America has changed a lot since Super Bowl 1 in 1967 but, as the cost of tickets, airfare, commercials, and beer have soared, real median incomes have risen just 9%... is it any wonder the 'people' are revolting.. towards Bernie and The Donald? However, the economics of Super Bowl 50 are every bit as cloudy as the general American economy... which looks set to be re-named "The Unicorn Bowl."

Even The Fed's "Owners" Aren't Buying What Janet Is Selling

Submitted by Tyler Durden on 02/07/2016 - 19:20 Despite a collapse in yields and implicit plunge in the odds of a rate-hike anytime soon, asset-gathering, commission-taking talking-heads continue to spew unrealities about the economy and where it goes next as excuse after excuse (low oil is good, services trump manufacturing etc) are discarded. What is worse is that none other than The Fed's "owners" - the primary dealers - refuse to play along with The Fed's transitory narrative as their Treasury Bond position is the longest since 2013.

"Few Are Yet Willing To Admit The Harsh Reality..."

Submitted by Tyler Durden on 02/07/2016 - 18:55 A multi-decade Credit Bubble is coming to an end. The past seven years has amounted to an incredible blow-off top and the ongoing worldwide collapse in financial stocks provides powerful support for the bursting global Bubble thesis. Few are yet willing to accept the harsh reality that the world has sunk back into crisis as mal-investment, over-investment and associated wealth destruction remain largely concealed so long as financial asset inflation persists. This is true as well for wealth redistribution. The unfolding adjustment process will deflate asset prices so as to converge more closely with deteriorating underlying economic fundamentals.

There is something seriously wrong taking place in the markets today. This is also true in the paper gold and silver markets as well. For a paper precious metals futures market to function properly, there has to be ample supplies of physical metal. However, the ongoing trend of falling precious metal inventories points to big trouble in the paper gold and silver markets.

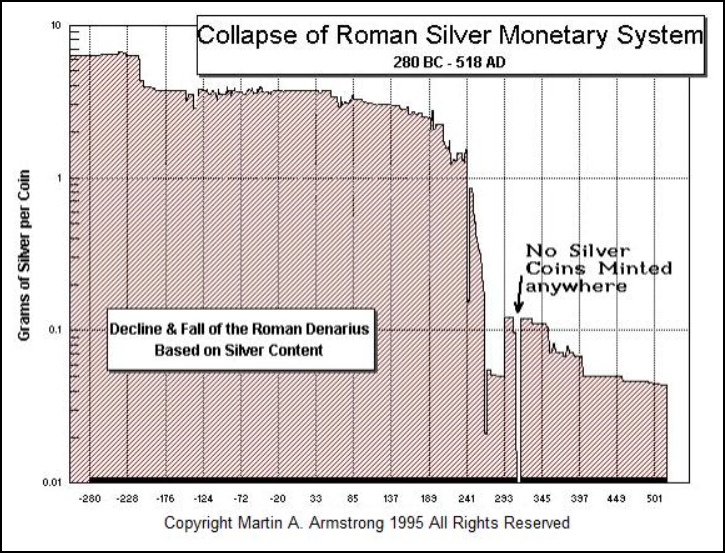

We must remember, a collapse does not happen overnight, but the endgame does. This can be clearly seen in the collapse of the Roman Monetary System:

Read More

Mainstream Media Guide To Obama's Economic "Recovery"

"Any minute now..."

Google Or Apple, FactSet Asks "Who's Bigger"?

Submitted by Tyler Durden on 02/07/2016 - 18:00 On the first day of this month, Google.. er, Alphabet.. turned in an impressive quarter. The stock jumped AH and just like that, Alphabet was the world’s most valuable stock, surpassing Apple. Since Monday, Apple regained the top spot in terms of market cap, but given the fanfare, it's worth taking a look at how the two most valuable companies in the world stack up to the rest of the field on a variety of "trivial" things like revenue and net income.

Another Exponential Chart: Record Numbers Renounce Their U.S. Citizenship In 2015

Few charts do the topic of US citizenship renunciation justice, like the one shown below.

Dear Barack... You Forgot To Mention A Few Things

While 'our' President was out this week patting himself on the back and taking victory laps over the "supposed" 4.9% unemployment rate, he forgot to mention a few important tidbits about what is really going on.

The Number Everyone's Been Waiting For: Chinese Reserves Plunge By $100BN - What Does It Mean For Markets?

As it stands now what is really happening with the biggest risk factor to commodity, credit and capital markets, remains a mystery, and instead of getting some much needed clarity from China's January reserve number, the world's traders and investors will now have to wait for the February reserve update one month from now to learn if China has managed to slay its capital outflow demons, or if these were just getting started.

2016 EPS Growth Estimates Slashed By 50% Just One Month Into The Year

Submitted by Tyler Durden on 02/07/2016 - 15:58 We open it up to readers to determine in how many weeks will full year 2016 EPS be revised tom 4.3% as of the start of the year, to 2.2% currently, to negative, indicating at least 7 consecutive quarters of declining EPS, something not recorded even during the peak of the financial crisis. Incidentally, an earnings recession is two consecutive negative quarters of EPS: we don't know what the technical term is for seven...

Crunch Time?

It seems monetary policy is exhausted and the next exogenous lever to pull would be political fiscal initiatives. If/when they fail to stimulate demand, there would be only one avenue left – currency devaluation. If/when confidence in the mightiest currency wanes, we would expect the US dollar to be devalued too - not against other fiat currencies, but against a relatively scarce Fed asset.

Ron Paul Slams Cruz And Hillary: They Are Both "Owned By Goldman"

Ted Cruz is no libertarian, Ron Paul rages, adding that "You take a guy like Cruz, people are liking the Cruz - they think he’s for the free market, and [in reality] he’s owned by Goldman Sachs. I mean, he and Hillary have more in common than we would have..."What The Charts Say: "Now Is The Time To Worry"

“Let me be clear with you. YES, it is time to worry, and it may be time to worry a lot. ...something wicked this way comes.”

10-Year Old Austrian Boy Raped By Iraqi Refugee Due To "Sexual Emergency"

Someone didn’t read the refugee pool rules cartoon...

Madeleine Albright Stunner: "There's A Special Place In Hell For Women Who Don't Help" Hillary

The Clinton campaign must be in full panic mode to resort to spewing this kind of utter garbage...

Bank Of America Admits The U.S. May Already Be In A Recession

Submitted by Tyler Durden on 02/07/2016 - 12:45 "The US Treasury curve is still steep by historical standards. Taken at face value, this may suggest recession odds are small. However, we argue this logic is flawed because the curve is structurally steep when the Fed Funds rate is close to zero. When adjusted for the proximity of rates to zero, the curve may already be inverted and therefore may already be priced for a recession./// Implied recession odds are as high as 64% if the adjusted OIS curve is used"Hillary Clinton used misleading language in Thursday night’s Democratic debate to describe the ongoing FBI investigation into her use of a private email server to conduct official government business while she was secretary of state, according to former senior FBI agents.

In the New Hampshire debate with Senator Bernie Sanders, which aired on MSNBC, Clinton told moderator Chuck Todd that nothing would come of the FBI probe, “I am 100 percent confident. This is a security review that was requested. It is being carried out.”

Not true says Steve Pomerantz, who spent 28 years at the FBI, and rose from field investigative special agent to the rank of assistant director, the third highest position in the Bureau.

Read More

from The Sleuth Journal:

When looking back from the perspective of the 1800’s America, the experience in the 20th and certainly the 21th centuries, has been a consistent and total repudiation of the underpinnings of civil liberties. With the widespread rejection of natural law, the secular humanism of the worldly culture has replaced the time tested and well-grounded principles that are the basis of Western Civilization. The sacredness of the individual has withered to the winds and drifts of arbitrary circumstance. Relative significance has replaced timeless permanence. Civil Liberties are not temporary or discretionary. Society cannot exist as an educated and respectful union among variegated parts, when the sanctity of personhood is not respected and protected.

Read More

When looking back from the perspective of the 1800’s America, the experience in the 20th and certainly the 21th centuries, has been a consistent and total repudiation of the underpinnings of civil liberties. With the widespread rejection of natural law, the secular humanism of the worldly culture has replaced the time tested and well-grounded principles that are the basis of Western Civilization. The sacredness of the individual has withered to the winds and drifts of arbitrary circumstance. Relative significance has replaced timeless permanence. Civil Liberties are not temporary or discretionary. Society cannot exist as an educated and respectful union among variegated parts, when the sanctity of personhood is not respected and protected.

Read More

by John Rubino, Dollar Collapse:

Once upon a time, falling interest rates were great for banks. A lower cost of capital gave lenders access to cheap raw material while causing borrowers to clamber for what banks were selling. Large profits usually ensued.

But not now. Rates have fallen past the banks’ sweet spot to levels that just don’t work. Borrowers appear to be spooked rather than energized and trading desks are imploding amid “paralyzing volatility“. See German 2-year bond yields collapse below -50bps for first time ever and UBS’s investment bank earnings decline 63% on equities trading.

Read More

Once upon a time, falling interest rates were great for banks. A lower cost of capital gave lenders access to cheap raw material while causing borrowers to clamber for what banks were selling. Large profits usually ensued.

But not now. Rates have fallen past the banks’ sweet spot to levels that just don’t work. Borrowers appear to be spooked rather than energized and trading desks are imploding amid “paralyzing volatility“. See German 2-year bond yields collapse below -50bps for first time ever and UBS’s investment bank earnings decline 63% on equities trading.

Read More

by Vern Gowdie, Daily Reckoning:

Interesting time on markets.

The Bank of Japan (BoJ) — Kuroda denied they’d take rates into negative territory — then took rates into negative territory — minus 0.1%.

Markets went wild for a day or so, but then reality set in. How bad are things to warrant this sort of action? Japan is now the fifth central bank to wander into negative territory and it won’t be the last. No doubt the Fed will be closely watching this action. It’s an each way bet the Fed’s next interest rate move could be down and not up.

Remember 2013 and PM Abe’s determination to create inflation with the boldest money printing program in history? Didn’t work.

Read More…

Interesting time on markets.

The Bank of Japan (BoJ) — Kuroda denied they’d take rates into negative territory — then took rates into negative territory — minus 0.1%.

Markets went wild for a day or so, but then reality set in. How bad are things to warrant this sort of action? Japan is now the fifth central bank to wander into negative territory and it won’t be the last. No doubt the Fed will be closely watching this action. It’s an each way bet the Fed’s next interest rate move could be down and not up.

Remember 2013 and PM Abe’s determination to create inflation with the boldest money printing program in history? Didn’t work.

Read More…

by David Gutierrez, Natural News:

If your best friend told you that drinking diet soda is healthier than drinking water, would you believe them? What about if a doctor said it?

According to a new study published in the International Journal of Obesity, low-energy sweetener consumption can help you reduce your energy intake and even lose weight. If this sounds like nonsense, that’s because it’s exactly that. Although it seems inconceivable, this Coca-Cola funded study is actually telling people who are possibly engaged in excruciating weight battles, that they should buy and drink more diet soda. Needless to say, this is nothing more than science twisted into a marketing campaign.

Read More

If your best friend told you that drinking diet soda is healthier than drinking water, would you believe them? What about if a doctor said it?

According to a new study published in the International Journal of Obesity, low-energy sweetener consumption can help you reduce your energy intake and even lose weight. If this sounds like nonsense, that’s because it’s exactly that. Although it seems inconceivable, this Coca-Cola funded study is actually telling people who are possibly engaged in excruciating weight battles, that they should buy and drink more diet soda. Needless to say, this is nothing more than science twisted into a marketing campaign.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment