DHS Monitoring Journalists

Iran Interest Rates Raised To 20% To Fight Hyperinflation; Iran Nuclear Scientist Killed In Street Bomb Explosion

Yesterday we reported how as a result of a financial embargo enacted on by the US on New Year's Day, Iran's economy had promptly entered freefall mode and is now experiencing hyperinflation as the currency implodes. Today EA WorldNews gives us the response, which confirms that indeed the economy is in terminal shape following an interest rate hike to 20%. From the Source: "State news agency IRNA has no news on the Iranian currency this morning, but it does feature an interview with an official, noting the rise in interest rates to 20%. The effort is to reduce the flow of cash in the economy, but the official says it will increase capital investment by banks in an "impressive market"." As noted before, every incremental creep worse in the status quo merely makes the probability of escalation higher due to a lower opportunity cost of "irrationality" although we hope we are wrong. And in other unreported so far news, EA also informs us that in a street bomb explosion in Tehran earlier, one Mostafa Ahmadi Roshan, deputy head of procurement at the Natanz uranium enrichment facility, was killed. Are predator drones now patrolling over the Iran capital? Who knows, but Iran is already spinning the news.by Steve Watson, InfoWars.com

On the back of his powerful second place win in New Hampshire, Ron Paul has urged his supporters to switch to a higher gear in order that the campaign can continue the momentum into South Carolina where the next primary takes place in ten days’ time.

In an urgent email shot, Paul told supporters “I’m going to try my best to spend a few hours relishing this great finish. But the truth is, I’m already thinking about South Carolina, Florida, and beyond.”

Adding that he was in the race for the long haul and was ready to fight, Paul noted that more funds for campaigning in South Carolina were needed immediately.

“I’m headed there tomorrow to begin a feverish round of campaigning. But I need to be able to pay for it all.” Paul stated.

“Unlike my opponents, I don’t have Wall Street banksters lining up to write fat checks to my campaign. I’m grateful I’ve been able to count on the generosity of good folks like you.” the email continued.

Paul urged supporters to begin donating immediately to a ‘South Carolina Money Bomb’, with the culmination of the fundraising effort set for this Saturday, January 14.

Read More @ InfoWars.com

Anyone anticipating more easing out of the ECB's Mario Draghi first thing tomorrow may be in for disappointment, according to Goldman (which certainly should know how its alumni think), which says that "We expect the ECB to leave policy rates unchanged at its monthly policy meeting on Thursday, and also expect no further announcement of non-standard measures at this point. Before taking further measures, the ECB will likely want to have more clarity on how the macro picture is evolving and how successful the measures taken in December have been in stabilising the situation. That said, the press conference may provide further indication of where the threshold for additional ECB action lies." It is unclear how the EURUsd will react to any such interim halt in currency devaluation, but it is likely that the record number of shorts in the currency will hardly be overjoyed.

FoxConn Workers Threaten With Mass Suicide If Working Conditions Aren't Fixed

FoxConn, which at last count had well over 1 million workers and rising, appears to have had enough of being the global electronic gadget sweatshop, and as the Telegraph reports,

saw its workers threaten with mass suicides unless working conditions

are not improved. "Around 150 Chinese workers at Foxconn, the world's

largest electronics manufacturer, threatened to commit suicide by

leaping from their factory roof in protest at their working conditions.

The workers were eventually coaxed down after two days on top of their

three-floor plant in Wuhan by Foxconn managers and local Chinese

Communist party officials." Does this mean that in the latest Apple

prospectus there will be a Risk Factor which says: "Our profit margins

may be severely impaired if our contracted work force decides to proceed

with mass self-induced genocide." We will find out, but if anyone

needed a loud and clear warning that the record profitability of high

margin electronics producers is about to go down, this is it.

FoxConn, which at last count had well over 1 million workers and rising, appears to have had enough of being the global electronic gadget sweatshop, and as the Telegraph reports,

saw its workers threaten with mass suicides unless working conditions

are not improved. "Around 150 Chinese workers at Foxconn, the world's

largest electronics manufacturer, threatened to commit suicide by

leaping from their factory roof in protest at their working conditions.

The workers were eventually coaxed down after two days on top of their

three-floor plant in Wuhan by Foxconn managers and local Chinese

Communist party officials." Does this mean that in the latest Apple

prospectus there will be a Risk Factor which says: "Our profit margins

may be severely impaired if our contracted work force decides to proceed

with mass self-induced genocide." We will find out, but if anyone

needed a loud and clear warning that the record profitability of high

margin electronics producers is about to go down, this is it.Goldman Unveils The Script In The Greek Haircut Kabuki

It

will come as no surprise to anyone (other than Dallara and Venizelos

perhaps) that all is not rosy in the Greek Public Sector Involvement

(PSI) discussions. Whether it is the Kyle-Bass-Based discussions of the

need for non-Troika haircuts to be 100% for any meaningful debt

reduction, or the CDS-market-based precedent that is set from chasing

after a purely voluntary, non-triggering, agreement, the entire process

remains mired in a reality that Greece needs much broader acceptance

of this haircut (or debt reduction) than is possible given the diverse

audience of bondholders (especially given the sub-25 price on most GGBs

now). As Goldman points out in a note today, the current PSI structure does not encourage high participation (due to the considerable 'voluntary' NPV losses), leaves effective debt-relief at a measly EUR30-35bln

after bank recaps etc., and as we have pointed out in the past leaves

the door open for a meaningful overall reduction in risk exposure to

European sovereigns should the CDS market be bypassed entirely (as the

second-best protection for risk-averse investors would be an outright

reduction in holdings). The GGB Basis (the package of Greek bond plus

CDS protection) has been bid up notably in the last month or two

suggesting that the banks (who are stuck with this GGB waste on their

books) are still willing to sell them as 'cheap' basis packages to

hedge funds. This risk transfer only exacerbates the unlikely PSI

agreement completion since hedgies who are holding the basis package

have no incentive to participate at all.

It

will come as no surprise to anyone (other than Dallara and Venizelos

perhaps) that all is not rosy in the Greek Public Sector Involvement

(PSI) discussions. Whether it is the Kyle-Bass-Based discussions of the

need for non-Troika haircuts to be 100% for any meaningful debt

reduction, or the CDS-market-based precedent that is set from chasing

after a purely voluntary, non-triggering, agreement, the entire process

remains mired in a reality that Greece needs much broader acceptance

of this haircut (or debt reduction) than is possible given the diverse

audience of bondholders (especially given the sub-25 price on most GGBs

now). As Goldman points out in a note today, the current PSI structure does not encourage high participation (due to the considerable 'voluntary' NPV losses), leaves effective debt-relief at a measly EUR30-35bln

after bank recaps etc., and as we have pointed out in the past leaves

the door open for a meaningful overall reduction in risk exposure to

European sovereigns should the CDS market be bypassed entirely (as the

second-best protection for risk-averse investors would be an outright

reduction in holdings). The GGB Basis (the package of Greek bond plus

CDS protection) has been bid up notably in the last month or two

suggesting that the banks (who are stuck with this GGB waste on their

books) are still willing to sell them as 'cheap' basis packages to

hedge funds. This risk transfer only exacerbates the unlikely PSI

agreement completion since hedgies who are holding the basis package

have no incentive to participate at all.The US Debt Ceiling Theater Is Back: Think The Issue Is On Autopilot? Think Again

As Zero Hedge reported first,

the US is once again, in just 5 short months (see chart), back at the

debt ceiling, with just $25 million in new debt issuance dry powder, or

in other words, no space of more debt absent resorting to the same

"technique" last seen in late July when the Treasury plundered from

government retirement accounts in order to accommodate new debt, such as

yesterday's issuance of 3 Year bonds, and today's 10 Year bonds. And

as The Hill reported yesterday,

Obama is expected to request that Congress allow the incremental and

final $1.2 trillion debt expansion (of the $2.1 trillion total) within a

few days. So it is all on autopilot right? Wrong. As Bank of America

explains below, it is very likely that the US will not have a debt

ceiling hike for at least a few weeks, meaning that while a debt hike

will ultimately come, it will very soon be all the song in dance,

potentially overtaking the GOP drama, coupled with the pillaging of

government retirement accounts yet again and likely leading to more

rating agency action as the US debt fiasco is once again brought front

and center. And the last thing the market needs is to experience the

August 2011 collapse which brought it to 2011 lows and sent it gyrating

for 400 DJIA points daily, in essence breaking the market as noted previously.

And the worst news is that even with $1.2 trillion in new debt

capacity, the total amount is guaranteed to not last through 2013, and

should tax withholdings dip as trends are already indicating on adverse

year over year comps, the $1.2 trillion in new debt may be exhausted as

soon as September, which at this point may be the only thing that

derails an Obama reelection if indeed he is running against "Wall

Street."

As Zero Hedge reported first,

the US is once again, in just 5 short months (see chart), back at the

debt ceiling, with just $25 million in new debt issuance dry powder, or

in other words, no space of more debt absent resorting to the same

"technique" last seen in late July when the Treasury plundered from

government retirement accounts in order to accommodate new debt, such as

yesterday's issuance of 3 Year bonds, and today's 10 Year bonds. And

as The Hill reported yesterday,

Obama is expected to request that Congress allow the incremental and

final $1.2 trillion debt expansion (of the $2.1 trillion total) within a

few days. So it is all on autopilot right? Wrong. As Bank of America

explains below, it is very likely that the US will not have a debt

ceiling hike for at least a few weeks, meaning that while a debt hike

will ultimately come, it will very soon be all the song in dance,

potentially overtaking the GOP drama, coupled with the pillaging of

government retirement accounts yet again and likely leading to more

rating agency action as the US debt fiasco is once again brought front

and center. And the last thing the market needs is to experience the

August 2011 collapse which brought it to 2011 lows and sent it gyrating

for 400 DJIA points daily, in essence breaking the market as noted previously.

And the worst news is that even with $1.2 trillion in new debt

capacity, the total amount is guaranteed to not last through 2013, and

should tax withholdings dip as trends are already indicating on adverse

year over year comps, the $1.2 trillion in new debt may be exhausted as

soon as September, which at this point may be the only thing that

derails an Obama reelection if indeed he is running against "Wall

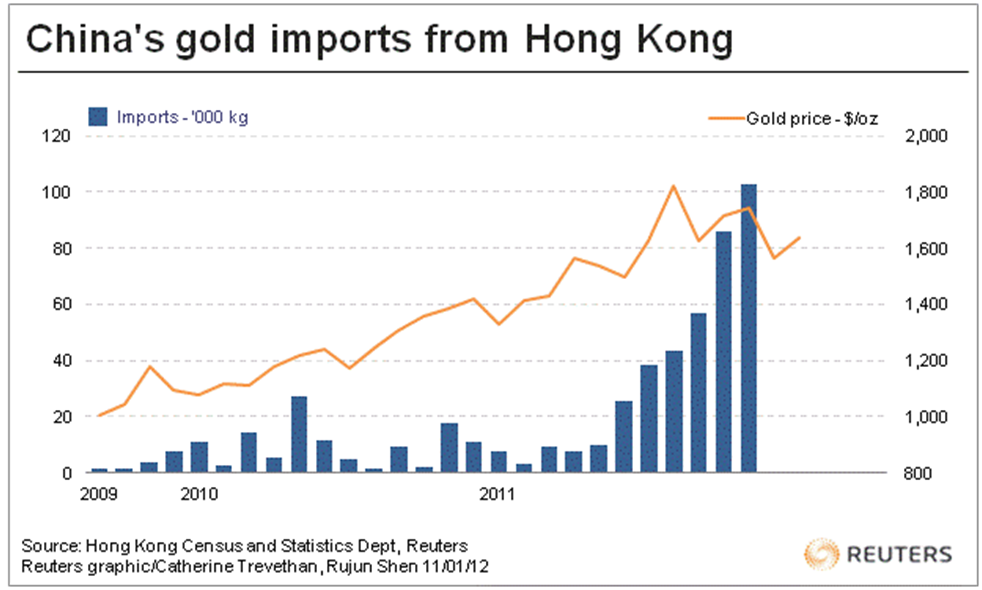

Street."China's Gold Imports From Hong Kong Surge to Highest Ever? - PBOC Buying?

The run into Chinese Lunar New Year has again seen higher than expected Chinese demand for gold and China's voracious appetite for gold is surprising even analysts who are positive about gold. As Chinese people's disposable incomes gain and concerns grow over inflation and equity and property markets, Chinese consumers and investors are turning to gold as a long term investment hedge. There is informed speculation that commercial Chinese banks may have taken advantage of the recent price dip to build stocks of coins and bars and accumulate bullion. China's demand for physical gold bullion has rocketed past India with the country now overtaking India in the third quarter as the largest gold jewellery market according to the World Gold Council. There is also informed speculation that some of the buying was from the People's Bank of China with one analyst telling Bloomberg that “there is always the possibility that some purchases were made by the central bank.”

EURUSD Pops On Merkel Statement She Is Ready To Pay More Capital Into ESM To "Send Message To Markets"

With the EURUSD below 1.27, it was time for today's Europe bailout, which just came courtesy of Frau Merkel, who in a press conference with Monti stated the following:- Merkel says Germany willing to pay more capital into ESM at the start in order to give message to markets

- Merkel says if soldairy is necessary we are ready to react immediately

- Merksel says there is still much money in the European structure and cohesion funds

Frontrunning: January 11

- Europe’s $39T Pension Threat Grows as Economy Sputters (Bloomberg)

- Monti Warns of Italy Protests as He Meets Merkel (Bloomberg)

- Bernanke Doubling Down on Housing Bet Asks Government to Help: Mortgages (Bloomberg)

- Europe Banks Resist Draghi Bid to Avoid Crunch by Hoarding Cash (Bloomberg)

- Europe Fears Rising Greek Cost (WSJ)

- ECB’s Nowotny Sees Risk of Mild Recession in Euro Region (Bloomberg)

- Republican Senators Criticize Fed Recommendations on Housing (Bloomberg)

- Spanish Banks Try to Build Their Way Out of Home Glut (WSJ)

- Europe Stocks Fluctuate After German Auction (Bloomberg)

Risk, Euro Tumbles Under 1.27 On Weak European Data, Continued Flight To Safety

Over the past hour the EURUSD has tumbled by nearly 100 pips on what some believe is a liquidation program, but is largely driven off continued European data weakness (and with the recession here, we will be getting much more of this in the days to come), as well as continued scramble for safety. Germany auctioned off a 5 year note which received €9billion bids for €4billion target; the bund yield 2.3bps was indicative of a safe haven bid, and explains why bank deposits with the ECB rose to a new record €486billion. The strength is somewhat peculiar as it was earlier reported that the German economy contracted by 0.25 bps in Q4, which is never a good thing, but the assessment is that German weakness will hit others more than Germany itself. Elsewhere, Spanish industrial production declined -7.0% Y/y vs an estimated -5.4%, the worst decline since Oct. 2009. Spain 2-year yield down -34bps, causing spread to bunds to fall 33bps. We doubt that this contraction will last, or the BTP yield flirting with the 7% barrier especially after Rabobank finally noted what we have been saying for a while, namely that LCH will soon have to hike Italian margins again. In Greece, CPI rose 2.2% Y/y vs est. 2.7%; a decline which is seen as a symptom of economic downturn. Confirming the slowdown, we learn that Euroarea Q3 economic growth was reduced to 0.1%, meaning that the recession likely started in Q4. Hungary is again a center of attention, after the forint drops following an EU statement it may suspend Hungary funding (unless the country hands over its legislative apparatus to the EU entirely). Finally, we find out that French Fitch is now channeling France, after saying that the ECB must do more to prevent a cataclysmic Euro collapse. All this leads to a drop in the EUR to under 1.27, a slide in crude to under $102, and a decline in gold to $1634 after nearly hitting $1650 in overnight trading as the world realizes that a return in Chinese inflation (that SHCOMP surge isnt coming on its own) courtesy of a loose PBOC, will mean a prompt retrace of the metal's all time highs.

Former hedge fund manager and Establishment candidate Mitt Romney, whose net worth is estimated at $250 million, took first place in New Hampshire Tuesday night. The people’s candidate, Constitutionalist Dr. Ron Paul finished in a strong second place with 24% of the vote – encouraging results despite the highly questionable accuracy and security of the Diebold voting machines which were used in nearly 90% of precincts.

Ron Paul’s campaign called on the rest of the Republican field to drop out of the race and unite behind him in order to defeat Mitt Romney.

“We urge Ron Paul’s opponents who have been unsuccessfully trying to be the conservative alternative to Mitt Romney to unite by getting out of the race and uniting behind Paul’s candidacy,” campaign chair Jesse Benton said in a statement.

“Ron Paul tonight had an incredibly strong second-place finish in New Hampshire and has stunned the national media and political establishment. When added to Paul’s top-tier showing in Iowa, it’s clear he is the sole Republican candidate who can take on and defeat both Mitt Romney and Barack Obama. The race is becoming more clearly a two-man race between establishment candidate Mitt Romney and Ron Paul, the candidate of authentic change. That means there is only one true conservative choice. Ron Paul has won more votes in Iowa and New Hampshire than any candidate but Mitt Romney. Ron Paul and Mitt Romney have been shown in national polls to be the only two candidates who can defeat Barack Obama.

Officially, America is now bankrupt: financially, economically,

politically – and morally. Its criminal aggression towards Iran is just

one of many parts of a jigsaw that add up to a clear and grotesque

picture of what the United States of America now represents in the 21st

Century world.

The numbers and pictures for these constituent parts of this odious jigsaw puzzle are well known. But what has become glaringly clear is just how integrated the official image of the US now is. Bankrupt.

Terminally in debt, mass poverty at record levels, rampant militarism, draconian curbs on civil liberties, government by the rich for the rich, and lately the reactionary, debased cat-fight that passes for political debate among Republican contenders for the Presidency. Cringing is the sight of super wealthy career politicians throwing sand in each other’s eyes to scrabble up the pole for yet further personal accumulation of capital; disturbing is the easy way that psychopathic targeting of imagined enemies whether at home or abroad is worn like a badge of honour. It is a sign of how depraved the American political mind has become when would-be presidents can so openly talk of conducting foreign policy in terms of unquestioned international aggression.

Read More @ GlobalResearch.ca

The numbers and pictures for these constituent parts of this odious jigsaw puzzle are well known. But what has become glaringly clear is just how integrated the official image of the US now is. Bankrupt.

Terminally in debt, mass poverty at record levels, rampant militarism, draconian curbs on civil liberties, government by the rich for the rich, and lately the reactionary, debased cat-fight that passes for political debate among Republican contenders for the Presidency. Cringing is the sight of super wealthy career politicians throwing sand in each other’s eyes to scrabble up the pole for yet further personal accumulation of capital; disturbing is the easy way that psychopathic targeting of imagined enemies whether at home or abroad is worn like a badge of honour. It is a sign of how depraved the American political mind has become when would-be presidents can so openly talk of conducting foreign policy in terms of unquestioned international aggression.

Read More @ GlobalResearch.ca

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment