Read More @ TheEconomicCollpaseBlog.com

by Joshua Zumbrun and Simon Kennedy, Bloomberg:

Federal Reserve Chairman The Bernank says the U.S. economy is “far from satisfactory.” His colleagues are moving to embrace policies that will stay in place until he’s satisfied.

Four Fed presidents have come out in favor of an open-ended strategy for bond buying, with three calling for the program to begin now. Rather than specify a fixed amount of bonds to purchase by a certain date, such a strategy would leave the Fed able to announce a pace of purchases that it could adjust as the economy gets closer to Bernanke’s goals.

“You would be able to react to the incoming data in an incremental way and not be in a situation where you have to either drop the bomb or do nothing,” St. Louis Fed President James Bullard said in an interview last week during the Fed’s annual monetary policy symposium in Jackson Hole, Wyoming.

Read More @ Bloomberg

Ever since the invasion of Afghanistan eleven years ago, a small but increasing number of brave journalists, researchers, and activists have been decrying the real reasons for the destruction of entire nations and the tragic loss of life imposed by the hands of NATO and other Anglo-American forces such as the puppet regimes located in the same regions as the target countries. Among these vassal states are the remnants of feudal monarchies like Saudi Arabia, Kuwait, Qatar, and others.

In the years since the first post-9/11 invasion, “real” reasons have abounded regarding the various countries provided with “democracy” by the United States. These reasons include vast oil reserves, oil pipelines,[1] opium fields, strategic positioning, no-bid contracts for the defense industry and military-industrial complex, and mineral deposits.

Read More @ Activist Post

by AGXIIK, Silver Doctors:

Where Should I Hide My Precious Metals?

Hiding PM’s is a tough decisions and there is no one perfect answer.

I personally believe having your metals at your home is the best idea. A fire rated safe can contain a huge amount of physical metal Use a dial type safe, not electronic. The E type can be hacked. In case of fire, E types are hard to open.

Mount it on a cement or very solid floor since it can weigh 1,000 lbs. Memorize the safe number.

Make sure you have a copy of the safe number with a trusted attorney with a large reputable law firm. Don’t discuss the existence of this safe. If you can, keep it in a store room or closet. Thrown a blanket over it to keep prying eyes off the safe

Read More @ Silver Doctors

Where Should I Hide My Precious Metals?

Hiding PM’s is a tough decisions and there is no one perfect answer.

I personally believe having your metals at your home is the best idea. A fire rated safe can contain a huge amount of physical metal Use a dial type safe, not electronic. The E type can be hacked. In case of fire, E types are hard to open.

Mount it on a cement or very solid floor since it can weigh 1,000 lbs. Memorize the safe number.

Make sure you have a copy of the safe number with a trusted attorney with a large reputable law firm. Don’t discuss the existence of this safe. If you can, keep it in a store room or closet. Thrown a blanket over it to keep prying eyes off the safe

Read More @ Silver Doctors

from Staff Report, The Daily Bell:

At Jackson Hole, a growing fear for Fed independence … Increasing political encroachment on the Federal Reserve, particularly from the Republican Party, could threaten the central bank‘s hard-won independence and undermine confidence in the nearly 100-year old institution. That was the pervasive sentiment among economists gathered at the Fed’s annual monetary policy symposium in Jackson Hole, Wyoming. – Reuters

Dominant Social Theme: If we don’t have a central bank, what have we got?

Free-Market Analysis: Here at the Daily Bell, we have simple questions that we ask regularly about central banking: How much money is enough, and how do central bankers know it?

The answer is that central bankers DON’T know how much money is too much. Only the market can inform us of the volume and value of money.

The market can do this two ways: via the pricing of gold and silver and the pricing of competitive currencies.

Read More @ TheDailyBell.com

At Jackson Hole, a growing fear for Fed independence … Increasing political encroachment on the Federal Reserve, particularly from the Republican Party, could threaten the central bank‘s hard-won independence and undermine confidence in the nearly 100-year old institution. That was the pervasive sentiment among economists gathered at the Fed’s annual monetary policy symposium in Jackson Hole, Wyoming. – Reuters

Dominant Social Theme: If we don’t have a central bank, what have we got?

Free-Market Analysis: Here at the Daily Bell, we have simple questions that we ask regularly about central banking: How much money is enough, and how do central bankers know it?

The answer is that central bankers DON’T know how much money is too much. Only the market can inform us of the volume and value of money.

The market can do this two ways: via the pricing of gold and silver and the pricing of competitive currencies.

Read More @ TheDailyBell.com

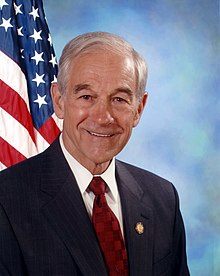

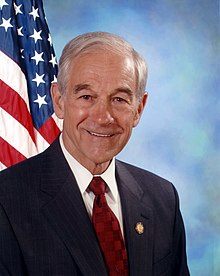

[Ed. Note:

This is why so many of us will not vote for Romney even if it means

Obama will get another 4 years. Blatant fraud and criminality is the

line in the sand and the RNC and GOP crossed it. Repeatedly.]

from messengersforliberty:

While we were in Tampa, Florida on August 26, 2012 we ran across several Ron Paul delegates who offered to share their experience with the GOP corruption that has been ongoing this year.

from BrotherJohnf:

from messengersforliberty:

While we were in Tampa, Florida on August 26, 2012 we ran across several Ron Paul delegates who offered to share their experience with the GOP corruption that has been ongoing this year.

by Mac Slavo, SHTFPlan:

Austerity measures, though unpopular and not discussed by government officials and media pundits, are in full effect across a broad spectrum of services and industries.

In many parts of the country local governments are being forced to layoff or cut the salaries of thousands of emergency personnel. Education spending cuts across debt behemoths like California, Illionois and Michigan are forcing elementary and high school classrooms to capacities exceeding thirty or forty students at a time and removing subjects like art, music and physical education from school schedules. Towns and cities all over America are declaring bankruptcy on an almost weekly basis. Government sponsored health care systems are feeling the pressure with major cuts in access to key prescription medications quickly becoming the norm.

Just two years ago the idea that austerity cuts would hit America like an 8-pound sledgehammer was inconceivable.

Read More @ SHTFPlan.com

Austerity measures, though unpopular and not discussed by government officials and media pundits, are in full effect across a broad spectrum of services and industries.

In many parts of the country local governments are being forced to layoff or cut the salaries of thousands of emergency personnel. Education spending cuts across debt behemoths like California, Illionois and Michigan are forcing elementary and high school classrooms to capacities exceeding thirty or forty students at a time and removing subjects like art, music and physical education from school schedules. Towns and cities all over America are declaring bankruptcy on an almost weekly basis. Government sponsored health care systems are feeling the pressure with major cuts in access to key prescription medications quickly becoming the norm.

Just two years ago the idea that austerity cuts would hit America like an 8-pound sledgehammer was inconceivable.

Read More @ SHTFPlan.com

from KingWorldNews:

Today James Turk told King World News, “This breakout (in gold and silver) is very important historically because it is not only ushering in the next great move in the metals, but it also signals the beginning of the next leg of the destruction of fiat money.” Turk also said, “Given that silver is still in stage 1, the media attention won’t begin until silver hits a new record high over $50 per ounce, and I think this is coming in just a few months.”

Here is what Turk had to say: “Even though the US is closed for the Labor Day holiday market, Eric, gold and silver are on fire over here in Europe. Silver has hurdled $32 while gold looks ready to take on resistance at $1700, which is a key level the bears have been defending since last March.”

Turk continues @ KingWorldNews.com

from AltInvestorsHangout:

Today James Turk told King World News, “This breakout (in gold and silver) is very important historically because it is not only ushering in the next great move in the metals, but it also signals the beginning of the next leg of the destruction of fiat money.” Turk also said, “Given that silver is still in stage 1, the media attention won’t begin until silver hits a new record high over $50 per ounce, and I think this is coming in just a few months.”

Here is what Turk had to say: “Even though the US is closed for the Labor Day holiday market, Eric, gold and silver are on fire over here in Europe. Silver has hurdled $32 while gold looks ready to take on resistance at $1700, which is a key level the bears have been defending since last March.”

Turk continues @ KingWorldNews.com

from AltInvestorsHangout:

from BrotherJohnf:

by ilene, Zero Hedge:

Here’s the latest installment of MarketShadows: The Man Who Sold the World: Sept. 2, 12.

Overview:

Here’s the latest installment of MarketShadows: The Man Who Sold the World: Sept. 2, 12.

Overview:

- Nothing announced at Jackson Hole.

- Jobs gained since 2008 were disproportionally low-wage jobs, as middle class jobs have been steadily declining (outsourced).

- Gains in the stock market since 2009 have been largely due to the Fed’s zero interest rate policy (ZIRP) and quantitative easing (QE).

- A majority of GDP growth has been due to the consumer, and the stock market. Obama has cut government jobs.

- The stock market reflects the moves in the Dollar; the Dollar is at a critical point.

- Exelon Corporation (EXC) is our stock pick this week. It’s going into the virtual portfolio as a buy-write–we’re selling a call and selling a put against 100 shares.

- Pause in Treasury supply next week, enough liquidity for market party to continue–assuming no surprises. Read More @ Zero Hedge

by Michael Snyder, Activist Post

What in the world have we done to our kids? If you spend much time with them, you quickly realize that the next generation of Americans is woefully unprepared to deal with the real world. They are overweight, lazy, undisciplined, disrespectful, disobedient to their parents, selfish, self-centered, and completely addicted to entertainment. And that is just for starters.

We feed them insane amounts of sugar and high fructose corn syrup and then when they become overactive we pump them full of prescription drugs to calm them down. Instead of raising our children ourselves, we allow the government schools and the entertainment industry to do it. By the time they reach the age of 18, they have spent far more time with their teachers, their video games and the television than they have spent with us.

Our young people are #1 in a lot of global categories, but almost all of them are bad. Young people in the United States are more obese than anyone else in the world, more sexually active than anyone else in the world and they become pregnant more often than anyone else in the world. Of course it probably doesn’t help that we have the highest divorce rate in the world either. Our families are a complete and total mess, and it is our kids that are paying the price. One top of everything else, we have accumulated a 16 trillion dollar debt which we will be handing down to the next generation. I am sure that they will appreciate that.

Read More @ Activist Post

What in the world have we done to our kids? If you spend much time with them, you quickly realize that the next generation of Americans is woefully unprepared to deal with the real world. They are overweight, lazy, undisciplined, disrespectful, disobedient to their parents, selfish, self-centered, and completely addicted to entertainment. And that is just for starters.

We feed them insane amounts of sugar and high fructose corn syrup and then when they become overactive we pump them full of prescription drugs to calm them down. Instead of raising our children ourselves, we allow the government schools and the entertainment industry to do it. By the time they reach the age of 18, they have spent far more time with their teachers, their video games and the television than they have spent with us.

Our young people are #1 in a lot of global categories, but almost all of them are bad. Young people in the United States are more obese than anyone else in the world, more sexually active than anyone else in the world and they become pregnant more often than anyone else in the world. Of course it probably doesn’t help that we have the highest divorce rate in the world either. Our families are a complete and total mess, and it is our kids that are paying the price. One top of everything else, we have accumulated a 16 trillion dollar debt which we will be handing down to the next generation. I am sure that they will appreciate that.

Read More @ Activist Post

Recording, communicating during protests, political events could be restricted

by Steve Watson, Info Wars:

Apple was granted a patent last week that will enable it to wirelessly disable the camera on iphones in certain locations, sparking fears that such techniques could be used to prevent citizens from communicating with each other or taking video during protests or events such as political conventions and gatherings.

The camera phone has revolutionized the flow of information in the digital age. Any time a major event takes place, news networks and video websites are immediately inundated with footage and photographs from the scene.

That could all change in the future however, with a flick of a switch, according to U.S. Patent No. 8,254,902, published on Tuesday, titled, “Apparatus and methods for enforcement of policies upon a wireless device.”

Read More @ InfoWars.com

by Steve Watson, Info Wars:

Apple was granted a patent last week that will enable it to wirelessly disable the camera on iphones in certain locations, sparking fears that such techniques could be used to prevent citizens from communicating with each other or taking video during protests or events such as political conventions and gatherings.

The camera phone has revolutionized the flow of information in the digital age. Any time a major event takes place, news networks and video websites are immediately inundated with footage and photographs from the scene.

That could all change in the future however, with a flick of a switch, according to U.S. Patent No. 8,254,902, published on Tuesday, titled, “Apparatus and methods for enforcement of policies upon a wireless device.”

Read More @ InfoWars.com

from Paul.House.Gov:

Amazingly, a new system was devised which allowed the U.S. to operate the printing presses for the world reserve currency with no restraints placed on it– not even a pretense of gold convertibility! Realizing the world was embarking on something new and mind-boggling, elite money managers, with especially strong support from U.S. authorities, struck an agreement with OPEC in the 1970s to price oil in U.S. dollars exclusively for all worldwide transactions. This gave the dollar a special place among world currencies and in essence backed the dollar with oil.

Read More @ Paul.House.Gov<

We frequently hear the

financial press refer to the U.S. dollar as the “world’s reserve

currency,” implying that our dollar will always retain its value in an

ever shifting world economy. But this is a dangerous and mistaken

assumption.

Since August 15, 1971,

when President Nixon closed the gold window and refused to pay out any

of our remaining 280 million ounces of gold, the U.S. dollar has

operated as a pure fiat currency. This means the dollar became an

article of faith in the continued stability and might of the U.S.

government.

In essence, we declared our insolvency in 1971. Everyone recognized

some other monetary system had to be devised in order to bring

stability to the markets.Amazingly, a new system was devised which allowed the U.S. to operate the printing presses for the world reserve currency with no restraints placed on it– not even a pretense of gold convertibility! Realizing the world was embarking on something new and mind-boggling, elite money managers, with especially strong support from U.S. authorities, struck an agreement with OPEC in the 1970s to price oil in U.S. dollars exclusively for all worldwide transactions. This gave the dollar a special place among world currencies and in essence backed the dollar with oil.

Read More @ Paul.House.Gov<

from gpc1981, Gains Pains & Capital:

The stock market is closed today for Labor Day.

A few thoughts on the preceding week:

1) The US Federal Reserve disappointed in a big way during its annual Jackson Hole meeting. It was in 2010 that Fed Chairman Ben Bernanke hinted at QE 2, which kicked off a large rally in stocks and other risk-on assets.

Investors and the mainstream financial media are desperate to claim he did something similar this time around. He did not. Instead, he issued the same message the Fed has issued for over a year: we stand ready to act if things get bad.

However, this has not stopped the media from proclaiming that the Fed has left the door wide open for announcements of QE at its September 12-13 FOMC meeting. This however is virtually impossible due to a) food prices, b) gas prices, c) the upcoming US Presidential election election and d) the fact that the banks don’t need QE, they already have ample liquidity sitting around (this is a solvency crisis, not a liquidity one).

Read More @ GainsPainsCapital.com

I'm PayPal Verified

The stock market is closed today for Labor Day.

A few thoughts on the preceding week:

1) The US Federal Reserve disappointed in a big way during its annual Jackson Hole meeting. It was in 2010 that Fed Chairman Ben Bernanke hinted at QE 2, which kicked off a large rally in stocks and other risk-on assets.

Investors and the mainstream financial media are desperate to claim he did something similar this time around. He did not. Instead, he issued the same message the Fed has issued for over a year: we stand ready to act if things get bad.

However, this has not stopped the media from proclaiming that the Fed has left the door wide open for announcements of QE at its September 12-13 FOMC meeting. This however is virtually impossible due to a) food prices, b) gas prices, c) the upcoming US Presidential election election and d) the fact that the banks don’t need QE, they already have ample liquidity sitting around (this is a solvency crisis, not a liquidity one).

Read More @ GainsPainsCapital.com

Donations help maintain and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

I'm PayPal Verified

by Svetlana Kalmykova, Global Research:

The US is launching a new stage of the arms race – a race of offensive computer weapons. Namely, the US is going to arm itself with computer viruses in order to destroy the enemy’s computer networks. Besides, the US Defense Department is developing a computer program which would deduce the level of information security of the enemy’s strategic facilities.

Until now, the US has been denying that it had any plans of developing “computer weapons”.

A website devoted to US state procurements recently announced two tenders. The first one, announced by the US Air Force, is a tender for creating computer programs which would be able to destroy the enemy’s computer networks and put computer-operated devices out of order. The Air Force is planning to spend $ 10 mln on that.

Read More @ GlobalResearch.ca

The US is launching a new stage of the arms race – a race of offensive computer weapons. Namely, the US is going to arm itself with computer viruses in order to destroy the enemy’s computer networks. Besides, the US Defense Department is developing a computer program which would deduce the level of information security of the enemy’s strategic facilities.

Until now, the US has been denying that it had any plans of developing “computer weapons”.

A website devoted to US state procurements recently announced two tenders. The first one, announced by the US Air Force, is a tender for creating computer programs which would be able to destroy the enemy’s computer networks and put computer-operated devices out of order. The Air Force is planning to spend $ 10 mln on that.

Read More @ GlobalResearch.ca

Silver

analyst Ted Butler remains convinced that silver’s multiplier effect

will continue to make it one of the best investment assets as it has

been overall for the past 10 years – manipulation or no.

by Lawrence Williams, MineWeb.com

One thing about writing for a site like Mineweb Is that it gives you

the opportunity to review all kinds of commentaries and analyses on

various aspects of the industry, some of which are well worth the read,

although others are remarkably uninformed and/or have the tendency to be

over promotional for the writer’s own business, or investment ideas.

One thing about writing for a site like Mineweb Is that it gives you

the opportunity to review all kinds of commentaries and analyses on

various aspects of the industry, some of which are well worth the read,

although others are remarkably uninformed and/or have the tendency to be

over promotional for the writer’s own business, or investment ideas.

On silver, Ted Butler’s views are always of interest, particularly his take on the shenanigans of the market place in terms of the huge short positions held by some major banks and traders. His conclusions regarding what he, and a number of others, see as subsequent price manipulation with trading volumes many, many times higher than the amount of silver actually available – a pattern also prevalent in the gold market – leads to the viewpoint that these markets are indeed rigged, but that ultimately market forces will prevail regardless.

Read More @ MineWeb.com

by Lawrence Williams, MineWeb.com

One thing about writing for a site like Mineweb Is that it gives you

the opportunity to review all kinds of commentaries and analyses on

various aspects of the industry, some of which are well worth the read,

although others are remarkably uninformed and/or have the tendency to be

over promotional for the writer’s own business, or investment ideas.

One thing about writing for a site like Mineweb Is that it gives you

the opportunity to review all kinds of commentaries and analyses on

various aspects of the industry, some of which are well worth the read,

although others are remarkably uninformed and/or have the tendency to be

over promotional for the writer’s own business, or investment ideas.On silver, Ted Butler’s views are always of interest, particularly his take on the shenanigans of the market place in terms of the huge short positions held by some major banks and traders. His conclusions regarding what he, and a number of others, see as subsequent price manipulation with trading volumes many, many times higher than the amount of silver actually available – a pattern also prevalent in the gold market – leads to the viewpoint that these markets are indeed rigged, but that ultimately market forces will prevail regardless.

Read More @ MineWeb.com

[Ed. Note:

As it relates to the fraud-riddled, HSBC custodian GLD ETF; In our

opinion the way you manage your risk is by getting out and purchasing

PHYSICAL, post haste.]

from Gold Silver Worlds:

Now that GLD has taken off like a rocket the last few days the question

arises “how does one manage the risks?”. That being the risks of

chasing a stock and sitting through a pullback right after one buys?

Now that GLD has taken off like a rocket the last few days the question

arises “how does one manage the risks?”. That being the risks of

chasing a stock and sitting through a pullback right after one buys?

Ever get caught up in the moment only to see shortly thereafter the stock pulls back after you are in? Isn’t it at those times you wished you had just remained calm, cool and collected to enable you to get a better fill?

That’s called chasing a bus here at All About Trends and every day we hammer the point home — do NOT chase buses, but instead wait for stocks to come to you via orderly pullbacks where you are buying a lower, risk adverse entry point.

One way that you can start to apply that type of thinking is to implement a disciplined method to the madness vs. getting caught up in the moment. The way we do that is via chart and employ the use of basic chart reading skills.

Read More @ GoldSilverWorlds.com

from Gold Silver Worlds:

Now that GLD has taken off like a rocket the last few days the question

arises “how does one manage the risks?”. That being the risks of

chasing a stock and sitting through a pullback right after one buys?

Now that GLD has taken off like a rocket the last few days the question

arises “how does one manage the risks?”. That being the risks of

chasing a stock and sitting through a pullback right after one buys?Ever get caught up in the moment only to see shortly thereafter the stock pulls back after you are in? Isn’t it at those times you wished you had just remained calm, cool and collected to enable you to get a better fill?

That’s called chasing a bus here at All About Trends and every day we hammer the point home — do NOT chase buses, but instead wait for stocks to come to you via orderly pullbacks where you are buying a lower, risk adverse entry point.

One way that you can start to apply that type of thinking is to implement a disciplined method to the madness vs. getting caught up in the moment. The way we do that is via chart and employ the use of basic chart reading skills.

Read More @ GoldSilverWorlds.com

from Gold Money:

Gold and silver prices surged on Friday, as Federal Reserve Chairman The Bernank launched a spirited defence of the Fed’s quantitative

easing efforts at his Jackson Hole symposium

speech. Though he did not announce an actual timetable for new monetary

stimulus measures – he wouldn’t have wanted to front run his other

colleagues on the Open Market Committee – Bernanke left traders

confident that new easing measures will be announced at the conclusion

of the next two-day FOMC meeting on September 13.

Gold and silver prices surged on Friday, as Federal Reserve Chairman The Bernank launched a spirited defence of the Fed’s quantitative

easing efforts at his Jackson Hole symposium

speech. Though he did not announce an actual timetable for new monetary

stimulus measures – he wouldn’t have wanted to front run his other

colleagues on the Open Market Committee – Bernanke left traders

confident that new easing measures will be announced at the conclusion

of the next two-day FOMC meeting on September 13.

December Comex gold, the most actively traded contract, gained 1.8% on the day ($30.50) to settle at $1,687.60/oz – a five-month high. In after hours trading gold extended its gains, nosing above the $1,690 mark. It now looks well positioned to break back above $1,700. Front-month silver gained around 3.3%, and is now trading comfortably north of $31.50 (though a lot can happen in silver very quickly, which means what’s comfortable one moment very quickly turns uncomfortable). Stocks and the broader commodity complex also rallied, with the S&P500 gaining 0.5%, while WTI crude gained 0.26% over the course of the week. Unsurprisingly given the dollar-bearish tenor of Bernanke’s comments, the Dollar Index lost 0.59% to settle at 81.21.

Read More @ GoldMoney.com

Gold and silver prices surged on Friday, as Federal Reserve Chairman The Bernank launched a spirited defence of the Fed’s quantitative

easing efforts at his Jackson Hole symposium

speech. Though he did not announce an actual timetable for new monetary

stimulus measures – he wouldn’t have wanted to front run his other

colleagues on the Open Market Committee – Bernanke left traders

confident that new easing measures will be announced at the conclusion

of the next two-day FOMC meeting on September 13.

Gold and silver prices surged on Friday, as Federal Reserve Chairman The Bernank launched a spirited defence of the Fed’s quantitative

easing efforts at his Jackson Hole symposium

speech. Though he did not announce an actual timetable for new monetary

stimulus measures – he wouldn’t have wanted to front run his other

colleagues on the Open Market Committee – Bernanke left traders

confident that new easing measures will be announced at the conclusion

of the next two-day FOMC meeting on September 13.December Comex gold, the most actively traded contract, gained 1.8% on the day ($30.50) to settle at $1,687.60/oz – a five-month high. In after hours trading gold extended its gains, nosing above the $1,690 mark. It now looks well positioned to break back above $1,700. Front-month silver gained around 3.3%, and is now trading comfortably north of $31.50 (though a lot can happen in silver very quickly, which means what’s comfortable one moment very quickly turns uncomfortable). Stocks and the broader commodity complex also rallied, with the S&P500 gaining 0.5%, while WTI crude gained 0.26% over the course of the week. Unsurprisingly given the dollar-bearish tenor of Bernanke’s comments, the Dollar Index lost 0.59% to settle at 81.21.

Read More @ GoldMoney.com

by Christopher Manion, Lew Rockwell:

Gary North’s insightful piece last week invites serious reflection. He refers briefly to Barack Obama’s twenty year discipleship with Rev. Jeremiah Wright, whose theological roots lie in the shallows of the faux religion called “Liberation Theology.” That term signifies the variant of Marxism that presents Jesus not as Savior, but as a materialist warlord and political liberator. In other words, Liberation Theology hides Marx’s impersonal and inexorable process of the Class Struggle behind a Christian, human face to make it more palatable to the masses and more intimidating to its clueless opponents – all without changing its methods or its goals.

This is what ideology is all about – the deceptive assertion of falsehood as the ground of truth and reality. It represents a perversion of metaphysics and philosophical anthropology – that is, it denies what’s true about reality and about us. But the Devil knows Latin, as the saying goes, and the ideologues feel free to pick and choose from among treasured, traditional language and symbols that once meant something real, but have long been emptied of their content and stuffed with tyrannical hemlock. Thus “patriotism” now means love of government. “Freedom” means bombing ornery foreigners into submission. And the “Two-Party System” means the one-power charade.

And “Change” means the same old same-old.

Read More @ LewRockwell.com

Gary North’s insightful piece last week invites serious reflection. He refers briefly to Barack Obama’s twenty year discipleship with Rev. Jeremiah Wright, whose theological roots lie in the shallows of the faux religion called “Liberation Theology.” That term signifies the variant of Marxism that presents Jesus not as Savior, but as a materialist warlord and political liberator. In other words, Liberation Theology hides Marx’s impersonal and inexorable process of the Class Struggle behind a Christian, human face to make it more palatable to the masses and more intimidating to its clueless opponents – all without changing its methods or its goals.

This is what ideology is all about – the deceptive assertion of falsehood as the ground of truth and reality. It represents a perversion of metaphysics and philosophical anthropology – that is, it denies what’s true about reality and about us. But the Devil knows Latin, as the saying goes, and the ideologues feel free to pick and choose from among treasured, traditional language and symbols that once meant something real, but have long been emptied of their content and stuffed with tyrannical hemlock. Thus “patriotism” now means love of government. “Freedom” means bombing ornery foreigners into submission. And the “Two-Party System” means the one-power charade.

And “Change” means the same old same-old.

Read More @ LewRockwell.com

by Alasdair Macleod, Gold Money:

Within the eurozone there are great stresses. At one extreme there are

punitive costs of borrowing for Greece, Cyprus, Portugal, Ireland,

Spain and Italy; at the other there is zero or negative interest rates

for Germany, the Netherlands and Finland. Doubtless the first group

begets the second, as captive investors in euros have to buy government

bonds, and this requirement is being funnelled away from risk into

safety.

Within the eurozone there are great stresses. At one extreme there are

punitive costs of borrowing for Greece, Cyprus, Portugal, Ireland,

Spain and Italy; at the other there is zero or negative interest rates

for Germany, the Netherlands and Finland. Doubtless the first group

begets the second, as captive investors in euros have to buy government

bonds, and this requirement is being funnelled away from risk into

safety.

This is the opposite of the convergence intended behind the creation of the euro. The euro itself, as can be seen from the chart below, is not looking too healthy either, and this is surely no coincidence. Furthermore, if it breaks the 1.2000 level to the US dollar, the chart will look very bad indeed.

The potential weakness in the euro, which on the chart suggests there is little visible support above the $0.80 level once $1.2000 is broken, suggests current difficulties in the eurozone could begin to have a serious effect on the currency. It is time therefore to think about the euro itself.

Read More @ GoldMoney.com

Within the eurozone there are great stresses. At one extreme there are

punitive costs of borrowing for Greece, Cyprus, Portugal, Ireland,

Spain and Italy; at the other there is zero or negative interest rates

for Germany, the Netherlands and Finland. Doubtless the first group

begets the second, as captive investors in euros have to buy government

bonds, and this requirement is being funnelled away from risk into

safety.

Within the eurozone there are great stresses. At one extreme there are

punitive costs of borrowing for Greece, Cyprus, Portugal, Ireland,

Spain and Italy; at the other there is zero or negative interest rates

for Germany, the Netherlands and Finland. Doubtless the first group

begets the second, as captive investors in euros have to buy government

bonds, and this requirement is being funnelled away from risk into

safety.This is the opposite of the convergence intended behind the creation of the euro. The euro itself, as can be seen from the chart below, is not looking too healthy either, and this is surely no coincidence. Furthermore, if it breaks the 1.2000 level to the US dollar, the chart will look very bad indeed.

The potential weakness in the euro, which on the chart suggests there is little visible support above the $0.80 level once $1.2000 is broken, suggests current difficulties in the eurozone could begin to have a serious effect on the currency. It is time therefore to think about the euro itself.

Read More @ GoldMoney.com

from Azizonomics:

Student debt levels continue to soar. In 2012 they hit $1 trillion for the first time ever.

But college education isn’t reaping the rewards it once did.

According to the Associated Press:

About 1.5 million, or 53.6 percent, of bachelor’s degree-holders under the age of 25 last year were jobless or underemployed, the highest share in at least 11 years.

And real wages have fallen for recent college graduates — although this has been part of a broader trend of falling real wages in the general population:

So why is student debt still soaring?

The crucial factor is that student debt isn’t like other debt — it cannot be discharged simply through bankruptcy.

Read More @ Azizonomics.com

Student debt levels continue to soar. In 2012 they hit $1 trillion for the first time ever.

But college education isn’t reaping the rewards it once did.

According to the Associated Press:

About 1.5 million, or 53.6 percent, of bachelor’s degree-holders under the age of 25 last year were jobless or underemployed, the highest share in at least 11 years.

And real wages have fallen for recent college graduates — although this has been part of a broader trend of falling real wages in the general population:

So why is student debt still soaring?

The crucial factor is that student debt isn’t like other debt — it cannot be discharged simply through bankruptcy.

Read More @ Azizonomics.com

The

structural benefits of gold are now showing clearly and the need to

side-line it from the monetary system could prove a dangerous handicap

for the monetary system.

by Julian Phillips, MineWeb.com

Since 2009 we have seen the signatory central banks of the Central

Bank Gold Agreement cease selling their gold. We have stated many times

in the past that the entire exercise of selling gold by these European

central banks was to support the birth and establishment of the euro.

They felt this was achieved by 2009, 10 years after the launch of the

euro.

Since 2009 we have seen the signatory central banks of the Central

Bank Gold Agreement cease selling their gold. We have stated many times

in the past that the entire exercise of selling gold by these European

central banks was to support the birth and establishment of the euro.

They felt this was achieved by 2009, 10 years after the launch of the

euro.

In the same year we saw the arrival of emerging nation’s central banks into the gold market as buyers. Since then they have set a pattern of buying gold that continues as a driving force behind the gold price even today. In this article we look at these events and other monetary developments in the gold market to see what to expect in the days and months ahead.

Which Central banks are buying gold and why?

It is the emerging nation’s central banks, whose reserves have been growing strongly that have led the way in buying gold for their reserves. Their aim is to diversify away from the U.S. dollar and other leading world currencies and to buy gold as a counter weight to those currencies.

Read More @ MineWeb.com

by Julian Phillips, MineWeb.com

Since 2009 we have seen the signatory central banks of the Central

Bank Gold Agreement cease selling their gold. We have stated many times

in the past that the entire exercise of selling gold by these European

central banks was to support the birth and establishment of the euro.

They felt this was achieved by 2009, 10 years after the launch of the

euro.

Since 2009 we have seen the signatory central banks of the Central

Bank Gold Agreement cease selling their gold. We have stated many times

in the past that the entire exercise of selling gold by these European

central banks was to support the birth and establishment of the euro.

They felt this was achieved by 2009, 10 years after the launch of the

euro.In the same year we saw the arrival of emerging nation’s central banks into the gold market as buyers. Since then they have set a pattern of buying gold that continues as a driving force behind the gold price even today. In this article we look at these events and other monetary developments in the gold market to see what to expect in the days and months ahead.

Which Central banks are buying gold and why?

It is the emerging nation’s central banks, whose reserves have been growing strongly that have led the way in buying gold for their reserves. Their aim is to diversify away from the U.S. dollar and other leading world currencies and to buy gold as a counter weight to those currencies.

Read More @ MineWeb.com

by John Mauldin, Gold Seek:

“No very deep knowledge of economics is usually needed for grasping the

immediate effects of a measure; but the task of economics is to

foretell the remoter effects, and so to allow us to avoid such acts as

attempt to remedy a present ill by sowing the seeds of a much greater

ill for the future.”

“No very deep knowledge of economics is usually needed for grasping the

immediate effects of a measure; but the task of economics is to

foretell the remoter effects, and so to allow us to avoid such acts as

attempt to remedy a present ill by sowing the seeds of a much greater

ill for the future.”

– Ludwig von Mises

We heard from Bernanke today with his Jackson Hole speech. Not quite the fireworks of his speech ten years ago, but it does offer us a chance to contrast his thinking with that of another Federal Reserve official who just published a paper on the Dallas Federal Reserve website. Bernanke laid out the rationalization for his policy of ever more quantitative easing. But how effective is it? And are there unintended consequences we should be aware of? Why is it that the markets seem to positively salivate over the prospect of additional QE?

Quickly, I will be doing an inaugural “Fireside Chat” with Barry Ritholtz on Tuesday, September 11 at 1 PM Eastern. This webinar will be hosted by my friends at Altegris Investments and will be available to accredited investors and financial professionals. If you have already registered with the Mauldin Circle (and are in the US), you will shortly be receiving an invitation to attend. If you have not, I invite you to go to www.mauldincircle.com and register today, so you can hear Barry and me discuss the latest news and, of course, touch on the election and what it means for investors. Now, let’s delve into quantitative easing.

Read More @ GoldSeek.com

“No very deep knowledge of economics is usually needed for grasping the

immediate effects of a measure; but the task of economics is to

foretell the remoter effects, and so to allow us to avoid such acts as

attempt to remedy a present ill by sowing the seeds of a much greater

ill for the future.”

“No very deep knowledge of economics is usually needed for grasping the

immediate effects of a measure; but the task of economics is to

foretell the remoter effects, and so to allow us to avoid such acts as

attempt to remedy a present ill by sowing the seeds of a much greater

ill for the future.”– Ludwig von Mises

We heard from Bernanke today with his Jackson Hole speech. Not quite the fireworks of his speech ten years ago, but it does offer us a chance to contrast his thinking with that of another Federal Reserve official who just published a paper on the Dallas Federal Reserve website. Bernanke laid out the rationalization for his policy of ever more quantitative easing. But how effective is it? And are there unintended consequences we should be aware of? Why is it that the markets seem to positively salivate over the prospect of additional QE?

Quickly, I will be doing an inaugural “Fireside Chat” with Barry Ritholtz on Tuesday, September 11 at 1 PM Eastern. This webinar will be hosted by my friends at Altegris Investments and will be available to accredited investors and financial professionals. If you have already registered with the Mauldin Circle (and are in the US), you will shortly be receiving an invitation to attend. If you have not, I invite you to go to www.mauldincircle.com and register today, so you can hear Barry and me discuss the latest news and, of course, touch on the election and what it means for investors. Now, let’s delve into quantitative easing.

Read More @ GoldSeek.com

by Jim Sinclair, JS Mineset:

My Dear Friends,

My Dear Friends,

Monty Guild, a friend of mine for more than forty years, is the most honest and capable man, in my opinion, in money management.

I respect Monty’s feelings on many matters, certainly the macro picture. Monty, like I, believes it is possible that coordinated central bank actions in the USA, EU, Japan and China are being discussed. The economic problems are so severe, so international, so global, so entwined, so insoluble and still caused primarily by the greed of 1990 to present finance in the form of OTC derivatives that only coordinated global action can kick this can one more time.

Gold is truly going to and through $3500. The gold business is the best business to be in.

Respectfully,

Jim

Read More @ JS Mineset

I'm PayPal Verified

My Dear Friends,

My Dear Friends,Monty Guild, a friend of mine for more than forty years, is the most honest and capable man, in my opinion, in money management.

I respect Monty’s feelings on many matters, certainly the macro picture. Monty, like I, believes it is possible that coordinated central bank actions in the USA, EU, Japan and China are being discussed. The economic problems are so severe, so international, so global, so entwined, so insoluble and still caused primarily by the greed of 1990 to present finance in the form of OTC derivatives that only coordinated global action can kick this can one more time.

Gold is truly going to and through $3500. The gold business is the best business to be in.

Respectfully,

Jim

Read More @ JS Mineset

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment