Fitch Says Greece Will Default By March 20 Bond Payment

It's all over but the crying at least as far as Greece is concerned. First, it was S&P's Kraemer telling Bloomberg yesterday the country is finished, now today for dramatic impact, we get Fitch's repeating the doom and gloom, stating that the country will likely default before its March 20 payment. From Bloomberg: "Greece is insolvent and will default on its debts, Fitch Ratings Managing Director Edward Parker said. The euro area’s most indebted country is unlikely to be able to honor a March 20 bond payment of 14.5 billion euros ($18 billion), Parker said in an interview in Stockholm today. Efforts to arrange a private sector deal on how to handle Greece’s obligations would constitute a default at Fitch, he said. “The so called private sector involvement, for us, would count as a default, it clearly is a default in our book,” Parker said. “So it won’t be a surprise when the Greek default actually happens and we expect it one way or the other to be relatively soon." Europe’s debt crisis is likely to be “long and drawn out,” Parker said." And here we go again, with official attempts to make what appeared apocalyptic as recently as a month ago, seem trite, boring and perfectly anticipated. In other words, the fact that this like every other piece of bad news that should be priced in, is priced in, is priced in. And so on, at least according to the kleptocrats, until we finally learn that nothing is priced in but endless market stupidity.

In

the wake of the collective downgrading of 9 eurozone countries,

including France, it’s become clear that the EU’s policy of rescue funds

coupled with fiscal austerity has exhausted itself. It’s time for

Angela Merkel and her partners to find a credible outcome, writes

Wolfgang Münchau.

by Wolfgang Münchau, PressEurop.eu:

At the end of a briefly euphoric week, reality caught up.

At the end of a briefly euphoric week, reality caught up.

On one level, Friday’s news was not really surprising. The French rating downgrade was a shock foretold. As was the breakdown in talks between private investors and the Greek government about a voluntary participation in a debt writedown. A proposition that was unrealistic to start with has been rejected. We should not feign surprise.

And yet both events are important because they show us the mechanism behind this year’s likely unfolding of events. The eurozone has fallen into a spiral of downgrades, falling economic output, rising debt and further downgrades. A recession has just started. Greece is now likely to default on most of its debts and may even have to leave the eurozone. When that happens, the spotlight will fall immediately on Portugal, and the next contagious round of downgrades will begin.

Read More @ PressEurop.eu

by Wolfgang Münchau, PressEurop.eu:

At the end of a briefly euphoric week, reality caught up.

At the end of a briefly euphoric week, reality caught up.On one level, Friday’s news was not really surprising. The French rating downgrade was a shock foretold. As was the breakdown in talks between private investors and the Greek government about a voluntary participation in a debt writedown. A proposition that was unrealistic to start with has been rejected. We should not feign surprise.

And yet both events are important because they show us the mechanism behind this year’s likely unfolding of events. The eurozone has fallen into a spiral of downgrades, falling economic output, rising debt and further downgrades. A recession has just started. Greece is now likely to default on most of its debts and may even have to leave the eurozone. When that happens, the spotlight will fall immediately on Portugal, and the next contagious round of downgrades will begin.

Read More @ PressEurop.eu

Ron Paul vs. Big Government ^ 3

Second MF Global Unveiled As Canadian Regulator Accuses Barret Capital Of Commingling Client Funds

When we learned of the MF Global client theft scandal, in the aftermath of its sudden bankruptcy filing, the one thing we predicted would happen (in addition to Jon Corzine never going to prison) was that many more brokers, banks and broadly financial intermediaries would be discovered having dipped in client accounts, or otherwise "commingled" capital in direct violation of the first rule of banking. Sure enough, a little over two months since, the second notable company to have been alleged to have abused client capital for own purposes has emerged. And it comes to us courtesy of sleep Canada whose "banks are all fine." As the Winnipeg Free Press reports, "One of Canada's investment regulators has accused Barret Capital Management, a firm specialized in futures and options on metals and other exchange-traded commodities, of using client money for its own purposes. The Investment Industry Regulatory Organization of Canada warned Monday that Barret clients are at risk due to the firm's "ongoing misappropriation of their money to fund losing trades and ongoing misinformation about the value and holdings in their accounts." IIROC has set a hearing for Tuesday morning to suspend Barret's membership in the organization and stop Barret from dealing with the public. In requesting the expedited hearing, the regulator alleged Barret made "significant misrepresentations to clients including through manipulating account values, misrepresenting account values and holdings by way of false account statements or otherwise providing false information to clients and by manipulating on and off book payments to clients." Where the story gets even more interesting is when one takes a look at just what it is that the company engages in, and how it fits into the scenario analysis conducted in the MF Global aftermath.Baltic Dry Index Slumps To Lowest Since January 2009

The

apparently critical-when-its-going-up-but-ignore-it-when-it-is-falling

index of the cost of dry bulk goods transportation has 'crashed' in

the last few weeks to its lowest level since January 2009 (back below

1000 according to today's levels). Whether this is seasonal output

differences or weather impacts, it seems clear that lower steel output

in China and a decline in European imports is having its impact on

global trade. The index has fallen for 19 days in a row, down almost 50%, its largest drop since the harrowing period of Q4 2008.

The

apparently critical-when-its-going-up-but-ignore-it-when-it-is-falling

index of the cost of dry bulk goods transportation has 'crashed' in

the last few weeks to its lowest level since January 2009 (back below

1000 according to today's levels). Whether this is seasonal output

differences or weather impacts, it seems clear that lower steel output

in China and a decline in European imports is having its impact on

global trade. The index has fallen for 19 days in a row, down almost 50%, its largest drop since the harrowing period of Q4 2008.Guest Post: Decentralization Is The Only Plausible Economic Solution Left

The

great lie that drives the fiat global financial locomotive forward is

the assumption that there is no other way of doing things. Many in

America believe that the U.S. dollar (a paper time-bomb ready to

explode) is the only currency we have at our disposal. Many believe

that the corporate trickle down dynamic is the only practical method

for creating jobs. Numerous others have adopted the notion that global

interdependency is a natural extension of “progress”, and that anyone

who dares to contradict this fallacy is an “isolationist” or

“extremist”. Much of our culture has been conditioned to support and

defend centralization as necessary and inevitable primarily because

they have never lived under any other system. Globalism has not made

the world smaller; it has made our minds smaller. By limiting choice,

we limit ingenuity and imagination. By narrowing focus, we lose sight

of the much bigger picture. This is the very purpose of the feudal

framework; to erase individual and sovereign strength, stifle all new

or honorable philosophies, and ensure the masses remain completely

reliant on the establishment for their survival, forever tied to the

rotting umbilical cord of a parasitic parent government.

The

great lie that drives the fiat global financial locomotive forward is

the assumption that there is no other way of doing things. Many in

America believe that the U.S. dollar (a paper time-bomb ready to

explode) is the only currency we have at our disposal. Many believe

that the corporate trickle down dynamic is the only practical method

for creating jobs. Numerous others have adopted the notion that global

interdependency is a natural extension of “progress”, and that anyone

who dares to contradict this fallacy is an “isolationist” or

“extremist”. Much of our culture has been conditioned to support and

defend centralization as necessary and inevitable primarily because

they have never lived under any other system. Globalism has not made

the world smaller; it has made our minds smaller. By limiting choice,

we limit ingenuity and imagination. By narrowing focus, we lose sight

of the much bigger picture. This is the very purpose of the feudal

framework; to erase individual and sovereign strength, stifle all new

or honorable philosophies, and ensure the masses remain completely

reliant on the establishment for their survival, forever tied to the

rotting umbilical cord of a parasitic parent government. GFMS reports substantial offtake of Gold by Central Banks

Trader Dan at Trader Dan's Market Views - 18 minutes ago

Dow Jones news is carrying a report this morning from GFMS (formerly Gold

Fields Mineral Services)detailing the amount of gold purchased last year by

the world's Central Banks. It was indeed a formidable number.

The net purchases of the yellow metal came in near 430 tons, a more than

5-fold increase on the previous year. It was also the highest level

recorded since 1964.

To give you a sense of the significance of these purchases - the amount of

NET purchases by Central Banks in 2010 was a mere 77 tons!

Surprising to me was the fact that Mexico was the largest buyer as far as

the of... more »

CNBC Video: Most Europe, US Ratings Should Be Lower

Admin at Marc Faber Blog - 1 hour ago

CNBC video interview, January 2012.

*Marc Faber is an international investor known for his uncanny predictions

of the stock market and futures markets around the world.*

Let People Go Bankrupt

Admin at Jim Rogers Blog - 1 hour ago

The best way to get out of it is to go ahead and to let people go bankrupt,

let the people who made mistakes take their losses, the banks who made the

bad loans, the people who invested in the bad banks – they should take

their losses and start over. - *in RT.com*

*Related, Banco Santander (STD), Deutsche Bank (DB), Royal Bank of Scotland

Group plc ADR (RBS) *

*Jim Rogers is an author, financial commentator and successful

international investor. He has been frequently featured in Time, The New

York Times, Barron’s, Forbes, Fortune, The Wall Street Journal, The

Financial Times and i... more »

You Should Not Bother To Pay Any Attention To The Rating Agencies

Admin at Jim Rogers Blog - 1 hour ago

It means that you should not bother to pay any attention to the rating

agencies. Everything they have done in the past 15 or 20 years has been

wrong. I stopped bothering about them long ago.

Everybody knows that France is no longer Triple-A, everybody knows that

Italy is no longer as highly-rated as it used to be. The market knows all

about this. This is not news. I know you have to report something, but this

is not news to people in the market. - *in RT.com*

Related, Moody`s Corporation (MCO)

*Jim Rogers is an author, financial commentator and successful

international investor. He... more »

Currency Devaluation No Pocket Change

Eric De Groot at Eric De Groot - 13 hours ago

Kevin reminds us all that changing composition and shrinking circulations of smaller denomination coins more often than not unrecognized symptoms of rampant currency devaluation across the globe. Awesome blog, Composition of loonies and toonies will be switched to a steel core from nickel Thought you might find this interesting... montrealgazette.com Kevin Headline: Canada to mint cheaper... [[ This is a content summary only. Visit my website for full links, other content, and more! ]]

Romney Pays Less In Tax Than His Secretary

First Buffet, now Mitt Romney. Via Bloomberg:- ROMNEY SAYS HIS EFFECTIVE TAX RATE CLOSER TO 15%

- ROMNEY SPEAKS TO REPORTERS IN FLORENCE, SOUTH CAROLINA

- ROMNEY SAYS MUCH OF HIS INCOME COMES FROM INVESTMENTS

While everything negative is "priced in" in perpetuity, just as it was in January 2011 when nobody cared about Europe for months, until it hit with a vengeance and the second failed Greek bailout had to be enacted, someone appears to have forgotten to tell the EFSF that its magnificent placement of €1.5 billion in ultra-short term Bills today is supposed to confirm all is well, and that the French downgrade is for chumps. The EFSF spread has now ballooned back to December 21 levels when the LTRO took place. Then again, with the market ramping now entirely on hopes of double downing €1 trillion LTRO as Zero Hedge reported first yesterday, fundamentals are the last thing that will matter.

UBS Explains Why AAA-Loss Is Actually Relevant

As

the buy-the-ratings-downgrade-news surge on European sovereigns stalls

(following a few weeks of sell-the-rumor on France for example), the

ever-ready-to-comment mainstream media remains convinced that the

impact is priced in and that ratings agencies are increasingly

irrelevant. UBS disagrees. In a note today from their global macro team,

they recognize that while the downgrades were hardly a surprise to

anyone (with size of downgrade the only real unknown), the effect on

'AAA-only' constrained portfolios is important (no matter how hard

politicians try to change the rules) but of more concern is the

political impact as the divergence between France's

rating (and outlook) and Germany (and UK perhaps) highlights harsh

economic realities and increases (as EFSF spreads widen further) the bargaining power of Germany in the economic councils of Europe. Furthermore, the potential for closer relationships with the UK

(still AAA-rated) increase as the number of AAA EU nations within the

Euro only just trumps the number outside of the single currency. This may be one of those rare occasions where politics is more important than economics.

As

the buy-the-ratings-downgrade-news surge on European sovereigns stalls

(following a few weeks of sell-the-rumor on France for example), the

ever-ready-to-comment mainstream media remains convinced that the

impact is priced in and that ratings agencies are increasingly

irrelevant. UBS disagrees. In a note today from their global macro team,

they recognize that while the downgrades were hardly a surprise to

anyone (with size of downgrade the only real unknown), the effect on

'AAA-only' constrained portfolios is important (no matter how hard

politicians try to change the rules) but of more concern is the

political impact as the divergence between France's

rating (and outlook) and Germany (and UK perhaps) highlights harsh

economic realities and increases (as EFSF spreads widen further) the bargaining power of Germany in the economic councils of Europe. Furthermore, the potential for closer relationships with the UK

(still AAA-rated) increase as the number of AAA EU nations within the

Euro only just trumps the number outside of the single currency. This may be one of those rare occasions where politics is more important than economics.S&P Issues Walk Thru On Follow Up Downgrades Of European Banks And Insurers

As expected in the aftermath of the concluded S&P ratings action on European sovereigns, the next action is for the rating agency to go ahead and start cutting related banks and insurers, as we noted over the weekend with many of the main European banks anticipated to see one or two notch cuts potentially as soon as today. Which is why the just released report "How Our Rating Actions On Eurozone Sovereigns Could Affect Other Issuers In The Region" will be read by great interest by many to get a sense of when the next shoe is about to drop. Here is what it says on that topic.Half Of Citi Pretax Income Over Past Two Years Comes From Loan Loss Reserve Releases

Wonder

why nobody trusts bank numbers, and why US financial institutions

trade at some fraction of book value? The chart below should explain a

big part of it. As can be quite vividly seen, of the $28 billion in

pre-tax net income from continuing operations "generated" over the past

two years, exactly half, or $14 billion, has been due from a simply

accounting trick, namely the release of loan loss reserves, which have

been positive for 8 quarters in a row, and which in the just completed

quarter amounted to more than the actual pretax number, confirming EPS

would have been negative absent accounting trickery (source).

One wonders what happens to Citi Net Income once the world openly

re-enters a recession, and releases have to become builds again... And

for those who enjoy the myth of reported numbers, and are trying to

reconcile the resurgence in bank stocks with abysmal earnings, yet wish

to understand why Citi has let go the well known Rohit Bansal, and

Chris Yanney, who headed the bank's distressed and HY trading

respectively, below is also a chart showing the dramatic collapse in

the bank's Securities and Banking revenue which just came at the lowest

in the past two years, with Norta American top line in particular

being decimated.

Wonder

why nobody trusts bank numbers, and why US financial institutions

trade at some fraction of book value? The chart below should explain a

big part of it. As can be quite vividly seen, of the $28 billion in

pre-tax net income from continuing operations "generated" over the past

two years, exactly half, or $14 billion, has been due from a simply

accounting trick, namely the release of loan loss reserves, which have

been positive for 8 quarters in a row, and which in the just completed

quarter amounted to more than the actual pretax number, confirming EPS

would have been negative absent accounting trickery (source).

One wonders what happens to Citi Net Income once the world openly

re-enters a recession, and releases have to become builds again... And

for those who enjoy the myth of reported numbers, and are trying to

reconcile the resurgence in bank stocks with abysmal earnings, yet wish

to understand why Citi has let go the well known Rohit Bansal, and

Chris Yanney, who headed the bank's distressed and HY trading

respectively, below is also a chart showing the dramatic collapse in

the bank's Securities and Banking revenue which just came at the lowest

in the past two years, with Norta American top line in particular

being decimated.Citigroup Misses Big On Top And Bottom Line: Earnings Negative Absent Loan Loss Release

Following last week's Easter egg by JPMorgan, the misses by financials continue, with Citi crapping the bed following a big miss in both top and bottom line after reporting $17.2 billion and $0.38 EPS on expectations of $18.5 billion and $0.52 per share. The biggest hit to the top line was the DVA adjustment courtesy of tightening CDS spreads, which while adding to top and bottom line in Q3, took out $1.9 billion in Q4 - of course like everything else it was also priced in. And while we are confident the full earnings presentation will be a labyrinth of loss covering, the first thing to realize is that absent a $1.5 billion in loan loss reserve releases, the bank would have reported negative net income, which was $1.364 billion pretax. Yet there is no way to explain the absolute bloodbath in the Securities and Banking group, which saw revenues implode by 53% from $6.7 billion to $3.2 billion Y/Y, and down 10% Q/Q. Notably, Lending revenues down 84% from $1 billion to $164 million. RIP Carry Trade.Global Gold Coin & Bar Demand Surges in 2011 - Thomson Reuters GFMS Annual Gold Survey

Gold coin purchases gained 13% last year and will increase 2.7% in the first half. Purchases of gold bars increased by 36% to nearly 2,000 (1,194) metric tonnes, concentrated in China, Germany, Switzerland and Austria. East Asia demand for gold bars rose 53% to 456 metric tonnes. India rose 9% to 297 metric tonnes and western markets demand for gold bars rose 41% to 335 metric tonnes. Central banks increased net purchases by a massive fivefold to 430 tons last year, and may buy another 90 tons in the first half, GFMS said. Combined official holdings stand at 30,788.9 tons, data from the London-based World Gold Council show. “Attitudes among central banks haven’t really changed,” Thomson Reuters GFMS annual survey said. “There’s still that desire to come into the gold market to diversify some of the assets away from foreign exchange and to boost gold holdings.” The Thomson Reuters GFMS annual gold survey also predicts that gold will struggle in the first half of the year, increasing in the later half towards $2,000. It also says the gold bull market is losing steam and predicts an end to the run as economies recover next year and interest rates begin to rise.EFSF, Spain, Belgium, Greece And Hungary Issue Bills; Deposits With ECB Pass Half A Trillion

The good news out of Europe is that despite the long-overdue downgrade 4 countries plus the EFSF issued debt successfully, namely the EFSF as well as Spain, Belgium, Greece And Hungary. The bad news is that all of the debt issued was Bills, which at least for now is not an issue when it comes to market access as the market believes that LTRO cash will cover anything with a sub-3 year maturity courtesy of the LTRO, even if in reality nobody is using the LTRO for debt roll purposes and all auctions are net cash withdrawing from the system. In brief: the EFSF sold €1.5 billion in 6 month bills at a 0.2664% yield and 3.10 BTC; Spain issued €4.9 billion out of a €5 targeted in 12 and 18 month bills, which priced better than the last such auction from December 13, at mixed Bids to Cover; Belgium raised €1.76 billion in 3 month bills at a higher yield or 0.429% compared to 0.264% before and in line BTC as well as €1.2 billion in 12 month Bills at a 1.162% yield compared to 2.167% and a lower BTC; Greece bill yields fell at a 3 month bill auction to 4.64% vs 4.68% before, selling €1.625 bn with €1.25b in competitive auction, meeting maximum competitive auction target of EU1.25b and so on. The picture is simple: when it comes to funding itself, Europe is great at ultra-short term debt, and not so good at anything longer. Regardless, Europe will spin this as a great success considering the S&P downgrade over the weekend. We'll wait to see how bond auctions longer than 5 years will fare, if of course any non-Bill auctions are conducted in Europe in the future. Some other good news came from the German Jan. ZEW confidence index which came at 28.4 vs est. 24.0. The result is that the expected EURUSD short covering has kicked in, and the pair is flirting with 1.28, as we get recoupling between asset classes. Bottom line: ultra short term debt and a rise in confidence is sufficient to push futures up by about 11 ES points. In the meantime, as the chart below shows, we get another record high parking of cash by European banks with the ECB at €502 billion, as the European superstorm - the failure of Greek restructuring talks - is about to hit, and banks have to prepare for the unknowable. Also, today we will likely see S&P begin downgrading hundreds of European banks and insurance companies. But that to is surely largely priced in.

Frontrunning: January 17

- Greece Running Out of Time as Debt Talks Stumble (Bloomberg)

- China Economic Growth Slows, May Prompt Wen to Ease Policies (Bloomberg)

- Spain Clears Short Term Debt Test, Bigger Hurdle Looms (Reuters)

- U.S. Market Shrinks for First Time Since 2009 (Bloomberg)

- IMF, EU May Need to Give E. Europe More Help (Bloomberg)

- Securities Regulator to Relax Rules on Listing (China Daily)

- Monti Seeks German Help on Borrowing (FT)

- Draghi Questions Role of Ratings Companies After Downgrades (Bloomberg)

by Constantin Gurdgiev, PressEurop.eu:

“In economics, things take longer to happen than you think they will, and then they happen faster than you thought they could,” as Rudiger Dornbusch remarked some years ago.

Friday the 13th – the day Standard and Poor’s (S&P) downgraded nine euro area sovereign bond ratings, stripping Austria and France off their AAA status, cutting Italy, Spain, Portugal and Cyprus’ rating by two notches, Malta, Slovakia and Slovenia by one notch each and placing 14 eurozone countries on negative watch for future downgrades. Finland, the Netherlands and Luxembourg are now also facing the potential loss of their AAA ratings. Greece is now in the imminent default territory and Italy is rated in the same risk group as Kazakhstan – BBB+.

Read More @ PressEurop.eu

Jan

16 (Reuters) – Clearing houses — the plumbers of high finance — could

become the next casualties of the crisis as regulators insist that banks

run their riskiest and private trades through them.

Jan

16 (Reuters) – Clearing houses — the plumbers of high finance — could

become the next casualties of the crisis as regulators insist that banks

run their riskiest and private trades through them.At the moment banks conduct over-the-counter trades between themselves: one to one dealings often involving multimillion-euro bets on differences in interest or other rates, the scale and complexity of which can be difficult to track.

But with the financial crisis still raging and banks, hedge funds and governments alike faced with unforeseen levels of debt, regulators are now forcing this shadowy, $600-trillion industry into the light.

The question being asked by industry insiders is whether the clearing houses, also known as central counterparties (CCPs), are any more secure.

Read More @ DailyBail.com

from Global Economic Analysis:

Bernanke is trying every way he can to get banks to lend (printing coupled with a multitude of lending facilities and Fed programs).

It’s easy enough to prove the printing: Base money supply is up about $1.8 trillion since the start of the recession.

Base Money Supply

Money Multiplier Theory

The Money Multiplier Theory (an incorrect theory) suggests this money would be lent out 10 times over causing rampant price-inflation and GDP growth.

Read More @ GlobalEconomicAnalysis.Blogspot.com

Bernanke is trying every way he can to get banks to lend (printing coupled with a multitude of lending facilities and Fed programs).

It’s easy enough to prove the printing: Base money supply is up about $1.8 trillion since the start of the recession.

Base Money Supply

Money Multiplier Theory

The Money Multiplier Theory (an incorrect theory) suggests this money would be lent out 10 times over causing rampant price-inflation and GDP growth.

Read More @ GlobalEconomicAnalysis.Blogspot.com

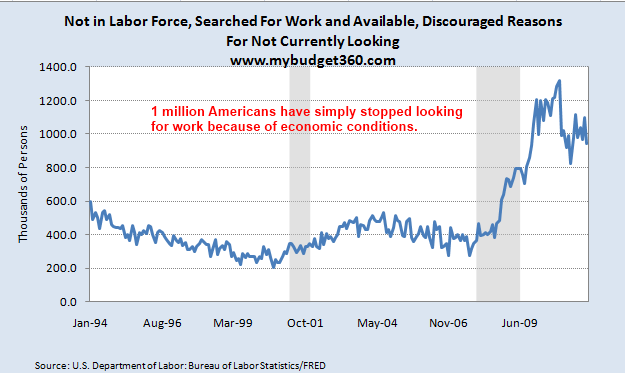

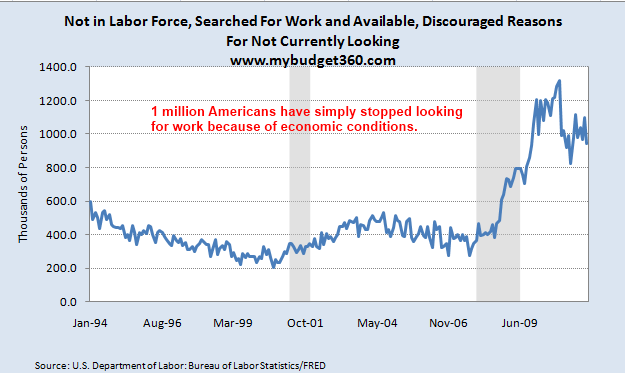

Before

recession hit 5,000,000 job openings were available while today there

are 3,000,000. 1,000,000 Americans have completely quit looking for work

and average duration of unemployment is 40 weeks, twice the amount of

the 1980s recession.

from mybudget360.com:

There is a growing disconnect in America as the middle class

is hollowed out. Many Americans hear talks of a recovery that is now

going on three years but look at their tight monthly budgets and wonder

what recovery is being discussed. The median household income is roughly $50,000 and with rising food, healthcare, energy, and college costs

many are left with little each month once the basics are paid for. And

that is the core of the issue. The typical American family is seeing

their paycheck devoured by items that are used on a daily basis. The

employment situation is tenuous at best. We still have a peak in

discouraged workers. Roughly 1,000,000 Americans have simply stopped

looking for work since the recession hit. These are people willing and

able to work but have given up in the current economy. We are adding

jobs and many are in the lower paying service sectors. What is meant by a recovery?

There is a growing disconnect in America as the middle class

is hollowed out. Many Americans hear talks of a recovery that is now

going on three years but look at their tight monthly budgets and wonder

what recovery is being discussed. The median household income is roughly $50,000 and with rising food, healthcare, energy, and college costs

many are left with little each month once the basics are paid for. And

that is the core of the issue. The typical American family is seeing

their paycheck devoured by items that are used on a daily basis. The

employment situation is tenuous at best. We still have a peak in

discouraged workers. Roughly 1,000,000 Americans have simply stopped

looking for work since the recession hit. These are people willing and

able to work but have given up in the current economy. We are adding

jobs and many are in the lower paying service sectors. What is meant by a recovery?

Read More @ myBudget360.com

from mybudget360.com:

There is a growing disconnect in America as the middle class

is hollowed out. Many Americans hear talks of a recovery that is now

going on three years but look at their tight monthly budgets and wonder

what recovery is being discussed. The median household income is roughly $50,000 and with rising food, healthcare, energy, and college costs

many are left with little each month once the basics are paid for. And

that is the core of the issue. The typical American family is seeing

their paycheck devoured by items that are used on a daily basis. The

employment situation is tenuous at best. We still have a peak in

discouraged workers. Roughly 1,000,000 Americans have simply stopped

looking for work since the recession hit. These are people willing and

able to work but have given up in the current economy. We are adding

jobs and many are in the lower paying service sectors. What is meant by a recovery?

There is a growing disconnect in America as the middle class

is hollowed out. Many Americans hear talks of a recovery that is now

going on three years but look at their tight monthly budgets and wonder

what recovery is being discussed. The median household income is roughly $50,000 and with rising food, healthcare, energy, and college costs

many are left with little each month once the basics are paid for. And

that is the core of the issue. The typical American family is seeing

their paycheck devoured by items that are used on a daily basis. The

employment situation is tenuous at best. We still have a peak in

discouraged workers. Roughly 1,000,000 Americans have simply stopped

looking for work since the recession hit. These are people willing and

able to work but have given up in the current economy. We are adding

jobs and many are in the lower paying service sectors. What is meant by a recovery?Read More @ myBudget360.com

by Rick Ackerman:

Fighting

the Fed is one thing. But fighting a global monetary blowout? Forget

it. The financial system is so glutted with virtual dollars these days

that U.S. stocks would probably hold their ground even if nuclear war

were to erupt. Although Friday’s news admittedly fell shy of that

threshold, we might have expected a little more deference on Wall Street

toward news that Standard & Poor’s had downgraded the credit of

France and Austria. Granted, this could have shocked no one, since

France had all but begged its comeuppance by pretending to be Germany’s

co-equal in the ongoing eurobailout dog-and-pony show. Still, we had

come to expect share prices to at least defer perfunctorily to such

news, since prop-desk traders typically knee-jerk in whichever direction

they expect their algorithm-driven, bipolar colleagues’ knees to jerk.

Thus, when the news is ostensibly bad, as was the case on Friday, it’s

supposed to cause institutional money to flow out of stocks, much as it

flowed out of Carnival shares after one of its liners ran disastrously

aground Friday off Italy’s coast.

Fighting

the Fed is one thing. But fighting a global monetary blowout? Forget

it. The financial system is so glutted with virtual dollars these days

that U.S. stocks would probably hold their ground even if nuclear war

were to erupt. Although Friday’s news admittedly fell shy of that

threshold, we might have expected a little more deference on Wall Street

toward news that Standard & Poor’s had downgraded the credit of

France and Austria. Granted, this could have shocked no one, since

France had all but begged its comeuppance by pretending to be Germany’s

co-equal in the ongoing eurobailout dog-and-pony show. Still, we had

come to expect share prices to at least defer perfunctorily to such

news, since prop-desk traders typically knee-jerk in whichever direction

they expect their algorithm-driven, bipolar colleagues’ knees to jerk.

Thus, when the news is ostensibly bad, as was the case on Friday, it’s

supposed to cause institutional money to flow out of stocks, much as it

flowed out of Carnival shares after one of its liners ran disastrously

aground Friday off Italy’s coast.

Read More @ RickAckerman.com

Fighting

the Fed is one thing. But fighting a global monetary blowout? Forget

it. The financial system is so glutted with virtual dollars these days

that U.S. stocks would probably hold their ground even if nuclear war

were to erupt. Although Friday’s news admittedly fell shy of that

threshold, we might have expected a little more deference on Wall Street

toward news that Standard & Poor’s had downgraded the credit of

France and Austria. Granted, this could have shocked no one, since

France had all but begged its comeuppance by pretending to be Germany’s

co-equal in the ongoing eurobailout dog-and-pony show. Still, we had

come to expect share prices to at least defer perfunctorily to such

news, since prop-desk traders typically knee-jerk in whichever direction

they expect their algorithm-driven, bipolar colleagues’ knees to jerk.

Thus, when the news is ostensibly bad, as was the case on Friday, it’s

supposed to cause institutional money to flow out of stocks, much as it

flowed out of Carnival shares after one of its liners ran disastrously

aground Friday off Italy’s coast.

Fighting

the Fed is one thing. But fighting a global monetary blowout? Forget

it. The financial system is so glutted with virtual dollars these days

that U.S. stocks would probably hold their ground even if nuclear war

were to erupt. Although Friday’s news admittedly fell shy of that

threshold, we might have expected a little more deference on Wall Street

toward news that Standard & Poor’s had downgraded the credit of

France and Austria. Granted, this could have shocked no one, since

France had all but begged its comeuppance by pretending to be Germany’s

co-equal in the ongoing eurobailout dog-and-pony show. Still, we had

come to expect share prices to at least defer perfunctorily to such

news, since prop-desk traders typically knee-jerk in whichever direction

they expect their algorithm-driven, bipolar colleagues’ knees to jerk.

Thus, when the news is ostensibly bad, as was the case on Friday, it’s

supposed to cause institutional money to flow out of stocks, much as it

flowed out of Carnival shares after one of its liners ran disastrously

aground Friday off Italy’s coast. Read More @ RickAckerman.com

by Gonzalo Lira:

A quick post.

A quick post.

As most people know, Wikipedia will go offline on Wednesday—in protest over the Stop Online Piracy Act (SOPA) and the Protect Intellectual Property Act (PIPA). The Financial Times has a brief but fairly comprehensive overview of what’s going on here.

A lot of people online—myself included—are against both SOPA and PIPA. And for one, I fully support what Wikipedia is trying to do: Shut itself down—the sixth most visited website on the planet—and thereby get those 234 million daily users to read its statement opposing SOPA and PIPA.

Read More @ GonzaloLira.Blogspot.com

A quick post.

A quick post.As most people know, Wikipedia will go offline on Wednesday—in protest over the Stop Online Piracy Act (SOPA) and the Protect Intellectual Property Act (PIPA). The Financial Times has a brief but fairly comprehensive overview of what’s going on here.

A lot of people online—myself included—are against both SOPA and PIPA. And for one, I fully support what Wikipedia is trying to do: Shut itself down—the sixth most visited website on the planet—and thereby get those 234 million daily users to read its statement opposing SOPA and PIPA.

Read More @ GonzaloLira.Blogspot.com

by Brittany Stepniak, WealthWire.com:

The Fed and central banks are off to a questionable start this year…

The Fed and central banks are off to a questionable start this year…

Quantitative easing has already begun in Europe. And they’ve got the U.S. to thank for the bail out.

“Essentially, we just bailed out Europe’s banking system with the full faith and credit of the United States” according to the New York Post‘s Jonathon Trugman. He goes on:

“Most Americans associate a covert action with the CIA, not the Fed. But that’s exactly what Ben Bernanke did at the end of November…In reality, the Federal Reserve has just extended essentially unlimited lines of credit, camouflaged as a swap to the world in US dollars.”

Here’s a run down on why you should be concerned:

Read More @ WealthWire.com

The Fed and central banks are off to a questionable start this year…

The Fed and central banks are off to a questionable start this year…Quantitative easing has already begun in Europe. And they’ve got the U.S. to thank for the bail out.

“Essentially, we just bailed out Europe’s banking system with the full faith and credit of the United States” according to the New York Post‘s Jonathon Trugman. He goes on:

“Most Americans associate a covert action with the CIA, not the Fed. But that’s exactly what Ben Bernanke did at the end of November…In reality, the Federal Reserve has just extended essentially unlimited lines of credit, camouflaged as a swap to the world in US dollars.”

Here’s a run down on why you should be concerned:

Read More @ WealthWire.com

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment