By Greg Hunter’s USAWatchdog.com

Dear CIGAs,

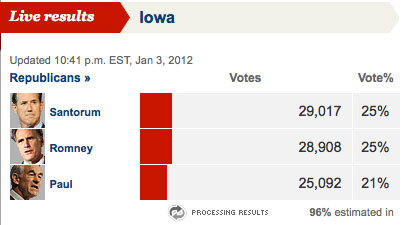

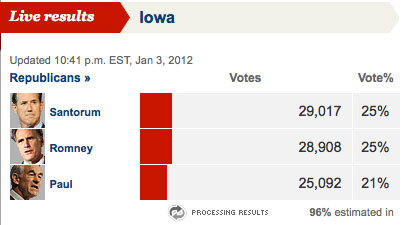

Nothing is more emblematic of the mainstream media (MSM) than NBC’s “Meet the Press.” I wonder if it should be renamed “Meet the Corporate Mainstream Press” because that is exactly what it was on Sunday. Before the first vote was cast, Sunday’s panel anointed Mitt Romney as the Republican candidate to face Barack Obama this fall. I really wonder why we have caucuses or primaries at all. We should all just watch TV and let shows like “Meet the Press” tell us what’s good for us. The word pompous comes to mind when I see them in action, and last night, Ron Paul showed them how little they know what America really wants by finishing just a few percentage points behing the Romney.

The MSM doesn’t tell reporters or guests what to say; they just pick the people who will say what they want. I heard only one relatively flattering thing about front runner Ron Paul during the entire discussion. Kathie Obradovich from the Des Moines Register said some of the caucus goers were “flocking” to Ron Paul because they were “desperate for real change,” and Congressman Paul was “completely different.” Other than that, every other word about Paul was negative. Why? Let’s face it, the left and right do not want real change and will try to taint or destroy anyone who brings it. They want the system of secret banker bailouts and Fed deals that rescue companies like General Electric from financial ruin which is part owner of NBC. (During the financial meltdown of 2008, GE was the sole owner of NBC and now has only a 49% share of the network.) They do not want prosecutions of Wall Street bankers for causing the financial meltdown with “liar loans” and “toxic” mortgage backed securities. Republicans and Democrats want what they have now and are just taking turns ripping off the country. The corporate owned MSM is just happy to take campain advertising money and are happy to cover the fake fighting.

You could not have gotten a more Romney biased panel on “Meet the Press” if you would have gone to Mitt’s campaign headquarters. Mike Murphy, GOP strategist, said Congressman Paul, “. . . would be the surprise disappointing finish.” Mark Halperin of Time Magazine said he saw “two scenarios for Romney and they were “great” and “good.” Andrea Mitchel of NBC said Paul “really hurt himself on foreign policy.” To be fair, it is not just NBC doing a hatchet job on Congressman Paul, other networks have been less than objective. Yesterday on FOX, Democratic strategist James Carville opined that Romney was the only Republican that “has a chance of winning nationally.”

I think the Democrats and President Obama would like nothing more than to run against the man who thinks “corporations are people too.” Mitt Romney would be predictable and would not go after the real issues that are holding America back. The main issue is the fraud and rip-offs in the financial system. There will be no recovery and little job creation unless and until the banks and Wall Street are no longer able to rig the system so they always win. There should also be some prosecutions, but I digress. Romney, who couldn’t get much more than 25% of the Iowa Republican vote, will be very beatable for Mr. Obama. Both are the picks of Super PAC corporations. Santorum would just be the Republican replacement for Romney if he can hold up after Iowa.

More…

Whether

its our old friend Binky from Deutsche or Tommy Lee from JPMorgan, the

uber-bullish permanence of these well-paid serial extrapolators seems

to pivot critically for 2012's forecasts on one thing: multiple expansion.

On whatever empirical metric the Bill Millers of the world look at,

stocks are cheap - no matter the changing dynamics underlying the

entire system that seems so obvious to the rest of us. As JPMorgan

notes, even assuming a 15% earnings decline (possible since in Q4 2011, the percent of negative S&P 500 earnings pre-announcements matched its 2001 and 2008 peak)

the S&P 500 is priced at the cheap end of history. The answer to

why measures such as Price-to-Book and Price-to-Earnings have adjusted

down so considerably is, however, very evident when once considers

where the profitability has come. In contrast to prior recovery cycles, current cycle profits have been driven significantly by very low labor compensation. David Cembalest says it best: "Given the fiscal, social and political issues this creates, it’s hard to pay a very high multiple for this kind of profits boom."

Whether

its our old friend Binky from Deutsche or Tommy Lee from JPMorgan, the

uber-bullish permanence of these well-paid serial extrapolators seems

to pivot critically for 2012's forecasts on one thing: multiple expansion.

On whatever empirical metric the Bill Millers of the world look at,

stocks are cheap - no matter the changing dynamics underlying the

entire system that seems so obvious to the rest of us. As JPMorgan

notes, even assuming a 15% earnings decline (possible since in Q4 2011, the percent of negative S&P 500 earnings pre-announcements matched its 2001 and 2008 peak)

the S&P 500 is priced at the cheap end of history. The answer to

why measures such as Price-to-Book and Price-to-Earnings have adjusted

down so considerably is, however, very evident when once considers

where the profitability has come. In contrast to prior recovery cycles, current cycle profits have been driven significantly by very low labor compensation. David Cembalest says it best: "Given the fiscal, social and political issues this creates, it’s hard to pay a very high multiple for this kind of profits boom."

Dear CIGAs,

Nothing is more emblematic of the mainstream media (MSM) than NBC’s “Meet the Press.” I wonder if it should be renamed “Meet the Corporate Mainstream Press” because that is exactly what it was on Sunday. Before the first vote was cast, Sunday’s panel anointed Mitt Romney as the Republican candidate to face Barack Obama this fall. I really wonder why we have caucuses or primaries at all. We should all just watch TV and let shows like “Meet the Press” tell us what’s good for us. The word pompous comes to mind when I see them in action, and last night, Ron Paul showed them how little they know what America really wants by finishing just a few percentage points behing the Romney.

The MSM doesn’t tell reporters or guests what to say; they just pick the people who will say what they want. I heard only one relatively flattering thing about front runner Ron Paul during the entire discussion. Kathie Obradovich from the Des Moines Register said some of the caucus goers were “flocking” to Ron Paul because they were “desperate for real change,” and Congressman Paul was “completely different.” Other than that, every other word about Paul was negative. Why? Let’s face it, the left and right do not want real change and will try to taint or destroy anyone who brings it. They want the system of secret banker bailouts and Fed deals that rescue companies like General Electric from financial ruin which is part owner of NBC. (During the financial meltdown of 2008, GE was the sole owner of NBC and now has only a 49% share of the network.) They do not want prosecutions of Wall Street bankers for causing the financial meltdown with “liar loans” and “toxic” mortgage backed securities. Republicans and Democrats want what they have now and are just taking turns ripping off the country. The corporate owned MSM is just happy to take campain advertising money and are happy to cover the fake fighting.

You could not have gotten a more Romney biased panel on “Meet the Press” if you would have gone to Mitt’s campaign headquarters. Mike Murphy, GOP strategist, said Congressman Paul, “. . . would be the surprise disappointing finish.” Mark Halperin of Time Magazine said he saw “two scenarios for Romney and they were “great” and “good.” Andrea Mitchel of NBC said Paul “really hurt himself on foreign policy.” To be fair, it is not just NBC doing a hatchet job on Congressman Paul, other networks have been less than objective. Yesterday on FOX, Democratic strategist James Carville opined that Romney was the only Republican that “has a chance of winning nationally.”

I think the Democrats and President Obama would like nothing more than to run against the man who thinks “corporations are people too.” Mitt Romney would be predictable and would not go after the real issues that are holding America back. The main issue is the fraud and rip-offs in the financial system. There will be no recovery and little job creation unless and until the banks and Wall Street are no longer able to rig the system so they always win. There should also be some prosecutions, but I digress. Romney, who couldn’t get much more than 25% of the Iowa Republican vote, will be very beatable for Mr. Obama. Both are the picks of Super PAC corporations. Santorum would just be the Republican replacement for Romney if he can hold up after Iowa.

More…

David Rosenberg On The Coming Gunfight At The OK Corral Between Mr Market And Mr Data

While the market continues to simply fret over when and where to start buying up risk in advance of inevitable printing by the US and European central banks, those of a slightly more contemplative constitution continue to wonder just what it is that has allowed the US to detach from the rest of the world for as long as it has - because decoupling, contrary to all hopes to the contrary, does not exist. And yet the lag has now endured for many more months than most thought possible. And making things even more complicated, the market which doesn't follow either the US nor European economy has decoupled from everything, breaking any traditional linkages when analyzing data, not to mention cause and effect. How does reconcile this ungodly mess? To help with the answer we turn to David Rosenberg who always seems to have the question on such topics. His answer - declining gas prices (kiss that goodbye with WTI at $103), and collapsing savings. What happens next: "in the absence of these dual effects — lower gas prices AND lower savings rates — we would have seen real PCE contract $125 billion or at a 3% annual rate since mid-2011 (looking at the monthly GDP estimates, there would have also been zero growth in the overall economy). Instead, real PCE managed to eke out a 2.7% annualized gain — but aided and abated by non-recurring items. Yes, employment growth has held up, but from an income standpoint, the advances in low paying retail and accommodation jobs have not compensated the losses in high paying financial sector and government employment." Indeed, one little noted tidbit in the monthly NFP data is that those who "find" jobs offset far better paying jobs in other sectors - as a simple example the carnage on Wall Street this year will be the worst since 2008. So quantity over quality, but when dealing with the government who cares. Finally, will the market continue to decouple from the HEADLINE driven economy, which in turn will decouple from everyone else? Not unless it can dodge many more bullets: "As was the case last year, the first quarter promises to be an interesting one from a macro standpoint. The U.S. economy has indeed been dodging bullets for a good year and a half now. It might not be October 26, 1881, but something tells me we have a gunfight at the O.K. Corral on our hands this quarter between Mr. Market and Mr. Data." Read on.Equity Valuations And The Jobless Recovery

Whether

its our old friend Binky from Deutsche or Tommy Lee from JPMorgan, the

uber-bullish permanence of these well-paid serial extrapolators seems

to pivot critically for 2012's forecasts on one thing: multiple expansion.

On whatever empirical metric the Bill Millers of the world look at,

stocks are cheap - no matter the changing dynamics underlying the

entire system that seems so obvious to the rest of us. As JPMorgan

notes, even assuming a 15% earnings decline (possible since in Q4 2011, the percent of negative S&P 500 earnings pre-announcements matched its 2001 and 2008 peak)

the S&P 500 is priced at the cheap end of history. The answer to

why measures such as Price-to-Book and Price-to-Earnings have adjusted

down so considerably is, however, very evident when once considers

where the profitability has come. In contrast to prior recovery cycles, current cycle profits have been driven significantly by very low labor compensation. David Cembalest says it best: "Given the fiscal, social and political issues this creates, it’s hard to pay a very high multiple for this kind of profits boom."

Whether

its our old friend Binky from Deutsche or Tommy Lee from JPMorgan, the

uber-bullish permanence of these well-paid serial extrapolators seems

to pivot critically for 2012's forecasts on one thing: multiple expansion.

On whatever empirical metric the Bill Millers of the world look at,

stocks are cheap - no matter the changing dynamics underlying the

entire system that seems so obvious to the rest of us. As JPMorgan

notes, even assuming a 15% earnings decline (possible since in Q4 2011, the percent of negative S&P 500 earnings pre-announcements matched its 2001 and 2008 peak)

the S&P 500 is priced at the cheap end of history. The answer to

why measures such as Price-to-Book and Price-to-Earnings have adjusted

down so considerably is, however, very evident when once considers

where the profitability has come. In contrast to prior recovery cycles, current cycle profits have been driven significantly by very low labor compensation. David Cembalest says it best: "Given the fiscal, social and political issues this creates, it’s hard to pay a very high multiple for this kind of profits boom."

by Bob Chapman, GlobalResearch.ca:

It

is now obvious to alert observers that the ECR’s new long-term

refinancing program, LTRO, is an end-run quantitative easing program.

The bankers and politicians would not dare call it what it really is.

Who would not want 3-year loans at 1%? Then there is Target 2, where the

Bundesbank has secretly but legally, lent the ECB $640 billion. That

money will be shared as a bailout for the six euro zone nations, which

are on the edge of bankruptcy. These are technically claims not loans.

You only discover the legerdemain if you root around in the footnotes of

the reports of euro zone members. Just five years ago these target

claims were just 7% of Bundesbank assets. They now represent 64% of

assets. Worst yet the collateral the ECB holds to back these loans is

toxic debt. If and when debt failure occurs proportionately Germany’s

part of all that debt is 28% of the total. We learn something new every

day. What this means is that $1 trillion swap, which is really a loan to

the ECB by the Fed, will probably be exclusively used to bail out

European banks, 523 at last count.

It

is now obvious to alert observers that the ECR’s new long-term

refinancing program, LTRO, is an end-run quantitative easing program.

The bankers and politicians would not dare call it what it really is.

Who would not want 3-year loans at 1%? Then there is Target 2, where the

Bundesbank has secretly but legally, lent the ECB $640 billion. That

money will be shared as a bailout for the six euro zone nations, which

are on the edge of bankruptcy. These are technically claims not loans.

You only discover the legerdemain if you root around in the footnotes of

the reports of euro zone members. Just five years ago these target

claims were just 7% of Bundesbank assets. They now represent 64% of

assets. Worst yet the collateral the ECB holds to back these loans is

toxic debt. If and when debt failure occurs proportionately Germany’s

part of all that debt is 28% of the total. We learn something new every

day. What this means is that $1 trillion swap, which is really a loan to

the ECB by the Fed, will probably be exclusively used to bail out

European banks, 523 at last count.

Just to give you an idea of debt structure, as a percentage of GDP, Germany’s public debt as a percentage of public debt in 2009 was 74% and today it is 83% of GDP. In Greece in 2009 it was 79% and today it is 82%. Italy is 120% and Greece 160%.

Read More @ GlobalResearch.ca

If there is one lesson to be learned from the Japanese experience with deleveraging over the past few decades it’s that deleveraging cycles have there own special rhythm of reflationary and deflationary interludes. Pretty simple thinking as balance sheet deleveraging by definition cannot be a short term process given the prior decades required to build up the leverage accumulated in any economic/financial system. If deleveraging were a short term process, it would play out as a massive short term depression. And clearly any central bank would act to disallow such an outcome, exactly has been the case not only in Japan over the last few decades, but now also in the US and the Eurozone. We just need to remember that this is a dance. There is an ebb and flow to the greater (generational) deleveraging cycle. Just as leveraging up was not a linear process, neither will the process of deleveraging be linear. Why bring this larger picture cycle rhythm up right now? The recent price volatility we’ve seen in assets that can be characterized as offering purchasing power protection within the context of a global central banking community debasing currencies as their preferred method of reflation for now, specifically recent the price volatility of gold.

It

is now obvious to alert observers that the ECR’s new long-term

refinancing program, LTRO, is an end-run quantitative easing program.

The bankers and politicians would not dare call it what it really is.

Who would not want 3-year loans at 1%? Then there is Target 2, where the

Bundesbank has secretly but legally, lent the ECB $640 billion. That

money will be shared as a bailout for the six euro zone nations, which

are on the edge of bankruptcy. These are technically claims not loans.

You only discover the legerdemain if you root around in the footnotes of

the reports of euro zone members. Just five years ago these target

claims were just 7% of Bundesbank assets. They now represent 64% of

assets. Worst yet the collateral the ECB holds to back these loans is

toxic debt. If and when debt failure occurs proportionately Germany’s

part of all that debt is 28% of the total. We learn something new every

day. What this means is that $1 trillion swap, which is really a loan to

the ECB by the Fed, will probably be exclusively used to bail out

European banks, 523 at last count.

It

is now obvious to alert observers that the ECR’s new long-term

refinancing program, LTRO, is an end-run quantitative easing program.

The bankers and politicians would not dare call it what it really is.

Who would not want 3-year loans at 1%? Then there is Target 2, where the

Bundesbank has secretly but legally, lent the ECB $640 billion. That

money will be shared as a bailout for the six euro zone nations, which

are on the edge of bankruptcy. These are technically claims not loans.

You only discover the legerdemain if you root around in the footnotes of

the reports of euro zone members. Just five years ago these target

claims were just 7% of Bundesbank assets. They now represent 64% of

assets. Worst yet the collateral the ECB holds to back these loans is

toxic debt. If and when debt failure occurs proportionately Germany’s

part of all that debt is 28% of the total. We learn something new every

day. What this means is that $1 trillion swap, which is really a loan to

the ECB by the Fed, will probably be exclusively used to bail out

European banks, 523 at last count.Just to give you an idea of debt structure, as a percentage of GDP, Germany’s public debt as a percentage of public debt in 2009 was 74% and today it is 83% of GDP. In Greece in 2009 it was 79% and today it is 82%. Italy is 120% and Greece 160%.

Read More @ GlobalResearch.ca

Guest Post: It Ain't Over 'Til It's Over

If there is one lesson to be learned from the Japanese experience with deleveraging over the past few decades it’s that deleveraging cycles have there own special rhythm of reflationary and deflationary interludes. Pretty simple thinking as balance sheet deleveraging by definition cannot be a short term process given the prior decades required to build up the leverage accumulated in any economic/financial system. If deleveraging were a short term process, it would play out as a massive short term depression. And clearly any central bank would act to disallow such an outcome, exactly has been the case not only in Japan over the last few decades, but now also in the US and the Eurozone. We just need to remember that this is a dance. There is an ebb and flow to the greater (generational) deleveraging cycle. Just as leveraging up was not a linear process, neither will the process of deleveraging be linear. Why bring this larger picture cycle rhythm up right now? The recent price volatility we’ve seen in assets that can be characterized as offering purchasing power protection within the context of a global central banking community debasing currencies as their preferred method of reflation for now, specifically recent the price volatility of gold.

from GoldCore:

Introduction

Introduction

With just a few trading days left in 2011, we can take stock of gold’s performance vis-à-vis other assets.

Gold is 13.7% higher in USD, 12% higher in GBP and 14.4% higher in EUR. Gains were seen in all fiat currencies and even stronger performing fiat currencies such as the CNY (yuan) and JPY (+9% and +8.75% respectively).

Stock markets globally had a torrid year with the S&P500 down 1.3%, the FTSE down 8% and the CAC and DAX down 19% and 15% respectively. Asian stock markets also fell with the Nikkei down 17%, the Hang Seng 20% and the Shanghai SE down 22%.

The MSCI World Index fell 9%.

Thus, gold again acted as a safe haven and protected and preserved wealth over the long term.

Read More @ GoldCore.com

Introduction

IntroductionWith just a few trading days left in 2011, we can take stock of gold’s performance vis-à-vis other assets.

Gold is 13.7% higher in USD, 12% higher in GBP and 14.4% higher in EUR. Gains were seen in all fiat currencies and even stronger performing fiat currencies such as the CNY (yuan) and JPY (+9% and +8.75% respectively).

Stock markets globally had a torrid year with the S&P500 down 1.3%, the FTSE down 8% and the CAC and DAX down 19% and 15% respectively. Asian stock markets also fell with the Nikkei down 17%, the Hang Seng 20% and the Shanghai SE down 22%.

The MSCI World Index fell 9%.

Thus, gold again acted as a safe haven and protected and preserved wealth over the long term.

Read More @ GoldCore.com

Happy New Year (LOL)

Dave in Denver at The Golden Truth - 18 minutes ago

*This is a crime on the same level as that of Bernie Madoff, only it

involves an ex-Senator/Governor, the two most prestigious Wall Street

investment banks, the CME, the CFTC, politicians, judges and even the Obama

Administration. That this crime is going unprosecuted and the main

perpetrator, Jon Corzine, is not waiting his justice in jail, is the

latest, largest and most obvious signal that the United States as it was

created and has existed is in full-scale collapse - *Dave in Denver on MF

Global

On that cheery thought, Happy New Year!

By now most of you have read the story... more »

You Decide...

from InfoWars.com:

UPDATE 10:48 PM CENTRAL: With 96% of precincts reporting, Rick Santorum narrowly leads Mitt Romney, both at 25% in Iowa. The candidates have wrestled back-and-forth as the final tallies are counted. Ron Paul at a close third with 21%, conceded the race calling himself ‘one of the three winners,’ while vowing to go on, continue raising funds and fighting for victory in what he termed a movement, rather than a campaign.

Santorum’s surprise last-minute surge coincides with announcements that the vote in Iowa would be counted at a secret location, and along with statements from top GOP officials strategizing how to effectively take out Ron Paul and diminish his significance. It is no secret that all the stops have been pulled to minimize Paul’s media visibility throughout the campaign trail, with many top GOP figures and media commentators going so far as to pre-script a plan to ignore Iowa in the event that Ron Paul won the caucuses, in order to prevent the Congressman from dominating the national stage.

Did the GOP establishment succeed in sabotaging the Ron Paul campaign as it vowed to do?

What accounts for Santorum’s swift rise to the top of polls in Iowa only days out from the contest when he barely showed a pulse in ANY state, let alone Iowa, among the crowded GOP field at any time in the weeks and months before?

Read More @ InfoWars.com

UPDATE 10:48 PM CENTRAL: With 96% of precincts reporting, Rick Santorum narrowly leads Mitt Romney, both at 25% in Iowa. The candidates have wrestled back-and-forth as the final tallies are counted. Ron Paul at a close third with 21%, conceded the race calling himself ‘one of the three winners,’ while vowing to go on, continue raising funds and fighting for victory in what he termed a movement, rather than a campaign.

Santorum’s surprise last-minute surge coincides with announcements that the vote in Iowa would be counted at a secret location, and along with statements from top GOP officials strategizing how to effectively take out Ron Paul and diminish his significance. It is no secret that all the stops have been pulled to minimize Paul’s media visibility throughout the campaign trail, with many top GOP figures and media commentators going so far as to pre-script a plan to ignore Iowa in the event that Ron Paul won the caucuses, in order to prevent the Congressman from dominating the national stage.

Did the GOP establishment succeed in sabotaging the Ron Paul campaign as it vowed to do?

What accounts for Santorum’s swift rise to the top of polls in Iowa only days out from the contest when he barely showed a pulse in ANY state, let alone Iowa, among the crowded GOP field at any time in the weeks and months before?

Read More @ InfoWars.com

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment