:

The Golden Jackass makes the SHOCKING claim that perhaps

60,000 tons of allocated, segregated gold have been improperly used by

the cartel to settle Asian margin calls!He states that we will see $5,000/oz gold not from quantitative easing or the public entering the bull market, but from the cartel banks replacing what they improperly used in their leveraged games from allocated gold accounts!

Willie also informed The Doc that it appears that Morgan Stanley was used by the cartel to prevent a collapse in treasury bonds in 2010, and believes that Morgan Stanley was set up at the time by cartel banks as the next major financial firm to fail. He states that there are no buyers for treasury bonds, and that the only demand for treasuries are interest rate swaps creating false, artificial demand, and that these IR swaps were what caused the 10 year rally & ‘flight to safety’ in 2010.

Read More @ Silver Doctors

by Jana Randow and Jeff Black, Bloomberg:

European Central Bank President Mario Draghi’s bond-buying proposal

involves unlimited purchases of government debt that will be sterilized

to assuage concerns about printing money, two central bank officials

briefed on the plan said.

European Central Bank President Mario Draghi’s bond-buying proposal

involves unlimited purchases of government debt that will be sterilized

to assuage concerns about printing money, two central bank officials

briefed on the plan said.Under the blueprint, which may be called “Monetary Outright Transactions,” the ECB would refrain from setting a public cap on yields, according to the people, and a third official, who spoke on condition of anonymity. The plan will only focus on government bonds rather than a broader range of assets and will target short-dated maturities of up to about three years, two of the people said.

The euro jumped half a cent on the report to $1.2596 and European stocks advanced. An ECB spokesman referred to an Aug. 20 statement in which the Frankfurt-based central bank said it was misleading to report on decisions that haven’t been taken yet.

Draghi told the European Parliament this week that the ECB needs to intervene in bond markets to wrest back control of interest rates in the fragmented euro-area economy and ensure the survival of the common currency.

Read More @ Bloomberg.com

by Bill Holter, MilesFranklin.com:

Spain had a nearly $100 billion outflow from it’s banking system in just the month of July (Fears Rising, Spaniards Pull Out Their Cash and Get Out of Spain).

They have a 25% unemployment rate, a declining economy and the

sovereign itself probably has less than 60 days before it goes total

“Greek”. This is a full fledged bank run in progress as their largest

bank Dexia was bailed out last week. The bailout of $7 billion or so

merely plugged the hole created over the last 90 days, it has done

nothing to stop the losses. While speaking of losses, their real estate

and housing sector makes ours here in the US look healthy which of

course is another hole in their banking sector hull. The “hope” is that

the ECB (Germany) will step in and save them, who will save Germany?

Spain had a nearly $100 billion outflow from it’s banking system in just the month of July (Fears Rising, Spaniards Pull Out Their Cash and Get Out of Spain).

They have a 25% unemployment rate, a declining economy and the

sovereign itself probably has less than 60 days before it goes total

“Greek”. This is a full fledged bank run in progress as their largest

bank Dexia was bailed out last week. The bailout of $7 billion or so

merely plugged the hole created over the last 90 days, it has done

nothing to stop the losses. While speaking of losses, their real estate

and housing sector makes ours here in the US look healthy which of

course is another hole in their banking sector hull. The “hope” is that

the ECB (Germany) will step in and save them, who will save Germany?

The above is not really “new” news but it is exactly what was predicted. It was “predicted” because it (as everything else financial) is basically a mathematical equation of logic. Greece was logic as is Spain, Italy is logic as is France, as is the US. My point? This is global and it is systemic to the very core. It is completely predictable as to “failure”. The timing is not fixed nor is the exact path taken, but mathematically the “end” will arrive at default, non payment and new/changed currencies.

Read more @ MilesFranklin.com

Spain had a nearly $100 billion outflow from it’s banking system in just the month of July (Fears Rising, Spaniards Pull Out Their Cash and Get Out of Spain).

They have a 25% unemployment rate, a declining economy and the

sovereign itself probably has less than 60 days before it goes total

“Greek”. This is a full fledged bank run in progress as their largest

bank Dexia was bailed out last week. The bailout of $7 billion or so

merely plugged the hole created over the last 90 days, it has done

nothing to stop the losses. While speaking of losses, their real estate

and housing sector makes ours here in the US look healthy which of

course is another hole in their banking sector hull. The “hope” is that

the ECB (Germany) will step in and save them, who will save Germany?

Spain had a nearly $100 billion outflow from it’s banking system in just the month of July (Fears Rising, Spaniards Pull Out Their Cash and Get Out of Spain).

They have a 25% unemployment rate, a declining economy and the

sovereign itself probably has less than 60 days before it goes total

“Greek”. This is a full fledged bank run in progress as their largest

bank Dexia was bailed out last week. The bailout of $7 billion or so

merely plugged the hole created over the last 90 days, it has done

nothing to stop the losses. While speaking of losses, their real estate

and housing sector makes ours here in the US look healthy which of

course is another hole in their banking sector hull. The “hope” is that

the ECB (Germany) will step in and save them, who will save Germany?The above is not really “new” news but it is exactly what was predicted. It was “predicted” because it (as everything else financial) is basically a mathematical equation of logic. Greece was logic as is Spain, Italy is logic as is France, as is the US. My point? This is global and it is systemic to the very core. It is completely predictable as to “failure”. The timing is not fixed nor is the exact path taken, but mathematically the “end” will arrive at default, non payment and new/changed currencies.

Read more @ MilesFranklin.com

Want To See $40 Billion Disappear In Less Than 4 months?

Dave in Denver at The Golden Truth - 9 minutes ago

*(Click on chart to enlarge)*

It took a little less than 4 months for Wall Street and the insiders at

Facebook make $40 billion disappear. It took more than 40 years for Bernie

Madoff to accomplish the same feat. Maybe it says something about the

devaluation of the U.S. dollar, since Madoff got started before the gold

standard was removed. This waste in wealth might even make the Government

blush.

This whole situation is just unbelievable. I've never seen a large-cap,

high profile IPO result in this degree of failure this quickly after it was

issued. Never. This is truly a ... more »

The German Economy Tanks, The ECB Throws Gasoline On The Fire, Eurozone Bailouts Enter Phantasy Land

from Testosterone Pit.com:

Slovenia joined the Eurozone in 2007, went on a borrowing binge that

blind bond buyers eagerly made possible, dousing some of its two million

people with riches, creating a real estate bubble that has since burst,

and driving up its external debt by 110%. And in October, it may go bankrupt, admitted

Prime Minister Janez Jansa. Because borrowing binges can last only so

long if you can’t print your own money. The sixth Eurozone country, of

seventeen, to need a bailout. But it’s just a speck, compared to Spain,

which will strain the bailout funds, and Italy, which is too large to

get bailed out. The other option is the European Central Bank. Its

printing press—the one it is not supposed to have—could easily bail out

the once blind but now seeing bondholders. As in all bailouts, workers

and taxpayers would get a haircut. And in Germany, the debate itself may

tear up the Eurozone—just as its economy is tanking.

Slovenia joined the Eurozone in 2007, went on a borrowing binge that

blind bond buyers eagerly made possible, dousing some of its two million

people with riches, creating a real estate bubble that has since burst,

and driving up its external debt by 110%. And in October, it may go bankrupt, admitted

Prime Minister Janez Jansa. Because borrowing binges can last only so

long if you can’t print your own money. The sixth Eurozone country, of

seventeen, to need a bailout. But it’s just a speck, compared to Spain,

which will strain the bailout funds, and Italy, which is too large to

get bailed out. The other option is the European Central Bank. Its

printing press—the one it is not supposed to have—could easily bail out

the once blind but now seeing bondholders. As in all bailouts, workers

and taxpayers would get a haircut. And in Germany, the debate itself may

tear up the Eurozone—just as its economy is tanking.

New car sales in Germany had been holding up well through June—a miracle in face of the fiasco playing out in the Eurozone’s auto industry. But they caved in July; and instead of miraculously recovering in August, they caved again: down 4.7% from August 2011 and down 8.6% from July. Ominously, sales of medium-heavy and heavy trucks, a thermometer of the business investment climate, fell off a cliff: -18.8% for trucks over 12 metric tons, -15.1% for trucks over 20 tons, and -9.4% for tractors (now down 5% for the year!).

Read More @ TestosteronePit.com

I'm PayPal Verified

Slovenia joined the Eurozone in 2007, went on a borrowing binge that

blind bond buyers eagerly made possible, dousing some of its two million

people with riches, creating a real estate bubble that has since burst,

and driving up its external debt by 110%. And in October, it may go bankrupt, admitted

Prime Minister Janez Jansa. Because borrowing binges can last only so

long if you can’t print your own money. The sixth Eurozone country, of

seventeen, to need a bailout. But it’s just a speck, compared to Spain,

which will strain the bailout funds, and Italy, which is too large to

get bailed out. The other option is the European Central Bank. Its

printing press—the one it is not supposed to have—could easily bail out

the once blind but now seeing bondholders. As in all bailouts, workers

and taxpayers would get a haircut. And in Germany, the debate itself may

tear up the Eurozone—just as its economy is tanking.

Slovenia joined the Eurozone in 2007, went on a borrowing binge that

blind bond buyers eagerly made possible, dousing some of its two million

people with riches, creating a real estate bubble that has since burst,

and driving up its external debt by 110%. And in October, it may go bankrupt, admitted

Prime Minister Janez Jansa. Because borrowing binges can last only so

long if you can’t print your own money. The sixth Eurozone country, of

seventeen, to need a bailout. But it’s just a speck, compared to Spain,

which will strain the bailout funds, and Italy, which is too large to

get bailed out. The other option is the European Central Bank. Its

printing press—the one it is not supposed to have—could easily bail out

the once blind but now seeing bondholders. As in all bailouts, workers

and taxpayers would get a haircut. And in Germany, the debate itself may

tear up the Eurozone—just as its economy is tanking.New car sales in Germany had been holding up well through June—a miracle in face of the fiasco playing out in the Eurozone’s auto industry. But they caved in July; and instead of miraculously recovering in August, they caved again: down 4.7% from August 2011 and down 8.6% from July. Ominously, sales of medium-heavy and heavy trucks, a thermometer of the business investment climate, fell off a cliff: -18.8% for trucks over 12 metric tons, -15.1% for trucks over 20 tons, and -9.4% for tractors (now down 5% for the year!).

Read More @ TestosteronePit.com

Donations help maintain and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

I'm PayPal Verified

The

easy fixes–throwing around trillions in “free money”–have all been

tried. Now the only choices left are the hard ones everyone has avoided

for four years because they’re politically impossible.

by Charles Hugh Smith, Of Two Minds:

I want to elaborate on a key point in yesterday’s entry The Resilience and Fragility of the Status Quo:

now that we’ve run through all the easy fixes, all we’ve got left are

the hard choices. You know, facing the music, dealing with reality,

making the cuts, taking the losses and tossing aside the impossible

promises.

I want to elaborate on a key point in yesterday’s entry The Resilience and Fragility of the Status Quo:

now that we’ve run through all the easy fixes, all we’ve got left are

the hard choices. You know, facing the music, dealing with reality,

making the cuts, taking the losses and tossing aside the impossible

promises.

The irony is that completely surrendering to the vested interests hasn’t fixed what’s broken, but neither will overthrowing them. Getting rid of the parasitic financial Elites would be a positive first step, but that won’t magically make Medicare a sustainable promise. Medicare is careening off the fiscal cliff regardless of who’s nominally in charge of the political machinery, for the reasons listed yesterday: demographics, the technological destruction of paid work and the diminishing returns on debt.

Here is the easy stuff that’s already been done:

Read More @ OfTwoMinds.com

Coming To Your Area...Sooner Then You Think...

by Charles Hugh Smith, Of Two Minds:

I want to elaborate on a key point in yesterday’s entry The Resilience and Fragility of the Status Quo:

now that we’ve run through all the easy fixes, all we’ve got left are

the hard choices. You know, facing the music, dealing with reality,

making the cuts, taking the losses and tossing aside the impossible

promises.

I want to elaborate on a key point in yesterday’s entry The Resilience and Fragility of the Status Quo:

now that we’ve run through all the easy fixes, all we’ve got left are

the hard choices. You know, facing the music, dealing with reality,

making the cuts, taking the losses and tossing aside the impossible

promises. The irony is that completely surrendering to the vested interests hasn’t fixed what’s broken, but neither will overthrowing them. Getting rid of the parasitic financial Elites would be a positive first step, but that won’t magically make Medicare a sustainable promise. Medicare is careening off the fiscal cliff regardless of who’s nominally in charge of the political machinery, for the reasons listed yesterday: demographics, the technological destruction of paid work and the diminishing returns on debt.

Here is the easy stuff that’s already been done:

Read More @ OfTwoMinds.com

Coming To Your Area...Sooner Then You Think...

by Mac Slavo, SHTFPlan:

As the economic and financial systems of the world rapidly approach the real possibility of total collapse, signs of what we can expect on a mass scale in the near future are beginning to appear throughout Europe.

In Spain, a country that just a few years ago was heralded as a shining example of real estate entrepreneurship, international tourism and a rising middle class, the situation is so bad that many are unable to meet the most basic necessities for life.

Social safety nets across the continent are visibly under stress and breaking down, so much so that unemployed Spaniards have begun raiding supermarkets in order to put food on the table. As recently as last month the people of Cadiz and Sevilla, which have a reported unemployment rate of 32%, joined together to loot local grocery stores of three tons of food - some of which was distributed to local food banks:

Read More @ SHTFPlan.com

As the economic and financial systems of the world rapidly approach the real possibility of total collapse, signs of what we can expect on a mass scale in the near future are beginning to appear throughout Europe.

In Spain, a country that just a few years ago was heralded as a shining example of real estate entrepreneurship, international tourism and a rising middle class, the situation is so bad that many are unable to meet the most basic necessities for life.

Social safety nets across the continent are visibly under stress and breaking down, so much so that unemployed Spaniards have begun raiding supermarkets in order to put food on the table. As recently as last month the people of Cadiz and Sevilla, which have a reported unemployment rate of 32%, joined together to loot local grocery stores of three tons of food - some of which was distributed to local food banks:

Read More @ SHTFPlan.com

US investigators interviewing former employees over $6b trading loss

from Gulf News:

New York: The fallout from a nearly $6 billion (Dh22 billion) trading

loss at JPMorgan Chase & Co looks like it will haunt the big US bank

and its high-profile chief executive, Jamie Dimon, for months to come.

New York: The fallout from a nearly $6 billion (Dh22 billion) trading

loss at JPMorgan Chase & Co looks like it will haunt the big US bank

and its high-profile chief executive, Jamie Dimon, for months to come.

US authorities are interviewing witnesses in both the United States and Europe to determine if three former London-based traders and others who worked with them at JPMorgan tried to hide some of the mounting losses during the first quarter of this year, said people familiar with the situation.

The situation presents several challenges to US authorities: the potentially irregular trading occurred in London; and it was carried out by non-US citizens, such as French national Bruno Iksil, who became known in the market as the “London Whale” for the size of his positions.

That translates into different rules for different jurisdictions and could raise extradition issues if any individuals are charged.

Read More @ GulfNews.com

from Gulf News:

New York: The fallout from a nearly $6 billion (Dh22 billion) trading

loss at JPMorgan Chase & Co looks like it will haunt the big US bank

and its high-profile chief executive, Jamie Dimon, for months to come.

New York: The fallout from a nearly $6 billion (Dh22 billion) trading

loss at JPMorgan Chase & Co looks like it will haunt the big US bank

and its high-profile chief executive, Jamie Dimon, for months to come.US authorities are interviewing witnesses in both the United States and Europe to determine if three former London-based traders and others who worked with them at JPMorgan tried to hide some of the mounting losses during the first quarter of this year, said people familiar with the situation.

The situation presents several challenges to US authorities: the potentially irregular trading occurred in London; and it was carried out by non-US citizens, such as French national Bruno Iksil, who became known in the market as the “London Whale” for the size of his positions.

That translates into different rules for different jurisdictions and could raise extradition issues if any individuals are charged.

Read More @ GulfNews.com

by William Pfaff Truth Dig:

The belief widely held is that enlarged federalism is the appropriate

response to the economic crisis provoked by the Wall Street credit

crash. Why? Fundamental to the crisis is the degree of federation it

already has. Seventeen economically disparate nations bound their

fortunes together in creating the euro zone, and it is exactly this that

has thrown the European project into crisis.

The belief widely held is that enlarged federalism is the appropriate

response to the economic crisis provoked by the Wall Street credit

crash. Why? Fundamental to the crisis is the degree of federation it

already has. Seventeen economically disparate nations bound their

fortunes together in creating the euro zone, and it is exactly this that

has thrown the European project into crisis.

Large parts of the populations of Greece, Spain and Portugal have been forced into destitution; the economies of all 17 members of the euro zone have been gravely damaged; governments of the weaker countries have been stripped of policy autonomy and placed under the tutelage of a “troika” of foreigners from the EU Commission, the International Monetary Fund and the European Central Bank, who are imposing uniform, highly controversial and thus far generally unsuccessful austerity programs.

Read More @ TruthDig.com

The belief widely held is that enlarged federalism is the appropriate

response to the economic crisis provoked by the Wall Street credit

crash. Why? Fundamental to the crisis is the degree of federation it

already has. Seventeen economically disparate nations bound their

fortunes together in creating the euro zone, and it is exactly this that

has thrown the European project into crisis.

The belief widely held is that enlarged federalism is the appropriate

response to the economic crisis provoked by the Wall Street credit

crash. Why? Fundamental to the crisis is the degree of federation it

already has. Seventeen economically disparate nations bound their

fortunes together in creating the euro zone, and it is exactly this that

has thrown the European project into crisis.Large parts of the populations of Greece, Spain and Portugal have been forced into destitution; the economies of all 17 members of the euro zone have been gravely damaged; governments of the weaker countries have been stripped of policy autonomy and placed under the tutelage of a “troika” of foreigners from the EU Commission, the International Monetary Fund and the European Central Bank, who are imposing uniform, highly controversial and thus far generally unsuccessful austerity programs.

Read More @ TruthDig.com

by Simon Black, Sovereign Man :

Every time I hear one of these western central bankers or politicians

talk about how there’s no inflation, it just makes me want to vomit.

Every time I hear one of these western central bankers or politicians

talk about how there’s no inflation, it just makes me want to vomit.

This is one of the most arrogant, disingenuous, intellectually dishonest statements one can make. And if these guys ever got off their butts and traveled somewhere, they’d see for themselves.

Case in point– here in Namibia, the country is between a rock and a hard place. Big time. Namibia’s economy is stalling. GDP growth is a mere 0.7% year over year, and unemployment has been estimated at anywhere between 28.4% to 51.2%. They just haven’t figured out which math to use yet.

Meanwhile, inflation in Namibia is becoming uncomfortably high. The official rate that the government acknowledges is at least 7%, but the street rate is well into double digits.

In the wealthy part of the world, they pretend that inflation doesn’t exist because Wal Mart cut the price of the iPhone 4S from $188 to $148. Of course, that doesn’t mean much in Namibia. These aren’t exactly the folks lining up at the Apple store.

Read More @ SovereignMan.com

Britain’s coveted AAA credit rating was under renewed pressure last

night after a leading international agency threatened to downgrade the

entire European Union.

Britain’s coveted AAA credit rating was under renewed pressure last

night after a leading international agency threatened to downgrade the

entire European Union.

Moody’s Investors Service cut the outlook on the EU’s AAA rating to ‘negative’ – warning the union could be stripped of its top notch credit score if the eurozone debt crisis escalates.

It said the decision reflected worries over the finances of Europe’s chief paymasters – Germany, France, the UK and the Netherlands – which supply nearly half of EU budget revenues.

The agency said: ‘It is reasonable to assume that the EU’s creditworthiness should move in line with the creditworthiness of its strongest key member states.’

The intervention piled pressure on eurozone leaders and the European Central Bank to tackle the three-year-old debt crisis which threatens the single currency.

Read More @ dailymail.co.uk

Spain

has issued a veiled warning that it will not accept a full bail-out

from Europe if the terms are too harsh, a move that would paralyse the

European Central Bank and call the euro’s survival into question.

by Ambrose Evans-Pritchard, The Telegraph:

In an escalating game of brinkmanship, Spanish finance minister Luis de Guindos said his country is not yet willing to sign a Memorandum giving up fiscal sovereignty to EU inspectors. “First of all, one must clarify the conditions,” he told German newspaper Handelsblatt.

Mr de Guindos said the crisis engulfing the region is larger than any one country and warned north Europe not to scapegoat Spain. “My colleagues are aware that the battle for the euro will be fought in Spain. Spain is right now the breakwater for the eurozone,” he said, adding that “solidarity” would be well-advised.

The warning comes as German Chancellor Angela Merkel leaves for Madrid for talks with premier Mariano Rajoy to thrash out the conditions of a full sovereign rescue of up €300bn (£238bn), beyond the €100bn bank rescue already agreed.

Read More @ Telegraph.co.uk

Participation was up 0.4 percent from May and 3.3 percent higher than a year earlier and has remained greater than 46 million all year as the unemployment rate stayed higher than 8 percent. New jobless numbers will be released Sept. 7.

“Too many middle-class families who have fallen on hard times are still struggling,” Agriculture Secretary Tom Vilsack said in an e-mailed statement today. “Our goal is to get these families the temporary assistance they need so they are able to get through these tough times and back on their feet as soon as possible.”

Food-stamp spending, which more than doubled in four years to a record $75.7 billion in the fiscal year ended Sept. 30, 2011, is the U.S. Department of Agriculture’s biggest annual expense.

Read More @ Bloomberg.com

I'm PayPal Verified

Every time I hear one of these western central bankers or politicians

talk about how there’s no inflation, it just makes me want to vomit.

Every time I hear one of these western central bankers or politicians

talk about how there’s no inflation, it just makes me want to vomit.This is one of the most arrogant, disingenuous, intellectually dishonest statements one can make. And if these guys ever got off their butts and traveled somewhere, they’d see for themselves.

Case in point– here in Namibia, the country is between a rock and a hard place. Big time. Namibia’s economy is stalling. GDP growth is a mere 0.7% year over year, and unemployment has been estimated at anywhere between 28.4% to 51.2%. They just haven’t figured out which math to use yet.

Meanwhile, inflation in Namibia is becoming uncomfortably high. The official rate that the government acknowledges is at least 7%, but the street rate is well into double digits.

In the wealthy part of the world, they pretend that inflation doesn’t exist because Wal Mart cut the price of the iPhone 4S from $188 to $148. Of course, that doesn’t mean much in Namibia. These aren’t exactly the folks lining up at the Apple store.

Read More @ SovereignMan.com

by Susanne Posel, Occupy Corporatism:

Ron Paul has introduced the Federal Reserve Transparency Act of 2012 ( HR459)

to the upset of Ben Bernanke, Chairman of the Federal Reserve Bank. In

August, the House of Representatives passed 327 – 98 on a vote which

exceeded the necessary 2/3rd majority.

Ron Paul has introduced the Federal Reserve Transparency Act of 2012 ( HR459)

to the upset of Ben Bernanke, Chairman of the Federal Reserve Bank. In

August, the House of Representatives passed 327 – 98 on a vote which

exceeded the necessary 2/3rd majority.

Paul, who is pushing for “transparency” in America’s relationship with the Fed, said that Americans are “sick and tired of what happened in the bailout and where the wealthy got bailed out and the poor lost their jobs and they lost their homes.”

The Audit legislation will direct the Government Accountability Office (GAO), which is an independent congressional agency, to oversee a full review of the Fed’s monetary policy while conducting an audit of them and their decisions will be turned over to the Federal Open Market Committee.

Read More @ OccupyCorporatism.com

Ron Paul has introduced the Federal Reserve Transparency Act of 2012 ( HR459)

to the upset of Ben Bernanke, Chairman of the Federal Reserve Bank. In

August, the House of Representatives passed 327 – 98 on a vote which

exceeded the necessary 2/3rd majority.

Ron Paul has introduced the Federal Reserve Transparency Act of 2012 ( HR459)

to the upset of Ben Bernanke, Chairman of the Federal Reserve Bank. In

August, the House of Representatives passed 327 – 98 on a vote which

exceeded the necessary 2/3rd majority.Paul, who is pushing for “transparency” in America’s relationship with the Fed, said that Americans are “sick and tired of what happened in the bailout and where the wealthy got bailed out and the poor lost their jobs and they lost their homes.”

The Audit legislation will direct the Government Accountability Office (GAO), which is an independent congressional agency, to oversee a full review of the Fed’s monetary policy while conducting an audit of them and their decisions will be turned over to the Federal Open Market Committee.

Read More @ OccupyCorporatism.com

from Wealth Cycles:

The latest news from Europe reinforces our view that the Eurozone

monetary pyramid scheme is teetering on the edge of a worldwide crash–a

crash potentially large enough to rock the foundations of the U.S.

institutions and the Federal Reserve’s paper dollar.

The latest news from Europe reinforces our view that the Eurozone

monetary pyramid scheme is teetering on the edge of a worldwide crash–a

crash potentially large enough to rock the foundations of the U.S.

institutions and the Federal Reserve’s paper dollar.

Missing from the front page headlines over the past two days of both the Financial Times and the Wall St. Journal is the fact that French President Francois Hollande went against his campaign promises and just nationalized the second-largest real estate group in the country, CIF.

The laughably circular (and therefore quite tiring) state of affairs in Europe is getting very bad. As we warned back on May 25, the then-predicted failure of the French mortgage lender may be the crack in the wall that brings the effects of European Union (EU) insolvency to the States.

Read More @ WealthCycles.com

[Ed. Note: You better sit down before hitting play on this one. These idiots don't even realize that the most basic tenet of our freedom is that the stinking GOVERNMENT belongs to the people, not the other way around.]

Here’s a reminder of what our Founders intended:

… That to secure these rights, Governments are instituted among Men, deriving their just powers from the consent of the governed, –That whenever any Form of Government becomes destructive of these ends, it is the Right of the People to alter or to abolish it, and to institute new Government…

from GOPICYMI:

The latest news from Europe reinforces our view that the Eurozone

monetary pyramid scheme is teetering on the edge of a worldwide crash–a

crash potentially large enough to rock the foundations of the U.S.

institutions and the Federal Reserve’s paper dollar.

The latest news from Europe reinforces our view that the Eurozone

monetary pyramid scheme is teetering on the edge of a worldwide crash–a

crash potentially large enough to rock the foundations of the U.S.

institutions and the Federal Reserve’s paper dollar.Missing from the front page headlines over the past two days of both the Financial Times and the Wall St. Journal is the fact that French President Francois Hollande went against his campaign promises and just nationalized the second-largest real estate group in the country, CIF.

The laughably circular (and therefore quite tiring) state of affairs in Europe is getting very bad. As we warned back on May 25, the then-predicted failure of the French mortgage lender may be the crack in the wall that brings the effects of European Union (EU) insolvency to the States.

Read More @ WealthCycles.com

[Ed. Note: You better sit down before hitting play on this one. These idiots don't even realize that the most basic tenet of our freedom is that the stinking GOVERNMENT belongs to the people, not the other way around.]

Here’s a reminder of what our Founders intended:

… That to secure these rights, Governments are instituted among Men, deriving their just powers from the consent of the governed, –That whenever any Form of Government becomes destructive of these ends, it is the Right of the People to alter or to abolish it, and to institute new Government…

from GOPICYMI:

from Mail Online:

Britain’s coveted AAA credit rating was under renewed pressure last

night after a leading international agency threatened to downgrade the

entire European Union.

Britain’s coveted AAA credit rating was under renewed pressure last

night after a leading international agency threatened to downgrade the

entire European Union.Moody’s Investors Service cut the outlook on the EU’s AAA rating to ‘negative’ – warning the union could be stripped of its top notch credit score if the eurozone debt crisis escalates.

It said the decision reflected worries over the finances of Europe’s chief paymasters – Germany, France, the UK and the Netherlands – which supply nearly half of EU budget revenues.

The agency said: ‘It is reasonable to assume that the EU’s creditworthiness should move in line with the creditworthiness of its strongest key member states.’

The intervention piled pressure on eurozone leaders and the European Central Bank to tackle the three-year-old debt crisis which threatens the single currency.

Read More @ dailymail.co.uk

by Ambrose Evans-Pritchard, The Telegraph:

In an escalating game of brinkmanship, Spanish finance minister Luis de Guindos said his country is not yet willing to sign a Memorandum giving up fiscal sovereignty to EU inspectors. “First of all, one must clarify the conditions,” he told German newspaper Handelsblatt.

Mr de Guindos said the crisis engulfing the region is larger than any one country and warned north Europe not to scapegoat Spain. “My colleagues are aware that the battle for the euro will be fought in Spain. Spain is right now the breakwater for the eurozone,” he said, adding that “solidarity” would be well-advised.

The warning comes as German Chancellor Angela Merkel leaves for Madrid for talks with premier Mariano Rajoy to thrash out the conditions of a full sovereign rescue of up €300bn (£238bn), beyond the €100bn bank rescue already agreed.

Read More @ Telegraph.co.uk

by Alan Bjerga, Bloomberg:

Food-stamp use reached a record 46.7 million people in June, the

government said, as Democrats prepare to nominate President Barack Obama

for a second term with the economy as a chief issue in the campaign. Participation was up 0.4 percent from May and 3.3 percent higher than a year earlier and has remained greater than 46 million all year as the unemployment rate stayed higher than 8 percent. New jobless numbers will be released Sept. 7.

“Too many middle-class families who have fallen on hard times are still struggling,” Agriculture Secretary Tom Vilsack said in an e-mailed statement today. “Our goal is to get these families the temporary assistance they need so they are able to get through these tough times and back on their feet as soon as possible.”

Food-stamp spending, which more than doubled in four years to a record $75.7 billion in the fiscal year ended Sept. 30, 2011, is the U.S. Department of Agriculture’s biggest annual expense.

Read More @ Bloomberg.com

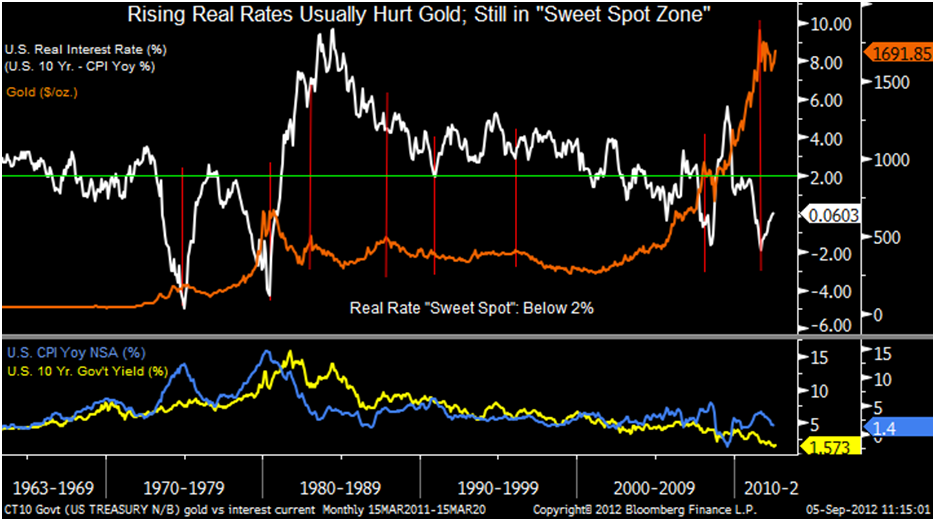

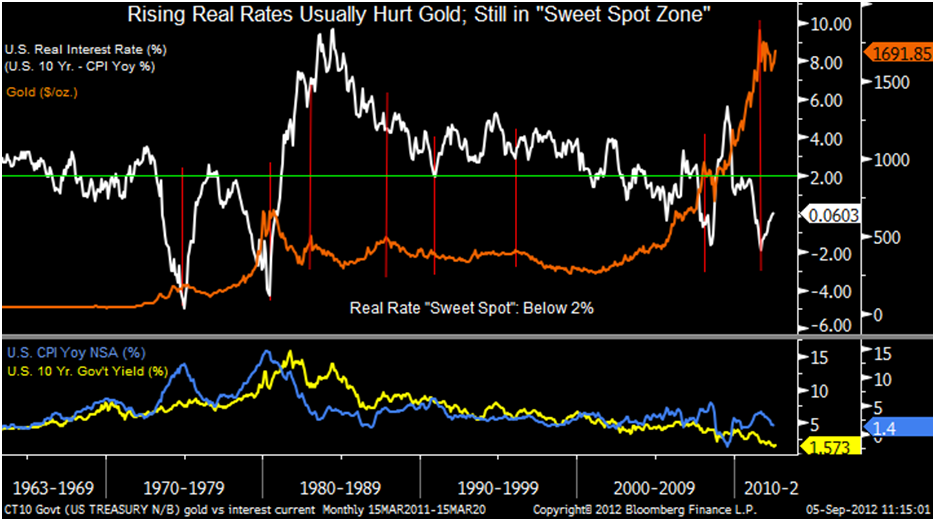

from Gold Core:

Gold edged down overnight, but is not far from the 6 month high hit

last session as weak economic data from the US bolstered hopes of

further stimulus measures by central banks.

Gold edged down overnight, but is not far from the 6 month high hit

last session as weak economic data from the US bolstered hopes of

further stimulus measures by central banks.

US manufacturing contracted at its fastest pace in more than three years in August and US construction spending dropped in July by the greatest amount in a year, the disappointing ISM index and construction spending data were released yesterday.

These reports ignite further hope for investors that Ben Bernanke will launch QE. Gold rose 4.5% in August and is now targeting the $1,700 price level again, the most since January, on speculation that the Federal Reserve will add to its $2.3 trillion bond-buying program.

Investors are awaiting the key US employment data due on Friday for further signals on the poor health of the US economy.

Bill Gross, the co-chief investment officer and founder of Pacific Investment Management Co., manager of the world’s biggest bond fund, said in a Twitter post yesterday that signs that the European Central Bank will also increase steps to boost economic growth are “very reflationary” and mean that investors should “buy gold, TIPS and real assets.”

Read More @ GoldCore.com

Today’s Items:

Finally, please prepare now for the escalating economic and social unrest. Good Day!

Gold edged down overnight, but is not far from the 6 month high hit

last session as weak economic data from the US bolstered hopes of

further stimulus measures by central banks.

Gold edged down overnight, but is not far from the 6 month high hit

last session as weak economic data from the US bolstered hopes of

further stimulus measures by central banks.US manufacturing contracted at its fastest pace in more than three years in August and US construction spending dropped in July by the greatest amount in a year, the disappointing ISM index and construction spending data were released yesterday.

These reports ignite further hope for investors that Ben Bernanke will launch QE. Gold rose 4.5% in August and is now targeting the $1,700 price level again, the most since January, on speculation that the Federal Reserve will add to its $2.3 trillion bond-buying program.

Investors are awaiting the key US employment data due on Friday for further signals on the poor health of the US economy.

Bill Gross, the co-chief investment officer and founder of Pacific Investment Management Co., manager of the world’s biggest bond fund, said in a Twitter post yesterday that signs that the European Central Bank will also increase steps to boost economic growth are “very reflationary” and mean that investors should “buy gold, TIPS and real assets.”

Read More @ GoldCore.com

Today’s Items:

There is going to be war in the Middle East and here are a few signs that it is near…

1. Major drills simulating missile strikes have recently been held in Tel Aviv.

2. Israel has ramped up the distribution of gas masks to the general public.

3. According to a new UN report, Iran’s nuclear program continues to grow stronger.

4. Iran is planning to hold a “massive air defense drill” during the month of October.

1. Major drills simulating missile strikes have recently been held in Tel Aviv.

2. Israel has ramped up the distribution of gas masks to the general public.

3. According to a new UN report, Iran’s nuclear program continues to grow stronger.

4. Iran is planning to hold a “massive air defense drill” during the month of October.

Next…

18 Indications That Europe Has Become An Economic Black Hole

http://theeconomiccollapseblog.com

18 Indications That Europe Has Become An Economic Black Hole

http://theeconomiccollapseblog.com

Here are a few…

1. The housing crash in Spain just continues to get worse.

2. Chinese exports to the EU declined by 16.2 percent in July. Even US exports are dropping.

3. Even the “strong” economies in Europe, like Germany, are being dragged down now.

4. Large U.S. companies have been rapidly getting prepared for a Greek exit from the euro-zone.

1. The housing crash in Spain just continues to get worse.

2. Chinese exports to the EU declined by 16.2 percent in July. Even US exports are dropping.

3. Even the “strong” economies in Europe, like Germany, are being dragged down now.

4. Large U.S. companies have been rapidly getting prepared for a Greek exit from the euro-zone.

Jim Rogers says that the Federal Reserve

is secretly printing money to avoid “getting egg on their face again”

after previous attempts to kick-start the collapsing economy when the

$2.3 Trillion from QE1 and QE2 failed. One look at the Fed’s balance

sheets, and one can see assets are building and it is not coming from

the tooth fairy. Jim Rogers went on to say that there is no end in

sight to the euro-zone’s problems as he sees more EU debt piled onto

old.

More and more signs are pointing to a big

event in the near future and it will most likely not involve Prince

Harry in Vegas. Too many analysts have come out lately, throwing

around lofty targets to the price of gold and silver markets. The

latest prediction for a moonshot in the silver, by James Turk. Could

this be the rocket launch or perhaps the set up for one final take-down

by those manipulating the silver market? We will see. At any rate,

it is still a good idea, after preparing, to keep stacking physical.

Here are a few…

1. When did we stop asking, “Can we afford this?” along with “Is this a good idea?” when it comes to government programs?

2. When did sticking to the Constitution and living within our means become “extremism?”

3. When did we stop caring if government programs worked or not as long as they sound compassionate?

4. When did we come to believe that we would never have to pay off our debt?

1. When did we stop asking, “Can we afford this?” along with “Is this a good idea?” when it comes to government programs?

2. When did sticking to the Constitution and living within our means become “extremism?”

3. When did we stop caring if government programs worked or not as long as they sound compassionate?

4. When did we come to believe that we would never have to pay off our debt?

Here is yet another black eye for Big

Pharm with K.I.S.S, or Keep It Simple Stupid gives us a solution.

While the pharmaceutical industry is busy trying to conjure up new

exotic drugs to tackle the antibiotic-resistant “superbug” epidemic, a

recent study published in the Journal of Clinical Investigation explains

how simple vitamin B3, or niacin, taken in high doses may effectively

thwart potentially life-threatening infections without the need for

drugs.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment