Summarizing The Sheer Chaos In Europe: 9 Meetings In 5 Days

For over a year, our premise #1 in interpreting the newsflow out of Europe has been that in the absence of actual practical ideas, and the continent's glaring inability to do simple math, the only option left to bEURaucrats has been to literally baffle people with so much endless bullshit that the general audience would be simply stunned by the possibility of an alternative that the union's leaders were all talk and absolutely no action, let alone analysis. As of today, we now know that that is precisely the case: for over a year Europe has been mouthing off hollow rhetoric in hopes that the market would just leave it alone, and that promises of promises and plans of plans would be sufficient. That plan (pardon the pun) has now failed. And so behind the scenes chaos turns into fully public panic. As the FT's Brussels blog summarizes, the only game left in town for Europe now is to push off D-Day, but not to some indefinite point in the future, like the US, but to tomorrow, and tomorrow and tomorrow, to channel the bard here. And nothing confirms better that it is all over for Europe, than the following summation of the terror and utter cluelessness gripping Europe, than the following sentence from the FT: "Just to recap, by Wednesday night there will have been nine meetings of ministers or national leaders in five days."The "Sunday Bazooka" Dud: Complete European Council (Lack Of) Conclusions... And Libya Scapegoating

Remember this from Sarkozy on Wednesday:

"If there isn't a solution by Sunday, everything is going to

collapse." Well, judging by the "conclusions" just released by the European Council, everything is

about to collapse, because the only "solution" reached is the

following: "The death of Muammar Gaddafi marks the end of an era of

despotism and repression from which the Libyan people have suffered for

too long. Today Libya can turn a page in its history, pursue national

reconciliation, and embrace a new democratic future." This is a

statement written by the Golum on the left in the picture below.

Remember this from Sarkozy on Wednesday:

"If there isn't a solution by Sunday, everything is going to

collapse." Well, judging by the "conclusions" just released by the European Council, everything is

about to collapse, because the only "solution" reached is the

following: "The death of Muammar Gaddafi marks the end of an era of

despotism and repression from which the Libyan people have suffered for

too long. Today Libya can turn a page in its history, pursue national

reconciliation, and embrace a new democratic future." This is a

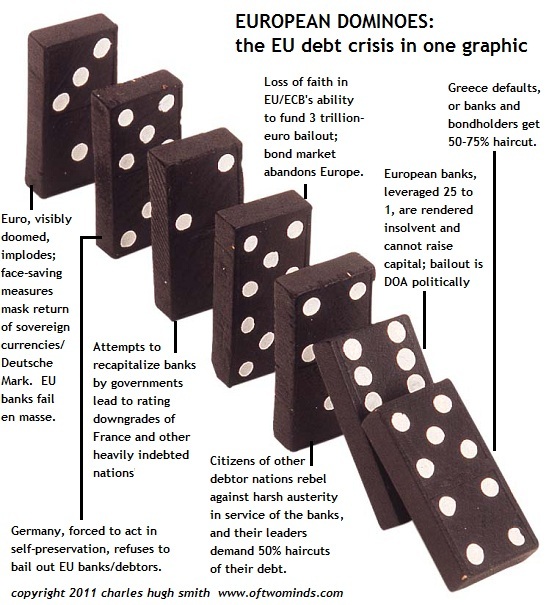

statement written by the Golum on the left in the picture below.Guest Post: The European Financial Crisis In One Graphic: The Dominoes Of Debt

"He/she who gets out first gets out best."

EURUSD Opens Lower

Hardly the apocalypse scenario that the G20 and Nicholas Sarkozy predicted, but certainly not a ringing endorsement of European cohesion and stability. If this melts up in the Sunday futures session, we fully expect it to be due to ongoing FX repatriation by French banks.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment