Harvey Organ, Wednesday, August 3, 2011

Check out the following video from 2008.

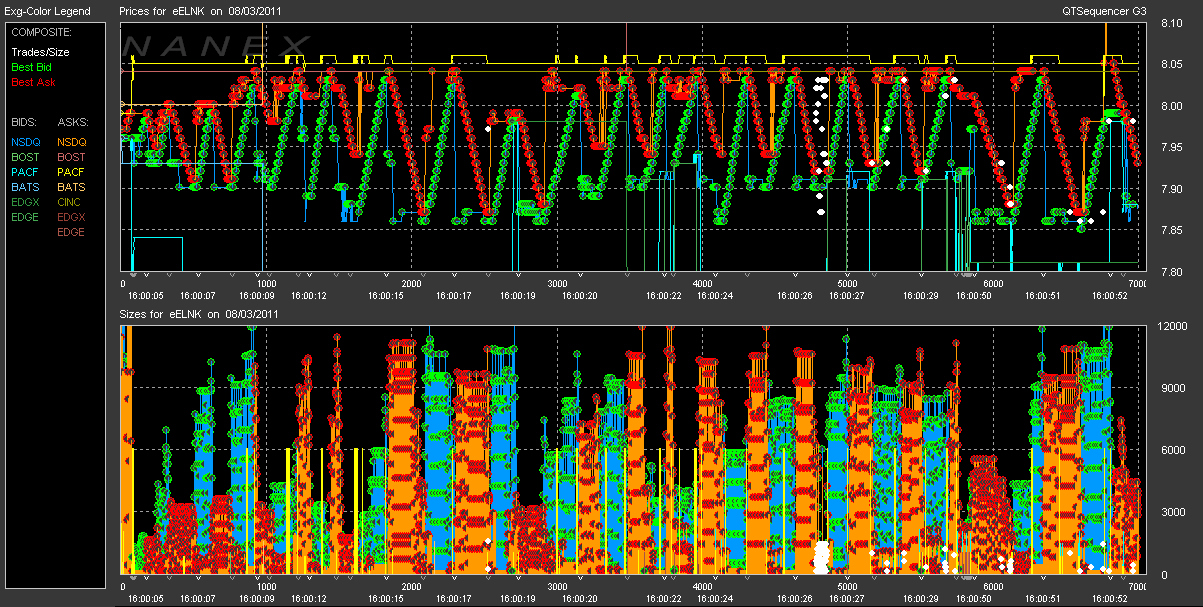

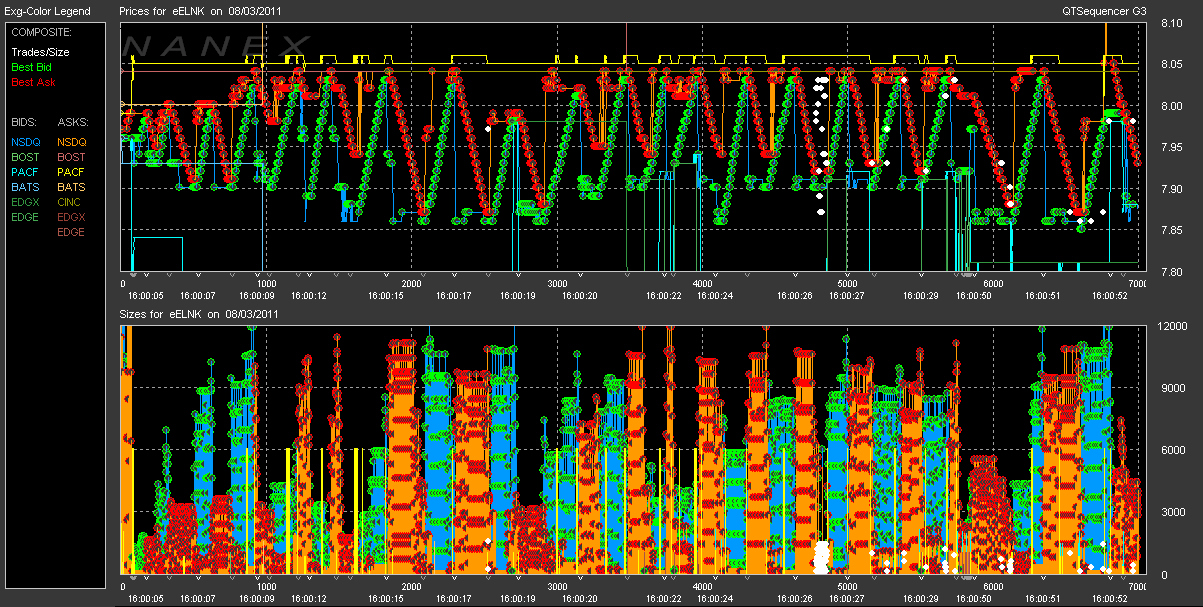

It feels like it was just yesterday that the Whack-A-Mole algo in Earthlink was wreaking NBBO havoc (completely unsupervised mind you: it is not like anyone would expect the SEC to move its little finger to address this glaring Reg NMS 'outlier'). Wait, it was... Which probably explains why the very same algo is back in the very same name, at the very same time.

Of all the dumbest things we heard today, the one that attributes the last minute jump in the market to a CNBC interview with Barton Biggs (or Not-So-Biggs based the meager $547 MM in AUM for his Offshore fund) easily takes the cake. The man whose only recent claim to fame is the following soundbite from last November which conclusively proves that in race for the 100% RDA of Geritol, Charlie Munger may have a serious competitor, ""Bernanke has gotten the stock market up, which is what he wants to do, the stock market is an important symbol of confidence, and Mr. Market is a pretty good forecaster of the economy" appeared on CNBC and told anyone who was not immediately bored to death or hit by a sudden urge to be incontinent, that the market is "grossly oversold" and sees a "significant rally" on the horizon, with a jump of 7-9% in the next three weeks virtually guaranteed. In retrospect this is precisely the idiocy the serves as a market catalyst in the post-11:30 trading block when Europe is closed, when Intesa Sanpaolo does not trade but not due to being halted all day, and when idiots and robots take over. Regardless, we decided to look at the levered beta momentum chaser's soundbite track record over just 2011. To our not so great dismay, Biggs has called at least 6 bull markets in a period of time in which the S&P has gone... negative.

Of all the dumbest things we heard today, the one that attributes the last minute jump in the market to a CNBC interview with Barton Biggs (or Not-So-Biggs based the meager $547 MM in AUM for his Offshore fund) easily takes the cake. The man whose only recent claim to fame is the following soundbite from last November which conclusively proves that in race for the 100% RDA of Geritol, Charlie Munger may have a serious competitor, ""Bernanke has gotten the stock market up, which is what he wants to do, the stock market is an important symbol of confidence, and Mr. Market is a pretty good forecaster of the economy" appeared on CNBC and told anyone who was not immediately bored to death or hit by a sudden urge to be incontinent, that the market is "grossly oversold" and sees a "significant rally" on the horizon, with a jump of 7-9% in the next three weeks virtually guaranteed. In retrospect this is precisely the idiocy the serves as a market catalyst in the post-11:30 trading block when Europe is closed, when Intesa Sanpaolo does not trade but not due to being halted all day, and when idiots and robots take over. Regardless, we decided to look at the levered beta momentum chaser's soundbite track record over just 2011. To our not so great dismay, Biggs has called at least 6 bull markets in a period of time in which the S&P has gone... negative.

Countdown to QEIII/ Economies in Italy, Spain, Greece in shambles

Mr Sinclair is referred to as Mr. Gold for a reason...

10 years ago... he predicted Gold would trade @ $1650 in 2011...

Next up $1764...

Dear CIGAs,Check out the following video from 2008.

Gross US Debt Surges By $240 Billion Overnight, US Debt To GDP Hits Post World War II High 97.2%, Official Debt Ceiling Increase Only $400 Billion

Two things happened when the Senate voted in the "Bipartisan" plan into law yesterday: i) deferred debt on the Treasury's balance sheet finally caught up with reality, and ii) as a result of i) America's Debt/GDP just hit a post World War 2 High of 97.2%. Becasue as the Daily Treasury Statement as of last night indicates, total US marketable debt surged by $124.6 billion, while debt in intragovernmental holdings (Social Security, Government Retirement Accounts, etc), soared by $113.6 billion, for a combined one day change of $238.2 billion, the single biggest one day increase of US debt in history. Obviously this is a result of massive underfunding and disinvestment in the various government retirement accounts as well as due to deferred debt which was to be booked since the debt was breached on May 16. However, how marketable debt could increase by a whopping $125 billion without any actual auction settlement is slightly confusing. Just as confusing is that according to the endnote in the debt subject to limit calculation, the new ceiling is not the $900 billion increase as requested, but only $400 billion more than the $14.294 billion previous, or at $14.694 billion. We hope this is some Treasury type or misunderstanding as this new ceiling will be breached in a month. And the last thing we need is this whole debt ceiling drama back again in September. One thing there is no confusion about, however, is that based on the latest gross debt number of $14.581 trillion, and the just reported Q2 GDP of $15.003 billion, total US debt to GDP is now a post World War II high of 97.2% (and that excludes the GSE off balance sheet debt).Guest Post: EFSF - Too Small? Too Big? Or Just Wrong?

The EFSF plan to let countries buy bonds at a discount is a true Catch-22 proposition. If they don’t source many bonds, the benefit to the country is too small to make a difference at the sovereign level, and sovereign contagion risk remains in play. But if they are able to buy a meaningful amount of bonds, those bonds will be coming from banks that had been desperately avoiding taking the mark to market hit, potentially triggering contagion among the banks. The narrow window where this program might stop sovereign contagion without triggering bank contagion is too small to think that a bunch of politicians or economists will be able to steer the course accurately and that some other unintended consequence won’t rear its ugly head.Presenting Why The SEC's Proposed "Market Volatility" Contingency Plan Is A Failure, Even As The SEC Continues To Lie To Everyone

The rational and efficient market mythbusters at Nanex have made another major discovery, having gone through the SEC's proposed plan to deal with extraordinary market conditions, better known as Limit Up/Limit Down Plan to Address Extraordinary Market Volatility, brilliantly abbreviated to LULD, and find that even if said been had been in place before May 6, 2010 it would have done absolutely nothing to prevent the 1000 swing in the Dow. Cutting through the chase, and partially explaining once again why there has been over $150 billion in domestic equity mutual fund outflows since the beginning of 2010, is that "The SEC has proposed many band-aid fixes since May 6, 2010 in an effort to make investors feel confident again about the equity market. The sad truth though is that none of their proposals so far will prevent another flash crash. Worse, some proposals, such as this one, will likely make things even worse." Bottom line: investors have no confidence that this market is at all better, and in fact it is very likely that the market could crash just as violently as May 6, at any given moment, as the SEC has done nothing to fix the underlying problems, but merely redirect and pretend that it is on top of things, while taking a nip and a tuck at some of the easily remedied symptoms. And as long as this mutually acceptable delusion continues, stocks are in constant danger of another epic wipe out courtesy of the SEC, which will eliminate what little confidence there is, even among those who trade purely with "Other People's Money." We thank Nanex for their ongoing pursuit of the truth behind the SEC's endless lies. Because if the regulator itself is corrupt and incompetent, then there really is no hope for market efficiency and fairness.Whack-A-Mole Algo Is Back

Submitted by Tyler Durden on 08/03/2011 - 17:02 Reg NMS

It feels like it was just yesterday that the Whack-A-Mole algo in Earthlink was wreaking NBBO havoc (completely unsupervised mind you: it is not like anyone would expect the SEC to move its little finger to address this glaring Reg NMS 'outlier'). Wait, it was... Which probably explains why the very same algo is back in the very same name, at the very same time.

With The S&P Down For The Year, Here Is A Chart Of Barton Biggs 6 Bull Market Calls In 2011

Of all the dumbest things we heard today, the one that attributes the last minute jump in the market to a CNBC interview with Barton Biggs (or Not-So-Biggs based the meager $547 MM in AUM for his Offshore fund) easily takes the cake. The man whose only recent claim to fame is the following soundbite from last November which conclusively proves that in race for the 100% RDA of Geritol, Charlie Munger may have a serious competitor, ""Bernanke has gotten the stock market up, which is what he wants to do, the stock market is an important symbol of confidence, and Mr. Market is a pretty good forecaster of the economy" appeared on CNBC and told anyone who was not immediately bored to death or hit by a sudden urge to be incontinent, that the market is "grossly oversold" and sees a "significant rally" on the horizon, with a jump of 7-9% in the next three weeks virtually guaranteed. In retrospect this is precisely the idiocy the serves as a market catalyst in the post-11:30 trading block when Europe is closed, when Intesa Sanpaolo does not trade but not due to being halted all day, and when idiots and robots take over. Regardless, we decided to look at the levered beta momentum chaser's soundbite track record over just 2011. To our not so great dismay, Biggs has called at least 6 bull markets in a period of time in which the S&P has gone... negative.

Of all the dumbest things we heard today, the one that attributes the last minute jump in the market to a CNBC interview with Barton Biggs (or Not-So-Biggs based the meager $547 MM in AUM for his Offshore fund) easily takes the cake. The man whose only recent claim to fame is the following soundbite from last November which conclusively proves that in race for the 100% RDA of Geritol, Charlie Munger may have a serious competitor, ""Bernanke has gotten the stock market up, which is what he wants to do, the stock market is an important symbol of confidence, and Mr. Market is a pretty good forecaster of the economy" appeared on CNBC and told anyone who was not immediately bored to death or hit by a sudden urge to be incontinent, that the market is "grossly oversold" and sees a "significant rally" on the horizon, with a jump of 7-9% in the next three weeks virtually guaranteed. In retrospect this is precisely the idiocy the serves as a market catalyst in the post-11:30 trading block when Europe is closed, when Intesa Sanpaolo does not trade but not due to being halted all day, and when idiots and robots take over. Regardless, we decided to look at the levered beta momentum chaser's soundbite track record over just 2011. To our not so great dismay, Biggs has called at least 6 bull markets in a period of time in which the S&P has gone... negative.![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment