Up

until now, the LHD 7 Iwo Jima Big-Deck Amphibious Warfare ship was all

alone in the Arabian Sea, patiently awaiting orders to liberate this

or that middle east country of their oil reserves. This is no longer

the case: launching today in general direction - Middle East - for a

brand new 7 month engagement, is the LHA 1 Peleliu Amphibious Ready

Group, consisting of the amphibious assault ship, the USS Peleliu which

consists of 4000 marines. LHA 1 also comprises of the amphibious

transport dock USS Green Bay and the dock landing ship USS Rushmore.

Also deploying Monday is the Marine Corps' 15th Marine Expeditionary

Unit and elements of Fleet Surgical Team 1, Helicopter Sea Combat

Squadron 23, Assault Craft Units 1 and 5, and Beach Master Unit 1. And

as we reported previously, the middle east veteran - the CVN 74 Stennis

aircraft carrier - was providently already on its way. In other words,

in about 2 weeks, the Middle east will be the focal point of 3 aircraft

carriers, 2 amphibious assault forces, and who knows how many

"developed" world armadas, all hell bent on securing that one extra bit

of Middle East oil, under the guise of spreading democracy and

liberating the local people who "hate America's for its freedom."

Up

until now, the LHD 7 Iwo Jima Big-Deck Amphibious Warfare ship was all

alone in the Arabian Sea, patiently awaiting orders to liberate this

or that middle east country of their oil reserves. This is no longer

the case: launching today in general direction - Middle East - for a

brand new 7 month engagement, is the LHA 1 Peleliu Amphibious Ready

Group, consisting of the amphibious assault ship, the USS Peleliu which

consists of 4000 marines. LHA 1 also comprises of the amphibious

transport dock USS Green Bay and the dock landing ship USS Rushmore.

Also deploying Monday is the Marine Corps' 15th Marine Expeditionary

Unit and elements of Fleet Surgical Team 1, Helicopter Sea Combat

Squadron 23, Assault Craft Units 1 and 5, and Beach Master Unit 1. And

as we reported previously, the middle east veteran - the CVN 74 Stennis

aircraft carrier - was providently already on its way. In other words,

in about 2 weeks, the Middle east will be the focal point of 3 aircraft

carriers, 2 amphibious assault forces, and who knows how many

"developed" world armadas, all hell bent on securing that one extra bit

of Middle East oil, under the guise of spreading democracy and

liberating the local people who "hate America's for its freedom."Update: The San Fran Fed Asks What People Think Of QE3: The People Respond

Update: Looks like quite a few people have shared their thoughts in the past 30 minutes. Compare before and after.

Update: Looks like quite a few people have shared their thoughts in the past 30 minutes. Compare before and after.On Friday, the San Francisco Fed, best known for such cutting edge research as "Why Is Unemployment Duration So Long?" (turns out it was Bernanke's fault), "US Household Deleveraging" which concluded incorrectly that "Going forward, it seems probable that many U.S. households will reduce their debt" (turns out completely wrong as consumer debt is now at a new all time record), and "This Time It Really Is Different" (turns out it wasn't), asked a simple question on its FacePlant page: "What effect do you think QE3 will have on the U.S. economy?" The people have now responded in a fashion that leaves little to the imagination. Actually, one thing is left to the imagination, namely whether the name of the one person responding that the $85 billion in monthly flow in perpetuity associated with QE3 is "not big enough" begins with Paul and ends with Krugman. Aside from that, in typical SF Fed fashion, no surprises at all.

by Peter Cooper, Silver Seek:

Silver prices are really going to be on a roll until at least next

Spring after Ben Bernanke unleashed his latest round of money printing

QE3 last week which echoed the ‘unlimited’ bond buying promised by the

ECB the week before.

Silver prices are really going to be on a roll until at least next

Spring after Ben Bernanke unleashed his latest round of money printing

QE3 last week which echoed the ‘unlimited’ bond buying promised by the

ECB the week before.

It’s coordinated ‘QE to infinity’ as Mr. Gold Jim Sinclair correctly forecast the week before. ArabianMoney like ‘The Economist’ magazine is a bit taken aback at the timing and intensity of QE3. We thought Mr.Bernanke might keep his powder dry for a while longer. He did not.

Mr.Bernanke clearly knows a lot more than he is letting on and it is not good news. He is reacting to the nasty known-knowns coming up, namely: the US ‘fiscal cliff’ at the year-end with lower spending and higher taxes; the Chinese economic slowdown or crash that is happening now; and the interminable eurozone sovereign debt crisis with Greece not likely to get a third bailout and Spanish bonds about to be tested to destruction.

Read More @ SilverSeek.com

Silver prices are really going to be on a roll until at least next

Spring after Ben Bernanke unleashed his latest round of money printing

QE3 last week which echoed the ‘unlimited’ bond buying promised by the

ECB the week before.

Silver prices are really going to be on a roll until at least next

Spring after Ben Bernanke unleashed his latest round of money printing

QE3 last week which echoed the ‘unlimited’ bond buying promised by the

ECB the week before.It’s coordinated ‘QE to infinity’ as Mr. Gold Jim Sinclair correctly forecast the week before. ArabianMoney like ‘The Economist’ magazine is a bit taken aback at the timing and intensity of QE3. We thought Mr.Bernanke might keep his powder dry for a while longer. He did not.

Mr.Bernanke clearly knows a lot more than he is letting on and it is not good news. He is reacting to the nasty known-knowns coming up, namely: the US ‘fiscal cliff’ at the year-end with lower spending and higher taxes; the Chinese economic slowdown or crash that is happening now; and the interminable eurozone sovereign debt crisis with Greece not likely to get a third bailout and Spanish bonds about to be tested to destruction.

Read More @ SilverSeek.com

The Fed Has Failed, Failed, Failed

The

unleashing of QE3--unlimited money-printing in support of the

financial Status Quo-- is proof the Fed has failed, failed, failed.

If anything the Fed has done in the past four years had actually had a

positive consequence in the real economy, Bernanke would have

identifed that policy and expanded it in a measured response. Instead

he went all-in, emptying the Fed's toolbox in one big dump: unlimited

money-printing, unlimited propping of the mortgage market, unlimited

support of low Treasury rates and three more years of zero-interest rate

policy (ZIRP). Here is the translation of the Fed Chairman's public comments: whatever.

Did you see any of his testimony? It was painfully obvious that either

1) he was sky-high on Ibogaine or 2) he was just going through the

motions, duly enunciating PR "cover" that he finds tiresome to repeat

and impossible to say with any sincerity or conviction. His body

language and delivery said: "You think I believe this canned shuck and

jive? Get real, chumps."

The

unleashing of QE3--unlimited money-printing in support of the

financial Status Quo-- is proof the Fed has failed, failed, failed.

If anything the Fed has done in the past four years had actually had a

positive consequence in the real economy, Bernanke would have

identifed that policy and expanded it in a measured response. Instead

he went all-in, emptying the Fed's toolbox in one big dump: unlimited

money-printing, unlimited propping of the mortgage market, unlimited

support of low Treasury rates and three more years of zero-interest rate

policy (ZIRP). Here is the translation of the Fed Chairman's public comments: whatever.

Did you see any of his testimony? It was painfully obvious that either

1) he was sky-high on Ibogaine or 2) he was just going through the

motions, duly enunciating PR "cover" that he finds tiresome to repeat

and impossible to say with any sincerity or conviction. His body

language and delivery said: "You think I believe this canned shuck and

jive? Get real, chumps."

by Bill Bonner, Daily Reckoning.com.au:

Zombocracy: a government run by parasites, loafers and chisellers… for the zombies, by the zombies and of the zombies.

How does a zombocracy end? Disastrously.

But we’ll come back to that. First, let’s look at the latest zombie news.

Ben Bernanke announced that he would keep feeding the zombies until… well… until the economy goes broke or improves. (We know which way we’re betting!) Here’s the story from Bloomberg:

Zombocracy: a government run by parasites, loafers and chisellers… for the zombies, by the zombies and of the zombies.

How does a zombocracy end? Disastrously.

But we’ll come back to that. First, let’s look at the latest zombie news.

Ben Bernanke announced that he would keep feeding the zombies until… well… until the economy goes broke or improves. (We know which way we’re betting!) Here’s the story from Bloomberg:

Bernanke’s Battle for Jobs Eclipses Inflation ConcernsRead More @ DailyReckoning.com.au

Ben S. Bernanke for the first time pledged that the Federal Reserve will buy bonds until the economy gets closer to his goals, cementing his place as the Fed’s most innovative chairman and signaling the battle against unemployment eclipses any concerns about inflation for now.

The central bank yesterday announced its third round of large-scale asset purchases since 2008, with the difference that it didn’t set any limit on the ultimate amount it would buy or the duration of the program. Instead, Bernanke said stimulus will be expanded until the Fed sees “sustained improvement” in the labor market.

There is not just a similarity in how gold and silver trade at the

same time period, but also how they trade at similar milestones, despite

the fact that those milestones are sometimes reached at different

times. This can cause silver or gold to be the leading indicator,

depending on the particular milestone. The 1980 peak for both gold and

silver is definitely an important milestone. For this 1980 milestone,

gold is undoubtedly the leading indicator (since gold has already passed

its 1980 high), so it could help us to project what silver might do

around this milestone.

There is not just a similarity in how gold and silver trade at the

same time period, but also how they trade at similar milestones, despite

the fact that those milestones are sometimes reached at different

times. This can cause silver or gold to be the leading indicator,

depending on the particular milestone. The 1980 peak for both gold and

silver is definitely an important milestone. For this 1980 milestone,

gold is undoubtedly the leading indicator (since gold has already passed

its 1980 high), so it could help us to project what silver might do

around this milestone.Market conditions often cause silver to fall behind gold, for quite some time, where after, silver normally catches-up in a big way. The fact that silver is still caught-up in a trading range lower than its 1980 high, at least four years longer than gold already, provides a classic opportunity for silver to follow that “catching-up pattern” and zoom to multiples of its 1980 high. In my opinion, silver will do just that and move much faster than gold in percentage terms, over the next months.

With gold having passed $1700 (twice the 1980 high of $850) already, given the above analysis, it stands to reason that $100 (twice the 1980 high of $50) silver could be virtually guaranteed.

Read More @ Silver Seek

Bavarian Finance Minister: Everyone Wants Our Money

The European 'Union' continues to be the most amusingly misdefined oxymoron in existence. Today's Exhibit A confirming just that: Spiegel's interview with Bavarian finance minister Markus Söder which can be summarized in the following 4 words: Everyone Wants Our Money.

Gold and Silver Require Patience

Eric De Groot at Eric De Groot - 1 hour ago

Roham, My advice is let the market talk, then react. Jim and I recommended

staying the course (Stay Course!) on August 24th as an increasing

number within the gold community had given up on gold. Gold trading over

$100 higher today has proven the doubters wrong once again. Try not to

"over thinking" or over trade this trend. The magenta 'fishing hooks' are

nothing more than dips...

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]]

I Suspect That The Euro Will Not Survive

Admin at Jim Rogers Blog - 1 hour ago

You have got countries that are essentially bankrupt. The solution to too

much debt is not more. I suspect that the euro will not survive. - *in ETF

Daily News*

*Jim Rogers is an author, financial commentator and successful

international investor. He has been frequently featured in Time, The New

York Times, Barron’s, Forbes, Fortune, The Wall Street Journal, The

Financial Times and is a regular guest on Bloomberg and CNBC.*Did QEternity Finally Kill Stocks? S&P Futures in 1 Point Range Last 2 Hours

Volumes

are dreadful this morning in cash and futures. S&P 500 e-mini

futures (ES) have seen a ridiculously low 5pt range since the open last

night but in the last 2 hours, the ES has traded in a 1 point range between 1456 and 1457! Meanwhile Dow Transports are deteriorating again...

Volumes

are dreadful this morning in cash and futures. S&P 500 e-mini

futures (ES) have seen a ridiculously low 5pt range since the open last

night but in the last 2 hours, the ES has traded in a 1 point range between 1456 and 1457! Meanwhile Dow Transports are deteriorating again...Libya - Doomed From Day One

People

often ask me why the West doesn’t attempt a Libya-style intervention

in Syria. After all, things are going so well in Libya. Oil production

is up. But oil production is merely a mirage, as is security in Libya,

which was doomed from the day one PG (post-Gaddafi) because of the way

it was “liberated”. Anyone who thinks that Libya will be a secure oil frontier after the formation of a new government next summer is mistaken.

On Wednesday, US envoy to Libya Christopher Stevens was killed along

with three other American diplomats in a rocket attack on the US

consulate in Benghazi. The anti-Islamic movie is a red herring in all of this.

“This is a cut and dry example of the backfire of the US intervention

strategy,” Bagley said. “Let’s hope it isn’t attempted in Syria.” The post-Gaddafi Libya is not real.

It’s a dangerous fabrication of materials stuck together by the glue

of dubious alliances with jihadists who are cut loose with their

weapons once the immediate goal (Gaddafi’s demise) was achieved. Forget

about the oil for now.

People

often ask me why the West doesn’t attempt a Libya-style intervention

in Syria. After all, things are going so well in Libya. Oil production

is up. But oil production is merely a mirage, as is security in Libya,

which was doomed from the day one PG (post-Gaddafi) because of the way

it was “liberated”. Anyone who thinks that Libya will be a secure oil frontier after the formation of a new government next summer is mistaken.

On Wednesday, US envoy to Libya Christopher Stevens was killed along

with three other American diplomats in a rocket attack on the US

consulate in Benghazi. The anti-Islamic movie is a red herring in all of this.

“This is a cut and dry example of the backfire of the US intervention

strategy,” Bagley said. “Let’s hope it isn’t attempted in Syria.” The post-Gaddafi Libya is not real.

It’s a dangerous fabrication of materials stuck together by the glue

of dubious alliances with jihadists who are cut loose with their

weapons once the immediate goal (Gaddafi’s demise) was achieved. Forget

about the oil for now.Is Nigel Farage Bailing Out The EU One Fine At A Time?

Back in 2010, everyone's favorite truthsayer in Europe - MEP Nigel Farage - opined on who exactly was Herman Van Rompuy - the new EU President. Claiming HvR's charisma approached that of a damp rag, we noted at the time that this was indeed slanderous to all the hard-working damp-rags out there. Well, given the EU's need for cash - by any route possible - it seems they have chosen to start building a mountain of fines. As AP reports, the EU parliament fined Nigel EUR2980 for his self-expression.Does everyone who call @euhvr a "damp rag" get a $4,000 fine?Given Germany's EUR 190bn ESM contribution, we assume that Nigel has 63 million more insults before Europe is fixed.

— zerohedge (@zerohedge) September 17, 2012

Europe Opens Week In the Red

Every European stock index closed red today

- that is something we have not seen in a few weeks. The drops were

not dramatic - and in fact IBEX rallied from open to close after an

ugly start to the day. Spanish and Portuguese bond markets sold off notably (in the front- and back-ends of the curve)

and given its place as fulcrum security we suspect the slight

underperformance in European credit markets relative to stocks indicates

the Draghi-induced reflex buying is starting to fade. Swiss 2Y was

stable; European VIX rose modestly; and EURUSD which saw some violent

swings into the US day-session open is ending its day fractionally

lower. All-in-all, given recent strength and momentum, sovereigns have

definitely stalled and equities will need a catalyst now (Spanish

bailout?).

Every European stock index closed red today

- that is something we have not seen in a few weeks. The drops were

not dramatic - and in fact IBEX rallied from open to close after an

ugly start to the day. Spanish and Portuguese bond markets sold off notably (in the front- and back-ends of the curve)

and given its place as fulcrum security we suspect the slight

underperformance in European credit markets relative to stocks indicates

the Draghi-induced reflex buying is starting to fade. Swiss 2Y was

stable; European VIX rose modestly; and EURUSD which saw some violent

swings into the US day-session open is ending its day fractionally

lower. All-in-all, given recent strength and momentum, sovereigns have

definitely stalled and equities will need a catalyst now (Spanish

bailout?).Presenting ZIRP's Latest Contraption: Master Unlimited Garbage Partnerships

The

reach for yield must be carefully balanced against the inane ignorance

of 'if it sounds too good to be true, then it is!' and it appears that

there are plenty of sucker-draining entrepreneurial asset managers out there willing to create whatever the market will bear. To wit, the WSJ reports

on the growing size of the Master Limited Partnership (MLP) market; for

years a haven for 'safer' income with upside potential this

asset-class has been seized upon as "private-equity firms,

eager to offload assets, are turning mountains of sand, gas stations

and coal mines into a special type of security that offers investors

annual yields as high as 19% for years to come." Seven of the last ten MLP IPOs have offered yields above 10% (sound reasonable?)

and with the sector's market cap having risen from $65bn in 2005 to

over $350bn now it seems like the thundering herd is willing to sell it

to the blundering herd. Critically though, as WSJ notes, these new MLPs

carry much more risk than their predecessors - as the promise of such high returns may be too good to be true. Indeed - though we assume that the Fed will be buying MLPs too by the time these go pear-shaped.

The

reach for yield must be carefully balanced against the inane ignorance

of 'if it sounds too good to be true, then it is!' and it appears that

there are plenty of sucker-draining entrepreneurial asset managers out there willing to create whatever the market will bear. To wit, the WSJ reports

on the growing size of the Master Limited Partnership (MLP) market; for

years a haven for 'safer' income with upside potential this

asset-class has been seized upon as "private-equity firms,

eager to offload assets, are turning mountains of sand, gas stations

and coal mines into a special type of security that offers investors

annual yields as high as 19% for years to come." Seven of the last ten MLP IPOs have offered yields above 10% (sound reasonable?)

and with the sector's market cap having risen from $65bn in 2005 to

over $350bn now it seems like the thundering herd is willing to sell it

to the blundering herd. Critically though, as WSJ notes, these new MLPs

carry much more risk than their predecessors - as the promise of such high returns may be too good to be true. Indeed - though we assume that the Fed will be buying MLPs too by the time these go pear-shaped.Europhoria Officially Over: Spanish 10Y Breaks 6% The Wrong Way

We

warned that the shine was coming off Draghi's rally late last week but

since mid-morning on Friday, Spain's 10Y spread has risen a very

notable 36bps and the 10Y yield has just broken back above 6% for the

first time in over two weeks. However, the seemingly impregnable

short-dated market has started to crack. Spain's 2Y has also broken back above 3% - up over 50bps in the last 3 days! It seems the reality of the cash position, as we described in detail last night, is perhaps starting to outweigh the unlimited-but-capped open-ended-but-conditional support that the ECB supposedly has.

We

warned that the shine was coming off Draghi's rally late last week but

since mid-morning on Friday, Spain's 10Y spread has risen a very

notable 36bps and the 10Y yield has just broken back above 6% for the

first time in over two weeks. However, the seemingly impregnable

short-dated market has started to crack. Spain's 2Y has also broken back above 3% - up over 50bps in the last 3 days! It seems the reality of the cash position, as we described in detail last night, is perhaps starting to outweigh the unlimited-but-capped open-ended-but-conditional support that the ECB supposedly has.

from My Fox DC:

Two southeast companies that make U.S. military uniforms are shedding

hundreds of jobs, as the government looks to federal inmates for the

fatigues.

Two southeast companies that make U.S. military uniforms are shedding

hundreds of jobs, as the government looks to federal inmates for the

fatigues.

American Power Source makes military clothing in Fayette, Ala., but its government contract expires in October. Federal Prison Industries – which also operates under the name UNICOR will snag the work, and leave the task to inmates. FPI has the first right of refusal for U.S. Government contracts, under a 1930 federal law.

American Apparel, the Selma, Ala., based military clothing manufacturer closed one of its plants and continues to downsize others due to the loss of some of its contracts to FPI. According retired Air Force colonel and spokesman Kurt Wilson, the company laid off 255 employees and cut the hours of 190 employees this year alone. So private workers end up losing their jobs to prisoners.

Read More @ MyFoxDC

Two southeast companies that make U.S. military uniforms are shedding

hundreds of jobs, as the government looks to federal inmates for the

fatigues.

Two southeast companies that make U.S. military uniforms are shedding

hundreds of jobs, as the government looks to federal inmates for the

fatigues.American Power Source makes military clothing in Fayette, Ala., but its government contract expires in October. Federal Prison Industries – which also operates under the name UNICOR will snag the work, and leave the task to inmates. FPI has the first right of refusal for U.S. Government contracts, under a 1930 federal law.

American Apparel, the Selma, Ala., based military clothing manufacturer closed one of its plants and continues to downsize others due to the loss of some of its contracts to FPI. According retired Air Force colonel and spokesman Kurt Wilson, the company laid off 255 employees and cut the hours of 190 employees this year alone. So private workers end up losing their jobs to prisoners.

Read More @ MyFoxDC

by Mike Shedlock, Global Economic Analysis:

In response to Petroleum And Gasoline Usage Charts for June, July, August; Unemployment vs. Gasoline Usage Analysis,

a post based on weekly petroleum stats from reader Tim Wallace, I

received a very nice email including a superb set of charts from James

Beck, Lead Analyst, Weekly Petroleum Supply Team for the Energy

Information Administration.

In response to Petroleum And Gasoline Usage Charts for June, July, August; Unemployment vs. Gasoline Usage Analysis,

a post based on weekly petroleum stats from reader Tim Wallace, I

received a very nice email including a superb set of charts from James

Beck, Lead Analyst, Weekly Petroleum Supply Team for the Energy

Information Administration.

James gave me permission to use his name and his charts as long as I mentioned that his email reflects his personal opinions, not necessarily that of the EIA.

It is a pleasure to get an email from a government worker who takes his job seriously, is exceptionally knowledgeable on his subject, and is willing to be quoted by name.

James writes …

In response to Petroleum And Gasoline Usage Charts for June, July, August; Unemployment vs. Gasoline Usage Analysis,

a post based on weekly petroleum stats from reader Tim Wallace, I

received a very nice email including a superb set of charts from James

Beck, Lead Analyst, Weekly Petroleum Supply Team for the Energy

Information Administration.

In response to Petroleum And Gasoline Usage Charts for June, July, August; Unemployment vs. Gasoline Usage Analysis,

a post based on weekly petroleum stats from reader Tim Wallace, I

received a very nice email including a superb set of charts from James

Beck, Lead Analyst, Weekly Petroleum Supply Team for the Energy

Information Administration.James gave me permission to use his name and his charts as long as I mentioned that his email reflects his personal opinions, not necessarily that of the EIA.

It is a pleasure to get an email from a government worker who takes his job seriously, is exceptionally knowledgeable on his subject, and is willing to be quoted by name.

James writes …

Hello, Mike and Tim,Read More @ GlobalEconomicAnalysis.blogspot.com

Thank you again for using the data from the Weekly Petroleum Status Report (WPSR) in your analyses of the demand of petroleum and gasoline. As the Lead Analyst for the WPSR at the Energy Information Administration, I always appreciate when others use our data in providing analysis!

by John Rubino, DollarCollapse.com:

The short version of the Long Wave story is that we’re emotional

creatures with limited memories. For as long as there have been markets

we’ve been passing through the same sequence of mental states, beginning

with anxious conservatism in the aftermath of hard times, followed by

cautious optimism and finally –as the original “depression-era”

generation is replaced by their clueless grandkids — let-it-all-hang-out

financial excess. A horrendous debt-driven crash then resets the cycle.

The short version of the Long Wave story is that we’re emotional

creatures with limited memories. For as long as there have been markets

we’ve been passing through the same sequence of mental states, beginning

with anxious conservatism in the aftermath of hard times, followed by

cautious optimism and finally –as the original “depression-era”

generation is replaced by their clueless grandkids — let-it-all-hang-out

financial excess. A horrendous debt-driven crash then resets the cycle.

There are several variations of Long Wave theory, but the most famous is based on the work of Nicolai Kondratieff, a Russian economist who gave the various stages seasonal names, with summer and autumn denoting the peak of financial speculation and winter the aftermath of the resulting crash.

The most recent cycle began after World War II and lasted until the tech stock crash of 2000, which means according to this theory we’ve already spent a decade in Kondratieff Winter. But the headline statistics published by the US and other major governments tell a different story, in which we have an anemic economy but not a depression.

Read More @ DollarCollapse.com

The short version of the Long Wave story is that we’re emotional

creatures with limited memories. For as long as there have been markets

we’ve been passing through the same sequence of mental states, beginning

with anxious conservatism in the aftermath of hard times, followed by

cautious optimism and finally –as the original “depression-era”

generation is replaced by their clueless grandkids — let-it-all-hang-out

financial excess. A horrendous debt-driven crash then resets the cycle.

The short version of the Long Wave story is that we’re emotional

creatures with limited memories. For as long as there have been markets

we’ve been passing through the same sequence of mental states, beginning

with anxious conservatism in the aftermath of hard times, followed by

cautious optimism and finally –as the original “depression-era”

generation is replaced by their clueless grandkids — let-it-all-hang-out

financial excess. A horrendous debt-driven crash then resets the cycle.There are several variations of Long Wave theory, but the most famous is based on the work of Nicolai Kondratieff, a Russian economist who gave the various stages seasonal names, with summer and autumn denoting the peak of financial speculation and winter the aftermath of the resulting crash.

The most recent cycle began after World War II and lasted until the tech stock crash of 2000, which means according to this theory we’ve already spent a decade in Kondratieff Winter. But the headline statistics published by the US and other major governments tell a different story, in which we have an anemic economy but not a depression.

Read More @ DollarCollapse.com

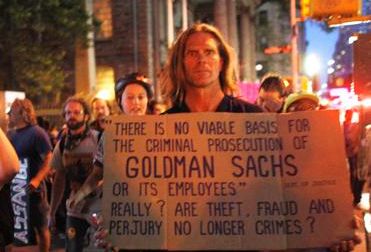

from CNBC:

Occupy Wall Street marks its first anniversary on Monday, and, in a

bid to rejuvenate a movement that has failed to sustain momentum after

sparking a national conversation about economic inequality last fall,

activists plan once again to descend on New York’s financial district.

Occupy Wall Street marks its first anniversary on Monday, and, in a

bid to rejuvenate a movement that has failed to sustain momentum after

sparking a national conversation about economic inequality last fall,

activists plan once again to descend on New York’s financial district.

The group, which popularized the phrase “We are the 99 percent,” will attempt to surround the New York Stock Exchange and disrupt morning rush hour in the financial district, according to a movement spokeswoman.

Monday’s protests will cap a weekend of Occupy Wall Street seminars, music and demonstrations in New York, said Linnea Paton, 24, an OWS spokeswoman. Demonstrations are also planned in other U.S. cities, other OWS organizers said.

The grassroots movement caught the world by surprise last fall with a spontaneous encampment in lower Manhattan that soon spread to cities across North America and Europe.

Read More @ CNBC.com

The group, which popularized the phrase “We are the 99 percent,” will attempt to surround the New York Stock Exchange and disrupt morning rush hour in the financial district, according to a movement spokeswoman.

Monday’s protests will cap a weekend of Occupy Wall Street seminars, music and demonstrations in New York, said Linnea Paton, 24, an OWS spokeswoman. Demonstrations are also planned in other U.S. cities, other OWS organizers said.

The grassroots movement caught the world by surprise last fall with a spontaneous encampment in lower Manhattan that soon spread to cities across North America and Europe.

Read More @ CNBC.com

Top rated You Tube comment: Chris Hedges opposed the NDAA in court = RESPECT!!

- HangthebankersDOTcom

from RTAmerica:

Today protesters are gathering in downtown Manhattan to mark the first anniversary of Occupy Wall Street movement which kicked out a year ago in Zuccotti Park . RT’s Marina Portnaya is speaking with Pulitzer Prize winning journalist and author Christopher Hedges about the impact of the OWS movement and its future.

- HangthebankersDOTcom

from RTAmerica:

Today protesters are gathering in downtown Manhattan to mark the first anniversary of Occupy Wall Street movement which kicked out a year ago in Zuccotti Park . RT’s Marina Portnaya is speaking with Pulitzer Prize winning journalist and author Christopher Hedges about the impact of the OWS movement and its future.

by Madison Ruppert, Activist Post

Jefferson Parish, Louisiana Sheriff Deputies turned on Sean Warren

last week simply for recording the questionable treatment meted out to

his brother, Casey Warren. The police beat him, tased him, handcuffed

him and smashed his cell phone after treating his brother in a nearly

identical manner.

Jefferson Parish, Louisiana Sheriff Deputies turned on Sean Warren

last week simply for recording the questionable treatment meted out to

his brother, Casey Warren. The police beat him, tased him, handcuffed

him and smashed his cell phone after treating his brother in a nearly

identical manner.

Unfortunately this is far from an isolated incident given that police across the country have been guilty of similar attempts to destroy evidence. Similarly, police have brutally beaten people simply for legally filming an arrest from the seeming safety of their own property.

Despite the phone being thrown to the ground after Sean Warren was sucker punched by the deputies, Warren managed to recover the video after taking his phone to a repair shop.

As Carlos Miller rightly points out, the recovered video (available here) is quite dark and grainy, thus making it quite difficult to make out exactly what is going on. However, “it does show deputies trying to shove Casey Warren into the back of a patrol car.”

Read More @ Activist Post

Jefferson Parish, Louisiana Sheriff Deputies turned on Sean Warren

last week simply for recording the questionable treatment meted out to

his brother, Casey Warren. The police beat him, tased him, handcuffed

him and smashed his cell phone after treating his brother in a nearly

identical manner.

Jefferson Parish, Louisiana Sheriff Deputies turned on Sean Warren

last week simply for recording the questionable treatment meted out to

his brother, Casey Warren. The police beat him, tased him, handcuffed

him and smashed his cell phone after treating his brother in a nearly

identical manner.Unfortunately this is far from an isolated incident given that police across the country have been guilty of similar attempts to destroy evidence. Similarly, police have brutally beaten people simply for legally filming an arrest from the seeming safety of their own property.

Despite the phone being thrown to the ground after Sean Warren was sucker punched by the deputies, Warren managed to recover the video after taking his phone to a repair shop.

As Carlos Miller rightly points out, the recovered video (available here) is quite dark and grainy, thus making it quite difficult to make out exactly what is going on. However, “it does show deputies trying to shove Casey Warren into the back of a patrol car.”

Read More @ Activist Post

by Susanne Posel, Occupy Corporatism:

S District Court Judge Katherine Forrester ruled earlier this year that the indefinite detention provision in the National Defense Authorization Act (NDAA) is unconstitutional and ordered a block

on its enforcement by federal agencies for those “suspected” to have

“substantially supported” al-Qaeda, the Taliban or “associated forces”.

S District Court Judge Katherine Forrester ruled earlier this year that the indefinite detention provision in the National Defense Authorization Act (NDAA) is unconstitutional and ordered a block

on its enforcement by federal agencies for those “suspected” to have

“substantially supported” al-Qaeda, the Taliban or “associated forces”.

While Obama’s lawyers have been fighting against this ruling with appeals, there has been installed a permanent injunction against the US government enforcing Section 1021 of the NDAA under “Homeland Battlefield” provisions.

Section 1021 says that the US President may “use all necessary and appropriate force pursuant to the Authorization for Use of Military Force (AUMF), including “the authority of the Armed Forces of the United States to detain covered persons.”

The explanation of a “covered person” includes “a person who was part of or substantially supported al-Qaeda, the Taliban, or associated forces that are engaged in hostilities against the United States or its coalition partners, including any person who has committed a belligerent act or has directly supported such hostilities in aid of such enemy forces.”

Read More @ OccupyCorporatism.com

S District Court Judge Katherine Forrester ruled earlier this year that the indefinite detention provision in the National Defense Authorization Act (NDAA) is unconstitutional and ordered a block

on its enforcement by federal agencies for those “suspected” to have

“substantially supported” al-Qaeda, the Taliban or “associated forces”.

S District Court Judge Katherine Forrester ruled earlier this year that the indefinite detention provision in the National Defense Authorization Act (NDAA) is unconstitutional and ordered a block

on its enforcement by federal agencies for those “suspected” to have

“substantially supported” al-Qaeda, the Taliban or “associated forces”.While Obama’s lawyers have been fighting against this ruling with appeals, there has been installed a permanent injunction against the US government enforcing Section 1021 of the NDAA under “Homeland Battlefield” provisions.

Section 1021 says that the US President may “use all necessary and appropriate force pursuant to the Authorization for Use of Military Force (AUMF), including “the authority of the Armed Forces of the United States to detain covered persons.”

The explanation of a “covered person” includes “a person who was part of or substantially supported al-Qaeda, the Taliban, or associated forces that are engaged in hostilities against the United States or its coalition partners, including any person who has committed a belligerent act or has directly supported such hostilities in aid of such enemy forces.”

Read More @ OccupyCorporatism.com

from TF Metals Report:

Another week is off and running. What will it hold? Will we all still be here come Friday?

Seriously, I’m starting to wonder. Maybe I’m beginning to get immunized somewhat to all of this craziness but don’t things seem a bit out of hand? Maybe the world has always been this crazy and I’ve just never really noticed before? Nah, I’m going with the former. This is madness.

Think back to…let’s say…1999 or so. Everything was peachy. Almost all of the countries in world were getting along just fine. Oh sure, there was the occasional battle in the Kashmir and you had No-Fly-Zones in Iraq, but I don’t recall checking the news with dread every time I opened a browser. Now you never know what might flare up next and the entire world seems on the edge of conflagration. Actually, in my gut, the world doesn’t just seem on the edge, I know that it is on the edge and this is sure keeping me from ever getting a good night’s sleep.

Read More @ TF Metals Report.com

Another week is off and running. What will it hold? Will we all still be here come Friday?

Seriously, I’m starting to wonder. Maybe I’m beginning to get immunized somewhat to all of this craziness but don’t things seem a bit out of hand? Maybe the world has always been this crazy and I’ve just never really noticed before? Nah, I’m going with the former. This is madness.

Think back to…let’s say…1999 or so. Everything was peachy. Almost all of the countries in world were getting along just fine. Oh sure, there was the occasional battle in the Kashmir and you had No-Fly-Zones in Iraq, but I don’t recall checking the news with dread every time I opened a browser. Now you never know what might flare up next and the entire world seems on the edge of conflagration. Actually, in my gut, the world doesn’t just seem on the edge, I know that it is on the edge and this is sure keeping me from ever getting a good night’s sleep.

Read More @ TF Metals Report.com

by Michael Scheuer, Lew Rockwell:

Soon after the Denver shootings, President Obama said it was time to put stricter gun-control measures in place. With the failure of Attorney General Holder’s “Fast and Furious” ploy to void the 2nd Amendment, it seems Obama thought he might capitalize on the Denver shootings to further damage the Constitution. The negative public reaction to his words, however, sent Obama backtracking, and senior Democrats like Senator Reid and Representative Pelosi quickly made public remarks to bury the issue – for now.

Before moving on, it is worth noting that Obama said gun laws must be changed but only in a way that protected Americans’ cherished tradition of hunting. Well, hunting game is not the central concern of the 2nd Amendment. What is central is that the 2nd Amendment protects the right of Americans to be armed in case they decide there is a need, in Jefferson’s words, “to alter or to abolish [the government]” and “to institute new Government, laying its foundation on such principles and organizing its powers in such form, as to them shall seem most likely to effect their Safety and Happiness.”

In creating the 2nd Amendment, the Founders – through James Madison‘s pen – took their cue from the British Bill of Rights (1689) which recognized that an unarmed populace could not protect its rights, liberty, and economic welfare against a king backed by a standing army, and so it allowed for an armed populace. The Founders also recalled that when London cracked down on New England’s resistance to the Crown, one of British General Thomas Gates’ first moves was to try to seize the munitions and ordnance the colonists had stockpiled around Boston. One reason for the British Army’s ill-fated expedition to Lexington and Concord in April, 1775, for example, was to capture the colonists’ stores of cannon, muskets, and munitions.

Read More @ LewRockwell.com

Soon after the Denver shootings, President Obama said it was time to put stricter gun-control measures in place. With the failure of Attorney General Holder’s “Fast and Furious” ploy to void the 2nd Amendment, it seems Obama thought he might capitalize on the Denver shootings to further damage the Constitution. The negative public reaction to his words, however, sent Obama backtracking, and senior Democrats like Senator Reid and Representative Pelosi quickly made public remarks to bury the issue – for now.

Before moving on, it is worth noting that Obama said gun laws must be changed but only in a way that protected Americans’ cherished tradition of hunting. Well, hunting game is not the central concern of the 2nd Amendment. What is central is that the 2nd Amendment protects the right of Americans to be armed in case they decide there is a need, in Jefferson’s words, “to alter or to abolish [the government]” and “to institute new Government, laying its foundation on such principles and organizing its powers in such form, as to them shall seem most likely to effect their Safety and Happiness.”

In creating the 2nd Amendment, the Founders – through James Madison‘s pen – took their cue from the British Bill of Rights (1689) which recognized that an unarmed populace could not protect its rights, liberty, and economic welfare against a king backed by a standing army, and so it allowed for an armed populace. The Founders also recalled that when London cracked down on New England’s resistance to the Crown, one of British General Thomas Gates’ first moves was to try to seize the munitions and ordnance the colonists had stockpiled around Boston. One reason for the British Army’s ill-fated expedition to Lexington and Concord in April, 1775, for example, was to capture the colonists’ stores of cannon, muskets, and munitions.

Read More @ LewRockwell.com

by Ron Holland, The Daily Bell:

“It is this Anglo-American

axis (a ‘special relationship’) that has dominated the Western world

for the past 150 years. It is a secretive and closely guarded group of

families and individuals with enormous wealth derived from the

implementation of mercantilist central banking.

In recent years, America has provided the military power and to a large

extent the corporate vehicles that have projected the ‘one world’

vision of the Anglo-American elite throughout the West, and even to

Africa and Asia.” – The Daily Bell, Glossary

“It is this Anglo-American

axis (a ‘special relationship’) that has dominated the Western world

for the past 150 years. It is a secretive and closely guarded group of

families and individuals with enormous wealth derived from the

implementation of mercantilist central banking.

In recent years, America has provided the military power and to a large

extent the corporate vehicles that have projected the ‘one world’

vision of the Anglo-American elite throughout the West, and even to

Africa and Asia.” – The Daily Bell, Glossary

Today in the 21st century as China again takes its rightful place as one of, if not the leading nation in the world we see many neoconservative “experts” warning of a clash of interests and civilizations between China and the West. Recent history shows us how the neocons took over traditional GOP foreign policy and they have never discovered a war or conflict they didn’t like. The Middle East, Asia and now Africa are experiencing wars and conflicts designed to advance their foreign policy at the point of a gun using American troops as cannon fodder for their global economic and political agenda.

Read More @ TheDailyBell.com

WWIII ...

part2

Donations will help maintain this goal and defray the operational costs. Paypal, a leading provider of secure online money transfers, will handle the donations. Thank you for your contribution.

“It is this Anglo-American

axis (a ‘special relationship’) that has dominated the Western world

for the past 150 years. It is a secretive and closely guarded group of

families and individuals with enormous wealth derived from the

implementation of mercantilist central banking.

In recent years, America has provided the military power and to a large

extent the corporate vehicles that have projected the ‘one world’

vision of the Anglo-American elite throughout the West, and even to

Africa and Asia.” – The Daily Bell, Glossary

“It is this Anglo-American

axis (a ‘special relationship’) that has dominated the Western world

for the past 150 years. It is a secretive and closely guarded group of

families and individuals with enormous wealth derived from the

implementation of mercantilist central banking.

In recent years, America has provided the military power and to a large

extent the corporate vehicles that have projected the ‘one world’

vision of the Anglo-American elite throughout the West, and even to

Africa and Asia.” – The Daily Bell, GlossaryToday in the 21st century as China again takes its rightful place as one of, if not the leading nation in the world we see many neoconservative “experts” warning of a clash of interests and civilizations between China and the West. Recent history shows us how the neocons took over traditional GOP foreign policy and they have never discovered a war or conflict they didn’t like. The Middle East, Asia and now Africa are experiencing wars and conflicts designed to advance their foreign policy at the point of a gun using American troops as cannon fodder for their global economic and political agenda.

Read More @ TheDailyBell.com

WWIII ...

by Russia Today, Global Research:

US to flex naval might in Persian Gulf war games

US to flex naval might in Persian Gulf war games

The US Navy is leading its largest-ever war games in the Persian Gulf, with warships from 25 countries being deployed in the region. Tehran, in return, is preparing for its biggest air defense war game in the history of Islamic Republic next month.

The countries that deployed the largest number of warships for the 12-day training mission are the US, Britain, France, Saudi Arabia and the UAE.

The exact number of aircraft carriers, battleships and submarines taking part is unclear. Three American aircraft carriers out of the four currently in commission are reportedly gathering in the Persian Gulf for the training.

USS Enterprise, USS John C. Stennis and USS Dwight D. Eisenhower have reportedly arrived.

The USS George Washington is believed to be on patrol in the Pacific Ocean but its exact whereabouts are a mystery. It was sighted near the island of Guam one week ago, and the air carrier’s Facebook page claims that it is still in the Pacific. But since the ship can travel at over 30 knots, it could be on its way to the Persian Gulf.

Read More @ GlobalResearch.ca

from Unconventional Finance:

US to flex naval might in Persian Gulf war games

US to flex naval might in Persian Gulf war gamesThe US Navy is leading its largest-ever war games in the Persian Gulf, with warships from 25 countries being deployed in the region. Tehran, in return, is preparing for its biggest air defense war game in the history of Islamic Republic next month.

The countries that deployed the largest number of warships for the 12-day training mission are the US, Britain, France, Saudi Arabia and the UAE.

The exact number of aircraft carriers, battleships and submarines taking part is unclear. Three American aircraft carriers out of the four currently in commission are reportedly gathering in the Persian Gulf for the training.

USS Enterprise, USS John C. Stennis and USS Dwight D. Eisenhower have reportedly arrived.

The USS George Washington is believed to be on patrol in the Pacific Ocean but its exact whereabouts are a mystery. It was sighted near the island of Guam one week ago, and the air carrier’s Facebook page claims that it is still in the Pacific. But since the ship can travel at over 30 knots, it could be on its way to the Persian Gulf.

Read More @ GlobalResearch.ca

from AltInvestorsHangout:

(1) The Money Printing madness this past week

(2) The Chinese economy (whether it will crash)

(3) The abiotic oil conspiracy.

(1) The Money Printing madness this past week

(2) The Chinese economy (whether it will crash)

(3) The abiotic oil conspiracy.

from Unconventional Finance:

part2

Donations will help maintain this goal and defray the operational costs. Paypal, a leading provider of secure online money transfers, will handle the donations. Thank you for your contribution.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment