Submitted by Tyler Durden on 04/08/2016 - 07:12

Here Is What Janet Yellen Answered When Asked If The U.S. Is In An "Economic Bubble"

Submitted by Tyler Durden on 04/08/2016 - 07:51 "...we tried carefully to look at evidence of potential financial instability that might be brewing and some of the hallmarks of that, clearly overvalued asset prices, high leverage, rising leverage, and rapid credit growth. We certainly don’t see those imbalances. And so although interest rates are low, and that is something that could encourage reach for yield behavior, I wouldn’t describe this as a bubble economy."

Lost Faith In Central Banks And The Economic End Game

Submitted by Tyler Durden on 04/07/2016 - 22:40 If the IMF is engineering a financial crisis in Europe in order to gain more power and influence, why wouldn’t the Fed be doing the same for the IMF in America? Just as the international bankers use stimulus and rate policy as tools, so, to, do they use chaos.

Bad News For Rebound Hopes: Consumer Spending Fails To Rise According To Card Spending Data

Submitted by Tyler Durden on 04/08/2016 - 09:37 While big banks blame the collapse in Q1 GDP on "residual seasonality" (more on that later), with BofA recently slashing its Q1 estimate from as much as 2.7% to just 0.2%, the reality is that something is not well with the US consumer. The latest proof of this comes from the most recent Bank of America credit and debt card spending data, which reveals that sales were once again down 0.1% yoy.When Will The BOJ Intervene: This Is What Wall Street Thinks Is Kuroda's Breaking Point

Submitted by Tyler Durden on 04/08/2016 - 08:55 With the Yen soaring (and USDJPY plunging) some 10% in 2016, in the process crushing the tightly correlated Nikkei and leading to such outcomes as the largest Asian clothes retailer slashing profits by a third in just 4 months due to the strong currency, everyone has been wondering i) why is the BOJ waiting to intervene when it had no problems unleashing NIRP when the USDJPY was about 1000 pips higher and ii) when will it intervene again?

Futures Spike After Bill Dudley Urges "Cautious Approach" As "Balance Of Risks Tilted To Downside"

Submitted by Tyler Durden on 04/08/2016 - 08:40 Caution is called for because of Fed’s limited ability to reduce policy rate, Federal Reserve Bank of New York President William Dudley says, Dudley comments in text of speech in Bridgeport, CT. “Although the downside risks have diminished since earlier in the year, I still judge the balance of risks to my inflation and growth outlooks to be tilted slightly to the downside”

from Infowars:

CNN criticized a plan devised by political insider Roger Stone and

radio host Alex Jones calling for Trump supporters to assemble at the

Republican National Convention in Cleveland in July.

CNN criticized a plan devised by political insider Roger Stone and

radio host Alex Jones calling for Trump supporters to assemble at the

Republican National Convention in Cleveland in July.

“We will have demonstrations at specific hotels where there are delegates so we can let them visually see the will of the people,” Stone says in a clip aired by Don Lemon. “We will have a daily protest. We will man the ramparts every day,” Stone says, clarifying he is calling for peaceful, non-violent demonstrations.

“That sounds slightly ominous. Is that the way you want the delegates counted?” Lemon asks CNN contributor Kayleigh McEnany and Blaze editor and former CIA intelligence officer Buck Sexton, who proceeded to launch an attack on Jones.

Read More

CNN criticized a plan devised by political insider Roger Stone and

radio host Alex Jones calling for Trump supporters to assemble at the

Republican National Convention in Cleveland in July.

CNN criticized a plan devised by political insider Roger Stone and

radio host Alex Jones calling for Trump supporters to assemble at the

Republican National Convention in Cleveland in July.“We will have demonstrations at specific hotels where there are delegates so we can let them visually see the will of the people,” Stone says in a clip aired by Don Lemon. “We will have a daily protest. We will man the ramparts every day,” Stone says, clarifying he is calling for peaceful, non-violent demonstrations.

“That sounds slightly ominous. Is that the way you want the delegates counted?” Lemon asks CNN contributor Kayleigh McEnany and Blaze editor and former CIA intelligence officer Buck Sexton, who proceeded to launch an attack on Jones.

Read More

Why Bank Of America Remains A "Seller Of Risk"

Submitted by Tyler Durden on 04/08/2016 - 08:15 It is not only BofA's "smart money" clients who have been selling the rally non-stop (and at an accelerating pace) for the past 10 weeks: so has the bank's chief investment strategist, Michael Hartnett, whose reluctance to embrace the mania has been duly documented on these pages.Below we lay out the reasons why he "remains a seller of risk."Frontrunning: April 8

- Stocks up as investors look to end bruising week on a high (Reuters)

- Treasuries Set for Two-Week Gain; Greenspan Warns of Global Risk (BBG)

- Yellen, alongside Fed alum, says rate hikes on track (Reuters)

- Oil Prices Lifted by Fed Comments on U.S. Economy (WSJ)

- China says G20 summit should be about economics, not politics (Reuters)

- Cameron Accused of Hypocrisy for Stake in Father's Offshore Fund (BBG)

Shocking Photo: Nearly 30 Oil Tankers in Traffic Jam Off Iraqi Coast

Submitted by Tyler Durden on 04/08/2016 - 09:15 Oil tankers are caught in a traffic jam near the Iraqi port of Basra, causing delays in loading. According to Reuters, around 30 very large crude carriers (VLCCs) are sitting in the Persian Gulf, and the backlog could cost ship owners more than $75,000 per day. Some could be waiting for weeks to reach the port. Check out this shocking satellite photo of the tanker traffic jam just off the coast of Iraq.

Stocks To Reopen In The Green For 2016 After Crude, USDJPY Rebound

Submitted by Tyler Durden on 04/08/2016 - 06:49 In the final day of the week, it has again been a story of currencies and commodities setting stock prices, however instead of yesterday's Yen surge which slammed the USDJPY as low as 107.67 and led to a global tumble in equities, and crude slide, today has been a mirror imoage after a modest FX short squeeze, which sent the Yen pair as high as 109.1, before easing back to the 108.80 range. This, coupled with a 3.5% bounce in WTI, which is back up to $38.54 and up 4.9% on the week as speculation has returned that Russia and OPEC members can reach a production freeze deal on April 17, led to a global stock rebound which will see the S&P open back in the green for 2016.

Who Is The Richest Person In Every State

Submitted by Tyler Durden on 04/07/2016 - 23:23 Due to popular demand, we are following up our post on which states have the most billionaires, with a list of the richest people by state, in map format

The Panama Papers Could Really End Hillary Clinton's Campaign

Submitted by Tyler Durden on 04/07/2016 - 22:35 Despite the supposedly ineluctable logic of Sanders’ unelectability, many pundits now believe there has been a seismic shift in the 2016 presidential race. It is becoming increasingly obvious that Americans are sick to death of the two corporatist political establishments and will do anything to send them a message. Then there’s the matter of the Panama Papers, which once again illustrate the stark contrast in judgement between Bernie Sanders and Hillary Clinton.

Puerto Rico Bonds Crash After "Moratorium" Raises Default Risk

Submitted by Tyler Durden on 04/07/2016 - 22:15 Just a day after Governor Alejandro Garcia Padilla signed a law that enables him to temporary halt debt payments, dramatically raising the risk of widespread defaults, Puerto Rico securities had the biggest one-day drop in more than eight months.

Are Russians In For Yet Another War?

Submitted by Tyler Durden on 04/07/2016 - 21:50 Just like the Cold War I, the Cold War II has its ideological underpinning, except, now it is not about communism versus capitalism, it is about multipolarity versus unipolarity. It just happened Russia was not willing to be a part of unipolar world. It just happened to be against Russian national character to be serving a “higher master”. How did it dare to disobey? Well, the nuclear weapons came handy for standing up to protect its national pride and its national interest in face of America bluntly stepping into Russia’s spheres of interest.

19 Facts That Prove Things In America Are Worse Than They Were Six Months Ago

Submitted by Tyler Durden on 04/07/2016 - 21:20 While we all very capable of discerning the 'recovery' facts from the peddled recovery fiction throughout President Obama's reign, a close up over the last six months suggests things are getting worse in a hurry. As The Economic Collapse blog's Michael Snyder details, while most people seem to think that since the stock market has rebounded significantly in recent weeks that everything must be okay, that is not true at all.

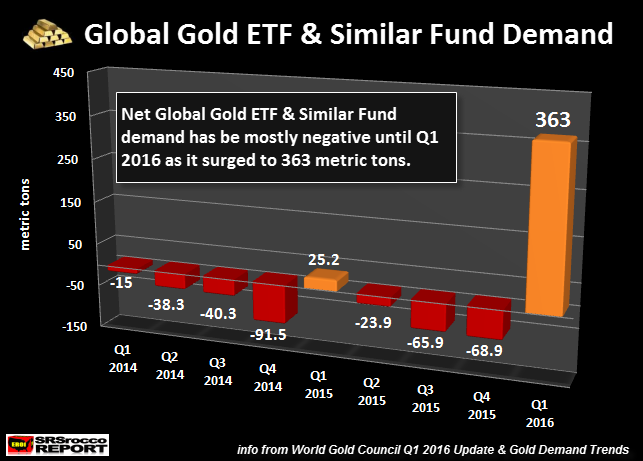

Something big happened in the gold market. It was a stunning trend change in mainstream gold demand during the first quarter of the year. This suggests investors are becoming increasingly worried about the stock markets and are looking for safety elsewhere.

Over the past several years, the gold market has suffered net outflows of metal from Gold ETF’s & Funds. However, this changed in a big way in Q1 2016:

According to the World Gold Council’s Gold Demand Trends, the market suffered net outflows from Gold ETF’s & Similar Funds except for the small 25 metric ton (mt) build during Q1 2015. Then in the first quarter of 2016, it surged to 363 mt. Actually, it was the second highest quarterly build of Gold ETF’s & Funds in history.

Read More

from Wolf Street:

The bitter irony of a trade agreement.

International arbitration lawyers have a soft spot for Latin America, for a reason: over the last ten years, the region has been one of the primary sources of their exorbitant fees, which can range from $375 to $700 per hour depending on where the arbitration takes place.

By 2008, more than half of all registered claims at the International Centre for Settlement of Investment Disputes (ICSID) were pending against Latin American countries. In 2012, around one-quarter of all new ICSID disputes involved a Latin American state.

Read More

The bitter irony of a trade agreement.

International arbitration lawyers have a soft spot for Latin America, for a reason: over the last ten years, the region has been one of the primary sources of their exorbitant fees, which can range from $375 to $700 per hour depending on where the arbitration takes place.

By 2008, more than half of all registered claims at the International Centre for Settlement of Investment Disputes (ICSID) were pending against Latin American countries. In 2012, around one-quarter of all new ICSID disputes involved a Latin American state.

Read More

by Jeff Nielson, Sprott Money:

Is there a connection between Human Freedom and a Gold Redeemable Money? At first glance it would seem that money belongs to the world of economics and human freedom to the political sphere.

But when you recall that one of the first moves by Lenin, Mussolini and Hitler was to outlaw individual ownership of gold, you begin to sense that there may be some connection between money, redeemable in gold, and the rare prize known as human liberty . [emphasis mine]

– Rep. Howard Buffett, 1948

Read More

Is there a connection between Human Freedom and a Gold Redeemable Money? At first glance it would seem that money belongs to the world of economics and human freedom to the political sphere.

But when you recall that one of the first moves by Lenin, Mussolini and Hitler was to outlaw individual ownership of gold, you begin to sense that there may be some connection between money, redeemable in gold, and the rare prize known as human liberty . [emphasis mine]

– Rep. Howard Buffett, 1948

Read More

from The Daily Bell:

The $1 Trillion Short Underlying Stocks’ Spring … Short interest

reaches highest level since 2008 despite gains … Level is contrarian

bullish, sets up powerful rally, says BofA … A funny thing has happened

in the U.S. stock market, where rather than loosen their grip bears have

grown ever-more impassioned. They’ve sent short interest to an

eight-year high and above $1 trillion, by one analyst’s math. -Bloomberg

The $1 Trillion Short Underlying Stocks’ Spring … Short interest

reaches highest level since 2008 despite gains … Level is contrarian

bullish, sets up powerful rally, says BofA … A funny thing has happened

in the U.S. stock market, where rather than loosen their grip bears have

grown ever-more impassioned. They’ve sent short interest to an

eight-year high and above $1 trillion, by one analyst’s math. -Bloomberg

Could the stock market move up hard in these upcoming months? Sometimes contrarian sentiment is an indicator of an unexpected stock market rise. And bearish sentiment is overwhelming at the moment, as you can see from the above Bloomberg excerpt.

So are we looking at a break out? It doesn’t seem likely of course for the reasons we and others have enumerated. Stocks are over-extended by any rational measure.

Read More

The $1 Trillion Short Underlying Stocks’ Spring … Short interest

reaches highest level since 2008 despite gains … Level is contrarian

bullish, sets up powerful rally, says BofA … A funny thing has happened

in the U.S. stock market, where rather than loosen their grip bears have

grown ever-more impassioned. They’ve sent short interest to an

eight-year high and above $1 trillion, by one analyst’s math. -Bloomberg

The $1 Trillion Short Underlying Stocks’ Spring … Short interest

reaches highest level since 2008 despite gains … Level is contrarian

bullish, sets up powerful rally, says BofA … A funny thing has happened

in the U.S. stock market, where rather than loosen their grip bears have

grown ever-more impassioned. They’ve sent short interest to an

eight-year high and above $1 trillion, by one analyst’s math. -BloombergCould the stock market move up hard in these upcoming months? Sometimes contrarian sentiment is an indicator of an unexpected stock market rise. And bearish sentiment is overwhelming at the moment, as you can see from the above Bloomberg excerpt.

So are we looking at a break out? It doesn’t seem likely of course for the reasons we and others have enumerated. Stocks are over-extended by any rational measure.

Read More

by Terence P. Jeffrey, CNS News:

Does the president of the United States have the power to unilaterally

tell millions of individuals who are violating federal law that he will

not enforce that law against them now, that they may continue to violate

that law in the future and that he will take action that makes them

eligible for federal benefit programs for which they are not currently

eligible due to their unlawful status?

Does the president of the United States have the power to unilaterally

tell millions of individuals who are violating federal law that he will

not enforce that law against them now, that they may continue to violate

that law in the future and that he will take action that makes them

eligible for federal benefit programs for which they are not currently

eligible due to their unlawful status?

Through Solicitor General Donald Verrilli, President Barack Obama is telling the Supreme Court exactly this right now.

The solicitor general calls what Obama is doing “prosecutorial discretion.”

He argues that under this particular type of “prosecutorial discretion,” the executive can make millions of people in this country illegally eligible for Social Security, disability and Medicare.

Read More…

Does the president of the United States have the power to unilaterally

tell millions of individuals who are violating federal law that he will

not enforce that law against them now, that they may continue to violate

that law in the future and that he will take action that makes them

eligible for federal benefit programs for which they are not currently

eligible due to their unlawful status?

Does the president of the United States have the power to unilaterally

tell millions of individuals who are violating federal law that he will

not enforce that law against them now, that they may continue to violate

that law in the future and that he will take action that makes them

eligible for federal benefit programs for which they are not currently

eligible due to their unlawful status?Through Solicitor General Donald Verrilli, President Barack Obama is telling the Supreme Court exactly this right now.

The solicitor general calls what Obama is doing “prosecutorial discretion.”

He argues that under this particular type of “prosecutorial discretion,” the executive can make millions of people in this country illegally eligible for Social Security, disability and Medicare.

Read More…

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment