Late

last week, a consortium of financial regulators in the United States,

including the Federal Reserve and the FDIC, issued an astonishing

condemnation of the US banking system, highlighting “continuing gaps between industry practices and the expectations for safe and sound banking.” They identified a huge jump in risky loans due to overexposure to weakening oil and gas industries.

Make no mistake; this is not chump change. The total exceeds $3.9

trillion worth of risky loans that US banks made with your money. Given that even the Fed is concerned about this, alarm bells should be ringing.

Obama Explains Why 'The Greatest Corporate Power Grab In History' Is "The Right Thing For America"

While some have called The Trans-Pacific Partnership, "the most brazen corporate power grab in American history," President Obama tells Americans - in an Op-Ed released today - that "it’s the right thing to do for our economy, for working Americans and for our middle class" Despite indepedent analysis that appears to confirm the creeping corporate coup d’état along with the final evisceration of national sovereignty, President Obama explains - in simple words - ObamaTrade is "a trade deal that helps working families get ahead," due, inhis opinion, to the "toughest global labor laws" which will allow American workers to compete on a so-called "level playing field."

It's Time To Blame The Weather Again: BofA, Citi Accuse Warm Weather For Poor Retail Sales

Behold! More shark jumping as BofA, Citi blame warm weather for weak October retail sales: "We believe abnormal weather patterns may have biased retail ex-auto sales lower in October."

Apple Cuts Component Orders By 10% Due To Weak iPhone 6s Demand: Credit Suisse

"Apple has lowered its component orders by as much as 10% according to our teams in Asia. The cuts seem to be driven by weak demand for the new iPhone 6s, as overall builds are now estimated to be below 80mn units for the December quarter and between 55-60mn units for the March quarter."

Billionaire Chinese "Beverly Hillbilly" Pays $170 Million For Naked Woman At Christie's

In what's being described as a "palpably tense" tense auction, a "Chinese Beverly Hillbilly" dubbed "The Eccentric Mr. Liu" paid the second highest price at auction in history for a Modigliani.

US Import Prices Tumble, Ex-Fuel Drop Biggest Since 2009 As World Races To Export Its Deflation

Submitted by Tyler Durden on 11/10/2015 - 08:44 The global export of deflation continues as import prices to the US dropped 0.5% MoM in October (notably more than expected) and recent history was revised markedly lower with the 7th miss in 2015. Year-over-year, prices also fell more than expected - down 10.5% vs -9.4% exp. - the biggest miss since April and hovering near the weakest in the cycle. This is the 15th month in a row of year-over-year declines in import prices. But most critically, Ex-petroleum, this is the biggest drop in import prices since 2009.Gold & Silver Slammed As Dollar Soars - 9th Down Day In A Row

As the USDollar surges ahead this morning - crushing the hopes and hupes of corporate earnings in America - so precious metals are being battered once again. Silver is now down for the 9th consecutive day - the longest streak in 8 months; and Gold is down again (after a brief reprieve yesterday) to its lowest levels in 3 months.

China Sends Fighter Jets To Island, Demands No Mention Of "Contentious Issues" At Summit

On the heels of Washington's move to send a guided missile destroyer to Subi Reef, Beijing has now moved its fighter jets closer to the Spratlys in what certainly looks like an effort to "deter" any further "meddling" by the US and its regional allies.EURUSD Crashes To 1.06 Handle - 7-Month Lows

It appears the stop sbelow yesterday's lows (following The ECB's jawboning of "big cuts" in rates) have been run, sparking a 40 pip waterfall to a 1.06 handle in EURUSD (and there are more ECB speakers to come). These are 7-month lows in EURUSD and are pressing The USD Index to break April's highs.

Valeant Business Update Call Dial-In Details

The Valeant drama continues, and one day after Bill Ackman hosted another desperate call to convince LPs in his fund not to submit redemption requests following a $2+ billion loss on his VRX investment (and maybe buy a little here and there), here comes Valeant itself which in a few moments will provide a "business update for investors on a conference call to be held Tuesday, November 10, 2015 at 8:00 a.m. ET."

Goldman Sees 60% Chance Current "Expansion" Continues Another 4 Years, Becomes Longest Ever

"Using a dataset on developed market business cycles, we calculate that the unconditional odds that a six-year-old expansion will avoid recession for another four years—and mature into a 10-year-old expansion—are about 60%."Frontrunning: November 10

- Bonds Rise as China Drags Down Metals, Selloff in Stocks Resumes (BBG)

- European Stock Rally Runs Out of Steam Amid China Growth Concern (BBG)

- Obama's immigration action blocked again; Supreme Court only option left (Reuters)

- Ukraine: Cyberwar’s Hottest Front (WSJ)

- With $170.4 Million Sale at Auction, Modigliani Work Joins Rarefied Nine-Figure Club (NYT)

- IEA Sees OPEC Market Share Growth in 2020 as Rivals Stagnate (BBG)

Global Stocks Fall For 5th Day On Disturbing Chinese Inflation Data; Renewed Rate Hike Fears; Copper At 6 Year Low

The ongoing failure of China to achieve any stabilization in its economy, after already cutting interest rates six times in the past year, and the prospect of a U.S. interest rate hike in December, had made markets increasingly jittery and worried which is not only why the S&P 500 Index had its biggest drop in a month, but thanks to the soaring dollar emerging market stocks are falling for a fourth day - led by China - bringing their decline in that period to almost 4 percent, and the global stock index down for a 5th consecutive day.

Chinese Stocks Longest Win Streak Since Bubble Peak After CPI, Commodities Tumble; Philippines Exports Crash

A busy night in Asia began with a total collapse in Philippines Exports (-24.7% YoY - the biggest miss since Lehman). This was quickly followed by a 0.3% drop (deflation) in CPI MoM (thanks to a drop in pork -1.9%, eggs -6.9%, and veggies -5.6%) which sparked buying in stocks (because moar stimulus). Chatter of a few large fund houses under investigation stymied the rally quickly but as nobody was summoned stocks recovered, then rallied strongly back into the green on renewed chatter of Stock Connect occurring sooner than expected. With CSI-300 (China's S&P 500), up at the break, this is the longest winning streak since the peak of the bubble in May. And finally Shanghai Copper and Nickel tumbled to new multi-year lows, dragging Bloomberg's Commodity Index to fresh 16-year lows.

Every day, we have investment banks and others telling us that the Australian housing party is over. Estimates for price declines over the next year or so vary from 7.5% to a plunge of 25%.

Even the Reserve Bank of Australia is in on the act. But it is trying to put a positive spin on any downturn after having for years encouraged new house and apartment construction as being “good for the economy.”

The full impact of new housing supply will not be felt for a year or so. It is almost certain that there will be a major surplus when everything now under construction is complete. This is a bad omen for the Australian economy, where building and selling of houses and apartments has been playing an outsized role.

Read More

from Zen Gardner:

What scares you off? What do you resign yourself to as some fundamental reality regarding the powers that appear to be and what you can or cannot do about yours or humanity’s situation? More subtly, what makes you stand back in an intimidated state of awe-stricken wonder, whether consciously or subconsciously?

Scarecrow’s are straw dummies, crude approximations of humans hanging on a stick to scare away crows and other predators from feeding on farmers’ crops. Sound familiar?

We can see it today in society, and it’s worked for millennia. This cowered sense of frozen resignation to self appointed higher powers ruling mankind is rampant in the human psyche.

Read More…

What scares you off? What do you resign yourself to as some fundamental reality regarding the powers that appear to be and what you can or cannot do about yours or humanity’s situation? More subtly, what makes you stand back in an intimidated state of awe-stricken wonder, whether consciously or subconsciously?

Scarecrow’s are straw dummies, crude approximations of humans hanging on a stick to scare away crows and other predators from feeding on farmers’ crops. Sound familiar?

We can see it today in society, and it’s worked for millennia. This cowered sense of frozen resignation to self appointed higher powers ruling mankind is rampant in the human psyche.

Read More…

by Jeff Nielson, Bullion Bulls Canada:

It’s now completely obvious that China is buying gold on the open

market every month, after at least 6 years where it bought ZERO gold on

the open market. As I noted at the beginning of this thread (and with my

“Gold Wars” commentaries), China’s open market purchases began at

roughly the same time that the One Bank and India’s new, corrupt

government launched their “gold deposit scheme” (and “gold bond scheme”)

to STEAL the gold of Indians.

It’s now completely obvious that China is buying gold on the open

market every month, after at least 6 years where it bought ZERO gold on

the open market. As I noted at the beginning of this thread (and with my

“Gold Wars” commentaries), China’s open market purchases began at

roughly the same time that the One Bank and India’s new, corrupt

government launched their “gold deposit scheme” (and “gold bond scheme”)

to STEAL the gold of Indians.

There is now no doubt that this is total fraud (assuming any doubt existed), because as noted in another recent post, India’s government has announced it will “AUCTION OFF” the gold that it is supposedly “storing” for Indians. Let me repeat, after urging Indians to “deposit” their gold with India’s government — so they can collect some paper “interest” on that gold — India’s government is now publicly announcing that it will be SELLING their gold “from time to time”.

Read More

There is now no doubt that this is total fraud (assuming any doubt existed), because as noted in another recent post, India’s government has announced it will “AUCTION OFF” the gold that it is supposedly “storing” for Indians. Let me repeat, after urging Indians to “deposit” their gold with India’s government — so they can collect some paper “interest” on that gold — India’s government is now publicly announcing that it will be SELLING their gold “from time to time”.

Read More

from X22Report:

filed under (unt

Rubio and Clinton are ‘the same person’

by Steve Watson, Infowars:

Presidential candidate Rand Paul says he sees Hillary Clinton as the

most neoconservative candidate in the election race, and that he sees no

difference between her and his GOP rival Marco Rubio.

Presidential candidate Rand Paul says he sees Hillary Clinton as the

most neoconservative candidate in the election race, and that he sees no

difference between her and his GOP rival Marco Rubio.

Speaking with Jake Tapper on CNN’s “State of the Union,” Paul also declared that Clinton is the most likely candidate to embroil the US in further war in the Middle East if she is elected President.

Read More

by Steve Watson, Infowars:

Presidential candidate Rand Paul says he sees Hillary Clinton as the

most neoconservative candidate in the election race, and that he sees no

difference between her and his GOP rival Marco Rubio.

Presidential candidate Rand Paul says he sees Hillary Clinton as the

most neoconservative candidate in the election race, and that he sees no

difference between her and his GOP rival Marco Rubio.Speaking with Jake Tapper on CNN’s “State of the Union,” Paul also declared that Clinton is the most likely candidate to embroil the US in further war in the Middle East if she is elected President.

Read More

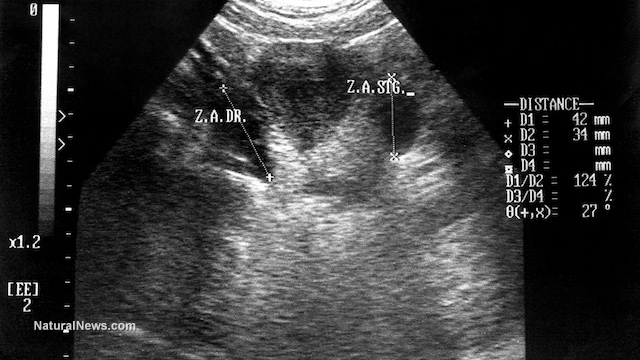

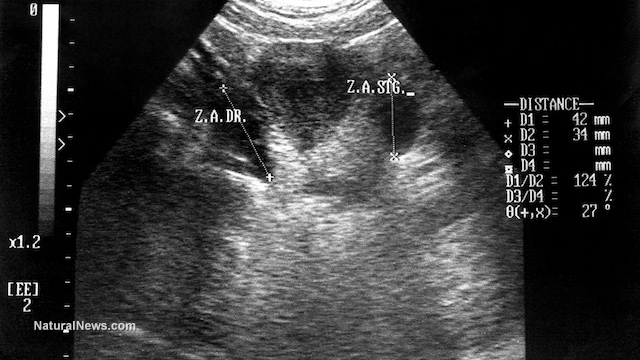

by L.J. Devon, Natural News:

A new undercover video released by the Center for Medical Progress

reveals the horrors and illegal practices occurring at Planned

Parenthood, the top feticide foundation in the US. In the video, a 2nd

trimester abortion provider from Austin, Texas openly admits to the

strategies used to extract intact fetal organs, extremities, and heads.

The body parts are donated to “scientific research” to create new

pharmaceuticals, among other ghastly-derived modern day science hokum.

A new undercover video released by the Center for Medical Progress

reveals the horrors and illegal practices occurring at Planned

Parenthood, the top feticide foundation in the US. In the video, a 2nd

trimester abortion provider from Austin, Texas openly admits to the

strategies used to extract intact fetal organs, extremities, and heads.

The body parts are donated to “scientific research” to create new

pharmaceuticals, among other ghastly-derived modern day science hokum.

Investigators posing as representatives for a fetal tissue procurement company conducted the interview on October 12, 2014. In the interview, abortion provider Dr. Amna Dermish describes how fetuses are meticulously removed from the womb to keep as many body parts intact as possible.

Dermish admits to using ultrasound to guide the fetus into certain breached positions. The fetus is then delivered partially (as in a partial birth abortion) so the body parts remain intact so they can be sold or donated to biotech companies.

Read More

A new undercover video released by the Center for Medical Progress

reveals the horrors and illegal practices occurring at Planned

Parenthood, the top feticide foundation in the US. In the video, a 2nd

trimester abortion provider from Austin, Texas openly admits to the

strategies used to extract intact fetal organs, extremities, and heads.

The body parts are donated to “scientific research” to create new

pharmaceuticals, among other ghastly-derived modern day science hokum.

A new undercover video released by the Center for Medical Progress

reveals the horrors and illegal practices occurring at Planned

Parenthood, the top feticide foundation in the US. In the video, a 2nd

trimester abortion provider from Austin, Texas openly admits to the

strategies used to extract intact fetal organs, extremities, and heads.

The body parts are donated to “scientific research” to create new

pharmaceuticals, among other ghastly-derived modern day science hokum.Investigators posing as representatives for a fetal tissue procurement company conducted the interview on October 12, 2014. In the interview, abortion provider Dr. Amna Dermish describes how fetuses are meticulously removed from the womb to keep as many body parts intact as possible.

Dermish admits to using ultrasound to guide the fetus into certain breached positions. The fetus is then delivered partially (as in a partial birth abortion) so the body parts remain intact so they can be sold or donated to biotech companies.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment