Jim Rogers: Bernanke, Geithner Leading Us Into Fiscal Armageddon

A Forensic Analysis Of The Great French Bank Run!

UMichigan consumer confidence just printed at 54.9, on expectations of 63.0. This is the lowest since May 1980. And what's worse, inflation expectations were unchanged. Looks like those high inflation expectations are starting to get anchored. In the meantime, with the Chairsatan saying to expect at least two more years of recession, is this really a surprise to anyone?

The real sad part, is that it would take so little to cover the cost of running this blog, if everyone helped a little...less then the cost of a cup of coffee per month.

Thank You

I'm PayPal Verified

And that my friends is the nail in the economic "recovery." August consumer sentiment was just reported at 54.9 from 63.7 in July. This is the lowest level since May 1980. The chart below shows the correlation with sentiment and the consumer component of GDP which is about 70% of the economy and why I say the "recovery" is over. In Q2 the consumer component of GDP was 0.07% from 1.46% in Q1. Based on historical correlations and today's sentiment data the Q3 consumer component will contract much further in the (2%) range. This will bleed into the fixed investment and inventory components of GDP causing further contraction.

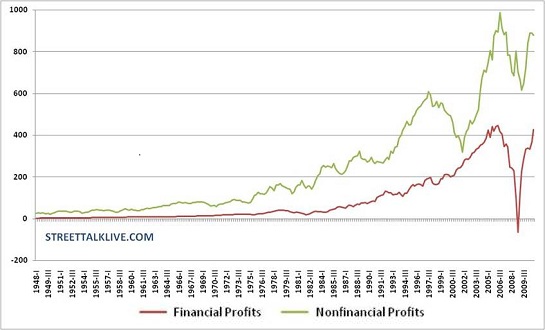

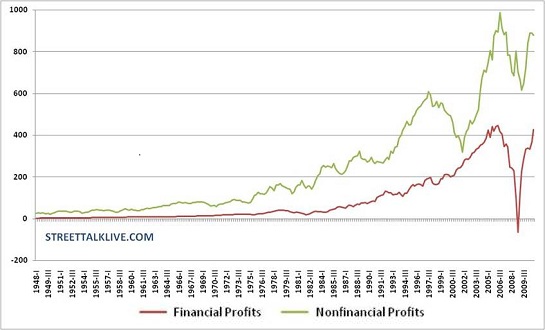

The entire "story" of the Bull market is stocks rests on one reed: permanently rising corporate profits. Too bad those profits are set to fall. Like everything else about the "recovery," the "rising corporate profits" story is founded on financial flim-flam, starting with the boost provided by a sinking dollar. To truly grasp the monumental scope of this smoke-and-mirrors game of "profits" rising from currency arbitrage, we have to recall that most of the big U.S. global corporations earn between 50% and 65% of their profits overseas. Since the dollar has weakened about 30% in the Fed's free-money campaign (quantitative easing), then we can guesstimate that fully 15% of all profits from global corporations is phantom: if half their profits are earned overseas, and the dollar declined 30%, then their overseas profits rose by 30%. Since that is half of all profit, then that 30% rise boosts total profits by 15%...The easy money's been made from slashing costs and dollar arbitrage; all four supports of corporate profits are at risk. With these props gone, how are corporate profits going to keep rising? If the "rising corporate profits" story dissipates, so does the Bull market.

A Forensic Analysis Of The Great French Bank Run!

08/12/2011 - 10:09

Consumer Confidence Plummets To May 1980 Level

UMichigan consumer confidence just printed at 54.9, on expectations of 63.0. This is the lowest since May 1980. And what's worse, inflation expectations were unchanged. Looks like those high inflation expectations are starting to get anchored. In the meantime, with the Chairsatan saying to expect at least two more years of recession, is this really a surprise to anyone?

Fed To Proceed With Reverse Repos Every Two Months

The Fed just announced that going forward it will proceed with reverse repo series every two months. The reason? "The operations have been designed to have no material impact on the availability of reserves or on market rates. Specifically, the aggregate amount of outstanding reverse repo transactions will be very small relative to the level of excess reserves, and the transactions will be conducted at current market rates." With liquidity already being very scarce courtesy of the FDIC assessment, of Europe wreaking havoc with money markets, of repos pulling out of the market at a record pace, of O/N General Collateral trading with the same volatility as the S&P, this will surely have no impact at all on anything, just like all other centrally planned, and carefully thought through actions.- "It is very sad that no one donates a dime. I find this site great! I have donated.

Cheers, Tim"

The real sad part, is that it would take so little to cover the cost of running this blog, if everyone helped a little...less then the cost of a cup of coffee per month.

If you find useful information here, please consider making a small donation, to help cover cost of running this blog. Without your support I will be forced to shut down this blog soon.

Thank You

I'm PayPal Verified Guest Post: Consumers Are Confident Of Recession

And that my friends is the nail in the economic "recovery." August consumer sentiment was just reported at 54.9 from 63.7 in July. This is the lowest level since May 1980. The chart below shows the correlation with sentiment and the consumer component of GDP which is about 70% of the economy and why I say the "recovery" is over. In Q2 the consumer component of GDP was 0.07% from 1.46% in Q1. Based on historical correlations and today's sentiment data the Q3 consumer component will contract much further in the (2%) range. This will bleed into the fixed investment and inventory components of GDP causing further contraction.

Guest Post: About Those Permanently Rising Corporate Profits...

The entire "story" of the Bull market is stocks rests on one reed: permanently rising corporate profits. Too bad those profits are set to fall. Like everything else about the "recovery," the "rising corporate profits" story is founded on financial flim-flam, starting with the boost provided by a sinking dollar. To truly grasp the monumental scope of this smoke-and-mirrors game of "profits" rising from currency arbitrage, we have to recall that most of the big U.S. global corporations earn between 50% and 65% of their profits overseas. Since the dollar has weakened about 30% in the Fed's free-money campaign (quantitative easing), then we can guesstimate that fully 15% of all profits from global corporations is phantom: if half their profits are earned overseas, and the dollar declined 30%, then their overseas profits rose by 30%. Since that is half of all profit, then that 30% rise boosts total profits by 15%...The easy money's been made from slashing costs and dollar arbitrage; all four supports of corporate profits are at risk. With these props gone, how are corporate profits going to keep rising? If the "rising corporate profits" story dissipates, so does the Bull market.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment