European Stocks Plunge to Lowest Close in Over Two Years (Click for Story)

Two Opposing Views On The SNB Intervention, Or Rather One View (Goldman's) And One Cartoon

When it comes to a simply horrible FX forecast track record, nobody beats Goldman's Thomas Stolper, who for the longest time was beating a drum that the EURCHF is fairly valued at 1.44 (and still does). It only took a massive central bank intervention (and one which will fail shortly, just as it did a year ago), to get the pair halfway to his target, and by the looks of things, even the 1.20 support will be breached quite soon, once the SNB's balance sheet loads up with a few hundred billion worthless EURs and Switzerland realizes that the trade off of exports for German dominance (and US the year before) is not worth it. That will take place in a few days to weeks. In the meantime, here are two opposite takes on what will happen in the meantime: the first, appropriately enough, from Stolper, who again beats the 1.44 EURCHF drum, and the second, a cartoon from Alex Gloy of Lighthouse Investment, which summarizes the "downside" case.

Guest Post: Currency Wars, Trade And The Consuming Crisis of Capitalism

The global consumer society funded by credit is in its end-game, and is the "Central State as guarantor of private consumption" model in which governments borrow/print vast sums of fiat currency to distribute to their citizenry to prop up consumption. Once exports go away, then domestic economies the world over implode. Ironically, perhaps, the one nation which doesn't depend on exporting its surplus production for its stability is the U.S. This is one reason why the Swiss pegging their fiat franc to the Euro will fail to hold back the ceaseless tide eroding the Euro. You can play games with currency pegs for awhile, but ultimately the value and utility of a fiat currency is established by trade, energy and the geopolitical issues outlined above. If we don't understand trade flows, surplus production, the surplus in labor and the resultant decline in its share of national income, credit and currencies in this Marxist-inspired historical perspective, we cannot make sense of the financial/political crises which are sweeping over the global economy. The end-game is at hand, and we need models that are up to the task of explaining the vast forces now in play.Italy Announces Austerity Plan 2.0 As Local Protests Spread, Turn Violent

After Berlusconi was scolded by everyone, but most importantly by backstop solvency provider ECB, for his bull in a China shop maneuver of the first, now defunct, Italian Austerity plan, here are the details from the next, soon to be gutted "Austerity", which readers may be forgiven, if they take it with just a grain of salt. According to Bloomberg, the details are as follows:- Plan to to include higher retirement age for women from 2014

- To add 3% tax on income over 500k euros

- Italy to approve constitutional law for budget balance Sept

- To increase VAT from 20% to 21%.

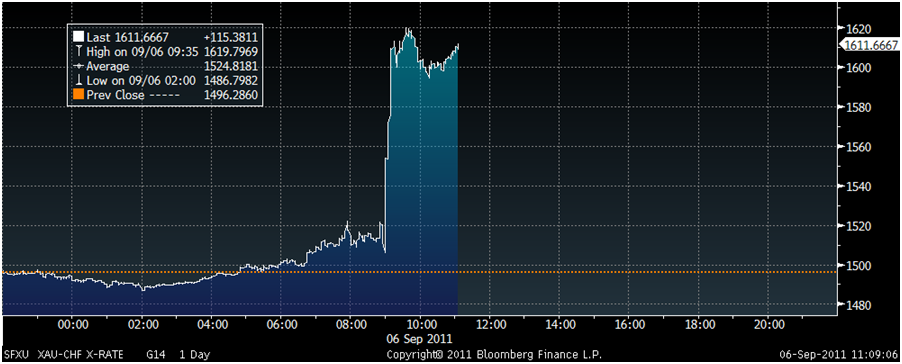

Swiss Franc Collapses 7% - Swiss National Bank to Fix CHF to EUR and Debase Currency

Currency markets have seen massive volatility this morning after the Swiss National Bank decision to fix the Swiss franc to the euro. Just prior to the announcement, spot gold for immediate delivery had risen to a new record nominal high of $1,921.15/oz in early morning trading in Europe. Then just before 0900 hours GMT came the news that the Swiss National Bank has decided to fix the country's exchange rate at 1.20 Swiss francs per euro. The SNB indicated it would buy an unlimited amount of euros regardless of the risk to maintain that value. In a matter of minutes, gold fell 3% from the high of $1,921.15 to an inter day low of $1,862.72. It then recovered as quickly and surged back to over $1,912/oz. Gold’s London AM fix this morning was USD 1,891.00, EUR 1,330.75, GBP 1,172.86 per ounce. Gold fixed lower in all currencies (USD 1,896.50, EUR 1,341.13, GBP 1,174.67 per ounce). The SNB announced the currency fix because of what it called "the current massive overvaluation of the Swiss franc." It said it will "no longer tolerate" an exchange rate below the minimum rate of 1.20 francs, which it said is still high.

Guest Post: "With Immediate Effect"

Holy Red Screen, Batman! If you haven’t seen the news, the Swiss National Bank has just announced that it is putting a ceiling on the franc’s appreciation against the euro… effectively abandoning its economic sovereignty and putting its future in the hands of woefully corrupt and incompetent bureaucrats. On the news, the franc fell off a cliff, dropping almost 10% INSTANTLY. Gold priced in Swiss francs jumped from 1497 to 1620 per troy ounce, all in about 45 seconds. Precious metals are now all alone as the only forms of sound money that are truly safe havens. Since then gold has soared roughly 20%, and as of this morning, the SNB has imposed capital controls to thwart the rise of its currency. This is just the beginning. The Swiss government has basically told the world that they will print as much money as it takes, and buy up as much crap sovereign debt as they can, to competitively devalue the currency. This essentially puts Switzerland in the same sinking boat as Italy, Greece, and Portugal… with one key difference: Switzerland has 0% interest rates. In other words, you can now borrow in francs at 0% and buy government-backed euro garbage yielding 5%, 10%, 30%…. with absolutely no downside currency risk.EU Officials Admit Lagarde Was Right on EU Banks

Just a headline for now but Reuters is citing sources that EU officials are set to discuss how to recapitalize weak banks today.

Just a week after fuming over Christine Lagarde's brutal honesty, it

seems once again that the market has pushed the ignorant into action.

Just a headline for now but Reuters is citing sources that EU officials are set to discuss how to recapitalize weak banks today.

Just a week after fuming over Christine Lagarde's brutal honesty, it

seems once again that the market has pushed the ignorant into action.The "Price Stability"

With

bankers and politicians arguing over their mandates and who should

move first fiscally or monetarily, we thought a look at the success of

'price stability' as the 'backbone' of European central bankers

day-to-day work would be useful.

With

bankers and politicians arguing over their mandates and who should

move first fiscally or monetarily, we thought a look at the success of

'price stability' as the 'backbone' of European central bankers

day-to-day work would be useful.The Gold Stock Train Keeps Rolling Along

Eric De Groot at Eric De Groot - 16 minutes ago

The gold stocks train left the station in 2010, but fear left many at the

station. The consolidation’s power down trend (PDT) has been broken to the

upside. The train has slowed but fear once again prevents a growing number

of onlookers from climbing on board. S&P Gold (Formerly Precious Metals

Mining)*

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]]

Daily US Opening News And Market Re-Cap: September 6

- The SNB set the minimum exchange rate target for EUR/CHF at 1.2000, and said that it will take further measures if risks to the economic outlook or that of deflation emerge

- According to an article in the FT, global bank regulators are preparing to ease new rules that would require banks to hold more liquid assets to withstand a funding crunch in a crisis

- Early market talk of a planned merger between Societe Generale and BNP Paribas provided support to equities

- The Italian/German and Spanish/German 10-year government bond yield spreads narrowed partly on the back of market talk that the ECB is buying the Italian and Spanish government bonds

Swiss Pledge Unlimited Currency Purchases

Eric De Groot at Eric De Groot - 16 minutes ago

Headline should have read, the Swiss pledge to be snapped like a dry twig by market forces. Intervention only works if it’s in sympathy with the secular trend. The trend is up, so this intervention will fail. Watch connected money fade this decline in the coming weeks. Headline: Swiss Pledge Unlimited Currency Purchases The Swiss central bank imposed a ceiling on the franc for the first... [[ This is a content summary only. Visit my website for full links, other content, and more! ]]

Heeeeeere's Rule 48

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment