"I’m not authorized to make any sort of conclusions, but a plane cannot simply disintegrate"...

Things You'll Never See

Presented with no comment...

China Arrests Three High Frequency Traders For "Destabilizing The Market And Profiting From Volatility"

As the crackdown against Zexi was taking place, Shanghai police also arrested 3 suspects as they cracked a case of stock futures price manipulation involving over 11.3 billion yuan (US$1.8 billion), police said yesterday in a statement. According to Shanghai Daily, Yishidun, a commercial company registered in Jiangsu Province’s Zhangjiagang City in 2012, was found to use an illegal stock futures trading software to destabilize the market and profit from volatility.Turkish Stocks, Currency Soar As Protesters Gassed, Possible Erdogan Assassin Shot After Elections

WTI Crude Gives Up Friday's Surge Gains, Back To $45 Handle, Amid China Storage, Tanker Fears

Submitted by Tyler Durden on 11/02/2015 - 08:46 Disappointed "this time it's different" analysts point out better-than-expected China PMI, a relatively large decline Friday for U.S. rig count, and overall sentiment today as reasons why crude oil prices should not be falling, but after hitting 2 week highs Friday, with algos running stops on every swing, it appears the harsher reality of China's full storage, plunging tanker rates, an unquivering OPEC, and ongoing production levels is too much to bear for the bulls...

US Equities' "Impressive Rebound" Is Hollow Inside

Submitted by Tyler Durden on 11/02/2015 - 08:29 If one looks at the NDX alone, one would have to conclude that the bull market is perfectly intact. The same is true of selected sub-sectors, but more and more sectors or stocks within sectors are waving good-bye to the rally. Even NDX and Nasdaq Composite have begun to diverge of late, underscoring the extreme concentration in big cap names. Naturally, divergences can be “repaired”, and internals can always improve. The reality is however that we have been able to observe weakening internals and negative divergences for a very long time by now, and they sure haven’t improved so far. In terms of probabilities, history suggests that it is more likely that the big caps will eventually succumb as well.

The Best And Worst Performing Assets In October And YTD

Submitted by Tyler Durden on 11/02/2015 - 08:14 The torrid October, with its historic S&P500 point rally, is finally in the history books, and at least for a select group of hedge funds such as Glenview, Pershing Square and Greenlight and certainly their L.P.s, a very scary Halloween couldn't come fast enough, leading to losses between 15% and 20%. How did everyone else fare? Below, courtesy of Deutsche Bank's Jim Reid, is a summary of what worked in October (and YTD), and what didn't.When is somebody going to be honest... and downgrade goldmansucks to the junk status it should be and jail the fuckers...

Goldman Downgrades Valeant On "Lack Of Confidence" After Charlie Munger Slams Company

Submitted by Tyler Durden on 11/02/2015 - 07:14 A bigger problem for Valeant, however, emerged today when none other than Warren Buffett's right hand man Charlie Munger in an interview with Bloomberg "tore anew into the besieged drug company, calling its practice of acquiring rights to treatments and boosting prices legal but “deeply immoral” and “similar to the worst abuses in for-profit education.” And to prove just how much clout Munger does indeed have, moments ago the most important Wall Street bank, Goldman Sachs, downgraded Valeant to Neutral from Buy, cutting its share price target from $180 to $122.

Futures Rebound From Overnight Lows On Stronger European Manufacturing Surveys, Dovish ECB

Submitted by Tyler Durden on 11/02/2015 - 06:52 On a day full of Manufacturing/PMI surveys from around the globe, the numbers everyone was looking at came out of China, where first the official, NBS PMI data disappointed after missing Mfg PMI expectations (3rd month in a row of contraction), with the Non-mfg PMI sliding to the lowest since 2008, however this was promptly "corrected" after the other Caixin manufacturing PMI soared to 48.3 in October from 47.2 in September - the biggest monthly rise of 2015 - and far better than the median estimate of 47.6, once again leading to the usual questions about China's Schrodinger economy, first defined here, which is continues to expand and contract at the same time.Partner Of "China's Carl Icahn" Executed By Local Police After Attempting Escape Following Insider Trading Charges

Ok, this is China: crazy things happen all the time. But where things got outright ridiculous, was when moments ago when as China National Radio reports,

Wu Shuang, a partner of Xu Xiang's at Zexi, and also an insider

trading suspect, was shot and killed by Chinese police when he

"resisted and tried to escape."

Ok, this is China: crazy things happen all the time. But where things got outright ridiculous, was when moments ago when as China National Radio reports,

Wu Shuang, a partner of Xu Xiang's at Zexi, and also an insider

trading suspect, was shot and killed by Chinese police when he

"resisted and tried to escape."Here Are The Five "Good News" That Can Cause A Market Selloff According To Bank of America

- China PMI>50.5

- US ISM>52

- US payroll>225K

- US banks rally: XLF>$26 would confirm stronger “domestic demand” expectations.

- US dollar stable: if the Fed can hike without boosting dollar this is positive

The Military-Industrial Complex's Latest Best Friend - Barack Obama

Submitted by Tyler Durden on 11/01/2015 - 21:35 The Pentagon just won another small skirmish in its long war with Social Security and Medicare. That is the unstated message of the budget deal just announced gleefully by congressional leaders and the President. To understand why, let’s take a quick trip down memory lane.PBOC Fixes Chinese Yuan Higher By 0.54%, Most Since 2005

Submitted by Tyler Durden on 11/01/2015 - 20:48 As per the fixing limits established as part of the August 11 Yuan devaluation, moments ago the PBOC announced that it had set the Yuan at a USDCNY fixing of 6.3154, a strengthening of a massive 0.54% - the most since 2005 - following the manic end of trading PBOC intervention on Friday that sent the Yuan soaring some 300 pips from 6.3475 to 6.3175.Putin's Approval Rating Reaches A New High

Submitted by Tyler Durden on 11/01/2015 - 20:25 Vladimir Putin’s approval rating in Russia has soared to yet another all time high; leaving all those who don’t like Putin or were hoping for some sort of regime change in Russia continue to be out of luck. One reason why we are even posting about this is that the Western press has also reported on the event, employing a somewhat less neutral tone of voice. What makes the sour grapes style reporting in the Western media especially funny is that while it is true that the Kremlin exerts extraordinary influence on the media in Russia, one wonders in what way their reportage on Syria is different from the reporting in the happily self-censoring US mainstream media on the Iraq war, especially in the run-up to said war.The ONLY country with a brain...

Taking the Gloves Off

– Since the very inception of the financial crisis of 2008, many

nations in the West(such as Greece, Ireland, or Cyprus) have found that

they’ve lost not only financially to the banksters that caused it, but

even more sadly, they’ve found that they’ve lost their freedoms and

political sovereignty as well. This loss of freedom has been the worst

blow of all, for a man can lose his wealth, and still have all the

things needed for a good life. Freedom though, once lost, deprives a man

of his very dignity, and can be extraordinarily hard to win back.

Taking the Gloves Off

– Since the very inception of the financial crisis of 2008, many

nations in the West(such as Greece, Ireland, or Cyprus) have found that

they’ve lost not only financially to the banksters that caused it, but

even more sadly, they’ve found that they’ve lost their freedoms and

political sovereignty as well. This loss of freedom has been the worst

blow of all, for a man can lose his wealth, and still have all the

things needed for a good life. Freedom though, once lost, deprives a man

of his very dignity, and can be extraordinarily hard to win back.However, while we’ve had to endure heart-wrenching stories of countries being made into totally humiliated puppet-states of the banksters…there have been a few success stories of peoples maintaining their freedom & dignity after the banking crisis, and even dealing a mighty blow to the bankers. One such heartening exception has been Iceland, where this newest announcement there just reminded the world, that they dare to defend their people against unscrupulous money lenders. Read this, if you haven’t already:

Read More…

Did you know that the United Nations intends to have biometric identification cards in the hands of every single man, woman and child on the entire planet by the year 2030? And did you know that a central database in Geneva, Switzerland will be collecting data from many of these cards? Previously, I have written about the 17 new “Global Goals” that the UN launched at the end of September. Even after writing several articles about these new Global Goals, I still don’t think that most of my readers really grasp how insidious they actually are. This new agenda truly is a template for a “New World Order”, and if you dig into the sub-points for these new Global Goals you find some very alarming things.

For example, Goal 16.9 sets the following target…

Read More…

from Armstrong Economics:

Le Pen warns that France is subservient to Germany. She stands for independence and sovereignty, which is the cornerstone of the French Constitution. Hollande argues that they are creating a single Europe because of two wars, but he cannot see that this dictatorship is indeed creating massive discontent, which creates the risk of war. Le Pen states that the massive invasion of refugees is insane.

Hollande & Merkel fail to grasp that a successful Europe does not require one government and one cultural policy nor one currency with one debt. Europe should be the freedom of movement, free trade, but not one government. Even in the USA, there are rumblings of separatism for one policy in Washington that is against the culture of one state. Such dominant central governments have never survived. Even in Germany, Bavaria sees itself as Bavarian first and Germen second. The sovereignty of people should be respected.

Le Pen warns that France is subservient to Germany. She stands for independence and sovereignty, which is the cornerstone of the French Constitution. Hollande argues that they are creating a single Europe because of two wars, but he cannot see that this dictatorship is indeed creating massive discontent, which creates the risk of war. Le Pen states that the massive invasion of refugees is insane.

Hollande & Merkel fail to grasp that a successful Europe does not require one government and one cultural policy nor one currency with one debt. Europe should be the freedom of movement, free trade, but not one government. Even in the USA, there are rumblings of separatism for one policy in Washington that is against the culture of one state. Such dominant central governments have never survived. Even in Germany, Bavaria sees itself as Bavarian first and Germen second. The sovereignty of people should be respected.

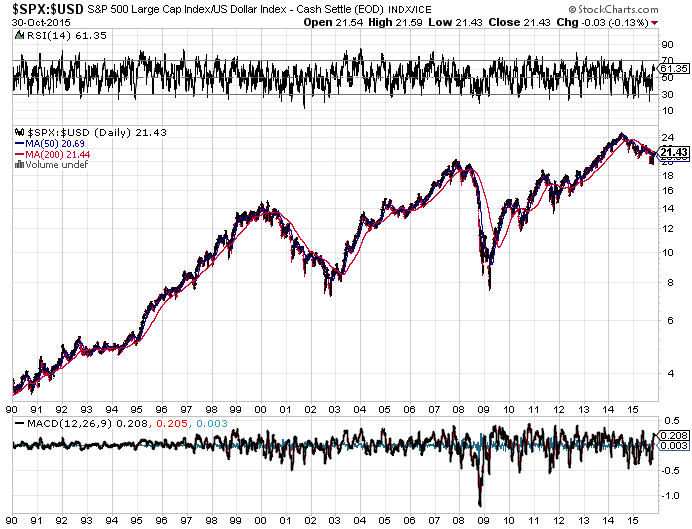

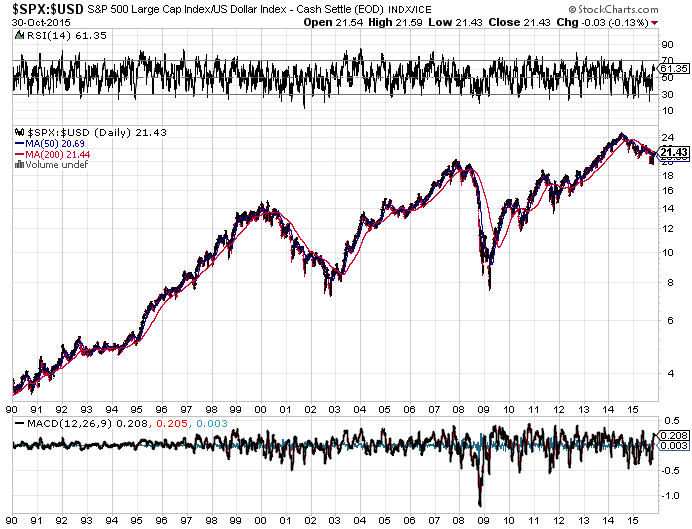

from Wolf Street:

Historically, the performance of the S&P 500 Index relative to

the US Dollar Index has been a good indicator of bull and bear markets.

This relationship is expressed in a ratio – the value of the S&P 500

index divided by the value of the U.S. Dollar Index:

Read More- In bull markets, the S&P 500/US Dollar Index ratio moves upward, the 200-day moving average slopes upward, and the ratio is above the 200-day moving average.

- In bear markets, the ratio moves downward, the 200-day moving average slopes downward, and the ratio is below the 200-day moving average.

by Justin O’Connell, GoldSilverBitcoin:

Entering into the gold business and starting your own gold dealing site is easier than ever. As goldbugs and silverbugs might notice, there is quite a bit of turnover in the online bullion retail scene. Moreover, the general websites that are highlighted are not the only ones. There are many, many online gold dealers who have carved out their own niche. The industry itself has gone through a lot of flux lately. We highlight in this article how you – Yes, YOU – can enter into the gold selling space. While we can’t go into certain technical details, this guide will make you aware of the tools you need. Here’s how.

There are numerous products precious metals oriented online retailers focus on, such as bullion gold, silver, platinum and palladium coins and bars, semi-numismatic gold and silver coins such as Morgan Dollars and Saint Gaudens (Pre-1993 gold coins), tube holders and survival gear. One thing many people, in my opinion, do not consider while opening a precious metals shop is jewelry. While precious metal coins oft carry small premiums – save for the Pre-1933 gold coins – jewelry has higher margins.

Read More

Entering into the gold business and starting your own gold dealing site is easier than ever. As goldbugs and silverbugs might notice, there is quite a bit of turnover in the online bullion retail scene. Moreover, the general websites that are highlighted are not the only ones. There are many, many online gold dealers who have carved out their own niche. The industry itself has gone through a lot of flux lately. We highlight in this article how you – Yes, YOU – can enter into the gold selling space. While we can’t go into certain technical details, this guide will make you aware of the tools you need. Here’s how.

There are numerous products precious metals oriented online retailers focus on, such as bullion gold, silver, platinum and palladium coins and bars, semi-numismatic gold and silver coins such as Morgan Dollars and Saint Gaudens (Pre-1993 gold coins), tube holders and survival gear. One thing many people, in my opinion, do not consider while opening a precious metals shop is jewelry. While precious metal coins oft carry small premiums – save for the Pre-1933 gold coins – jewelry has higher margins.

Read More

from The Daily Coin:

from Liberty Blitzkrieg:

By

inserting individual arbitration clauses into a soaring number of

consumer and employment contracts, companies like American Express

devised a way to circumvent the courts and bar people from joining

together in class-action lawsuits, realistically the only tool citizens

have to fight illegal or deceitful business practices.

By

inserting individual arbitration clauses into a soaring number of

consumer and employment contracts, companies like American Express

devised a way to circumvent the courts and bar people from joining

together in class-action lawsuits, realistically the only tool citizens

have to fight illegal or deceitful business practices.

By

inserting individual arbitration clauses into a soaring number of

consumer and employment contracts, companies like American Express

devised a way to circumvent the courts and bar people from joining

together in class-action lawsuits, realistically the only tool citizens

have to fight illegal or deceitful business practices.

By

inserting individual arbitration clauses into a soaring number of

consumer and employment contracts, companies like American Express

devised a way to circumvent the courts and bar people from joining

together in class-action lawsuits, realistically the only tool citizens

have to fight illegal or deceitful business practices.

Thousands

of cases brought by single plaintiffs over fraud, wrongful death and

rape are now being decided behind closed doors. And the rules of

arbitration largely favor companies, which can even steer cases to

friendly arbitrators, interviews and records show.

The

sharp shift away from the civil justice system has barely registered

with Americans. F. Paul Bland Jr., the executive director of Public

Justice, a national consumer advocacy group, attributed this to the

tangle of bans placed inside clauses added to contracts that no one

reads in the first place.

“Corporations

are allowed to strip people of their constitutional right to go to

court,” Mr. Bland said. “Imagine the reaction if you took away people’s

Second Amendment right to own a gun.”

Read Morefrom FutureMoneyTrends:

from Jesse’s Café Américain:

I like Dean Baker quite well, and often link to his columns. On most things we are pretty much on the same page.

I like Dean Baker quite well, and often link to his columns. On most things we are pretty much on the same page.

And to his credit he was one of the few ‘mainstream’ economists to actually see the housing bubble developing, and call it out. Some may claim to have done so, and can even cite a sentence or two where they may have mentioned it, like Paul Krugman for example. But very few spoke about doing something about it while it was in progress. The Fed was aware according to their own minutes, and ignored it.

The difficulty we have in the economics profession, I fear, is a great deal of herd instinct and concern about what others may say. And when the Fed runs their policy pennants up the flagpole, only someone truly secure in their thinking, or forsworn to some strong ideological interpretation of reality or bias if we are truly honest, dare not salute it.

Read More

I like Dean Baker quite well, and often link to his columns. On most things we are pretty much on the same page.

I like Dean Baker quite well, and often link to his columns. On most things we are pretty much on the same page.And to his credit he was one of the few ‘mainstream’ economists to actually see the housing bubble developing, and call it out. Some may claim to have done so, and can even cite a sentence or two where they may have mentioned it, like Paul Krugman for example. But very few spoke about doing something about it while it was in progress. The Fed was aware according to their own minutes, and ignored it.

The difficulty we have in the economics profession, I fear, is a great deal of herd instinct and concern about what others may say. And when the Fed runs their policy pennants up the flagpole, only someone truly secure in their thinking, or forsworn to some strong ideological interpretation of reality or bias if we are truly honest, dare not salute it.

Read More

from Greg Hunter:

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment