by Marshall Swing, Silver Doctors:

Commercials sold off an incredibly massive -91 longs on the week and

purchased a respectable -2,261 shorts to end the week with 46.13% of all

open interest, an increase of +0.31% in their share since last week,

and now stand as a group at 236,360,000 ounces net short, a MASSIVE INCREASE OF 11,760,000 more net short ounces from the previous week.

Commercials sold off an incredibly massive -91 longs on the week and

purchased a respectable -2,261 shorts to end the week with 46.13% of all

open interest, an increase of +0.31% in their share since last week,

and now stand as a group at 236,360,000 ounces net short, a MASSIVE INCREASE OF 11,760,000 more net short ounces from the previous week.Clearly, the commercials were preparing for a massive raid on Thursday, until Bernanke dropped their pants by announcing QE∞.

This means that rather than the massive raid that was apparently planned for Thursday’s FOMC release by the cartel, they now find themselves with nearly a 250 million ounce net short position with the reality of QE∞ staring them in the face.

Everyone now will be buying the dips in gold and silver in order to protect themselves from the Fed’s official policy of currency devaluation to infinity. The cartel will have to cover these shorts at some point- expect this to begin in an orderly fashion, and potentially result in a short covering disorderly move to the upside in silver.

Read More @ Silver Doctors

from KingWorldNews:

With gold on the move once again, today John Embry told King World News, “I’m still of the mind that we will be in record territory before year end.” Embry also said, “We did our bit by buying another $392 million worth of gold for the Sprott Physical Gold Trust.” Embry spoke about silver, “I’m wildly bullish on silver. I don’t think the physical market has ever been this tight.”

Here is what Embry, who is Chief Investment Strategist at Sprott Asset Management, had to say: “I think the action is positive, but at the same time I’m infuriated by the continued interference with the markets by the powers that be. There is tremendous manipulation going on in both gold and silver right now. Two days before the QE announcement they dropped the price of silver about $1.50 in a nanosecond.”

Embry continues @ KingWorldNews.com

With gold on the move once again, today John Embry told King World News, “I’m still of the mind that we will be in record territory before year end.” Embry also said, “We did our bit by buying another $392 million worth of gold for the Sprott Physical Gold Trust.” Embry spoke about silver, “I’m wildly bullish on silver. I don’t think the physical market has ever been this tight.”

Here is what Embry, who is Chief Investment Strategist at Sprott Asset Management, had to say: “I think the action is positive, but at the same time I’m infuriated by the continued interference with the markets by the powers that be. There is tremendous manipulation going on in both gold and silver right now. Two days before the QE announcement they dropped the price of silver about $1.50 in a nanosecond.”

Embry continues @ KingWorldNews.com

BofA Sees Fed Assets Surpassing $5 Trillion By End Of 2014... Leading To $3350 Gold And $190 Crude

Yesterday, when we first presented our calculation of what the Fed's balance sheet would look like through the end of 2013, some were confused why we assumed that the Fed would continue monetizing the long-end beyond the end of 2012. Simple: in its statement, the FOMC said that "If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency mortgage backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability." Therefore, the only question is by what point the labor market would have improved sufficiently to satisfy the Fed with its "improvement" (all else equal, which however - and here's looking at you inflation - will not be). Conservatively, we assumed that it would take at the lest until December 2014 for unemployment to cross the Fed's "all clear threshold." As it turns out we were optimistic. Bank of America's Priya Misra has just released an analysis which is identical to ours in all other respects, except for when the latest QE version would end. BofA's take: "We do not believe there will be “substantial” improvement in the labor market for the next 1.5-2 years and foresee the Fed buying Treasuries after the end of Operation Twist." What does this mean for total Fed purchases? Again, simple. Add $1 trillion to the Zero Hedge total of $4TRN. In other words, Bank of America just predicted at least 2 years and change of constant monetization, which would send the Fed's balance sheet to grand total of just over $5,000,000,000,000 as the Fed adds another $2.2 trillion MBS and Treasury notional to the current total of $2.8 trillion.

Latest move represents huge transfer of wealth from the middle class to the elite

by Alex Jones & Paul Joseph Watson, Info Wars:

While Ben Bernanke’s announcement that the Federal Reserve will embark

on an open ended scheme to purchase $40 billion in mortgage-backed

securities each month has been touted by the establishment media as the

beginning of “QE3″ it is in fact nothing less than another banker

bailout in disguise.

While Ben Bernanke’s announcement that the Federal Reserve will embark

on an open ended scheme to purchase $40 billion in mortgage-backed

securities each month has been touted by the establishment media as the

beginning of “QE3″ it is in fact nothing less than another banker

bailout in disguise.

by Alex Jones & Paul Joseph Watson, Info Wars:

While Ben Bernanke’s announcement that the Federal Reserve will embark

on an open ended scheme to purchase $40 billion in mortgage-backed

securities each month has been touted by the establishment media as the

beginning of “QE3″ it is in fact nothing less than another banker

bailout in disguise.

While Ben Bernanke’s announcement that the Federal Reserve will embark

on an open ended scheme to purchase $40 billion in mortgage-backed

securities each month has been touted by the establishment media as the

beginning of “QE3″ it is in fact nothing less than another banker

bailout in disguise.

While many have rightly attacked the Fed’s policy of

printing money as a band aid that does little to solve the economy in

the long term, this new move isn’t even about that. The policy announced

yesterday will merely see the Fed use taxpayer money to purchase more

bad debt in the form of junk mortgage-backed derivative based securities

that have been sold over and over again.

This has nothing to do with getting the economy going

again and will only serve as yet another huge wealth transfer from the

middle class to the elite.

While the fed claims the move will facilitate more lending it will do nothing of the sort. As the China Securities Journal reports today, “QE3 is not likely to result in more loans.”

Read More @ InfoWars.com

by Susanne Posel, Occupy Corporatism:

According to the Census Bureau , 15% of the US population descended into poverty in 2011. That amounts to 46 million Americans at or below the poverty threshold with an average household income of $23,200.00 annually for a family of four.

Socialist programs like social security benefits assured that 21 million people were kept out of poverty. At the same time unemployment benefits floated 2.3 million people from being totally destitute. Food Stamps have increased to help 3.9 million people.

The fact of low-paying jobs and the unemployed are causing our American economy to continue to flounder. This is a direct causation to the destruction of the middle class in America.

Read More @ OccupyCorporatism.com

According to the Census Bureau , 15% of the US population descended into poverty in 2011. That amounts to 46 million Americans at or below the poverty threshold with an average household income of $23,200.00 annually for a family of four.

Socialist programs like social security benefits assured that 21 million people were kept out of poverty. At the same time unemployment benefits floated 2.3 million people from being totally destitute. Food Stamps have increased to help 3.9 million people.

The fact of low-paying jobs and the unemployed are causing our American economy to continue to flounder. This is a direct causation to the destruction of the middle class in America.

Read More @ OccupyCorporatism.com

Ray Dalio On How The Economic Machine Works

"It's never different this time." Ray Dalio's recent discussion at the Council for Foreign Relations is probably the most in-depth access to his 'model' explanation of the way the world works

we have encountered. From bubbles to deleveragings and how the

inter-relationships of various cycles bring about consistent trends and

corrections; the full-length discussion, succinct interview with Foreign Affairs,

and full readings are perhaps more useful than ever as we tread Wile

E. Coyote-like off the edge of traditional monetary policy and

encounter apparently different environments that in fact have occurred

in perhaps alternate ways again and again over time. Great weekend

viewing/reading on the three ways out of the panic-crisis that the Fed clearly believes we are in and the inevitability of his findings that "in all deleveragings, in the end they print money."

"It's never different this time." Ray Dalio's recent discussion at the Council for Foreign Relations is probably the most in-depth access to his 'model' explanation of the way the world works

we have encountered. From bubbles to deleveragings and how the

inter-relationships of various cycles bring about consistent trends and

corrections; the full-length discussion, succinct interview with Foreign Affairs,

and full readings are perhaps more useful than ever as we tread Wile

E. Coyote-like off the edge of traditional monetary policy and

encounter apparently different environments that in fact have occurred

in perhaps alternate ways again and again over time. Great weekend

viewing/reading on the three ways out of the panic-crisis that the Fed clearly believes we are in and the inevitability of his findings that "in all deleveragings, in the end they print money."QE3, Economic Trouble Ahead, Jim's Warning About Retirement Accounts

Eric De Groot at Eric De Groot - 7 hours ago

Jim’s suggested retreat from "carrot on a stick" government retirement

programs may seem prohibitively expensive and foolish to some right now,

but it takes only one unexpected event and historical predictable reaction

to it to smash the basket that carries all your investment eggs. Bernanke’s

open-ended QE3 provide a real sense of the urgency behind the scenes. If

the Fed wanted to stimulate...

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]]

by Staff Report, The Daily Bell:

Analysts should also have financial investigatory/forensic accounting experience in non-traditional arenas including drug money laundering, Sharia-compliant banking, terrorist finance, informal and formal money transfer mechanisms (hawala), trade based value transfers, and parallel reconstruction. Knowledge of emerging alternative and mobile payment methods is also desired (Bitcoin, Secondlife, etc).” – Lockheed Martin/BrassRing

Dominant Social Theme: Silvio Gesell and Major Douglas had it right. Pure fiat, paper and electronic, is the wave of the future. Just make sure you keep track of every transaction.

Free-Market Analysis: It has been a puzzle to us why the United Nations would want to encourage alternative currencies and why there has been a surge of feedback comment on alternative websites about “usury” and the evils of interest.

One after the other, websites and blogs have suddenly sprung up like mushrooms dutifully prating the idea that people should not be allowed to use interest, that gold and silver were entirely controlled by the Rothschilds (they are not) and that monopoly private banking was the duty of the government (God help us) not private “banksters.”

Read More @ TheDailyBell.com

Analysts should also have financial investigatory/forensic accounting experience in non-traditional arenas including drug money laundering, Sharia-compliant banking, terrorist finance, informal and formal money transfer mechanisms (hawala), trade based value transfers, and parallel reconstruction. Knowledge of emerging alternative and mobile payment methods is also desired (Bitcoin, Secondlife, etc).” – Lockheed Martin/BrassRing

Dominant Social Theme: Silvio Gesell and Major Douglas had it right. Pure fiat, paper and electronic, is the wave of the future. Just make sure you keep track of every transaction.

Free-Market Analysis: It has been a puzzle to us why the United Nations would want to encourage alternative currencies and why there has been a surge of feedback comment on alternative websites about “usury” and the evils of interest.

One after the other, websites and blogs have suddenly sprung up like mushrooms dutifully prating the idea that people should not be allowed to use interest, that gold and silver were entirely controlled by the Rothschilds (they are not) and that monopoly private banking was the duty of the government (God help us) not private “banksters.”

Read More @ TheDailyBell.com

Rosenberg: "If The US Is Truly Japan, The Fed Will End Up Owning The Entire Market"

What the Fed did was actually much more than QE3. Call it QE3-plus... a gift that will now keep on giving. The new normal of bad news being good news is now going to be more fully entrenched for the market

and 'housing data' (the most trustworthy of data) - clearly the Fed's

preferred transmission mechanism - is now front-and-center in driving

volatility. I don't think this latest Fed action does anything more for

the economy than the previous rounds did. It's just an added reminder

of how screwed up the economy really is and that the U.S. is much closer to resembling Japan of the past two decades than is generally recognized. It would seem as though the Fed's macro models have a massive coefficient for the 'wealth effect' factor.

The wealth effect may well stimulate economic activity at the bottom

of an inventory or a normal business cycle. But this factor is really

irrelevant at the trough of a balance sheet/delivering recession. The economy is suffering from a shortage of aggregate demand. Full stop. It just perpetuates

the inequality that is building up in the country, and while this is

not a headline maker, it is a real long term risk for the health of the

country, from a social stability perspective as well.

What the Fed did was actually much more than QE3. Call it QE3-plus... a gift that will now keep on giving. The new normal of bad news being good news is now going to be more fully entrenched for the market

and 'housing data' (the most trustworthy of data) - clearly the Fed's

preferred transmission mechanism - is now front-and-center in driving

volatility. I don't think this latest Fed action does anything more for

the economy than the previous rounds did. It's just an added reminder

of how screwed up the economy really is and that the U.S. is much closer to resembling Japan of the past two decades than is generally recognized. It would seem as though the Fed's macro models have a massive coefficient for the 'wealth effect' factor.

The wealth effect may well stimulate economic activity at the bottom

of an inventory or a normal business cycle. But this factor is really

irrelevant at the trough of a balance sheet/delivering recession. The economy is suffering from a shortage of aggregate demand. Full stop. It just perpetuates

the inequality that is building up in the country, and while this is

not a headline maker, it is a real long term risk for the health of the

country, from a social stability perspective as well.

by J. D. Heyes, Natural News:

Do citizens of Hong Kong have a better understanding of what it means to be free than millions of Americans do these days? Given many of the changes to our society – and what more and more of us seem to be willing to put up with – the answer is yes.

Here’s a case in point.

Recently, officials in Hong Kong backed off plans to force students there to take Chinese patriotism classes after a week of protests in the one-time British colony that were ignited over fears of pro-Beijing “brainwashing,” the Associated Press reported.

The leader of the semi-autonomous city, Leung Chun-ying, said it will be up to schools to decide for themselves whether they want to hold the classes, which were on pace to become a mandatory part of curriculum in 2015 after a three-year voluntary period.

Read More @ NaturalNews.com

Do citizens of Hong Kong have a better understanding of what it means to be free than millions of Americans do these days? Given many of the changes to our society – and what more and more of us seem to be willing to put up with – the answer is yes.

Here’s a case in point.

Recently, officials in Hong Kong backed off plans to force students there to take Chinese patriotism classes after a week of protests in the one-time British colony that were ignited over fears of pro-Beijing “brainwashing,” the Associated Press reported.

The leader of the semi-autonomous city, Leung Chun-ying, said it will be up to schools to decide for themselves whether they want to hold the classes, which were on pace to become a mandatory part of curriculum in 2015 after a three-year voluntary period.

Read More @ NaturalNews.com

Egan Jones Downgrades US From AA To AA-

From Egan-Jones, which downgraded the US for the first time ever last July, two weeks ahead of S&P: "Up, up, and away - the FED's QE3 will stoke the stock market and commodity prices, but in our opinion will hurt the US economy and, by extension, credit quality. Issuing additional currency and depressing interest rates via the purchasing of MBS does little to raise the real GDP of the US, but does reduce the value of the dollar (because of the increase in money supply), and in turn increase the cost of commodities (see the recent rise in the prices of energy, gold, and other commodities). The increased cost of commodities will pressure profitability of businesses, and increase the costs of consumers thereby reducing consumer purchasing power. Hence, in our opinion QE3 will be detrimental to credit quality for the US."On This Week In History, Gas Prices Have Never Been Higher

To the vast majority of the US citizenry, the Dow Jones Industrial Average is an odd number that flashes on the new 42" plasma-screen during dinner; wedged between a news story about a panda sneezing and some well-endowed weather-girl saying "hot, damn hot". This is why the behavior of Ben Bernanke this week might go unnoticed by most of the great unwashed. That is, of course, if they do not drive or eat food. For those that do eat or use vehicles; for the first time in history, national average gas prices for the 2nd week of September were over $4.00. Of course, this is mere transitory market speculators - and is not real money leaving their EBT card.

Stocks Extend Gains But VIX/Credit Unimpressed

Despite a last minute surge (as stock indices lurched from their day-session open to closing VWAP levels), US equity markets extended gains but basically slid lower once Europe had closed. The day session opened gap higher as Europe extended (though Spanish debt slumped) and rushed out of the gate to new multi-year highs only to stumble on high volume and large block size into the European close. Also notable that VIX - which had tracked stocks from the QE3 announcement, began to push higher as stocks 'capitulated' up in the high 1460s and then stocks rolled back downhill for the rest of the day. VIX ended the day up 0.5vol at 14.5% while ES closed up 8pts. Equity sectors have split into 3 groups from the FOMC statement - Materials/Energy/Financials +~3.5%, Industrials/Discretionary/Tech +~2%, and Healthcare/Staples/Utilities +~0.5%. The USD lost 1.65% on the week (EUR +2.3% and JPY -0.18%) as Treasuries saw some vol but were basically one-way street with the long-bond +26bps, 10Y +20bps, and 5Y +6bps. Commodities outperformed USD-implied moves with Oil/Silver/Gold all up around 2-3% on the week - while Copper surged overnight to gain just under 5% on the week. Credit markets were less exuberant than their tracking stocks yesterday with HYG ended the day red.

Chinese CAT-Equivalent, Sany, Finds Itself In Liquidity Crunch, Seeks Covenant Waiver

QE3 And Bernanke's Folly - Part I

Against

what seemed logical (given the assumption that Bernanke would save his

limited ammo for a weaker market/economic environment), Bernanke

launched an open ended mortgage backed securities bond buying program

for $40 billion a month "until employment begins to show recovery." That key statement is what this entire program hinges on. The focus of the Fed has now shifted away from a concern on inflation to an all out war on employment and ultimately the economy.

However, will buying mortgage backed bonds promote real employment,

and ultimately economic, growth. Furthermore, will this program

continue to support the nascent housing recovery? Clearly, the Fed's

actions, and statement, signify that the economy is substantially weaker than previously thought.

While Bernanke's latest program of bond buying was done under the

guise of providing an additional support to the "recovery," the question now is becoming whether he has any ammo left to offset the next recession when it comes.

Against

what seemed logical (given the assumption that Bernanke would save his

limited ammo for a weaker market/economic environment), Bernanke

launched an open ended mortgage backed securities bond buying program

for $40 billion a month "until employment begins to show recovery." That key statement is what this entire program hinges on. The focus of the Fed has now shifted away from a concern on inflation to an all out war on employment and ultimately the economy.

However, will buying mortgage backed bonds promote real employment,

and ultimately economic, growth. Furthermore, will this program

continue to support the nascent housing recovery? Clearly, the Fed's

actions, and statement, signify that the economy is substantially weaker than previously thought.

While Bernanke's latest program of bond buying was done under the

guise of providing an additional support to the "recovery," the question now is becoming whether he has any ammo left to offset the next recession when it comes.Inflation Expectations Suggest 5% Inflation Is In The Cards

Color us stunned. While the world and their pet cat Roger are not worrying about inflation because Bernanke says CPI/PPI are still well-anchored and everything else is "transitory";

it turns out the market has a 'different' opinion. We have discussed

inflation expectations before (whether 5Y5Y forward views or 10Y

inflation swap breakevens) as a trigger for Fed action (or inaction) but

this time, the market front-ran Bernanke's Bazooka and in the last two

days of QEternity has exploded higher with 5Y forward expectations now

near 6 year highs. CPI remains below 2% but there is a clear lag

between the rise in market-implied inflation and it showing up in the

unicorn-laden CPI prints - what this means is that given the hubris of

the Fed yesterday, market expectations of inflation are inferring CPI could rise to over 5% within the next 3 to 6 months.

It will surely be difficult for Ben to keep-on-buying ('Finding

Nemo'-like) in the face of that kind of 'transitory' rise in real data -

though for now, real money remains bid as risk comes off a little

(even as the long-bond yield blows 26bps higher this week) - oh and CPI and PPI jump their most in 3 years.

Color us stunned. While the world and their pet cat Roger are not worrying about inflation because Bernanke says CPI/PPI are still well-anchored and everything else is "transitory";

it turns out the market has a 'different' opinion. We have discussed

inflation expectations before (whether 5Y5Y forward views or 10Y

inflation swap breakevens) as a trigger for Fed action (or inaction) but

this time, the market front-ran Bernanke's Bazooka and in the last two

days of QEternity has exploded higher with 5Y forward expectations now

near 6 year highs. CPI remains below 2% but there is a clear lag

between the rise in market-implied inflation and it showing up in the

unicorn-laden CPI prints - what this means is that given the hubris of

the Fed yesterday, market expectations of inflation are inferring CPI could rise to over 5% within the next 3 to 6 months.

It will surely be difficult for Ben to keep-on-buying ('Finding

Nemo'-like) in the face of that kind of 'transitory' rise in real data -

though for now, real money remains bid as risk comes off a little

(even as the long-bond yield blows 26bps higher this week) - oh and CPI and PPI jump their most in 3 years.

by Mike Shedlock, Global Economic Analysis:

Is the government watching your emails?

They are probably watching mine. The House just approved extending an eavesdropping bill another five years. The National Security Agency is collecting a staggering amount of Americans’ conversations, but only examining a small slice of them, or so they say.

The bill specifically allows eavesdropping without cause, if the government believes the conversation is with someone who lives outside the US.

Since I exchange emails with people from all over the world, the government probably has a huge file on “Mish”.

Worse yet, the Government’s amazing interpretation “of out of the country” applies to anyone in the country as well as long as the government is doing so on grounds they are looking for al-Qaida.

Read More @ GlobalEconomicAnalysis.blogspot.com

from Jesse’s Café Américain:

Can a pit boss also be a good casino host?

“Blythe Masters, a widely known figure in the securities industry who oversees JPMorgan’s commodities businesses, has been given the additional assignment of running regulatory affairs for the corporate and investment bank under her boss James Staley.

“Having her in this role will be critical to helping us drive the business’s strategy in light of changing regulations,” Cavanagh and Pinto wrote in the memo.

In her regulatory role, Masters will report to Barry Zubrow, the former chief risk officer who came under the microscope after the bank in early summer reported an expected $6 billion trading loss. Zubrow has been head of the bank’s corporate and regulatory affairs office since January.“

It appears that Blythe Masters will be dual reporting to James Staley and Barry Zubrow.

Read More @ Jesse’s Café Américain:

Can a pit boss also be a good casino host?

“Blythe Masters, a widely known figure in the securities industry who oversees JPMorgan’s commodities businesses, has been given the additional assignment of running regulatory affairs for the corporate and investment bank under her boss James Staley.

“Having her in this role will be critical to helping us drive the business’s strategy in light of changing regulations,” Cavanagh and Pinto wrote in the memo.

In her regulatory role, Masters will report to Barry Zubrow, the former chief risk officer who came under the microscope after the bank in early summer reported an expected $6 billion trading loss. Zubrow has been head of the bank’s corporate and regulatory affairs office since January.“

It appears that Blythe Masters will be dual reporting to James Staley and Barry Zubrow.

Read More @ Jesse’s Café Américain:

from Off Grid Survival:

Become a DIY Expert – Start doing more DIY things, instead of buying pre-made foods start making bread from scratch, learn how to make your own laundry soap, learn to sew or knit, rather than throwing broken things out, try to fix them.

GunLuvinChick

Look for Sales & Use Coupons – I only buy when it’s on sale, off season clearance or I have a coupon.

Penny Pincher

Barter – Don’t forget about bartering. I try to barter for just about everything. I’m a handyman so I can often trade my services for gear, food, or whatever it is that I might need.

Bob

Be Self Sufficient – A good way to prepare yourself, gain skills and save money is to find ways to be more self sufficient. You could plant a garden or look in to getting a couple multi-purpose farm animals, goats, chickens, rabbits, etc..

Read More @ OffGridSurvival.com

from BrotherJohnf:

Become a DIY Expert – Start doing more DIY things, instead of buying pre-made foods start making bread from scratch, learn how to make your own laundry soap, learn to sew or knit, rather than throwing broken things out, try to fix them.

GunLuvinChick

Look for Sales & Use Coupons – I only buy when it’s on sale, off season clearance or I have a coupon.

Penny Pincher

Barter – Don’t forget about bartering. I try to barter for just about everything. I’m a handyman so I can often trade my services for gear, food, or whatever it is that I might need.

Bob

Be Self Sufficient – A good way to prepare yourself, gain skills and save money is to find ways to be more self sufficient. You could plant a garden or look in to getting a couple multi-purpose farm animals, goats, chickens, rabbits, etc..

Read More @ OffGridSurvival.com

from BrotherJohnf:

State Department sets up 24-hour monitoring team for embassy crisis

by Josh Rogin, The Cable:

The State Department has gone into full-blown crisis mode, organizing a

round-the-clock effort to coordinate the U.S. government’s response to

the expanding attacks on U.S. embassies in the Middle East and North

Africa.

The State Department has gone into full-blown crisis mode, organizing a

round-the-clock effort to coordinate the U.S. government’s response to

the expanding attacks on U.S. embassies in the Middle East and North

Africa.

“The State Department has stood up a 24-hr monitoring team to insure appropriate coordination of information and our response. In addition, our consular team is working with missions around the world to protect American citizens and issue appropriate public warden information,” a senior State Department official told reporters Friday afternoon.

“We have been monitoring events in the Middle East and North Africa intensively today, and working with our personnel and missions overseas and host governments to strengthen security in all locations and to respond effectively where protests have turned violent,” the official said.

The official noted that U.S. embassies in Libya and Yemen have been reinforced with Marine FAST teams and noted that other unspecified measures are being taken to strengthen embassy security around the region. The State Department is working with the governments in Tunisia and Sudan to increase security at the U.S. embassies there as well, the official said.

Read More @ thecable.foreignpolicy.com

by Josh Rogin, The Cable:

The State Department has gone into full-blown crisis mode, organizing a

round-the-clock effort to coordinate the U.S. government’s response to

the expanding attacks on U.S. embassies in the Middle East and North

Africa.

The State Department has gone into full-blown crisis mode, organizing a

round-the-clock effort to coordinate the U.S. government’s response to

the expanding attacks on U.S. embassies in the Middle East and North

Africa. “The State Department has stood up a 24-hr monitoring team to insure appropriate coordination of information and our response. In addition, our consular team is working with missions around the world to protect American citizens and issue appropriate public warden information,” a senior State Department official told reporters Friday afternoon.

“We have been monitoring events in the Middle East and North Africa intensively today, and working with our personnel and missions overseas and host governments to strengthen security in all locations and to respond effectively where protests have turned violent,” the official said.

The official noted that U.S. embassies in Libya and Yemen have been reinforced with Marine FAST teams and noted that other unspecified measures are being taken to strengthen embassy security around the region. The State Department is working with the governments in Tunisia and Sudan to increase security at the U.S. embassies there as well, the official said.

Read More @ thecable.foreignpolicy.com

from Azizonomics:

The YouTube video depicting Mohammed is

nothing more than the straw that broke the camel’s back. This kind of

violent uprising against American power and interests in the region has

been a long time in the making. It is not just the continuation of drone

strikes which often kill civilians in Pakistan, Yemen, Somalia and

Afghanistan, either. Nor is it the American invasions and occupations of

Iraq and Afghanistan. Nor is it the United States and the West’s

support for various deeply unpopular regimes such as the monarchies in

Bahrain and Saudi Arabia (and formerly Iran). Nor is it that America has

long favoured Israel over the Arab states, condemning, invading and

fomenting revolution in Muslim nations for the pursuit of nuclear

weapons while turning a blind eye to Israel’s nuclear weapons and its

continued expansion into the West Bank.

Mark LeVine, Professor of Middle Eastern history at U.C. Irvine, writes:Americans and Europeans are no doubt looking at the protests over the “film”, recalling the even more violent protests during the Danish cartoon affair, and shaking their heads one more at the seeming irrationality and backwardness of Muslims, who would let a work of “art”, particularly one as trivial as this, drive them to mass protests and violence.

Read More @ Azizonomics.com

from Silver Vigilante:

The Bretton Woods System established the new, post Second World War

rules for commercial and financial relations between the world’s major

industrial states and periphery nations in the middle of the twentieth

century. The First Bretton Woods system represented the first totally

planned monetary order made to govern the global money supply. It

resulted in a centralization of world power, supremely seated in

Washington D.C. It’s incipience starts before the end of the Second

World War, as 730 delegates from all 44 Allied nations met in Bretton

Woods, New Hampshire for what was called the United Nations Monetary and

Financial Conference.

The Bretton Woods System established the new, post Second World War

rules for commercial and financial relations between the world’s major

industrial states and periphery nations in the middle of the twentieth

century. The First Bretton Woods system represented the first totally

planned monetary order made to govern the global money supply. It

resulted in a centralization of world power, supremely seated in

Washington D.C. It’s incipience starts before the end of the Second

World War, as 730 delegates from all 44 Allied nations met in Bretton

Woods, New Hampshire for what was called the United Nations Monetary and

Financial Conference.

The system of rules, institutions, and procedures which came out of this meeting aimed at regulating the international monetary system, with the US leading the international organization. The central planners of Bretton Woods setup the International Monetary Fund, the International Bank for Reconstruction and Development, both of which are today part of the World Bank Group.

Read More @ Silver Vigilante

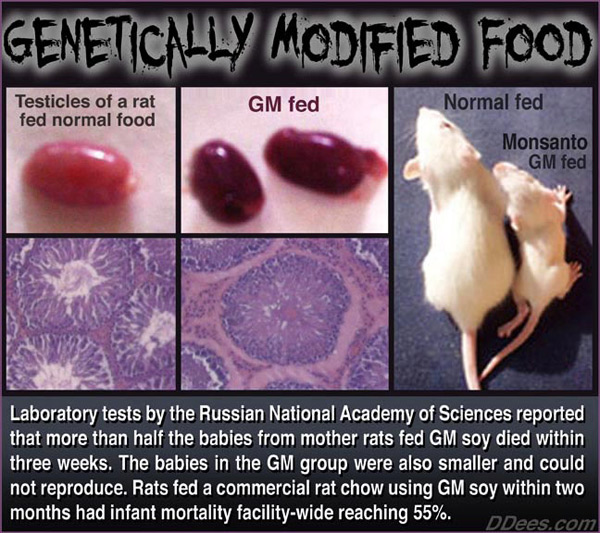

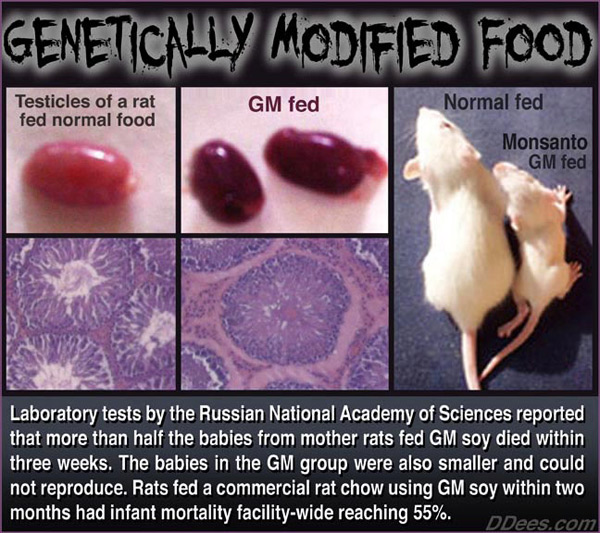

Bill Gates, Monsanto, and Eugenics: A Corporate takeover of global agriculture

from VictoryIndependence:

The Bretton Woods System established the new, post Second World War

rules for commercial and financial relations between the world’s major

industrial states and periphery nations in the middle of the twentieth

century. The First Bretton Woods system represented the first totally

planned monetary order made to govern the global money supply. It

resulted in a centralization of world power, supremely seated in

Washington D.C. It’s incipience starts before the end of the Second

World War, as 730 delegates from all 44 Allied nations met in Bretton

Woods, New Hampshire for what was called the United Nations Monetary and

Financial Conference.

The Bretton Woods System established the new, post Second World War

rules for commercial and financial relations between the world’s major

industrial states and periphery nations in the middle of the twentieth

century. The First Bretton Woods system represented the first totally

planned monetary order made to govern the global money supply. It

resulted in a centralization of world power, supremely seated in

Washington D.C. It’s incipience starts before the end of the Second

World War, as 730 delegates from all 44 Allied nations met in Bretton

Woods, New Hampshire for what was called the United Nations Monetary and

Financial Conference.The system of rules, institutions, and procedures which came out of this meeting aimed at regulating the international monetary system, with the US leading the international organization. The central planners of Bretton Woods setup the International Monetary Fund, the International Bank for Reconstruction and Development, both of which are today part of the World Bank Group.

Read More @ Silver Vigilante

by James Smith, Prepper Podcast:

Surprise! The DHS Immigration and Customs Enforcement have requested more ammunition.

However, it is the type of ammunition and not necessarily the quantity that is troubling.

First on the agenda is the .223 rifle ammunition. Just a measly 40 million rounds in the first year, and another 160 million rounds in the following four years. 200,00 million rounds in total. You know, just enough to make you cringe thinking that some government office that is not military has more ammunition than you do.

The .223 caliber round is a decent hunting round, but that is not the rounds to be concerned about.

The .308 rounds should have you a bit concerned. Quite a bit concerned.

Why the .308? Because the same folks at DHS think they need two types of .308 caliber rounds. Blank ammunition and 168 grain hollow point boat tail ammunition.

Read More @ PrepperPodcast.com

Surprise! The DHS Immigration and Customs Enforcement have requested more ammunition.

However, it is the type of ammunition and not necessarily the quantity that is troubling.

First on the agenda is the .223 rifle ammunition. Just a measly 40 million rounds in the first year, and another 160 million rounds in the following four years. 200,00 million rounds in total. You know, just enough to make you cringe thinking that some government office that is not military has more ammunition than you do.

The .223 caliber round is a decent hunting round, but that is not the rounds to be concerned about.

The .308 rounds should have you a bit concerned. Quite a bit concerned.

Why the .308? Because the same folks at DHS think they need two types of .308 caliber rounds. Blank ammunition and 168 grain hollow point boat tail ammunition.

Read More @ PrepperPodcast.com

by Eric Margolis, Lew Rockwell:

This week, Israel’s prime minister, Benjamin Netanyahu, demanded Obama openly define the conditions under which the US would attack Iran. Netanyahu’s American supporters accuse Obama of “throwing Israel under a bus.” At times, it appears there are three candidates for office in Washington: Obama, Romney and Netanyahu.

Netanyahu scolded and rebuked Obama for not sending American troops and spending American treasure to attack Iran because it is a potential rival or threat to Israel. Netanyahu is now openly backing Romney for president.

In Yiddish, such behavior is called “chutzpah,” a mixture of brazen nerve and outrageous presumption.

Add all this up and we have evil memories of the hysteria and military posturing of August, 1914, the lead-up to World War I, a totally unnecessary conflict that ran out of control and wrecked Europe.

Read More @ LewRockwell.com

This week, Israel’s prime minister, Benjamin Netanyahu, demanded Obama openly define the conditions under which the US would attack Iran. Netanyahu’s American supporters accuse Obama of “throwing Israel under a bus.” At times, it appears there are three candidates for office in Washington: Obama, Romney and Netanyahu.

Netanyahu scolded and rebuked Obama for not sending American troops and spending American treasure to attack Iran because it is a potential rival or threat to Israel. Netanyahu is now openly backing Romney for president.

In Yiddish, such behavior is called “chutzpah,” a mixture of brazen nerve and outrageous presumption.

Add all this up and we have evil memories of the hysteria and military posturing of August, 1914, the lead-up to World War I, a totally unnecessary conflict that ran out of control and wrecked Europe.

Read More @ LewRockwell.com

With

the Ganesh Chaturthi celebration next week, where the elephant-headed

God will be welcomed to most homes, Indian consumers are buying up large

quantities of gold, to please the Gods and ready for the festivities

ahead.

by Shivom Seth, MineWeb.com

Boosted by the US Fed’s stimulus package and buoyed by demand for the wedding season, gold prices climbed to a fresh record high in India.

Gold rose 0.6% to $1,778 an ounce in Singapore – the highest traded level since February 29. In India, local buying by jewellers and stockists ahead of the marriage and festive season boosted sentiment.

High prices notwithstanding, consumers in India are stepping into stores and purchasing gold coins and bars. Jewellers and retailers say sales across India have shot up by 10-20%.

Read More @ MineWeb.com

by Shivom Seth, MineWeb.com

Boosted by the US Fed’s stimulus package and buoyed by demand for the wedding season, gold prices climbed to a fresh record high in India.

Gold rose 0.6% to $1,778 an ounce in Singapore – the highest traded level since February 29. In India, local buying by jewellers and stockists ahead of the marriage and festive season boosted sentiment.

High prices notwithstanding, consumers in India are stepping into stores and purchasing gold coins and bars. Jewellers and retailers say sales across India have shot up by 10-20%.

Read More @ MineWeb.com

Bill Gates, Monsanto, and Eugenics: A Corporate takeover of global agriculture

from VictoryIndependence:

from Gold Money:

As expected, Federal Reserve Chairman Ben Bernanke didn’t disappoint yesterday: “QE3” is here at last, though it wasn’t called that by him. The Fed is now committed to open-ended purchases of $40 billion’s worth of mortgage-backed securities (MBS) a month in order to stimulate the housing market and to keep long-term interest rates subdued. The FOMC also pledged to persist with “Operation Twist” (swapping short-term US government debt for longer-duration paper) and prolonged its forecast for how long it will keep interest rates at record lows. The Fed promised to keep rates at current levels until the summer of 2015, where previously it has cited 2014 as the outer limit.

“QE to infinity” would be another way of describing this policy. “Inflate or die” is another. Either way, precious metal holders have reason to feel happy. Gold, silver, platinum and palladium all took off yesterday following the news from Washington, with the reaction in the “monetary metals” (gold and silver) particularly violent. Gold burst through resistance it had been facing around $1,735-40 like a hot knife through butter, while silver accelerated decisively past the $32.50-$33 level that has served as resistance for good chunks of the last year.

Read More @ GoldMoney.com

As expected, Federal Reserve Chairman Ben Bernanke didn’t disappoint yesterday: “QE3” is here at last, though it wasn’t called that by him. The Fed is now committed to open-ended purchases of $40 billion’s worth of mortgage-backed securities (MBS) a month in order to stimulate the housing market and to keep long-term interest rates subdued. The FOMC also pledged to persist with “Operation Twist” (swapping short-term US government debt for longer-duration paper) and prolonged its forecast for how long it will keep interest rates at record lows. The Fed promised to keep rates at current levels until the summer of 2015, where previously it has cited 2014 as the outer limit.

“QE to infinity” would be another way of describing this policy. “Inflate or die” is another. Either way, precious metal holders have reason to feel happy. Gold, silver, platinum and palladium all took off yesterday following the news from Washington, with the reaction in the “monetary metals” (gold and silver) particularly violent. Gold burst through resistance it had been facing around $1,735-40 like a hot knife through butter, while silver accelerated decisively past the $32.50-$33 level that has served as resistance for good chunks of the last year.

Read More @ GoldMoney.com

from Capital Account:

US consumer prices rose in August by the most in three years. The Consumer Price Index increased .6 percent, with gasoline prices accounting for 80 percent of the rise. But should we even believe government statistics? And how does QE fit into the inflation calculation as central banks try to reflate asset prices? Marc Faber, Gloom Boom and Doom publisher, lays out his case for a deflationary collapse. We play the second part of our interview with him from yesterday’s show in the second half.

And yesterday, as the news of QE overshadowed all other financial news, a 500 billion dollar spending bill easily passed in the House. The spending package aims to fund federal operations until March. Meanwhile, the US government has borrowed nearly 35 cents for every dollar it has spent this year according to the Wall Street Journal. Lawmakers hope to address spending after the election. We talk to Edward Harrison, founder of Credit Writedowns, about the dangers of deficit spending.

Also, since the Fed is targeting depressed housing prices with its MBS policy, we play the game “Economic Symptom or Disease?” The Federal Reserve is trying to treat this symptom with QE, instead of addressing the disease of the high debt – debt that keeps people from buying homes or getting out of them. We talk about this new game show idea in Friday’s Viewer Feedback.

US consumer prices rose in August by the most in three years. The Consumer Price Index increased .6 percent, with gasoline prices accounting for 80 percent of the rise. But should we even believe government statistics? And how does QE fit into the inflation calculation as central banks try to reflate asset prices? Marc Faber, Gloom Boom and Doom publisher, lays out his case for a deflationary collapse. We play the second part of our interview with him from yesterday’s show in the second half.

And yesterday, as the news of QE overshadowed all other financial news, a 500 billion dollar spending bill easily passed in the House. The spending package aims to fund federal operations until March. Meanwhile, the US government has borrowed nearly 35 cents for every dollar it has spent this year according to the Wall Street Journal. Lawmakers hope to address spending after the election. We talk to Edward Harrison, founder of Credit Writedowns, about the dangers of deficit spending.

Also, since the Fed is targeting depressed housing prices with its MBS policy, we play the game “Economic Symptom or Disease?” The Federal Reserve is trying to treat this symptom with QE, instead of addressing the disease of the high debt – debt that keeps people from buying homes or getting out of them. We talk about this new game show idea in Friday’s Viewer Feedback.

by Jurriaan Maessen, Info Wars:

On September 12th 2012 the Dutch people have convinced themselves they actually had something to choose from on election day. The current ruling party in the Netherlands was declared winner, it’s leader (a self-proclaimed “liberal” named Mark Rutte who attended the 2012 Bilderberg conference) recently shoveled some 4 billion euro into the pockets of European bankers, with an option of some 140 billion euro more, when the European Commission deems more cash-injections necessary. Meanwhile the little people were allowed their glorious day of self-deception in the voting booth.

Some of the political parties on the ballot pretended opposition to EU supreme rule, others openly embraced it. I have watched leaders of all major parties in the Netherlands openly proclaim that losing national sovereignty- in some cases abolishing altogether- is really a good thing- and all scepticism to the rule of European technocratic commissioners must either be met with accusations of xenophobia, or horrific specters of doom must be sketched if there is no immediate compliance to EU dictates.

As a Dutch citizen, it’s truly disheartening to witness these hordes of people voting themselves into oblivion, and doing so with a self-complementary smile- probably thinking they are actually voting for this or that party- while they are in fact tightening the chains that hold them bound to unelected commisszars.

Read More @ InfoWars.com

On September 12th 2012 the Dutch people have convinced themselves they actually had something to choose from on election day. The current ruling party in the Netherlands was declared winner, it’s leader (a self-proclaimed “liberal” named Mark Rutte who attended the 2012 Bilderberg conference) recently shoveled some 4 billion euro into the pockets of European bankers, with an option of some 140 billion euro more, when the European Commission deems more cash-injections necessary. Meanwhile the little people were allowed their glorious day of self-deception in the voting booth.

Some of the political parties on the ballot pretended opposition to EU supreme rule, others openly embraced it. I have watched leaders of all major parties in the Netherlands openly proclaim that losing national sovereignty- in some cases abolishing altogether- is really a good thing- and all scepticism to the rule of European technocratic commissioners must either be met with accusations of xenophobia, or horrific specters of doom must be sketched if there is no immediate compliance to EU dictates.

As a Dutch citizen, it’s truly disheartening to witness these hordes of people voting themselves into oblivion, and doing so with a self-complementary smile- probably thinking they are actually voting for this or that party- while they are in fact tightening the chains that hold them bound to unelected commisszars.

Read More @ InfoWars.com

by Eric Blair, Activist Post

Ben Bernanke and the Federal Reserve announced an open-ended bailout for the banks yesterday by a new mechanism called QE Infinity where they plan to purchase $40 billion of toxic mortgage-backed securities per month “until further notice”.

Shrouded in confusing language like “unlimited stimulus” or “quantitative easing”, this unprecedented move and rule change by the Fed was said to be warranted because employment remains weak even though they still maintain the false notion that “economic activity has continued to expand at a moderate pace in recent months.”

Read More @ Activist Post

Dear CIGAs,

To all the readers of JSMineset and Tanzanian Royalty Exploration websites:

I am writing to give thanks to the most brilliant, seasoned and clear mind in international economics and finance, Jim Sinclair.

Events of the past weeks in Europe, the US, and many other parts of the world have conclusively brought to fruition the predictions of Jim Sinclair in an unmistakably clear manner for the entire investing universe to see.

Jim’s repeated, steadfast and consistent statements that QE to infinity would be the result of government behaviors have been clearly verified and demonstrated by the action of the US Federal Reserve yesterday.

Taken alone, the $40 billion per month QE is stunning. We remember this is being done while maintaining all previous programs, operation twist and etc. When taken with consideration of the context provided by the recent actions in Europe, China, Japan, UK and many other countries to do types of QE, it provides an irrefutable example of how QE to infinity is playing out.

For all of your readers may I gratefully say many thanks for your wisdom and guidance, Jim.

Monty Guild

My Dear Extended Family,

There is one more serious problem with all retirement accounts above and beyond the Sentinel Ruling and the integrity of the custodian.

If a systemic failure and lower dollar causes an unwanted increase in interest rates in light of the Fed as the major consumer of treasury paper in the last 18 months, how would the US government fund itself? You can be certain that China and the Middle East are not coming to the rescue.

One way would be to liquidate retirement accounts ($2 trillion USD) and put treasury paper into them to save the poor worker and coming retirees from loss as MSM and MOPE would say.

Look around the world at governments either eyeing retirement programs or invading them. You will find it is already happening.

Please, at a minimum, stop creating and funding them.

Regards,

Jim

Jim Sinclair’s Commentary

Could it be that Romney erred in pre-firing Bernanke?

Remember the picture of the clients of Walmart? They are the people who elect a president, not you and I.

Gold is going to and through $3500.

Obama Erases Romney’s Edge on Economy

President Obama has taken away Mitt Romney’s longstanding advantage as the candidate voters say is most likely to restore the economy and create jobs, according to the latest poll by The New York Times and CBS News, which found a modest sense of optimism among Americans that White House policies are working.

But while the climate for Mr. Obama has improved since midsummer, and Mr. Romney has failed to shift sentiment decisively in his favor, the poll found that the presidential race is narrowly divided.

With their conventions behind them and the general election fully engaged, the Democratic Party is viewed more favorably than the Republican Party. The poll also found more likely voters give an edge to Mr. Obama on foreign policy, Medicare and addressing the challenges of the middle class. The only major issue on which Mr. Romney held an advantage was handling the federal budget deficit.

More…

Jim Sinclair’s Commentary

If you believe this is happening as a protest to a movie, I will sell you a nice bridge from Brooklyn to Manhattan for cash, cheap.

Pravda was more honest under Stalin than MSM in the West today.

West urges end to film protests 14 September 2012 Last updated at 20:40 ET

Western countries have appealed for an end to violent protests targeting their embassies, sparked by a film mocking the Prophet Muhammad.

The EU urged leaders in Arab and Muslim countries to "call immediately for peace and restraint".

The US is sending marines to defend its embassy in Khartoum and has called on Sudan to protect foreign diplomats.

At least seven people died in protests in Khartoum, Tunis and Cairo on Friday and there are fears of further unrest.

US embassies have borne the brunt of the attacks after clips of the film – which was made in the US – were distributed online.

Protest timeline – main flashpoints

11 September

1. US embassy in Cairo attacked, flag torn down and replaced with black Islamist banner

2. Mob attacks US consulate in Benghazi, US ambassador Chris Stevens and three other Americans killed

13 September

3. Protesters break into the US embassy compound in Sanaa, Yemen, amid clashes with security forces

14 September

4. Sudanese protesters attack US, German and UK embassies in Khartoum and clash with police. Three killed

5. One person killed in Lebanon in protest at a KFC restaurant

6. Protesters in Tunis attack the US embassy, with a large fire reported and shots heard. Two killed

7. Riot police in Cairo clash with protesters near US embassy. One person killed

More…

Jim Sinclair’s Commentary

Here is a thought for your consideration. Romney invited Bernanke to make his move yesterday by pre-firing him.

Jim Sinclair’s Commentary

It happened exactly as anticipated, including the monthly characteristic, yet to infinity.

QE to infinity here and there, the USA and Euroland.

Jim Sinclair’s Commentary

Are you warm and cozy with your wealth in Street Name?

More Americans opting out of banking system By Danielle Douglas, Published: September 12

In the aftermath of one of the worst recessions in history, more Americans have limited or no interaction with banks, instead relying on check cashers and payday lenders to manage their finances, according to a new federal report.

Not only are these Americans more vulnerable to high fees and interest rates, but they are also cut off from credit to buy a car or a home or pay for college, the report from the Federal Deposit Insurance Corp. said.

Released Wednesday, the study found that 821,000 households opted out of the banking system from 2009 to 2011 and that the so-called unbanked population grew to 8.2 percent of U.S. households.

That means that roughly 17 million adults are without a checking or savings account. Another 51 million adults have a bank account, but use pawnshops, payday lenders or rent-to-own services, the FDIC said. This underbanked population has grown from 18.2 percent to 20.1 percent of households nationwide.

The study also found that one in four households, or 28.3 percent, either had one or no bank account. A third of these households said they do not have enough money to open and fund an account. Minorities, the unemployed, young people and lower-income households are least likely to have accounts.

Stubbornly high unemployment and underemployment have placed millions of Americans in precarious financial positions, leaving them unable to absorb overdraft charges or minimum-balance fees.

More…

Violent protests across Middle East target embassies, Pope visit to Lebanon Published September 14, 2012

FoxNews.com

Anti-American violence flared Friday across North Africa and the Middle East, with Muslim mobs reportedly scaling the walls of the U.S. Embassies in Tunisia and Sudan, breaking windows and setting fires.

A Marine team, meanwhile, was on the ground in Yemen Friday as a "precautionary measure" in the wake of violence and protests in the capital city of Sanaa, a Pentagon spokesman confirmed to Fox News.

Protesters reportedly broke into the German Embassy in Sudan — pulling down its emblem and raising the Islamic flag — and demonstrators in Lebanon burned Kentucky Fried Chicken and Arby’s restaurants while chanting against the pope’s visit to Lebanon.

At least one protester was killed and 25 were injured in the northern Lebanese city of Tripoli after clashes between police and protesters over an anti-Islam film, security officials said.

In Egypt, protesters in Ciaro’s Tahrir Square could be seen carrying a 4-foot-tall poster of Usama bin Laden, and graffiti reportedly found on the U.S. Embassy there read: "Take care America. We have 1.5 billion bin Ladens."

More…

Jim,

If the government took over IRA and 401k accounts and replaced them with treasury bonds how would the government avoid depressing the equity markets when they liquidate the securities from those accounts? It would seem that the anticipation of liquidating 2 trillion in securities would drive down prices.

Thanks for all that you do.

CIGA Jimmer

Jimmer,

Yes. This is at 2015 to 2017 problem.

Jim

Hello Mr Sinclair,

Thank you for all the analysis and advice over the years. I just wanted to let you know I had ordered a DVD back in 2005 that you made with Monex on The Case For Gold. Since 2005 I have dusted it off about 2-3 times per year to review your interview. It is just as valid now as it was then. It has been a really great tool for understanding the Gold picture. I get a chuckle every time I watch it, because of the accuracy of the various statements and predictions you covered 7 years ago, and how they have come to pass.

Thank you,

CIGA Jim and Claire Z

Hello Jim,

As promised, here is an update on the time it took to get the DRS completed.

I finally have my first batch of Computershare ownership advices in the mail yesterday.

From start to finish (including all the hollering) six weeks, most of that spent "hollering" at the broker.

Really feeling relieved that I have gone through the process and the shares are out of the "system". My next tranche of shares should be easier.

Thank you for all you do.

Cheers,

CIGA Patrice

Hello Jim,

Further to successfully getting my DRS of equities completed, I would advise other CIGAs to take advantage of the online services provided by the Registrar.

For instance, Computershare has a good online system for tracking etc. If there are any difficulties, particularly for non-US or non-Canada CIGAs, contact service@computershare.com to help you create and setup the online access account on Computershare.

They would need to have with them for the process the printed Computershare ownership advice that they will receive once the DRS has been completed by the broker. In fact it (the printed document) is the only way they will know for sure that the Broker did do as requested.

Thanks and Cheers,

CIGA Patrice

Dear Jim,

GDX :GOLD chart below showing potential to double/triple share prices/

Penny traders are playing for peanuts… this is unreal.

Regards,

CIGA Luis Ahlborn Sequeira

Dear Luis,

Here is my take.

Gold today has intervention from the Exchange Stabilization Fund. There was none yesterday so gold would underscore the Fed desire for more inflation, less deflation. It is an anomaly that when the Chairman speaks that gold is allowed to rally $35 plus.

The Exchange stabilization fund via Goldman hit paper gold 7 times at $1775.00. In fact, Goldman is the Exchange Stabilization Fund as the treasury has the right to appoint whomever they and the President wish by law to run day to day operations.

Today there is some intervention selling. Gold now is focused on the $2025.00 magnet and like wasted currency intervention, gold intervention will not stop the market from doing what it is ready to do.

All the best,

Jim

![clip_image002[1] clip_image002[1]](http://www.jsmineset.com/wp-content/uploads/2012/09/clip_image0021_thumb.jpg)

Jim,

I watched segments of Bernanke’s speech announcing QE 3 (another $40 billion per month in added stimulus, in addition to $84 billion per month in buying back our own debt that nobody wants to own).

What he said was that he wants the stock market to go higher so that people with money in their IRAs and 401-K’s will feel richer, and start spending again. He actually said this!

My take… if you have money in an IRA, you’re not going to cash it out and take the penalty. As for spending more, If you don’t have a job, and your mortgaged house is underwater, and personal income is dropping faster than Luca Brasi in the East River (we’re back to 1990 income levels, according to Bloomberg), then you’re just NOT going into deeper debt and spend more.

Wake up America.

Yours,

CIGA Wolfgang Rech

Dear Wolfgang,

There is one more serious problem with all retirement accounts above and beyond the Sentinel Ruling and the integrity of the custodian.

If a systemic failure and lower dollar causes an unwanted increase in interest rates in light of the Fed as the major consumer of treasury paper in the last 18 months, how would the US government fund itself? One way would be to liquidate retirement accounts and put treasury paper into them to save the poor worker and coming retirees from loss as MSM and MOPE would say.

Look around the world at governments either eyeing retirement programs or invading them. You will find it is already happening.

Regards,

Jim

Dear Jim,

My emotions are mixed with yesterday’s decision by the Fed. On one hand I am happy that my long wait will have paid out and on the other Financial Armageddon?

I have been reading your column from almost the beginning, when I did not understand more than half of what you were teaching. I stuck with it. I used Investopedia a lot. Found other like thinkers like Dan Norcini, Gerald Celente, Mark Faber, etc. to gather information and purchased precious metal when I could. I have had to endure many years of criticism from my friends and family (sound familiar?) about my belief in you and my desire not to follow Keynesian economics. You have educated a carpenter/contractor in the ways of money and I thank you. I am probably better prepared than most of my critical piers.

Thanks again for all you do and God bless.

CIGA Gene

Gene,

Then my efforts are rewarded. You success is my joy.

Jim

Hi Jim,

For 10+ years you have posted over and over that this was coming and your Formula continues to play out. It’s almost surreal. On my end I have helped probably a few hundred people get the insurance to protect their families from the hyperinflation that now looks like a sure thing; a currency event not economic.

CIGA Ian

Jim Sinclair’s Commentary

Sit babies backward in the back seat. Put your money at risk to the government to save on taxes until you retire. Put lights on our trunks. What else is Big Brother going to do for us?

Sugary drinks over 16-ounces banned in New York City, Board of Health votes CIGA Eric

More "joy sticking" of society by controllers through the long arm of regulation rather than education. Does this new rule mark the return of speakeasies and the Cosa Nostra into the super sized soft drink market?Santanya once wrote, those who do not read history are doomed to repeat it. He may have also wrote, what a bunch of dumb asses, but I cannot verify that.

Headline: Sugary drinks over 16-ounces banned in New York City, Board of Health votes

(CBS News) Large sugary drinks are on their way out of New York City restaurants. New York City’s Board of Health today passed a rule banning super-sized, sugary drinks at restaurants, concession stands and other eateries.

The ban passed Thursday will place a limit of 16-ounces on bottles and cups of sugar-containing sodas and other non-diet sweetened beverages beginning in March 2013.

Source: cbsnews.com

More…

Census: Middle class shrinks to an all-time low CIGA Eric

Let’s not politicize the description of what’s taking place here. The middle class will continue taking an economic and financial beating until the cycle lows are reached (chart).

If asked today why such a sharp divide between rich and poor (middle class) exists today, Grover Cleveland would have said,

At times like the present, when the evils of unsound finance threaten us, the speculator may anticipate a harvest gathered from the misfortune of others, the capitalist may protect himself by hoarding or may even find profit in the fluctuations of values; but the wage earner–the first to be injured by a depreciated currency and the last to receive the benefit of its correction–is practically defenseless. He relies for work upon the ventures of confident and contented capital. This failing him, his condition is without alleviation, for he can neither prey on the misfortunes of others nor hoard his labor.

My friends, today’s divisive climate of class warfare that includes finger pointing and specific blame will get worse before it gets better.

Chart: Personal Income and Personal Income to London P.M. Fixed Gold Ratio (PIGLDLR)

Headline: Census: Middle class shrinks to an all-time low

Kristen Wyatt/AP – Laura Fritz, 27, left, with her daughter Adalade Goudeseune fills out a form at the Jefferson Action Center, an assistance center in the Denver suburb of Lakewood in July. Fritz grew up in the Denver suburbs in a solidly middle class family, but she and her boyfriend, who has struggled to find work, are now relying on government assistance to cover food and $650 rent for their family.

Income inequality increased by 1.6 percent, the Census Bureau said in its annual report on poverty, income and health insurance. This was the biggest one-year increase in almost two decades and suggested that a trend in place since the late 1970s was picking up steam.

Source: washingtonpost.com

More…

Ben Bernanke and the Federal Reserve announced an open-ended bailout for the banks yesterday by a new mechanism called QE Infinity where they plan to purchase $40 billion of toxic mortgage-backed securities per month “until further notice”.

Shrouded in confusing language like “unlimited stimulus” or “quantitative easing”, this unprecedented move and rule change by the Fed was said to be warranted because employment remains weak even though they still maintain the false notion that “economic activity has continued to expand at a moderate pace in recent months.”

Read More @ Activist Post

Dear CIGAs,

To all the readers of JSMineset and Tanzanian Royalty Exploration websites:

I am writing to give thanks to the most brilliant, seasoned and clear mind in international economics and finance, Jim Sinclair.

Events of the past weeks in Europe, the US, and many other parts of the world have conclusively brought to fruition the predictions of Jim Sinclair in an unmistakably clear manner for the entire investing universe to see.

Jim’s repeated, steadfast and consistent statements that QE to infinity would be the result of government behaviors have been clearly verified and demonstrated by the action of the US Federal Reserve yesterday.

Taken alone, the $40 billion per month QE is stunning. We remember this is being done while maintaining all previous programs, operation twist and etc. When taken with consideration of the context provided by the recent actions in Europe, China, Japan, UK and many other countries to do types of QE, it provides an irrefutable example of how QE to infinity is playing out.

For all of your readers may I gratefully say many thanks for your wisdom and guidance, Jim.

Monty Guild

My Dear Extended Family,

There is one more serious problem with all retirement accounts above and beyond the Sentinel Ruling and the integrity of the custodian.

If a systemic failure and lower dollar causes an unwanted increase in interest rates in light of the Fed as the major consumer of treasury paper in the last 18 months, how would the US government fund itself? You can be certain that China and the Middle East are not coming to the rescue.

One way would be to liquidate retirement accounts ($2 trillion USD) and put treasury paper into them to save the poor worker and coming retirees from loss as MSM and MOPE would say.

Look around the world at governments either eyeing retirement programs or invading them. You will find it is already happening.

Please, at a minimum, stop creating and funding them.

Regards,

Jim

Jim Sinclair’s Commentary

Could it be that Romney erred in pre-firing Bernanke?

Remember the picture of the clients of Walmart? They are the people who elect a president, not you and I.

Gold is going to and through $3500.

Obama Erases Romney’s Edge on Economy

President Obama has taken away Mitt Romney’s longstanding advantage as the candidate voters say is most likely to restore the economy and create jobs, according to the latest poll by The New York Times and CBS News, which found a modest sense of optimism among Americans that White House policies are working.

But while the climate for Mr. Obama has improved since midsummer, and Mr. Romney has failed to shift sentiment decisively in his favor, the poll found that the presidential race is narrowly divided.

With their conventions behind them and the general election fully engaged, the Democratic Party is viewed more favorably than the Republican Party. The poll also found more likely voters give an edge to Mr. Obama on foreign policy, Medicare and addressing the challenges of the middle class. The only major issue on which Mr. Romney held an advantage was handling the federal budget deficit.

More…

Jim Sinclair’s Commentary

If you believe this is happening as a protest to a movie, I will sell you a nice bridge from Brooklyn to Manhattan for cash, cheap.

Pravda was more honest under Stalin than MSM in the West today.

West urges end to film protests 14 September 2012 Last updated at 20:40 ET

Western countries have appealed for an end to violent protests targeting their embassies, sparked by a film mocking the Prophet Muhammad.

The EU urged leaders in Arab and Muslim countries to "call immediately for peace and restraint".

The US is sending marines to defend its embassy in Khartoum and has called on Sudan to protect foreign diplomats.

At least seven people died in protests in Khartoum, Tunis and Cairo on Friday and there are fears of further unrest.

US embassies have borne the brunt of the attacks after clips of the film – which was made in the US – were distributed online.

Protest timeline – main flashpoints

11 September

1. US embassy in Cairo attacked, flag torn down and replaced with black Islamist banner

2. Mob attacks US consulate in Benghazi, US ambassador Chris Stevens and three other Americans killed

13 September

3. Protesters break into the US embassy compound in Sanaa, Yemen, amid clashes with security forces

14 September

4. Sudanese protesters attack US, German and UK embassies in Khartoum and clash with police. Three killed

5. One person killed in Lebanon in protest at a KFC restaurant

6. Protesters in Tunis attack the US embassy, with a large fire reported and shots heard. Two killed

7. Riot police in Cairo clash with protesters near US embassy. One person killed

More…

Jim Sinclair’s Commentary

Here is a thought for your consideration. Romney invited Bernanke to make his move yesterday by pre-firing him.

Jim Sinclair’s Commentary

It happened exactly as anticipated, including the monthly characteristic, yet to infinity.

QE to infinity here and there, the USA and Euroland.

Jim Sinclair’s Commentary

Are you warm and cozy with your wealth in Street Name?

More Americans opting out of banking system By Danielle Douglas, Published: September 12

In the aftermath of one of the worst recessions in history, more Americans have limited or no interaction with banks, instead relying on check cashers and payday lenders to manage their finances, according to a new federal report.

Not only are these Americans more vulnerable to high fees and interest rates, but they are also cut off from credit to buy a car or a home or pay for college, the report from the Federal Deposit Insurance Corp. said.

Released Wednesday, the study found that 821,000 households opted out of the banking system from 2009 to 2011 and that the so-called unbanked population grew to 8.2 percent of U.S. households.

That means that roughly 17 million adults are without a checking or savings account. Another 51 million adults have a bank account, but use pawnshops, payday lenders or rent-to-own services, the FDIC said. This underbanked population has grown from 18.2 percent to 20.1 percent of households nationwide.

The study also found that one in four households, or 28.3 percent, either had one or no bank account. A third of these households said they do not have enough money to open and fund an account. Minorities, the unemployed, young people and lower-income households are least likely to have accounts.

Stubbornly high unemployment and underemployment have placed millions of Americans in precarious financial positions, leaving them unable to absorb overdraft charges or minimum-balance fees.

More…

Violent protests across Middle East target embassies, Pope visit to Lebanon Published September 14, 2012

FoxNews.com

Anti-American violence flared Friday across North Africa and the Middle East, with Muslim mobs reportedly scaling the walls of the U.S. Embassies in Tunisia and Sudan, breaking windows and setting fires.

A Marine team, meanwhile, was on the ground in Yemen Friday as a "precautionary measure" in the wake of violence and protests in the capital city of Sanaa, a Pentagon spokesman confirmed to Fox News.

Protesters reportedly broke into the German Embassy in Sudan — pulling down its emblem and raising the Islamic flag — and demonstrators in Lebanon burned Kentucky Fried Chicken and Arby’s restaurants while chanting against the pope’s visit to Lebanon.

At least one protester was killed and 25 were injured in the northern Lebanese city of Tripoli after clashes between police and protesters over an anti-Islam film, security officials said.

In Egypt, protesters in Ciaro’s Tahrir Square could be seen carrying a 4-foot-tall poster of Usama bin Laden, and graffiti reportedly found on the U.S. Embassy there read: "Take care America. We have 1.5 billion bin Ladens."

More…