Financial "Cataclysm" To Come; Gold To Unimaginable Levels

Fed Dissenter Says Latest Step Won't Help The Economy

Cash Is King No More, Gold Reigns

Quiz: Determine Who You Should Support For President

Goldman's Jim O'Neill: "Let's Worry About Everything"

Presenting some deeply philosophical observations from the man who has been wrong about pretty much everything, and to whom the jarring return of reality and its relentless destruction of the ivory towers he has carefully erected his entire career, can only be described as "surreal." No Jim - it's not surreal. It is all too real. The only surreal thing will be the response when GSAM's LP get their year end performance statement.Citi Follows Bank Of America In Instituting Debit Card Fee, $1.9 Trillion In Deposits At Risk

When we reported that Bank of America will be the first bank to institute debit card fees we made the following less than insightful observation: "The problem is that the bulk of depositor clients will simply walk away from Bank of America (which had $1,038 billion in deposits as of June 30), and any other institutions that piggy back on this, and from a game theory perspective, everyone has to do it, or nobody will do it." Well, Citigroup, which had no other choice, has just decided to follow in BofA's footsteps, which i) proves there is indeed a collusive move of desperation by the bank cartel, which in a normal country would see at least a statement from Eric Rip Van Holder, and ii) our thesis about America's impatience with petty theft - they are more than ok with grand scale larson such as that by the Fed via shadow inflation and currency devaluation, but when it comes to paying up an additional $5/month, well, just look at Netflix, which instituted a $6/month price hike two months ago... and is now fighting for survival. As for the exemption requirements, they will likely be the same as Bank of Countrywide Lynch's: either have a mortgage with the TBTF behemoth, or have $20k in a deposit account - both which will likely not be much of a help to 90%+ of the bank clients. The biggest problem is that suddenly at risk are $1.9 trillion in deposits - $1 trillion at BofA, $866 billion at Citi. While the financial crisis did little to dent the banks' deposit buffer, it will be highly ironic if it is an act of the banks themselves that begins the great bank run that resets it all...Third Point Down 3.6% In September: Liquidations To Shift From Gold Back To Stocks Next?

One of the sterling performers in the hedge fund arena so far has just gone negative in several of his hedge funds for the year after another painful month. And if one of the best is unch, what can the rest say? Remember when we said 25% of the hedge fund space may be "redeemed"? We were being very optimistic...Guest Post: Bailout Lost Opportunity Cost

This Bloomberg article about German utilities giving away power got me thinking what our world would look like if the trillions in bailout money had instead been spent to build alternative energy infrastructure. From Bloomberg: “The 15 mile-per-hour winds that buffeted northern Germany on July 24 caused the nation’s 21,600 windmills to generate so much power that utilities such as EON AG and RWE AG (RWE) had to pay consumers to take it off the grid.” “You’re looking at a future where on a sunny day in Germany , you’ll have negative prices,” Bloomberg New Energy Finance chief solar analyst Jenny Chase said about power rates in wholesale trading. “And a lot of the other markets are heading the same way.” I will use only simple round numbers and calculations to make my point.If it walks like a duck, and talks like a duck, is the COT report a duck?

silvergoldsilver at silvergoldsilver - 34 minutes ago

This report comes to you on the eve of what I *suspect* is the last day on

this blogspot as we are off to the www.silvergoldsilver.com site. After

mulling over the COT report, and then making many many phone calls,

something is not sitting right with me.

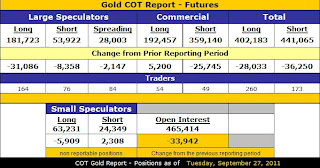

Lets first post up the COT report, I have copied it straight over from Harveys

Blog (click here for more):

There are a few things that are not lining up for me. You know me, I could

sit here and cheerlead this to death right now, but thats not my place. Do I

think silver will get to $500? Yes. By next week? No. So dont shoot the ... more »

October 1 2011: How The European Rot Entered Wall Street

Ilargi at The Automatic Earth - 4 hours ago

Detroit Publishing Co. Lower Manhattan 1904"New York Stock Exchange, Wall and Broad Streets" Ilargi: There were mass protests in Portugal today. The country has been largely left outside of the international media recently, but the people in Lisbon still hurt. Austerity raises electricity and gas prices at the same time that jobs are lost en masse. No-one in southern Europe bats a surprised eye

No Rise in Home Prices Until 2020: Bankers

Doug Casey Answers The Hard Questions About Hard Times

CNN: Forecast says double-dip recession is imminent.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment