from Beacon Equity Research:

U.S. consumers already bellyaching about soaring gas and food prices

can expect an escalation of more of the same in the second half of the

year and into 2013, according to two prominent market observers, Jim

Rickards of Tangent Capital and Richard Russell of Dow Theory Letters.

U.S. consumers already bellyaching about soaring gas and food prices

can expect an escalation of more of the same in the second half of the

year and into 2013, according to two prominent market observers, Jim

Rickards of Tangent Capital and Richard Russell of Dow Theory Letters.

Speaking with Rick Wiles of TRUNEWS on Apr. 11, Rickards warned investors that, due to Beijing’s policy shift back to a stronger renminbi against the dollar, higher US import prices from China are coming to America. The unofficial US inflation rate of 6.2 percent, according to ShadowStats.com, is expected to escalate back up to double digits as the dollar slides anew.

“It’s been a couple of years, but my advise to investors is, look out, here it [inflation] comes,” said Rickards, “and we’re going to see inflation pick up over the rest of this year and into 2013.”

Read More @ BeaconEquity.com

Speaking with Rick Wiles of TRUNEWS on Apr. 11, Rickards warned investors that, due to Beijing’s policy shift back to a stronger renminbi against the dollar, higher US import prices from China are coming to America. The unofficial US inflation rate of 6.2 percent, according to ShadowStats.com, is expected to escalate back up to double digits as the dollar slides anew.

“It’s been a couple of years, but my advise to investors is, look out, here it [inflation] comes,” said Rickards, “and we’re going to see inflation pick up over the rest of this year and into 2013.”

Read More @ BeaconEquity.com

The Bernank’s Warning... We Stand on the Precipice of Economic Destruction

by Kurt Nimmo, Infowars:

Earlier this week, Federal Reserve boss The Bernank again warned that out of control borrowing and spending will eventually destroy the country.

Earlier this week, Federal Reserve boss The Bernank again warned that out of control borrowing and spending will eventually destroy the country.

Said Ben to the the Budget Committee:

Earlier this week, Federal Reserve boss The Bernank again warned that out of control borrowing and spending will eventually destroy the country.

Earlier this week, Federal Reserve boss The Bernank again warned that out of control borrowing and spending will eventually destroy the country.Said Ben to the the Budget Committee:

Sustained high rates of government borrowing would both drain funds away from private investment and increase our debt to foreigners, with adverse long-run effects on U.S. output, incomes, and standards of living. Moreover, diminishing investor confidence that deficits will be brought under control would ultimately lead to sharply rising interest rates on government debt and, potentially, to broader financial turmoil. In a vicious circle, high and rising interest rates would cause debt-service payments on the federal debt to grow even faster, resulting in further increases in the debt-to-GDP ratio and making fiscal adjustment all the more difficult.But here is something The Bernank didn’t mention – a large chunk of that debt is owed to the Federal Reserve. In February, the corporate media fessed up to this undeniable fact. From CNBC:

That’s right, the biggest single holder of U.S. government debt is inside the United States and includes the Federal Reserve system and other intragovernmental holdings. Of this number, The Fed’s system of banks owns approximately $1.65 trillion in U.S. Treasury securities (as of January 2012), while other U.S. intragovernmental holdings – which include large funds such as the Medicare Trust Fund and the Social Security Trust Fund - hold the rest.

The bankers that own the Federal Reserve love debt and that’s why they continually expand the money supply.

Read More @ InfoWars.com

Right from a young age, children should be taught the greatness of our ancient culture. They should develop humility, love, and reverence toward elders and respect everyone. Children and youth should be moulded into ideal citizens. One can earn the respect of others only when one first respects others. Respect does not mean merely greeting by saying ‘hello’. One should offer their respects to the others with humility and reverence. Na-maskara means offering your respects without a trace of ego and attachment (ahamkara and mamakara). For anything, practise is very important. The responsibility lies with the parents and teachers to make the children and youth adhere to our ancient tradition. Then society will certainly progress and enjoy peace and prosperity. If we practise our ancient values, society will attain kshe mam (welfare), otherwise it will be afflicted with kshamam (famine). Practising one’s sacred culture is the true sign of education. –SSB 2003

My Dear Friends,

This week nine board members of the US Federal reserve spoke on the subject of QE, some of them more than one time. MSM has interpreted their message as saying we have QE ready to go but we do not necessarily see it as required.

Consumer Confidence has sundered and all the China bashers are going wild over the possibility that China growth might drop to 5% to 7%. MSM is again hammering the euro. The net result is downside pressure on gold and equities because it is liquidity that floats those boats.

QE to infinity is infinite debt monetization. That is cosmos level liquidity. The sum total of all this MSM news today, truly understood, is that QE to infinity is guaranteed in both the US and in Euroland. It is more certain than death and taxes. Because of this it is better to buy breaks in general equities to trade than sell short equities for investment, and to hold your gold insurance. The manipulators love a day like this because the long side is the side that the gold banks will be on when they makes the most money in the shortest time as they did in 1980.

Long your gold they scared out of your hands by total BS on days like today.

Regards,

Jim

Jim Sinclair’s Commentary

Here is the latest from John Williams’ www.ShadowStats.com.

- CPI Headline Inflation of 0.3% Was 0.8% Not Seasonally Adjusted

- March Year-to-Year Inflation: 2.7% (CPI-U), 2.9% (CPI-W), 10.3% (SGS)

- Broad-Based Inflation Reflected in Stronger “Core” Inflation

- February Trade Improvement Should Boost GDP Expectations

"No. 428: March CPI and PPI, February Trade Balance"

http://www.shadowstats.com

[Ed. Note: An excellent article we somehow missed on April 5th. If you missed it too, it's certainly worth a read now.]

from Zero Hedge :

In an article that is about three years overdue, “JPMorgan’s practices bring scrutiny” the FT finally takes aim at that other “vampire

squid”, JP Morgan, which technically is incorrect: because if Goldman

is a nimble and aggressive creature, with infinite tentacles in every

governmental office, and unencumbered by massive liabilities, JPMorgan

is just as connected, but unlike Goldman, it is a behemoth in every

other possible capacity, and with its trillion in deposits, matched by

tens of billions in bad loans, is a true Bank Holding Company. As such ‘Jabba the Hutt‘ would be a far more appropriate allegory to describe the the firm, whose reach, scope and scale lead the FT to classify it as “Three times a pallbearer, never a corpse.”

In an article that is about three years overdue, “JPMorgan’s practices bring scrutiny” the FT finally takes aim at that other “vampire

squid”, JP Morgan, which technically is incorrect: because if Goldman

is a nimble and aggressive creature, with infinite tentacles in every

governmental office, and unencumbered by massive liabilities, JPMorgan

is just as connected, but unlike Goldman, it is a behemoth in every

other possible capacity, and with its trillion in deposits, matched by

tens of billions in bad loans, is a true Bank Holding Company. As such ‘Jabba the Hutt‘ would be a far more appropriate allegory to describe the the firm, whose reach, scope and scale lead the FT to classify it as “Three times a pallbearer, never a corpse.”

As some may recall, back in October 2009, Zero Hedge did an exhaustive expose on the relationship between JPMorgan and the then version of MF Global, Lehman Brothers, whose perfectly functioning division, its North American Brokerage, ended up being scooped up by Barclays for pennies on the dollar. In the meantime, however, JPMorgan, with the backing of the Fed, proceeded to demand as much extra collateral for Lehman repo positions on hold with JP Morgan and the Tri-Party repo system, of which JPM is one of only two custodians, simply because it could, and because this is the easiest way for the bank that is even closer to the Fed than Goldman Sachs, to procure liquidity during times of broad distress. Such as when the money market is about to freeze to death. Since then, the topic of just how much JPMorgan may have ripped off the Lehman estate has escalated, and is set to be an epic showdown in the form of a lawsuit which “accuses JPMorgan of using its “life and death power as the brokerage firm’s primary clearing bank” to put a “financial gun” to its head and demand excess collateral.” And here is the kicker: “It claims JPMorgan abused its access to US government officials and then “accelerated Lehman’s free fall into bankruptcy”, hoovering up collateral to protect itself to the detriment of the firm and other eventual creditors.”

Read More @ ZeroHedge.com

from Zero Hedge :

In an article that is about three years overdue, “JPMorgan’s practices bring scrutiny” the FT finally takes aim at that other “vampire

squid”, JP Morgan, which technically is incorrect: because if Goldman

is a nimble and aggressive creature, with infinite tentacles in every

governmental office, and unencumbered by massive liabilities, JPMorgan

is just as connected, but unlike Goldman, it is a behemoth in every

other possible capacity, and with its trillion in deposits, matched by

tens of billions in bad loans, is a true Bank Holding Company. As such ‘Jabba the Hutt‘ would be a far more appropriate allegory to describe the the firm, whose reach, scope and scale lead the FT to classify it as “Three times a pallbearer, never a corpse.”

In an article that is about three years overdue, “JPMorgan’s practices bring scrutiny” the FT finally takes aim at that other “vampire

squid”, JP Morgan, which technically is incorrect: because if Goldman

is a nimble and aggressive creature, with infinite tentacles in every

governmental office, and unencumbered by massive liabilities, JPMorgan

is just as connected, but unlike Goldman, it is a behemoth in every

other possible capacity, and with its trillion in deposits, matched by

tens of billions in bad loans, is a true Bank Holding Company. As such ‘Jabba the Hutt‘ would be a far more appropriate allegory to describe the the firm, whose reach, scope and scale lead the FT to classify it as “Three times a pallbearer, never a corpse.” As some may recall, back in October 2009, Zero Hedge did an exhaustive expose on the relationship between JPMorgan and the then version of MF Global, Lehman Brothers, whose perfectly functioning division, its North American Brokerage, ended up being scooped up by Barclays for pennies on the dollar. In the meantime, however, JPMorgan, with the backing of the Fed, proceeded to demand as much extra collateral for Lehman repo positions on hold with JP Morgan and the Tri-Party repo system, of which JPM is one of only two custodians, simply because it could, and because this is the easiest way for the bank that is even closer to the Fed than Goldman Sachs, to procure liquidity during times of broad distress. Such as when the money market is about to freeze to death. Since then, the topic of just how much JPMorgan may have ripped off the Lehman estate has escalated, and is set to be an epic showdown in the form of a lawsuit which “accuses JPMorgan of using its “life and death power as the brokerage firm’s primary clearing bank” to put a “financial gun” to its head and demand excess collateral.” And here is the kicker: “It claims JPMorgan abused its access to US government officials and then “accelerated Lehman’s free fall into bankruptcy”, hoovering up collateral to protect itself to the detriment of the firm and other eventual creditors.”

Read More @ ZeroHedge.com

Biggest Weekly Stock Plunge In 2012 As Financials FUBAR'd

The heaviest weekly loss (down 2%) in the S&P 500 since mid-December and largest two-week drop since the rally began in November was dominated by losses in financials (and energy). The major financials most notably have been crushed

from the start of April (MS -13%, Citi/BofA -11%, GS -8.5% since the

European close on 4/2). Credit broadly underperformed on the day (after

ripping to pre-NFP levels yesterday) but HYG (the high-yield bond ETF)

outperformed surprisingly but this appears to be related to an equity-credit (SPY-HYG) convergence trade as HYG looks very rich now once again to its NAV.

The dismal close in ES (S&P futures) on significantly heavier

volume and block size. VIX pushed back above 19.5% and we worry that the

violent swings that we saw in credit and equity markets this week are very reminiscent of the beginning of the chaos mid-Summer last year

- and perhaps rightfully so given the European situation that is

escalating. FX markets were much more active today with EURUSD breaking

back under 1.31 and AUD leaking lower after gapping down on China GDP

news last night. Interestingly the USD ended basically unchanged from last week's close while Gold managed to hold onto its gains for the week (+1.5% at $1655)

despite drops in Silver and Copper also today (Silver and Gold

retracing the spike highs from yesterday). Copper kept sliding -4.7% on

the week. Treasuries slipped lower in yield from late

last night exaggerated by China's news with the entire complex notably

lower (5-9bps on the week) in yield and flatter as the long-end

outperformed. Stocks pulled back towards CONTEXT with broad risk

assets at the close today though it remains rich to Treasuries and

credit on a medium-term basis.

The heaviest weekly loss (down 2%) in the S&P 500 since mid-December and largest two-week drop since the rally began in November was dominated by losses in financials (and energy). The major financials most notably have been crushed

from the start of April (MS -13%, Citi/BofA -11%, GS -8.5% since the

European close on 4/2). Credit broadly underperformed on the day (after

ripping to pre-NFP levels yesterday) but HYG (the high-yield bond ETF)

outperformed surprisingly but this appears to be related to an equity-credit (SPY-HYG) convergence trade as HYG looks very rich now once again to its NAV.

The dismal close in ES (S&P futures) on significantly heavier

volume and block size. VIX pushed back above 19.5% and we worry that the

violent swings that we saw in credit and equity markets this week are very reminiscent of the beginning of the chaos mid-Summer last year

- and perhaps rightfully so given the European situation that is

escalating. FX markets were much more active today with EURUSD breaking

back under 1.31 and AUD leaking lower after gapping down on China GDP

news last night. Interestingly the USD ended basically unchanged from last week's close while Gold managed to hold onto its gains for the week (+1.5% at $1655)

despite drops in Silver and Copper also today (Silver and Gold

retracing the spike highs from yesterday). Copper kept sliding -4.7% on

the week. Treasuries slipped lower in yield from late

last night exaggerated by China's news with the entire complex notably

lower (5-9bps on the week) in yield and flatter as the long-end

outperformed. Stocks pulled back towards CONTEXT with broad risk

assets at the close today though it remains rich to Treasuries and

credit on a medium-term basis."There’s No Place For Hope On Friday the 13th" - Rout Post-Mortem With Goldman

"All might be well in China, but Europe again is a cause for serious concern. Spain is the victim of the most intense violence – CDS trades to new all-time wides, and local banks sent nearly 5% lower. The hope might have been that once European markets closed, US equities would recoup losses. But there’s no place for hope on Friday the 13th, and stocks close at the low. The post-close price action in futures was even worse as ES1 drops further still. Back below the 50d again. Perhaps spillover from weakness in European financials, but problematic as tech, the other obvious leader of the year’s rally, is also flagging. SPX drops 17 to close 1370 (-1.25%). The DOW drops 137 to close 12850 (1.05%). The NASDAQ drops 44 to close 3011 (-1.45%)."Transcendent Economic Understanding (TEU)

Richard Daughty, a.k.a., 'The Mogambo Guru' at Mogambo Guru Report! - 1 hour ago

I woke up earlier than usual, and suddenly decided to try and quietly sneak

out of the house so that I could get breakfast out, someplace where wives

and children are not yammering about something.

My tiptoeing around in the dark is, of course, the silent signal to the

wife and kids that I am trying to sneak out of the house unmolested and, if

they know what is good for them, they will pretend they are asleep, as if

in a coma, until long, long after I am gone so as to include a safety

margin of time against my suddenly remembering that I forgot something and

have to come back for it... more »

SP 500 and NDX Futures Daily Chart - Risk Off in the Wash and Rinse Cycle

Don't Believe Every Energy Dividend Story You Hear

My most recent trip to Calgary gave me a welcome chance to catch up

with friends and colleagues in Cow Town's oil and gas sector. I found

out about new projects, investigated companies of interest, and came

away with an improved feel for the current state of affairs – what's

hot, what's not, and why. The outlook from here is not great. When

markets turn bearish, investment strategies often turn toward income

stocks, and rightly so: if market malaise is expected to keep share

prices in check, dividends become a very good place to look for

profits. But whenever a particular characteristic – such as a good

dividend yield – becomes desirable, it also becomes dangerous. The sad

truth is that scammers and profiteers jump aboard the bandwagon and

start making offers that seem too good to refuse. It was just such an

offer that reminded me of this danger. In the question-and-answer

period following my talk in Calgary at the Cambridge House Resource

Conference, an audience member asked my opinion of a new, private

company that was offering a 14.7% monthly dividend yield.

