21 Signs that the New Reality for Many Baby Boomers Will be to Work as Wage Slaves Until They Drop Dead

Greece Activates Last-Ditch Liquidity Rescue Package To Preserve Its Financial System

The biggest news of the day today was not that some old crony capitalist had doubled down yet more of his non-taxable wealth on a bet Bank of America would yet again be bailed out, or that Wall Street is about to be sumberged under 3 feet of water. No, the most notable event from today was what we commented on in our first post from 7 am, namely that: "If we crossed through some spacetime vortex that brought us back in time just two short months ago, to July of this year, today's confirmation that the second Greek bailout has now failed, following the Finnish finance minister's comments that the country will defy Germany and will not give in to demands to abandon its deal for Greek collateral, which in turn has sent the Greek 2 year bond bidless, its yield up 227 bps to an all time record 46.38%, would have been enough to send the futures and the EURUSD plunging." Well, a few hours later, we did get a plunge, even if it was not in the US, but in Germany, where the entire local market flash crashed upon realizing what we noted hours prior: that Greece is now pretty much done. Yet it turns out there was more: unwilling to admit defeat yet, Greece was forced to pull out the last rabbit hiding deep in the recesses of the hat. As the Telegraph reports, "In a move described as the "last stand for Greek banks", the embattled country's central bank activated Emergency Liquidity Assistance (ELA) for the first time on Wednesday night." Such efficiency out of the Greeks for once- not a single Persian was harmed, or even needed, in this 21st century version of Thermopylae: the Greeks did it all on their own.Guest Post: Federal Reserve Policy Mixed With Extreme Weather Has Put The World On A Fast Track To Revolution And War

There are many factors that clearly demonstrate why it would be disastrous for the Federal Reserve to repeat their vicious Quantitative Easing (QE) policy. If you want to know a significant reason why they cannot get away with another round of QE, here is an equation for you: (Quantitative Easing + Extreme Weather = Revolution + World War III)Presenting Warren "Archimedes" Buffett's Amazing 24 Hour Monster Bank of America Due Diligence Session

Earlier today, courtesy of the unbreakable bond between Warren Buffett and CNBC's Becky Quick, we learned that supposedly Warren came up with the idea to invest $5 billion in Bank of America (which really is $2 billion when accounting for the intrinsic value of the warrants, which in turn makes the dividend on his at risk investment a stunning 15% but we digress - more here) while in the bathtub on Wednesday morning. What is interesting, is that according to the just released Securities Purchase Agreement, between Warren's Archimedes moment yesterday, and the announcement this morning, here is what he contractually represents and warrants that he did...

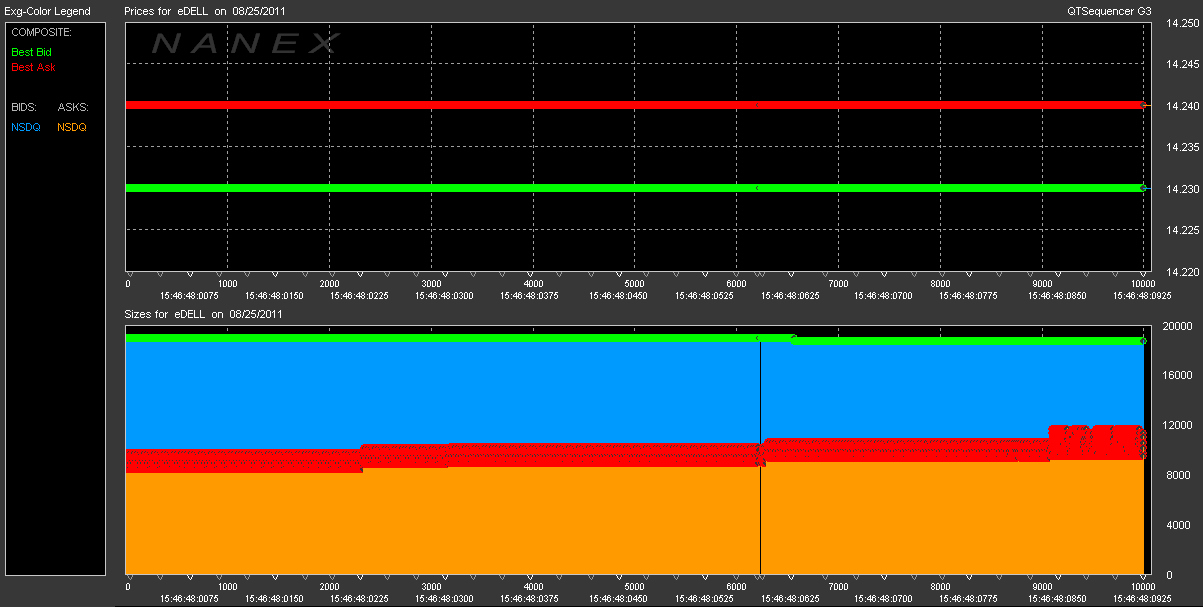

Dear HFT, Please Explain This

On August 25, 2011 at 15:45:48, in a one second period of time, there were more than 10,000 quotes and exactly zero trades in DELL. Close inspection of these quotes reveals something very disturbing. This cannot be dismissed as a computer problem or glitch. This can't be explained as stupidity or some oversight. It is not pinging for hidden liquidity. And it's certainly not price discovery. As far as we can tell, it's not adding liquidity or narrowing the bid/ask spread. There are approximately 4,000 stocks that quote during active trading. Which means 40 million quotes/second if just one of the 9 exchanges allow this nonsense to spread to all 4,000 symbols. You would need 40 gigabits per second of bandwidth to receive data at that rate. Unfortunately, we think it's just a matter of time, because events like this one in Dell are no longer isolated or rare. And it doesn't look like there are any grown-ups in charge.

Tomorrow's "Other" Event - A Sub-1% GDP Report

In addition to tomorrow's 10am headline event, which most likely will not tell us anything we don't already know, a just as important data release will occur at 8:30 am, when the BEA releases its second Q2 GDP estimate. Wall Street, which is now proven to be beyond incompetent when predicting GDP data (just recall the first Q2 GDP number fiasco), anticipates a number of 1.1%, down from the preliminary 1.3% announced last month. What is disturbing is that the far more credible analysts at Stone McCarthy, a firm that does not sell bonds or stocks, and just so happens is far more accurate than most sellsiders, now predicts a stunning 0.7% first revision to GDP. And remember: this number comes 90 minutes before Bernanke comes off embargo. What will happen to the market if the algos suddenly realize that the economy is currently experiencing its first sub-0% growth GDP quarter (the first condition of a recession), and there is no help coming from Bernanke. Furthermore, Wall Street has already started revising down its August NFP data, due out the first week of September. So with the next FOMC meeting on September 20 (followed by the November 1-2 two day meeting, during whicha week ago the Fed formally announced QE2), how will the market react knowing there is no help in sight for at least 4 weeks? We doubt it will be favorable.

Harvey Organ, Thursday, August 25, 2011

Gold rises by $7.70 to $1759.80 despite margin increases/silver shines rising by $1.58 to $40.74/ Buffet temporarily bails out Bank of America

My Dear Friends,

I am amazed at the day later geniuses that send out dire warnings on gold. Selling against the upper two Angels was obvious. There is no top in gold.

Kenny places the odds at 50/50 that yesterday’s low was the low. He says that if it was not then the low is not far below.

I have never seen such capitulation among people especially in outrageously undervalued gold shares. Pros were dropping dead today. In bullion you had to walk close to the building to be safe from the golden flyers.

I have told you time and time again that gold will be violent in its exponential stage. What you have seen is nothing compared to what is to come. Truth be known, this kitchen is going to get hotter by the day so if you cannot handle the heat sell partially at each Angel until you have cut yourself back to the sleeping well size position.

For heaven’s sake stop barfing into weakness. Stop selling weakness and buying strength. That is a kindergarten type error.

Stop the margin. It will kill you. Stop watching every tick. That is certain to make you crazy.

You will in the future be very sorry you sold down to a sleeping position at Angels, but stopping pain is not an illogical purpose.

Respectfully,

Jim

Jim Sinclair’s Commentary

A little humor, if it’s even really funny…

BREAKING NEWS: Seismologists have confirmed that it WAS an earthquake and NOT the 14.6 trillion dollar check bouncing on the East Coast.

Market Commentary From Monty Guild

August 25, 2011, at 2:51 pm

by Monty Guild in the category Guild Investment | Print This Post Print This Post | Email This Post Email This Post

QE Watch

As we watch the meltdown in Europe, events appear to be developing very much as we anticipated.

Gold is up. European stocks and banks are down, and so, too, are world stocks.

The fear of a global recession is growing, a fear we expect to persist until the next massive money printing effort —the third round of quantitative easing (QE) — is launched in Europe later this year. The U.S. and Japan will follow suit, and probably China and other countries as well. While different in form and name than previous bond-buying QE endeavors, the effect will be very similar. Large amounts of liquidity will be infused into the global economy to raise stock markets and encourage the optimism of consumers.

Until governments roll out the next versions of QE in a few weeks or months, look for continued weakness in global stocks and a rise in bonds as investors retreat to short-term debt instruments. These are consequences of the fear phase, which, we hasten to add, is bullish for gold and currencies of the types we have been recommending in our newsletter.

Many pundits in the U.S. think a new manifestation of QE by the Federal Reserve will not happen. They are wrong. The U.S. will do a big kind of QE or a combination job creation program/QE with lots of fanfare as we get closer to the elections of November 2012. You can count on it. Unfortunately, politicians dictate fiscal policies, and they all want to get re-elected. This situation inspired us to paraphrase that great musical hit of yesteryear, the “Beer Barrel Polka.”

Roll out the money, we’ll have a barrel of dough.

Roll out the money, don’t matter how much we owe!

Zing boom tararrel, ring out a song of good cheer,

Now’s the time to roll out the money…the election’s near.

New Rounds of QE Are Taking Shape In Europe, Brazil, And In Other Countries.

At the present, a variety of QE-type activity is already underway in a number of countries. Their goal is to decrease the value of their currencies out of concern for the rising price of exports. A prime example is Switzerland, which has pumped 80 billion Swiss francs (over 100 billion dollars) of liquidity into the market to purchase Swiss bonds and swaps. That’s a lot of money. It totals about 13 percent of the total U.S. QE from September 2010 until June 2011. Moreover, it was done in a short period. The Swiss did manage to get their francs to fall a little but they paid a high price. According to the following excerpt from Citibank economist Michael Saunders last week, the Swiss Central Bank has indicated more moves may be on the way. He cites a Swiss National Bank report that says:

“The measures taken thus far by the Swiss National Bank (SNB) against the strength of the Swiss franc are having an impact. Nevertheless, the Swiss franc remains massively overvalued. The SNB has therefore decided to expand again significantly the supply of liquidity to the Swiss franc money market. In so doing, it is increasing the downward pressure on money market interest rates with a view to further weakening the Swiss franc exchange rate. With immediate effect, it aims to expand banks’ sight deposits at the SNB further, from CHF 120 billion to CHF 200 billion. In order to achieve this new target level as quickly as possible, it will continue to repurchase outstanding SNB Bills and to employ foreign exchange swaps. Furthermore, the SNB reiterates that it will, if necessary, take further measures against the strength of the Swiss franc."

One way to diminish the attraction of a strong currency is to print more money and buy bonds with the money. Fiscal manipulations of this sort have been commonly applied in the past and sooner or later will also be pursued by Australia, Canada, Brazil, and other countries as their currencies rise in value against the falling U.S. dollar and Euro. These activities will increase world liquidity and cause asset prices to rise.

Another type of liquidity being engineered by the European Central Bank involves buying bonds of the profligate and irresponsible Greek, Portuguese and Irish. Later, it will also buy bonds of Italy, Belgium, Spain and even France. To no one’s surprise, German taxpayers will pay the bill.

So, get ready for a big stock market and industrial commodities rally later in the year after QE maneuvers in Europe and the U.S.

World Watch: Oil and Turmoil

Events in Libya and Syria aside, we believe there’s considerable volatility and discontent yet to unfold in the Arab world. Revolts are far from over.

It’s summer now across the Arab world and temperatures routinely top 130 degrees fahrenheit. The heat may have a temporary cooling effect, so to speak, on bottled-up emotions and angers. Wait until the weather cools off for yet another new upsurge of protests and uprisings, and perhaps even sooner on the Israel-Palestinian front.

We expect regional turmoil to last for quite a while, and this opinion is one reason why we still believe that oil can move to $150 per barrel. Whatever the level when the disturbances begin, you can bet that oil will move higher.

Anti-Corruption Movements on the Rise

Recently we have been watching and applauding as a major anti-corruption movement gains momentum in India, one of the world’s fastest growing countries.

Those of you who live in so-called developed nations like Europe, Japan, the U.S., Canada, Australia or New Zealand, and have never lived in India, have no idea about the depth of corruption in that country. Doing business typically requires permission from discouraging layers of government agencies and bureaucrats who delay any progress unless they receive some inspiration to move your project along. Such inspiration almost always takes the form of a cash payment or favor. The people of India are getting fed up. We include a link to a New York Times article that describes the extent of the problem. Please click the following link for the New York Times article.

India is not alone. In China and Brazil, corruption is often encountered at the ministerial and bureaucratic level. In these countries, too, fed-up citizens and media are becoming louder and bolder in their criticism of corrupt officials. They are especially vociferous about shoddy public works projects that have led to serious safety problems. It is accurate to say that public dissatisfaction with corrupt officials has reached a new high in all three countries.

Corruption is a drain on a nation’s GDP and diminishes the national growth rate. First, bribe-paying taxes every level of society. Secondly, income from corruption is hidden from tax authorities so it cuts government revenues.

We view the public hue and cry as a very positive development. To be sure, we don’t expect an entrenched tradition of corruption and influence-peddling to vanish or change overnight. But the fact that a significant backlash has emerged makes us feel optimistic. Less corruption will help India, China, and Brazil become stronger, improve their GDP, and increase their economic growth and influence.

A Bit of Caution is in Order on the Gold Front

Gold is experiencing a pullback. It ran up more than $400/oz in a seven-week period. It is normal to see a strong correction after a dynamic price rise of this magnitude. Long term we continue to favor gold but we are cognizant of the fact that gold has had a record-breaking rise over the last 10 years, and a decisive spike in recent weeks.

We have repeatedly emphasized in this letter the wisdom in taking some profits on rallies and waiting for a pullback before recommitting. As gold spiked early this week, we took partial profits for clients on Monday 8/22/11 and very early on Tuesday 8/23. We will buy some of the gold back at lower prices. Remember steep price increases give rise to sharp price corrections. Be sure to take profits on spikes.

Gold has good long term prospects, but short term it is definitely vulnerable to continuing volatility. We have been dismayed by the degree of overconfidence among some gold investors. For example, we heard from several gold buyers between August 15 and 22nd; when we suggested to them that gold could have a violent correction at any time they scoffed. They were deluding themselves.

As any experienced investor knows, gold (and every other investment) is vulnerable to corrections, and as gold rises to new highs, corrections will become more frequent and more violent.

Over the long term, gold can maintain strength as long as there is demand from central banks and as long as Europe continues to screw up its debt problems. Because of Europe’s debt issues, gold will be perceived as a store of value among Europeans for the foreseeable future.

The ultimate upside for gold could be achieved if gold is accepted as part of a world monetary system. It’s a great idea, but not likely to happen until much more suffering is visited upon the world’s central banks.

Gold shares are grossly undervalued when compared to the gold price, especially if gold stays above $1,400 an ounce for a prolonged period of time. With mining shares, just be careful to only buy well managed companies with good growth prospects.

To request information about Guild Investment Management services and offerings please call (310) 826-8600 or email guild@guildinvestment.com

We thank you for the continued support, if you like to forward our commentary to a friend, please use the following link Forward to a Friend

|

On the BAC deal

08/25/2011 - 16:41

08/25/2011 - 19:36

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment