Ambrose Evans-Pritchard: Europe's money markets freeze as crisis builds in Italy, Spain

Harvey Organ, Tuesday August 2, 2011

Gold hits Record Level rising to $1654.00 USA/silver follows suit/Italian bonds hit 6.22% as money markets freeze

Red Alert

08/02/2011 - 20:37

Quaintance And Brodsky On "Change We Can Belive In" Or The Coming "Monetary" Revolution

That the two heads of QBAMCO, Lee Quaintance and Paul Brodsky, have traditionally been in the non-conformist camp is no secret. They are two of the fund managers who will, when all is said and done, save and probably increase their clients' purchasing power (we won't call it money because money's days in its current version are numbered), unlike the vast preponderance of momentum chasing sheep who only find solace in their great delusion in even greater numbers (aka the ratings agency effect: "we may be wrong, but we will all be wrong"). In their latest letter, the duo does not uncover any great truths but merely keep exposing ever more dirt in the grave of the current monetary system. They also make short shrift of all the neo-Keynesian hacks who pretend to understand the fault-lines of modern monetary theory: "We would argue a system built upon unreserved bank credit expansion is inequitable, regressive, opaque, the source of asset boom/bust cycles and the root of virtually all the financial, economic and political chaos we are experiencing today. We assume this is in the process of being more widely intuited by global societies. Those that understand monetary identities are best prepared to shift wealth in advance of the necessary de-leveraging that must take place to restore equilibrium." Just as interesting is their observation that the 10 Year only trades where it does (2.6%) due to the ability of the big market players to lever up their return by 10, 20 times. Devoid of all theoretical textbook mumbo jumbo, they may well have hit the nail on the head: "the majority of bond investors driving marginal pricing such as primary dealers, hedge funds and central banks are quite a bit more leveraged. We would argue the Note is not trading at 49 because levered investors have incentive to collect 25% or more in current income (2.74% x 10 or 20) while awaiting their annual bonus or performance fee (or, in the case of the Fed, propping up the economy)." Translated: take away infinite leverage (thank you ZIRP) and the 10 year would be priced more fairly around 12.13% (dollar price of $49.20). Needless to say, their observations on gold, which this week borrow heavily from David Rosenberg are spot on. In a process first used by Dylan Grice, the QBAMCO duo defines the...Moody's Sells Out As Usual: Leaves US At AAA, Puts Outlook On Negative Not To Appear Overly Corrupt Or Incompetent

As that uber-sycophant, Mark Zandi (who has yet to be right about one thing in his entire career), put it so well a few days ago, when discussing the deal that will bring the US to 110% debt/GDP within a year "I'm not in the rating agency... but listening to what they have to say, I think this would be sufficient... but this is substantive and should avoid a big downgrade." Sure enough, the former Moody's top "economist" certainly knows his own, and as of several minutes ago Moody's has confirmed it will not touch America's AAA rating. However, it will put the rating outlook on negative. That should shut them up. Full report of how to sell out like the best of them is attached. And the kicker: "Moody's has also confirmed the Aaa ratings of certain US government-guaranteed bonds issued by the governments of Israel and Egypt, which had been on review for possible downgrade as a result of the review of the US government's bond rating." Well at least America's direct protectorate states (as opposed to its indirect ones) can sleep well.China Boldly Goes (Again) Where Moody's Has Never Gone Before, Downgrades US From A+ To A, Outlook Negative

As was predicted last week, China's rating agency Dagong, unlike its worthless western counterparts, has come through on its threat to downgrade the US in the event a subpar debt ceiling deal was hammered out. As Xinhua reports, 'Dagong Global Credit Rating Co. said Wednesday it has cut the credit rating of the United States from A+ to A with a negative outlook after the U.S. federal government announced that the country's debt limit would be increased." Confirming that not being branded a NRSRO is the only thing that allows a rater to still think straight (and not in terms of lost client revenue if one goes ahead and tells the truth), Dagong's decision was spot on: "The decision to lift the debt ceiling will not change the fact that the U.S. national debt growth has outpaced that of its overall economy and fiscal revenue, which will lead to a decline in its debt-paying ability, said Dagong Global in a statement." So while Moody's, which is now certified as the laughing stock of the sheep herd (sorry Mark Zandi, you will never be promoted to anything in this administration - we promise you), pretend that all is well and that the only thing better than $14.3 trillion in debt is $16.8 trillion, China demonstrates what happens when a rating agency actually knows how to do addition and/or long division.Step Right Up: It's HFT Whack-A-Mole Time

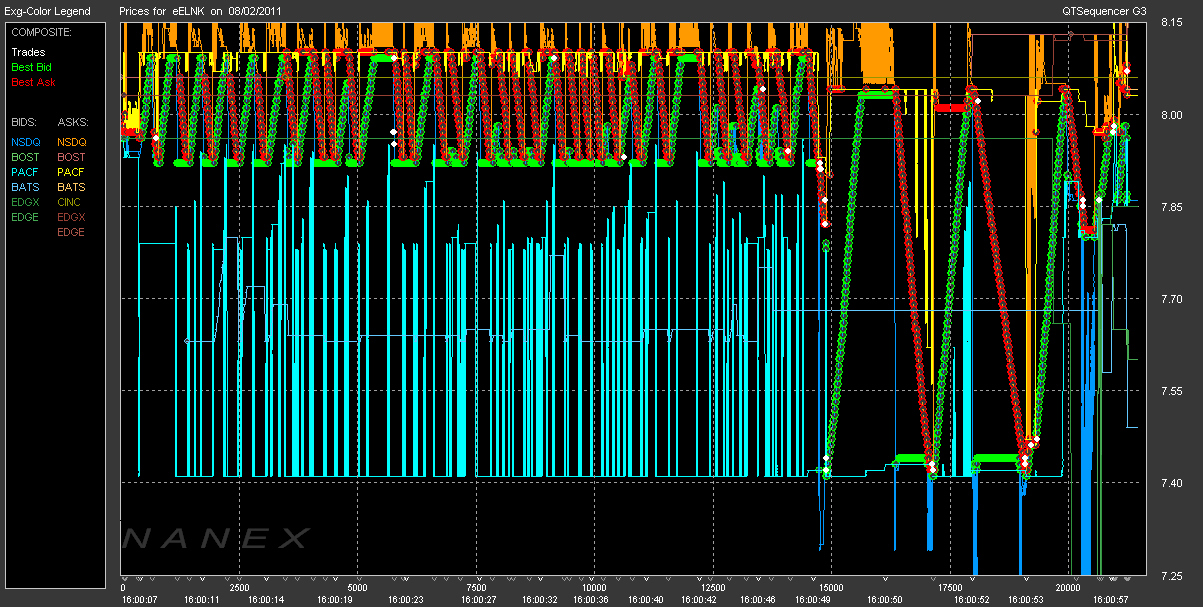

For those who thought the crocodile algo or the fractal HFT patterns were

crazy, you ain't seen nothing yet. Earlier today, Nanex caught

arguably the most berserk HFT algorithm yet captured on film, or jpeg

as the case may be, in the trading of Earthlink stock shortly after

hours. What happened next is one for the ages... Because it certainly

will not make it to the regulators. In essence, we had our first

spotted appearance of the Whack-A-Mole algorithm, which allowed one, if

one is fast enough, and incidentally one isn't, as all the bids would

be cancelled at the same time as they were sent out, to make free money

on a 10% trading spread between the bid and ask. Gone is any pretense

of an NBBO, gone is any pretense of an orderly market: it is the wild,

electronic, and nanosecond west out there.

For those who thought the crocodile algo or the fractal HFT patterns were

crazy, you ain't seen nothing yet. Earlier today, Nanex caught

arguably the most berserk HFT algorithm yet captured on film, or jpeg

as the case may be, in the trading of Earthlink stock shortly after

hours. What happened next is one for the ages... Because it certainly

will not make it to the regulators. In essence, we had our first

spotted appearance of the Whack-A-Mole algorithm, which allowed one, if

one is fast enough, and incidentally one isn't, as all the bids would

be cancelled at the same time as they were sent out, to make free money

on a 10% trading spread between the bid and ask. Gone is any pretense

of an NBBO, gone is any pretense of an orderly market: it is the wild,

electronic, and nanosecond west out there.More "Change You Can Believe In"...

Food Stamp Use Surges By Most In Years As Alabama Foodstamp Recipients Double In May

It

appears that GDP data revisions are not the only thing that the

administration enjoys fudging with in order to make the Chinese ministry

of Truth seem like a real ministry of truth. After last month the data

for April food stamp recipients indicated

the we may, just may, be reaching an inflection point in the foodstamp

participation following a mere 60 thousand jump in those receiving

Supplemental Nutrition Assistance Program (SNAP), today's just released data confirmed

that the BLS and BEA may have had a hand or two when determining this

latest data series. Because the just announced jump in foodstamp usage

of over 1.1 million is entirely out of the blue, and as the chart below

shows, is the highest single monthly jump in Foodstamp participation

since mid 2009, when eligibility requirements were adjusted. Yes, that's

45.8 million people (obviously an all time record) living on

foodstamps which amount to the whopping $133.80 per person (an increase

of $0.54 M/M) and $283.65 (an increase of $1.29) per household.

Obviously, annualizing the latest monthly rate of 1.1 million people,

it means that over 13 million Americans will live on about one third

what the cheapest iPad costs in about a year. But wait, there's more.

Digging into the numbers reveals something pecuiliar: virtually the

entire surge in monthly SNAP participation is due to one state alone:

Alabama, which saw those living on foodstamps jump from 868K to

1.762MM. That's 36% of Alabama's population.

It

appears that GDP data revisions are not the only thing that the

administration enjoys fudging with in order to make the Chinese ministry

of Truth seem like a real ministry of truth. After last month the data

for April food stamp recipients indicated

the we may, just may, be reaching an inflection point in the foodstamp

participation following a mere 60 thousand jump in those receiving

Supplemental Nutrition Assistance Program (SNAP), today's just released data confirmed

that the BLS and BEA may have had a hand or two when determining this

latest data series. Because the just announced jump in foodstamp usage

of over 1.1 million is entirely out of the blue, and as the chart below

shows, is the highest single monthly jump in Foodstamp participation

since mid 2009, when eligibility requirements were adjusted. Yes, that's

45.8 million people (obviously an all time record) living on

foodstamps which amount to the whopping $133.80 per person (an increase

of $0.54 M/M) and $283.65 (an increase of $1.29) per household.

Obviously, annualizing the latest monthly rate of 1.1 million people,

it means that over 13 million Americans will live on about one third

what the cheapest iPad costs in about a year. But wait, there's more.

Digging into the numbers reveals something pecuiliar: virtually the

entire surge in monthly SNAP participation is due to one state alone:

Alabama, which saw those living on foodstamps jump from 868K to

1.762MM. That's 36% of Alabama's population.What Happens If The U.S. Gets A Sovereign Credit Downgrade?

08/02/2011 - 22:38

08/02/2011 - 22:29

Hello Jim,

I’ve received numerous calls today of a congratulatory nature towards

you and your Gold price prediction 10 years ago. Our people don’t worry

about the timing as much as they worried about the direction. The calls

are coming in to say “Thank You Jim” for your guidance and direction in

a world where few can be trusted. Onward and upward we go till Gold is

put in its rightful spot; backing a currency a world of investors can

trust.

Your pal,CIGA JB Slear

Gold train leaving largely empty, and silver short squeeze is possible, Davies says

Fed may weigh more stimulus amid slow recovery

Paul proposes bill to cancel $1.6 trillion in U.S. debt to Federal Reserve

Submitted by cpowell on Tue, 2011-08-02 21:36. Section: Daily Dispatches

By Pete Kasperowicz

The Hill, Washington, D.C.

Tuesday, August 2, 2011

http://thehill.com/blogs/floor-action/house/174953-rep-paul-introduces-b...

U.S. Rep. Ron Paul on Monday introduced legislation that would lower the federal government's debt by canceling the roughly $1.6 trillion in debt held by the Federal Reserve.

The Hill, Washington, D.C.

Tuesday, August 2, 2011

http://thehill.com/blogs/floor-action/house/174953-rep-paul-introduces-b...

U.S. Rep. Ron Paul on Monday introduced legislation that would lower the federal government's debt by canceling the roughly $1.6 trillion in debt held by the Federal Reserve.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment