FT Reports Italian Government On Brink Of Collapse

Certainly not helping European sentiment is the report from the FT that "Silvio Berlusconi’s centre-right coalition government in Italy appears in danger of collapsing over European Union demands for a demonstration of concrete action on economic reform by Wednesday’s summit of eurozone leaders. The EU ultimatum delivered to Mr Berlusconi in Brussels on Sunday risks breaking his coalition instead of giving it an external impetus to move ahead on measures to cut Italy’s debt and promote economic growth." So you mean that extending the retirement age by a few hours is not credible reform? That surely is news to Bunga Bunga. And after all, remember the dedication with which Italy promised it would promptly enforce austerity after it was admitted to the SMP bond monetization program, only to completely forget all promises 48 hours later? It seems Europe, which has had enough of being humiliated by the corrupt pederast, has remembered: "The ultimatum was delivered as part of efforts to resolve the eurozone sovereign debt crisis, but the Italians’ failure to reach agreement on reform threatens EU leaders’ stated goal of finalising at Wednesday’s summit a comprehensive solution to the crisis." So the question is: how long before The Guardian refutes all FT speculation that Italy is scuttled with a well-timed rumor at 3:45pm?Guest Post: Mystery Solved: ECB Can’t Afford The Greek Barber Shop

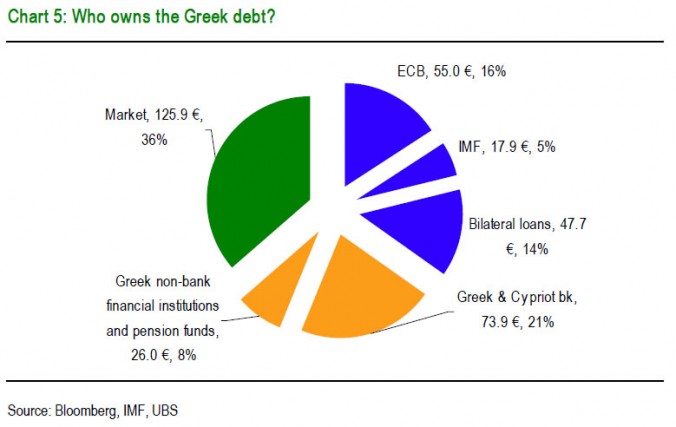

Whenever you come across a mystery in finance there always is an explanation. Like the question why the ECB would so ferociously resist any “haircuts” on Greek debt. Despite all the evidence that current debt, now expected to peak at levels exceeding most calculators’ capacity, is unsustainable. Why would the ECB, the largest single holder of Greek debt, not set an example by accepting the 21% haircut orchestrated by the banking lobby in July? (In order to still reach the 90% acceptance rate, the ECB was simply to be excluded from the calculation). Instead, the ECB promised Sodom and Gomorrah in case of a haircut (“Greek restructuring would be a disaster” – ECB’s Bini Smaghi, July 20th).

Key Drivers Of Overnight Action: Rumors Of RRR Easing Out Of China

A relatively subdued overnight session which has seen the futures spike only modestly from their lows, on yet another forced squeeze in the EURUSD which hit a high of 1.3960 after hitting a low of 1.3877 around 3am Eastern, has seen a rumor of a Chinese Reserve Ratio cut as one of the main drivers of action, which has also pushed gold to over $1660 and silver to $32. If validated, and if China is indeed welcoming inflation with open arms, counterintuitively following the completely irrelevant PMI beat, look for these two to resume their antigravitational glidepath. As for other key developments watched by the market, here is a succinct overview from Bloomberg.Frontrunning: October 25

- German lawmakers win full say on EFSF (Reuters)

- Spain Slipping on Deficit Increases Chances of Contagion (Bloomberg)

- China faces tight power supply this winter (China Daily)

- Greece, China sign memorandum of cooperation (Kathimerini)

- Gov. Corbett launches state takeover of Pa. capital, declares fiscal emergency (WaPo)

- In Cautious Times, Banks Flooded With Cash (NYT)

- An apocalyptic end to world’s biggest bubble (MarketWatch)

"Buy Gold" - Gartman's Latest Flip Flop On The Yellow Metal

Newsletter writer Dennis Gartman has done a swift about turn and is now adding to his gold position by buying the metal priced in dollars, pounds and euros, he wrote today in his daily Gartman Letter. Only last Tuesday, Gartman wrote that the gold market is suffering "very real damage." His comments were picked up very widely making headlines in the financial media internationally. Gartman warned that he feared that the rally from September's lows is "now under assault." Today, Gartman said in his newsletter that he was certain gold prices would break upwards sooner rather than later. Gartman said that the EU debt plan would hurt currencies. Therefore, gold will rally as currencies fall. "The authorities have no choice but to inflate their way out of the morass that they’ve found themselves falling into and that shall mean the diminution of currencies generally and the advancement of gold as the only currency not diminished", he said.Guilt, Growth, Lies, Laziness, And Liquidity

We are getting closer and closer to some actual details. Eventually EFSF will be only one or two things. We will see how much or how little outside money gets contributed.The Dealbreaker: Barclays Sees A 50-60% Haircut As A CDS Trigger

Finally someone dares to go ahead and say what is on everyone's mind, namely that proclaiming a 60% "haircut" as voluntary is about the dumbest thing to ever come out of ISDA. As is well known, the ECB and the entire Eurozone are terrified of what may happen should Greek CDS be activated, and "contagion waterfall" ensue. The fear is not so much on what happens with Greece, where daily CDS variation margin has long since been satisfied so the only catalyst from a cash flow market perspective would be a formality. Where it won't be a formality, however, is for the ECB which has been avoiding reality, and which will have to remark its entire array of Greek bonds from par to 40 cents on the dollar, which as Alex Gloy indicated earlier, will render the central bank immediately insolvent all else equal. What it also will impact is treatment of all other banks and pledged collateral valuations which is effectively the only bridge in the chasm between Mark to Unicorn and reality. So here is Barclays with what can be the effective dealbreaker, because if a bank: an entity that owns the credit event determinations committee at ISDA, comes out with a contrarian statement to the conventional "stick your head in the sand" wisdom, then pretty soon everyone else will have to follow sui: "In our view, there is little doubt that a large notional haircut of c. 50-60% would be considered a credit event, consequently triggering CDS contracts." And here is why Wednesday's summit is now guaranteed to be a flop: "We consider that launching a hard restructuring without the adequate backstop could be too risky from a financial stability perspective, and we think the ECB would likely take this view." Since the summit will have to announce a decision on the Greek haircuts to be taken even remotely seriously, and since the ECB simply can not make one at this point, look for major disappointment, whether the summit is Wednesday, Thursday, next month, or next year, simply because the ECB will not be ready to pull the trigger for a long, long time.Please consider making a small donation, to help cover some of the labor and cost for this blog.

Thank You

Is The Euro Summit Already A Failure Following An Early EcoFin Meeting Cancellation?

The European farce descends into surrealism and gortesque tragicomedy. Just out of the FT's Brussels Blog which discussed what appears to be an early cancellation of the critical EcoFin (not to be confused with Euro Coffin) meeting: "A letter sent last night by Jacek Rostowski, the Polish finance minister, makes an [EcoFin meeting doubtful]. Since Poland currently holds the European Union’s rotating presidency, Rostowski is charged with convening a meeting of all 27 EU finance ministers tomorrow ahead of the big summit to lay the groundwork for a final agreement. But officials tell Brussels Blog the so-called “Ecofin” council meeting is now likely off, and in a letter to Jean-Claude Juncker, the Luxembourg prime minister who chairs the group of 17 eurozone finance ministers, Rostowski makes it appear the cancellation is due to a failure to agree on outstanding issues." No.... they couldn't agree??? Nobody could have possibly foreseen this. Nobody.No Housing Bottom As Case-Shiller Declines For 4th Consecutive Month; Misses YoY Expectations

Not like it matters considering it is pretty much November, but back in August, the Case Shiller index once again missed expectations. The overall index declined 3.8% compared to an expectation of 3.5%, but more importantly, to all those calling for a bottom to housing, we draw your attention to the Composite Top 20 Seasonally Adjusted index, which declined for a 4th consecutive month, in August dropping to 140.56, a decline of -0.05%, following a revised drop of -0.15% in July. No good news were to be found in the prepared remarks either: "The 10- and 20-City Composites posted annual returns of -3.5% and -3.8% versus August 2010, respectively. At -8.5%, Minneapolis posted the lowest year-over-year return, but has improved in each of the last three months. Detroit and Washington DC were the only two cities to post positive annual returns of +2.7% and +0.3% respectively." Here is the bottom line: the seasonally adjusted data has posted 4 consecutive declines; and 14 out of 15 consecutive drops. The Top 20 SA index is now at 140.56, the second lowest in years, and better only than the 140.39 in March 2011. In other news - there is no housing bottom.

EcoFin Meeting Cancelled, Euro Plunges

As we warned an hour or so ago... Euro plunges.

Consumer Confidence Plunges To 39.8 From 45.4 On Expectations Of A Bump; Lowest Since March 2009

So

much for the US consumer confidencing [sic] his way up to buying

houses and other stuff. even with 2000x leverage. According to the

Conference Board, October Consumer Confidence, plunged from a downward

revised 45.4 to 39.8, the lowest since March 2009. The forecast looked

for an increase to 46.0. Current conditions were even more horrendous,

dropping to 26.3. And with crude on its way back to $100 (thank you

Dudley) and gas back to $4.00, this number is not going higher any time

soon. But wait, there's more: the jobs plentiful dropped from 5.5 to

3.4, jobs hard to get also dropped from 50 to 46.1, and the cherry on

top is that 1 Year inflation expectations are, well, anchored at 5.8%

versus 5.7% previously.

So

much for the US consumer confidencing [sic] his way up to buying

houses and other stuff. even with 2000x leverage. According to the

Conference Board, October Consumer Confidence, plunged from a downward

revised 45.4 to 39.8, the lowest since March 2009. The forecast looked

for an increase to 46.0. Current conditions were even more horrendous,

dropping to 26.3. And with crude on its way back to $100 (thank you

Dudley) and gas back to $4.00, this number is not going higher any time

soon. But wait, there's more: the jobs plentiful dropped from 5.5 to

3.4, jobs hard to get also dropped from 50 to 46.1, and the cherry on

top is that 1 Year inflation expectations are, well, anchored at 5.8%

versus 5.7% previously.Gold, Silver Surge

Gold

finger? Or did the market just get it through its greasy, vacuum-tubed

head that the only option for the status quo cabal to preserve said

status quo is to print, print, print? Or, perhaps this headline from

the FT is finally getting some play: "Italian government on brink of collapse." Or, perhaps this one: "Eurozone crisis fund ‘may be weeks away’." Or, has the break out, predicted yesterday, commenced? Stay tuned to find out.

Gold

finger? Or did the market just get it through its greasy, vacuum-tubed

head that the only option for the status quo cabal to preserve said

status quo is to print, print, print? Or, perhaps this headline from

the FT is finally getting some play: "Italian government on brink of collapse." Or, perhaps this one: "Eurozone crisis fund ‘may be weeks away’." Or, has the break out, predicted yesterday, commenced? Stay tuned to find out.Charting The Impact Of Eurozone Meetings On The Most Critical European Security

While the US may have its "committee" decision to every problem in the world, Europe has the "summit meeting" which in the past would kiss and make everything better. No longer. As the following chart from Reuters indicates, annotating the relentless rise in Italian yields (which have about 100 bps in buffer from full out Eurozone collapse: if the 10 Year BTP hits 7.00% it's game over), the half life of the mere meeting in terms of favorable impact is now negligible and in fact, negative. Just like BOJ (and, some would add, Fed) interventions in the market now do more harm than good, so hollow Eurozone meetings without any actual resolution, simply make the Eurozone troubles that much more acute. Keep a close eye on the BTPs. They are already at 6% following last week's tumble first documented on Zero Hedge. If the price drops that much more, that will be it for the EMU experiment.

Latest European Headlines

Over the next 24 hours expect many post of this nature:- DE JAGER SAYS ITALY NEEDS TO TAKE EXTRA GOVERNANCE MEASURES

- GREEK BONDHOLDER LOSS WILL BE 60%, ANA CITES VERHOFSTADT SAYING

Annotated European Union Document On EFSF Status

Here is the draft document with our thoughts inserted directly into the document. As more actual details or termsheets become available we will attempt to analyze them as well.In Asia They Work Hard, They Save As Much As They Can

If you look at America and the west, everybody is spending and consuming and

borrowing. That`s not the way things are done in Asia. In Asia everybody has

a very high savings rate. They work hard, they save as much as they can. - *in

Smart Money*

*Jim Rogers is an author, financial commentator and successful international

investor. He has been frequently featured in Time, The New York Times,

Barron’s, Forbes, Fortune, The Wall Street Journal, The Financial Times and

is a regular guest on Bloomberg and CNBC.*

Overextended States With The US Union

Headlines: The Little State With a Big Mess On the night of Sept. 8, Gina M. Raimondo, a financier by trade, rolled up here with news no one wanted to hear: Rhode Island, she declared, was going broke. Maybe not today, and maybe not tomorrow. But if current trends held, Ms. Raimondo warned, the Ocean State would soon look like Athens on the Narragansett: undersized and overextended. Its economy... [[ This is a content summary only. Visit my website for full links, other content, and more! ]]

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment