Submitted by Tyler Durden on 04/27/2016 - 18:38

Submitted by Tyler Durden on 04/27/2016 - 18:38

Venezuela is now so broke that it no longer has enough money to pay for its money.

by Steve St. Angelo, SRS Rocco:

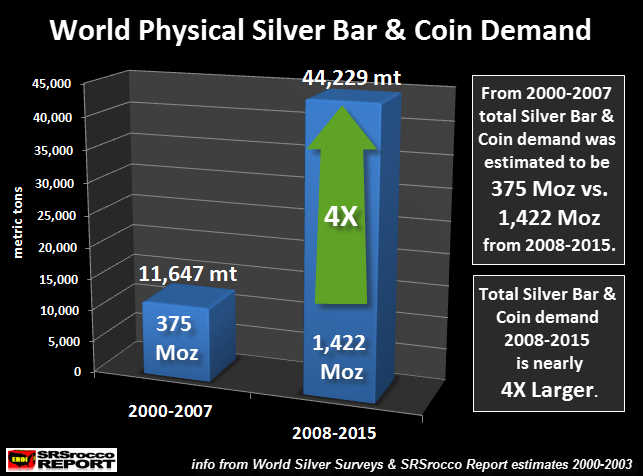

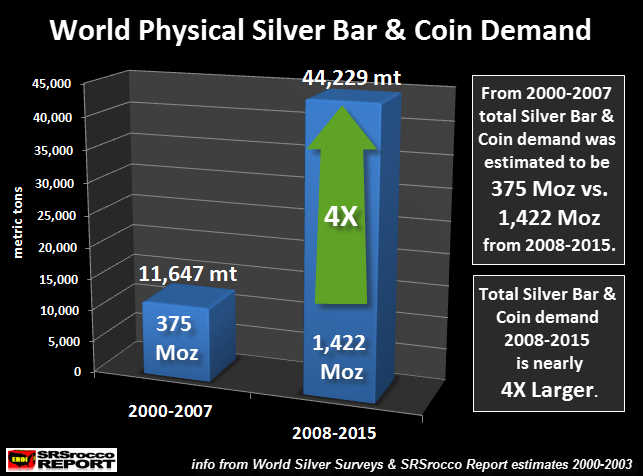

The best reason to own silver is based upon underlying market fundamentals. However, most of the markets today aren’t being valued by fundamentals, but rather on Fed and Central Bank interventions. This has destroyed the ability for investors and markets to properly value most assets.

I, as well as many precious metals analysts have received some ridicule for getting it wrong on the price movements of gold and silver since 2012. Of course, no one was complaining when the silver price moved up from an average $6.67 in 2004 to $35.12 in 2011.

Sure, we precious metals analysts deserve some criticism for not foreseeing how much monetary printing the Fed and Central Banks would do as well as the massive corruption and deceit conducted by the top banks in the world.

Read More

The best reason to own silver is based upon underlying market fundamentals. However, most of the markets today aren’t being valued by fundamentals, but rather on Fed and Central Bank interventions. This has destroyed the ability for investors and markets to properly value most assets.

I, as well as many precious metals analysts have received some ridicule for getting it wrong on the price movements of gold and silver since 2012. Of course, no one was complaining when the silver price moved up from an average $6.67 in 2004 to $35.12 in 2011.

Sure, we precious metals analysts deserve some criticism for not foreseeing how much monetary printing the Fed and Central Banks would do as well as the massive corruption and deceit conducted by the top banks in the world.

Read More

"We All Work As A Team" - Millennials Explain How It's Going Living 'Rent-Free' At Home

Submitted by Tyler Durden on 04/27/2016 - 16:40 "I had an apartment in Chicago. It was tiny and expensive. I was miserable. I moved back... My parents have done so much for me, and now they're letting me live here rent-free, so I try to help out. I pick up my sister from school, do the dishes or whatever chore needs to be done. My mom makes dinner. We all work as a team."

Japanese Bloodbath After BoJ Disappoints - Nikkei Drops 1000 Points, USDJPY Crashes

Submitted by Tyler Durden on 04/27/2016 - 23:14 If there was a sign that nothing else matters but central bank largess, this was it. The moment The Bank of Japan statement hit and proclaims "unchanged" a vacuum hit USDJPY and Japanese stocks. Reflecting that Japan's economy has "continued a moderate recovery trend" which is utter crap given the quintuple-dip recession, Kuroda and his cronies said they will "add easing if necessary" and apparently that is not now. Not so much as a higher ETF purchase or moar NIRP.. and the aftermath is carnage - NKY -1000 points and USDJPY crashed to a 108 handle!!

Paul Craig Roberts: World War III Has Begun

Submitted by Tyler Durden on 04/27/2016 - 22:25 The Third World War is currently being fought. How long before it moves into its hot stage?Chinese Commodity Trading Volume Crashes: "Most Don't Even Know What They Are Trading"

Submitted by Tyler Durden on 04/27/2016 - 22:00

by Pam Martens and Russ Martens, Wall St On Parade:

Back in 2010, with the public still numb from the epic financial crash

and still in the dark about the trillions of dollars of secret loans the

Federal Reserve had pumped into the Wall Street mega banks to

resuscitate their sinking carcasses, Matt Taibbi penned his classic profile of Goldman Sachs at Rolling Stone,

with this, now legendary, summation: “The world’s most powerful

investment bank is a great vampire squid wrapped around the face of

humanity, relentlessly jamming its blood funnel into anything that

smells like money.”

Back in 2010, with the public still numb from the epic financial crash

and still in the dark about the trillions of dollars of secret loans the

Federal Reserve had pumped into the Wall Street mega banks to

resuscitate their sinking carcasses, Matt Taibbi penned his classic profile of Goldman Sachs at Rolling Stone,

with this, now legendary, summation: “The world’s most powerful

investment bank is a great vampire squid wrapped around the face of

humanity, relentlessly jamming its blood funnel into anything that

smells like money.”

Historically, what smells like money to Goldman Sachs has been eight-figure money and higher. As recently as 2013, the New York Times reported that Goldman had a $10 million minimum to manage private wealth and was kicking out its own employees’ brokerage accounts if they were less than $1 million. Now, all of a sudden, Goldman Sachs Bank USA is offering FDIC insured savings accounts with no minimums and certificates of deposits for as little as $500 with above-average yields, meaning it’s going after this money aggressively from the little guy. What could possibly go wrong?

Read More

Back in 2010, with the public still numb from the epic financial crash

and still in the dark about the trillions of dollars of secret loans the

Federal Reserve had pumped into the Wall Street mega banks to

resuscitate their sinking carcasses, Matt Taibbi penned his classic profile of Goldman Sachs at Rolling Stone,

with this, now legendary, summation: “The world’s most powerful

investment bank is a great vampire squid wrapped around the face of

humanity, relentlessly jamming its blood funnel into anything that

smells like money.”

Back in 2010, with the public still numb from the epic financial crash

and still in the dark about the trillions of dollars of secret loans the

Federal Reserve had pumped into the Wall Street mega banks to

resuscitate their sinking carcasses, Matt Taibbi penned his classic profile of Goldman Sachs at Rolling Stone,

with this, now legendary, summation: “The world’s most powerful

investment bank is a great vampire squid wrapped around the face of

humanity, relentlessly jamming its blood funnel into anything that

smells like money.”Historically, what smells like money to Goldman Sachs has been eight-figure money and higher. As recently as 2013, the New York Times reported that Goldman had a $10 million minimum to manage private wealth and was kicking out its own employees’ brokerage accounts if they were less than $1 million. Now, all of a sudden, Goldman Sachs Bank USA is offering FDIC insured savings accounts with no minimums and certificates of deposits for as little as $500 with above-average yields, meaning it’s going after this money aggressively from the little guy. What could possibly go wrong?

Read More

Apple Suicide: Man With Head Wound Found Dead Inside Apple Conference Room; Gun Nearby

Submitted by Tyler Durden on 04/27/2016 - 21:46 Deputies were called to the company's corporate headquarters on Wednesday morning after a person was found dead, but only few details were immediately available. Multiple police vehicles could be seen at the campus.

Central Bankers To The Masses: "Let Them Eat Rate"

Submitted by Tyler Durden on 04/27/2016 - 21:35 A new generation of revolutionary central bankers must be called to arms for all of our sake. Their battle cry: We commit to never returning rates to zero or below again, to never let be money be free and forever ensure there is a true cost associated with borrowing. Release the markets to set interest rates now and forever! Will it work? Stranger things have been known to succeed in capitalistic economies with competitive and freely functioning markets.

Debt Is Growing Faster Than Cash Flow By The Most On Record

Submitted by Tyler Durden on 04/27/2016 - 21:25 Net debt growth skyrocketing nearly 30% y/y, while EBITDA has been contracting for the past year. In fact, as SocGen shows below, the difference in the growth rate between these two most critical data series is now over 35% - the biggest deficit in over 20 years.

What If The BOJ Disappoints Tonight: How To Trade It

Submitted by Tyler Durden on 04/27/2016 - 21:03 The biggest argument for a BOJ disappointment is that with the G7 meeting in Japan in on month on 26–27 May 2016, it’s unlikely that Japanese policymakers will want to draw attention yet again to the idea that they are in the business of manipulating the JPY lower. After all the most recent G20 meeting once again confirmed that absent "disorderly moves" in the Yen, the US would frown on any attempt to dramatically manipulate its currency lower.

America's Entitled (And Doomed) Upper Middle Class

Submitted by Tyler Durden on 04/27/2016 - 20:55 The upper middle class is well and truly doomed by self-delusion and the pathology of entitlement.

One More Casualty Of The 9/11 Farce - The Petrodollar

Submitted by Tyler Durden on 04/27/2016 - 20:45 It’s been about 15 years now since passenger airliners struck the World Trade Center towers on 9/11, and we are still suffering the consequences of that day, though perhaps not in the ways many Americans might believe. The 9/11 attacks were billed by the Bush Administration as a “wake-up call” for the U.S., and neocons called it the new Pearl Harbor. But instead of it being an awaking, the American public was led further into blind ignorance. Clearly, after 15 years of disastrous policy, it is time to admit that the U.S. response to 9/11 has damaged us far more than the actual attacks ever could.

China Industrial Profits Soar Most In 18 Months But Overcapacity Looms

Submitted by Tyler Durden on 04/27/2016 - 20:20 Profit growth of Chinese industrial companies rebounded dramatically in March. Of course this should not be totally surprising given the trillion-dollar credit injection in Q1 and artificially-elevated commodity prices juicing the zombified industrial base but it does leave The Fed today with a problem - they're running out of excuses. So in being patriotic, we will help - first, as Goldman warns, this profit spike is unsustainabe given the surge in overcapacity; and second, nobody is paying - payment delays have surged to the highest in 17 years as the ponzi accelerates.

"Carnage" - Dan Loeb Explains Why This Has Been A "Catastrophic" Time or Hedge Funds

Submitted by Tyler Durden on 04/27/2016 - 19:54 "The result of all of this was one of the most catastrophic periods of hedge fund performance that we can remember since the inception of this fund... There is no doubt that we are in the first innings of a washout in hedge funds and certain strategies."

Someone Is Pouring Record Amounts Of Money Into Bets On Soaring Volatility

Submitted by Tyler Durden on 04/27/2016 - 19:53 "Our view that the VIX may remain low in the near term is at odds with the VIX ETP market, as investors seem to be pouring money into levered long VIX ETPs." - Goldman Sachs

The Death of Free Speech: The West Veils Itself

Submitted by Tyler Durden on 04/27/2016 - 19:30 Last week, Nazimuddin Samad sat at his computer at home and penned a few critical lines against the Islamist drift of his country, Bangladesh. The day after, Samad was approached by four men shouting "Allahu Akbar!" ("Allah is great!") and hacked him to death with machetes. But this and other shocking killings have not been worth of a single line in Europe's newspapers. Is it because these bloggers are less famous than the cartoonists murdered at Charlie Hebdo? Is it because their stories did not come from the City of Light, Paris, but from one of the poorest and darkest cities in the world, Dhaka? No, it is because the West has capitulated on freedom of expression.

What $499,000 Buys You In Brooklyn: A 20-by-97 Foot Lot With A "House"

Submitted by Tyler Durden on 04/27/2016 - 19:04 Today we find a "palatial" 20-by-97 foot lot with a "house" on it. Located in Brooklyn and going for a reasonable $499,000, interested parties should pick up the phone while the offer still stands. The price has been strategically set to come in just under half a million dollars, which will undoubtebly lead to more offers.

George Orwell's Ghost Is Laughing - Obama's "No Boots On The Ground" Doublespeak

Submitted by Tyler Durden on 04/27/2016 - 18:15 What’s the difference between “boots on the ground” and military personnel wearing boots who are engaged in combat – and perhaps dying – on the ground? If you can answer that question convincingly, perhaps you’d like to apply for John Kirby’s job, because he’s not doing it very successfully. Kirby is the State Department spokesman who, in answer to a question from a reporter about the 250 US troops being sent to Syria, denied President Obama ever said there’d be “no boots on the ground” in Syria.

A Major Warning From Tom McClellan : "Can This Possibly End Well?"

Submitted by Tyler Durden on 04/27/2016 - 18:12 "VIX futures ETF extremely popular now. Can this possibly end well?" - Tom McClellan

from The Daily Bell:

Trump’s World to watch as Trump outlines his foreign policy …

Critics have accused the Republican front-runner of bigotry and posing a

danger to U.S. national security. Many foreign policy and defense

advisers say his views are worrying, mingling isolationism and

protectionism, with calls to force U.S. allies to pay more for their

defense and proposals to impose punitive tariffs on some imported goods.

– Reuters

Trump’s World to watch as Trump outlines his foreign policy …

Critics have accused the Republican front-runner of bigotry and posing a

danger to U.S. national security. Many foreign policy and defense

advisers say his views are worrying, mingling isolationism and

protectionism, with calls to force U.S. allies to pay more for their

defense and proposals to impose punitive tariffs on some imported goods.

– Reuters

Former Congressman Ron Paul lost the GOP presidential nomination in large part due to his stance on US military foreign involvement. Now the GOP, which is the engine of the US military-industrial complex, faces a similar challenge in the potential presidency of Donald Trump.

Trump’s stance, like Ron Paul’s before him, has been significantly skeptical of US foreign wars. Even the sprawling overseas occupation of the US military has come into question during his campaign.

Read More

Trump’s World to watch as Trump outlines his foreign policy …

Critics have accused the Republican front-runner of bigotry and posing a

danger to U.S. national security. Many foreign policy and defense

advisers say his views are worrying, mingling isolationism and

protectionism, with calls to force U.S. allies to pay more for their

defense and proposals to impose punitive tariffs on some imported goods.

– Reuters

Trump’s World to watch as Trump outlines his foreign policy …

Critics have accused the Republican front-runner of bigotry and posing a

danger to U.S. national security. Many foreign policy and defense

advisers say his views are worrying, mingling isolationism and

protectionism, with calls to force U.S. allies to pay more for their

defense and proposals to impose punitive tariffs on some imported goods.

– ReutersFormer Congressman Ron Paul lost the GOP presidential nomination in large part due to his stance on US military foreign involvement. Now the GOP, which is the engine of the US military-industrial complex, faces a similar challenge in the potential presidency of Donald Trump.

Trump’s stance, like Ron Paul’s before him, has been significantly skeptical of US foreign wars. Even the sprawling overseas occupation of the US military has come into question during his campaign.

Read More

from Mining.com:

On Wednesday, silver jumped to the highest since mid-May last year, as

the metal continues to be rerated against the gold price and industrial

metals demand gets a boost.

On Wednesday, silver jumped to the highest since mid-May last year, as

the metal continues to be rerated against the gold price and industrial

metals demand gets a boost.

Silver futures in New York for delivery in May, the most active contract, added nearly 2% in early dealings to trade at $17.48 an ounce, before paring some of those gains by the close.

With a 26% advance year to date, silver is now outperforming gold as investors seek an alternative to gold following the yellow metal’s disappointing retreat from 13-month highs hit in March.

Read More

On Wednesday, silver jumped to the highest since mid-May last year, as

the metal continues to be rerated against the gold price and industrial

metals demand gets a boost.

On Wednesday, silver jumped to the highest since mid-May last year, as

the metal continues to be rerated against the gold price and industrial

metals demand gets a boost.Silver futures in New York for delivery in May, the most active contract, added nearly 2% in early dealings to trade at $17.48 an ounce, before paring some of those gains by the close.

With a 26% advance year to date, silver is now outperforming gold as investors seek an alternative to gold following the yellow metal’s disappointing retreat from 13-month highs hit in March.

Read More

Trump now has 954 delegates and Cruz 562

by Kurt Nimmo, Infowars:

Ted Cruz

said outside a pancake house in Indianapolis, Indiana, he will make a

major announcement about his campaign this afternoon. “We’ll be making a

major announcement so I encourage folks to come and join us,” he said.

Ted Cruz

said outside a pancake house in Indianapolis, Indiana, he will make a

major announcement about his campaign this afternoon. “We’ll be making a

major announcement so I encourage folks to come and join us,” he said.

by Kurt Nimmo, Infowars:

Ted Cruz

said outside a pancake house in Indianapolis, Indiana, he will make a

major announcement about his campaign this afternoon. “We’ll be making a

major announcement so I encourage folks to come and join us,” he said.

Ted Cruz

said outside a pancake house in Indianapolis, Indiana, he will make a

major announcement about his campaign this afternoon. “We’ll be making a

major announcement so I encourage folks to come and join us,” he said.

Speculation is rife Cruz will announce a running mate

following a slew of defeats on Super Tuesday. The only vice presidential

pick the Cruz team is known to have been vetting is the former

Hewlett-Packard chief executive and failed candidate Carly Fiorina.

Read More

by Pater Tenebrarum, Acting Man:

The Cracks in the Economy’s Foundation Become Bigger

The Cracks in the Economy’s Foundation Become Bigger

Last week the Bureau of Economic Analysis has updated its gross output data for US industries until the end of Q4 2015. Unfortunately these data are only available with a considerable lag, but they used to be published only once every few years in the past, so the current situation represents a significant improvement.

As Ned Piplovic summarizes in his update on the situation on Dr. Mark Skousen’s site:

“US economic activity continued to slow dramatically in the 4th quarter 2015, threatening recession. As a whole, the growth rate of the economy was anemic, almost flat, for 2015.

Read More

The Cracks in the Economy’s Foundation Become Bigger

The Cracks in the Economy’s Foundation Become BiggerLast week the Bureau of Economic Analysis has updated its gross output data for US industries until the end of Q4 2015. Unfortunately these data are only available with a considerable lag, but they used to be published only once every few years in the past, so the current situation represents a significant improvement.

As Ned Piplovic summarizes in his update on the situation on Dr. Mark Skousen’s site:

“US economic activity continued to slow dramatically in the 4th quarter 2015, threatening recession. As a whole, the growth rate of the economy was anemic, almost flat, for 2015.

Read More

by Dave Kranzler, Investment Research Dynamics:

Silver continues to trade DIFFERENTLY, in a positive manner that it has not done in YEARS. The potential for the silver price to explode in the very near future is all there. The shares continue to maintain their own positive tone and refuse to give up much ground on corrections. – Bill Murphy from GATA’s Midas report

Nearly the entire precious metals investing community looks at the Comex options expiration and the Fed’s FOMC meetings with trepidation, as historically those two events have triggered a massive Comex paper attack on the price of the metals. Having both events back to back in the same week elicits even more fear. Of course, Goldman Sachs commodities clown, Jeffrey Currie, was on CNBC again today calling for $1000 gold. This guy has absolutely no shame about continuously making an idiot of himself with his price predictions for gold.

Read More

Silver continues to trade DIFFERENTLY, in a positive manner that it has not done in YEARS. The potential for the silver price to explode in the very near future is all there. The shares continue to maintain their own positive tone and refuse to give up much ground on corrections. – Bill Murphy from GATA’s Midas report

Nearly the entire precious metals investing community looks at the Comex options expiration and the Fed’s FOMC meetings with trepidation, as historically those two events have triggered a massive Comex paper attack on the price of the metals. Having both events back to back in the same week elicits even more fear. Of course, Goldman Sachs commodities clown, Jeffrey Currie, was on CNBC again today calling for $1000 gold. This guy has absolutely no shame about continuously making an idiot of himself with his price predictions for gold.

Read More

from Wolf Street:

Apple shares are currently getting crushed. At $95.66, they’re down 8.3% after the bell. The company reported second quarter earnings that, as it has been termed, “missed across the board.”

Revenue dropped 13% to $55.5 billion. Net income plunged 22% to $10.52 billion. Earnings per share plunged 18% from $2.33 per share a year ago to $1.90 per share.

Oh, and iPhone sales fell for the first time ever. Not “fell.” But “plunged.” In dollar terms, they plunged 18.4% from a year ago. In unit terms, they plunged 16%.

Here are four interactive charts depicting the revenue and unit-sales fiasco in the different segments. Hover over them to get the specific data (Data curated by FindTheCompany):

Read More

Apple shares are currently getting crushed. At $95.66, they’re down 8.3% after the bell. The company reported second quarter earnings that, as it has been termed, “missed across the board.”

Revenue dropped 13% to $55.5 billion. Net income plunged 22% to $10.52 billion. Earnings per share plunged 18% from $2.33 per share a year ago to $1.90 per share.

Oh, and iPhone sales fell for the first time ever. Not “fell.” But “plunged.” In dollar terms, they plunged 18.4% from a year ago. In unit terms, they plunged 16%.

Here are four interactive charts depicting the revenue and unit-sales fiasco in the different segments. Hover over them to get the specific data (Data curated by FindTheCompany):

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment