Submitted by Tyler Durden on 04/13/2016 - 08:16

Submitted by Tyler Durden on 04/13/2016 - 08:16

In a historic event, one which is perhaps the lowlight of the sad demise of the US coal industry, U.S. coal giant Peabody Energy, the largest U.S. coal producer which employs 8,300 workers, filed for bankruptcy on Wednesday, the most powerful convulsion yet in an industry that’s enduring the worst slump in decades.

Why Aren't We Talking About A Four-Candidate Race For The Presidency?

Submitted by Tyler Durden on 04/13/2016 - 09:42 The American public deserves the opportunity to vote for Sanders, Trump, and whatever hacks the two elitist war parties select.

Peter Thiel Says Everything Is Overvalued: "Public Equities, Houses, Government Bonds"

Submitted by Tyler Durden on 04/13/2016 - 09:21 Since the Fed may not, or simply refuses, to see if not a bubble then at least "froth" in any asset class, perhaps it should hire Peter Thiel to be on its macroproduential supervisory committee, because according to the venture capital legend who co-founded PayPal everything is overvalued. Speaking at the LendIt USA Conference in San Francisco on Tuesday, he said that he is "somewhat concerned about the frothiness of the markets" and adds that "startup tech stocks may be overvalued, but so are public equities, so are houses, so are government bonds."

Rich Flee "Crime Infested Hell Hole" Chicago Amid Racial Strife, Civil Unrest

Submitted by Tyler Durden on 04/12/2016 - 23:00 As time goes on the city of Chicago is rapidly turning into a crime infested hell hole, rife with poverty, debt, and racial tension. The city is well on its way to joining the likes of Detroit, and there may be no escaping that eventuality. That’s why many of the city’s wealthy elites are getting the hell out of there. The Chicago Tribune reports that roughly 3,000 millionaires have left the city over the past year alone, which amounts to about 2 percent of their wealthy population. This is the largest exodus of wealthy people in the United States, and one of the largest in the world.

by Michael Snyder, The Economic Collapse Blog:

The elite are fleeing major cities around the globe at a staggering rate. In fact, the Chicago Tribune is reporting that approximately 3,000 millionaires left the city of Chicago alone during 2015. The same study discussed in that Chicago Tribune article found that 7,000 millionaires left Paris, France last year. So why is this happening? Why are thousands of millionaires suddenly packing up and moving away from the big cities? Could it be possible that they have many of the same concerns that “preppers” do about what is coming?

For quite a while, I have been writing about how the elite have been preparing for the coming collapse. But I had no idea that literally thousands of them are packing up and permanently leaving our major cities. As I mentioned above, the Chicago Tribune is reporting that about 3,000 of them left the city of Chicago alone during the previous calendar year…

Read More

The elite are fleeing major cities around the globe at a staggering rate. In fact, the Chicago Tribune is reporting that approximately 3,000 millionaires left the city of Chicago alone during 2015. The same study discussed in that Chicago Tribune article found that 7,000 millionaires left Paris, France last year. So why is this happening? Why are thousands of millionaires suddenly packing up and moving away from the big cities? Could it be possible that they have many of the same concerns that “preppers” do about what is coming?

For quite a while, I have been writing about how the elite have been preparing for the coming collapse. But I had no idea that literally thousands of them are packing up and permanently leaving our major cities. As I mentioned above, the Chicago Tribune is reporting that about 3,000 of them left the city of Chicago alone during the previous calendar year…

Read More

Rail freight volume plunges to 2007 levels.

Rail freight volumes are an indicator of China’s goods-producing and goods-consuming economy, not just manufacturing, construction, agriculture, and the like, but also consumer goods. Thus they’re also an indication of consumer spending on goods. Alas, rail freight volume is collapsing: the first quarter this year puts volume for the whole year on track to revisit levels not seen since 2007.

While China’s economy was strong, rail freight volumes were soaring. For example, in 2010, when China was pump-priming its economy, rail freight volume jumped 10.8% from a year earlier. In 2011, it rose 6.9%. It had soared 44% from 2005 to 2011! But 2011 was the peak.

Read More

Is Tail Risk Really At An 18-Month Low?

Submitted by Tyler Durden on 04/13/2016 - 09:02 The CBOE SKEW Index just closed at its lowest level since October 2014 – but is tail risk in the stock market really that low?

US Retail Sales Tumble Into Recession Territory Driven By Auto Sales Plunge

Submitted by Tyler Durden on 04/13/2016 - 08:40 After stumbling sideways around unch MoM for 3 months, US retail sales tumbled 0.3% in March (considerably worse than the 0.1% MoM gain expected) confirming BofA's credit card data as we warned. March's print is practically the weakest month since Feb 2015 and is unlikely to get much better given the dismally weak start to April, as we noted here. After 3 months of low-base bounce in YoY retail sales, March saw it collapse back to just 1.7% YoY - deep in recession territory.

George Soros Warns Europe: Absorb 500k Refugees Costing $34Bn, Or Risk "Existential Threat"

Submitted by Tyler Durden on 04/13/2016 - 08:30 The asylum policy that emerged from last month’s EU-Turkey negotiations has four fundamental flaws, according to Billionaire puppet-master George Soros, which combined pose an "existential threat to Europe." His solution is 'simple' - Accept 500,000 refugees per year costing $34 billion year (via "surge" funding through more borrowing, and a newly-created refugee crisis fund from increased VAT on member states) or else, in his words, "the European Union is in mortal danger?"

Dear Dallas Fed, Any Comment?

Submitted by Tyler Durden on 04/13/2016 - 07:55 "In September, regulators from the OCC, the Federal Reserve and the Federal Deposit Insurance Corp. met with dozens of energy bankers at Wells Fargo’s office in Houston... Regulators pushed lenders to focus instead on a borrower’s ability to make enough money to repay the loan, according to the person familiar with the discussions."

It Begins: Obama Forgives Student Debt Of 400,000 Americans

Submitted by Tyler Durden on 04/13/2016 - 08:01 Joining the ranks of "broke lawyers" who can cancel their student debt, "Americans with disabilities have a right to student loan relief,” now according to Ted Mitchell, the undersecretary of education, said in a statement. Almost 400,000 student loan borrowers will now have an easier path to a debt bailout as Obama primes the populist voting pump just in time for the elections.

Oil Rally Fizzles After OPEC Sees Lower Global Demand; BofA Says "Reduce Risk Into Doha"

Submitted by Tyler Durden on 04/13/2016 - 07:54 OPEC came out this morning with a warning on perhaps the biggest wildcard of all: global demand for oil, which OPEC now declining. The now defunct cartel sees 2016 demand growth ~1.2m b/d vs previous estimate of 1.25m b/d. "Current negative factors seem to outweigh positive ones and possibly imply downward revisions in oil demand growth, should existing signs persist going forward," the organization’s Vienna-based secretariat said in its monthly market report. "Economic developments in Latin America and China are of concern."

JPM Q1 Profit Slides 7%; Trading Revenue Beats; Loss Reserve Jumps Most In 6 Years - Full Summary

Submitted by Tyler Durden on 04/13/2016 - 07:28 There was a sigh of relief, when moments ago JPM reported that it had beat expectations of a $1.25 print, when it announced $1.41 in adjusted EPS, with total revenue sliding by $700 MM to $24.1 billion but also beating lowered expectations of $23.8 billion. The largest U.S. bank by assets reported a profit of $5.52 billion, or $1.35 a share before 6 cents in adjustments, a drop of 6.7% compared to the profit of $5.91 billion, or $1.45 a share, in the same period of 2015. However, perhaps reminding that not all is well, JPM's consolidated loan loss reserve was a material $439 million greater than the preceding quarter and the biggest reserve build in six years, since Q1 of 2010.

Futures Jump On Chinese Trade Data; Oil Declines; Global Stocks Turn Green For 2016

Submitted by Tyler Durden on 04/13/2016 - 06:49 With oil losing some of its euphoric oomph overnight, following the API report of a surge in US oil inventories, and a subsequent report that Iran's oil minister would skip the Doha OPEC meeting altogether, the global stock rally needed another catalyst to maintain the levitation. It got that courtesy of the return of USDJPY levitation, which has pushed the pair back above 109, the highest in over a week, as well as a boost in sentiment from the previously reported Chinese trade data where exports rose the most in over a year, however much of the bounce was due to a favorable base effect from last year's decline. Additionally, as RBC reported, the 116.5% y/y increase in China’s reported March imports from HK likely reflects the growing trend of "over-invoicing", which is merely another form of capital outflow.

by Graham Reinders, GoldSeek:

What Do We Want From Gold?

Roosevelt proved that gold was a political/financial tool, and its value is politically governed.

Nixon proved two things: that the “Gold Standard” was nothing more than an arbitrary political tool, and indeed he made gold “legally” not money anymore. To make it illegal is an easy step if necessary. Gold is now such a small fraction of the economy I do not think it matters except as an underground currency.

Read More

What Do We Want From Gold?

Roosevelt proved that gold was a political/financial tool, and its value is politically governed.

Nixon proved two things: that the “Gold Standard” was nothing more than an arbitrary political tool, and indeed he made gold “legally” not money anymore. To make it illegal is an easy step if necessary. Gold is now such a small fraction of the economy I do not think it matters except as an underground currency.

Read More

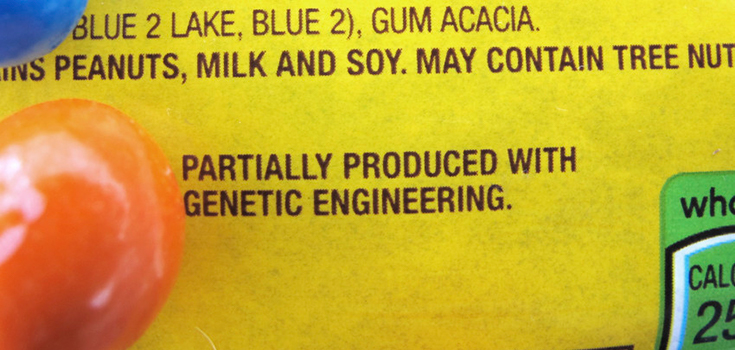

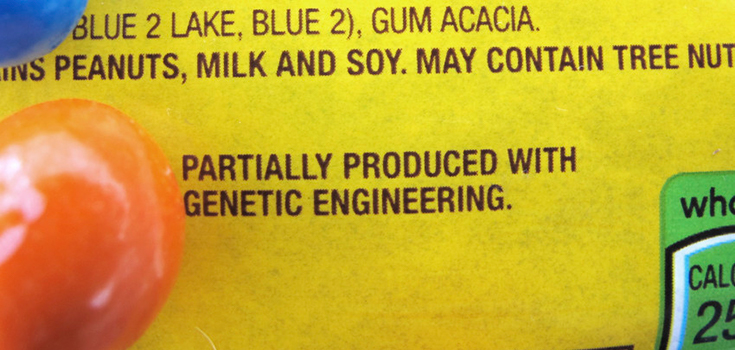

by Julie Fidler, Natural Society:

Staring July 1, Vermont will require all foods containing genetically modified (GM) ingredients to be labeled under Act 120, making it the first state in the U.S. to enact such a law. The state’s attorney general said last week in no uncertain terms that his office will enforce the law by targeting “willful violations” by manufacturers and not products that were produced before July 1 that are still on store shelves.

Staring July 1, Vermont will require all foods containing genetically modified (GM) ingredients to be labeled under Act 120, making it the first state in the U.S. to enact such a law. The state’s attorney general said last week in no uncertain terms that his office will enforce the law by targeting “willful violations” by manufacturers and not products that were produced before July 1 that are still on store shelves.

Said Todd Daloz, an assistant attorney general:

Read More

Every time someone accidentally enters a wrong username or password...they consider it an attempt to hack what a joke...

/ Staring July 1, Vermont will require all foods containing genetically modified (GM) ingredients to be labeled under Act 120, making it the first state in the U.S. to enact such a law. The state’s attorney general said last week in no uncertain terms that his office will enforce the law by targeting “willful violations” by manufacturers and not products that were produced before July 1 that are still on store shelves.

Staring July 1, Vermont will require all foods containing genetically modified (GM) ingredients to be labeled under Act 120, making it the first state in the U.S. to enact such a law. The state’s attorney general said last week in no uncertain terms that his office will enforce the law by targeting “willful violations” by manufacturers and not products that were produced before July 1 that are still on store shelves.Said Todd Daloz, an assistant attorney general:

Read More

Every time someone accidentally enters a wrong username or password...they consider it an attempt to hack what a joke...

by Melanie Hunter CNSnews:

IRS Commissioner John Koskinen told the Senate Finance Committee on

Tuesday that the Internal Revenue Service’s computers “withstand more

than 1 million malicious attempts to access them each day.”

IRS Commissioner John Koskinen told the Senate Finance Committee on

Tuesday that the Internal Revenue Service’s computers “withstand more

than 1 million malicious attempts to access them each day.”

“We work continuously to protect our main computer systems from cyber attacks and to safeguard taxpayer information stored in our databases. These systems withstand more than 1 million malicious attempts to access them each day,” Koskinen said in his opening statement.

Read More…

IRS Commissioner John Koskinen told the Senate Finance Committee on

Tuesday that the Internal Revenue Service’s computers “withstand more

than 1 million malicious attempts to access them each day.”

IRS Commissioner John Koskinen told the Senate Finance Committee on

Tuesday that the Internal Revenue Service’s computers “withstand more

than 1 million malicious attempts to access them each day.”“We work continuously to protect our main computer systems from cyber attacks and to safeguard taxpayer information stored in our databases. These systems withstand more than 1 million malicious attempts to access them each day,” Koskinen said in his opening statement.

Read More…

by Adan Salazar, Infowars:

An anonymous gun dealer in Arizona recently recounted how he

participated in selling multiple guns to straw purchasers amid

“Operation Fast and Furious” at the behest of the US Bureau of Alcohol,

Tobacco, Firearms and Explosives.

An anonymous gun dealer in Arizona recently recounted how he

participated in selling multiple guns to straw purchasers amid

“Operation Fast and Furious” at the behest of the US Bureau of Alcohol,

Tobacco, Firearms and Explosives.

The ill-planned scheme, which started in 2009 and reportedly ended in 2013 under the Obama administration, sought to trace guns sold to Mexican cartels by straw purchasers. The operation came to a head when a “Fast and Furious” weapon was found at the scene where US Border Patrol Agent Brian Terry was gunned down.

Sitting down with humor magazine Cracked, “James,” a former worker at a gun store in Phoenix, said he was contacted by the ATF after making a few sales of Barrett .50 caliber rifles to suspicious people.

Read More

An anonymous gun dealer in Arizona recently recounted how he

participated in selling multiple guns to straw purchasers amid

“Operation Fast and Furious” at the behest of the US Bureau of Alcohol,

Tobacco, Firearms and Explosives.

An anonymous gun dealer in Arizona recently recounted how he

participated in selling multiple guns to straw purchasers amid

“Operation Fast and Furious” at the behest of the US Bureau of Alcohol,

Tobacco, Firearms and Explosives.

The ill-planned scheme, which started in 2009 and reportedly ended in 2013 under the Obama administration, sought to trace guns sold to Mexican cartels by straw purchasers. The operation came to a head when a “Fast and Furious” weapon was found at the scene where US Border Patrol Agent Brian Terry was gunned down.

Sitting down with humor magazine Cracked, “James,” a former worker at a gun store in Phoenix, said he was contacted by the ATF after making a few sales of Barrett .50 caliber rifles to suspicious people.

Read More

by J. D. Heyes, Natural News:

During the rise of Nazi Germany, The Associated Press (AP) willingly

cooperated with Adolf Hitler’s Third Reich, submitting to dramatic

restrictions on freedom of the press

and providing the regime with images from the news service’s photo

archives so they could be used in anti-Semitic and anti-Western

propaganda, according to a new report.

During the rise of Nazi Germany, The Associated Press (AP) willingly

cooperated with Adolf Hitler’s Third Reich, submitting to dramatic

restrictions on freedom of the press

and providing the regime with images from the news service’s photo

archives so they could be used in anti-Semitic and anti-Western

propaganda, according to a new report.

As noted by the Times of Israel, when Hitler’s National Socialists rose to power in 1933, every international news agency save the U.S.-based AP, which was founded in 1846, was ordered to leave Germany; the AP continued to operate in Nazi Germany until 1941, when America declared war on the Axis following Japan’s “surprise attack” on Pearl Harbor.

According to German historian Harriet Scharnberg, what is now the world’s largest news organization was only permitted to remain in Germany because it agreed to a deal with the Nazi regime.

Read More

During the rise of Nazi Germany, The Associated Press (AP) willingly

cooperated with Adolf Hitler’s Third Reich, submitting to dramatic

restrictions on freedom of the press

and providing the regime with images from the news service’s photo

archives so they could be used in anti-Semitic and anti-Western

propaganda, according to a new report.

During the rise of Nazi Germany, The Associated Press (AP) willingly

cooperated with Adolf Hitler’s Third Reich, submitting to dramatic

restrictions on freedom of the press

and providing the regime with images from the news service’s photo

archives so they could be used in anti-Semitic and anti-Western

propaganda, according to a new report.As noted by the Times of Israel, when Hitler’s National Socialists rose to power in 1933, every international news agency save the U.S.-based AP, which was founded in 1846, was ordered to leave Germany; the AP continued to operate in Nazi Germany until 1941, when America declared war on the Axis following Japan’s “surprise attack” on Pearl Harbor.

According to German historian Harriet Scharnberg, what is now the world’s largest news organization was only permitted to remain in Germany because it agreed to a deal with the Nazi regime.

Read More

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment