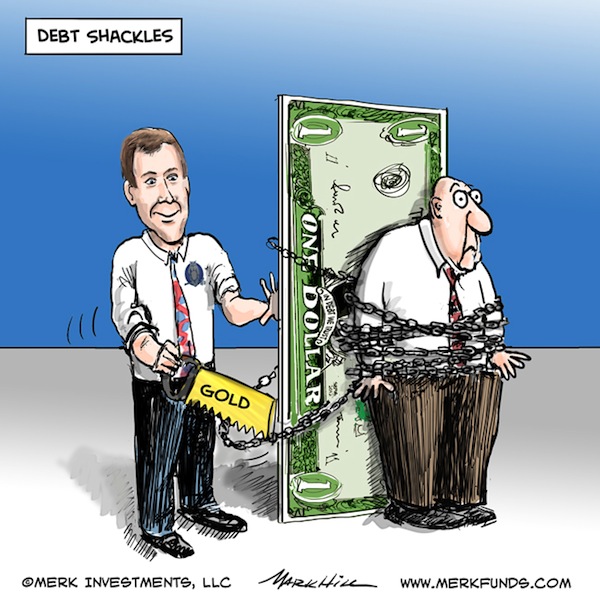

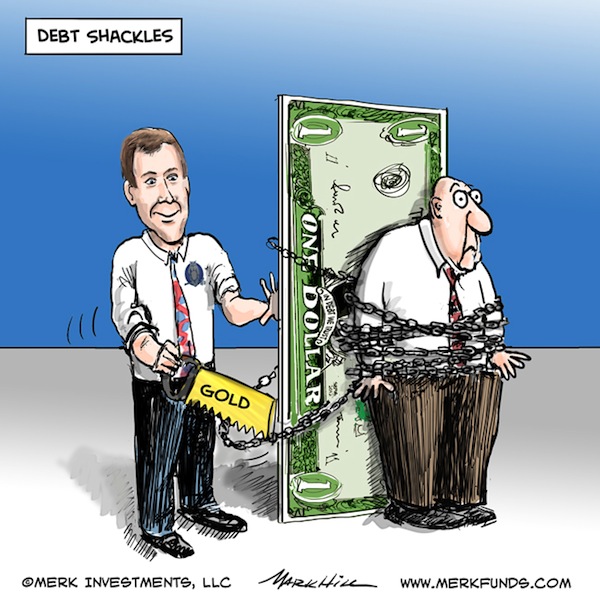

by Axel Merk, MerkFunds.com:

Vice President Joe Biden was accused of racism when suggesting a Romney administration would “unchain banks” that in turn might put the black audience he was talking to back into “shackles.” The political uproar overshadows a reality that knows no racial boundaries: a person in debt is not a free person; a nation in debt is not a free nation. Does it mean those with large bank accounts are free? Not so fast…

We don’t want to downplay the horrific crime of slavery, but want to provide food for thought: debt is often taken on voluntarily; once taken on, however, one is forced to work to pay off one’s debt. To be unshackled from banks and creditors, investors may want to consider living debt free and owning gold. Let us explain.

Access to credit may fundamentally change one’s lifestyle. On the plus side, it opens the path to home ownership and access to capital goods, be that a car, or these days even a mattress or exercise machine. But it also makes the creditor, rather than oneself the boss. One symptom of the building credit bubble that caught my attention a decade ago was the rise of Spanish language billboards promoting mortgages. Proud immigrants in search of the American dream were lured into mortgages they could ill afford. Rather than focusing on feeding themselves and their family, the focus shifted to serving the bank. That shift only became apparent once the loan became too expensive to service, either because interest rates were resetting to higher levels or because someone lost their job and thus their income, but the debt remained.

Berkshire Hathaway CEO Warren Buffett famously discusses in his annual shareholder letters that the insurance business is a great business to be in, as policyholders pay him to hold money:

Read More @ MerkFunds.com

Vice President Joe Biden was accused of racism when suggesting a Romney administration would “unchain banks” that in turn might put the black audience he was talking to back into “shackles.” The political uproar overshadows a reality that knows no racial boundaries: a person in debt is not a free person; a nation in debt is not a free nation. Does it mean those with large bank accounts are free? Not so fast…

We don’t want to downplay the horrific crime of slavery, but want to provide food for thought: debt is often taken on voluntarily; once taken on, however, one is forced to work to pay off one’s debt. To be unshackled from banks and creditors, investors may want to consider living debt free and owning gold. Let us explain.

Access to credit may fundamentally change one’s lifestyle. On the plus side, it opens the path to home ownership and access to capital goods, be that a car, or these days even a mattress or exercise machine. But it also makes the creditor, rather than oneself the boss. One symptom of the building credit bubble that caught my attention a decade ago was the rise of Spanish language billboards promoting mortgages. Proud immigrants in search of the American dream were lured into mortgages they could ill afford. Rather than focusing on feeding themselves and their family, the focus shifted to serving the bank. That shift only became apparent once the loan became too expensive to service, either because interest rates were resetting to higher levels or because someone lost their job and thus their income, but the debt remained.

Berkshire Hathaway CEO Warren Buffett famously discusses in his annual shareholder letters that the insurance business is a great business to be in, as policyholders pay him to hold money:

Read More @ MerkFunds.com

by Jeff Nielson, SilverGoldBull:

The World Gold Council recently released its second quarter statistics

on gold “demand and supply trends”. For those not familiar with the

WGC, it is an “industry trade group” composed of large-cap gold miners who love bankers.

The World Gold Council recently released its second quarter statistics

on gold “demand and supply trends”. For those not familiar with the

WGC, it is an “industry trade group” composed of large-cap gold miners who love bankers.

How much do these mining companies love bankers? So much that they allow the bankers to keep all the records for their sector, and pretty much do all of their of their promotion to the world. It is the WGC which elevated two private “consultancies” (of bankers) – GFMS and the CPM Group – to the status of quasi-official record-keepers for the entire global gold (and silver) industry.

It would be problematic at best for the gold industry to allow itself to be almost entirely represented by a “profession” now known only for its rampant fraud. However, given the known hatred of the banking community toward gold and silver, and their relentless attacks on both the bullion market and the miners themselves; it’s almost beyond comprehension that the world’s largest gold miners choose bankers as their spokesmen.

Read More @ SilverGoldBull

The World Gold Council recently released its second quarter statistics

on gold “demand and supply trends”. For those not familiar with the

WGC, it is an “industry trade group” composed of large-cap gold miners who love bankers.

The World Gold Council recently released its second quarter statistics

on gold “demand and supply trends”. For those not familiar with the

WGC, it is an “industry trade group” composed of large-cap gold miners who love bankers.How much do these mining companies love bankers? So much that they allow the bankers to keep all the records for their sector, and pretty much do all of their of their promotion to the world. It is the WGC which elevated two private “consultancies” (of bankers) – GFMS and the CPM Group – to the status of quasi-official record-keepers for the entire global gold (and silver) industry.

It would be problematic at best for the gold industry to allow itself to be almost entirely represented by a “profession” now known only for its rampant fraud. However, given the known hatred of the banking community toward gold and silver, and their relentless attacks on both the bullion market and the miners themselves; it’s almost beyond comprehension that the world’s largest gold miners choose bankers as their spokesmen.

Read More @ SilverGoldBull

Donations will help maintain and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

I'm PayPal Verified A Texas leader is warning of what he calls a ‘civil war’ and possible

invasion of United Nations troops if President Barack Obama is

re-elected.

A Texas leader is warning of what he calls a ‘civil war’ and possible

invasion of United Nations troops if President Barack Obama is

re-elected.Lubbock County Judge Tom Head is convinced that Mr. Obama winning a second term would lead to a revolt by the American people and he’s is pushing a tax increase for the district attorney’s office and the Lubbock County Sheriff’s Office. He says the money is needed to “beef up” it’s resources in case President Obama wins the November election.

In the event of civil unrest Judge Head said he’s concerned the President would hand over sovereignty of the United States to the U.N. and that the American public would react violently.

“He’s going to try to hand over the sovereignty of the U.S. to the United Nations, what’s going to happen when that happens?” Judge Head told FOX 34 in Lubbock.

“I’m thinking worse case scenario,” Judge Head explained. “Civil unrest, civil disobedience, civil war maybe…we’re not just talking a few riots or demonstrations.”

Read More @ CBS local

from PeterSantilliTV:

The President of The Rutherford Institute and Lead Attorney for Brandon Raub, John Whitehead, just hours ago confirmed in an interview with Pete Santilli for The Pete Santilli Show, that the Veteran was arrested for posting song lyrics. In the interview Mr. Whitehead warns: If you make the wrong statement on Facebook you could be arrested.

Pete also gets and update on the location of Brandon Raub. U.S. Air Force Veteran Kristen Meghan (YouTube: iamkristenmeghan ) reports that she contacted the V.A. facility in Salem Virgina where Brandon Raub has reportedly been transferred. The V.A. had “no record” of a Brandon Raub, although at the time of this upload Kristen has verified that Brandon’s family has had personal contact with him.

The President of The Rutherford Institute and Lead Attorney for Brandon Raub, John Whitehead, just hours ago confirmed in an interview with Pete Santilli for The Pete Santilli Show, that the Veteran was arrested for posting song lyrics. In the interview Mr. Whitehead warns: If you make the wrong statement on Facebook you could be arrested.

Pete also gets and update on the location of Brandon Raub. U.S. Air Force Veteran Kristen Meghan (YouTube: iamkristenmeghan ) reports that she contacted the V.A. facility in Salem Virgina where Brandon Raub has reportedly been transferred. The V.A. had “no record” of a Brandon Raub, although at the time of this upload Kristen has verified that Brandon’s family has had personal contact with him.

by Harvey Organ, HarveyOrgan.Blogspot.ca:

Good evening Ladies and Gentlemen:

Gold closed slightly down to the tune of $2.50 to $1637.40. Silver on the other hand refused to listen to gold and advanced another 13 cents to $29.55. However after the comex close, the Fed released it’s beige book and the feeling is that the Fed will have to engage in official QEIII before long. Gold and silver shot up big time as did the Euro.

Here are the closing access gold and silver closings:

gold; $1654.10 (up now a full $15.50)

silver: $29.91 (up 58 cents from yesterday’s close)

Late last night, Japan released her trade figures and it was awful as this nation saw a rare trade deficit.

Japan’s trade with the EU crumbled 25% year over and year and that set the mood for European trading.

All bourses in Europe proceeded to head southbound. The Spanish Ibex finished the day down a huge 2.7%. We will be going over these and many other stories but first…..

Let us head over to the comex and see how trading at the comex fared today as well as movements of silver and gold.

Read More @ HarveyOrgan.Blogspot.ca

Good evening Ladies and Gentlemen:

Gold closed slightly down to the tune of $2.50 to $1637.40. Silver on the other hand refused to listen to gold and advanced another 13 cents to $29.55. However after the comex close, the Fed released it’s beige book and the feeling is that the Fed will have to engage in official QEIII before long. Gold and silver shot up big time as did the Euro.

Here are the closing access gold and silver closings:

gold; $1654.10 (up now a full $15.50)

silver: $29.91 (up 58 cents from yesterday’s close)

Late last night, Japan released her trade figures and it was awful as this nation saw a rare trade deficit.

Japan’s trade with the EU crumbled 25% year over and year and that set the mood for European trading.

All bourses in Europe proceeded to head southbound. The Spanish Ibex finished the day down a huge 2.7%. We will be going over these and many other stories but first…..

Let us head over to the comex and see how trading at the comex fared today as well as movements of silver and gold.

Read More @ HarveyOrgan.Blogspot.ca

Will Obama Keep Power ‘by Any Means Necessary’?

Let’s go there: if Obama thinks he’s losing, will he allow safe and fair elections on November 6? And if he does lose, will he peacefully turn over power to Mitt Romney on January 20, 2013? Or will he cling to power “by any means necessary,” as a highly placed insider alleges?Attention U.S. Military: You are Being Demonized. This is an Extremely Important Article

It’s now becoming overt. The meme emanating rapidly from the mainstream media is that the U.S. military is a threat to the nation! It sounds very 1984 and backwards, but what isn’t these days.Thanks Obama – Here Are 24 Stats That Show How Much You Have Royally Messed Up Our Economy

Under Barack Obama, the U.S. economy has performed worse than it did under any other president since the end of the Great Depression. After every other recession since World War II, the U.S. economy always regained what was lost and got even stronger before the next recession began. During this “economic recovery”, we have not even come close to getting back to where we were in 2008.

Jim Sinclair’s Commentary

Fed looks set to ease fairly soon barring swift rebound

By Pedro da Costa and Alister Bull

WASHINGTON | Wed Aug 22, 2012 5:28pm EDT

(Reuters) – The Federal Reserve is likely to deliver another round of monetary stimulus “fairly soon” unless the economy improves considerably, minutes from the U.S. central bank’s latest meeting suggested.

While the July 31-August 1 meeting occurred before some encouraging economic data, including a stronger-than-expected rise in July payrolls, policymakers were pretty categorical about their dissatisfaction with the outlook, according to the minutes released on Wednesday.

“Many members judged that additional monetary accommodation would likely be warranted fairly soon unless incoming information pointed to a substantial and sustainable strengthening in the pace of the economic recovery,” the Fed said.

Wall Street stocks erased most losses after the Fed released the minutes. Treasury bond prices, which have been under pressure from stronger economic figures, extended gains. The dollar fell and the euro surged to a seven-week high against the greenback at the prospect of the Fed providing more stimulus.

The Dow Jones industrial average closed down 30.82 points at 13,172.76, although well above its session low, but the broader S&P 500 Index clawed back from losses to end 0.32 point higher at 1,413.49.

More…

Jim Sinclair’s Commentary

Fed minutes show active discussion of QE3

A new ‘substantial’ round of bond buys considered

Aug. 22, 2012, 3:13 p.m. EDT

By Steve Goldstein, MarketWatch

WASHINGTON (MarketWatch) — Members of the Federal Reserve got closer to pushing the button on a new round of bond purchases even as a less-aggressive step of altering language on a low-rate pledge seems to be in the works, according to minutes from the most recent meeting released Wednesday.

The minutes of the July 31-Aug. 1 meeting of the central bank’s Federal Open Market Committee showed a central bank worried about signs of decelerating growth — and itching to take action.

“Many members judged that additional monetary accommodation would likely be warranted fairly soon unless incoming information pointed to a substantial and sustainable strengthening in the pace of the economic recovery,” the minutes said.

The release of the minutes triggered an immediate move in markets. Stocks SPX +0.02% pared their losses and the dollar EURUSD -0.03% weakened against the euro.

“The FOMC minutes paint a picture of a committee more open to easing than the market was anticipating,” said David Semmens,senior U.S. economist for Standard Chartered, in a note to clients.

More…

Jim Sinclair’s Commentary

Survivalist congressman is ready for doomsday

By Ben Pershing, The Washington Post

Posted Aug. 20, 2012, at 6:02 a.m.

Deep in the West Virginia woods, in a small cabin powered by the sun and the wind, a bespectacled, white-haired man is giving a video tour of his basement, describing techniques for the long-term preservation of food in case of “an emergency.”

“We don’t really think of those today, because it’s so convenient to go to the supermarket,” he cautions. “But you know, you’re planning because the supermarket may not always be there.”

The electrical grid could fail tomorrow, he frequently warns. Food would disappear from the shelves. Water would no longer flow from the pipes. Money might become worthless. People could turn on each other, and millions would die.

Such concerns are typical among “survivalists,” a loose national movement of individuals who advocate self-sufficiency in the face of natural or man-made disasters, gathering online or in person to discuss the best ways to prepare for the worst.

What is atypical is that the owner of this cabin is Roscoe Bartlett, the longtime Republican congressman from Maryland. Over the past two decades, he has developed a following as one of the country’s premier proponents of preparedness against impending doom, even urging the more than 80 percent of Americans who live in urban areas to relocate.

More…

I'm PayPal Verified

Baring a Swift rebound? What is that Fed smoking?

Fed looks set to ease fairly soon barring swift rebound

By Pedro da Costa and Alister Bull

WASHINGTON | Wed Aug 22, 2012 5:28pm EDT

(Reuters) – The Federal Reserve is likely to deliver another round of monetary stimulus “fairly soon” unless the economy improves considerably, minutes from the U.S. central bank’s latest meeting suggested.

While the July 31-August 1 meeting occurred before some encouraging economic data, including a stronger-than-expected rise in July payrolls, policymakers were pretty categorical about their dissatisfaction with the outlook, according to the minutes released on Wednesday.

“Many members judged that additional monetary accommodation would likely be warranted fairly soon unless incoming information pointed to a substantial and sustainable strengthening in the pace of the economic recovery,” the Fed said.

Wall Street stocks erased most losses after the Fed released the minutes. Treasury bond prices, which have been under pressure from stronger economic figures, extended gains. The dollar fell and the euro surged to a seven-week high against the greenback at the prospect of the Fed providing more stimulus.

The Dow Jones industrial average closed down 30.82 points at 13,172.76, although well above its session low, but the broader S&P 500 Index clawed back from losses to end 0.32 point higher at 1,413.49.

More…

Jim Sinclair’s Commentary

QE 3 announced on a monthly basis with the Fed reviewing the amount

each month, and if it is to continue, is a definition of QE to infinity.

For the ECB to limit the interest rates of weak country bonds is an

announcement of QE to Infinity. Chancellor Merkel will go along for the

ride screaming and creating a soap opera all the way.

QE to infinity is as certain as death and taxes in the entire Western world financial system.

Fed minutes show active discussion of QE3

A new ‘substantial’ round of bond buys considered

Aug. 22, 2012, 3:13 p.m. EDT

By Steve Goldstein, MarketWatch

WASHINGTON (MarketWatch) — Members of the Federal Reserve got closer to pushing the button on a new round of bond purchases even as a less-aggressive step of altering language on a low-rate pledge seems to be in the works, according to minutes from the most recent meeting released Wednesday.

The minutes of the July 31-Aug. 1 meeting of the central bank’s Federal Open Market Committee showed a central bank worried about signs of decelerating growth — and itching to take action.

“Many members judged that additional monetary accommodation would likely be warranted fairly soon unless incoming information pointed to a substantial and sustainable strengthening in the pace of the economic recovery,” the minutes said.

The release of the minutes triggered an immediate move in markets. Stocks SPX +0.02% pared their losses and the dollar EURUSD -0.03% weakened against the euro.

“The FOMC minutes paint a picture of a committee more open to easing than the market was anticipating,” said David Semmens,senior U.S. economist for Standard Chartered, in a note to clients.

More…

Jim Sinclair’s Commentary

Darn! There is sure to be one politician left.

Survivalist congressman is ready for doomsday

By Ben Pershing, The Washington Post

Posted Aug. 20, 2012, at 6:02 a.m.

Deep in the West Virginia woods, in a small cabin powered by the sun and the wind, a bespectacled, white-haired man is giving a video tour of his basement, describing techniques for the long-term preservation of food in case of “an emergency.”

“We don’t really think of those today, because it’s so convenient to go to the supermarket,” he cautions. “But you know, you’re planning because the supermarket may not always be there.”

The electrical grid could fail tomorrow, he frequently warns. Food would disappear from the shelves. Water would no longer flow from the pipes. Money might become worthless. People could turn on each other, and millions would die.

Such concerns are typical among “survivalists,” a loose national movement of individuals who advocate self-sufficiency in the face of natural or man-made disasters, gathering online or in person to discuss the best ways to prepare for the worst.

What is atypical is that the owner of this cabin is Roscoe Bartlett, the longtime Republican congressman from Maryland. Over the past two decades, he has developed a following as one of the country’s premier proponents of preparedness against impending doom, even urging the more than 80 percent of Americans who live in urban areas to relocate.

More…

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment