Submitted by Tyler Durden on 04/27/2016 - 17:25

Submitted by Tyler Durden on 04/27/2016 - 17:25

As the battle heats up between the presumptive nominees for President, the word-wars have begun. Following Hillary's "love Trump's hate" breaking-barriers speech last night, a seemingly calmer, friendlier Trump went after Hillary exclaiming that "the only thing she's got going is the woman's card...and the beautiful thing is that women don't like her." Trump added that he'll "do far more for women than Hillary Clinton will do," and that "if Hillary Clinton were a man, I don't think she'd get 5 percent of the vote."

Delaware Has One Billion Reasons Not To Change Its Laws Of Incorporation

Submitted by Tyler Durden on 04/27/2016 - 17:49 In the aftermath of the Panama Papers scandal, one topic that will only continue to receive attention as this topic moves along, is the state of Delaware and its perceived status as a U.S. tax shelter. According to Bloomberg, the state has about 1.1 million business entities, and one single building located at Wilmington's 1209 Orange Street is the home address of 285,000 companies including Alphabet (Google), Ford Motor Co., and Wal-Mart. However, as pressure from mounts from the outside asking Delaware to reform some of its laws around incorporation and business in general, there is one good reason why the state will choose to leave everything at the status quo if at all possible.

by Justin Spittler, Casey Research:

Sam Zell has called the top again…

Zell is a real estate mogul and self-made billionaire. He made a fortune buying property for pennies on the dollar during recessions in the 1970s and 1990s. This earned him the nickname “The Grave Dancer.”

Zell was also one of the only real estate gurus to spot the last property bubble and get out before it popped. In February 2007, he sold $23 billion worth of office buildings. U.S. commercial property prices peaked nine months later and went on to plunge 42%.

Read More…

Sam Zell has called the top again…

Zell is a real estate mogul and self-made billionaire. He made a fortune buying property for pennies on the dollar during recessions in the 1970s and 1990s. This earned him the nickname “The Grave Dancer.”

Zell was also one of the only real estate gurus to spot the last property bubble and get out before it popped. In February 2007, he sold $23 billion worth of office buildings. U.S. commercial property prices peaked nine months later and went on to plunge 42%.

Read More…

"We All Work As A Team" - Millennials Explain How It's Going Living 'Rent-Free' At Home

Submitted by Tyler Durden on 04/27/2016 - 16:40 "I had an apartment in Chicago. It was tiny and expensive. I was miserable. I moved back... My parents have done so much for me, and now they're letting me live here rent-free, so I try to help out. I pick up my sister from school, do the dishes or whatever chore needs to be done. My mom makes dinner. We all work as a team."

Apple Suicide: Man With Head Wound Found Dead At Apple Headquarters Conference Room; Gun Found Nearby

Submitted by Tyler Durden on 04/27/2016 - 14:34 Deputies were called to the company's corporate headquarters on Wednesday morning after a person was found dead, but only few details were immediately available. Multiple police vehicles could be seen at the campus.Fed-nado Trumps AAPLocalypse: Panic-Buying Spree Pushes S&P Back Over 2,100 (And Fails)

Submitted by Tyler Durden on 04/27/2016 - 17:00The Worst Law Most Americans Have Never Heard Of

Submitted by Tyler Durden on 04/27/2016 - 17:00

Trump To Get More Primary Votes Than Anyone In History

Submitted by Tyler Durden on 04/27/2016 - 16:22 With a number of states remaining including California, Trump is set to surpass current record holder George W. Bush, who received 10.8 million votes in 2000.Facebook Soars After Beating Sales, EPS As Tax Rate Tumbles: Reports 1.09 Billion Daily Users

Submitted by Tyler Durden on 04/27/2016 - 16:13 If yesterday it was doom and gloom for tech stocks, then today it's Facebook's turn for soom upside down frown turning boom. Moments ago the social network reported another round of blowout results...

Watch Live: Congressional Hearing Pits Bill Ackman And Outgoing Valeant CEO Against Angry Senators

Submitted by Tyler Durden on 04/27/2016 - 16:12 In a few moments, a major showdown will take place in Congress when on the same table Valeant's outgoing CEO Michael Pearson will sit next to Valeant's most prominent investor Bill Ackman and also the former CFO, Howard Schiller, who the company recently tried to scapegoat for most of the problem that sent the stock price of VRX crashing 85% from its summer 2015 highs.

Ted Cruz Announces Carly Fiorina As VP Running Mate: Live Feed

Submitted by Tyler Durden on 04/27/2016 - 16:04 As we predicted during our preview of Ted Cruz's "big announcement" earlier today, the republican presidential candidate, in hopes of kickstarting his mathematically impossible to win campaign, is set to announce that Carly Fiorina will be his vice presidential nominee if he’s the Republican Party’s pick for president according to Politico.

Question Everything?

Submitted by Tyler Durden on 04/27/2016 - 15:50 We've lost "hope," so this must be the "change"?

And So It Begins?

Submitted by Tyler Durden on 04/27/2016 - 15:35 Over the last few years we have made it abundantly clear that sooner or later it would be shown that the whole Silicon Valley meme of “It’s different this time” (i.e., in regards to unicorns, social everything, eye balls for ads etc., etc.) was nothing more than the equivalent of a teenager’s response of “because” when arguing why valuations of many of "The Valley’s" newest, or trans-formative platforms were clearly not only out-of-whack with reality, but bordered on insanity.

The $2 Trillion Gamble That Saudi Arabia Cannot Win

Submitted by Tyler Durden on 04/27/2016 - 15:05 The Vision for 2030 is mostly smoke and mirrors. Saudi Arabia probably cannot replace the money it will lose if oil goes out of style and so is doomed to downward mobility and very possibly significant instability. It has been a great party since the 1940s; it is going to be a hell of a hangover.

Iran's Supreme Leader Accuses Obama Of Lifting Sanctions Only "On Paper"

Submitted by Tyler Durden on 04/27/2016 - 14:57 Relations between Iran and Saudi Arabia, which supposed had thawed as part of Obama's landmark 2015 nuclear deal which also allowed Iran to resume exporting its oil, are once again on the fence following a statement by Iran's Supreme Leader, Ayatollah Ali Khamenei, which accused the United States of scaring businesses away from Tehran and undermining a deal to lift international sanctions.

It's That Time Again For Stocks

Submitted by Tyler Durden on 04/27/2016 - 14:45 What happens next?FOMC Statement Key Take Aways: "Fed Leaves Door Open For June Rate Hike"

Submitted by Tyler Durden on 04/27/2016 - 14:29- The April 27 statement downgraded economic activity, said it "slowed", but labor market conditions "improved further" and inflation still expected to rise toward 2% over the medium term.

- Removed language that "global economic and financial developments continue to pose risks".

- Kansas City Fed's Esther George dissented in favor of a rate hike.

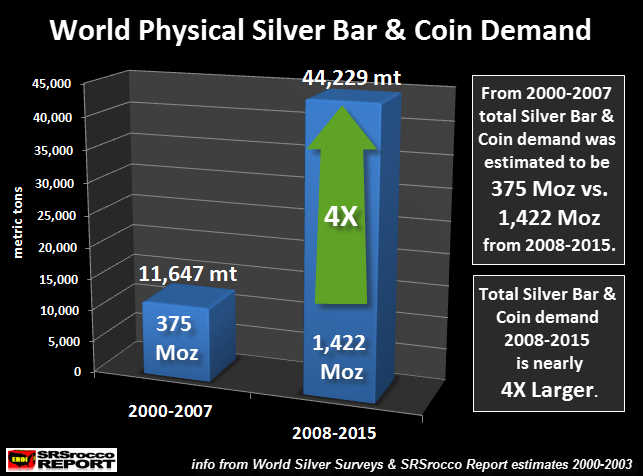

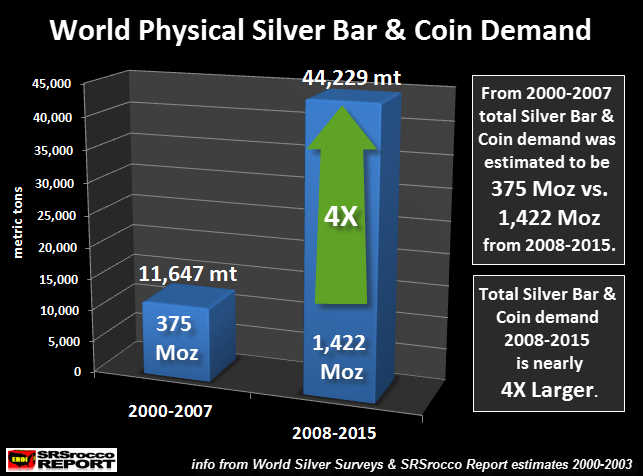

by Steve St. Angelo, SRS Rocco:

The best reason to own silver is based upon underlying market fundamentals. However, most of the markets today aren’t being valued by fundamentals, but rather on Fed and Central Bank interventions. This has destroyed the ability for investors and markets to properly value most assets.

I, as well as many precious metals analysts have received some ridicule for getting it wrong on the price movements of gold and silver since 2012. Of course, no one was complaining when the silver price moved up from an average $6.67 in 2004 to $35.12 in 2011.

Sure, we precious metals analysts deserve some criticism for not foreseeing how much monetary printing the Fed and Central Banks would do as well as the massive corruption and deceit conducted by the top banks in the world.

Read More

The best reason to own silver is based upon underlying market fundamentals. However, most of the markets today aren’t being valued by fundamentals, but rather on Fed and Central Bank interventions. This has destroyed the ability for investors and markets to properly value most assets.

I, as well as many precious metals analysts have received some ridicule for getting it wrong on the price movements of gold and silver since 2012. Of course, no one was complaining when the silver price moved up from an average $6.67 in 2004 to $35.12 in 2011.

Sure, we precious metals analysts deserve some criticism for not foreseeing how much monetary printing the Fed and Central Banks would do as well as the massive corruption and deceit conducted by the top banks in the world.

Read More

Market Reacts To Fed Confusion With Chaotic Stop Hunt: Bonds Beating Stocks, Banks Pump'n'Dump

Submitted by Tyler Durden on 04/27/2016 - 14:22 Update: Risk on is fading fast with bonds & bullion topping stocksThe kneejerk - USD up, stocks down, bonds down - reaction has faded and with The Fed statement pitching its dovish tent back in domestic concerns while keeping a hawkish eye on global developments. The Long bond is back in the green but it appears machines are busier running oil stops higher and dumping gold. Rate hike odds rose but very modestly from 21% pre- to 23.5% post-FOMC.

Fed Removes "Global Risk" Alert But Keeps Monitoring "Global Economic And Financial Developments" - Full Statement Redline

Submitted by Tyler Durden on 04/27/2016 - 14:02 Since Yellow-Yellen's March dovefest, stocks have rallied, China has stabilized, and while economic data has been weak in general - jobs and inflation (which is what The Fed claims to care about) have been positive. So how does The Fed make June a live meeting, tilt hawkish, and still protect the narrative of recovery and the sanctity of their equity market (which is all that really matters)...- *FED REMOVES REFERENCE TO GLOBAL EVENTS POSING RISKS TO OUTLOOK

- *FED SAYS LABOR MARKET IMPROVED EVEN AMID SIGNS OF SLOWER GROWTH

- *FED REPEATS ECONOMIC SITUATION WARRANTS ONLY GRADUAL RATE HIKES

FOMC Preview: The Fed Is "Scared To Death" & "The Knock-On Effects Could Be Spectacular"

Submitted by Tyler Durden on 04/27/2016 - 13:50 Federal Reserve officials are virtually certain to hold interest rates steady when their meeting ends today but they could try to send a message to markets and outside observers about what likely comes next. With no press conference scheduled after this week’s meeting and no new economic forecasts to be released, all the attention will be focused on their words and the market is more aware than ever that the Fed doesn’t act in a vacuum. As Bloomberg's Richard Breslow notes, The Fed is hopeful (that their always-wrong forecasts come true this time) but they're also scared to death on the consequences.

America's Entitled (And Doomed) Upper Middle Class

Submitted by Tyler Durden on 04/27/2016 - 13:45 The upper middle class is well and truly doomed by self-delusion and the pathology of entitlement.

Business "Subsidies" Plummet 70% As Government Support Evaporates

Submitted by Tyler Durden on 04/27/2016 - 13:40 In order to attract and retain small and big business alike, it's long been a tactic by states and local governments to offer tax breaks. However, as times have got tough - and rules have changed - in Obama's "recovery", government subsidies to their cronies - of at least $50 million - have plummeted by 70% Bloomberg reports.

Former House Speaker And "Serial Child Molester" Dennis Hastert Sentenced To 15 Months In Prison

Submitted by Tyler Durden on 04/27/2016 - 13:30 Moments ago, former House Speaker Dennis Hastert was sentenced to 15 months in prison in his hush-money case by a judge who called him a "serial child molester" and ordered him to enroll in a sex-offender treatment program. As NBC reports, Hastert, 74, was accused of abusing four boys between the ages of 14 and 17 when he was a coach at Yorkville High School decades ago. While he was not charged with any sexual crimes because of the statute of limitations, but he pleaded guilty to making illegal cash withdrawals to pay off one of his accusers.

by J. D. Heyes, Natural News:

Americans

jaded by decades of growing government unresponsiveness, were shocked

when the Michigan attorney general announced that he would file charges

against two state environmental officials and a Flint city official, for

negligently continuing to provide lead-tainted water to residents, even

after becoming aware that the water was contaminated.

Americans

jaded by decades of growing government unresponsiveness, were shocked

when the Michigan attorney general announced that he would file charges

against two state environmental officials and a Flint city official, for

negligently continuing to provide lead-tainted water to residents, even

after becoming aware that the water was contaminated.

And yet, as reported by The New York Times and other media, that is precisely what happened in recent days. The three are the first to face criminal charges in a scandal where residents unwittingly drank tainted water for nearly 18 months.

Read More

Americans

jaded by decades of growing government unresponsiveness, were shocked

when the Michigan attorney general announced that he would file charges

against two state environmental officials and a Flint city official, for

negligently continuing to provide lead-tainted water to residents, even

after becoming aware that the water was contaminated.

Americans

jaded by decades of growing government unresponsiveness, were shocked

when the Michigan attorney general announced that he would file charges

against two state environmental officials and a Flint city official, for

negligently continuing to provide lead-tainted water to residents, even

after becoming aware that the water was contaminated.And yet, as reported by The New York Times and other media, that is precisely what happened in recent days. The three are the first to face criminal charges in a scandal where residents unwittingly drank tainted water for nearly 18 months.

Read More

by Stewart Thomson , GoldSeek:

All institutional analyst eyes are on this week’s central bank announcements from Japan and America. Most gold community analysts seem to have a difficult time grasping the idea that Japan’s fiat currency is viewed by top FOREX money managers as a safe haven, albeit less of one than gold.

All institutional analyst eyes are on this week’s central bank announcements from Japan and America. Most gold community analysts seem to have a difficult time grasping the idea that Japan’s fiat currency is viewed by top FOREX money managers as a safe haven, albeit less of one than gold.

- The Japanese government is a huge debtor, but the citizens are even bigger creditors,and the bottom line is that the weakness of the debtors is superseded by the strength of the creditors.

- It’s possible that the Bank of Japan fires a “bazooka” this week, but how that will affect the Japanese stock market, the dollar-yen trade, and gold… is unknown.

by Charles Hugh Smith, Of Two Minds:

The upper middle class is well and truly doomed by self-delusion and the pathology of entitlement.

Two recent articles describe America’s entitled (and doomed) upper middle class: the top 5% of households with incomes above $206,500 annually and individuals with incomes of $160,000 or higher annually. (source: Historical Income Tables: Households Census.gov)

The first describes how businesses are responding to the new Gilded Age in which spending by the top 5% has pulled away from the stagnating bottom 95%:

Read More…

The upper middle class is well and truly doomed by self-delusion and the pathology of entitlement.

Two recent articles describe America’s entitled (and doomed) upper middle class: the top 5% of households with incomes above $206,500 annually and individuals with incomes of $160,000 or higher annually. (source: Historical Income Tables: Households Census.gov)

The first describes how businesses are responding to the new Gilded Age in which spending by the top 5% has pulled away from the stagnating bottom 95%:

Read More…

by Andy Hoffman, Miles Franklin:

It’s early Wednesday morning; on what may, following this afternoon’s

Fed decision, and tonight’s by the Bank of Japan, turn out to be a “day of Central banking infamy.” Which is why, before I get to today’s extremely important topic, I’m going to start with my fourth straight day of detailed “manipulation analysis.”

It’s early Wednesday morning; on what may, following this afternoon’s

Fed decision, and tonight’s by the Bank of Japan, turn out to be a “day of Central banking infamy.” Which is why, before I get to today’s extremely important topic, I’m going to start with my fourth straight day of detailed “manipulation analysis.”

Frankly, nothing I have seen in 14 years in the sector has been as blatant, and desperate, as what I’ve seen in the last week – as the Cartel chaotically attempts, and fails, to respond to the hard fact that dollar-priced gold, silver, and platinum have joined PM markets in the world’s other 180 currencies in BULL MARKETS. And this, ironically, on the five-year anniversary of the May 1st, 2011 “Sunday Night Paper Silver Massacre.”

Read More

It’s early Wednesday morning; on what may, following this afternoon’s

Fed decision, and tonight’s by the Bank of Japan, turn out to be a “day of Central banking infamy.” Which is why, before I get to today’s extremely important topic, I’m going to start with my fourth straight day of detailed “manipulation analysis.”

It’s early Wednesday morning; on what may, following this afternoon’s

Fed decision, and tonight’s by the Bank of Japan, turn out to be a “day of Central banking infamy.” Which is why, before I get to today’s extremely important topic, I’m going to start with my fourth straight day of detailed “manipulation analysis.”Frankly, nothing I have seen in 14 years in the sector has been as blatant, and desperate, as what I’ve seen in the last week – as the Cartel chaotically attempts, and fails, to respond to the hard fact that dollar-priced gold, silver, and platinum have joined PM markets in the world’s other 180 currencies in BULL MARKETS. And this, ironically, on the five-year anniversary of the May 1st, 2011 “Sunday Night Paper Silver Massacre.”

Read More

by Dave Kranzler, Investment Research Dynamics:

BRICS countries are large economies with large reserves of gold and an impressive volume of production and consumption of this precious metal. In China, the gold trade is conducted in Shanghai, in Russia it is in Moscow. Our idea is to create a link between the two cities in order to increase trade between the two markets,” First Deputy Governor of the Russian Central Bank Sergey Shvetsov told TASS – RT.com, April 19

The article in RT.com from which the above quote is sourced surprisingly did not receive a lot of attention from the alternative media. Perhaps it was overshadowed by the highly anticipated move by China to commence fixing the price of gold on the Shanghai Gold Exchange in yuan. I suggested that we would not see an immediate impact on the price of gold, which we have not, but that the move was part of a larger plan by China to “de-dollarize” the world.

Read More

BRICS countries are large economies with large reserves of gold and an impressive volume of production and consumption of this precious metal. In China, the gold trade is conducted in Shanghai, in Russia it is in Moscow. Our idea is to create a link between the two cities in order to increase trade between the two markets,” First Deputy Governor of the Russian Central Bank Sergey Shvetsov told TASS – RT.com, April 19

The article in RT.com from which the above quote is sourced surprisingly did not receive a lot of attention from the alternative media. Perhaps it was overshadowed by the highly anticipated move by China to commence fixing the price of gold on the Shanghai Gold Exchange in yuan. I suggested that we would not see an immediate impact on the price of gold, which we have not, but that the move was part of a larger plan by China to “de-dollarize” the world.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment