"I know how you get things done. I am a progressive who wants to make progress and actually produce real results in people's lives. That's what I'm offering."

by Pam Martens and Russ Martens, Wall Street on Parade:

Today’s digital edition of The New York Times captures the essence of the cancer eating away at our democracy: a leading newspaper is endorsing a deeply tarnished candidate for the highest office in America while a major Wall Street bank that has played a key role in her conflicted candidacy runs a banner ad as if to salute the endorsement. The slogan on Citigroup’s ad, “cash back once just isn’t enough,” perfectly epitomizes the frequency with which the Clintons have gone to the Citigroup well.

According to the Center for Responsive Politics, among the top five largest lifetime donors to Hillary’s campaigns, Citigroup tops the list, with three other Wall Street banks also making the cut: Goldman Sachs, JPMorgan Chase and Morgan Stanley. (The monies come from employees and/or family members or PACs of the firms, not the corporation itself.)

Read More…

Today’s digital edition of The New York Times captures the essence of the cancer eating away at our democracy: a leading newspaper is endorsing a deeply tarnished candidate for the highest office in America while a major Wall Street bank that has played a key role in her conflicted candidacy runs a banner ad as if to salute the endorsement. The slogan on Citigroup’s ad, “cash back once just isn’t enough,” perfectly epitomizes the frequency with which the Clintons have gone to the Citigroup well.

According to the Center for Responsive Politics, among the top five largest lifetime donors to Hillary’s campaigns, Citigroup tops the list, with three other Wall Street banks also making the cut: Goldman Sachs, JPMorgan Chase and Morgan Stanley. (The monies come from employees and/or family members or PACs of the firms, not the corporation itself.)

Read More…

Clinton Gets $6 Million From Soros As Money Race Winners Revealed Ahead Of Iowa Caucus

On Sunday night we got a look at the 2015 campaign reports for US presidential candidates as the deadline for FEC filings came and went. There were a number of notable donations, but the headline grabber was George Soros who in the second half of last year gave $6 million to Hillary Clinton’s super PAC. Meanwhile, Donald Trump spent nearly $1 million on hats.

Explaining The "Rise Of The American Protest Vote": It's The "Popular Discontent," Stupid

Submitted by Tyler Durden on 02/01/2016 - 10:12 "Unless the root causes of popular discontent are addressed (uneven growth, pockets of high unemployment and weak wage growth), the protest vote is unlikely to go away. In fact, it may well grow."

US Manufacturing Remains In Recession As ISM Misses, Contracts For Fourth Month

Submitted by Tyler Durden on 02/01/2016 - 10:06 While January's final manufacturing PMI print disappointed (52.4 vs 52.6 expectations) and dropped from its initial print, its still managed a seasonally-adjusted bounce off December's two year lows. As Markit warned, this is still one of the worst prints in the last 2 years as "the manufacturing sector continues to struggle against the headwinds of weak global demand, the strong dollar, slumping investment in the energy sector and rising financial market uncertainty." ISM Manufacturing also rose very modestly but disappointed as December's data was revised lower still with employment crashing to June 2009 lows.

WTI Crude Plunges To $31 Handle As Production Cut Gains Entirely Erased

Submitted by Tyler Durden on 02/01/2016 - 09:57 Denials and Goldman's dismissal and Thursday's exuberance is done...IEX Strikes Back: Charges NYSE With "Tiering" Order Flow, Shows "Latency Arbitrage" Is Real

Submitted by Tyler Durden on 02/01/2016 - 09:49 Since granting IEX exchange status would lead to an immediate market structure disruption, one which would impair such embedded HFT players as Citadel which, as we have explained previously is the NY Fed's preferred "arms length" intermediator in the market to ingite momentum at critical downward junctions, we are very skeptical that when all is said and done, the SEC will grant IEX what it wants: after all there are too many status quo revenue models at stake, not to mention a potential threat to the Fed's preferred market "intervention" pipeline.

The Best And Worst Performing Assets Of A Miserable January

Submitted by Tyler Durden on 02/01/2016 - 09:20 As DB's Jim Reid points out, it was definitely not the easiest start to the year with many global equity markets suffering from their worst January in a post-Lehman world.

Chipotle Jumps Ahead Of Earnings As CDC Expected To Say Epidemic Is "Over"

Submitted by Tyler Durden on 02/01/2016 - 09:15 Great timing for a short-squeeze rumor? With Chipotle due to report what is likely to be ugly earnings after the bell today, CNBC reports (citing Dow Jones) that the CDS may declare an end to the E.Coli outbreak today. This, as we suggested last night, has ripped stocks 4-5% higher (to one-week highs) squeezing shorts.

Gold And Gold Stocks - A Meaningful Reversal?

Submitted by Tyler Durden on 02/01/2016 - 08:53 The recent reversal is definitely positive. Both false breakouts and false breakdowns often turn out to be reliable trend change signals. An additional bonus in this case was that the initial breakdown has induced widespread capitulation. Contrary to the immediately preceding rally attempt, the current one has been a “scared rally” so far. The mainstream financial press is still busy penning obituaries on gold, which is generally a good sign as well.

Savings Rate Surges To Highest Since 2012 As Spending Disappoints

Submitted by Tyler Durden on 02/01/2016 - 08:39 The Keynesians will not be pleased. Despite the holiday season, December spending disappointed with no change MoM (0.0% vs +0.1% exp). This is further sentiment-destructivbe as income data rose more than expected MoM (+0.3% vs +0.2% exp) even as income growth YoY slipped to its weakest in 9 months. This of course means the personal savings rate rose, pushing to 5.5% - the highest since 2012.

Key Events In The Coming "Payrolls" Week

Submitted by Tyler Durden on 02/01/2016 - 08:22 After last week's relatively quiet, on macro data if not central bank news, week the newsflow picks up with the usual global PMI survey to start, and end the week with the US January payrolls report.

Rates Are "Screaming" That Investors Are In Panic Mode, Trader Warns

Submitted by Tyler Durden on 02/01/2016 - 08:05 "When one of the world’s key economic inputs, oil prices, can rally 30% but still be down on the month, then investors may have a valid reason to be scared."

Crude Sinks To Day Lows After Goldman Explains Why No Oil Production Cuts Are Coming

Submitted by Tyler Durden on 02/01/2016 - 07:46 "Despite the sharp bounce in oil prices that these headlines generated, we do not expect such a cut will occur unless global growth weakens sharply from current levels, which is not our economists' forecast. This view is anchored by our belief that such a cut would be self-defeating given the short-cycle of shale production and the only nascent non-OPEC supply response to OPEC's November 2014 decision to maximize long-term revenues."

Rally Hobbled As Ugly China Reality Replaces Japan NIRP Euphoria; Oil Rebound Fizzles

Submitted by Tyler Durden on 02/01/2016 - 06:56 It didn't take much to fizzle Friday's Japan NIRP-driven euphoria, when first ugly Chinese manufacturing (and service) PMI data reminded the world just what the bull in the China shop is leading to a 1.8% Shanghai drop on the first day of February. Then it was about oil once more when Goldman itself said not to expect any crude production cuts in the near future. Finally throw in some very cautious words by the sellside what Japan's act of NIRP desperation means, and it becomes clear why stocks on both sides of the pond are down, why crude is not far behind, and why gold continues to rise.

by Michael Snyder, The Economic Collapse Blog:

Why are small towns in conservative states being specifically targeted for refugee resettlement? Of course the Obama administration will never publicly admit that this is happening, but it doesn’t take a genius to figure out what is going on. Just look at the uproar that refugee resettlement is now causing in small communities in Idaho, Montana, North Dakota and Kansas. The Obama administration has deemed large cities such as Washington D.C. to be “too expensive” for the refugees, and so large numbers of them are being dispersed throughout smaller communities all over the nation. If you drop a few hundred refugees into a major city of several million people, it isn’t going to make much of a difference. But if you drop a few hundred refugees into a small town that has only a few thousand people living there, you can start to fundamentally alter the character of the whole area. Could it be possible that this is yet another way that Barack Obama is attempting to “fundamentally transform” America?

Read More

Why are small towns in conservative states being specifically targeted for refugee resettlement? Of course the Obama administration will never publicly admit that this is happening, but it doesn’t take a genius to figure out what is going on. Just look at the uproar that refugee resettlement is now causing in small communities in Idaho, Montana, North Dakota and Kansas. The Obama administration has deemed large cities such as Washington D.C. to be “too expensive” for the refugees, and so large numbers of them are being dispersed throughout smaller communities all over the nation. If you drop a few hundred refugees into a major city of several million people, it isn’t going to make much of a difference. But if you drop a few hundred refugees into a small town that has only a few thousand people living there, you can start to fundamentally alter the character of the whole area. Could it be possible that this is yet another way that Barack Obama is attempting to “fundamentally transform” America?

Read More

The neo-conservatives and liberal hawks who have been preparing the war against Syria since 2001 have been relying on several states from the UNO and the Gulf Co-operation Council. While we know about the role played by General David Petraeus in launching and pursuing the war until today, two personalities – Jeffrey Feltman (number 2 at the UNO) and Volker Perthes (Director of the main German think tank) – have remained in the shadows. Together, with the support of Berlin, they have been using and are still manipulating the United Nations in order to destroy Syria.

In 2005, when Jeffrey Feltman – then the US ambassador in Beirut – supervised the assassination of Rafic Hariri, he relied on support from Germany, both for the assassination itself (Berlin supplied the weapon) [1], and for the UNO Commission charged with accusing Presidents el-Assad and Lahoud (prosecutor Detlev Mehlis, police commissioner Gerhard Lehmann and their team).

Read More

by Daisy Luther, The Organic Prepper:

Some commercial farms in California came up with their own solution to the drought, and it’s not pretty. They decided to use recycled oil industry waste water to grow their produce. Chevron Oil Company treats 21 million gallons of waste water per day and sells it to farmers, who in turn use it to water 45,000 acres of crops in one of the country’s primary produce-growing areas.

It’s like something used in third world countries that we scorn for their unsafe practices:

In most developing countries wastewater treatment systems are hardly functioning or have a very low coverage, resulting in large scale water pollution and the use of very poor quality water for crop irrigation especially in the vicinity of urban centres. This can create significant risks to public health, particularly where crops are eaten raw.

Read More

Some commercial farms in California came up with their own solution to the drought, and it’s not pretty. They decided to use recycled oil industry waste water to grow their produce. Chevron Oil Company treats 21 million gallons of waste water per day and sells it to farmers, who in turn use it to water 45,000 acres of crops in one of the country’s primary produce-growing areas.

It’s like something used in third world countries that we scorn for their unsafe practices:

In most developing countries wastewater treatment systems are hardly functioning or have a very low coverage, resulting in large scale water pollution and the use of very poor quality water for crop irrigation especially in the vicinity of urban centres. This can create significant risks to public health, particularly where crops are eaten raw.

Read More

from The Sleuth Journal:

Monsanto has decided to move forward with suing California over the listing of a particular herbicide ingredient as a carcinogen. The company is allegedly seeking to prevent the main ingredient of their Roundup product from being added to the state’s list of known carcinogens and they’ve filed a lawsuit against the Office of Environmental Health Hazard Assessment (OEHHA). They are allegedly working to keep their ingredient glyphosate off the Proposition 65 list of chemicals that are known to cause cancer, birth defects, or other reproductive harm.

Last year, the OEHHA said that it had the intention to add glyphosate to the list of carcinogens after the World Health Organization’s International Agency for Research on Cancer (IARC) effectively classified the ingredient as a probable human carcinogen.

Read More

Monsanto has decided to move forward with suing California over the listing of a particular herbicide ingredient as a carcinogen. The company is allegedly seeking to prevent the main ingredient of their Roundup product from being added to the state’s list of known carcinogens and they’ve filed a lawsuit against the Office of Environmental Health Hazard Assessment (OEHHA). They are allegedly working to keep their ingredient glyphosate off the Proposition 65 list of chemicals that are known to cause cancer, birth defects, or other reproductive harm.

Last year, the OEHHA said that it had the intention to add glyphosate to the list of carcinogens after the World Health Organization’s International Agency for Research on Cancer (IARC) effectively classified the ingredient as a probable human carcinogen.

Read More

by Jessica Dye, AllGov:

Chemical maker DuPont will face 40 trials a year starting April 2017 involving plaintiffs who say they developed cancer from a toxic chemical used to make Teflon that leaked from one of the company’s plants in West Virginia.

The schedule laid out by U.S. District Judge Edmund Sargus in the Southern District of Ohio during a hearing Wednesday is aimed at pushing the parties closer to resolving more than 3,550 lawsuits.

The outcome could have a material impact on Chemours Co, since liability for litigation connected with the chemical C-8 was passed on to the firm spun-off by DuPont in 2015.

Read More

Chemical maker DuPont will face 40 trials a year starting April 2017 involving plaintiffs who say they developed cancer from a toxic chemical used to make Teflon that leaked from one of the company’s plants in West Virginia.

The schedule laid out by U.S. District Judge Edmund Sargus in the Southern District of Ohio during a hearing Wednesday is aimed at pushing the parties closer to resolving more than 3,550 lawsuits.

The outcome could have a material impact on Chemours Co, since liability for litigation connected with the chemical C-8 was passed on to the firm spun-off by DuPont in 2015.

Read More

by Joshua Green, Bloomberg:

Over the last several weeks, the story of the Iowa caucuses has become the battle between Donald Trump and Ted Cruz.

For months, the two outsiders appeared to have struck an alliance, as they beat back their opponents and rose to the top of the Republican field—only to turn on each other in early January and launch a succession of brutal attacks. Cruz’s 10-point lead over Trump in December’s Bloomberg Politics/Des Moines Register Iowa Poll has become a casualty of that battle: in the new Jan. 30th survey, Trump vaulted past Cruz and to take a 28 percent to 23 percent lead.

Read More

Over the last several weeks, the story of the Iowa caucuses has become the battle between Donald Trump and Ted Cruz.

For months, the two outsiders appeared to have struck an alliance, as they beat back their opponents and rose to the top of the Republican field—only to turn on each other in early January and launch a succession of brutal attacks. Cruz’s 10-point lead over Trump in December’s Bloomberg Politics/Des Moines Register Iowa Poll has become a casualty of that battle: in the new Jan. 30th survey, Trump vaulted past Cruz and to take a 28 percent to 23 percent lead.

Read More

from Wolf Street:

Clearly, American consumers failed to do their job of propping up GDP in the fourth quarter.

GDP was crummy, with its snail-like growth rate of 0.7%, hammered by energy, exports, production, and inventories that are coming out of everyone’s ears and that businesses are finally whittling down. Even auto production has suddenly softened though it had been booming for years. And spending by businesses, which are caught up in a wave of cost-cutting and financial engineering, was dismal.

Read More

Clearly, American consumers failed to do their job of propping up GDP in the fourth quarter.

GDP was crummy, with its snail-like growth rate of 0.7%, hammered by energy, exports, production, and inventories that are coming out of everyone’s ears and that businesses are finally whittling down. Even auto production has suddenly softened though it had been booming for years. And spending by businesses, which are caught up in a wave of cost-cutting and financial engineering, was dismal.

Read More

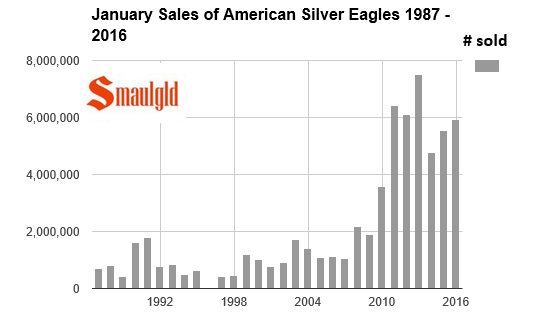

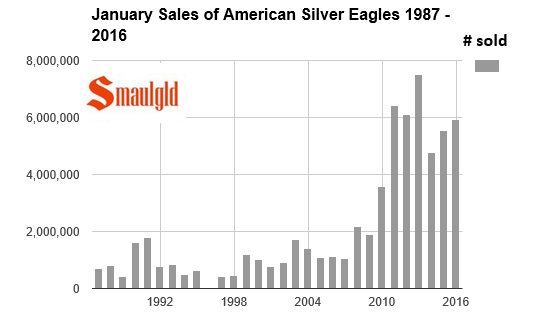

by Louis Cammarosano, Smaulgld:

Silver and Gold Sales at the U.S. Mint in January 2016.

Silver and Gold Sales at the U.S. Mint in January 2016.

Sales of American Silver Eagle Coins in January were 5,926,500.

January American Silver Eagle sales limited by U.S. Mint allocations to its Authorized Purchasers.

Sales of American Silver Eagles in January 2016 were 7.2% greater than January 2015 sales and were the fourth largest January monthly sales ever.

Sales of one ounce American Gold Eagle Coins in January were 89,000.

Read More

Silver and Gold Sales at the U.S. Mint in January 2016.

Silver and Gold Sales at the U.S. Mint in January 2016.Sales of American Silver Eagle Coins in January were 5,926,500.

January American Silver Eagle sales limited by U.S. Mint allocations to its Authorized Purchasers.

Sales of American Silver Eagles in January 2016 were 7.2% greater than January 2015 sales and were the fourth largest January monthly sales ever.

Sales of one ounce American Gold Eagle Coins in January were 89,000.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment