By Gary North, GaryNorth.com

From the day Ron Paul declared he was running, the mainstream media have had a problem: how to keep Paul’s message from getting a hearing.

With a bunch of conservatives in the race, the media could safely focus on the conservative-of-the-month. But now Santorum has quit. It’s down to three: Romney, Gingrich, and Paul.

How will the media spin this? How will they make it a race between Romney and Gingrich, with what’s his name not mentioned?

Paul has money to spend. He will run TV ads. Here’s one aimed at Texans.

If Gingrich is in second place in the primaries, that benefits the mainstream media. They can try to make it a two-horse race. But that tactic will be obvious. It will not work. The Web will not let them get away with anything like this.

If Paul beats Gingrich, the media will keep saying he should pull out of the race. Why should he? He is building his mailing list, primary by primary.

The media will hammer on this: Ron Paul is eccentric who cannot win. This raises a question: How come his campaign has money? How can he afford ton run those ads? How does an eccentric raise so much money?

Read More @ GaryNorth.com

Good evening Ladies and Gentlemen: Gold closed up today by $30.30 to $1679.50 Silver followed suit rising by $1.00 to $32.50. The bankers certainly put pressure on gold starting with their usual attack at 3 am in the morning, and then hitting the sell button at the comex opening. However for two out of the last 3 days we have outside day reversals which is extremely rare. I wonder what the

As we have recently pointed out (here),

the exponential level of global central bank one-upmanship has created

a level of dependency in capital markets never seen so obviously

before. Critically, though, it is not the sheer scale of the

balance sheet (or STOCK of assets) that is good enough anymore - equity

market performance is all about the marginal change in that stock

(FLOW). Nowhere is this "It's The Flow Stupid"

better highlighted than in the chart below showing the periods of

central bank balance sheet expansion coinciding almost perfectly with

the largest surges in equity market performance. Furthermore, as the

flow fades so the performance starts to fade (unable to counter the

natural tendency of retail to exit the risky markets perhaps) and as the

Fed's balance sheet begins to actually compress marginally (as it has

the last few weeks), so equity market performance has turned negative -

and notably so. This leaves the Fed with the dilemma that it

is not just about the size of the bazooka anymore but the frequency

with which you are willing to use it - and as we are likely to

see this week - jaw-boning alone will not do the trick (no matter what

today's market might have been hoping for) as unless we see the

balance sheet of the Fed expand again (which would mean a rise of

around 0.4% - something we haven't seen since mid February), we should expect the rolling 4-week performance of equities to continue to fall.

As we have recently pointed out (here),

the exponential level of global central bank one-upmanship has created

a level of dependency in capital markets never seen so obviously

before. Critically, though, it is not the sheer scale of the

balance sheet (or STOCK of assets) that is good enough anymore - equity

market performance is all about the marginal change in that stock

(FLOW). Nowhere is this "It's The Flow Stupid"

better highlighted than in the chart below showing the periods of

central bank balance sheet expansion coinciding almost perfectly with

the largest surges in equity market performance. Furthermore, as the

flow fades so the performance starts to fade (unable to counter the

natural tendency of retail to exit the risky markets perhaps) and as the

Fed's balance sheet begins to actually compress marginally (as it has

the last few weeks), so equity market performance has turned negative -

and notably so. This leaves the Fed with the dilemma that it

is not just about the size of the bazooka anymore but the frequency

with which you are willing to use it - and as we are likely to

see this week - jaw-boning alone will not do the trick (no matter what

today's market might have been hoping for) as unless we see the

balance sheet of the Fed expand again (which would mean a rise of

around 0.4% - something we haven't seen since mid February), we should expect the rolling 4-week performance of equities to continue to fall.

The number the market has been waiting for with bated breath arrives:

CHINA 1Q GDP GROWS 8.1% ON YEAR, EXPECTED 8.4%, and whispered at 9.0%

CHINA STATISTICS BUREAU SAYS PROBLEMS REMAIN IN THE ECONOMY

NBS: CHINA STILL FACES UPWARD PRESSURE ON INFLATION

NBS: CHINA FACES DIFFICULTY STABILIZING EXPORTS

And so the rumormill, which was expecting some ridiculous GDP print of 9.0% based on a third-rate research report released overnight, despite China posting some epic budget surpluses in the past few months, is stuck dumping risk in this late hour. Everything selling off as China's GDP posts the biggest sequential drop since March 2009 and the lowest sequential GDP rise since September 2009.

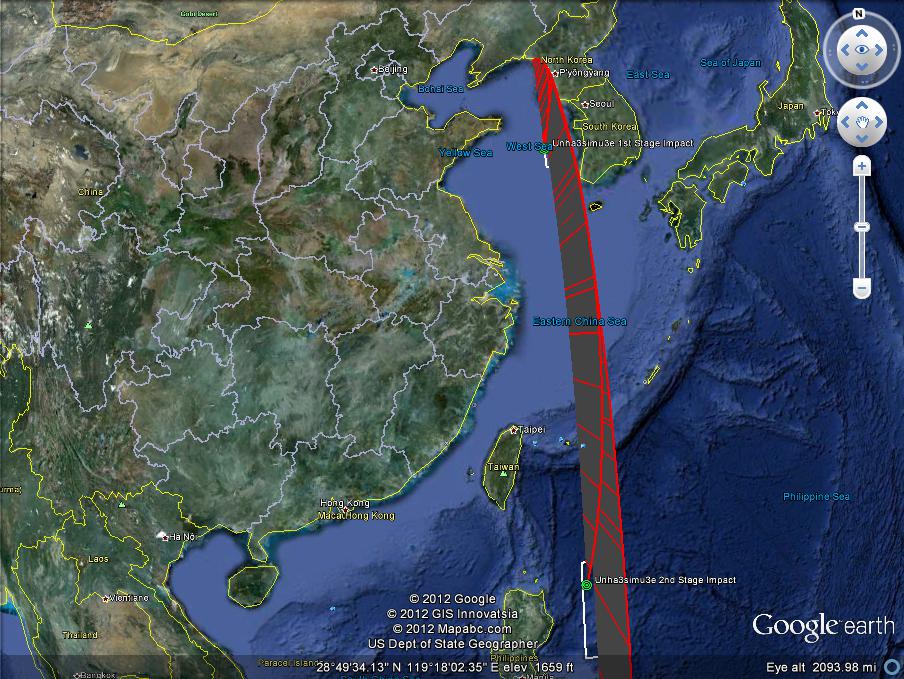

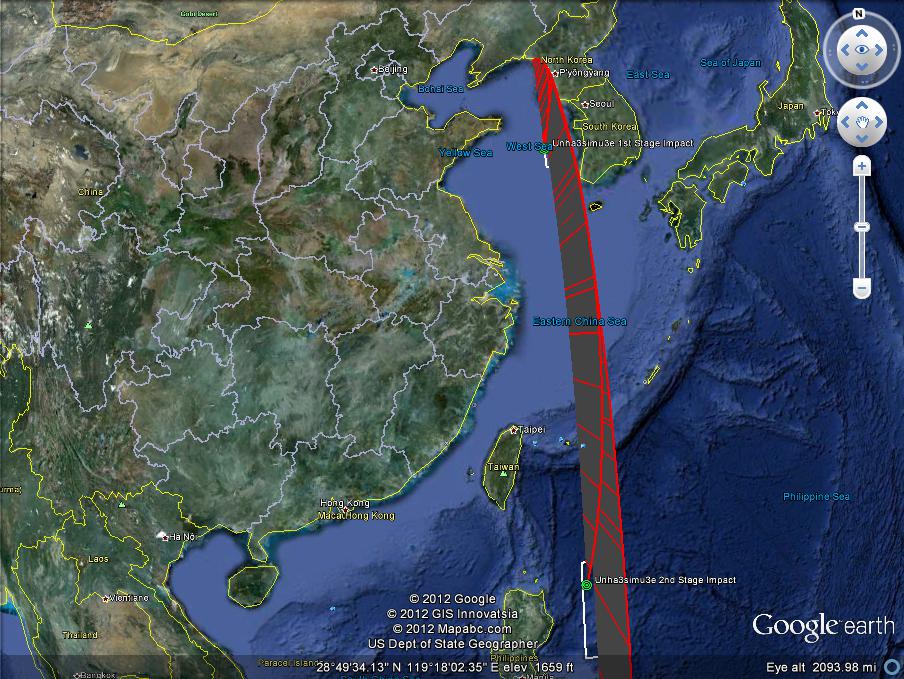

Red headline time. From Yonhap:

Red headline time. From Yonhap:

North Korea launches rocket - S.Korea's YTN Television

U.S official confirms North Korea has launched rocket

Rocket launch took place at 7:39 local time - South Korea Defense Ministry,

Japan likely in full mobilization mode right about now. Or not: this just in:

ABC's Martha Raddatz reports the North Korean rocket launch has FAILED.

Somebody is about to be punished big time since local rockets no fly long time.

You have seen the trees. Now see the forest.

You have seen the trees. Now see the forest.

More

jaw-boning helped squeeze shorts as equity indices, credit, and

precious metals all closed their highest since the NFP dive as QE3 hope

is back on the table. The best day in four months for Materials (now the only sector green from before the NFP print)

and Industrials, and the best two-day gain in financials and energy in

four months but the S&P 500 remains around 1% off pre-NFP levels

(but managed to fill the gap to the lows of last Thursday in S&P

futures). Credit (both investment grade and high-yield spreads) managed - just as in Europe - to rip up to pre-NFP levels

also (outperforming stocks). Notable divergence between AAPL and SPY

started at 1045ET today - as GOOG volume picked up and accelerated which

was also when ES (S&P e-mini futures) broke Tuesday's opening

level and ran stops. Volume was average with higher average trade size coming in as we reached post-NFP highs (suggesting again professionals selling into strength as weak shorts are squeezed out in a hurry). The dovish comments sent Gold and Silver surging (and China rumors pushed Copper up - and WTI to around $104). VIX crumbled into the close - with its largest drop in over 5 months in percentage terms - though still higher than last Thursday's close. FX markets

were noisy once again through Europe but USD ebbed higher in the

afternoon - still very modestly lower on the week and day (with JPY

leaking weaker today helping carry support risk a little). Treasuries also leaked higher in yield

but remain at the immediate spike low yields post-NFP (pretty much in

line with stocks generally) but between FX and TSYs, broad risk assets

were not as excited as credit and equity markets specifically as we

suspect this was weak recent shorts being shaken out suddenly. In

context, the S&P 500 is down over 3% in gold terms from before the payrolls print.

More

jaw-boning helped squeeze shorts as equity indices, credit, and

precious metals all closed their highest since the NFP dive as QE3 hope

is back on the table. The best day in four months for Materials (now the only sector green from before the NFP print)

and Industrials, and the best two-day gain in financials and energy in

four months but the S&P 500 remains around 1% off pre-NFP levels

(but managed to fill the gap to the lows of last Thursday in S&P

futures). Credit (both investment grade and high-yield spreads) managed - just as in Europe - to rip up to pre-NFP levels

also (outperforming stocks). Notable divergence between AAPL and SPY

started at 1045ET today - as GOOG volume picked up and accelerated which

was also when ES (S&P e-mini futures) broke Tuesday's opening

level and ran stops. Volume was average with higher average trade size coming in as we reached post-NFP highs (suggesting again professionals selling into strength as weak shorts are squeezed out in a hurry). The dovish comments sent Gold and Silver surging (and China rumors pushed Copper up - and WTI to around $104). VIX crumbled into the close - with its largest drop in over 5 months in percentage terms - though still higher than last Thursday's close. FX markets

were noisy once again through Europe but USD ebbed higher in the

afternoon - still very modestly lower on the week and day (with JPY

leaking weaker today helping carry support risk a little). Treasuries also leaked higher in yield

but remain at the immediate spike low yields post-NFP (pretty much in

line with stocks generally) but between FX and TSYs, broad risk assets

were not as excited as credit and equity markets specifically as we

suspect this was weak recent shorts being shaken out suddenly. In

context, the S&P 500 is down over 3% in gold terms from before the payrolls print.

Reiterating

his earlier year call to dollar-cost-average into long Gold via GLD

and short Euro (FXE) positions, Charles Biderman of TrimTabs suggests

that while the sell-off in stocks may have begun, he does not expect it to pick up steam until after April. His thesis for being long Gold remains the same, the US,

Europe, and Japan continue to create ever-increasing amounts of

paper-money with which they pay bills - and that is not going to end

soon. EM central banks will continue to load up on gold in

reserves with an endgame of replacing USD reserve status quo. His short

Euro thesis has, in his view, become more prescient as the European

recession grows deeper and the EUR drifts towards parity with the USD

(whether or not the Fed 'allows' it). He ends with a noteworthy comment

on the removal of safe-haven status for common carry currencies such as NZD, AUD, and CAD due to crumbling housing fundamentals.

Reiterating

his earlier year call to dollar-cost-average into long Gold via GLD

and short Euro (FXE) positions, Charles Biderman of TrimTabs suggests

that while the sell-off in stocks may have begun, he does not expect it to pick up steam until after April. His thesis for being long Gold remains the same, the US,

Europe, and Japan continue to create ever-increasing amounts of

paper-money with which they pay bills - and that is not going to end

soon. EM central banks will continue to load up on gold in

reserves with an endgame of replacing USD reserve status quo. His short

Euro thesis has, in his view, become more prescient as the European

recession grows deeper and the EUR drifts towards parity with the USD

(whether or not the Fed 'allows' it). He ends with a noteworthy comment

on the removal of safe-haven status for common carry currencies such as NZD, AUD, and CAD due to crumbling housing fundamentals.

Well this feels a lot better, doesn’t it?

The Eurozone drama, the Fed’s burgeoning balance sheet, $16 Trillion in U.S. debt. There’s no shortage of reasons to own metals. And yes, the criminal cartel can control silver, until the day comes when they can’t. At which time all hell will break loose in the PHYSICAL precious metals market.

Got physical?

GOLD: The Money of Kings

SILVER: The Achilles’ Heel

by Jeff Nielson, Bullion Bulls Canada:

Let me preface this piece by first stating that my reason for writing

it was not to induce people to guess which scenario they found more

probable, and then to place their bets beforehand. Rather, my purpose

was exactly opposite: to prepare people for either scenario so that when

they recognized one or the other unfolding they wouldn’t do something

stupid in a moment of panic (or greed).

Let me preface this piece by first stating that my reason for writing

it was not to induce people to guess which scenario they found more

probable, and then to place their bets beforehand. Rather, my purpose

was exactly opposite: to prepare people for either scenario so that when

they recognized one or the other unfolding they wouldn’t do something

stupid in a moment of panic (or greed).

Sadly, in our markets to “do something stupid in a moment of panic” generally means doing precisely the opposite of what one should be doing. This also explains why the bankers like to start panics. First of all, as the cause of these panics the banksters are neither “panicked” nor (obviously) surprised themselves. So they continue to operate calmly (in this feeding-frenzy) while the sheep make themselves especially easy to sheer.

Read More @ TF Metals Report.com

I'm PayPal Verified

From the day Ron Paul declared he was running, the mainstream media have had a problem: how to keep Paul’s message from getting a hearing.

With a bunch of conservatives in the race, the media could safely focus on the conservative-of-the-month. But now Santorum has quit. It’s down to three: Romney, Gingrich, and Paul.

How will the media spin this? How will they make it a race between Romney and Gingrich, with what’s his name not mentioned?

Paul has money to spend. He will run TV ads. Here’s one aimed at Texans.

If Gingrich is in second place in the primaries, that benefits the mainstream media. They can try to make it a two-horse race. But that tactic will be obvious. It will not work. The Web will not let them get away with anything like this.

If Paul beats Gingrich, the media will keep saying he should pull out of the race. Why should he? He is building his mailing list, primary by primary.

The media will hammer on this: Ron Paul is eccentric who cannot win. This raises a question: How come his campaign has money? How can he afford ton run those ads? How does an eccentric raise so much money?

Read More @ GaryNorth.com

Lousy Italian bond auction/Dudley and Yellen call for QEIII as bourses rise/

Harvey Organ at Harvey Organ's - The Daily Gold and Silver Report - 6 hours ago

Good evening Ladies and Gentlemen: Gold closed up today by $30.30 to $1679.50 Silver followed suit rising by $1.00 to $32.50. The bankers certainly put pressure on gold starting with their usual attack at 3 am in the morning, and then hitting the sell button at the comex opening. However for two out of the last 3 days we have outside day reversals which is extremely rare. I wonder what the

Meat (sic) The Other Slimes

Because pink slime was just the beginning.

Why The Market Is Praying The Fed Does Not Plug Its Heavy Flow

As we have recently pointed out (here),

the exponential level of global central bank one-upmanship has created

a level of dependency in capital markets never seen so obviously

before. Critically, though, it is not the sheer scale of the

balance sheet (or STOCK of assets) that is good enough anymore - equity

market performance is all about the marginal change in that stock

(FLOW). Nowhere is this "It's The Flow Stupid"

better highlighted than in the chart below showing the periods of

central bank balance sheet expansion coinciding almost perfectly with

the largest surges in equity market performance. Furthermore, as the

flow fades so the performance starts to fade (unable to counter the

natural tendency of retail to exit the risky markets perhaps) and as the

Fed's balance sheet begins to actually compress marginally (as it has

the last few weeks), so equity market performance has turned negative -

and notably so. This leaves the Fed with the dilemma that it

is not just about the size of the bazooka anymore but the frequency

with which you are willing to use it - and as we are likely to

see this week - jaw-boning alone will not do the trick (no matter what

today's market might have been hoping for) as unless we see the

balance sheet of the Fed expand again (which would mean a rise of

around 0.4% - something we haven't seen since mid February), we should expect the rolling 4-week performance of equities to continue to fall.

As we have recently pointed out (here),

the exponential level of global central bank one-upmanship has created

a level of dependency in capital markets never seen so obviously

before. Critically, though, it is not the sheer scale of the

balance sheet (or STOCK of assets) that is good enough anymore - equity

market performance is all about the marginal change in that stock

(FLOW). Nowhere is this "It's The Flow Stupid"

better highlighted than in the chart below showing the periods of

central bank balance sheet expansion coinciding almost perfectly with

the largest surges in equity market performance. Furthermore, as the

flow fades so the performance starts to fade (unable to counter the

natural tendency of retail to exit the risky markets perhaps) and as the

Fed's balance sheet begins to actually compress marginally (as it has

the last few weeks), so equity market performance has turned negative -

and notably so. This leaves the Fed with the dilemma that it

is not just about the size of the bazooka anymore but the frequency

with which you are willing to use it - and as we are likely to

see this week - jaw-boning alone will not do the trick (no matter what

today's market might have been hoping for) as unless we see the

balance sheet of the Fed expand again (which would mean a rise of

around 0.4% - something we haven't seen since mid February), we should expect the rolling 4-week performance of equities to continue to fall.China GDP Misses Expectations By A Mile, Rises Only 8.1%, Slowest Pace Since September 2009

The number the market has been waiting for with bated breath arrives:

CHINA 1Q GDP GROWS 8.1% ON YEAR, EXPECTED 8.4%, and whispered at 9.0%

CHINA STATISTICS BUREAU SAYS PROBLEMS REMAIN IN THE ECONOMY

NBS: CHINA STILL FACES UPWARD PRESSURE ON INFLATION

NBS: CHINA FACES DIFFICULTY STABILIZING EXPORTS

And so the rumormill, which was expecting some ridiculous GDP print of 9.0% based on a third-rate research report released overnight, despite China posting some epic budget surpluses in the past few months, is stuck dumping risk in this late hour. Everything selling off as China's GDP posts the biggest sequential drop since March 2009 and the lowest sequential GDP rise since September 2009.

Was The SEC "Explanation" Of The Flash Crash Maliciously Fabricated Or Completely Flawed Out Of Plain Incompetence?

Regular readers know that since the beginning, Zero Hedge has been vehemently opposed to the official SEC explanation of the chain of events that brought upon the Flash Crash of May 6, 2010, in which the Dow Jones Industrial Average lost 1000 points in a span of seconds, and during which billions were lost when stop loss orders were triggered catching hapless victims unaware (unless of course, one had a stop loss well beyond a reasonable interval of 20%, in which case the trades were simply DKed). It is no secret that one of the main reasons why the retail investor has since declared a boycott of capital markets, which lasts to this day, and manifests itself in hundreds of billions pulled out of equities and deposited into bonds and hard assets, has been precisely the SEC's unwillingness to probe into this still open issue, and not only come up with a reasonable and accurate explanation for what truly happened, but hold anyone responsible for the biggest market crash in history in absolute terms. Instead, the SEC, naively has been pushing forth a ridiculous story that the entire market crash was the doing of one small mutual fund: Waddell and Reed, and its 75,000 E-mini trade, which initially was opposed to being scapegoated, but subsequently went oddly radio silent. Well, if they didn't mind shouldering the blame, the SEC was likely right, most would say. However, as virtually always happens, most would be wrong. Over the past few days, Nanex has one again, without any assistance from the regulators or any third parties, managed to unravel a critical component of the entire 104 page SEC "findings" which as is now known, indemnified all forms of high frequency trading (even as subsequently it was found, again by Nanex, that it was precisely HFT quote churning that was the primary, if not sole, reason for the catastrophic chain of events) with a finding so profound which in turn discredits the entire analytical framework of the SEC report, and makes it null and void.... The only open question is whether the SEC, which certainly co-opted the authors of the paper to reach the desired conclusion, real facts be damned, acted out of malice and purposefully fabricated the data knowing very well the evidence does not support the conclusion, or, just as bad, was the entire supporting cast and crew so glaringly incompetent they did not understand what they were looking at in the first place.North Korea Launches Rocket, ABC Reports Launch Has Failed

Red headline time. From Yonhap:

Red headline time. From Yonhap:North Korea launches rocket - S.Korea's YTN Television

U.S official confirms North Korea has launched rocket

Rocket launch took place at 7:39 local time - South Korea Defense Ministry,

Japan likely in full mobilization mode right about now. Or not: this just in:

ABC's Martha Raddatz reports the North Korean rocket launch has FAILED.

Somebody is about to be punished big time since local rockets no fly long time.

CME Lowers Silver, Copper Margins

While it is unknown if this is merely a bull trap to get yet another bubble going, then to slaughter everyone with the same relentless barrage of margin hikes as we saw in the spring of 2011, or simply volumes in commodities have gotten so low that even the CME is willing to allow a little price appreciation in exchange for participation is unknown, but as of April 16 silver initial and maintenance margins will be 12.5% lower, while copper margins are declining by 20%.The "Buffett Rule" In Perspective

You have seen the trees. Now see the forest.

You have seen the trees. Now see the forest.Fed Doves Send Risk Soaring, Apples Dropping

More

jaw-boning helped squeeze shorts as equity indices, credit, and

precious metals all closed their highest since the NFP dive as QE3 hope

is back on the table. The best day in four months for Materials (now the only sector green from before the NFP print)

and Industrials, and the best two-day gain in financials and energy in

four months but the S&P 500 remains around 1% off pre-NFP levels

(but managed to fill the gap to the lows of last Thursday in S&P

futures). Credit (both investment grade and high-yield spreads) managed - just as in Europe - to rip up to pre-NFP levels

also (outperforming stocks). Notable divergence between AAPL and SPY

started at 1045ET today - as GOOG volume picked up and accelerated which

was also when ES (S&P e-mini futures) broke Tuesday's opening

level and ran stops. Volume was average with higher average trade size coming in as we reached post-NFP highs (suggesting again professionals selling into strength as weak shorts are squeezed out in a hurry). The dovish comments sent Gold and Silver surging (and China rumors pushed Copper up - and WTI to around $104). VIX crumbled into the close - with its largest drop in over 5 months in percentage terms - though still higher than last Thursday's close. FX markets

were noisy once again through Europe but USD ebbed higher in the

afternoon - still very modestly lower on the week and day (with JPY

leaking weaker today helping carry support risk a little). Treasuries also leaked higher in yield

but remain at the immediate spike low yields post-NFP (pretty much in

line with stocks generally) but between FX and TSYs, broad risk assets

were not as excited as credit and equity markets specifically as we

suspect this was weak recent shorts being shaken out suddenly. In

context, the S&P 500 is down over 3% in gold terms from before the payrolls print.

More

jaw-boning helped squeeze shorts as equity indices, credit, and

precious metals all closed their highest since the NFP dive as QE3 hope

is back on the table. The best day in four months for Materials (now the only sector green from before the NFP print)

and Industrials, and the best two-day gain in financials and energy in

four months but the S&P 500 remains around 1% off pre-NFP levels

(but managed to fill the gap to the lows of last Thursday in S&P

futures). Credit (both investment grade and high-yield spreads) managed - just as in Europe - to rip up to pre-NFP levels

also (outperforming stocks). Notable divergence between AAPL and SPY

started at 1045ET today - as GOOG volume picked up and accelerated which

was also when ES (S&P e-mini futures) broke Tuesday's opening

level and ran stops. Volume was average with higher average trade size coming in as we reached post-NFP highs (suggesting again professionals selling into strength as weak shorts are squeezed out in a hurry). The dovish comments sent Gold and Silver surging (and China rumors pushed Copper up - and WTI to around $104). VIX crumbled into the close - with its largest drop in over 5 months in percentage terms - though still higher than last Thursday's close. FX markets

were noisy once again through Europe but USD ebbed higher in the

afternoon - still very modestly lower on the week and day (with JPY

leaking weaker today helping carry support risk a little). Treasuries also leaked higher in yield

but remain at the immediate spike low yields post-NFP (pretty much in

line with stocks generally) but between FX and TSYs, broad risk assets

were not as excited as credit and equity markets specifically as we

suspect this was weak recent shorts being shaken out suddenly. In

context, the S&P 500 is down over 3% in gold terms from before the payrolls print.Google Reports Earnings, Beats EPS, Meets Ex-TAC Revenues, Announces 2:1 Stock Split And New Non-Voting Class

The headlines flow in:- GOOGLE 1Q REVENUE $10.65B

- GOOGLE 1Q REVENUE EX TAC $8.14B, EST. $8.14B

- GOOGLE 1Q ADJ. EPS $10.08, EST. $9.64

- GOOGLE 1Q PAID CLICKS ROSE 39% VS YEAR AGO

- GOOGLE 1Q TRAFFIC ACQUISITION COSTS $2.51B

- GOOGLE 1Q COST PER CLICK DOWN 12%

Largest US Teacher Pension Fund Underfunding Increases By $9 Billion To $64.5 Billion, Only 69% Funded

While the epically underfunded status of the US, by all definitions a ponzi scheme, whose combined liabilities have a net present value of about $100 trillion, is known to everyone, most can simply shake it off for too reasons: 1) it is a number too big to comprehend, and 2) by the time the ponzi blows up it will be some other generation's problem. However, it may not be so easy for California's retiring teachers. Minutes ago, CalSTRS, or the California State Teachers' Retirement System, with a portfolio valued at $152 billion as of February 29, 2012, and is the largest teacher pension fund in the United States, reported that its underfunding increased by a massive 15%, or from $56 billion to $64.5 billion, which happened despite the market being relatively flat over the past year. In fact this is supposed to be good news: as CalSTRS states, its underfunding was supposed to be even worse by $4.3 billion. So this is really good news. We wonder how good the news will be to tens of thousands of retiring and retired teachers once they understand that their obligations are only funded 69%. And dropping. But wait, there's more: new normal, no new normal, here is what CalSTRS did: it reduced "the assumed rate of investment returns from 7.75 percent to 7.5 percent, which increased the funding shortfall by $3.5 billion." In other words, if the market grows at a true New Normal of 1-2%, or worse, is flat over the long run, we wonder if the obligation coverage ratio would even be in the single digit percentage.Biderman Short Of Euros In Gold Terms

Reiterating

his earlier year call to dollar-cost-average into long Gold via GLD

and short Euro (FXE) positions, Charles Biderman of TrimTabs suggests

that while the sell-off in stocks may have begun, he does not expect it to pick up steam until after April. His thesis for being long Gold remains the same, the US,

Europe, and Japan continue to create ever-increasing amounts of

paper-money with which they pay bills - and that is not going to end

soon. EM central banks will continue to load up on gold in

reserves with an endgame of replacing USD reserve status quo. His short

Euro thesis has, in his view, become more prescient as the European

recession grows deeper and the EUR drifts towards parity with the USD

(whether or not the Fed 'allows' it). He ends with a noteworthy comment

on the removal of safe-haven status for common carry currencies such as NZD, AUD, and CAD due to crumbling housing fundamentals.

Reiterating

his earlier year call to dollar-cost-average into long Gold via GLD

and short Euro (FXE) positions, Charles Biderman of TrimTabs suggests

that while the sell-off in stocks may have begun, he does not expect it to pick up steam until after April. His thesis for being long Gold remains the same, the US,

Europe, and Japan continue to create ever-increasing amounts of

paper-money with which they pay bills - and that is not going to end

soon. EM central banks will continue to load up on gold in

reserves with an endgame of replacing USD reserve status quo. His short

Euro thesis has, in his view, become more prescient as the European

recession grows deeper and the EUR drifts towards parity with the USD

(whether or not the Fed 'allows' it). He ends with a noteworthy comment

on the removal of safe-haven status for common carry currencies such as NZD, AUD, and CAD due to crumbling housing fundamentals.Well this feels a lot better, doesn’t it?

The Eurozone drama, the Fed’s burgeoning balance sheet, $16 Trillion in U.S. debt. There’s no shortage of reasons to own metals. And yes, the criminal cartel can control silver, until the day comes when they can’t. At which time all hell will break loose in the PHYSICAL precious metals market.

Got physical?

GOLD: The Money of Kings

SILVER: The Achilles’ Heel

Let me preface this piece by first stating that my reason for writing

it was not to induce people to guess which scenario they found more

probable, and then to place their bets beforehand. Rather, my purpose

was exactly opposite: to prepare people for either scenario so that when

they recognized one or the other unfolding they wouldn’t do something

stupid in a moment of panic (or greed).

Let me preface this piece by first stating that my reason for writing

it was not to induce people to guess which scenario they found more

probable, and then to place their bets beforehand. Rather, my purpose

was exactly opposite: to prepare people for either scenario so that when

they recognized one or the other unfolding they wouldn’t do something

stupid in a moment of panic (or greed).Sadly, in our markets to “do something stupid in a moment of panic” generally means doing precisely the opposite of what one should be doing. This also explains why the bankers like to start panics. First of all, as the cause of these panics the banksters are neither “panicked” nor (obviously) surprised themselves. So they continue to operate calmly (in this feeding-frenzy) while the sheep make themselves especially easy to sheer.

Read More @ TF Metals Report.com

“The

UBS rogue trader story was a total fabrication, written and staged to

conceal the removal of all UBS gold from their reserves inventory.” - Jim Willie

by Jim Willie, GoldSeek.com:

What an incredibly complex confusing and treacherous month. It can be

safely said that 80% of the activity is almost totally kept from the

public. The financial system is breaking in an accelerated fashion.

Compare to some grisly horror movie where a man is strapped in a chair.

The more he moves, the tighter the bindings pull on his gasping throat

and pressed nether stones. The most significant two factors at work are

the Iran sanctions and their powerful backfire, and the futile efforts

in Europe to stem the banking center collapse. The anti-USDollar

federation that spans widely across the globe is gathering strong

momentum. Financial aggression is being met by financial alternative

development. As Greece moved off the daily news fabrication factory, the

reality of a collapse in Spain and Italy has moved to the front center

of observations. Meanwhile, the American nitwits continue to argue over

Quantitative Easing when it never stopped, and in fact, went global

under their noses. The US news machine, dominated by the syndicate,

churns out absurdities after more nonsensical bites on an economic

recovery. The subprime loan machinery has ramped up. The retail factor

does not tell of strength, but of weakness. Spending on consumption does

not indicate strength, but a path to ruin still not well recognized.

The gap between reality and reports is diverging.

What an incredibly complex confusing and treacherous month. It can be

safely said that 80% of the activity is almost totally kept from the

public. The financial system is breaking in an accelerated fashion.

Compare to some grisly horror movie where a man is strapped in a chair.

The more he moves, the tighter the bindings pull on his gasping throat

and pressed nether stones. The most significant two factors at work are

the Iran sanctions and their powerful backfire, and the futile efforts

in Europe to stem the banking center collapse. The anti-USDollar

federation that spans widely across the globe is gathering strong

momentum. Financial aggression is being met by financial alternative

development. As Greece moved off the daily news fabrication factory, the

reality of a collapse in Spain and Italy has moved to the front center

of observations. Meanwhile, the American nitwits continue to argue over

Quantitative Easing when it never stopped, and in fact, went global

under their noses. The US news machine, dominated by the syndicate,

churns out absurdities after more nonsensical bites on an economic

recovery. The subprime loan machinery has ramped up. The retail factor

does not tell of strength, but of weakness. Spending on consumption does

not indicate strength, but a path to ruin still not well recognized.

The gap between reality and reports is diverging.

Read More @ GoldSeek.com

by Jim Willie, GoldSeek.com:

What an incredibly complex confusing and treacherous month. It can be

safely said that 80% of the activity is almost totally kept from the

public. The financial system is breaking in an accelerated fashion.

Compare to some grisly horror movie where a man is strapped in a chair.

The more he moves, the tighter the bindings pull on his gasping throat

and pressed nether stones. The most significant two factors at work are

the Iran sanctions and their powerful backfire, and the futile efforts

in Europe to stem the banking center collapse. The anti-USDollar

federation that spans widely across the globe is gathering strong

momentum. Financial aggression is being met by financial alternative

development. As Greece moved off the daily news fabrication factory, the

reality of a collapse in Spain and Italy has moved to the front center

of observations. Meanwhile, the American nitwits continue to argue over

Quantitative Easing when it never stopped, and in fact, went global

under their noses. The US news machine, dominated by the syndicate,

churns out absurdities after more nonsensical bites on an economic

recovery. The subprime loan machinery has ramped up. The retail factor

does not tell of strength, but of weakness. Spending on consumption does

not indicate strength, but a path to ruin still not well recognized.

The gap between reality and reports is diverging.

What an incredibly complex confusing and treacherous month. It can be

safely said that 80% of the activity is almost totally kept from the

public. The financial system is breaking in an accelerated fashion.

Compare to some grisly horror movie where a man is strapped in a chair.

The more he moves, the tighter the bindings pull on his gasping throat

and pressed nether stones. The most significant two factors at work are

the Iran sanctions and their powerful backfire, and the futile efforts

in Europe to stem the banking center collapse. The anti-USDollar

federation that spans widely across the globe is gathering strong

momentum. Financial aggression is being met by financial alternative

development. As Greece moved off the daily news fabrication factory, the

reality of a collapse in Spain and Italy has moved to the front center

of observations. Meanwhile, the American nitwits continue to argue over

Quantitative Easing when it never stopped, and in fact, went global

under their noses. The US news machine, dominated by the syndicate,

churns out absurdities after more nonsensical bites on an economic

recovery. The subprime loan machinery has ramped up. The retail factor

does not tell of strength, but of weakness. Spending on consumption does

not indicate strength, but a path to ruin still not well recognized.

The gap between reality and reports is diverging. Read More @ GoldSeek.com

from Gold Seek Radio:

John

John

Embry & Chris Waltzek – April 11, 2012.

Powered by Podbean.com

Embry & Chris Waltzek – April 11, 2012.

Powered by Podbean.com

To download this show in Mp3 format: click here.

by James E. Miller, Mises.ca:

“Thus

one government intervention begets a further government intervention.

Because government has failed in its primary task…politicians ask, in

effect, for price and wage fixing; and we are driven toward totalitarian

control.”

“Thus

one government intervention begets a further government intervention.

Because government has failed in its primary task…politicians ask, in

effect, for price and wage fixing; and we are driven toward totalitarian

control.”

- Henry Hazlitt “What You Should Know About Inflation“

Though commenting on the state’s backing of union thuggery, Hazlitt pinpoints one of the essential rules of conduct for public officials. That is, intervene in private life to appease one wealthy interest group to then create the groundwork for further power grabs with the inevitable disaster which emerges. Thankfully, blatant usurpation of authority by lawmakers is still frowned upon by many taxpayers. That’s why, less a case of opportunistic disaster (“you never let a serious crisis go to waste” as lifelong parasite and former ballerina Rahm Emanuel put it), authoritarianism is achieved in small doses.

Read More @ Mises.ca

I'm PayPal Verified

“Thus

one government intervention begets a further government intervention.

Because government has failed in its primary task…politicians ask, in

effect, for price and wage fixing; and we are driven toward totalitarian

control.”

“Thus

one government intervention begets a further government intervention.

Because government has failed in its primary task…politicians ask, in

effect, for price and wage fixing; and we are driven toward totalitarian

control.”- Henry Hazlitt “What You Should Know About Inflation“

Though commenting on the state’s backing of union thuggery, Hazlitt pinpoints one of the essential rules of conduct for public officials. That is, intervene in private life to appease one wealthy interest group to then create the groundwork for further power grabs with the inevitable disaster which emerges. Thankfully, blatant usurpation of authority by lawmakers is still frowned upon by many taxpayers. That’s why, less a case of opportunistic disaster (“you never let a serious crisis go to waste” as lifelong parasite and former ballerina Rahm Emanuel put it), authoritarianism is achieved in small doses.

Read More @ Mises.ca

Total donations so far this year... $10.00 Thank You James H.

Please consider making a small donation, to help cover some of the labor and costs to run this blog.

Thank You

I'm PayPal Verified

by William K Black, PHD, Financial Sense:

“Pink slime” just had its fifteen minutes of fame. BPI, the producer of

pink slime, calls it “Lean Finely Textured Beef.” BPI’s slogan is

“expect a higher standard.” Pink slime starts with fatty tissues that

are inherently more likely to be repositories of salmonella and e coli

infections. The tissues are shredded and rendered and most of the fat

drained off. The pink slime, however, is still more likely to be

infected after this processing and that makes it dangerous and can make

it smell spoiled. BPI’s “innovation” was to gas the pink slime in Mr.

Clean (ammonia) to try to kill bacteria and reduce the stink. The

resultant pink slime is then frozen into bricks and shipped in bulk.

“Pink slime” just had its fifteen minutes of fame. BPI, the producer of

pink slime, calls it “Lean Finely Textured Beef.” BPI’s slogan is

“expect a higher standard.” Pink slime starts with fatty tissues that

are inherently more likely to be repositories of salmonella and e coli

infections. The tissues are shredded and rendered and most of the fat

drained off. The pink slime, however, is still more likely to be

infected after this processing and that makes it dangerous and can make

it smell spoiled. BPI’s “innovation” was to gas the pink slime in Mr.

Clean (ammonia) to try to kill bacteria and reduce the stink. The

resultant pink slime is then frozen into bricks and shipped in bulk.

Pink slime was originally limited to dog food, but it has secretly been fed to Americans for a decade. Major hamburger chains, grocery stores, and school lunch programs added it to make up 15% of our burgers. The government didn’t require disclosure of pink slime or ammonia. Tests have established that pink slime remains more likely to harbor dangerous bacteria and that the only way to reduce that problem is to add so much Mr. Clean that the pink slime stinks and tastes awful.

Read More @ Financial Sense.com

“Pink slime” just had its fifteen minutes of fame. BPI, the producer of

pink slime, calls it “Lean Finely Textured Beef.” BPI’s slogan is

“expect a higher standard.” Pink slime starts with fatty tissues that

are inherently more likely to be repositories of salmonella and e coli

infections. The tissues are shredded and rendered and most of the fat

drained off. The pink slime, however, is still more likely to be

infected after this processing and that makes it dangerous and can make

it smell spoiled. BPI’s “innovation” was to gas the pink slime in Mr.

Clean (ammonia) to try to kill bacteria and reduce the stink. The

resultant pink slime is then frozen into bricks and shipped in bulk.

“Pink slime” just had its fifteen minutes of fame. BPI, the producer of

pink slime, calls it “Lean Finely Textured Beef.” BPI’s slogan is

“expect a higher standard.” Pink slime starts with fatty tissues that

are inherently more likely to be repositories of salmonella and e coli

infections. The tissues are shredded and rendered and most of the fat

drained off. The pink slime, however, is still more likely to be

infected after this processing and that makes it dangerous and can make

it smell spoiled. BPI’s “innovation” was to gas the pink slime in Mr.

Clean (ammonia) to try to kill bacteria and reduce the stink. The

resultant pink slime is then frozen into bricks and shipped in bulk.Pink slime was originally limited to dog food, but it has secretly been fed to Americans for a decade. Major hamburger chains, grocery stores, and school lunch programs added it to make up 15% of our burgers. The government didn’t require disclosure of pink slime or ammonia. Tests have established that pink slime remains more likely to harbor dangerous bacteria and that the only way to reduce that problem is to add so much Mr. Clean that the pink slime stinks and tastes awful.

Read More @ Financial Sense.com

Idols Of The Unaware

from Truth in Gold:

Gold Is Scarce: “Safe Asset” And “Rising Demand for Safe Assets”…”In the future there will be rising demand for safe assets, but fewer of them will be available, increasing the price for safety in global markets.” -IMF

Well, there ya go. In fact, that quote ties into the subject of my

title, but first I wanted to comment on potential for the bottom of this

vicious precious metals correction that began in late April last year.

The sentiment indicators are at rock bottom. I can say from some of

the comments that have been posted on my blog over the past few weeks

that even some pretty long time gold bulls have thrown in the towel on

the mining stocks. Usually this type of sentiment marks the bottom of

the next big move higher.

Well, there ya go. In fact, that quote ties into the subject of my

title, but first I wanted to comment on potential for the bottom of this

vicious precious metals correction that began in late April last year.

The sentiment indicators are at rock bottom. I can say from some of

the comments that have been posted on my blog over the past few weeks

that even some pretty long time gold bulls have thrown in the towel on

the mining stocks. Usually this type of sentiment marks the bottom of

the next big move higher.

Also, Dennis Gartman, who happens to be singularly one of the best contrarian indicators of the gold market – and this fact has been close 100% consistent over the last seven years that I’ve been aware of Gartman mentioning gold in his newsletter – declared the end of the gold bull market about a week ago. Gold is up 5% since he advised his readers to dump gold.

Read More @ Truthingold.blogspot.com

Gold Is Scarce: “Safe Asset” And “Rising Demand for Safe Assets”…”In the future there will be rising demand for safe assets, but fewer of them will be available, increasing the price for safety in global markets.” -IMF

Well, there ya go. In fact, that quote ties into the subject of my

title, but first I wanted to comment on potential for the bottom of this

vicious precious metals correction that began in late April last year.

The sentiment indicators are at rock bottom. I can say from some of

the comments that have been posted on my blog over the past few weeks

that even some pretty long time gold bulls have thrown in the towel on

the mining stocks. Usually this type of sentiment marks the bottom of

the next big move higher.

Well, there ya go. In fact, that quote ties into the subject of my

title, but first I wanted to comment on potential for the bottom of this

vicious precious metals correction that began in late April last year.

The sentiment indicators are at rock bottom. I can say from some of

the comments that have been posted on my blog over the past few weeks

that even some pretty long time gold bulls have thrown in the towel on

the mining stocks. Usually this type of sentiment marks the bottom of

the next big move higher. Also, Dennis Gartman, who happens to be singularly one of the best contrarian indicators of the gold market – and this fact has been close 100% consistent over the last seven years that I’ve been aware of Gartman mentioning gold in his newsletter – declared the end of the gold bull market about a week ago. Gold is up 5% since he advised his readers to dump gold.

Read More @ Truthingold.blogspot.com

from Washington Post:

The U.S. budget deficit is running slightly lower than last year’s

through the first six months of the budget year but is still on track to

top $1 trillion for a fourth straight year.

The U.S. budget deficit is running slightly lower than last year’s

through the first six months of the budget year but is still on track to

top $1 trillion for a fourth straight year.

The Treasury Department said Wednesday that the deficit in March totaled $198.2 billion, a record for that month. That left the gap through the first half of 2012 at $779 billion, down 6.1 percent from a year ago.

The Congressional Budget Office forecasts a deficit of $1.17 trillion for the entire 2012 budget year, which began Oct. 1. This would be a small improvement from last year’s $1.3 trillion deficit. Still, the chronic budget deficits are likely to be a top issue in the presidential election.

Read More @ WashingtonsPost.com

Click here to visit Trader Dan Norcini’s website

Dear CIGAs,

Years ago there was a men’s hair care product (okay – let’s call it what it really was and do away with the euphemisms – GREASE) by the name of Brylcreem. Boys and men slathered this stuff between the palms of their hands and then rubbed it into their hair. The result was that you could make that hair so stiff it would stay there all day no matter rain, fog, or gloom of night. Problem hair? No problem! Grease it into obedience!

In watching the price action in the S&P 500 this morning I am reminded of that commercial (Yeah I know – my brain thinks in weird terms!). The index had the audacity to become like a problem hair – uncooperative, unruly and generally out of place in the minds of the monetary authorities idea of what is supposed to be a beautiful head of hair.

So what to do about this? Why send the boyz out to the microphone and "grease" this thing back into compliance.

Note the price chart and you will see what I am talking about. For the first time this year the S&P had fallen BELOW the techically significant 50 day moving average. That is a gigantic "NO-NO", as it signifies a market moving toward a bearish posture.

Why, miracle of miracles, out trots New York Fed President Dudley with his comments fanning the hopes of those wishing for more QE, and "Voila!", back goes the S&P 500 through the 50 day moving average! Problem solved; hair greased back into place; now let’s go play Dodge Ball!

More…

Fathom the hypocrisy of a government that will require every citizen to prove they are insured…but not everyone must prove they are a citizen. – Author Unknown

My Dear Friends,

Jim Sinclair’s Commentary

The world becomes safer?

North Korea fires long-range rocket By JEAN H. LEE, Associated Press – 27 minutes ago

PYONGYANG, North Korea (AP) — North Korea’s much-anticipated rocket launch ended quickly in failure early Friday, splintering into pieces over the Yellow Sea soon after takeoff, according to South Korean and U.S. officials.

There was silence on the launch from officials in Pyongyang, which proceeded despite protests from the U.S., South Korea and other countries that called the launch a cover for a test of missile technology. North Korea said the rocket was part of a peaceful effort to send a satellite into space to the commemorate the anniversary of its founder’s birth.

In response to the launch, Washington announced it was suspending plans to contribute food aid to the North in exchange for a rollback of its nuclear programs.

The rocket exploded in midair one or two minutes after launching from the west coast launch pad in the hamlet of Tongchang-ri, said Maj. Gen. Shin Won-sik, a South Korean Defense Ministry official.

The U.S. North American Aerospace Defense Command said officials detected and tracked the launch of the rocket — which it called a missile — over the Yellow Sea; the first stage fell into the sea 165 kilometers (100 miles) west of Seoul, while stages two and three failed.

More…

Jim Sinclair’s Commentary

This is a trader’s outing from the gold banks. Go on guys, go for it!

Jim Sinclair’s Commentary

Jim Sinclair’s Commentary

Sony sheds 10,000 staff in major reorganization 12 April 2012 Last updated at 04:22 ET

Electronics firm Sony is to shed 10,000 jobs as part of a major reorganisation, chief executive Kazuo Hirai has said.

The cuts, which represent 6% of the global workforce, will be made over the next 12 months.

The reduction includes staff working in businesses that are being sold, such as its chemicals division.

Sony has been struggling to compete in the television business with South Korea’s Samsung and LG, while Apple has challenged it in audio gear and phones.

On Tuesday, Sony forecast a record annual loss of $6.4bn (£4bn), double its previous estimate. Its share price has fallen 40% over the past 12 months.

Entrepreneurial spirit

Sony says it will focus its business on three areas – digital imaging, games consoles and mobile devices.

More…

Jim Sinclair’s Commentary

Jim Sinclair’s Commentary

System to promote yuan use globally Updated: 2012-04-12 09:08

By Wang XiaoTian in Beijing, Diao Ying in London and Oswald Chen in Hong Kong (China Daily)

New trading platform expected to enhance cross-border settlements

A system to settle cross-border yuan payments and boost the convertibility of the currency will be set up, central bank officials said on Wednesday.

The move will promote the international use of the yuan, analysts said.

The China International Payment System will be established in one or two years. It will make yuan clearance safer and more efficient for cross-border trade and investment settled in the currency, said Li Bo, head of the central bank’s second monetary policy department, at a news briefing in Beijing.

The system will help gradually make the currency convertible and will facilitate wider use of the yuan in cross-border settlements, Li said.

Currently cross-border yuan clearance is conducted through the Hong Kong and Macao branches of Bank of China, or agency banks of overseas participants.

While demand for cross-border renminbi settlement is increasing, transaction costs in the current payment system are higher than those conducted in other major currencies, such as the US dollar, analysts said.

"The new system will link domestic and overseas participants directly, and support different languages including Chinese and English. What’s more, the working hours will be extended to 17 or 18 from the current eight to nine hours to cover yuan settlement demand from different time zones," said Li Yue, director of the payment and settlement department at the People’s Bank of China.

More…

Jim Sinclair’s Commentary

Iran imposes oil "counter-sanctions" on EU: TV By Marcus George

DUBAI | Tue Apr 10, 2012 6:12pm EDT

(Reuters) – Iran has cut oil exports to Spain and may halt sales to Germany and Italy, Iran’s English-language state television reported on Tuesday, in an apparent move to strengthen its position ahead of crucial talks with world powers later this week.

But, in an indication that Tehran’s "counter-sanctions" were of little impact, Spain’s biggest refiner said it had already replaced Iranian crude with Saudi Arabian oil months ago.

Iran has played a tit-for-tat game over crude shipments since the European Union decided in January to stop all Iranian oil imports as of July, part of a range of tough new sanctions aimed at forcing Tehran to curb the atomic work that the West suspects is part of a nuclear weapons program.

Talks between Tehran and six world powers aimed at easing the nuclear stand-off are set to resume in Istanbul on Saturday, and could pave the way for an easing of sanctions and might lift the threat of Israeli air strikes on Iran.

EU states have sought alternative oil supplies ahead of July’s deadline, with Iran threatening to cut exports first, something Iran’s Press TV said was well under way.

"Tehran has cut oil supply to Spain after stopping crude export to Greece as part of its counter-sanctions," Press TV said, citing unidentified sources, adding that a similar move was being considered for Germany and Italy.

More…

Alabama county could hike rates to pay sewer debt: receiver CIGA Eric

States lacking the power of the printing press either raise taxes or default. Municipalities trying to stave off poor decision-making during expansion often try to pass tax increases into the teeth of a contraction. That is, until an angry crowd marches to the steps of the capital with pitchforks, drums, and signs suggesting something along the lines of ‘Up Yours!’

Headline: Alabama county could hike rates to pay sewer debt: receiver

BIRMINGHAM, Alabama – Politically unpopular rate hikes could cover the debt service on the $3.14 billion of sewer-system debt that drove Alabama’s Jefferson County last year to file the biggest municipal bankruptcy in U.S. history, the system’s receiver said on Wednesday. John Young, the receiver who was stripped of his executive authority in January by a bankruptcy judge, testified during a court hearing in Birmingham that rates paid by the county sewer system’s customers were below the U.S. average. "Over time, you could certainly service the debt with rate increases," Young said, adding in response to a lawyer’s question that "it happens everywhere every day, and it will happen here. This is happening all over the country, and rates have always been raised to cover debt service."

Source: cnbc.com

More…

Jobless claims cast cloud on labor market CIGA Eric

The labor market will become increasingly cloudy as the economic cycles kick-in. The Fed despite the pomp and circumstance surrounding it is just another market follower. Market forces are pushing QE to infinity regardless of public acceptance or recognition.

Chart: Average Weekly Initial Claims State Unemployment (AWIC) And YOY Change

Headline: Jobless claims cast cloud on labor market

WASHINGTON (Reuters) – The number of Americans filing for jobless aid rose last week to the highest level since January, a development that could raise fears the labor market recovery was stalling after job creation slowed in March. Initial claims for state unemployment benefits increased 13,000 to a seasonally adjusted 380,000, the Labor Department said on Thursday, defying economists’ expectations for a drop to 355,000. The four-week moving average for new claims, considered a better measure of labor market trends, rose 4,250 to 368,500. Some economists blamed the Easter holidays for the spike in claims and expected applications to trend lower in coming weeks. "It’s very difficult to know the extent to which that’s driven by seasonal effects from Easter or not," said Eric Green, chief economist at TD Securities in New York. "This is not a game changer, this does not confirm the weakness in the report we saw last Friday. We suspect that much of the increase was due to seasonal issues and we would therefore expect it to drift lower." The claims data comes in the wake of Friday’s disappointing employment report for March, which showed the economy created 120,000 new jobs, the smallest amount since October. Despite the rise in claims last week, both first-time applications for unemployment aid and the four-week average held below the 400,000 mark, implying steady job gains.

More…

Jim Sinclair’s Commentary

Jim,

This came today from our largest vendor.

CIGA Marc

There are a few prices increases and announcements you need to know about so I thought I would give you a heads up.

USG Sheetrock mud is going up February 27th by 9% across the board. We will raise our stock pricing on March 1st.

USG ceiling metal tile grid is going up 6% on February 27th. We will raise our stock pricing on March 1st.

USG ceiling tile is going up 5% January 30th. We will hold pricing till after the show. We will raise our stock pricing on March 1st.

Poly construction film is going up this week from 5% to 9% this week from various manufactures. We will hold timesaver pricing but show pricing might be higher.

Generac is going up 2% March 1st due to new EPA requirements. In fact look for all small engine equipment to go up because of EPA design changes

I saw the first price increase on nails announced from a supplier go out this week for a 9% increase on February 1st. Imports are going up slowly but steel is expected to go up in price by March or April.

Columbia Doors has closed their operation and gone out of business. We purchased their inventory so we have what we believe will be about a 6 month supply. We are looking and talking with manufactures for a competitive replacement. Metal security doors seem to be a problem asColumbia had the best price in the country. We’ll find a replacement but look for them to be higher in cost.

Quikrete has announced a 3% across the board increase February 1st. They are holding our warehouse pricing tillMarch 15th. Buy your drop ships at the show and save big money

Greenfiber Cellulose Insulation gave us an immediate increase this month of 22%. The timesaver price is based on the old price and when it’s gone it’s gone. The reason given was raw materials and transportation cost had become too much to absorb. This is the first increase in 3 years

We had added Lomanco ventilation products in both Inwood and Hurricane so now Lomanco is available company wide. Lomanco has severed their relationship with Prime Source as of January 1, 2012. This is a very good opportunity to go after that business in all areas especially the Northeast.

Jim

Coeure Suggests ECB Could Restart Bond Purchases for Spain?! They never stopped!

Best regards,

CIGA Christopher

Dear Christopher,

Coeure Suggests ECB Could Restart Bond Purchases for Spain By Mark Deen and Jana Randow on April 11, 2012

European Central Bank Executive Board member Benoit Coeure suggested that the bank could revive its bond-purchase program to reduce Spain’s borrowing costs.

“Market conditions are not justified,” Coeure said at an event in Paris today. “Will the ECB intervene? We have an instrument, the securities markets program, which hasn’t been used recently but it still exists.”

Prime Minister Mariano Rajoy’s three-month-old government is struggling to convince investors it can reduce the budget deficit and crack down on overspending by regional administrations. Spain’s 10-year borrowing costs have jumped more than 1 percentage point since March 2, when Rajoy said the country will miss a 2012 deficit goal approved by the European Union.

“We have a new government in Spain that has taken very strong deficit measures,” said Coeure, who joined the ECB board at the start of the year and heads the bank’s market operations division. “All this takes time. The political will is enormous.”

The euro gained more than a quarter of a cent after the remarks and traded at $1.3143 at 1 p.m. in Frankfurt. The yield on Spanish 10-year bonds, which climbed to 5.99 percent this morning, slid to 5.87 percent. European stocks rose, with the Stoxx Europe 600 Index (SXXP) up 1 percent.

More…

The Sky Is Falling Indicator

CIGA Eric

MOVB(E) is a proprietary, bounded momentum indicator adjusted by volatility. A weekly reading of -75.71% was generated on the Amex’s gold and silver mining index (XAU) on October 24th 2008 at the height of investor panic. Today’s weekly reading of -62.71 represents the sixth clustered reading below -60% since 2001. That’s roughly one buy signal every two years. Rare indeed. Please keep that in mind when the media’s version of chicken little screams the sky is falling.

Chart: Amex Gold and Silver Mining Index (XAU)

More…

Creative Economic Perspective Elicits Market Responses CIGA Eric

The invisible hand is very good at using creative economic perspective (misdirection, misinformation, etc) to elicit market responses. Market responses such as covering paper shorts into price weakness in the gold market.

The only way to challenge economic perspective is to attack it head on. Could the economic recovery have been considered strong before Friday’s employment data? The following chart compares job creation during comparable liquidity periods of 2010-2012 and 2004-2006 (see chart). The chart clearly shows that job creation from January to April of 2010, 2011, 2012 has significantly lagged that of 2004, 2005, and 2006. For instance, April’s labor report needs to show an increases of 428 thousand jobs (635 thousand + 428 thousand) to equal the 1.063 million jobs created by April 2006. The phrase, I doubt it, quickly comes to mind.

While this data manipulation may be a complicated why of making comparisons, it offers the ability to challenge creative perspective and recognize market operations.

Chart: Birth/Death Model (BDM) Contribution to Nonfarm Net Payrolls (NFP) Added/(Lost)

Headline: Weak U.S. jobs data renew QE bets

NEW YORK (Reuters) – Disappointing U.S. job growth reported last Friday favored safe-haven assets and supported short-term rates futures contracts on Monday as another round of large-scale bond purchases to support the U.S. economy looked more likely. On Friday, government data showed U.S. payrolls grew by 120,000 jobs last month, fewer than the 203,000 new jobs predicted by economists. The jobless rate fell to a three-year low of 8.2 percent, largely because discouraged workers stopped looking for jobs. The sluggish pace of job creation since the end of the worst recession in 70 years has remained a top concern for the Fed and has fueled speculation whether the U.S. central bank would undertake a third round of quantitative easing, nicknamed QE3, to prevent the economic recovery from fading. The Dec 2014 Eurodollar contract traded unchanged at 98.835. On Friday it recorded its biggest one-day rise since Jan 25 when it rose 17.5 basis points. This implied traders see the unsecured funding cost for three-month dollars for banks and Wall Street at the end of 2014 at 1.165 percent. The U.S. Treasury sold $31 billion three-month bills at a high rate of 0.085 percent, awarding 51.12 percent of the bids at the high.

Source: news.yahoo.com

More…

My Dear Extended Family,

The U.S. budget deficit is running slightly lower than last year’s

through the first six months of the budget year but is still on track to

top $1 trillion for a fourth straight year.

The U.S. budget deficit is running slightly lower than last year’s

through the first six months of the budget year but is still on track to

top $1 trillion for a fourth straight year.The Treasury Department said Wednesday that the deficit in March totaled $198.2 billion, a record for that month. That left the gap through the first half of 2012 at $779 billion, down 6.1 percent from a year ago.

The Congressional Budget Office forecasts a deficit of $1.17 trillion for the entire 2012 budget year, which began Oct. 1. This would be a small improvement from last year’s $1.3 trillion deficit. Still, the chronic budget deficits are likely to be a top issue in the presidential election.

Read More @ WashingtonsPost.com

Click here to visit Trader Dan Norcini’s website

Dear CIGAs,

Years ago there was a men’s hair care product (okay – let’s call it what it really was and do away with the euphemisms – GREASE) by the name of Brylcreem. Boys and men slathered this stuff between the palms of their hands and then rubbed it into their hair. The result was that you could make that hair so stiff it would stay there all day no matter rain, fog, or gloom of night. Problem hair? No problem! Grease it into obedience!

In watching the price action in the S&P 500 this morning I am reminded of that commercial (Yeah I know – my brain thinks in weird terms!). The index had the audacity to become like a problem hair – uncooperative, unruly and generally out of place in the minds of the monetary authorities idea of what is supposed to be a beautiful head of hair.

So what to do about this? Why send the boyz out to the microphone and "grease" this thing back into compliance.

Note the price chart and you will see what I am talking about. For the first time this year the S&P had fallen BELOW the techically significant 50 day moving average. That is a gigantic "NO-NO", as it signifies a market moving toward a bearish posture.

Why, miracle of miracles, out trots New York Fed President Dudley with his comments fanning the hopes of those wishing for more QE, and "Voila!", back goes the S&P 500 through the 50 day moving average! Problem solved; hair greased back into place; now let’s go play Dodge Ball!

More…

Fathom the hypocrisy of a government that will require every citizen to prove they are insured…but not everyone must prove they are a citizen. – Author Unknown

My Dear Friends,

Eric King of www.KingWorldNews.com was kind enough to interview me today. I feel the items we discussed are worth your time to listening to.

The hyperlink will be posted here tonight was well as emailed to you

if you have signed up for our free email service. If you have not signed

up please do by typing in your email address at the top of the page.

Our email list is purely informational with NO ADVERTISING whatsoever.

We also do not sell our list to anyone and you can instantly unsubscribe

at any time.

In other news, do not let today’s trade deficit figures bother you.

The last 9 times there was a drop in imports like which has occurred

this month, it resulted in an impending or in place recession.

The trade report fits our parameters for QE to infinity.

Regards,

Jim

Jim

Jim Sinclair’s Commentary

The world becomes safer?

North Korea fires long-range rocket By JEAN H. LEE, Associated Press – 27 minutes ago

PYONGYANG, North Korea (AP) — North Korea’s much-anticipated rocket launch ended quickly in failure early Friday, splintering into pieces over the Yellow Sea soon after takeoff, according to South Korean and U.S. officials.

There was silence on the launch from officials in Pyongyang, which proceeded despite protests from the U.S., South Korea and other countries that called the launch a cover for a test of missile technology. North Korea said the rocket was part of a peaceful effort to send a satellite into space to the commemorate the anniversary of its founder’s birth.

In response to the launch, Washington announced it was suspending plans to contribute food aid to the North in exchange for a rollback of its nuclear programs.

The rocket exploded in midair one or two minutes after launching from the west coast launch pad in the hamlet of Tongchang-ri, said Maj. Gen. Shin Won-sik, a South Korean Defense Ministry official.

The U.S. North American Aerospace Defense Command said officials detected and tracked the launch of the rocket — which it called a missile — over the Yellow Sea; the first stage fell into the sea 165 kilometers (100 miles) west of Seoul, while stages two and three failed.

More…

Jim Sinclair’s Commentary

This is a trader’s outing from the gold banks. Go on guys, go for it!

Jim Sinclair’s Commentary

A New wave of home foreclosure is in the pipeline as a result of the settlement that whitewashed robo-signing.

Foreclosures this year are estimated at no less than 1,000,000 versus

last year’s 800,000. Now that is one hell of a economic recovery.

Damn MOPE, MSM and their supporters.

Jim Sinclair’s Commentary

QE to infinity is as sure as death and taxes.

Sony sheds 10,000 staff in major reorganization 12 April 2012 Last updated at 04:22 ET

Electronics firm Sony is to shed 10,000 jobs as part of a major reorganisation, chief executive Kazuo Hirai has said.

The cuts, which represent 6% of the global workforce, will be made over the next 12 months.

The reduction includes staff working in businesses that are being sold, such as its chemicals division.

Sony has been struggling to compete in the television business with South Korea’s Samsung and LG, while Apple has challenged it in audio gear and phones.

On Tuesday, Sony forecast a record annual loss of $6.4bn (£4bn), double its previous estimate. Its share price has fallen 40% over the past 12 months.

Entrepreneurial spirit

Sony says it will focus its business on three areas – digital imaging, games consoles and mobile devices.

More…

Jim Sinclair’s Commentary

I asked what Ezra the mule thought about sterilized QE. He blew hot air with some very green snot.

Jim Sinclair’s Commentary

In 2012 you will see a large movement away from the US dollar as an

international contract settlement momentum that will be reflected by the

antiquated USDX index at .7200

System to promote yuan use globally Updated: 2012-04-12 09:08

By Wang XiaoTian in Beijing, Diao Ying in London and Oswald Chen in Hong Kong (China Daily)

New trading platform expected to enhance cross-border settlements

A system to settle cross-border yuan payments and boost the convertibility of the currency will be set up, central bank officials said on Wednesday.

The move will promote the international use of the yuan, analysts said.

The China International Payment System will be established in one or two years. It will make yuan clearance safer and more efficient for cross-border trade and investment settled in the currency, said Li Bo, head of the central bank’s second monetary policy department, at a news briefing in Beijing.

The system will help gradually make the currency convertible and will facilitate wider use of the yuan in cross-border settlements, Li said.

Currently cross-border yuan clearance is conducted through the Hong Kong and Macao branches of Bank of China, or agency banks of overseas participants.

While demand for cross-border renminbi settlement is increasing, transaction costs in the current payment system are higher than those conducted in other major currencies, such as the US dollar, analysts said.

"The new system will link domestic and overseas participants directly, and support different languages including Chinese and English. What’s more, the working hours will be extended to 17 or 18 from the current eight to nine hours to cover yuan settlement demand from different time zones," said Li Yue, director of the payment and settlement department at the People’s Bank of China.

More…

Jim Sinclair’s Commentary

You expected something other than this?

Iran imposes oil "counter-sanctions" on EU: TV By Marcus George

DUBAI | Tue Apr 10, 2012 6:12pm EDT

(Reuters) – Iran has cut oil exports to Spain and may halt sales to Germany and Italy, Iran’s English-language state television reported on Tuesday, in an apparent move to strengthen its position ahead of crucial talks with world powers later this week.

But, in an indication that Tehran’s "counter-sanctions" were of little impact, Spain’s biggest refiner said it had already replaced Iranian crude with Saudi Arabian oil months ago.

Iran has played a tit-for-tat game over crude shipments since the European Union decided in January to stop all Iranian oil imports as of July, part of a range of tough new sanctions aimed at forcing Tehran to curb the atomic work that the West suspects is part of a nuclear weapons program.

Talks between Tehran and six world powers aimed at easing the nuclear stand-off are set to resume in Istanbul on Saturday, and could pave the way for an easing of sanctions and might lift the threat of Israeli air strikes on Iran.

EU states have sought alternative oil supplies ahead of July’s deadline, with Iran threatening to cut exports first, something Iran’s Press TV said was well under way.

"Tehran has cut oil supply to Spain after stopping crude export to Greece as part of its counter-sanctions," Press TV said, citing unidentified sources, adding that a similar move was being considered for Germany and Italy.

More…

Alabama county could hike rates to pay sewer debt: receiver CIGA Eric

States lacking the power of the printing press either raise taxes or default. Municipalities trying to stave off poor decision-making during expansion often try to pass tax increases into the teeth of a contraction. That is, until an angry crowd marches to the steps of the capital with pitchforks, drums, and signs suggesting something along the lines of ‘Up Yours!’

Headline: Alabama county could hike rates to pay sewer debt: receiver