from The American Dream:

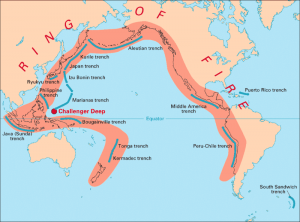

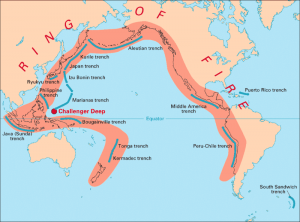

Does it seem to you like there has been an unusual amount of seismic

activity around the world lately? Well, it isn’t just your

imagination. The Ring of Fire is roaring to life and that is really bad

news for the west coast of the United States. Approximately 90 percent

of all earthquakes and approximately 75 percent of all volcanic

eruptions occur along the Ring of Fire. Considering the fact that the

entire west coast of the United States lies along the Ring of Fire, we

should be very concerned that the Ring of Fire is becoming more active.

On Wednesday, the most powerful strike-slip earthquake ever recorded

happened along the Ring of Fire. If that earthquake had happened in a

major U.S. city along the west coast, the city would have been entirely

destroyed. Scientists tell us that there is nearly a 100% certainty

that the “Big One” will hit California at some point. In recent years

we have seen Japan, Chile, Indonesia and New Zealand all get hit by

historic earthquakes. It is inevitable that there will be earthquakes

of historic importance on the west coast of the United States as well.

So far we have been very fortunate, but that good fortune will not last

indefinitely.

Does it seem to you like there has been an unusual amount of seismic

activity around the world lately? Well, it isn’t just your

imagination. The Ring of Fire is roaring to life and that is really bad

news for the west coast of the United States. Approximately 90 percent

of all earthquakes and approximately 75 percent of all volcanic

eruptions occur along the Ring of Fire. Considering the fact that the

entire west coast of the United States lies along the Ring of Fire, we

should be very concerned that the Ring of Fire is becoming more active.

On Wednesday, the most powerful strike-slip earthquake ever recorded

happened along the Ring of Fire. If that earthquake had happened in a

major U.S. city along the west coast, the city would have been entirely

destroyed. Scientists tell us that there is nearly a 100% certainty

that the “Big One” will hit California at some point. In recent years

we have seen Japan, Chile, Indonesia and New Zealand all get hit by

historic earthquakes. It is inevitable that there will be earthquakes

of historic importance on the west coast of the United States as well.

So far we have been very fortunate, but that good fortune will not last

indefinitely.

Read More @ EndOfTheAmericanDream.com

Does it seem to you like there has been an unusual amount of seismic

activity around the world lately? Well, it isn’t just your

imagination. The Ring of Fire is roaring to life and that is really bad

news for the west coast of the United States. Approximately 90 percent

of all earthquakes and approximately 75 percent of all volcanic

eruptions occur along the Ring of Fire. Considering the fact that the

entire west coast of the United States lies along the Ring of Fire, we

should be very concerned that the Ring of Fire is becoming more active.

On Wednesday, the most powerful strike-slip earthquake ever recorded

happened along the Ring of Fire. If that earthquake had happened in a

major U.S. city along the west coast, the city would have been entirely

destroyed. Scientists tell us that there is nearly a 100% certainty

that the “Big One” will hit California at some point. In recent years

we have seen Japan, Chile, Indonesia and New Zealand all get hit by

historic earthquakes. It is inevitable that there will be earthquakes

of historic importance on the west coast of the United States as well.

So far we have been very fortunate, but that good fortune will not last

indefinitely.

Does it seem to you like there has been an unusual amount of seismic

activity around the world lately? Well, it isn’t just your

imagination. The Ring of Fire is roaring to life and that is really bad

news for the west coast of the United States. Approximately 90 percent

of all earthquakes and approximately 75 percent of all volcanic

eruptions occur along the Ring of Fire. Considering the fact that the

entire west coast of the United States lies along the Ring of Fire, we

should be very concerned that the Ring of Fire is becoming more active.

On Wednesday, the most powerful strike-slip earthquake ever recorded

happened along the Ring of Fire. If that earthquake had happened in a

major U.S. city along the west coast, the city would have been entirely

destroyed. Scientists tell us that there is nearly a 100% certainty

that the “Big One” will hit California at some point. In recent years

we have seen Japan, Chile, Indonesia and New Zealand all get hit by

historic earthquakes. It is inevitable that there will be earthquakes

of historic importance on the west coast of the United States as well.

So far we have been very fortunate, but that good fortune will not last

indefinitely.Read More @ EndOfTheAmericanDream.com

by Richard Cottrell, The Intel Hub:

As if the current circumstances of austerity-riven Greece were not bad

enough already, it seems that the country is set to have a dozen or so

concentration camps dotted around the country.

As if the current circumstances of austerity-riven Greece were not bad

enough already, it seems that the country is set to have a dozen or so

concentration camps dotted around the country.

In language that might have been lifted straight from the Nazi lexicon, these establishments will be known as ‘closed-hospitality’ centers.

The incarcerates will be undocumented – meaning unwanted – refugees flooding in from North Africa, particularly the once prosperous and richest country in the Maghreb belt, namely Libya.

Most of the Mediterranean countries are in the thick of the refugee tide, but Greece is so far the only country that plans to compulsorily pen them up.

The first ‘reception center’ is scheduled to open at a former army base near Athens in the next few weeks.

Read More @ TheIntelHub.com

As if the current circumstances of austerity-riven Greece were not bad

enough already, it seems that the country is set to have a dozen or so

concentration camps dotted around the country.

As if the current circumstances of austerity-riven Greece were not bad

enough already, it seems that the country is set to have a dozen or so

concentration camps dotted around the country.In language that might have been lifted straight from the Nazi lexicon, these establishments will be known as ‘closed-hospitality’ centers.

The incarcerates will be undocumented – meaning unwanted – refugees flooding in from North Africa, particularly the once prosperous and richest country in the Maghreb belt, namely Libya.

Most of the Mediterranean countries are in the thick of the refugee tide, but Greece is so far the only country that plans to compulsorily pen them up.

The first ‘reception center’ is scheduled to open at a former army base near Athens in the next few weeks.

Read More @ TheIntelHub.com

from ChrisMartensondotcom :

In this interview, Chris and Paul discuss gold’s current range-bound trading. In general, he’s in favor of a stay-the-course approach for bullion investors at the moment as world markets work through their liquidity-induced “sugar highs”:

In this interview, Chris and Paul discuss gold’s current range-bound trading. In general, he’s in favor of a stay-the-course approach for bullion investors at the moment as world markets work through their liquidity-induced “sugar highs”:

Sheila Bair, Washington Post:

Are you concerned about growing income inequality in America? Are you

resentful of all that wealth concentrated in the 1 percent? I’ve got the

perfect solution, a modest proposal that involves just a small

adjustment in the Federal Reserve’s easy monetary policy. Best of all,

it will mean that none of us have to work for a living anymore.

Are you concerned about growing income inequality in America? Are you

resentful of all that wealth concentrated in the 1 percent? I’ve got the

perfect solution, a modest proposal that involves just a small

adjustment in the Federal Reserve’s easy monetary policy. Best of all,

it will mean that none of us have to work for a living anymore.

For several years now, the Fed has been making money available to the financial sector at near-zero interest rates. Big banks and hedge funds, among others, have taken this cheap money and invested it in securities with high yields. This type of profit-making, called the “carry trade,” has been enormously profitable for them.

So why not let everyone participate?

Under my plan, each American household could borrow $10 million from the Fed at zero interest. The more conservative among us can take that money and buy 10-year Treasury bonds. At the current 2 percent annual interest rate, we can pocket a nice $200,000 a year to live on. The more adventuresome can buy 10-year Greek debt at 21 percent, for an annual income of $2.1 million. Or if Greece is a little too risky for you, go with Portugal, at about 12 percent, or $1.2 million dollars a year. (No sense in getting greedy.)

Read More @ WashingtonsPost.com

Are you concerned about growing income inequality in America? Are you

resentful of all that wealth concentrated in the 1 percent? I’ve got the

perfect solution, a modest proposal that involves just a small

adjustment in the Federal Reserve’s easy monetary policy. Best of all,

it will mean that none of us have to work for a living anymore.

Are you concerned about growing income inequality in America? Are you

resentful of all that wealth concentrated in the 1 percent? I’ve got the

perfect solution, a modest proposal that involves just a small

adjustment in the Federal Reserve’s easy monetary policy. Best of all,

it will mean that none of us have to work for a living anymore.For several years now, the Fed has been making money available to the financial sector at near-zero interest rates. Big banks and hedge funds, among others, have taken this cheap money and invested it in securities with high yields. This type of profit-making, called the “carry trade,” has been enormously profitable for them.

So why not let everyone participate?

Under my plan, each American household could borrow $10 million from the Fed at zero interest. The more conservative among us can take that money and buy 10-year Treasury bonds. At the current 2 percent annual interest rate, we can pocket a nice $200,000 a year to live on. The more adventuresome can buy 10-year Greek debt at 21 percent, for an annual income of $2.1 million. Or if Greece is a little too risky for you, go with Portugal, at about 12 percent, or $1.2 million dollars a year. (No sense in getting greedy.)

Read More @ WashingtonsPost.com

from CapitalAccount:

Just when you thought it was safe to get back in the water…US and European stock markets remained under pressure today, some eurozone government bonds once again came under intense pressure from investors. We ask if we’re headed for 2008 style trouble…has the subprime mortgage crisis given way to the subprime sovereign debt crisis?

Just when you thought it was safe to get back in the water…US and European stock markets remained under pressure today, some eurozone government bonds once again came under intense pressure from investors. We ask if we’re headed for 2008 style trouble…has the subprime mortgage crisis given way to the subprime sovereign debt crisis?

[Ed. Note:

What is this guy, like 40 years old? Seriously? VP??? Hmmm, let's

see... Marco Rubio or Ron Paul as a truly viable VP... oh wait, sorry -

thought we lived in a Constitutional Republic there for a second. My

bad.]

by Patrick Henningsen, Infowars:

The Washington Post’s report yesterday that the supranational globalist steering organization Bilderberg Group

will be picking imminent GOP nominee Mitt Romney’s Vice Presidential

running mate, has set the media alight – fueled with speculation as to

who that pick might be.

The Washington Post’s report yesterday that the supranational globalist steering organization Bilderberg Group

will be picking imminent GOP nominee Mitt Romney’s Vice Presidential

running mate, has set the media alight – fueled with speculation as to

who that pick might be.

It’s quite sureal to see the cryptic Bilderberg Group grabbing major media headlines, and Americans should be rightly outraged as to why a shadowy group of internationalists could be selecting an American VP. But there may be even more interesting aspect to this story, quietly boiling under the surface.

Washington Post insider Al Kamen indicated that both President Obama and Secretary of State Hillary Clinton will be attending the Summit of the Americas this weekend in Cartagena, Colombia. Interestingly, they will also be accompanied by Senator Marco Rubio (R-Fla.), a burgeoning Latino political icon who many pundits believe will be Romney’s running mate.

Read More @ InfoWars.com

by Patrick Henningsen, Infowars:

The Washington Post’s report yesterday that the supranational globalist steering organization Bilderberg Group

will be picking imminent GOP nominee Mitt Romney’s Vice Presidential

running mate, has set the media alight – fueled with speculation as to

who that pick might be.

The Washington Post’s report yesterday that the supranational globalist steering organization Bilderberg Group

will be picking imminent GOP nominee Mitt Romney’s Vice Presidential

running mate, has set the media alight – fueled with speculation as to

who that pick might be.It’s quite sureal to see the cryptic Bilderberg Group grabbing major media headlines, and Americans should be rightly outraged as to why a shadowy group of internationalists could be selecting an American VP. But there may be even more interesting aspect to this story, quietly boiling under the surface.

Washington Post insider Al Kamen indicated that both President Obama and Secretary of State Hillary Clinton will be attending the Summit of the Americas this weekend in Cartagena, Colombia. Interestingly, they will also be accompanied by Senator Marco Rubio (R-Fla.), a burgeoning Latino political icon who many pundits believe will be Romney’s running mate.

Read More @ InfoWars.com

from KingWorldNews:

With continued volatility in gold and silver, today King World News

interviewed 25 year veteran Caesar Bryan. Gabelli & Company has

over $31 billion under management and Caesar Bryan has managed the gold

fund since its inception in 1994. Caesar told KWN the European banking

system is stil on fire, and we are now seeing bank runs in both Spain

and Italy. He also stated that today’s trading at the end of the day in

gold was very “odd.” Here is what Caesar had to say about the

situation: “We had been having a recovery in the price of gold

recently, but then gold was taken down around 1:15 pm today. There was

quite significant volume in the last 15 minutes, before the COMEX

closed.”

With continued volatility in gold and silver, today King World News

interviewed 25 year veteran Caesar Bryan. Gabelli & Company has

over $31 billion under management and Caesar Bryan has managed the gold

fund since its inception in 1994. Caesar told KWN the European banking

system is stil on fire, and we are now seeing bank runs in both Spain

and Italy. He also stated that today’s trading at the end of the day in

gold was very “odd.” Here is what Caesar had to say about the

situation: “We had been having a recovery in the price of gold

recently, but then gold was taken down around 1:15 pm today. There was

quite significant volume in the last 15 minutes, before the COMEX

closed.”

Caesar Bryan continues @ KingWorldNews.com

With continued volatility in gold and silver, today King World News

interviewed 25 year veteran Caesar Bryan. Gabelli & Company has

over $31 billion under management and Caesar Bryan has managed the gold

fund since its inception in 1994. Caesar told KWN the European banking

system is stil on fire, and we are now seeing bank runs in both Spain

and Italy. He also stated that today’s trading at the end of the day in

gold was very “odd.” Here is what Caesar had to say about the

situation: “We had been having a recovery in the price of gold

recently, but then gold was taken down around 1:15 pm today. There was

quite significant volume in the last 15 minutes, before the COMEX

closed.”

With continued volatility in gold and silver, today King World News

interviewed 25 year veteran Caesar Bryan. Gabelli & Company has

over $31 billion under management and Caesar Bryan has managed the gold

fund since its inception in 1994. Caesar told KWN the European banking

system is stil on fire, and we are now seeing bank runs in both Spain

and Italy. He also stated that today’s trading at the end of the day in

gold was very “odd.” Here is what Caesar had to say about the

situation: “We had been having a recovery in the price of gold

recently, but then gold was taken down around 1:15 pm today. There was

quite significant volume in the last 15 minutes, before the COMEX

closed.”Caesar Bryan continues @ KingWorldNews.com

by Keith Weiner, Zero Hedge :

I am writing this, having just returned from the fourth course at the New Austrian School of Economics, in Munich. The single biggest theme was the rate of interest and its linkage to prices. Kondratieff, among several others, have observed that rising prices lead to rising interest rates and vice versa. And the opposite case is also true, falling interest rates go with falling prices (all else being equal). I plan to write a separate paper on this topic.

One of the most important ideas proposed by Professor Fekete is that a rise in the rate of interest reduces the burden of debt that has been accumulated previously. And a fall in the rate of interest increases the burden of debt.

Read More @ ZeroHedge.com

I am writing this, having just returned from the fourth course at the New Austrian School of Economics, in Munich. The single biggest theme was the rate of interest and its linkage to prices. Kondratieff, among several others, have observed that rising prices lead to rising interest rates and vice versa. And the opposite case is also true, falling interest rates go with falling prices (all else being equal). I plan to write a separate paper on this topic.

One of the most important ideas proposed by Professor Fekete is that a rise in the rate of interest reduces the burden of debt that has been accumulated previously. And a fall in the rate of interest increases the burden of debt.

Read More @ ZeroHedge.com

SBSS. 19 Silver Manipulation Part 1

SBSS 19. Silver Manipulation Part 2

from wmjsarah:

vs

vs

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment