The Scariest Chart Ever?

There

are many charts out there all of which are to some extent worth of the

adjective "scary" although today's Bloomberg chart of the day may just

take the prize, if only for a few days until the European hopium daze

passes and reality manifests itself in the form of line and bar charts.

The chart below is perfectly simple and perfectly self-explanatory...

There

are many charts out there all of which are to some extent worth of the

adjective "scary" although today's Bloomberg chart of the day may just

take the prize, if only for a few days until the European hopium daze

passes and reality manifests itself in the form of line and bar charts.

The chart below is perfectly simple and perfectly self-explanatory...Citi Joins Goldman And JPMorgan In Settling Fraudulent And Misleading CDO Practices: Wristslap Costs $285 Million

And so Citi becomes the third firm after Goldman and JPM to put all their gross CDO criminal (wait, allegedly, they neither admitted nor denied) activity behind them with a $285 million wristslap.- Citigroup will pay USD 285mln to settle SEC charges for misleading investors about selling CDOs related to housing market, according to SEC

- Citigroup's main US broker-dealer unit misled investors about USD 1bln CDO tied to US housing market, in which Citigroup bet against investors.

Video: Preparing Your Kids For The 21th Century

Preparing your kids for the 21th Century - Smart Money video

*Jim Rogers is an author, financial commentator and successful international

investor. He has been frequently featured in Time, The New York Times,

Barron’s, Forbes, Fortune, The Wall Street Journal, The Financial Times and

is a regular guest on Bloomberg and CNBC.*

We Have A Record Wealth & Income Inequality

In fact, the problem in America is that real wages, real compensation has been down since the 1970s. But at the same time, asset prices, equities, real estate and so forth have gone up dramatically, and that favors people who have these assets. And so the ratio expanded and you have now a record wealth inequality, and income inequality. - *in Bloomberg* *Marc Faber is an international investor known for his uncanny predictions of the stock market and futures markets around the world.*

Art Cashin Shares His Personal Experience On The Anniversary Of Black Monday

The best thing about veteran traders, such as Art Cashin, is that they have truly seen it all, not just one or two gyrations of the business cycle, or in most cases, half. Which is why we are delighted to share this anecdote from the grizzled UBS trader and Fermentation committee chairman, of his personal remembrances on this anniversary of the day in which the Dow Jones plunged than 22%, and has since entered popular folklore as Black Monday.Europe - Solving The Solution - Not The Problem

Several (all) European nations spent too much, borrowed too much and promised too much to their people. That led the market to question whether these countries could pay back their debt. That led to spread widening. As spreads widened and deficits increased, investors became concerned about the ability to roll over their debt. This caused spreads to widen further, CDS activity to pick up as investors want to hedge their positions and speculators want to profit from further weakness. Economic conditions decline. Debt grows more rapidly than forecast and current budget deficits increase. Rolling over debt in the public market becomes very difficult if not impossible. CDS trades in points up front and the yield curve inverts as the bonds trade on price rather than yield, with investors focusing on potential recovery. The solution that they are closest to "achieving" is the destruction of the sovereign CDS market. Naked short bans are on the way. Forced Restructuring that doesn't trigger a Credit Event is the current plan, and one of the EFSF or ECB is likely to sell protection. Sov CDS only has any bid because people don't believe they can force 100 per cent of bonds to restructure so their will be residual value as countries choose to pay off or default on the stub pieces.ECB Back In The Market To Prevent Sovereign Bond Rout

Like yesterday when just before 10 am we had a big gap down in PIIGS bonds, represented in this case by Italy's BTPs, only to be followed by ECB buying of peripherals, so today, same time, same place, the ECB gets involved to prevent yet another market rout, this time amplified by the fact that one can not longer short PIIGS using CDS and shorting cash bonds is the only option. Alas, as the chart below demonstrates, as yesterday the ECB intervention merely delayed the downward price trajectory of Italian bonds, so today we expect the same result. In the meantime, ECB buying has driven the EURUSD, and thus the ES higher, however briefly.

Guest Post: Portugal - Fiddler Paid, Music Stops

In May, shortly before receiving a EUR 78bn bailout, the Portuguese government trumpeted encouraging snippets regarding the state of the economy. “Fiscal revenues up 16.8% y/y in April” (May 20th). “January-through-April central government deficit EUR 1.55bn, 2.28bn less than a year ago” (5/20). The new government announced “to set an example of cutting spending in administration” and intended “to surprise, go beyond bailout terms” (Coelho 6/6). The good news continued: “Central government deficit for the first five months of 2011 cut to 1.03bn”; “State spending fell 7.2%, revenues rose 6.9% in the period January through May” (June 20th). With all those feel-good reports it was only fair for the EU’s Troika report on Portugal to be “very positive” (Baroso, June 23rd). The EFSF disbursed its funds to Portugal on June 29th. However, as anybody who has ever visited a Hungarian coffee house can confirm, as soon as you pay the fiddler, the music stops. After six months, “there was a shortfall of 1.1% of GDP in budget” (Finance Minister, August 12th). Wait a minute. According to the INE (Instituto Nacional de Estatistica) the budget deficit for H1 2011 amounted to 8.4% of GDP or roughly EUR 6.7bn. So we went from 1bn at the end of May to 6.7bn mere four weeks later?

Watch Senate Hearing On Market Microstructure And The Synthetic CDOs Known As ETFs

Anyone still left trading stocks may be interested in this Senatorial hearing on market microstructure which will focus on the synthetic CDOs known as ETFs and their variants. Since all market participants get are hearings but never action, we are confident the hearing will be educational and... that's it."GAAP-uccino" - David Einhorn's Full Short Green Mountain Coffee Presentation

For those who have been asking for it, even though it doesn't really say much that has not been said already many times before and is now just a question of beta and overall market timing, here is the full David Einhorn presentation on shorting GMCR: "GAAP-uchino."EUR Drops As Latest Truth Emerges: Sarkozy Says Eurozone Deal Talks Stuck

But, but, but...- France's Sarkozy says Euro zone deal talks stuck over relations between EFSF and ECB according to centre right legislators - RTRS

- France's Sarkozy ready to travel to Berlin this afternoon to make progress on Euro-zone deal according to MPs - RTRS

Global Market Update From Damien Cleusix

To everyone needing a big picture refresh of all that is happening in the world, and to focus on the forest behind the trees of endless headlines, here is Damien Cleusix' latest macro markets update. "We will start with some rumblings on the financial sector in general and banks in particular. For those only interested in the financial market calls they are at the end... THE KEY for the future of the system has we know it will be the decision which will be made in the weeks/months to come with regard to banks. If politicians screw this once more we are afraid that this will be remembered as the final trigger toward a radical change on how our financial system work. This won't happen overnight but be sure that the system you will be living in in 5 years will be RADICALLY different than today's. While the "Occupy Wall Street" movement remains marginal, be sure that it will grow exponentially if politicians make the bad choices. It will grow so much that it might ultimately dictate the political (regulator) agenda. Far fetched? Probably but we have done some far fetched prediction in the past 10 years and they have come to pass to why not try our luck once more. How could politicians and regulators screw it once more? Simply by not letting the losses fall upon those who made the wrong bets. Did they learn from the 2008-2009 mistake? We don't think so and so there is a very high probability that they will screw it again (we apologize for the choice of word but this is really what they are doing, they are paving the way for a whole generation toward insecurity, poverty and despair)."

CPI Comes In Line, Permits Miss, Housing Starts Better Than Expected As Multifamily Units Come At Highest Since September 2008

Unlike yesterday's PPI which surged past even the highest expectations, the September CPI came right in line, rising by 0.3%, just as predicted, and down from 0.4% in August. The index for all items less food and energy increased 0.1 percent in September, its smallest increase since March. The index for apparel declined in September after a series of sharp increases, and the indexes for used cars and recreation turned down as well. The indexes for new vehicles and household furnishings and operations were both flat. The shelter index rose, but posted its smallest increase since April, while the indexes for medical care, airline fares, and tobacco all increased. And in crawling along the bottom news, Housing Starts soared by 15% to 625,000 from a revised 572K and well above expectations of 590K. That this number was not as strong as headlined, is that it was driven exclusively by multi-family units (5+) which came at 227K, a surge from the 148K in August. Since these numbers have been crawling at the bottom for years, and all moves are merely kneejerk reactions, in this case to accrued buildup following a weak summer season, it should be largely ignored (or else interpreted as a build up of unnecessary inventory: remember that whole foreclosure halt?), especially since Housing Permits of 594K missed expectations of 610K, and declined from a revised August print of 625K. Lastly completions were basically unchanged at 647K compared to 634K in August. Summarizing it all? Noise.

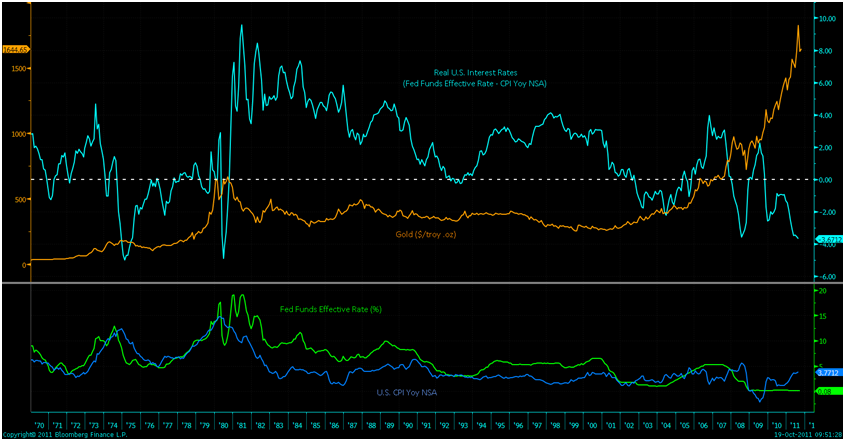

Gold Supported At 144 DMA And By Negative Real Interest Rates in US - Charts Of Day

With France's AAA credit rating looking shakier by the day and Spain being downgraded by two notches, gold should be supported by safe haven demand. Every day that goes by without resolving the issue of too much debt in the global financial system is a day closer to financial contagion. Gold looks very well supported between the 100 and 144 day moving average (simple) with the 144 day moving average providing strong support for nearly three years - since January 2009. Bullion dealers in Hong Kong say physical demand is robust at these levels with one dealer reporting “a wave of physical buying” once prices went below $1,630/oz. Newsletter writer, Dennis Gartman again made negative sounds about gold’s prospects. This is bullish in the short term as many of his short term calls in recent months have been inaccurate. Indeed, some traders use him as a good short term contrarian indicator. The Chart of the Day (‘Real Interest Rates and Gold – 1970-2011’) shows that gold prices rise during periods of negative real interest rates in the U.S. as was clearly seen in the 1970s and again since the early 2000s.

Greek Pay-Per-Riot-View Is Back - Live Strikecam From Syntagma Square

Why Greece does not collect $29.95 for live webcasts of the Syntagma square riot cams, we do not understand. That would easily offset G-Pap's 3rd summer villa expenses and perhaps even leave some cash to purchase ink so the country can finally print those tax forms. Anyway, for all of you who have been in riotcam withdrawal, and whose life depends on spotting the Riot dog in action, you are in luck as tear gas dissemination is currently in progress.

$1.12 Of Morgan Stanley's $1.14 Q3 EPS Comes From Benefit Of Spread Blow Out

There is just one piece of information one needs to see to realize just how big of a farce financial results reporting has become in America, with the accountants' and auditors' blessing. Morgan Stanley today reported income of $2.2 billion, or $1.14 per diluted share on an apples to unicorns basis, compared with income of $314 million, or $0.05 per diluted share, for the same period a year ago. Net revenues were $9.9 billion for the current quarter compared with $6.8 billion a year ago. Expectations were for revenue and EPS of $7.28 billion and $0.30. Both were massively missed because "results for the current quarter included positive revenue of $3.4 billion, or $1.12 per diluted share, compared with negative revenue of $731 million a year ago related to changes in Morgan Stanley’s debt-related credit spreads and other credit factors (Debt Valuation Adjustment, DVA)." As the DVA, or the benefit from corporate spread explosions, is a top and bottom line number, the real results were $6.5 billion and $0.02. But, no, why report reality when there are fudge factors that soften the blow when a company underperforms. And furthermore, as every bank will tell you, its CDS marks are meaningless: after all, the "CDS market is illiquid and controlled by maniacs" or whatever David Viniar said on the Goldman conference call yesterday (more later on this). As for what matters: Institutional Securities revenue would have been $3 billion net of the DVA compared to $5.2 billion in Q2 - said otherwise a complete business collapse in the quarter.German 10 Year Bund Auction Fails To Cover Issuance As Contagion Rages At The Core

If that headline is confusing to readers, it simply means, in a polite way, that Germany had a failed Bund auction. The country sold €4.075 billion in 10 Year Bunds after it had attempted to sell €5 billion and got just €4.55 billion in bids. The result made it "technically uncovered" and reflects the fear in the market that Germany will be forced to shoulder the burden of the EFSF expansion. And even with this poor result, the OAT-Bund spread still managed to blow out to another all time record of 115 bps overnight. The contagion at the core is there.Summarizing The "Reasons" Behind The Latest Overnight Risk Melt Up

Greek riot resumption? Debunked European bailout rumor? Spain downgrade? Apple miss? Failed German Bund auction? Continued freezing in the interbank market? No, none of these are enough to dent risk appetite overnight, driven one again exclusively by the EURUSD, which has picked over 100 pips overnight. The driver? THe same old that always drives the EUR higher: hopes, rumors and hopes that the rumors are true. Here is Bloomberg with a summary of reality and the opposite, lately better known as "capital markets."The Morning After (The CDS Ban)

Sovereign CDS is tighter and SOVX is a lot tighter. I'm not sure by exactly how much as that products is heading the way of EDS's (equity default swaps) and binary bonds (100% payout after a Credit Event) or TRS on high yield bond indices. Sov CDS will not look like other interventions. Those typically seem to work for awhile and then the market returns to normal. I expect Sov CDS volumes go dwindle as naked short ban hits home, as the EU attempts to avoid a CDS credit event at all coats reducing their practical use to any bank that actually cares about risk managed returns, and finally the likelihood of some form of EFSF or ECB selling. The market will move on. SOVX is a relatively new product and until recently CDS on sovereigns were dull. At some point people will hang on to CDS because there will be a time all the contagion caused by EFSF (linking all the countries to the weakest fits any normal definition of contagion) will create a negative momentum that the EU and ECB can't manipulate around. I for one will not be watching Sov CDS for meaningful insights into the market in the meantime.The Only, and I Mean the Only, Investment/Research House To Warn Of An Apple Miss Is Vindicated!!!

10/19/2011 - 08:48

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment