Submitted by Tyler Durden on 02/08/2016 - 16:04

by Bill Holter, JS Mineset:

A topic I have written about before, “GAPS”. This is no acronym, simply

a description of what is going to happen, probably quite soon! If you

don’t now what a gap is now, you will know it when you see it! In

technical terms, a “gap” opening is when a market opens either higher

than the previous day’s high and does not trade down to that previous

high …or, trades below the previous low and does not trade back up to

that low. On a chart this action will leave a “gap” of emptiness

signifying no trading took place in the gap area.

A topic I have written about before, “GAPS”. This is no acronym, simply

a description of what is going to happen, probably quite soon! If you

don’t now what a gap is now, you will know it when you see it! In

technical terms, a “gap” opening is when a market opens either higher

than the previous day’s high and does not trade down to that previous

high …or, trades below the previous low and does not trade back up to

that low. On a chart this action will leave a “gap” of emptiness

signifying no trading took place in the gap area.

One place we are already seeing “gaps”, many in fact, are the gold and silver mining stocks. Since the beginning of the year there have been four or five instances where these gaps have occurred. Under “normal” circumstances, almost all gaps get “filled”. Meaning the asset in question will ultimately trade back to the gap levels and “fill” in the chart. We in my opinion are in no way living in “normal” times and the current and coming gap openings will be huge and never be filled. “Never” is a very long time, in this case it will be a generation or more in many asset classes.

Read More

A topic I have written about before, “GAPS”. This is no acronym, simply

a description of what is going to happen, probably quite soon! If you

don’t now what a gap is now, you will know it when you see it! In

technical terms, a “gap” opening is when a market opens either higher

than the previous day’s high and does not trade down to that previous

high …or, trades below the previous low and does not trade back up to

that low. On a chart this action will leave a “gap” of emptiness

signifying no trading took place in the gap area.

A topic I have written about before, “GAPS”. This is no acronym, simply

a description of what is going to happen, probably quite soon! If you

don’t now what a gap is now, you will know it when you see it! In

technical terms, a “gap” opening is when a market opens either higher

than the previous day’s high and does not trade down to that previous

high …or, trades below the previous low and does not trade back up to

that low. On a chart this action will leave a “gap” of emptiness

signifying no trading took place in the gap area.One place we are already seeing “gaps”, many in fact, are the gold and silver mining stocks. Since the beginning of the year there have been four or five instances where these gaps have occurred. Under “normal” circumstances, almost all gaps get “filled”. Meaning the asset in question will ultimately trade back to the gap levels and “fill” in the chart. We in my opinion are in no way living in “normal” times and the current and coming gap openings will be huge and never be filled. “Never” is a very long time, in this case it will be a generation or more in many asset classes.

Read More

After Crashing, Deutsche Bank Is Forced To Issue Statement Defending Its Liquidity

Submitted by Tyler Durden on 02/08/2016 - 14:33 "Today Deutsche Bank published updated information related to its 2016 and 2017 payment capacity for Additional Tier 1 (AT1) coupons based on preliminary and unaudited figures. The 2016 payment capacity is estimated to be approximately EUR 1 billion, sufficient to pay AT1 coupons of approximately EUR 0.35 billion on 30 April 2016."

Gundlach: Bonds Won't Bottom Until Panic Sends VIX Above 40

Submitted by Tyler Durden on 02/08/2016 - 16:52 More troubling for the bulls who are unable to get the much needed close of trading panic flush as a result of daily last hour levitations is Gundlach's call that the VIX needs to surge above 40 before a bottom can be made in the high-yield junk bond market. Today the VIX closed up 11% to 26.00, a long way off from the panic and revulsion that would send it north of 40. Indeed, the last time the VIX rose above that level was on August 24, when the VIX calculation actually was broken for a brief period of time to avoid crushing countless VIX-linked investors.

The Bubble Deflates – And Crash Risk Rises

Submitted by Tyler Durden on 02/08/2016 - 16:30 We already suspected in mid 2013 (worrying about the market far too early as it has turned out in hindsight) that there were parallels to what happened in the late 1990s bull market, specifically near its end in the year 2000. However, in the meantime, even more such parallels have become noticeable.Stress in the financial sector triggered by worries over global growth and the impact of negative interest rates drove European share prices to their lowest in 16 months on Monday and sent the cost of insuring bank debt soaring.

Concern over the health of the sector, which has prompted comparisons with the early days of the global financial crisis in 2008, pushed borrowing costs in the euro zone’s most indebted countries higher and sent investors to the relative safety of ultra-low-risk government debt.

Read More

… It’s early Monday, and gold is surging, silver is unchanged, and everything else is collapsing – from stocks, to Treasury yields, crude oil prices, and currencies. I was initially going to discuss the news that China’s currency reserves declined by another $100 billion in January, taking the total down to roughly $1 trillion in the past year alone; and the fact that, per yesterday’s “will Wednesday be the Yellen Reversal?” article, money market “betting” on the Fed taking interest rates negative has exploded.

Or better yet, this weekend’s utterly astonishing news that Europe’s largest bank, and purveyor of over-the-counter derivatives, Deutschebank (i.e., the NEXT LEHMAN), amidst an utterly imploding stock price and exploding credit default swap rate – took the unprecedented, extraordinary step of writing an open letter to the ECB and Bank of Japan to STOP reducing interest rates – claiming NIRP is destroying the system by increasing the risks of stock, bond, currency and commodity collapses. Read More

Credit Better Be Wrong This Time

Submitted by Tyler Durden on 02/08/2016 - 16:16 Who do you trust?

by Mac Slavo, SHTFPlan:

Back in the 1970’s as recession gripped the world for a decade, stocks stagnated and commodities crashed, investor Jim Rogers made a fortune. His understanding of markets, capital flows and timing is legendary.

As crisis struck in late 2008, he did it again, often recommending gold and silver to those looking for wealth preservation strategies – move that would have paid of multi-fold when precious metals hit all time highs in 2011. He warned that the crash would lead to massive job losses, dependence on government bailouts, and unprecedented central bank printing on a global scale.

Read More

Back in the 1970’s as recession gripped the world for a decade, stocks stagnated and commodities crashed, investor Jim Rogers made a fortune. His understanding of markets, capital flows and timing is legendary.

As crisis struck in late 2008, he did it again, often recommending gold and silver to those looking for wealth preservation strategies – move that would have paid of multi-fold when precious metals hit all time highs in 2011. He warned that the crash would lead to massive job losses, dependence on government bailouts, and unprecedented central bank printing on a global scale.

Read More

Monday Humor: A Preview Of The Bernie Sanders Presidency

Pres(ident)ed with no comment.

Either Banks Are Cheap... Or The Market's Gonna Crash

Submitted by Tyler Durden on 02/08/2016 - 15:35 Simply put, either large cap Financials are cheap, or the entire U.S. equity market is still overpriced. Their precipitous decline year to date means markets fear they are both the transmission mechanism for a global slowdown/recession to come and a primary victim of that event.

"We Can Put Refugees On Buses": Leaked Memo Shows Erdogan Blackmailed Europe For Billions

Submitted by Tyler Durden on 02/08/2016 - 15:17 Turkish President Recep Tayyip Erdogan's bullying isn’t confined to his domestic political agenda. Greek media has obtained an internal memo which suggests the Turkish strongman effectively blackmailed the EU by demanding cash payments in exchange for efforts to curb the flow of migrants into Western Europe "So how will you deal with the refugees if you don't get a deal? Kill them?"

The Increasingly Fragile Upper-Middle Class

Submitted by Tyler Durden on 02/08/2016 - 15:00 The upper-middle class that's supported the "recovery" with massive discretionary spending is far more vulnerable to implosion/insolvency than is generally appreciated.

After The European Bank Bloodbath, Is Canada Next?

Submitted by Tyler Durden on 02/08/2016 - 14:52 Here is the one chart showing why the time to panic about Canadian banks may have finally arrived...

"Timmy" Geithner Gets Loan From Jamie Dimon For PE Investment

“You are in a position to make 20 percent to 30 percent on your position in the fund. Why wouldn’t you buy in at Libor-plus to leverage that up?”

from Sovereign Man:

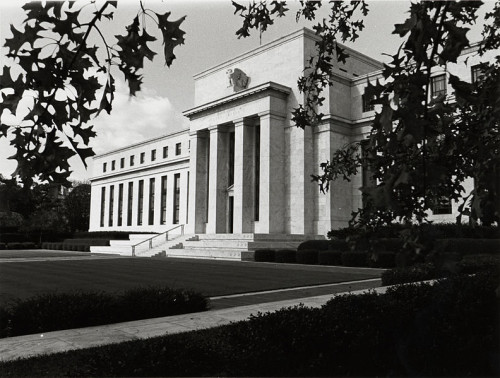

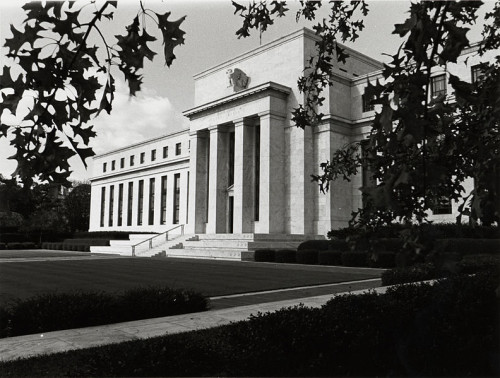

A Shandong 5000 electroglide flatbed currency printing machine named ‘Ted’ has edged ahead in a fiercely competitive fight for the chairmanship of the US Federal Reserve, narrowly in front of its major rival, the Heidelberger Druckmaschinen high speed sheet fed rotary offset press, christened ‘Heidi’.

In an ominous sign for supporters of the Heidelberger Druckmaschinen candidacy, a number of US Senate Republicans are circulating a letter supporting the Shandong 5000 model in its quest to replace Janet Yellen at the head of the world’s most important central bank.

Read More

A Shandong 5000 electroglide flatbed currency printing machine named ‘Ted’ has edged ahead in a fiercely competitive fight for the chairmanship of the US Federal Reserve, narrowly in front of its major rival, the Heidelberger Druckmaschinen high speed sheet fed rotary offset press, christened ‘Heidi’.

In an ominous sign for supporters of the Heidelberger Druckmaschinen candidacy, a number of US Senate Republicans are circulating a letter supporting the Shandong 5000 model in its quest to replace Janet Yellen at the head of the world’s most important central bank.

Read More

from The Burning Platform:

Reserve economic stimulus plan is edging toward the Twilight Zone now that the Fed sees its recovery about to be eaten by an economic apocalypse greater than its imagination could conceive. Though many think of central bankers as stogy and uncreative, the Fed has been quite creative when it comes to massive economic ideas that don’t work or are extremely repressive to normal market functioning.

Take for example this one:

Federal Reserve Economic Stimulus Plan I

I would summarize all of the Federal Reserve’s past economic stimulus plans as follows:

Read More

Reserve economic stimulus plan is edging toward the Twilight Zone now that the Fed sees its recovery about to be eaten by an economic apocalypse greater than its imagination could conceive. Though many think of central bankers as stogy and uncreative, the Fed has been quite creative when it comes to massive economic ideas that don’t work or are extremely repressive to normal market functioning.

Take for example this one:

Federal Reserve Economic Stimulus Plan I

I would summarize all of the Federal Reserve’s past economic stimulus plans as follows:

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment