Breaking! RON PAUL WARNS OF WORLD CURRENCY PLAN During South Carolina Eagle Aviation

Tyler Durden and Paul Krugman agree! – The EU is toast!

01/14/2012 - 15:21

Jim Sinclair’s Commentary

There is an axiom that must be remembered under today’s strange financial circumstances with top financial management by sociopaths.

The guarantee is no better than the guarantor.

Hi Jim,

Regarding Jeff Berwick’s article, "Who Really Owns Your Gold Stocks?," it is important for JSMineset readers to understand the limitations of SIPC protection. Page four of the booklet “How SIPC Protects You” says, "Customers of a failed brokerage firm get back all securities (such as stocks and bonds) that already are registered in their name or are in the process of being registered."

I asked SIPC specifically if securities held in "street name" are considered to be registered in the name of the customer and thus eligible for complete protection. SIPC replied:

"In a liquidation proceeding under the Securities Investor Protection Act ("SIPA"), customers of a failed brokerage firm first get back all securities that are already registered in their name or are in the process of being registered, these are called "customer name securities." Customer name securities are negotiable only by the registered owner.

Securities held in "street name" are not considered customer name securities. In a SIPA liquidation proceeding, after the return of customer name securities, the remaining customer assets make up the "fund of customer property." The fund of customer property includes all customer securities held in "street name." The fund of customer property is divided on a pro rata basis with funds shared in proportion to the size of claims. If securities are still missing after the pro rata distribution, the customer would then be entitled to the coverage provided by SIPC, up to the statutory limit."

The SIPC brochure is available for download here: http://www.sipc.org/how/brochure.cfm

I could elaborate on discussions I had with SIPC, which raised additional red flags, but the above should be enough to encourage anyone who is serious about protecting him or herself to take action.

Best Wishes,

CIGA Paul

Dear CIGAs,

Please do not sleep on my dear friends. If you do nothing, you may very well have nothing in the end.

If you do not want to get it in the end you will have to act now on what I have already told you. The material contained in here concerning the system and market events is correct, even though it proposes its own solution. I should know. I have owned brokerage and clearing houses.

The answer lies, in my opinion, in going to direct registration at the transfer agent and out of the clearing agent and ultimately, where possible, to paper certificates. If the company you are invested in does not participate in direct registration and also does not issue paper certificates, raise hell with them.

Who Really Owns Your Gold Stocks? Jeff Berwick

Published 1/11/2012

Do you own gold and silver mining stocks? Or any stocks for that matter? Even if you say, "yes", chances are you don’t really own them.

It is one of the dirtiest little secrets in the brokerage business. And 99.9% of people have no idea it is even being done to them. It’s called "street name registration" and it’s how the brokerage where you hold your stocks "registers" your shares. To save money and time, and to allow your shares to be included as assets that they can use to do what they want with, your brokerage never actually registers you as an owner of the shares.

Street name registration allows your broker to lend your shares to short sellers, thereby driving down the price of your own stocks. Additionally, this method allows your broker to “re-hypothecate” your assets–meaning it allows your broker to borrow money against your shares and speculate in the derivatives market.

These hidden risks are planting the seeds of tomorrow’s ultimate collapse – In which there may be a system-wide collapse of broker dealers, taking down millions of investors, and ensuring permanent non-recoverable losses to an entire generation!

MF Global Was Just the First to Go Down

MF Global investors found out first hand just how secure their funds were. Most don’t realize it, but MF Global was a clearing house for both stocks and futures. Like many/most brokerages, they "invest" their own funds, often on a highly leveraged basis, to earn income. But, with the recent collapse of Greek government bonds and with MF Global’s highly leveraged position in them, MF Global was bankrupted in an instant.

The problem is, they tried to cover their losses with their customer’s own funds. You see, unless your shares are registered in your own name – a process that isn’t that difficult or costly – your brokerage considers it as assets they can use for their own needs.

Plus, once a brokerage goes bankrupt (which is something we expect to happen very often over the coming years) if you hadn’t personally registered your shares then your shares go down as assets of the brokerage and are used to pay off their creditors.

“Several million private accounts may vanish – brokerage accounts, pension funds, mutual funds, they’re all at risk. We are getting into the middle stages of implosion, where I believe the public will not wake up until at least one million private accounts are stolen, and completely vanish.” – Jim Willie, The Hat Trick Letter

The Western Financial System Is In A State Of Collapse

The reason for this coming broker-dealer crisis is simple. The entire western financial system is built on debt – it’s an anti-capitalist system set-up to make the rich richer and the poor poorer. It started in 1913 with the founding of the Federal Reserve, it went further down the slippery slope with gold confiscation in the US in 1933 and reached the beginning of the end in 1971 with Nixon closing the gold window, turning the US dollar (officially called the Federal Reserve Note) into a completely fiat currency.

In more recent times, it was the repeal of the Glass-Steagel act that allowed investment banks to acquire broker-dealers, and pass the risks of 100-1 leverage downstream to all client accounts. Therefore, your stock investments are now only as safe as the speculative portfolio of your broker-dealer. Considering most Western Investment Houses are leveraged at least 40-1, this means your stocks are no safer than a 40-1 bet on European bonds (with which most western investment banks are leveraged to the teeth).

Some believe their stocks will be protected by the Securities Investor Protection Corporation (SIPC), which insures stocks accounts from broker collapse up to $500k for securities, and account cash balances up to $250k. But what if you have more than $250k in cash and/or more than $500k of securities in your account? What if one of the largest broker dealers in the country went bust, bringing down thousands of accounts and depleting the entire reserves of the SIPC? What if the SIPC itself goes bankrupt? What few people are aware of, is that the SIPC only carries about $1 billion in funds to cover investors! This means only one or two high profile broker dealer bankruptcies will be enough to completely wipe out the SIPC.

Some may claim the US government will bail out the SIPC to whatever extent needed. But what if two major broker dealers went bust while at the same time the US government suffers a major Treasury bond auction failure? This is all but a certainty in the coming years.

And the same thing applies in Canada to Canadian brokerages and Canadian stocks. The Canadian economy is intricately tied to the US. In fact, not many people are aware, but all that backs the Canadian dollar is the US dollar. The Canadian Government sold all its gold decades ago.

The entire monetary & financial system is headed for its final destination – total collapse… and 2008 was just the beginning.

“If you were lucky enough not to be a customer of MF Global … then you should view the MFG episode as a warning shot. You might not get another warning shot.” -Steven Saville, The Speculative Investor

One Last Bubble?

But, we’ve been predicting there are still a few more years left… not 10. But maybe two to three more years… or a little more. We believe the Federal Reserve and all western central banks will print enough money to get the system through for another few years… just enough for them to get out of office and retired to their Caribbean island villas before all the western fiat currencies enter hyperinflation.

And, we believe this will create one final bubble. The tech bubble is dead. The housing bubble is dead. And the bubble in government debt is in its death throes. What will be the final bubble? It will be in gold and silver mining stocks.

But the question remains — how can we safely invest in gold and silver mining shares and avoid the collapse brought on by the coming broker dealer crisis?

There are two methods of owning stocks your broker-dealer will never tell you about. These two methods completely remove the broker dealer counter party risk attached to your shares – effectively removing them from “the system.”

These two methods deprive your broker dealer the abilities to sell your stocks short and to “re-hypothecate” them. Your broker dealer will never willingly tell you about these methods – because they make more money when your shares are in their hands – precisely where risks are greatest to you.

These methods are so safe, that even if your broker dealer collapsed tomorrow, and stole every penny from every client investment account you would be able to sleep safe and sound, knowing your stocks are far out of reach, and legally unavailable to access by your broker-dealer.

This means everyone – all brokers in the Unites States and Canada. If every broker collapsed tomorrow due to waves of bankruptcies, these ownership methods will protect you 100%. You will be able to sleep safe and sound at night, knowing your shares are carrying zero counter party risk.

More…

I sure hope it never comes to this...

Jim Sinclair’s Commentary

QE to infinity in the entire Western financial world. There is no other alternative.

Fed to Weigh Further Easing Amid Doubts About Recovery Published: Friday, 13 Jan 2012 | 11:55 AM ET

Federal Reserve officials are seriously considering giving the US economy—and especially the housing market—an added jolt with more quantitative easing. Fed officials are likely to discuss such a move at their Jan. 24-25 meeting, when the central bank will issue its first quarterly forecast on interest rates under the new communication policy.

Two of the new voting members this year on the Federal Open Market Committee , which sets interest-rate policy, have recently suggested they would support more assets purchases.

San Francisco Fed President John Williams said that sustained high levels of unemployment, as forecast by many Fed members, "does make an argument that we should have more stimulus."

Another new voter, Cleveland Fed President Sandra Pianalto, said in a recent speech that economic models indicate the Fed "should be even more accommodative than it is today."

They join other members, including New York Fed President Bill Dudley and several Fed governors, who have openly suggested they would support more QE As part of an normal rotation of presidents, the makeup of the FOMC will become more dovish this year.

More…

Dear Friends,

Please report the levels of success you are having with direct registration in the name of the custodian and your tax protected securities accounts.

Every brokerage house can do it, but only a few will.

Regards,

Jim

The Greatest Truth Never Told: 43. The Rigged Game

Iran Foreign Ministry Claims Nuclear Scientist Was Executed By CIA, As Nigeria Strike Talks Collapse

While on one hand we get news from Nigeria that the government and the labor unions have failed to end a labor strike, raising the prospect of a halt of all production in the country which produces 2.4 million barrels of oil per day or roughly the same as Iran exports, we now find out that the US attempt at de-escalating tensions with Iran (following Thursday's news of an extension in the oil embargo deadline by 6 months - one would almost think Obama realized $5.00 gas may be an issue with the election looming) may have failed massively, and it is now Iran's attempt to score political brownie points knowing well it has all the advantage. As EA WorldView reports, instead of backing away from last week's sensitive issue of the assasination of a nuclear scientist, Iran has ripped the scab right off the wound and its foreign ministry has boldly proclaimed that it has "reliable documents and evidence that this terrorist act was planned, guided and supported by the CIA. The documents clearly show that this terrorist act was carried out with the direct involvement of CIA-linked agents." So the ball is now squarely back in America's court, and any further attempts at appeasement, such as the embargo extension was perceived as being, will merely serve to make US foreign policy appear even more toothless. Which Hillary will hardly stomach. So we may well be back at square one (only this time with two aircraft carriers in the Arabian Sea instead of just one).Presenting Mitt Romney's Top Campaign Contributors

Periodically refreshed without commentary.

by Ned W. Schmidt, MarketOracle.co.uk:

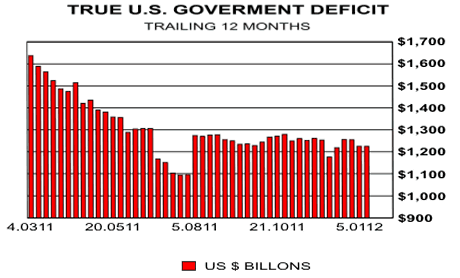

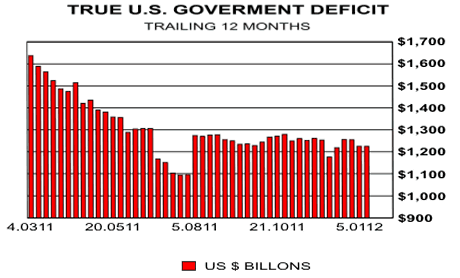

Debt constrains one’s enjoyment of life. Without debt to repay, we could use our incomes solely for the pursuit of the good life. You get to define of what that consists, be it food and wine, debauchery or charitable deeds. With debt, life is miserable. Greece has learned that lesson. Spain and Portugal now know that. Those that lost their homes due to the bursting of the Federal Reserve’s housing bubble know that. Seems just about everyone but Keynesian economists hiding in their academic cloisters, free of the real world, are fully aware of economic death through debt.

Only condition worse than having debt is having one’s debt burden growing. Each day brings one closer to the time when one will not be able to spend money as one wishes because of debt payments. Any kind of enjoyable life will be unaffordable, much less the good life. Seems everyone knows that, with the exception of the Obama Regime and their moribund Keynesian advisors.

Read More @ MarketOracle.co.uk

Debt constrains one’s enjoyment of life. Without debt to repay, we could use our incomes solely for the pursuit of the good life. You get to define of what that consists, be it food and wine, debauchery or charitable deeds. With debt, life is miserable. Greece has learned that lesson. Spain and Portugal now know that. Those that lost their homes due to the bursting of the Federal Reserve’s housing bubble know that. Seems just about everyone but Keynesian economists hiding in their academic cloisters, free of the real world, are fully aware of economic death through debt.

Only condition worse than having debt is having one’s debt burden growing. Each day brings one closer to the time when one will not be able to spend money as one wishes because of debt payments. Any kind of enjoyable life will be unaffordable, much less the good life. Seems everyone knows that, with the exception of the Obama Regime and their moribund Keynesian advisors.

Read More @ MarketOracle.co.uk

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment