EFSF Denies It Is An Illegal Pyramid Scheme

If there is one thing one can say about the insolvent European continent is that despite everything, it is a bastion of truth, and a knight of see-thru disclosure. After all, who can forget such brutally honest statements as "Greece will not default", or the follow ups: "Ireland is not Greece", "Portugal is not Ireland", "Spain is not Portugal", "Italy is fine", "Italy has turned down money from the IMF", "The IMF has never offered any money to Italy", and then the old standbys, "the ECB will not be a lender of last resort", "the EFSF will use 4-5x leverage", wait, make that "the EFSF will use 3-4x leverage", and last but not least, "Europe is not America" and "it is all the fault of evil CDS speculators." Well we have one more to add to the list: "the EFSF is not an illegal ponzi scheme" - because after the mindboggling report in the Telegraph yesterday that the EFSF has bought hundreds of millions of its own bonds, exposing the scam in the heart of the Eurozone for anyone to see, the European rescuer of last resort (at least until the ECB comes out monetizing and Eurobonds are issued)has no choice but to join in the parade of truths and as Reuters reports "said on Sunday that it did not buy its own bonds last week, denying a British newspaper report that it spent more than 100 million euros ($137 million) to cover a shortfall of demand. "The EFSF did not buy its own bonds and the book was 3 billion euros," an EFSF spokesman said, referring to the 3 billion euros raised in last Monday's 10-year bond issue." We are certain that in order to dispel rumors about its fraud-i-ness, the EFSF will promptly submit a full breakdown of the entities that received bond allocations (we know that Japan is good for €300 million, that China is good for €0.0, and that as Merkel said one week ago, "hardly any countries in G20 have said they will participate in the EFSF." So, because we believe everything that comes out of Europe, we are patiently waiting to see just who it was that bought EFSF bonds when nobody else did. And yet what is most troubling to us, is that it took the world 5 minutes to completely agree that the EFSF is a ponzi scheme, with nobody doubting this supposedly "refuted" disclosure for even a second. Perhaps that tells you more about the current state of Europe than anything else...Sovereign CDS, EFSF, And The IIF

UPDATE: EFSF is denying it bought its own bonds. We suspect semantics as the denial is very specifically worded and EIB or ECB involvement is possible and frankly just as incredible. Perhaps the ECB really is the lender of ONLY resort.We earlier discussed the desperate actions that occurred surrounding the EFSF self-aggrandizement this week and Peter Tchir, of TF Market Advisors, notes that the whole situation was bizarre and is becoming more and more Enronesque every day. But the lack of demand for EFSF debt is simply, as we have repeatedly pointed out, a factor of their own design and a symptom of the actions that a bloated lobbying IIF and the feckless politicians have taken. One of the obvious consequences of the EU and IIF decision to pursue this restructuring is they cannot fully rely on CDS, and markets will treat net exposure numbers with skepticism.

So banks will sell bonds/loans and unwind their CDS positions and manage their exposure the old fashioned way, by adding or reducing to their bond/loan position. That impact seemed obvious to everyone other than the EU and IIF. So the pseudo-private money (EU banks, EU pension funds, and EU insurance companies) are reluctant to buy EFSF bonds because they already have too much sovereign exposure, and the EU is likely to force "voluntary" changes on EFSF debt before it would on actual outright sovereign debt. Real private money is confused by the structure. Who does that leave? Only sovereign wealth funds and other supra-national entities.

EFSF is the bond only a mother could love.

The Euro Fiasco Suicide Formula (EFSF)

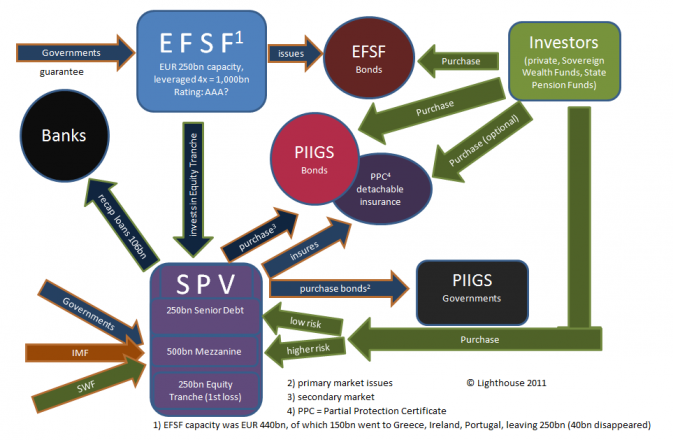

There is one simple rule for investors: avoid all things beginning with “Euro-”. Eurotunnel ended in bankruptcy. Eurodisney was a disaster for public shareholders. And so the Euro itself is following the same path. European politicians are faced with one problem: none of their plans to end Europe’s debt crisis has worked. Absolutely nothing. Which is not that surprising – since when does adding debt solve a debt problem? Fishing in Lake Acronym yielded only meager catches like SGP (“Stability and Growth Programme”, a paradox), SMP (“Securities Market Programme”, which has less to do with market than with manipulation), and, finally, the bazooka: the EFSF (European Financial Stability Facility). “Stability” sounds good, and “Facility” leaves the uninitiated in the dark as to whether this is another debt pyramid and who will ultimately foot the bill. The idea behind the EFSF must be so good the agency wants to keep it to itself and prefers not to shed light on the mechanism behind it. Based on leaked drafts and comments in the press it could look like this.

We Have Shortages Of Everything From Oil To Food

Admin at Jim Rogers Blog - 5 hours ago

We have shortages of everything from oil to food and on top of that we have

governments printing more money. Put the two together and you have some

serious inflation coming down the road.

Governments will eventually put in place price controls but if you tell

someone they can only make so much money he is going to stop producing. The

Chinese are seeing this and that's why they are out looking to buy assets.

They are down here in Australia trying to buy up more. - *in

sl.farmonline.com.au*

*Related ETFs, United States Oil Fund (USO), ELEMENTS Rogers Intl Commodity

Index - Agricultur... more »

Bundesbank's Jens Weidmann Discusses The ECB's Role As An Overthrower Of European Rulers, Bashes EFSF Incompetence

One of the last remaining Germans at the ECB, Jens Weidmann, gave an interview to the FT earlier today, in which the president of the Bundesbank, shared some pragmatic responses to questions about the depths of ECB intervention in the capital markets. The man who on Tuesday clinically stated explicitly that the "ECB can't print money to finance public debt" (to which he adds today that "this is a very fundamental issue. If we now overstep that mandate, we call into question our own independence"... odd, never prevented the Fed from questioning its own independence), follows up with some much needed clarity on just where the ECB sees itself in the coming weeks and months, touches on the rumor that sent stocks surging on Friday, namely that it would proceed to fix interest rates (it won't), and shares some rather amusing observations on the recent revelation that the ECB has become a weapon of political (de)stabilization: after all it took the ECB's bond buying program - the SMP - just two days of not buying Italian bonds for Silvio Berlusconi to resign after BTPs hit an all time rock bottom price. Yet the most amusing slap in the face of the Eurocrats is precisely what we mock every single day, namely the perpetually changing nature of the EFSF on a day to day basis, confirming the cluelessness of the continent's leaders, and which has cost Europe all credibility in the face of capital markets, explaining why the EFSF has to resort to not only buying its own bonds, but issuing terse statements denying anything and everything: "EU governments have decided how to finance the EFSF. They agreed on guarantees for the EFSF and, in their last meeting, on two options on how to leverage the EFSF – by an insurance model or a special purpose vehicle. Instead of working on implementing these approaches, we now have the next idea that is completely out of the realm of what has been discussed previously. I don’t think it builds confidence in crisis resolution capabilities if from week to week, from one meeting to the next, you are questioning your last decision."Former German chancellor silent on Fed memo linking him to gold suppression

Japan Could Be Vulnerable As Well

Admin at Marc Faber Blog - 4 hours ago

I believe that the next country that is very vulnerable would be Japan or

the United States. Also in Europe within the EU we have the so-called

PIIGS, in other words, Portugal, Italy, Ireland, Greece and Spain. These

countries are quite vulnerable. - *in Yahoo Finance*

*Ticker, iShares MSCI Japan Index ETF (EWJ) *

*Marc Faber is an international investor known for his uncanny predictions

of the stock market and futures markets around the world.*

EURUSD Opens 30 pips Higher At 1.3780

Over

the weekend we get a historic, and peaceful, overthrow of a 17 year

ruler (Italian at that), an event that is supposed to make everything

better, and all the EURUSD can achieve is a meager 30 pip push higher in

the first minutes of FX trade resumption? Is the market, perhaps,

skeptical for once?

Over

the weekend we get a historic, and peaceful, overthrow of a 17 year

ruler (Italian at that), an event that is supposed to make everything

better, and all the EURUSD can achieve is a meager 30 pip push higher in

the first minutes of FX trade resumption? Is the market, perhaps,

skeptical for once?Goldman Sachs International Advisor Mario Monti Is Italy's New Prime Minister

Not on even a Sunday is the headline barrage over:- MARIO MONTI ASKED TO FORM NEW ITALIAN GOVERNMENT

- MONTI TO MAKE COMMENTS AFTER ACCEPTING OFFER TO LEAD ITALY

- MARIO MONTI THANKS NAPOLITANO FOR OFFER TO FORM GOVERNMENT

- MARIO MONTI SAYS ITALY MUST BE PROTAGONIST IN EUROPE

- MARIO MONTI SAYS HE'LL ACT TO SAVE ITALY FROM CRISIS

Sol Sanders | Follow the money No. 92 Obama [tries] to move the drama East

11/13/2011 - 10:07

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment