Top Chinese general in unusual move tells troops to ready for combat with Japan

by Bill Gertz, Free Beacon:

China’s most powerful military leader, in an unusual public statement, last week ordered military forces to prepare for combat, as Chinese warships deployed to waters near disputed islands and anti-Japan protests throughout the country turned violent.

Protests against the Japanese government’s purchase of three privately held islands in the Senkakus chain led to mass street protests, the burning of Japanese flags, and attacks on Japanese businesses and cars in several cities. Some carried signs that read “Kill all Japanese,” and “Fight to the Death” over disputed islands. One sign urged China to threaten a nuclear strike against Japan.

Read More @ FreeBeacon.com

by BeijingDragon , The Daily Bell:

“Hope is like a road in the country; there was never a road, but when many people walk on it, the road comes into existence.” − Lin Yutang

On September 11th, 2012, the Japanese government under Prime Minister Yoshihiko Noda declared nationalization of the Diaoyu Islands, a traditional Chinese territory under Japanese control. This move caused great fury in China. In protest of Japan’s illegal occupation of Chinese territory, hundreds of thousands of outraged demonstrators took to the streets in more than 50 cities across China, burning Japanese flags and attacking the Japanese embassy and consulates. Meanwhile, Chinese media was rife with condemnations of the Japanese aggression by not only state leaders but also political party spokespersons, grassroots citizens and intellectuals. More disturbingly, the Chinese Army staged several large-scaled military exercises in the Eastern China Sea, firing more than 40 ballistic missiles with coverage wide enough to reach Tokyo. And on September 17th, with the escort of Chinese marine surveillance ships, thousands of Chinese fishing boats rushed and flocked to the waters near Diaoyu Islands to start their annual post-ban fishing, in open defiance of the roaming Japanese Coast Guard patrol ships nearby ….

Reading these frantic headlines, I couldn’t help wondering how things got so much worse in only one week. What on Earth has spurred the Chinese to react so furiously this time? And what kind of hatred is this?

Read More @ TheDailyBell.com

by Bill Gertz, Free Beacon:

China’s most powerful military leader, in an unusual public statement, last week ordered military forces to prepare for combat, as Chinese warships deployed to waters near disputed islands and anti-Japan protests throughout the country turned violent.

Protests against the Japanese government’s purchase of three privately held islands in the Senkakus chain led to mass street protests, the burning of Japanese flags, and attacks on Japanese businesses and cars in several cities. Some carried signs that read “Kill all Japanese,” and “Fight to the Death” over disputed islands. One sign urged China to threaten a nuclear strike against Japan.

Read More @ FreeBeacon.com

“Hope is like a road in the country; there was never a road, but when many people walk on it, the road comes into existence.” − Lin Yutang

On September 11th, 2012, the Japanese government under Prime Minister Yoshihiko Noda declared nationalization of the Diaoyu Islands, a traditional Chinese territory under Japanese control. This move caused great fury in China. In protest of Japan’s illegal occupation of Chinese territory, hundreds of thousands of outraged demonstrators took to the streets in more than 50 cities across China, burning Japanese flags and attacking the Japanese embassy and consulates. Meanwhile, Chinese media was rife with condemnations of the Japanese aggression by not only state leaders but also political party spokespersons, grassroots citizens and intellectuals. More disturbingly, the Chinese Army staged several large-scaled military exercises in the Eastern China Sea, firing more than 40 ballistic missiles with coverage wide enough to reach Tokyo. And on September 17th, with the escort of Chinese marine surveillance ships, thousands of Chinese fishing boats rushed and flocked to the waters near Diaoyu Islands to start their annual post-ban fishing, in open defiance of the roaming Japanese Coast Guard patrol ships nearby ….

Reading these frantic headlines, I couldn’t help wondering how things got so much worse in only one week. What on Earth has spurred the Chinese to react so furiously this time? And what kind of hatred is this?

Read More @ TheDailyBell.com

from KingWorldNews:

Today acclaimed money manager Stephen Leeb told King World News that despite pullbacks, “Silver will blow right through $100 and continue higher.” Leeb also warned about coming inflation, “We’ve got to wake up or this could become total chaos.” Here is what Leeb had to say: “It’s going to be chaotic going forward. Look at what’s happened already. A major figure in the US was quoted last night as saying that 47% of the US eat by grace of government. We are already chaotic, Eric, but things will become even more chaotic.”

Leeb continues @ KingWorldNews.com

Today acclaimed money manager Stephen Leeb told King World News that despite pullbacks, “Silver will blow right through $100 and continue higher.” Leeb also warned about coming inflation, “We’ve got to wake up or this could become total chaos.” Here is what Leeb had to say: “It’s going to be chaotic going forward. Look at what’s happened already. A major figure in the US was quoted last night as saying that 47% of the US eat by grace of government. We are already chaotic, Eric, but things will become even more chaotic.”

Leeb continues @ KingWorldNews.com

Bank Of Japan Increases Asset Purchases By Y10 Trillion, Total Program Now Y80 Trillion, Total Debt Still Y1 Quadrillion

It seems like only yesterday that we were lamenting "Einstein rolling over in his grave" as a result of the BOJ's latest increase in its asset purchase program from Y65 to Y70 trillion, although technically it was 5 months ago on April 27. We would excuse Einstein if he were doing cartwheels in his grave right about now, following the BOJ's latest attempt to keep doing what has definitvely failed for 30 years, hoping this time it will be different, as a result of the just announced latest expansion in the asset purchase program's size by yet another Y10 trillion, this time to a total of Y80 trillion. The expansion impacts only JGBs and T-Bills, both of which will be monetized by a further Y5 trillion. Putting this in perspective, Japan's total public debt is Y1 quadrillion, and counting very fast. All other components of the Japanese LSAP program, including CP, Corporate Bonds, ETFs and REITs (yes, unlike the Fed, the BOJ is quite open about its equity and corporate bond purchases) remain the same. Bottom line, just as we predicted back in July 2009, the global race to debase continues unabated, and as a result of QEternity will merely accelerate until the only true currency is gold tungsten.The New Style of Warfare - Bloodless but Extremely Devastating

Trader Dan at Trader Dan's Market Views - 1 hour ago

Take a look at the following article and you will see that the Biblical

concept of "the borrower becomes the lender's slave" is once again proving

itself to be true in any age at any time.

Beijing hints at bond attack on JapanA senior advisor to the Chinese

government has called for an attack on the Japanese bond market to

precipitate a funding crisis and bring the country to its knees, unless

Tokyo reverses its decision to nationalise the disputed Senkaku/Diaoyu

islands in the East China Sea.

http://www.telegraph.co.uk/finance/china-business/9551727/Beijing-hints-at-bond-attack-on-... more »

Ron Paul or No Vote in November...

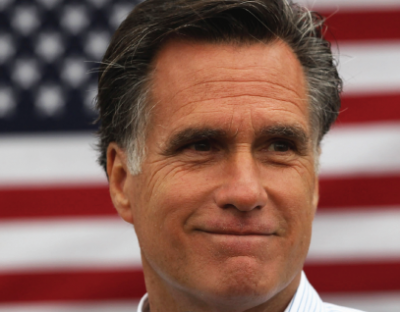

Mitt

Romney told supporters behind closed doors that he’s disadvantaged

because he was born to a rich white family, that he’d have a better

chance to win if his dad were a Mexican. It’s getting hard to decide if

Romney is simply a country-club racist or delusional, writes Robert

Parry.

Mitt

Romney told supporters behind closed doors that he’s disadvantaged

because he was born to a rich white family, that he’d have a better

chance to win if his dad were a Mexican. It’s getting hard to decide if

Romney is simply a country-club racist or delusional, writes Robert

Parry.Mitt Romney has taken some heat for comments made at a Republican fundraiser disparaging “47 percent” of the American people as leaches who get government benefits and “believe that they are victims.” But perhaps even more troubling was his claim that he would be better off politically if his father were Mexican.

The comment suggests that the GOP presidential nominee has no idea the challenges faced in the United States by immigrants and people of color, compared to the advantages that he enjoyed being the son of a wealthy white auto executive who also had a successful career in politics, becoming governor of Michigan.

Given Mitt Romney’s limited intellect and his clumsy people skills, the odds are that he never would have made it very far in America if he had not been born into a family of prominence and privilege.

Read More @ GlobalResearch.ca

from BenSwannRealityCheck:

Ben Swann Reality Check takes a look at how the situation in Afghanistan is trending in the wrong direction and what President Obama says about these so called “Green on Blue” attacks

Ben Swann Reality Check takes a look at how the situation in Afghanistan is trending in the wrong direction and what President Obama says about these so called “Green on Blue” attacks

from RT:

A lone appeals judge bowed down to the Obama administration late Monday and reauthorized the White House’s ability to indefinitely detain American citizens without charge or due process.

Last week, a federal judge ruled that an temporary injunction on section 1021 of the National Defense Authorization Act for Fiscal Year 2012 must be made permanent, essentially barring the White House from ever enforcing a clause in the NDAA that can let them put any US citizen behind bars indefinitely over mere allegations of terrorist associations. On Monday, the US Justice Department asked for an emergency stay on that order, and hours later US Court of Appeals for the Second Circuit Judge Raymond Lohier agreed to intervene and place a hold on the injunction.

The stay will remain in effect until at least September 28, when a three-judge appeals court panel is expected to begin addressing the issue.

On December 31, 2011, US President Barack Obama signed the NDAA into law, even though he insisted on accompanying that authorization with a statement explaining his hesitance to essentially eliminate habeas corpus for the American people.

Read More @ RT.com

A lone appeals judge bowed down to the Obama administration late Monday and reauthorized the White House’s ability to indefinitely detain American citizens without charge or due process.

Last week, a federal judge ruled that an temporary injunction on section 1021 of the National Defense Authorization Act for Fiscal Year 2012 must be made permanent, essentially barring the White House from ever enforcing a clause in the NDAA that can let them put any US citizen behind bars indefinitely over mere allegations of terrorist associations. On Monday, the US Justice Department asked for an emergency stay on that order, and hours later US Court of Appeals for the Second Circuit Judge Raymond Lohier agreed to intervene and place a hold on the injunction.

The stay will remain in effect until at least September 28, when a three-judge appeals court panel is expected to begin addressing the issue.

On December 31, 2011, US President Barack Obama signed the NDAA into law, even though he insisted on accompanying that authorization with a statement explaining his hesitance to essentially eliminate habeas corpus for the American people.

Read More @ RT.com

Additional purchase includes bullets designated for snipers

from Infowars:

Following controversy over its purchase of around 1.2 billion bullets in the last six months alone, the Department of Homeland Security has put out a new solicitation for over 200 million more rounds of ammunition, some of which are designated to be used by snipers.

A series of new solicitations posted on the FedBizOpps website show that the DHS is looking to purchase 200 million rounds of .223 rifle ammunition over the next four years, as well as 176,000 rounds of .308 caliber 168 grain hollow point boat tail (HPBT) rounds in addition to 25,000 rounds of blank .308 caliber bullets.

Read More @ Infowars

from Infowars:

Following controversy over its purchase of around 1.2 billion bullets in the last six months alone, the Department of Homeland Security has put out a new solicitation for over 200 million more rounds of ammunition, some of which are designated to be used by snipers.

A series of new solicitations posted on the FedBizOpps website show that the DHS is looking to purchase 200 million rounds of .223 rifle ammunition over the next four years, as well as 176,000 rounds of .308 caliber 168 grain hollow point boat tail (HPBT) rounds in addition to 25,000 rounds of blank .308 caliber bullets.

As James Smith over at the Prepper Podcast website highlights, “It is the type of ammunition and not necessarily the quantity that is troubling.”

Smith points out that the DHS’ acquisition of .308 rounds is of concern because they are set to be used by well-trained snipers.

“All of the sniper grade ammunition is being used by

trained, or in-the-process-of-being-trained snipers,” writes Smith,

noting that the math adds up to 135,384 potential kills for the snipers

to make, using the 176,000 rounds of ammunition, basing the figures on

the fact that United States Army and Marine Corps snipers in the Vietnam

War expended 1.3 rounds of ammunition for each claimed and verified

kill.

by Richard Giedroyc, World Coin News:

You might want to go through dealer junk boxes a little more carefully. Those obsolete German mark and pfennig coins mixed in with the other obsolete world coins may not be so obsolete.

In fact, the official fixed exchange rate at the Deutsche Bundesbank or German central bank is 1 euro to 1.95583 German marks. This may appear to be confusing, considering Germany’s mark denominated currency ceased to be legal tender on Jan. 1, 2002, the date on which the European Union’s euro currency officially went into circulation. While countries including France and Italy set expiration dates after which their former currencies could no longer be exchanged for euros, Germany never established a date after which the former German currency could no longer be exchanged.

Now it appears not only can Germany’s former coins and bank notes be exchanged, but German merchants are increasingly accepting them in lieu of euros when consumers make purchases.

Read More @ Numismaster.com

from ASecond0pinion:

The 2nd District Court of Appeals has just granted a temporary stay of Judge Katherine Forrest’s injunction against the NDAA. Since May, Judge Forrest had prevented the NDAA from being used anywhere in the world. Now, the NDAA is back in full effect, bringing with it the Law of War. Military law, as authorized under the NDAA, grants you no Constitutional rights whatsoever.

There is no First Amendment rights in the Law of War. There are no 2nd, 3rd, 4th, 5th or 6th Amendment rights in the Law of War. The Law of War is anathema to our Constitution, our Bill of Rights, and everything America stands for.

Thanks to the criminal 2nd District Court of Appeals, we again have military law in AmeriKa.

Join us in the fight for Liberty: http://www.peopleagainstndaa.com/join-us

from Silver Doctors:

You might want to go through dealer junk boxes a little more carefully. Those obsolete German mark and pfennig coins mixed in with the other obsolete world coins may not be so obsolete.

In fact, the official fixed exchange rate at the Deutsche Bundesbank or German central bank is 1 euro to 1.95583 German marks. This may appear to be confusing, considering Germany’s mark denominated currency ceased to be legal tender on Jan. 1, 2002, the date on which the European Union’s euro currency officially went into circulation. While countries including France and Italy set expiration dates after which their former currencies could no longer be exchanged for euros, Germany never established a date after which the former German currency could no longer be exchanged.

Now it appears not only can Germany’s former coins and bank notes be exchanged, but German merchants are increasingly accepting them in lieu of euros when consumers make purchases.

Read More @ Numismaster.com

from ASecond0pinion:

The 2nd District Court of Appeals has just granted a temporary stay of Judge Katherine Forrest’s injunction against the NDAA. Since May, Judge Forrest had prevented the NDAA from being used anywhere in the world. Now, the NDAA is back in full effect, bringing with it the Law of War. Military law, as authorized under the NDAA, grants you no Constitutional rights whatsoever.

There is no First Amendment rights in the Law of War. There are no 2nd, 3rd, 4th, 5th or 6th Amendment rights in the Law of War. The Law of War is anathema to our Constitution, our Bill of Rights, and everything America stands for.

Thanks to the criminal 2nd District Court of Appeals, we again have military law in AmeriKa.

Join us in the fight for Liberty: http://www.peopleagainstndaa.com/join-us

from Silver Doctors:

by Darryl Robert Schoon, Gold Seek:

Stagflation is where economic growth slows, unemployment is high and prices rise.

Stagflation’s appearance in the 1970s was like an outbreak of three-headed children. It wasn’t supposed to happen. Prevailing wisdom—an oxymoron among economists—held that high employment and rising prices were economic handmaidens; and that, conversely, slowing economies and inflation were mutually exclusive.

In the 1970s, for the first time in capitalism’s history stagflation appeared, i.e. prices rose and economic growth stagnated; and, while economists would search for reasons to explain the apparently inexplicable, it was only because they avoided the obvious that they did not find the answer.

Read More @ GoldSeek.com

Stagflation is where economic growth slows, unemployment is high and prices rise.

Stagflation’s appearance in the 1970s was like an outbreak of three-headed children. It wasn’t supposed to happen. Prevailing wisdom—an oxymoron among economists—held that high employment and rising prices were economic handmaidens; and that, conversely, slowing economies and inflation were mutually exclusive.

In the 1970s, for the first time in capitalism’s history stagflation appeared, i.e. prices rose and economic growth stagnated; and, while economists would search for reasons to explain the apparently inexplicable, it was only because they avoided the obvious that they did not find the answer.

Read More @ GoldSeek.com

by Marin Katusa, Casey Research:

Last week saw business pundits once again endlessly debating whether Ben Bernanke would kick off another round of quantitative easing. On Thursday, he did: QE3 will see the Federal Reserve buy $40 billion worth of mortgage-backed securities each month until the labor market “improves substantially.”

Never mind that two previous rounds of quantitative easing failed to achieve that goal; that the funds to support this new round of stimulus don’t exist; or any number of other reasons to believe QE3 will fail.

It doesn’t matter. QE3, another year of Operation Twist, the EU’s new $645-billion rescue fund – these massive stimulus measures are now just a drop in the overflowing bucket of global money supply. From Germany to Japan to Brazil to the United States, the world’s big economies are drowning themselves in their own currencies.

Read More @ CaseyResearch.com

Last week saw business pundits once again endlessly debating whether Ben Bernanke would kick off another round of quantitative easing. On Thursday, he did: QE3 will see the Federal Reserve buy $40 billion worth of mortgage-backed securities each month until the labor market “improves substantially.”

Never mind that two previous rounds of quantitative easing failed to achieve that goal; that the funds to support this new round of stimulus don’t exist; or any number of other reasons to believe QE3 will fail.

It doesn’t matter. QE3, another year of Operation Twist, the EU’s new $645-billion rescue fund – these massive stimulus measures are now just a drop in the overflowing bucket of global money supply. From Germany to Japan to Brazil to the United States, the world’s big economies are drowning themselves in their own currencies.

Read More @ CaseyResearch.com

by Graham Summers, Gains Pains Capital:

Ben Bernanke and Mario Draghi must be absolutely terrified.

These two men, in the last two weeks, have both initiated open-ended bond buying programs. The purpose of these programs, aside from keeping insolvent banks in business, was to scare the markets into believing that no matter what happens, the Central Banks will be able to step in and support the financial system.

From a philosophical standpoint, this was Draghi’s and Bernanke’s “all in” moment. I won’t say they they’ve gone “nuclear,” as they have yet to truly monetize everything, but they’re not far from that.

And they’ve both failed.

Read More @ GainsPainsCapital.com

The

latest fad for gold hungry Indians is a mobile application that enables

consumers to purchase gold and silver coins at the tap of a key.

by Shivom Seth, MineWeb.com

The Muthoot group, India’s 125-year-old non-banking financial major, has launched a ‘Muthoot Group Apps’ for Apple, iOS and Android smartphones and tablets users across India. The app will provide the prevailing rates for gold and silver and for various currencies. Users can buy gold and silver coins offered by the Muthoot Precious Metals Corporation.

Nearly 15 million mobile subscribers are added every month in India.

Alexander George Muthoot, managing director at Muthoot Group said, “Our endeavour is to provide everyone with new and innovative ways to manage their financial investments. Being a customer driven segment, we are always looking for new mediums to connect with people.”

Read More @ MineWeb.com

Ben Bernanke and Mario Draghi must be absolutely terrified.

These two men, in the last two weeks, have both initiated open-ended bond buying programs. The purpose of these programs, aside from keeping insolvent banks in business, was to scare the markets into believing that no matter what happens, the Central Banks will be able to step in and support the financial system.

From a philosophical standpoint, this was Draghi’s and Bernanke’s “all in” moment. I won’t say they they’ve gone “nuclear,” as they have yet to truly monetize everything, but they’re not far from that.

And they’ve both failed.

Read More @ GainsPainsCapital.com

by Mac Slavo, SHTFPlan:

If you think the Federal Reserve’s quantitative easing will only affect the US dollar, think again. Now that the United States has officially begun it’s third round of money printing to the tune of at least $40 billion monthly, central banks around the world will also act to ‘defend’ their currencies in kind.

Moreover, because everyone is joining the fray, all of that extra money will make its way into key resource stocks and commodities, adding further upside price pressure to essential goods like food and fuel.

It’s a race to the bottom, and the losers are the 99.9% of us who aren’t being kept in the loop.

If you think the Federal Reserve’s quantitative easing will only affect the US dollar, think again. Now that the United States has officially begun it’s third round of money printing to the tune of at least $40 billion monthly, central banks around the world will also act to ‘defend’ their currencies in kind.

Moreover, because everyone is joining the fray, all of that extra money will make its way into key resource stocks and commodities, adding further upside price pressure to essential goods like food and fuel.

It’s a race to the bottom, and the losers are the 99.9% of us who aren’t being kept in the loop.

Quantitative easing is really another word for currency wars. A weak U.S. currency puts continued pressure on the Japanese Yen, the Chinese Yuan, the South Korean Won, the Australian dollar and other currencies.

Read More @ SHTFPlan.com

by J. D. Heyes, Natural News:

A new report by House Republican members of the Homeland Security Committee’s subcommittee on Transportation Security essentially confirms what many Americans have known for years: The Transportation Security Administration is inept, overly burdensome to the transportation industry and largely ineffective in terms of identifying future threats.

In classic understatement fashion the report, titled, “Rebuilding TSA into a Smarter, Leaner Organization,” concluded that “despite the reality that we have not endured another successful terrorist attack since 2001, TSA is failing to meet taxpayers’ expectations.”

The panel went on to to concede that bloated, all-powerful agency’s insensitivity and obsession with defending grossly unpopular screening procedures is actually acting as an impediment to security – procedures and policies that also do not match current threat levels.

Read More @ NaturalNews.com

Donations will help maintain this goal and defray the operational costs. Paypal, a leading provider of secure online money transfers, will handle the donations. Thank you for your contribution.

A new report by House Republican members of the Homeland Security Committee’s subcommittee on Transportation Security essentially confirms what many Americans have known for years: The Transportation Security Administration is inept, overly burdensome to the transportation industry and largely ineffective in terms of identifying future threats.

In classic understatement fashion the report, titled, “Rebuilding TSA into a Smarter, Leaner Organization,” concluded that “despite the reality that we have not endured another successful terrorist attack since 2001, TSA is failing to meet taxpayers’ expectations.”

The panel went on to to concede that bloated, all-powerful agency’s insensitivity and obsession with defending grossly unpopular screening procedures is actually acting as an impediment to security – procedures and policies that also do not match current threat levels.

Read More @ NaturalNews.com

Donations will help maintain this goal and defray the operational costs. Paypal, a leading provider of secure online money transfers, will handle the donations. Thank you for your contribution.

I'm PayPal Verified

by David Schectman, MilesFranklin.com:

In the 1970s gold rose from $35 to $850. In inflation-adjusted

dollars, this cycle could see gold replicate the move in the 70s and

rise from $350 to $8000. In this environment, silver could also revert

to its 1970 ratio of around 20 to 1, which would peg its price at $400.

History absolutely can repeat. If you go by Jim Sinclair’s numbers,

then cut the above in half. $4000 and $200 is far better than holding

onto dollars and earning a few percent a year over the next 3 to 5

years, by which time the bull market should have peaked.

In the 1970s gold rose from $35 to $850. In inflation-adjusted

dollars, this cycle could see gold replicate the move in the 70s and

rise from $350 to $8000. In this environment, silver could also revert

to its 1970 ratio of around 20 to 1, which would peg its price at $400.

History absolutely can repeat. If you go by Jim Sinclair’s numbers,

then cut the above in half. $4000 and $200 is far better than holding

onto dollars and earning a few percent a year over the next 3 to 5

years, by which time the bull market should have peaked.

There is 100 times more paper than metal (gold and silver). People holding paper gold and silver (GLD and SLV) will be disappointed. There are no counter-party risks in holding the physicals. No one can default on your holdings.

Read More @ MilesFranklin.com

In the 1970s gold rose from $35 to $850. In inflation-adjusted

dollars, this cycle could see gold replicate the move in the 70s and

rise from $350 to $8000. In this environment, silver could also revert

to its 1970 ratio of around 20 to 1, which would peg its price at $400.

History absolutely can repeat. If you go by Jim Sinclair’s numbers,

then cut the above in half. $4000 and $200 is far better than holding

onto dollars and earning a few percent a year over the next 3 to 5

years, by which time the bull market should have peaked.

In the 1970s gold rose from $35 to $850. In inflation-adjusted

dollars, this cycle could see gold replicate the move in the 70s and

rise from $350 to $8000. In this environment, silver could also revert

to its 1970 ratio of around 20 to 1, which would peg its price at $400.

History absolutely can repeat. If you go by Jim Sinclair’s numbers,

then cut the above in half. $4000 and $200 is far better than holding

onto dollars and earning a few percent a year over the next 3 to 5

years, by which time the bull market should have peaked.There is 100 times more paper than metal (gold and silver). People holding paper gold and silver (GLD and SLV) will be disappointed. There are no counter-party risks in holding the physicals. No one can default on your holdings.

Read More @ MilesFranklin.com

by Shivom Seth, MineWeb.com

The Muthoot group, India’s 125-year-old non-banking financial major, has launched a ‘Muthoot Group Apps’ for Apple, iOS and Android smartphones and tablets users across India. The app will provide the prevailing rates for gold and silver and for various currencies. Users can buy gold and silver coins offered by the Muthoot Precious Metals Corporation.

Nearly 15 million mobile subscribers are added every month in India.

Alexander George Muthoot, managing director at Muthoot Group said, “Our endeavour is to provide everyone with new and innovative ways to manage their financial investments. Being a customer driven segment, we are always looking for new mediums to connect with people.”

Read More @ MineWeb.com

by Keelan Balderson, Activist Post

Unelected President of the EU Commission, José Manuel Barroso, announced last week plans for an all encompassing “banking union”, which would give the European Central Bank supervisory powers over every member-state financial institution [1]; yet another step in a long-planned superstate agenda.

“We need to move to common supervisory decisions,” Barroso brazenly declared, demanding that the ECB should rule over all euro-zone banks, a number that pushes 6,000 individual institutions.

Without mincing words the Bilderberg member called for the end of national sovereignty, and in its wake a “federation of nation-states” under the centralized control of unelected EU bureaucrats should be formed [2]; a vastly different system than was originally sold to the public back in the 1950s.

Read More @ Activist Post

Unelected President of the EU Commission, José Manuel Barroso, announced last week plans for an all encompassing “banking union”, which would give the European Central Bank supervisory powers over every member-state financial institution [1]; yet another step in a long-planned superstate agenda.

“We need to move to common supervisory decisions,” Barroso brazenly declared, demanding that the ECB should rule over all euro-zone banks, a number that pushes 6,000 individual institutions.

Without mincing words the Bilderberg member called for the end of national sovereignty, and in its wake a “federation of nation-states” under the centralized control of unelected EU bureaucrats should be formed [2]; a vastly different system than was originally sold to the public back in the 1950s.

Read More @ Activist Post

by Mark Heisler, Truth Dig:

Contrary to what conservatives have been pushing, reducing taxes for

the wealthiest Americans will not grow the economy. However, according

to a new study by the Congressional Research Service, it does help to create income inequality.

Contrary to what conservatives have been pushing, reducing taxes for

the wealthiest Americans will not grow the economy. However, according

to a new study by the Congressional Research Service, it does help to create income inequality.

According to the report:

Contrary to what conservatives have been pushing, reducing taxes for

the wealthiest Americans will not grow the economy. However, according

to a new study by the Congressional Research Service, it does help to create income inequality.

Contrary to what conservatives have been pushing, reducing taxes for

the wealthiest Americans will not grow the economy. However, according

to a new study by the Congressional Research Service, it does help to create income inequality. According to the report:

Throughout the late-1940s and 1950s, the top marginal tax rate was typically above 90%; today it is 35%. Additionally, the top capital gains tax rate was 25% in the 1950s and 1960s, 35% in the 1970s; today it is 15%. The real GDP growth rate averaged 4.2% and real per capita GDP increased annually by 2.4% in the 1950s. In the 2000s, the average real GDP growth rate was 1.7% and real per capita GDP increased annually by less than 1%. There is not conclusive evidence, however, to substantiate a clear relationship between the 65-year steady reduction in the top tax rates and economic growth. Analysis of such data suggests the reduction in the top tax rates have had little association with saving, investment, or productivity growth. However, the top tax rate reductions appear to be associated with the increasing concentration of income at the top of the income distribution.

Read More @ TruthDig.com

by John Rubino, DollarCollapse.com:

Remember when our problems were mostly just financial, when the scariest possibility was Greece leaving the eurozone and a few zombie banks evaporating? Those were the days.

This week, geopolitics — that is, guns, bombs, and ideology — pushed finance off the front burner. In the East China Sea, for instance, everyone has inexplicably become obsessed with a few barren islands and is apparently willing to trade blood for rocks:

Japanese firms shut plants in China as territorial row escalates

“Major Japanese firms have closed their factories in China and urged expatriate workers on Monday to stay home ahead of what could be further angry protests over a territorial dispute that threatens to hurt trade ties between Asia’s two largest economies.”

Read More @ DollarCollapse.com

Dear CIGAs,

Tanzania takes the lead in dealing with energy companies, affirming the sanctity of contracts.

Tanzania will not revoke any oil and gas PSAs -Energy Minister 1:13 PM Eastern Daylight Time Sep 18, 2012

DAR ES SALAAM, Sept 18 (Reuters) – Tanzania will not alter or revoke existing oil and gas contracts, its energy minister said on Tuesday, two days after he was widely reported in local media saying unfavourable deals would be scrapped.

"We are not trying to stop any business. We will not revoke any contract, we will respect all contracts," Energy and Minerals Minister Sospeter Muhongo told Reuters.

Muhongo said he had been misquoted in Tanzania’s local media.

(Reporting by Fumbuka Ng’wankilala in Dar Es Salaam and Kelly Golblom in Nairobi; Editing by Richard Lough)

((Email: nairobi.newsroom@reuters.com)(Tel: +254 20 222 4717)(Reuters Messaging: richard.lough.thomsonreuters.com@reuters.net))

Dear CIGAs,

This is a major game changer. It has taken place in a West African gold miner. It speaks to certain African countries as excellent investments. It underscores that prediction of 12 years ago.

It screams at undervaluation. It is the recognition that gold mines mine money. This is a recognition of the dwindling supply side of gold. This is a recognition that gold is the only Honest Money. This is a recognition of gold’s role in high tech.

The end of the bear market inflicted by the hedges on gold shares is absolutely over. The shorts in good gold shares after today are self destructively insane.

This is it for good gold shares. The long bull phase in gold shares starts now.

Cluff Gold plc

("Cluff Gold" or "the Company")

12 September 2012

AIM: CLF/TSX: CFG

Strategic Alliance between Cluff Gold and Samsung

Cluff Gold plc, the dual AIM/TSX listed West African focused gold mining company, is pleased to announce that it has signed a Memorandum of Understanding for a long term strategic partnership with Samsung C&T Corporation ("Samsung"). This alliance commences with an unhedged US$20m facility to provide additional funding to Cluff Gold to further the development of its portfolio of assets. The Memorandum of Understanding provides a general framework for the potential long term funding of Baomahun and other development opportunities.

The initial facility forms part of a wider strategic alliance between Cluff Gold and Samsung which is a global trading company. Cluff Gold has a producing mine, Kalsaka in Burkina Faso, and a strong pipeline of development assets which is expected to generate a long term production profile. Through this long term partnership Samsung will have access to a reliable supply of gold bullion, underpinned by the Company’s strong operational and management team whilst Cluff Gold will benefit from Samsung’s financial support. The relationship is expected to result in a significant financing in Cluff Gold’s Baomahun project, subject to the outcome of the feasibility study, together with an ongoing commitment to jointly assess other opportunities in the region.

Under the terms of the agreement signed today, an initial US$20m of debt finance will be drawn immediately, supported by the Company’s interest in its Kalsaka/Sega project. These funds will be used to strengthen the Company’s balance sheet and ensure the Company remains well funded during the development of Sega to continue the ongoing exploration and development work across its asset portfolio.

Subject to the outcome of the feasibility study, the alliance envisages a further substantial financing for the development of Cluff Gold’s Baomahun project in Sierra Leone, which has 2.1Moz of indicated resources (25.6Mt at 2.5g/t)[i]. Baomahun is fully permitted, with work ongoing to complete a feasibility study.

The Memorandum of Understanding does not require any exclusivity between Samsung and the Company in respect of further financing and is not binding on either party in that respect. Negotiations with other debt providers will continue in parallel with the due diligence undertaken by Samsung.

John McGloin, Chairman of Cluff Gold, commented:

"We are very pleased to have formed an alliance with Samsung as we develop our project portfolio. This agreement provides immediate financing support on competitive terms compared to other recent financings without the requirement to hedge any of our current or future gold production. More importantly, it also offers a framework for a cornerstone financing in the Baomahun project or other development opportunities, capable of satisfying a significant portion of the total Baomahun financing needs. The initial US$20m drawdown provides us with the balance sheet flexibility to use existing cash flow to fund our exploration programmes whilst maintaining development momentum at Sega and Baomahun. We look forward to working with Samsung as we deliver our Company strategy to grow into a mid-tier producer through the development of our existing portfolio whilst looking at other accretive growth opportunities in the region."

Link to full news release…

You can say any foolish thing to a dog, and the dog will give you a look that says, ‘Wow, you’re right! I never would’ve thought of that! –Dave Barry

Jim Sinclair’s Commentary

My suspicion is central planning intervention just like at the total of nine touches of gold at $1775 in a pre election period. It was that or release from the strategic petroleum stockpile which means nothing to gas prices.

Fat finger not likely cause of Monday oil plunge: CFTC’s Chilton Published: Tuesday, 18 Sep 2012 | 4:07 PM ET

WASHINGTON (Reuters) – A trader pressing the wrong key was not the likely cause of a brief plunge in oil prices on Monday, a top regulator at the Commodity Futures Trading Commission told Reuters.

"Based upon our initial review, it does not appear that a fat finger is the likely cause of the oil price dive yesterday," Commissioner Bart Chilton said on Tuesday.

Brent crude prices plummeted more than $3 in a matter of minutes just before 2 p.m. EDT (1800 GMT) on Monday as trading volumes – which had been muted by the Rosh Hashana holiday – shot up.

It was not immediately clear what caused the price plunge, but CFTC officials are looking into the matter.

More…

Jim Sinclair’s Commentary

I think we all heard of this many years ago.

Fed’s ‘QE-Infinity’ Will Push Gold to $2,400: Pro By John Melloy | CNBC

In one of the most bullish gold calls since the Federal Reserve announced a new round of easing last week, one strategist sees a 36 percent jump in the metal’s price (CEC:Commodities Exchange Centre: GCCV1), to $2,400 an ounce, by the end of 2014.

"The new target reflects our view that the Fed will maintain mortgage purchases until the end of 2014 and will move to buy Treasuries following the end of Operation Twist this coming December," wrote Francisco Blanch, a global investment strategist with Bank of America Merrill Lynch, in a note to clients Tuesday.

"Given the new open-ended nature of QE3, the upward pressure on gold prices should continue until employment is strong enough to require a change in policy," Blanch added. "In our view, this is unlikely to happen until the end of 2014."

Last week, the Federal Reserve announced its third round of stimulus since the financial crisis, saying it would buy $40 billion in mortgage-backed securities each month.

The Fed used open-ended language in describing how long so-called QE3 would last, saying in its statement it would continue these purchases – and possibly employ other methods – until the outlook for the labor market improves substantially.

More…

Donations will help maintain this goal and defray the operational costs. Paypal, a leading provider of secure online money transfers, will handle the donations. Thank you for your contribution.

Jim Sinclair’s Commentary

I don’t know what Yoda will think of this.

Jim Sinclair’s Commentary

Slowly, slowly, the dollar moves away from its role as the international settlement mechanism. That is the loss of the bullish perk on a reserve currency going south.

Jim Sinclair’s Commentary

Mr. T. Ferguson has done a nice job of cutting through all the MSM commentary on QE by the time honored method of "Follow the Money." He clearly outlines how the banksters to their benefit act as what we used to call stooges to buy Treasury paper. As such, the Fed is Debt Monetizing without any question. Markets will wake up to what all this means soon. Gold is going to and through $3500 with all its usual and sometime bone grinding drama.

This educational piece is quite worth your time.

Brass Tacks Tuesday, September 18, 2012 at 10:13 am

OK, so it has been a few days since QE to infinity became official Fed policy. There is certainly an abundance of swirling news and discussion out there that dances around the real significance. Today, we cut to the chase.

Let’s go back and hit on the main FED points:

The Fed will keep rates "extraordinarily low" through 2015

The Fed will continue $45B/month in Operation Twist through year end

The Fed will begin buying $40B/month in mortgage-backed securities (MBS) with no end date or target purchase amount given

So many of us have been seemingly immunized against the jolting effect of these headlines. Not just here at TFMR but nearly everywhere that "awakened" citizens congregate on the internet. We take the headlines at face-value but rarely stop to consider things on the next level. But we need to go there today because without a full understanding of what the true meaning and implications are, you’re likely to delay actions that you should be immediately taking.

So, let’s go back to the three bullet points above and take them, one-by-one. First,

The Fed will keep rates "extraordinarily low" through 2015

What is The Fed telling you here? Well, a couple of things. First of all, 2015?? That’s three freaking years from now! It’s one thing to say that rates will stay low for the next 6-12 months. It’s something entirely different to say three freaking years! The negative implications of this are dramatic as institutions such as pension funds and insurance companies will be ravaged by the continuance of ZIRP. Additionally, however, what is The Fed telling you about their expectations of economic "recovery"? Despite all of their official forecasts of growth and jobs, it sure doesn’t seem that they believe it. Like the old adage says: Watch what they do, not what they say. We talk here incessantly about the miserable economy and the dim prospects for recovery. It is now clear that The Fed feels this way, too.

The Fed will continue $45B/month in Operation Twist through year end

First of all, remember what Operation Twist is. The Fed is selling their short-term maturity holdings (where there is actual demand for "safe havens") and using the proceeds to purchase longer-term notes and bonds. This process is considered "sterilized" because, allegedly, The Fed isn’t creating any new money. They are simply "re-positioning" some of their "assets". Whatever. I don’t care to get sidetracked as to whether or not this is really a "sterile" process. All that matters is that The Fed is currently executing this strategy to the tune of about $45B/month. The problem for them is, they’re almost out of short-term bills and notes to sell and, once this inventory of paper is depleted, the $45B/month is going to have to come from other, "non-sterile" sources.

The Fed will begin buying $40B/month in mortgage-backed securities (MBS) with no end date or target purchase amount given

And now here’s where it gets interesting. The key to this bullet point is the "no end date, open-ended" component. In fact, The Fed went so far as to state that they "stand ready" to increase the monthly amount of MBS purchases if "the labor market doesn’t improve". OK, again, watch what they do, not what they say.

ZIRP will continue through 2015 but Operation Twist runs out of funds and ends late this year. Well, then, from where will the $45B/month in Operation Twist be replaced. That’s an easy one. The Fed has already told you the answer. Since the labor market won’t be improving anytime soon, they will simply increase their monthly purchases of MBS from $40B to $85B.

An here’s where almost everyone drops the ball. The mainstream media will tell you that The Fed is "supporting the mortgage market" and "helping to keep homes affordable" with this program. This is complete, unadulterated BS. Sure, The Fed is buying $85B in MBS every month…but…from whom??? Which institutions own these MBS and are obligingly selling them to The Fed??? I’ll wait here and let you think about that one for a few moments…

The Primary Dealers! Goldman, The Morgue, MorganStanley, Citi, BoA…all of them. They own or purchase new the MBS which The Fed buys from them. And here’s the very important next step: The Primary Dealers turn around and use the proceeds from these sales to buy U.S. treasuries! To the tune of $85B/month. Let me do the math for you…that’s slightly more than one trillion dollars over the next year. And what does the Congressional Budget Office project the U.S. federal deficit to be in fiscal 2013? It will again be north of one trillion dollars, at a minimum. http://www.cbo.gov/publication/43539

At the end of the day…and here’s where we get down to brass tacks…last week The U.S. Federal Reserve announced a plan whereby they will be almost completely and directly monetizing the deficit spending of the U.S. government. Though the illusion of legitimate borrowing will be maintained and politicians will continue to claim that "we’re borrowing all of this from China", you should not be fooled. We have entered a new paradigm of direct debt monetization. By doing so, The Federal Reserve has begun the process of overt currency debasement and devaluation.

Your only financial protection from this game-ending disaster is the ownership of physical precious metal. Though, in the short-term, dollar-denominated paper assets may perform reasonably well, they offer no long-term protection against your inevitable loss of purchasing power and wealth. Only physical precious metal can protect you in the days ahead. Buy some and add to your stack before it’s too late.

More…

Jim Sinclair’s Commentary

It is all about energy. You were told this would occur 5 years ago.

Japan: Chinese Ships Enter Territorial Waters Posted September 18th, 2012 at 9:55 am (UTC-4)

Japan’s Coast Guard says at least two Chinese government vessels have entered territorial waters near Japanese-controlled islands, as a dispute escalates on the sensitive anniversary of Japan’s invasion of China.

The vessels are among 11 Chinese ships spotted Tuesday near the East China Sea islands, known as Senkaku in Japan and Diaoyu in China. Japanese authorities earlier turned away another Chinese patrol ship.

Two Japanese activists briefly landed on one the islands Tuesday, prompting an angry response from China’s Foreign Ministry, which called the act a “gravely provocative” violation of Chinese sovereignty.

The dispute over the mostly uninhabited islands led to a day of anti-Japan protests in major cities across China. In Beijing, at least 1,000 protesters marched outside the Japanese embassy, holding signs, chanting nationalistic slogans and calling for China to defend its claim to the islands. Many Japanese companies, including Honda, Toyota, Mitsubishi and Panasonic have cut back operations in China because of sporadic outbreaks of violence.

Tuesday is the 81st anniversary of the so-called Manchurian Incident, a pretext Japan used to invade China in 1931.

More…

Jim Sinclair’s Commentary

Yell at Yahoo, not me.

4 signs that Israel’s showdown with Iran is almost here By The Week’s Editorial Staff | The Week – 22 hrs ago

Israel warns that the clock is ticking, and that Iran is dangerously close to acquiring nuclear weapons. Is a long-feared military clash looking more and more likely?

Over the last several days, Israeli Prime Minister Benjamin Netanyahu has loudly and repeatedly urged that President Obama draw a "red line" that Iran’s nuclear program can’t cross, warning that without such a line, the Islamic Republic will likely be within reach of building its first atomic bomb in six or seven months. Obama administration officials say Netanyahu’s timetable is wrong, and that Tehran will need at least a year to gather the nuclear fuel it would need, and even longer to fit a warhead onto a missile. Is a violent showdown between Iran and Israel nearly here? Many analysts see Netanyahu’s increasingly vocal demands as proof that conflict is looming. Here, four other signs that the clock might really be running out:

1. Iran is getting more and more belligerent

Tehran hasn’t exactly been mending its ways in the face of aggressive warnings and tightening sanctions, says Tyler Durden at Zero Hedge. In fact, Iran’s Revolutionary Guard recently stoked tensions even further by admitting that "its troops are now on the ground in Syria," helping the embattled regime in its effort to wipe out the pro-democracy opposition. Of all the disturbing developments surrounding Iran’s refusal to curb its nuclear program, that could be the one "to light this whole mess on fire."

2. And accusing nuclear inspectors of sabotage

Iran’s nuclear program chief, Fereydoon Abbasi-Davani, says "only mutual trust" will allow his country to soothe the West’s fears about his country’s nuclear program, say Najmeh Bozorgmehr and James Blitz in Britain’s Financial Times, which Iran insists is for peaceful purposes. But it’s becoming pretty clear that neither side believes a word the other says. This week, Abbasi-Davani even accused International Atomic Energy Agency inspectors of having been infiltrated by "terrorists and saboteurs" who in August used explosives to knock out power to one of Iran’s uranium enrichment facilities. The IAEA, of course, denies the charge, and says Iran is simply unwilling to cooperate to provide "credible assurance" that it’s not trying to build a bomb.

More…

Jim Sinclair’s Commentary

Another title for this piece is "Euro to rise to mid 1.35 for second stop. Euro to kill massively short ex pat euro snobs."

Dollar Index Headed for Rapid Collapse: Chart Published: Monday, 17 Sep 2012 | 11:51 PM ET

Quantitative easing is really another word for currency wars. A weak U.S. currency puts continued pressure on the Japanese Yen, the Chinese Yuan, the South Korean Won, the Australian dollar and other currencies.

Cheap money also fuels speculation and this money quickly drifts into commodity markets and the ETFs that help propel commodity market speculation. This is inflationary for food prices.

The lower the U.S. dollar the greater the intensity of currency wars. The break below the key uptrend line on the Dollar Index chart was an early warning of the third round of quantitative easing (QE3). The most important question now is to use the chart to examine the potential downside limits of a QE3 weakened U.S. dollar.

The U.S. Dollar Index [.DXY 79.14  0.13 (+0.16%)

0.13 (+0.16%)  ]

is a basket of currencies. They are the Euro, yen, British Pound,

Canadian dollar, Swiss Franc and Swedish Krona. The Dollar Index is used

as a measure of the strength or weakness of the U.S. dollar.

]

is a basket of currencies. They are the Euro, yen, British Pound,

Canadian dollar, Swiss Franc and Swedish Krona. The Dollar Index is used

as a measure of the strength or weakness of the U.S. dollar.

There are three significant features on the weekly Dollar Index chart. The first feature is the uptrend line that started in September 2011.

One year later, in September 2012, the Dollar Index fell below this uptrend line. The weekly close below this uptrend line was the first signal of a major change in the trend direction. It came before the announcement of QE3, last week. Traders had good warning to move to the correct side of the new market trend by closing long side trades.

More…

Jim Sinclair’s Commentary

CIGA Craig asks if the next discovery will be unallocated gold and silver. I will add to his question how about allocated gold and silver?

Remember the soybean oil scandal in New Jersey when I was a young? When the creditors with liens against the tanks looked into the tanks there was nothing whatsoever but air.

Exclusive: Ghost warehouse stocks haunt China’s steel sector By Ruby Lian and Fayen Wong

SHANGHAI | Sun Sep 16, 2012 3:07pm EDT

(Reuters) – Chinese banks and companies looking to seize steel pledged as collateral by firms that have defaulted on loans are making an uncomfortable discovery: the metal was never in the warehouses in the first place.

China’s demand has faltered with the slowing economy, pushing steel prices to a three-year low and making it tough for mills and traders to keep up with payments on the $400 billion of debt they racked up during years of double-digit growth.

As defaults have risen in the world’s largest steel consumer, lenders have found that warehouse receipts for metal pledged as collateral do not always lead them to stacks of stored metal. Chinese authorities are investigating a number of cases in which steel documented in receipts was either not there, belonged to another company or had been pledged as collateral to multiple lenders, industry sources said.

Ghost inventories are exacerbating the wider ailments of the sector in China, which produces around 45 percent of the world’s steel and has over 200 million metric tons (220.5 million tons) of excess production capacity. Steel is another drag on a financial system struggling with bad loans from the property sector and local governments.

"What we have seen so far is just the tip of the iceberg," said a trader from a steel firm in Shanghai who declined to be identified as he was not authorized to speak to the media. "The situation will get worse as poor demand, slumping prices and tight credit from banks create a domino effect on the industry."

More…

Jim Sinclair’s Commentary

MSM’s near blackout on the developments in the Persian Gulf are broken by an Associated Press report. They must not have gotten the message that the word is mum.

Iran deploys Russian-made submarine in Gulf Associated Press – 14 mins ago

TEHRAN, Iran (AP) — Iran has deployed a Russian-made submarine after it was overhauled earlier this year.

State TV says Taregh-1 joined the fleet in the southern port of Bandar Abbas. It’s one of three Russian Kilo class submarines that Iran obtained in early 1990s.

Tehran has tried to build a self-sufficient military program since 1992 and has several smaller, Iranian-built submarines. In May, it had to repair another Russian-made sub.

Tuesday’s announcement comes as U.S.-led naval exercises are under way in the Persian Gulf. The drill is seen as a response to Iranian warnings it could close the strategic oil route in the Strait of Hormuz in retaliation for tighter Western sanctions. Tehran later withdrew the threat.

The U.S. and its allies suspect Iran is pursuing a nuclear weapon, a charge Iran denies.

More…

Jim Sinclair’s Commentary

QE is by definition a currency war.

Prepare for New ‘Currency Wars’ After QE3: Analyst Posted By: Holly Ellyatt | Assistant News Editor

17 Sep 2012 | 09:49 AM ET

The Federal Reserve and the European Central Bank’s new rounds of quantitative easing could herald a new era of “currency wars”, according to Bank of New York (BNY) Mellon research.

The dollar fell to a seven-month low against the yen and a four-month low against the euro last week after the Fed announced a new round of quantitative easing (QE3) on Thursday. Under the latest plan, the Fed will buy up $40 billion of mortgage-backed securities a month in order to stimulate the U.S. economy.

Adding insult to the greenback’s injury on Friday, the ratings agency Egan-Jones cut the U.S. sovereign rating to AA-minus from AA, saying the Fed’s QE3 would reduce the value of the dollar, rather than reduce national debt.

"The Fed’s QE3 will stoke the stock market and commodity prices, but in our opinion will hurt the U.S. economy and, by extension, credit quality," the firm said.

Central banks such as Brazil and others around the globe are already moving to mitigate the effects of the “debasement” of the dollar by taking “measures to prevent excessive currency strength,” according to BNY Mellon.

More…

Donations will help maintain this goal

and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

Remember when our problems were mostly just financial, when the scariest possibility was Greece leaving the eurozone and a few zombie banks evaporating? Those were the days.

This week, geopolitics — that is, guns, bombs, and ideology — pushed finance off the front burner. In the East China Sea, for instance, everyone has inexplicably become obsessed with a few barren islands and is apparently willing to trade blood for rocks:

Japanese firms shut plants in China as territorial row escalates

“Major Japanese firms have closed their factories in China and urged expatriate workers on Monday to stay home ahead of what could be further angry protests over a territorial dispute that threatens to hurt trade ties between Asia’s two largest economies.”

Read More @ DollarCollapse.com

Dear CIGAs,

Tanzania takes the lead in dealing with energy companies, affirming the sanctity of contracts.

Tanzania will not revoke any oil and gas PSAs -Energy Minister 1:13 PM Eastern Daylight Time Sep 18, 2012

DAR ES SALAAM, Sept 18 (Reuters) – Tanzania will not alter or revoke existing oil and gas contracts, its energy minister said on Tuesday, two days after he was widely reported in local media saying unfavourable deals would be scrapped.

"We are not trying to stop any business. We will not revoke any contract, we will respect all contracts," Energy and Minerals Minister Sospeter Muhongo told Reuters.

Muhongo said he had been misquoted in Tanzania’s local media.

(Reporting by Fumbuka Ng’wankilala in Dar Es Salaam and Kelly Golblom in Nairobi; Editing by Richard Lough)

((Email: nairobi.newsroom@reuters.com)(Tel: +254 20 222 4717)(Reuters Messaging: richard.lough.thomsonreuters.com@reuters.net))

Dear CIGAs,

This is a major game changer. It has taken place in a West African gold miner. It speaks to certain African countries as excellent investments. It underscores that prediction of 12 years ago.

It screams at undervaluation. It is the recognition that gold mines mine money. This is a recognition of the dwindling supply side of gold. This is a recognition that gold is the only Honest Money. This is a recognition of gold’s role in high tech.

The end of the bear market inflicted by the hedges on gold shares is absolutely over. The shorts in good gold shares after today are self destructively insane.

This is it for good gold shares. The long bull phase in gold shares starts now.

Cluff Gold plc

("Cluff Gold" or "the Company")

12 September 2012

AIM: CLF/TSX: CFG

Strategic Alliance between Cluff Gold and Samsung

Cluff Gold plc, the dual AIM/TSX listed West African focused gold mining company, is pleased to announce that it has signed a Memorandum of Understanding for a long term strategic partnership with Samsung C&T Corporation ("Samsung"). This alliance commences with an unhedged US$20m facility to provide additional funding to Cluff Gold to further the development of its portfolio of assets. The Memorandum of Understanding provides a general framework for the potential long term funding of Baomahun and other development opportunities.

The initial facility forms part of a wider strategic alliance between Cluff Gold and Samsung which is a global trading company. Cluff Gold has a producing mine, Kalsaka in Burkina Faso, and a strong pipeline of development assets which is expected to generate a long term production profile. Through this long term partnership Samsung will have access to a reliable supply of gold bullion, underpinned by the Company’s strong operational and management team whilst Cluff Gold will benefit from Samsung’s financial support. The relationship is expected to result in a significant financing in Cluff Gold’s Baomahun project, subject to the outcome of the feasibility study, together with an ongoing commitment to jointly assess other opportunities in the region.

Under the terms of the agreement signed today, an initial US$20m of debt finance will be drawn immediately, supported by the Company’s interest in its Kalsaka/Sega project. These funds will be used to strengthen the Company’s balance sheet and ensure the Company remains well funded during the development of Sega to continue the ongoing exploration and development work across its asset portfolio.

Subject to the outcome of the feasibility study, the alliance envisages a further substantial financing for the development of Cluff Gold’s Baomahun project in Sierra Leone, which has 2.1Moz of indicated resources (25.6Mt at 2.5g/t)[i]. Baomahun is fully permitted, with work ongoing to complete a feasibility study.

The Memorandum of Understanding does not require any exclusivity between Samsung and the Company in respect of further financing and is not binding on either party in that respect. Negotiations with other debt providers will continue in parallel with the due diligence undertaken by Samsung.

John McGloin, Chairman of Cluff Gold, commented:

"We are very pleased to have formed an alliance with Samsung as we develop our project portfolio. This agreement provides immediate financing support on competitive terms compared to other recent financings without the requirement to hedge any of our current or future gold production. More importantly, it also offers a framework for a cornerstone financing in the Baomahun project or other development opportunities, capable of satisfying a significant portion of the total Baomahun financing needs. The initial US$20m drawdown provides us with the balance sheet flexibility to use existing cash flow to fund our exploration programmes whilst maintaining development momentum at Sega and Baomahun. We look forward to working with Samsung as we deliver our Company strategy to grow into a mid-tier producer through the development of our existing portfolio whilst looking at other accretive growth opportunities in the region."

Link to full news release…

You can say any foolish thing to a dog, and the dog will give you a look that says, ‘Wow, you’re right! I never would’ve thought of that! –Dave Barry

Jim Sinclair’s Commentary

My suspicion is central planning intervention just like at the total of nine touches of gold at $1775 in a pre election period. It was that or release from the strategic petroleum stockpile which means nothing to gas prices.

Fat finger not likely cause of Monday oil plunge: CFTC’s Chilton Published: Tuesday, 18 Sep 2012 | 4:07 PM ET

WASHINGTON (Reuters) – A trader pressing the wrong key was not the likely cause of a brief plunge in oil prices on Monday, a top regulator at the Commodity Futures Trading Commission told Reuters.

"Based upon our initial review, it does not appear that a fat finger is the likely cause of the oil price dive yesterday," Commissioner Bart Chilton said on Tuesday.

Brent crude prices plummeted more than $3 in a matter of minutes just before 2 p.m. EDT (1800 GMT) on Monday as trading volumes – which had been muted by the Rosh Hashana holiday – shot up.

It was not immediately clear what caused the price plunge, but CFTC officials are looking into the matter.

More…

Jim Sinclair’s Commentary

I think we all heard of this many years ago.

Fed’s ‘QE-Infinity’ Will Push Gold to $2,400: Pro By John Melloy | CNBC

In one of the most bullish gold calls since the Federal Reserve announced a new round of easing last week, one strategist sees a 36 percent jump in the metal’s price (CEC:Commodities Exchange Centre: GCCV1), to $2,400 an ounce, by the end of 2014.

"The new target reflects our view that the Fed will maintain mortgage purchases until the end of 2014 and will move to buy Treasuries following the end of Operation Twist this coming December," wrote Francisco Blanch, a global investment strategist with Bank of America Merrill Lynch, in a note to clients Tuesday.

"Given the new open-ended nature of QE3, the upward pressure on gold prices should continue until employment is strong enough to require a change in policy," Blanch added. "In our view, this is unlikely to happen until the end of 2014."

Last week, the Federal Reserve announced its third round of stimulus since the financial crisis, saying it would buy $40 billion in mortgage-backed securities each month.

The Fed used open-ended language in describing how long so-called QE3 would last, saying in its statement it would continue these purchases – and possibly employ other methods – until the outlook for the labor market improves substantially.

More…

Donations will help maintain this goal and defray the operational costs. Paypal, a leading provider of secure online money transfers, will handle the donations. Thank you for your contribution.

I'm PayPal Verified

Jim Sinclair’s Commentary

I don’t know what Yoda will think of this.

Jim Sinclair’s Commentary

Slowly, slowly, the dollar moves away from its role as the international settlement mechanism. That is the loss of the bullish perk on a reserve currency going south.

Jim Sinclair’s Commentary

Mr. T. Ferguson has done a nice job of cutting through all the MSM commentary on QE by the time honored method of "Follow the Money." He clearly outlines how the banksters to their benefit act as what we used to call stooges to buy Treasury paper. As such, the Fed is Debt Monetizing without any question. Markets will wake up to what all this means soon. Gold is going to and through $3500 with all its usual and sometime bone grinding drama.

This educational piece is quite worth your time.

Brass Tacks Tuesday, September 18, 2012 at 10:13 am

OK, so it has been a few days since QE to infinity became official Fed policy. There is certainly an abundance of swirling news and discussion out there that dances around the real significance. Today, we cut to the chase.

Let’s go back and hit on the main FED points:

The Fed will keep rates "extraordinarily low" through 2015

The Fed will continue $45B/month in Operation Twist through year end

The Fed will begin buying $40B/month in mortgage-backed securities (MBS) with no end date or target purchase amount given

So many of us have been seemingly immunized against the jolting effect of these headlines. Not just here at TFMR but nearly everywhere that "awakened" citizens congregate on the internet. We take the headlines at face-value but rarely stop to consider things on the next level. But we need to go there today because without a full understanding of what the true meaning and implications are, you’re likely to delay actions that you should be immediately taking.

So, let’s go back to the three bullet points above and take them, one-by-one. First,

The Fed will keep rates "extraordinarily low" through 2015

What is The Fed telling you here? Well, a couple of things. First of all, 2015?? That’s three freaking years from now! It’s one thing to say that rates will stay low for the next 6-12 months. It’s something entirely different to say three freaking years! The negative implications of this are dramatic as institutions such as pension funds and insurance companies will be ravaged by the continuance of ZIRP. Additionally, however, what is The Fed telling you about their expectations of economic "recovery"? Despite all of their official forecasts of growth and jobs, it sure doesn’t seem that they believe it. Like the old adage says: Watch what they do, not what they say. We talk here incessantly about the miserable economy and the dim prospects for recovery. It is now clear that The Fed feels this way, too.

The Fed will continue $45B/month in Operation Twist through year end

First of all, remember what Operation Twist is. The Fed is selling their short-term maturity holdings (where there is actual demand for "safe havens") and using the proceeds to purchase longer-term notes and bonds. This process is considered "sterilized" because, allegedly, The Fed isn’t creating any new money. They are simply "re-positioning" some of their "assets". Whatever. I don’t care to get sidetracked as to whether or not this is really a "sterile" process. All that matters is that The Fed is currently executing this strategy to the tune of about $45B/month. The problem for them is, they’re almost out of short-term bills and notes to sell and, once this inventory of paper is depleted, the $45B/month is going to have to come from other, "non-sterile" sources.

The Fed will begin buying $40B/month in mortgage-backed securities (MBS) with no end date or target purchase amount given

And now here’s where it gets interesting. The key to this bullet point is the "no end date, open-ended" component. In fact, The Fed went so far as to state that they "stand ready" to increase the monthly amount of MBS purchases if "the labor market doesn’t improve". OK, again, watch what they do, not what they say.

ZIRP will continue through 2015 but Operation Twist runs out of funds and ends late this year. Well, then, from where will the $45B/month in Operation Twist be replaced. That’s an easy one. The Fed has already told you the answer. Since the labor market won’t be improving anytime soon, they will simply increase their monthly purchases of MBS from $40B to $85B.

An here’s where almost everyone drops the ball. The mainstream media will tell you that The Fed is "supporting the mortgage market" and "helping to keep homes affordable" with this program. This is complete, unadulterated BS. Sure, The Fed is buying $85B in MBS every month…but…from whom??? Which institutions own these MBS and are obligingly selling them to The Fed??? I’ll wait here and let you think about that one for a few moments…

The Primary Dealers! Goldman, The Morgue, MorganStanley, Citi, BoA…all of them. They own or purchase new the MBS which The Fed buys from them. And here’s the very important next step: The Primary Dealers turn around and use the proceeds from these sales to buy U.S. treasuries! To the tune of $85B/month. Let me do the math for you…that’s slightly more than one trillion dollars over the next year. And what does the Congressional Budget Office project the U.S. federal deficit to be in fiscal 2013? It will again be north of one trillion dollars, at a minimum. http://www.cbo.gov/publication/43539

At the end of the day…and here’s where we get down to brass tacks…last week The U.S. Federal Reserve announced a plan whereby they will be almost completely and directly monetizing the deficit spending of the U.S. government. Though the illusion of legitimate borrowing will be maintained and politicians will continue to claim that "we’re borrowing all of this from China", you should not be fooled. We have entered a new paradigm of direct debt monetization. By doing so, The Federal Reserve has begun the process of overt currency debasement and devaluation.

Your only financial protection from this game-ending disaster is the ownership of physical precious metal. Though, in the short-term, dollar-denominated paper assets may perform reasonably well, they offer no long-term protection against your inevitable loss of purchasing power and wealth. Only physical precious metal can protect you in the days ahead. Buy some and add to your stack before it’s too late.

More…

Jim Sinclair’s Commentary

It is all about energy. You were told this would occur 5 years ago.

Japan: Chinese Ships Enter Territorial Waters Posted September 18th, 2012 at 9:55 am (UTC-4)

Japan’s Coast Guard says at least two Chinese government vessels have entered territorial waters near Japanese-controlled islands, as a dispute escalates on the sensitive anniversary of Japan’s invasion of China.

The vessels are among 11 Chinese ships spotted Tuesday near the East China Sea islands, known as Senkaku in Japan and Diaoyu in China. Japanese authorities earlier turned away another Chinese patrol ship.

Two Japanese activists briefly landed on one the islands Tuesday, prompting an angry response from China’s Foreign Ministry, which called the act a “gravely provocative” violation of Chinese sovereignty.

The dispute over the mostly uninhabited islands led to a day of anti-Japan protests in major cities across China. In Beijing, at least 1,000 protesters marched outside the Japanese embassy, holding signs, chanting nationalistic slogans and calling for China to defend its claim to the islands. Many Japanese companies, including Honda, Toyota, Mitsubishi and Panasonic have cut back operations in China because of sporadic outbreaks of violence.

Tuesday is the 81st anniversary of the so-called Manchurian Incident, a pretext Japan used to invade China in 1931.

More…

Jim Sinclair’s Commentary

Yell at Yahoo, not me.

4 signs that Israel’s showdown with Iran is almost here By The Week’s Editorial Staff | The Week – 22 hrs ago

Israel warns that the clock is ticking, and that Iran is dangerously close to acquiring nuclear weapons. Is a long-feared military clash looking more and more likely?

Over the last several days, Israeli Prime Minister Benjamin Netanyahu has loudly and repeatedly urged that President Obama draw a "red line" that Iran’s nuclear program can’t cross, warning that without such a line, the Islamic Republic will likely be within reach of building its first atomic bomb in six or seven months. Obama administration officials say Netanyahu’s timetable is wrong, and that Tehran will need at least a year to gather the nuclear fuel it would need, and even longer to fit a warhead onto a missile. Is a violent showdown between Iran and Israel nearly here? Many analysts see Netanyahu’s increasingly vocal demands as proof that conflict is looming. Here, four other signs that the clock might really be running out:

1. Iran is getting more and more belligerent

Tehran hasn’t exactly been mending its ways in the face of aggressive warnings and tightening sanctions, says Tyler Durden at Zero Hedge. In fact, Iran’s Revolutionary Guard recently stoked tensions even further by admitting that "its troops are now on the ground in Syria," helping the embattled regime in its effort to wipe out the pro-democracy opposition. Of all the disturbing developments surrounding Iran’s refusal to curb its nuclear program, that could be the one "to light this whole mess on fire."

2. And accusing nuclear inspectors of sabotage