by Dominique de Kevelioc de Bailleul, Beacon Equity Research:

It’s finally here—the long-awaited run on silver supplies.

It’s finally here—the long-awaited run on silver supplies.

Speaking with Alternative Investors Hangout (AIH), GATA’s Bill Murphy tells investors, “Just pay attention, right now,” because the buying is so heavy in an unprecedentedly tight silver market, we “don’t know what will happen here; it’s historic.”

And investors should, indeed, pay attention to Murphy’s latest assessment of the silver market. In July, he said an unidentified European billionaire told him to expect the bull market in silver to resume in late August.

“The fellow I spoke with I’ve known for years, one of the wealthier men in all of Europe,” Murphy told SGTReport in late July [BER article]. “He’s got a lot of connections . . . It will be tough for the gold and silver markets [during the month of July], but starting in August they would start to ‘go nuts’, and they would ‘stay nuts’ for a long time. . . Big, big moves are coming, starting in August.”

After 15 months of a painfully long consolidation, the big move in the silver price began, just as Murphy’s source predicted. After briefly toughing the low $27 level, silver has soared more than $7 within three weeks, a gain of approximately 27 percent, or an annual compound rate of 6,500 percent!

Read More @ BeaconEquity.com

What is it that makes Keynesians so insanely self destructive? Is it their mindless blind faith in the power of government? Their unfortunate ignorance of the mechanics of monetary stimulus? Their pompous self-righteousness derived from years of intellectual idiocy? Actually, I suspect all of these factors play a role. Needless to say, many of them truly believe that the strategy of fiat injection is viable, even though years of application have proven absolutely fruitless. Anyone with any sense would begin to question what kind of madness it takes to pursue or champion the mindset of the private Federal Reserve bank… Quantitative easing has shown itself to be impotent in the improvement of America’s economic situation. Despite four years of free reign in central banking, employment remains dismal in the U.S., the housing market continues its freefall, and, our national debt swirls like a vortex at the heart of the Bermuda Triangle. Despite this abject failure of Keynesian theory, the Federal Reserve is attempting once again to convince you, the happy-go-lucky American citizen, that somehow, this time around, everything will be “different”.

It’s finally here—the long-awaited run on silver supplies.

It’s finally here—the long-awaited run on silver supplies.Speaking with Alternative Investors Hangout (AIH), GATA’s Bill Murphy tells investors, “Just pay attention, right now,” because the buying is so heavy in an unprecedentedly tight silver market, we “don’t know what will happen here; it’s historic.”

And investors should, indeed, pay attention to Murphy’s latest assessment of the silver market. In July, he said an unidentified European billionaire told him to expect the bull market in silver to resume in late August.

“The fellow I spoke with I’ve known for years, one of the wealthier men in all of Europe,” Murphy told SGTReport in late July [BER article]. “He’s got a lot of connections . . . It will be tough for the gold and silver markets [during the month of July], but starting in August they would start to ‘go nuts’, and they would ‘stay nuts’ for a long time. . . Big, big moves are coming, starting in August.”

After 15 months of a painfully long consolidation, the big move in the silver price began, just as Murphy’s source predicted. After briefly toughing the low $27 level, silver has soared more than $7 within three weeks, a gain of approximately 27 percent, or an annual compound rate of 6,500 percent!

Read More @ BeaconEquity.com

Get Ready For An Epic Fiat Currency Avalanche

What is it that makes Keynesians so insanely self destructive? Is it their mindless blind faith in the power of government? Their unfortunate ignorance of the mechanics of monetary stimulus? Their pompous self-righteousness derived from years of intellectual idiocy? Actually, I suspect all of these factors play a role. Needless to say, many of them truly believe that the strategy of fiat injection is viable, even though years of application have proven absolutely fruitless. Anyone with any sense would begin to question what kind of madness it takes to pursue or champion the mindset of the private Federal Reserve bank… Quantitative easing has shown itself to be impotent in the improvement of America’s economic situation. Despite four years of free reign in central banking, employment remains dismal in the U.S., the housing market continues its freefall, and, our national debt swirls like a vortex at the heart of the Bermuda Triangle. Despite this abject failure of Keynesian theory, the Federal Reserve is attempting once again to convince you, the happy-go-lucky American citizen, that somehow, this time around, everything will be “different”.

Germany Opines: "Obama's Middle East Policy Is in Ruins"

However, if you want to distinguish truth from propaganda, if you want to know the real reasons behind the global conflicts in our recent history, you must first learn about the petrodollar system. Without this crucial piece of info, you will have a hard time understanding what really happened in Libya, what’s happening in Syria right now and what’s going to happen in Iran next.

Why did NATO and the U.S. aid Libyan “rebels” in killing Gaddafi? Why was our government willing to support and arm the same terrorists that would later turn on our embassy and murder Libya ambassador Chris Stevens? Why was killing Gaddafi so absolutely imperative?

Why are “we” now doing the same thing in Syria? Why are U.S. operatives currently on the ground in Syria aiding Al Qaeda to topple Assad? Why are we willing to work along side known terrorists just to destabilize Syria and overthrow the regime there?

Read More @ CrisisHQ.com

Video: Send Every Household $10 Million

Admin at Marc Faber Blog - 37 minutes ago

Video Summary: In this "Worldwide Exchange" excerpt, Marc Faber, managing

director and editor of The Gloom Boom and Doom report, suggests that "if

you want to have an expansionary monetary policy that helps the man on the

street" you should send every household a large check in the millions of

dollars. But he still warns that fueling consumption is only a temporary

fix for the economy and leads to bigger problems later.

*Marc Faber is an international investor known for his uncanny predictions

of the stock market and futures markets around the world.*

Marc Faber: Government Spending is 'Cancer'

Admin at Marc Faber Blog - 40 minutes ago

*Marc Faber: Government Spending is 'Cancer' *

On "Worldwide Exchange," Marc Faber, managing director and editor of The

Gloom Boom and Doom report, argues that increasing government spending is

"taking the freedom of people away."

*Marc Faber is an international investor known for his uncanny predictions

of the stock market and futures markets around the world.*

Bonds Might Have Topped Out... for Good...

Trader Dan at Trader Dan's Market Views - 1 hour ago

Today's price action in the long bond is highly suggesting that the

multi-decade bull market in US bonds is over. The inflationary impact off

three successive experiments in Quantitative Easing has seemed to have

finally gotten the attention of that endangered species once known as the

bond vigilante. Remember, this latest round of QE is not targetting US

Treasuries but rather agency debt. That removes a major source of demand.

With the US Dollar falling apart thanks to a deliberate attempt by the Fed

to debauch it, buyers, particularly foreign buyers, are going to demand

higher rat... more »

Stocks Are Not Cheap

Valuations;

stocks are cheap; money-on-the-sidelines; everyone's bearish; trend is

your friend. We've all heard them and we've all played them but the

following charts from Morgan Stanley will at least provide some nuance

of sense for those stunned into silence by a market seeing its nominal

price surging amid Bernanke blowing bubbles. The headline is - with real rates this low (and staying low for a few more years yet) current P/E multiples are extremely high and even on a long-run empirical basis, hope remains excessive at 22xShiller P/E versus an average 16x. Remember,

a long-term investment is a short-term trade gone bad. But it seems

for now that you buy because you'll always be able to sell it back

higher to the next smarter dumber

Valuations;

stocks are cheap; money-on-the-sidelines; everyone's bearish; trend is

your friend. We've all heard them and we've all played them but the

following charts from Morgan Stanley will at least provide some nuance

of sense for those stunned into silence by a market seeing its nominal

price surging amid Bernanke blowing bubbles. The headline is - with real rates this low (and staying low for a few more years yet) current P/E multiples are extremely high and even on a long-run empirical basis, hope remains excessive at 22xShiller P/E versus an average 16x. Remember,

a long-term investment is a short-term trade gone bad. But it seems

for now that you buy because you'll always be able to sell it back

higher to the next smarter dumber Europe and US Un-Decoupling

The

US is no longer the cleanest dirty shirt, or least syphilitic hooker

in the whorehouse as we so responsibly noted previously. Year-to-date, the US Dow Jones Industrials 30 and Europe's EuroStoxx 50 - the two major blue-chip indices of the beleaguered regions - are now equally awesome at +11.35%. Of course, Gold and Silver are outperforming both of these (and the long-bond is unchanged) but nevertheless, even with EURUSD now up over 200 pips on the year, 2Y Spain yields are unchanged and 10Y Spain yields up 70bps. Context is king here, especially when we just keep anchoring to the latest 5 minute trend.

The

US is no longer the cleanest dirty shirt, or least syphilitic hooker

in the whorehouse as we so responsibly noted previously. Year-to-date, the US Dow Jones Industrials 30 and Europe's EuroStoxx 50 - the two major blue-chip indices of the beleaguered regions - are now equally awesome at +11.35%. Of course, Gold and Silver are outperforming both of these (and the long-bond is unchanged) but nevertheless, even with EURUSD now up over 200 pips on the year, 2Y Spain yields are unchanged and 10Y Spain yields up 70bps. Context is king here, especially when we just keep anchoring to the latest 5 minute trend.This Is Blowback

The

YouTube video depicting Mohammed is nothing more than the straw that

broke the camel’s back. This kind of violent uprising against American

power and interests in the region has been a long time in the making.

It is not just the continuation of drone strikes which often kill

civilians in Pakistan, Yemen, Somalia and Afghanistan, either. Nor is

it the American invasions and occupations of Iraq and Afghanistan. Nor

is it the United States and the West’s support for various deeply

unpopular regimes such as the monarchies in Bahrain and Saudi Arabia

(and formerly Iran). Nor is it that America has long favoured Israel

over the Arab states, condemning, invading and fomenting revolution in

Muslim nations for the pursuit of nuclear weapons while turning a blind

eye to Israel’s nuclear weapons and its continued expansion into the

West Bank.

The

YouTube video depicting Mohammed is nothing more than the straw that

broke the camel’s back. This kind of violent uprising against American

power and interests in the region has been a long time in the making.

It is not just the continuation of drone strikes which often kill

civilians in Pakistan, Yemen, Somalia and Afghanistan, either. Nor is

it the American invasions and occupations of Iraq and Afghanistan. Nor

is it the United States and the West’s support for various deeply

unpopular regimes such as the monarchies in Bahrain and Saudi Arabia

(and formerly Iran). Nor is it that America has long favoured Israel

over the Arab states, condemning, invading and fomenting revolution in

Muslim nations for the pursuit of nuclear weapons while turning a blind

eye to Israel’s nuclear weapons and its continued expansion into the

West Bank.Friday Humor: The iPhone X+1

Kimmel 1 - the Borg 0

Kimmel 1 - the Borg 0

by Greg Canavan, Daily Reckoning.com.au:

‘Lost: One plot…went missing on the afternoon of 13th September 2012

in Marriner Eccles Building, Washington D.C. Please contact Ben Bernanke

if found.’

‘Lost: One plot…went missing on the afternoon of 13th September 2012

in Marriner Eccles Building, Washington D.C. Please contact Ben Bernanke

if found.’

That’s right, dear reader, Ben Bernanke has officially lost the plot. In a desperate attempt to boost employment in the US (or so he says), the Fed chief announced he will buy USD$40 billion in mortgage backed securities every month until the situation improves.

In that case he’ll be buying for a long time. USD$40 billion in monthly asset purchases is not that much. We know that sounds like an insane statement but in this already hugely inflated monetary world, it’s not. When Bernanke fired his first shot of QE in 2009, the monthly rate of Treasury purchases was US$75 billion. This is a diminishing amount of QE.

QE1 and 2 didn’t improve the employment situation, and neither will this upcoming monetary injection. Such actions profoundly distort the functioning of a market-based economy. At times like this it is important to remember just why the US (and global) economy is in such a mess…it’s because central banks held the rate of interest well below the market rate for a prolonged period of time.

Read More @ DailyReckoning.com.au

‘Lost: One plot…went missing on the afternoon of 13th September 2012

in Marriner Eccles Building, Washington D.C. Please contact Ben Bernanke

if found.’

‘Lost: One plot…went missing on the afternoon of 13th September 2012

in Marriner Eccles Building, Washington D.C. Please contact Ben Bernanke

if found.’That’s right, dear reader, Ben Bernanke has officially lost the plot. In a desperate attempt to boost employment in the US (or so he says), the Fed chief announced he will buy USD$40 billion in mortgage backed securities every month until the situation improves.

In that case he’ll be buying for a long time. USD$40 billion in monthly asset purchases is not that much. We know that sounds like an insane statement but in this already hugely inflated monetary world, it’s not. When Bernanke fired his first shot of QE in 2009, the monthly rate of Treasury purchases was US$75 billion. This is a diminishing amount of QE.

QE1 and 2 didn’t improve the employment situation, and neither will this upcoming monetary injection. Such actions profoundly distort the functioning of a market-based economy. At times like this it is important to remember just why the US (and global) economy is in such a mess…it’s because central banks held the rate of interest well below the market rate for a prolonged period of time.

Read More @ DailyReckoning.com.au

from Bullion Street:

World’s largest gold producer China’s production hit 208 metric tons in the first seven months of this year.

World’s largest gold producer China’s production hit 208 metric tons in the first seven months of this year.

According to Ministry of Industry and Information Technology, the production increased by 7.09% from last year.

In July alone, China produced 31.3 metric tons, and the industry’s gross output value reached RMB 31.85 billion yuan.

At the end of half year period, China’s production grew by 7 per cent in the first six months of the year, taking output of the yellow metal to 182 tons.

Gross output value of the gold industry grew 20.79% YoY to 173.08 billion yuan in the seven-month period.

China continued to be the world’s largest gold producer for a fifth year in 2011, as gold output that year hit 360.96 tons, up 5.89 percent year-on-year.

I'm PayPal Verified

World’s largest gold producer China’s production hit 208 metric tons in the first seven months of this year.

World’s largest gold producer China’s production hit 208 metric tons in the first seven months of this year.According to Ministry of Industry and Information Technology, the production increased by 7.09% from last year.

In July alone, China produced 31.3 metric tons, and the industry’s gross output value reached RMB 31.85 billion yuan.

At the end of half year period, China’s production grew by 7 per cent in the first six months of the year, taking output of the yellow metal to 182 tons.

Gross output value of the gold industry grew 20.79% YoY to 173.08 billion yuan in the seven-month period.

China continued to be the world’s largest gold producer for a fifth year in 2011, as gold output that year hit 360.96 tons, up 5.89 percent year-on-year.

from Azizonomics:

The Keynesians and Monetarists who have so berated the Federal Reserve

and demanded more asset purchases and a nominal GDP target to get GDP

level up to the long-term growth trend have essentially got their wish.

The Keynesians and Monetarists who have so berated the Federal Reserve

and demanded more asset purchases and a nominal GDP target to get GDP

level up to the long-term growth trend have essentially got their wish.

This is a radical departure:

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee agreed today to increase policy accommodation by purchasing additional agency mortgage-backed securities at a pace of $40 billion per month. The Committee also will continue through the end of the year its program to extend the average maturity of its holdings of securities as announced in June, and it is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities. These actions, which together will increase the Committee’s holdings of longer-term securities by about $85 billion each month through the end of the year, should put downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative.

The Committee will closely monitor incoming information on economic and financial developments in coming months. If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency mortgage-backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability. In determining the size, pace, and composition of its asset purchases, the Committee will, as always, take appropriate account of the likely efficacy and costs of such purchases.

Read More @ Azizonomics.com

The Keynesians and Monetarists who have so berated the Federal Reserve

and demanded more asset purchases and a nominal GDP target to get GDP

level up to the long-term growth trend have essentially got their wish.

The Keynesians and Monetarists who have so berated the Federal Reserve

and demanded more asset purchases and a nominal GDP target to get GDP

level up to the long-term growth trend have essentially got their wish.This is a radical departure:

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee agreed today to increase policy accommodation by purchasing additional agency mortgage-backed securities at a pace of $40 billion per month. The Committee also will continue through the end of the year its program to extend the average maturity of its holdings of securities as announced in June, and it is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities. These actions, which together will increase the Committee’s holdings of longer-term securities by about $85 billion each month through the end of the year, should put downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative.

The Committee will closely monitor incoming information on economic and financial developments in coming months. If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency mortgage-backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability. In determining the size, pace, and composition of its asset purchases, the Committee will, as always, take appropriate account of the likely efficacy and costs of such purchases.

Read More @ Azizonomics.com

I'm PayPal Verified

by Dr. Ron Paul, Lew Rockwell:

“No one is surprised by the Fed’s action today to inject even more

money into the economy through additional asset purchases. The Fed’s

only solution for every problem is to print more money and provide more

liquidity. Mr. Bernanke and Fed governors appear not to understand that

our current economic malaise resulted directly because of the excessive

credit the Fed already pumped into the system.

“No one is surprised by the Fed’s action today to inject even more

money into the economy through additional asset purchases. The Fed’s

only solution for every problem is to print more money and provide more

liquidity. Mr. Bernanke and Fed governors appear not to understand that

our current economic malaise resulted directly because of the excessive

credit the Fed already pumped into the system.

“For all of its vaunted policy tools, the Fed now finds itself repeating the same basic action over and over in an attempt to prime the economy with more debt and credit. But this latest decision to provide more quantitative easing will only prolong our economic stagnation, corrupt market signals, and encourage even more misallocation and malinvestment of resources. Rather than stimulating a real recovery by focusing on a strong dollar and market interest rates, the Fed’s announcement today shows a disastrous detachment from reality on the part of our central bank. Any further quantitative easing from the Fed, in whatever form, will only make our next economic crash that much more serious.”

“No one is surprised by the Fed’s action today to inject even more

money into the economy through additional asset purchases. The Fed’s

only solution for every problem is to print more money and provide more

liquidity. Mr. Bernanke and Fed governors appear not to understand that

our current economic malaise resulted directly because of the excessive

credit the Fed already pumped into the system.

“No one is surprised by the Fed’s action today to inject even more

money into the economy through additional asset purchases. The Fed’s

only solution for every problem is to print more money and provide more

liquidity. Mr. Bernanke and Fed governors appear not to understand that

our current economic malaise resulted directly because of the excessive

credit the Fed already pumped into the system.“For all of its vaunted policy tools, the Fed now finds itself repeating the same basic action over and over in an attempt to prime the economy with more debt and credit. But this latest decision to provide more quantitative easing will only prolong our economic stagnation, corrupt market signals, and encourage even more misallocation and malinvestment of resources. Rather than stimulating a real recovery by focusing on a strong dollar and market interest rates, the Fed’s announcement today shows a disastrous detachment from reality on the part of our central bank. Any further quantitative easing from the Fed, in whatever form, will only make our next economic crash that much more serious.”

from Silver Doctors:

The CFTC’s Bart Chilton was on CNBC this morning

discussing a warning letter he sent to Ben Bernanke yesterday regarding

the Volcker Rule and Chilton’s concerns that the large banks (ie Morgan and Goldman) will attempt to find and use every loophole they can to get against the prop trading restrictions contained in the Volcker rule.

The CFTC’s Bart Chilton was on CNBC this morning

discussing a warning letter he sent to Ben Bernanke yesterday regarding

the Volcker Rule and Chilton’s concerns that the large banks (ie Morgan and Goldman) will attempt to find and use every loophole they can to get against the prop trading restrictions contained in the Volcker rule.

The CFTC’s Bart Chilton was on CNBC this morning

discussing a warning letter he sent to Ben Bernanke yesterday regarding

the Volcker Rule and Chilton’s concerns that the large banks (ie Morgan and Goldman) will attempt to find and use every loophole they can to get against the prop trading restrictions contained in the Volcker rule.

The CFTC’s Bart Chilton was on CNBC this morning

discussing a warning letter he sent to Ben Bernanke yesterday regarding

the Volcker Rule and Chilton’s concerns that the large banks (ie Morgan and Goldman) will attempt to find and use every loophole they can to get against the prop trading restrictions contained in the Volcker rule.I’m okay if they hedge their risks. But there’s a thin line between hedging and speculating. So you manage your risks, if that over time, if that hedging of your risk continues to result in large profits like you’re making a lot more money than the risks that you’re losing, then you have to say there’s a presumption that they’re willful and trying to be evasive. We do need to make sure that they can hedge their business risks. It’s just not going crazy and going out and betting against their customers like we’ve seen where they set up these fake info where they populate the funds with their own customers and then take the opposite position to their own customers.Read More @ Silver Doctors

by Michael Krieger, Liberty Blitzkreig

So I was dead wrong about what the Fed would do in the video blog that I

put out last night. I did not expect them to expand their balance

sheet with asset prices as high as they are and the economy supposedly

growing. This is THE signal I have been waiting for (and the spark that

I mentioned in my recent GoldMoney interview) to be sure that this latest rally in the precious metals is the real deal and that new highs are in the cards.

So I was dead wrong about what the Fed would do in the video blog that I

put out last night. I did not expect them to expand their balance

sheet with asset prices as high as they are and the economy supposedly

growing. This is THE signal I have been waiting for (and the spark that

I mentioned in my recent GoldMoney interview) to be sure that this latest rally in the precious metals is the real deal and that new highs are in the cards.

It doesn’t take long to realize how bullish this is for gold and silver. Everyone I know has been waiting for new QE to really make serious changes and now we have it. This action will lead to two questions being asked by investors. First, if the economy is recovering why do this? Second, if they are doing this now what do you think they will be forced to do when things get worse?

Read More @ LibertyBlitzkreig.com

So I was dead wrong about what the Fed would do in the video blog that I

put out last night. I did not expect them to expand their balance

sheet with asset prices as high as they are and the economy supposedly

growing. This is THE signal I have been waiting for (and the spark that

I mentioned in my recent GoldMoney interview) to be sure that this latest rally in the precious metals is the real deal and that new highs are in the cards.

So I was dead wrong about what the Fed would do in the video blog that I

put out last night. I did not expect them to expand their balance

sheet with asset prices as high as they are and the economy supposedly

growing. This is THE signal I have been waiting for (and the spark that

I mentioned in my recent GoldMoney interview) to be sure that this latest rally in the precious metals is the real deal and that new highs are in the cards.It doesn’t take long to realize how bullish this is for gold and silver. Everyone I know has been waiting for new QE to really make serious changes and now we have it. This action will lead to two questions being asked by investors. First, if the economy is recovering why do this? Second, if they are doing this now what do you think they will be forced to do when things get worse?

Read More @ LibertyBlitzkreig.com

from CNBC:

“Government spending is a cancer that is spreading and taking the freedom of people away and with more and more regulation they are harassing the entrepreneurs,” says Marc Faber, managing director and editor of The Gloom Boom and Doom report.

“Government spending is a cancer that is spreading and taking the freedom of people away and with more and more regulation they are harassing the entrepreneurs,” says Marc Faber, managing director and editor of The Gloom Boom and Doom report.

from Wealth Cycles:

An event horizon, is in laymans terms, “the point of no return” according to Wikipedia–more

specifically, “the point at which the gravitational pull becomes so

great as to make escape impossible. The most common case of an event

horizon is that surrounding a black hole.”

An event horizon, is in laymans terms, “the point of no return” according to Wikipedia–more

specifically, “the point at which the gravitational pull becomes so

great as to make escape impossible. The most common case of an event

horizon is that surrounding a black hole.”

Today the private bank charged with the privilege of issuing dollar notes as a liability (otherwise known as the Federal Reserve) crossed that boundary: it announced today it would begin creating new currency–what we at Wealth Cycles refer to as “printing money–with no end date announced. That means there is no end date. The impacts on the purchasing power of the dollar and both silver and gold will become more and more profound as the reality of what the Fed is doing sinks in.

With all of the speculation about just this type of open-ended “flow” printing leading up to the announcement today, a black SUV speeding through Los Angeles was temporarily mistaken to be Federal Reserve (Fed) Chairman Bernanke himself, throwing fist-fulls of cash out of the window on his way to the two-day Federal Open Market Committee (FOMC) meeting. A witness commented to CBS LA:

Read More @ WealthCycles.com

An event horizon, is in laymans terms, “the point of no return” according to Wikipedia–more

specifically, “the point at which the gravitational pull becomes so

great as to make escape impossible. The most common case of an event

horizon is that surrounding a black hole.”

An event horizon, is in laymans terms, “the point of no return” according to Wikipedia–more

specifically, “the point at which the gravitational pull becomes so

great as to make escape impossible. The most common case of an event

horizon is that surrounding a black hole.”Today the private bank charged with the privilege of issuing dollar notes as a liability (otherwise known as the Federal Reserve) crossed that boundary: it announced today it would begin creating new currency–what we at Wealth Cycles refer to as “printing money–with no end date announced. That means there is no end date. The impacts on the purchasing power of the dollar and both silver and gold will become more and more profound as the reality of what the Fed is doing sinks in.

With all of the speculation about just this type of open-ended “flow” printing leading up to the announcement today, a black SUV speeding through Los Angeles was temporarily mistaken to be Federal Reserve (Fed) Chairman Bernanke himself, throwing fist-fulls of cash out of the window on his way to the two-day Federal Open Market Committee (FOMC) meeting. A witness commented to CBS LA:

Read More @ WealthCycles.com

by Bill Holter, MilesFranklin.com:

I wrote on Wednesday “Crash Alert”, I should have titled it “Panic

Alert”, which is exactly what the Fed did yesterday. Yesterday they

announced “QE 3.5″(Fed Pulls Trigger, to Buy Mortgages in Effort to Lower Rates)

where on top of Operation Twist and after QE1 and 2, they will purchase

$40 billion per month of MBS (mortgage backed securities). I do want

to mention that this is an outright confession that what they have done

so far …has not worked, otherwise there would be no need for “more.”

We, us peons, us sheep, were told (spun) all along things like “green

shoots, recovery, sustainable recovery” etc., what have not heard

because it is neither credible nor believable is the word “expansion”

(growth). Yesterday the Fed admitted the failure of previous policy

response.

I wrote on Wednesday “Crash Alert”, I should have titled it “Panic

Alert”, which is exactly what the Fed did yesterday. Yesterday they

announced “QE 3.5″(Fed Pulls Trigger, to Buy Mortgages in Effort to Lower Rates)

where on top of Operation Twist and after QE1 and 2, they will purchase

$40 billion per month of MBS (mortgage backed securities). I do want

to mention that this is an outright confession that what they have done

so far …has not worked, otherwise there would be no need for “more.”

We, us peons, us sheep, were told (spun) all along things like “green

shoots, recovery, sustainable recovery” etc., what have not heard

because it is neither credible nor believable is the word “expansion”

(growth). Yesterday the Fed admitted the failure of previous policy

response.

The timing of this latest panicky policy response should tell you more than you need to know. We have an election coming up in less than 60 days, never, NEVER (other than 2008) has the Fed eased policy within 6 months of an election, this should tell you a lot! In fact, because the program is “open ended” (as in infinity as Jim Sinclair has said many times before), the Fed has gone “all in”. The $40 billion per month was not the key, the “open ended” part is because it illustrates that the oh so famous “exit strategy” talked about in 2009 and ’10 will never come. There is no turning back now.

Read more @ MilesFranklin.com

I wrote on Wednesday “Crash Alert”, I should have titled it “Panic

Alert”, which is exactly what the Fed did yesterday. Yesterday they

announced “QE 3.5″(Fed Pulls Trigger, to Buy Mortgages in Effort to Lower Rates)

where on top of Operation Twist and after QE1 and 2, they will purchase

$40 billion per month of MBS (mortgage backed securities). I do want

to mention that this is an outright confession that what they have done

so far …has not worked, otherwise there would be no need for “more.”

We, us peons, us sheep, were told (spun) all along things like “green

shoots, recovery, sustainable recovery” etc., what have not heard

because it is neither credible nor believable is the word “expansion”

(growth). Yesterday the Fed admitted the failure of previous policy

response.

I wrote on Wednesday “Crash Alert”, I should have titled it “Panic

Alert”, which is exactly what the Fed did yesterday. Yesterday they

announced “QE 3.5″(Fed Pulls Trigger, to Buy Mortgages in Effort to Lower Rates)

where on top of Operation Twist and after QE1 and 2, they will purchase

$40 billion per month of MBS (mortgage backed securities). I do want

to mention that this is an outright confession that what they have done

so far …has not worked, otherwise there would be no need for “more.”

We, us peons, us sheep, were told (spun) all along things like “green

shoots, recovery, sustainable recovery” etc., what have not heard

because it is neither credible nor believable is the word “expansion”

(growth). Yesterday the Fed admitted the failure of previous policy

response.The timing of this latest panicky policy response should tell you more than you need to know. We have an election coming up in less than 60 days, never, NEVER (other than 2008) has the Fed eased policy within 6 months of an election, this should tell you a lot! In fact, because the program is “open ended” (as in infinity as Jim Sinclair has said many times before), the Fed has gone “all in”. The $40 billion per month was not the key, the “open ended” part is because it illustrates that the oh so famous “exit strategy” talked about in 2009 and ’10 will never come. There is no turning back now.

Read more @ MilesFranklin.com

by Susanne Posel, Occupy Corporatism:

Protests are erupting across the Middle East as demonstrators throw rocks and Molotov cocktails at police who retaliate with tear gas canisters being shot into the crowds. The US Embassy in Cario has become a new target.

On the 11th anniversary of September 11th, a US-sponsored false flag attack occurred wherein the US Embassy in Libya was bombed. The US Ambassador, J. Christopher Stevens was suffocated to death and his dead body dragged through the streets amid a mob of fake revolutionaries supported by the CIA-funded al-Qaeda.

Obama, using this manufactured Islamic extremist threat to his advantage, admonished Egypt saying “they’re not taking responsibilities, as all other countries do where we have embassies, I think that’s going to be a real big problem.”

In Yemen, mobs have formed and stormed the US Embassy in Sanaa, Egypt. This latest protest is being tied to the Islamic film that sparked the violence in Libya.

Read More @ OccupyCorporatism.com

Protests are erupting across the Middle East as demonstrators throw rocks and Molotov cocktails at police who retaliate with tear gas canisters being shot into the crowds. The US Embassy in Cario has become a new target.

On the 11th anniversary of September 11th, a US-sponsored false flag attack occurred wherein the US Embassy in Libya was bombed. The US Ambassador, J. Christopher Stevens was suffocated to death and his dead body dragged through the streets amid a mob of fake revolutionaries supported by the CIA-funded al-Qaeda.

Obama, using this manufactured Islamic extremist threat to his advantage, admonished Egypt saying “they’re not taking responsibilities, as all other countries do where we have embassies, I think that’s going to be a real big problem.”

In Yemen, mobs have formed and stormed the US Embassy in Sanaa, Egypt. This latest protest is being tied to the Islamic film that sparked the violence in Libya.

Read More @ OccupyCorporatism.com

Analysts

concur that gold will hit at least $1,800 by November and silver and

PGMs will be among the biggest winners of the Federal Reserve’s new

third quantitative easing program.

by Dorothy Kosich, MineWeb.com

The Federal Reserve’s announcement Thursday that it would purchase buy

an additional $40 billion per month in mortgage-backed securities,

increasing its holdings of longer-term securities by about $85 million

each month through the end of the year, as well as keeping interest

rates “exceptionally low” until 2015, sent investors running after gold

and silver.

The Federal Reserve’s announcement Thursday that it would purchase buy

an additional $40 billion per month in mortgage-backed securities,

increasing its holdings of longer-term securities by about $85 million

each month through the end of the year, as well as keeping interest

rates “exceptionally low” until 2015, sent investors running after gold

and silver.

Gold futures rose to $1,773.10 per ounce, while silver jumped 6% to $34.78 per ounce.

“Expectations of a stronger U.S. economy resulting from this policy should help industrial demand for industrial base and precious metals, as well as, gold,” TD Securities’ Bart Melek advised. “The tighter supply/demand conditions should move prices higher, possibly above their respective cost structures.”

The uptick in gold and silver also boosted copper to $3.74 per pound, as December palladium rose $9.70 to $689 per ounce. October platinum increased $29.90 to $1,679.50 per ounce. The world’s largest bullion ETF, SPDR Gold Shares hit its highest price since February, closing at $171.31 per share while the iShares Silver Trust closed at $33.61 per share, up 4.35%.

Read More @ MineWeb.com

by Dorothy Kosich, MineWeb.com

The Federal Reserve’s announcement Thursday that it would purchase buy

an additional $40 billion per month in mortgage-backed securities,

increasing its holdings of longer-term securities by about $85 million

each month through the end of the year, as well as keeping interest

rates “exceptionally low” until 2015, sent investors running after gold

and silver.

The Federal Reserve’s announcement Thursday that it would purchase buy

an additional $40 billion per month in mortgage-backed securities,

increasing its holdings of longer-term securities by about $85 million

each month through the end of the year, as well as keeping interest

rates “exceptionally low” until 2015, sent investors running after gold

and silver.Gold futures rose to $1,773.10 per ounce, while silver jumped 6% to $34.78 per ounce.

“Expectations of a stronger U.S. economy resulting from this policy should help industrial demand for industrial base and precious metals, as well as, gold,” TD Securities’ Bart Melek advised. “The tighter supply/demand conditions should move prices higher, possibly above their respective cost structures.”

The uptick in gold and silver also boosted copper to $3.74 per pound, as December palladium rose $9.70 to $689 per ounce. October platinum increased $29.90 to $1,679.50 per ounce. The world’s largest bullion ETF, SPDR Gold Shares hit its highest price since February, closing at $171.31 per share while the iShares Silver Trust closed at $33.61 per share, up 4.35%.

Read More @ MineWeb.com

by Dr. Paul Craig Roberts, PaulCraigRoberts.org:

Today the Western peoples are experiencing the destruction of their

well being that is comparable to what the one percent in Rome imposed on

Roman citizens and conquered peoples. Here is how John Williams (shadowstats.com, 9-12-12) phrases the wipeout of Americans’ hopes:

Today the Western peoples are experiencing the destruction of their

well being that is comparable to what the one percent in Rome imposed on

Roman citizens and conquered peoples. Here is how John Williams (shadowstats.com, 9-12-12) phrases the wipeout of Americans’ hopes:

“Consumers simply cannot make ends meet. Inflation-adjusted, or real, median household income declined for the fourth-straight year, plunging to its lowest level since 1995. Deflated by the CPI-U, the 2011 reading actually stood below levels seen in the late-1960s and early-1970s.”

“At the same time, despite the ongoing nature of the economic and systemic-solvency crises, and the effects of the 2008 financial panic, income dispersion—the movement of income away from the middle towards both high- and low-level extremes—has hit a record high, instead of moderating, as might be expected during periods of financial distress. Extremes in income dispersion usually foreshadow financial-market and economic calamities. With the current circumstance at a record extreme, and well above levels estimated to have prevailed before the 1929 stock-market crash and the Great Depression, increasingly difficult times are likely for the next several years.”

Read More @ PaulCraigRoberts.org

Today the Western peoples are experiencing the destruction of their

well being that is comparable to what the one percent in Rome imposed on

Roman citizens and conquered peoples. Here is how John Williams (shadowstats.com, 9-12-12) phrases the wipeout of Americans’ hopes:

Today the Western peoples are experiencing the destruction of their

well being that is comparable to what the one percent in Rome imposed on

Roman citizens and conquered peoples. Here is how John Williams (shadowstats.com, 9-12-12) phrases the wipeout of Americans’ hopes:“Consumers simply cannot make ends meet. Inflation-adjusted, or real, median household income declined for the fourth-straight year, plunging to its lowest level since 1995. Deflated by the CPI-U, the 2011 reading actually stood below levels seen in the late-1960s and early-1970s.”

“At the same time, despite the ongoing nature of the economic and systemic-solvency crises, and the effects of the 2008 financial panic, income dispersion—the movement of income away from the middle towards both high- and low-level extremes—has hit a record high, instead of moderating, as might be expected during periods of financial distress. Extremes in income dispersion usually foreshadow financial-market and economic calamities. With the current circumstance at a record extreme, and well above levels estimated to have prevailed before the 1929 stock-market crash and the Great Depression, increasingly difficult times are likely for the next several years.”

Read More @ PaulCraigRoberts.org

[Ed. Note:

As we follow the unleashing of QE to infinity, remember that we are

trying to track multiple enemies of liberty. The motto of the 'Elite' is

Divide & Conquer, ours is 'We're all in this mess together', so

let's spread the word and take this thing back'.]

by Cora Currier, Pro Publica:

Drones have become the go-to weapon of the U.S.’s counter-terrorism strategy, with strikes in Yemen in particular increasing steadily. U.S. drones reportedly killed twenty-nine people in Yemen recently, including perhaps ten civilians.

Drones have become the go-to weapon of the U.S.’s counter-terrorism strategy, with strikes in Yemen in particular increasing steadily. U.S. drones reportedly killed twenty-nine people in Yemen recently, including perhaps ten civilians.

Administration officials regularly celebrate the drone war’s apparent successes— often avoiding details or staying anonymous, but claiming tacit credit for the U.S.

In June, a day after Abu Yahya Al-Libi was killed in Pakistan, White House spokesman Jay Carney trumpeted the death of “Al Qaeda’s Number-Two.” Unnamed officials confirmed the strike in at least ten media outlets. Similarly, the killing of U.S. citizen Anwar al-Awlaki by a CIA drone last September was confirmed in many news outlets by anonymous officials. President Obama called Awlaki’s death “a tribute to our intelligence community.”

Just last week President Obama spoke about drone warfare on CNN, saying the decision to target individuals for killing rather than capture involves “an extensive process with a lot of checks.”

Read More @ ProPublica.org

I'm PayPal Verified

by Cora Currier, Pro Publica:

Drones have become the go-to weapon of the U.S.’s counter-terrorism strategy, with strikes in Yemen in particular increasing steadily. U.S. drones reportedly killed twenty-nine people in Yemen recently, including perhaps ten civilians.

Drones have become the go-to weapon of the U.S.’s counter-terrorism strategy, with strikes in Yemen in particular increasing steadily. U.S. drones reportedly killed twenty-nine people in Yemen recently, including perhaps ten civilians.Administration officials regularly celebrate the drone war’s apparent successes— often avoiding details or staying anonymous, but claiming tacit credit for the U.S.

In June, a day after Abu Yahya Al-Libi was killed in Pakistan, White House spokesman Jay Carney trumpeted the death of “Al Qaeda’s Number-Two.” Unnamed officials confirmed the strike in at least ten media outlets. Similarly, the killing of U.S. citizen Anwar al-Awlaki by a CIA drone last September was confirmed in many news outlets by anonymous officials. President Obama called Awlaki’s death “a tribute to our intelligence community.”

Just last week President Obama spoke about drone warfare on CNN, saying the decision to target individuals for killing rather than capture involves “an extensive process with a lot of checks.”

Read More @ ProPublica.org

by Mac Slavo, SHTFPlan:

The Federal Reserve has officially begun its long awaited monetary stimulus, and the world has breathed a sigh of relief – for a week or two at least.

The stock market staged a huge rally Thursday after investors got the aggressive economic help they wanted from the Federal Reserve.

The Dow Jones industrial average spiked more than 200 points and cleared 13,500 for the first time since the beginning of the Great Recession. The average is within 625 points of its all-time high.

The Fed said it would buy $40 billion of mortgage securities a month until the economy improves.

It’s reminiscent of 1930, when the effects of what the stock market crash of 1929 actually meant for the global economy and geo-political climate were yet to be realized by an unsuspecting public.

Read More @ SHTFPlan.com

While claiming otherwise, White House has pushed for measure all along

by Paul Joseph Watson, Info Wars:

Within 24 hours of a historic court ruling that struck down the

indefinite detention provision of the National Defense Authorization

Act, the Obama administration has appealed the ruling, emphasizing once

again how the White House – while claiming to be against the measure –

has aggressively pushed for it at every turn.

Within 24 hours of a historic court ruling that struck down the

indefinite detention provision of the National Defense Authorization

Act, the Obama administration has appealed the ruling, emphasizing once

again how the White House – while claiming to be against the measure –

has aggressively pushed for it at every turn.

On Wednesday, New York federal judge Katherine Forrest issued a ruling which blocked provisions of the NDAA that could have seen American citizens kidnapped and held indefinitely without charge.

The Federal Reserve has officially begun its long awaited monetary stimulus, and the world has breathed a sigh of relief – for a week or two at least.

The stock market staged a huge rally Thursday after investors got the aggressive economic help they wanted from the Federal Reserve.

The Dow Jones industrial average spiked more than 200 points and cleared 13,500 for the first time since the beginning of the Great Recession. The average is within 625 points of its all-time high.

The Fed said it would buy $40 billion of mortgage securities a month until the economy improves.

It’s reminiscent of 1930, when the effects of what the stock market crash of 1929 actually meant for the global economy and geo-political climate were yet to be realized by an unsuspecting public.

Read More @ SHTFPlan.com

by Paul Joseph Watson, Info Wars:

Within 24 hours of a historic court ruling that struck down the

indefinite detention provision of the National Defense Authorization

Act, the Obama administration has appealed the ruling, emphasizing once

again how the White House – while claiming to be against the measure –

has aggressively pushed for it at every turn.

Within 24 hours of a historic court ruling that struck down the

indefinite detention provision of the National Defense Authorization

Act, the Obama administration has appealed the ruling, emphasizing once

again how the White House – while claiming to be against the measure –

has aggressively pushed for it at every turn.On Wednesday, New York federal judge Katherine Forrest issued a ruling which blocked provisions of the NDAA that could have seen American citizens kidnapped and held indefinitely without charge.

The suit was brought by activists and journalists,

including former New York Times columnist Chris Hedges, who argued that

the law was unconstitutional because it could see journalists abducted

and detained merely for speaking their minds.

In “permanently” halting the enforcement of the law,

Forrest noted how the plaintiffs presented “evidence that First

Amendment rights have already been harmed and will be harmed by the

prospect of (the law) being enforced. The public has a strong and

undoubted interest in the clear preservation of First and Fifth

Amendment rights.”

However, the very next day the Obama administration

reportedly moved to appeal the decision in an attempt to reinstate the

indefinite detention provisions.

Read More @ InfoWars.com

The geniuses at the Federal Reserve have concocted a bold new plan to

revive the U.S. economy — print a bunch of money, loan it to Americans

at super low interest rates so they can speculate on rising real estate

prices, extract the appreciated equity and spend it on consumer goods.

In other words, build an economy of real estate, by real estate, and for

real estate. The only problem is we’ve been there and done that. The

last time it almost destroyed the U.S.economy. I guess almost isn’t

quite good enough for the Fed, so now it’s determined to finish the job.

These actions will destroy Americans’ savings and hurt people on fixed incomes. To protect yourself, I recommend a strategy of foreign equities, commodities, and gold and silver.

These actions will destroy Americans’ savings and hurt people on fixed incomes. To protect yourself, I recommend a strategy of foreign equities, commodities, and gold and silver.

by Greg Hunter, USAWatchdog:

I just want to focus on two stories today: the Federal Reserve’s latest round of money printing and the Middle East. Let’s start with the Fed’s announcement. It will print money and spend it buying $40 billion a month in sour debt. It says it is to keep interest rates low and to spur employment, but it’s much more about a continued bailout of the big banks. That’s what economist John Williams of Shadowstats.com says. Inflation is a lock, and gold and silver prices shot up on the money printing news. Over in the EU, the European Central Bank is doing the same thing, but theirs is “unlimited.” The Germans caved to the pressure, and fresh money is being printed on both sides of the Atlantic. You have to be crazy to be long on the dollar or the euro. On to the Middle East, and what a mess that is. It will not get better anytime soon. Just last week, I was telling you how the Russians were warning the U.S. about using terrorists in Libya, Egypt and Syria to further their goals of regime change.

Read More @ USAWatchdog.com

I just want to focus on two stories today: the Federal Reserve’s latest round of money printing and the Middle East. Let’s start with the Fed’s announcement. It will print money and spend it buying $40 billion a month in sour debt. It says it is to keep interest rates low and to spur employment, but it’s much more about a continued bailout of the big banks. That’s what economist John Williams of Shadowstats.com says. Inflation is a lock, and gold and silver prices shot up on the money printing news. Over in the EU, the European Central Bank is doing the same thing, but theirs is “unlimited.” The Germans caved to the pressure, and fresh money is being printed on both sides of the Atlantic. You have to be crazy to be long on the dollar or the euro. On to the Middle East, and what a mess that is. It will not get better anytime soon. Just last week, I was telling you how the Russians were warning the U.S. about using terrorists in Libya, Egypt and Syria to further their goals of regime change.

Read More @ USAWatchdog.com

from Gold Core:

Bernanke’s announcement of further money printing and ultra loose

monetary policies saw gold and silver surge in all currencies yesterday.

Gold rose $34.30 or 1.98% in New York and closed at $1,732.00. Silver

soared to a high of $34.781 and finished with a gain of 4.34%.

Bernanke’s announcement of further money printing and ultra loose

monetary policies saw gold and silver surge in all currencies yesterday.

Gold rose $34.30 or 1.98% in New York and closed at $1,732.00. Silver

soared to a high of $34.781 and finished with a gain of 4.34%.

Gold surged to a 6 month high in dollars, to very close to new record highs in euros and importantly to an all time record nominal high in Swiss francs (see chart below). Gold climbed as much as 2.2% in the “safe haven” Swiss franc to 1,657 per ounce.

Platinum topped $1,700 an ounce for the first time since March and silver and palladium also hit their highest prices in 6 months, as the Fed announced an open-ended debt buying program and promised to keep interest rates near zero until at least mid-2015.

Commodities and oil surged alongside equities. Oil rose to $100 a barrel in New York for the first time since May after the Fed news while unrest in the Middle East and North Africa fanned concern that supplies will be threatened.

Commodities are set for the longest run of weekly gains since 2010. The Fed decision is fuelling expectations raw-material use will rise.

Read More @ GoldCore.com

Bernanke’s announcement of further money printing and ultra loose

monetary policies saw gold and silver surge in all currencies yesterday.

Gold rose $34.30 or 1.98% in New York and closed at $1,732.00. Silver

soared to a high of $34.781 and finished with a gain of 4.34%.

Bernanke’s announcement of further money printing and ultra loose

monetary policies saw gold and silver surge in all currencies yesterday.

Gold rose $34.30 or 1.98% in New York and closed at $1,732.00. Silver

soared to a high of $34.781 and finished with a gain of 4.34%.Gold surged to a 6 month high in dollars, to very close to new record highs in euros and importantly to an all time record nominal high in Swiss francs (see chart below). Gold climbed as much as 2.2% in the “safe haven” Swiss franc to 1,657 per ounce.

Platinum topped $1,700 an ounce for the first time since March and silver and palladium also hit their highest prices in 6 months, as the Fed announced an open-ended debt buying program and promised to keep interest rates near zero until at least mid-2015.

Commodities and oil surged alongside equities. Oil rose to $100 a barrel in New York for the first time since May after the Fed news while unrest in the Middle East and North Africa fanned concern that supplies will be threatened.

Commodities are set for the longest run of weekly gains since 2010. The Fed decision is fuelling expectations raw-material use will rise.

Read More @ GoldCore.com

by Eugene Robinson, Truth Dig:

Once upon a time there was a silver-tongued president. His foreign

policy must have been seen by enemies of the United States as weak and

feckless, because these enemies became emboldened. Mideast terrorists

staged a brutal, bloody attack in which innocent Americans were killed.

The president’s response could be seen as a display of shameful weakness

rather than steely resolve.

Once upon a time there was a silver-tongued president. His foreign

policy must have been seen by enemies of the United States as weak and

feckless, because these enemies became emboldened. Mideast terrorists

staged a brutal, bloody attack in which innocent Americans were killed.

The president’s response could be seen as a display of shameful weakness

rather than steely resolve.

I’m referring, of course, to Ronald Reagan and the 1983 Marine barracks bombing in Beirut, which claimed 241 American lives—and led Reagan to withdraw U.S. forces from Lebanon.

It’s useful to keep this antecedent in mind as opportunistic critics embarrass themselves looking for ways to bash President Obama over the spreading anti-U.S. violence in Egypt, Libya and now Yemen.

I mean Mitt Romney. Really. U.S. diplomatic posts are attacked abroad, and your first reaction is to issue a statement blasting the president? J. Christopher Stevens, the American ambassador to Libya, and three other officials are killed in a commando-style assault on the U.S. Consulate in Benghazi, and your instinct is to seek not safety for other Americans at risk, not justice for the coldblooded killers, but political advantage for yourself?

Read More @ TruthDig.com

Once upon a time there was a silver-tongued president. His foreign

policy must have been seen by enemies of the United States as weak and

feckless, because these enemies became emboldened. Mideast terrorists

staged a brutal, bloody attack in which innocent Americans were killed.

The president’s response could be seen as a display of shameful weakness

rather than steely resolve.

Once upon a time there was a silver-tongued president. His foreign

policy must have been seen by enemies of the United States as weak and

feckless, because these enemies became emboldened. Mideast terrorists

staged a brutal, bloody attack in which innocent Americans were killed.

The president’s response could be seen as a display of shameful weakness

rather than steely resolve.I’m referring, of course, to Ronald Reagan and the 1983 Marine barracks bombing in Beirut, which claimed 241 American lives—and led Reagan to withdraw U.S. forces from Lebanon.

It’s useful to keep this antecedent in mind as opportunistic critics embarrass themselves looking for ways to bash President Obama over the spreading anti-U.S. violence in Egypt, Libya and now Yemen.

I mean Mitt Romney. Really. U.S. diplomatic posts are attacked abroad, and your first reaction is to issue a statement blasting the president? J. Christopher Stevens, the American ambassador to Libya, and three other officials are killed in a commando-style assault on the U.S. Consulate in Benghazi, and your instinct is to seek not safety for other Americans at risk, not justice for the coldblooded killers, but political advantage for yourself?

Read More @ TruthDig.com

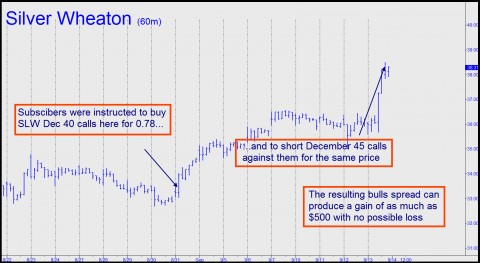

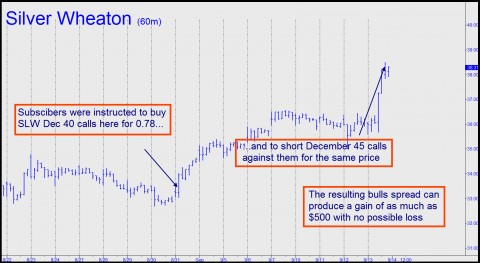

by Rick Ackerman, Rick Ackerman.com:

Interesting times, for sure – and by no means accursed for those with

the wisdom to have bought silver or gold before yesterday. Both took

flight on word that Helicopter Ben has promised to do whatever it takes

to bring U.S. unemployment down to more reasonable levels. If Americans

knew what it will ultimately cost them to have the Fed target

unemployment rather than the money supply, they’d be having second

thoughts about this latest phase of Bernanke’s bold experiment. Because

trillions of dollars worth of stimulus have failed thus far to keep

unemployment merely from rising, we can scarcely imagine how many

trillions more it might take to actually push unemployment down.

Interesting times, for sure – and by no means accursed for those with

the wisdom to have bought silver or gold before yesterday. Both took

flight on word that Helicopter Ben has promised to do whatever it takes

to bring U.S. unemployment down to more reasonable levels. If Americans

knew what it will ultimately cost them to have the Fed target

unemployment rather than the money supply, they’d be having second

thoughts about this latest phase of Bernanke’s bold experiment. Because

trillions of dollars worth of stimulus have failed thus far to keep

unemployment merely from rising, we can scarcely imagine how many

trillions more it might take to actually push unemployment down.

But for now, at least now, because Bernanke has deigned to reimagine QE3 with no limits, investors can be fearless about exposure to bullion. Too bad it took the ECB’s Draghi to show him the way. Recall that Draghi one-upped his colleagues a while back with a pledge to hold Spain’s borrowing costs down come hell or high water. We’re not sure which is more ambitious: ensuring the steady flow of cheap credit to Spain, with its 25% unemployment and a middle-class scramble to move savings out of the country; or creating jobs in the U.S., where regaining the illusion of prosperity will be possible only if home values can be goosed into another parabola.

Read More @ RickAckerman.com

from VictoryIndependence:

Interesting times, for sure – and by no means accursed for those with

the wisdom to have bought silver or gold before yesterday. Both took

flight on word that Helicopter Ben has promised to do whatever it takes

to bring U.S. unemployment down to more reasonable levels. If Americans

knew what it will ultimately cost them to have the Fed target

unemployment rather than the money supply, they’d be having second

thoughts about this latest phase of Bernanke’s bold experiment. Because

trillions of dollars worth of stimulus have failed thus far to keep

unemployment merely from rising, we can scarcely imagine how many

trillions more it might take to actually push unemployment down.

Interesting times, for sure – and by no means accursed for those with

the wisdom to have bought silver or gold before yesterday. Both took

flight on word that Helicopter Ben has promised to do whatever it takes

to bring U.S. unemployment down to more reasonable levels. If Americans

knew what it will ultimately cost them to have the Fed target

unemployment rather than the money supply, they’d be having second

thoughts about this latest phase of Bernanke’s bold experiment. Because

trillions of dollars worth of stimulus have failed thus far to keep

unemployment merely from rising, we can scarcely imagine how many

trillions more it might take to actually push unemployment down.But for now, at least now, because Bernanke has deigned to reimagine QE3 with no limits, investors can be fearless about exposure to bullion. Too bad it took the ECB’s Draghi to show him the way. Recall that Draghi one-upped his colleagues a while back with a pledge to hold Spain’s borrowing costs down come hell or high water. We’re not sure which is more ambitious: ensuring the steady flow of cheap credit to Spain, with its 25% unemployment and a middle-class scramble to move savings out of the country; or creating jobs in the U.S., where regaining the illusion of prosperity will be possible only if home values can be goosed into another parabola.

Read More @ RickAckerman.com

from VictoryIndependence:

from, Gold Silver Worlds:

The Fed has announced the next round of QE after the Europeans,

Chinese, Japanese and South Koreans make stimulative moves to devalue

their currencies and boost their economies. This is very bullish for

gold and silver. Gold and silver is extending its rally from early

August while the miners breakout being led by the silver miners

The Fed has announced the next round of QE after the Europeans,

Chinese, Japanese and South Koreans make stimulative moves to devalue

their currencies and boost their economies. This is very bullish for

gold and silver. Gold and silver is extending its rally from early

August while the miners breakout being led by the silver miners

We have reiterated for some time that the Fed’s solitary success has been in inflating U.S. debt assets to create the feeling of wealth through record low interest rates in order that consumers with deep pockets will spend and invest in quality companies which in turn will create capital expenditures for an ongoing recovery. So far this has not happened. Record low interest rates until mid 2015 and open ended QE means the government is manipulating the market in order to lend money very cheaply.

This capital was not flowing to the undervalued resource stocks but was being kept by institutions in cash or in large cap dividend paying stocks, which have improved earnings per share at the expense of laying off thousands of workers. Money sitting in banks at 0% interest was not a solution to this economic malaise. The Fed acted aggressively surprising savers with open ended QE which gives the Central Bankers a tool to devalue the dollar on a monthly basis according to how they see the economy.

Read More @ GoldSilverWorlds.com

The Fed has announced the next round of QE after the Europeans,

Chinese, Japanese and South Koreans make stimulative moves to devalue

their currencies and boost their economies. This is very bullish for

gold and silver. Gold and silver is extending its rally from early

August while the miners breakout being led by the silver miners

The Fed has announced the next round of QE after the Europeans,

Chinese, Japanese and South Koreans make stimulative moves to devalue

their currencies and boost their economies. This is very bullish for

gold and silver. Gold and silver is extending its rally from early

August while the miners breakout being led by the silver minersWe have reiterated for some time that the Fed’s solitary success has been in inflating U.S. debt assets to create the feeling of wealth through record low interest rates in order that consumers with deep pockets will spend and invest in quality companies which in turn will create capital expenditures for an ongoing recovery. So far this has not happened. Record low interest rates until mid 2015 and open ended QE means the government is manipulating the market in order to lend money very cheaply.

This capital was not flowing to the undervalued resource stocks but was being kept by institutions in cash or in large cap dividend paying stocks, which have improved earnings per share at the expense of laying off thousands of workers. Money sitting in banks at 0% interest was not a solution to this economic malaise. The Fed acted aggressively surprising savers with open ended QE which gives the Central Bankers a tool to devalue the dollar on a monthly basis according to how they see the economy.

Read More @ GoldSilverWorlds.com

by John Rubino, DollarCollapse.com:

Gold bugs are a generally happy bunch this week. But they’d be a lot happier if precious metals mining stocks hadn’t been such horrendous, pathetic, flaccid, zero-credibility losers (sorry, this is a bit personal). Since early 2011 the largest gold miners have underperformed gold itself by about 40%, while the junior miners have done even worse (I’m talking to you, Great Basin).

Because of this divergence between the metals and the miners, it’s been possible to clearly understand the monetary destruction that’s ongoing in the developed world, conclude that gold and silver are the places to be, make a decisive bet on this thesis — and still end up looking like you’d invested in Spanish and Italian bonds.

There are two possible conclusions to draw from this: Either mining as a business has changed fundamentally and will be crappy from now on, in which case we should just own physical metal and forget about paper proxies. Or the past couple of years were one of those inexplicable divergences from established relationships that produce huge gains when they snap back to normal.

Read More @ DollarCollapse.com

Gold bugs are a generally happy bunch this week. But they’d be a lot happier if precious metals mining stocks hadn’t been such horrendous, pathetic, flaccid, zero-credibility losers (sorry, this is a bit personal). Since early 2011 the largest gold miners have underperformed gold itself by about 40%, while the junior miners have done even worse (I’m talking to you, Great Basin).

Because of this divergence between the metals and the miners, it’s been possible to clearly understand the monetary destruction that’s ongoing in the developed world, conclude that gold and silver are the places to be, make a decisive bet on this thesis — and still end up looking like you’d invested in Spanish and Italian bonds.

There are two possible conclusions to draw from this: Either mining as a business has changed fundamentally and will be crappy from now on, in which case we should just own physical metal and forget about paper proxies. Or the past couple of years were one of those inexplicable divergences from established relationships that produce huge gains when they snap back to normal.

Read More @ DollarCollapse.com

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment