Austerity, Social Unrest, And Europe's 'Lose-Lose' Proposition

The link between government spending cuts and social unrest is highly non-linear and extremely troublesome. We first noted the must-read quantification of the relationship between so-called CHAOS of social unrest and spending cuts back in early January

and this brief lecture reiterates some of the frightening conclusions.

Critically, small spending cuts impact social unrest in very marginal

ways but once the cuts begin to rise to 2-3% of GDP then the probability of considerable and painful social unrest becomes much higher.

As Hans-Joachim Voth points out in this INET lecture, analogizing

between a burning cigarette as a catalyst for a forest fire in an arid

landscape, he suggests the rapid build up of combustible material caused

by austerity (youth unemployment in Spain perhaps?) could be inflamed

by a seemingly small catalyst that would otherwise be ignored in

general (a poor immigrant being shot or motorist murdered in a bad part

of town) when spending cuts are at the extremes we see across Europe

currently. The frightening reality of the non-economic, real social costs of the Troika's handiwork look set to be tested going forward

as the link between periods of very heavy unrest (clusters of rioting

for instance) and austerity is very strong. His findings on the post-chaos fiscal policies, (what does the government do once social unrest explodes) are perhaps more worrisome in that governments will immediately withdraw from austerity patterns which leads to some tough game-theoretical perspectives on the endgame in Europe in a 'lose-lose proposition' for austerity as the uncertainty shock of these events cause dramatic drops in Industrial Production.

The link between government spending cuts and social unrest is highly non-linear and extremely troublesome. We first noted the must-read quantification of the relationship between so-called CHAOS of social unrest and spending cuts back in early January

and this brief lecture reiterates some of the frightening conclusions.

Critically, small spending cuts impact social unrest in very marginal

ways but once the cuts begin to rise to 2-3% of GDP then the probability of considerable and painful social unrest becomes much higher.

As Hans-Joachim Voth points out in this INET lecture, analogizing

between a burning cigarette as a catalyst for a forest fire in an arid

landscape, he suggests the rapid build up of combustible material caused

by austerity (youth unemployment in Spain perhaps?) could be inflamed

by a seemingly small catalyst that would otherwise be ignored in

general (a poor immigrant being shot or motorist murdered in a bad part

of town) when spending cuts are at the extremes we see across Europe

currently. The frightening reality of the non-economic, real social costs of the Troika's handiwork look set to be tested going forward

as the link between periods of very heavy unrest (clusters of rioting

for instance) and austerity is very strong. His findings on the post-chaos fiscal policies, (what does the government do once social unrest explodes) are perhaps more worrisome in that governments will immediately withdraw from austerity patterns which leads to some tough game-theoretical perspectives on the endgame in Europe in a 'lose-lose proposition' for austerity as the uncertainty shock of these events cause dramatic drops in Industrial Production.More "Change You Can Believe In"...

Americans Can't Wait For Their Tax Refunds... To Immediately File For Bankruptcy

In yet another sad reflection on the state of the Schrodinger-economy, USA Today notes that over 200,000 households will use their tax rebate this year to pay for (drum roll please) a bankruptcy filing and associated legal fees.

The NBER research confirms a little known fact (outside of bankruptcy

lawyer circles) that 'at the first part of the year, when Americans

receive their tax refunds, there almost always is a spike in personal

bankruptcy filings.' but this has been especially true since the cost

of bankruptcy soared (from $921 in 2005 to $1477 two years later

according to the US GAO) after law changes in 2005. The bulk of the

fees go to the lawyers of course but the fact that the law was changed

to prevent bankruotcy abuse as it was thought too many people who could

afford to pay their debts were taking advantage of the system. The

sadder truth, according to the USA Today article, is that the drop in bankruptcy filings doesn't necessarily mean that the change has curtailed abuse of the system. "It just means that financially distressed people are not necessarily getting the help they need,"

Last year's average tax refund was $2913 - enough for many Americans

to file for bankruptcy. So we wonder what impact this will have on

AAPL's earnings as bankruptcy fees outweigh iPad purchases from this

year's rebates. Brilliant!

In yet another sad reflection on the state of the Schrodinger-economy, USA Today notes that over 200,000 households will use their tax rebate this year to pay for (drum roll please) a bankruptcy filing and associated legal fees.

The NBER research confirms a little known fact (outside of bankruptcy

lawyer circles) that 'at the first part of the year, when Americans

receive their tax refunds, there almost always is a spike in personal

bankruptcy filings.' but this has been especially true since the cost

of bankruptcy soared (from $921 in 2005 to $1477 two years later

according to the US GAO) after law changes in 2005. The bulk of the

fees go to the lawyers of course but the fact that the law was changed

to prevent bankruotcy abuse as it was thought too many people who could

afford to pay their debts were taking advantage of the system. The

sadder truth, according to the USA Today article, is that the drop in bankruptcy filings doesn't necessarily mean that the change has curtailed abuse of the system. "It just means that financially distressed people are not necessarily getting the help they need,"

Last year's average tax refund was $2913 - enough for many Americans

to file for bankruptcy. So we wonder what impact this will have on

AAPL's earnings as bankruptcy fees outweigh iPad purchases from this

year's rebates. Brilliant!Total donations so far this year... $10.00 Thank You James H.

Please consider making a small donation, to help cover some of the labor and costs to run this blog.

Thank You

I'm PayPal VerifiedAlgorithms Gone Wild - AGAIN, and AGAIN, and AGAIN

What more is left to say at this point other than the fact that the hedge

fund computers and their damnable algorithms have destroyed the integrity

of the US futures markets. The sheer size, extent, ferocity and volatility

of the moves that these pestilential computers are creating have rendered

these markets basically useless for what they originally came into being

for, namely, risk management for commercial entities.

Price swings of this magnitude are blowing up hedged positions put on by

commercials and other end users/merchants/processors, etc. While margins

are reduced for leg... more »

JP Morgan To World: Heads We Win, Tails You Lose

*Once you start quantitative easing, such as we have, $17 trillion, how in

the world do you pull back from it? How do you stop without having

everything collapse behind you? Truth be known, Bernanke didn’t have a

choice. If Bernanke did not do QE, this place would look like the day after

(the movie) ‘Mad Max.’ - *Jim Sinclair, link below

Happy Friday everyone! I only wanted to link the Sinclair interview on

King World News but I decided it was important to blog about what JP Morgan

is doing.

To begin with, they reported earnings today and all the media fell in love

JPM's report... more »

Egan Jones Downgrades JPMorgan

The iconoclastic rating agency, and fully recognized NRSRO to the dismay of some tabloids, which just refuses to play by the status quo rules, and which downgraded the US for the second time last Friday, to be followed soon by other rating agencies as soon as US debt crosses the $16.4 trillion threshold in a few short months, has just done the even more unthinkable and downgraded Fed boss JPMorgan from AA- to A+.No Hints Of QE In Latest Bernanke Word Cloud

Addressing his perception of lessons learned from the financial crisis, Ben Bernanke is speaking this afternoon

on poor risk management and shadow banking vulnerabilities - all of

which remain obviously as we continue to draw attention to. However,

more worrisome for the junkies is the total lack of QE3 chatter in his speech. While he does note the words 'collateral' and 'repo' the proximity of the words 'Shadow, Institutions, & Vulnerabilities' are awkwardly close.

Addressing his perception of lessons learned from the financial crisis, Ben Bernanke is speaking this afternoon

on poor risk management and shadow banking vulnerabilities - all of

which remain obviously as we continue to draw attention to. However,

more worrisome for the junkies is the total lack of QE3 chatter in his speech. While he does note the words 'collateral' and 'repo' the proximity of the words 'Shadow, Institutions, & Vulnerabilities' are awkwardly close.Deja 2011 All Over Again

From the first day of 2012 we predicted, and have done so until we were blue in the face, that 2012 would be a carbon copy of 2011... and thus 2010. Unfortunately when setting the screenplay, the central planners of the world really don't have that much imagination and recycling scripts is the best they can do. And while this forecast will not be glaringly obvious until the debt ceiling fiasco is repeated at almost the same time in 2012 as it was in 2011, we are happy that more and more people are starting to, as quite often happens, see things our way. We present David Rosenberg who summarizes why 2012 is Deja 2011 all over again.Summarizing The Event Risk Horizon

Whether its rating downgrades (which are much more critical than one would imagine given haircuts and collateral shortages), anxiety-inducing elections that could bring tensions in the 'party' that is Europe's political union, or referenda,

the next few months have more than their fair share of event risk to

navigate. Starting with Italian (and then Spanish banks) next week, it

seems the market is starting to sense the squeeze that events could

cause.

Whether its rating downgrades (which are much more critical than one would imagine given haircuts and collateral shortages), anxiety-inducing elections that could bring tensions in the 'party' that is Europe's political union, or referenda,

the next few months have more than their fair share of event risk to

navigate. Starting with Italian (and then Spanish banks) next week, it

seems the market is starting to sense the squeeze that events could

cause.Europe Slumps With Spain At March 2009 Lows

It appears the chaotic

volatility of last Summer is rearing its ugly head once again as

credit and equity markets in Europe flip-flop from best performance in

months to worst performance day after day. With Spain

front-and-center as pivot security (as we have been aggressively noting

for weeks), sovereigns and financials are lagging dreadfully once

again. The Bloomberg 500 (Europe's S&P 500 equivalent) back near mid January lows,

having swung from unchanged to pre-NFP levels back to worst of the

week at today's close, European banks are leading the charge lower as

the simple fact that liquidity can't fix insolvency is rwit large in

bank spreads and stocks. Treasuries have benefited, even as Bunds saw

huge flows, outperforming Bunds by 18bps since pre-NFP but it is Portugal +33bps, Spain +22bps, and Italy +9bps

from then that is most worrisome. LTRO Stigma remains at its 4 month

wides but financials broadly are under pressure as many head back

towards pre-LTRO record wides. Europe's VIX is back up near recent highs

around 30%. With too-big-to-save Spain seeing record wide CDS and even

the manipulated bond market unable to hold up under the real-money

selling pressure, the ECB's dry powder in SMP looks de minimus with only

unbridled QE (since banks have no more collateral to lend) and the ECB

taking the entire Spanish debt stock on its books as a solution,

access to capital markets is about to case for Spain (outside of

central-bank-inspired reacharounds) and as we noted earlier - every

time the ECB executes its SMP it increases the credit risk for

existing sovereign bondholders (and implicitly all the Spanish banks). Spain's equity market is a mere 5% above its March 2009 lows (55% off its highs).

It appears the chaotic

volatility of last Summer is rearing its ugly head once again as

credit and equity markets in Europe flip-flop from best performance in

months to worst performance day after day. With Spain

front-and-center as pivot security (as we have been aggressively noting

for weeks), sovereigns and financials are lagging dreadfully once

again. The Bloomberg 500 (Europe's S&P 500 equivalent) back near mid January lows,

having swung from unchanged to pre-NFP levels back to worst of the

week at today's close, European banks are leading the charge lower as

the simple fact that liquidity can't fix insolvency is rwit large in

bank spreads and stocks. Treasuries have benefited, even as Bunds saw

huge flows, outperforming Bunds by 18bps since pre-NFP but it is Portugal +33bps, Spain +22bps, and Italy +9bps

from then that is most worrisome. LTRO Stigma remains at its 4 month

wides but financials broadly are under pressure as many head back

towards pre-LTRO record wides. Europe's VIX is back up near recent highs

around 30%. With too-big-to-save Spain seeing record wide CDS and even

the manipulated bond market unable to hold up under the real-money

selling pressure, the ECB's dry powder in SMP looks de minimus with only

unbridled QE (since banks have no more collateral to lend) and the ECB

taking the entire Spanish debt stock on its books as a solution,

access to capital markets is about to case for Spain (outside of

central-bank-inspired reacharounds) and as we noted earlier - every

time the ECB executes its SMP it increases the credit risk for

existing sovereign bondholders (and implicitly all the Spanish banks). Spain's equity market is a mere 5% above its March 2009 lows (55% off its highs).Charting The Housing Market

...Add all these charts up and we get a snapshot of a housing recovery that seems to have stalled or rolled over. The reasons why are apparent: mortgage debt remains elevated, a vast "shadow inventory" of underwater or foreclosed homes remains off the market and household income has stagnated or declined, as reported in What If Housing Is Done for a Generation?.

The US government pretends to live under the rule of law, to respect

human rights, and to provide freedom and democracy to citizens.

Washington’s pretense and the stark reality are diametrically opposed.

The US government pretends to live under the rule of law, to respect

human rights, and to provide freedom and democracy to citizens.

Washington’s pretense and the stark reality are diametrically opposed.US government officials routinely criticize other governments for being undemocratic and for violating human rights. Yet, no other country except Israel sends bombs, missiles, and drones into sovereign countries to murder civilian populations. The torture prisons of Abu Gahraib, Guantanamo, and CIA secret rendition sites are the contributions of the Bush/Obama regimes to human rights.

Washington violates the human rights of its own citizens. Washington has suspended the civil liberties guaranteed in the US Constitution and declared its intention to detain US citizens indefinitely without due process of law. President Obama has announced that he, at his discretion, can murder US citizens whom he regards as a threat to the US.

Read More @ PrisonPlanet.com

from GoldSilver.com:

Peter Oppenheimer, the Chief Global Equity Strategist from Goldman Sachs, the “vampire squid” known for bilking its own clients, released the firm’s March 21st call for its clients to sell bonds to Goldman and to buy stocks from Goldman.

Peter Oppenheimer, the Chief Global Equity Strategist from Goldman Sachs, the “vampire squid” known for bilking its own clients, released the firm’s March 21st call for its clients to sell bonds to Goldman and to buy stocks from Goldman.

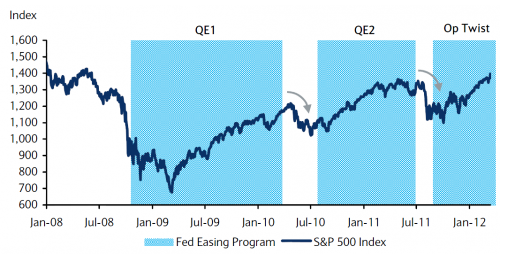

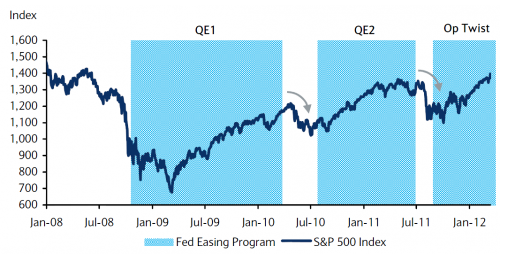

This is precisely the same trade that Goldman suggested in 2011, and again, back in 2010. As we have posted prior to this exposé, Quantitative Easing (also known as printing) does wonders in artificially goosing markets. Can you spot the patterned annual sell off in stocks (below) each time the dollar print shop punch bowl is taken away?

Read More @ GoldSilver.com

Peter Oppenheimer, the Chief Global Equity Strategist from Goldman Sachs, the “vampire squid” known for bilking its own clients, released the firm’s March 21st call for its clients to sell bonds to Goldman and to buy stocks from Goldman.

Peter Oppenheimer, the Chief Global Equity Strategist from Goldman Sachs, the “vampire squid” known for bilking its own clients, released the firm’s March 21st call for its clients to sell bonds to Goldman and to buy stocks from Goldman.This is precisely the same trade that Goldman suggested in 2011, and again, back in 2010. As we have posted prior to this exposé, Quantitative Easing (also known as printing) does wonders in artificially goosing markets. Can you spot the patterned annual sell off in stocks (below) each time the dollar print shop punch bowl is taken away?

Read More @ GoldSilver.com

from The Daily Bell:

Spanish bailout ‘impossible’ for eurozone, says prime minister Mariano

Rajoy … The eurozone is not equipped to bail out Spain, the country’s

prime minister Mariano Rajoy has admitted, as global traders continued

to punish the nation’s stocks and bonds. Mr Rajoy said it was “not

possible to rescue Spain” but insisted his country did not need a

Greek-style international bail-out anyway …Christine Lagarde, the boss

of the International Monetary Fund

(IMF), also warned that Europe’s rescue mechanisms were not enough to

restore confidence to global markets but said the IMF could provide a

“global firewall”. Speaking in Washington on Thursday, Ms Lagarde, who

is seeking to raise $500bn (£313.4bn) in extra funds for the IMF from

the G20, warned risks to the global economy “remain high; the situation

fragile”. “We need a broader approach – and a stronger global firewall –

if we are to push back this crisis. The IMF can help. But to be as

effective as possible, we need to increase our resources.” – UK

Telegraph

Spanish bailout ‘impossible’ for eurozone, says prime minister Mariano

Rajoy … The eurozone is not equipped to bail out Spain, the country’s

prime minister Mariano Rajoy has admitted, as global traders continued

to punish the nation’s stocks and bonds. Mr Rajoy said it was “not

possible to rescue Spain” but insisted his country did not need a

Greek-style international bail-out anyway …Christine Lagarde, the boss

of the International Monetary Fund

(IMF), also warned that Europe’s rescue mechanisms were not enough to

restore confidence to global markets but said the IMF could provide a

“global firewall”. Speaking in Washington on Thursday, Ms Lagarde, who

is seeking to raise $500bn (£313.4bn) in extra funds for the IMF from

the G20, warned risks to the global economy “remain high; the situation

fragile”. “We need a broader approach – and a stronger global firewall –

if we are to push back this crisis. The IMF can help. But to be as

effective as possible, we need to increase our resources.” – UK

Telegraph

Dominant Social Theme: What is needed is a global currency.

Free-Market Analysis: We’ve long since come to the conclusion that the EU‘s sovereign crisis is a manufactured one. This article supports such a conclusion, in our view.

Read More @ TheDailyBell.com

Spanish bailout ‘impossible’ for eurozone, says prime minister Mariano

Rajoy … The eurozone is not equipped to bail out Spain, the country’s

prime minister Mariano Rajoy has admitted, as global traders continued

to punish the nation’s stocks and bonds. Mr Rajoy said it was “not

possible to rescue Spain” but insisted his country did not need a

Greek-style international bail-out anyway …Christine Lagarde, the boss

of the International Monetary Fund

(IMF), also warned that Europe’s rescue mechanisms were not enough to

restore confidence to global markets but said the IMF could provide a

“global firewall”. Speaking in Washington on Thursday, Ms Lagarde, who

is seeking to raise $500bn (£313.4bn) in extra funds for the IMF from

the G20, warned risks to the global economy “remain high; the situation

fragile”. “We need a broader approach – and a stronger global firewall –

if we are to push back this crisis. The IMF can help. But to be as

effective as possible, we need to increase our resources.” – UK

Telegraph

Spanish bailout ‘impossible’ for eurozone, says prime minister Mariano

Rajoy … The eurozone is not equipped to bail out Spain, the country’s

prime minister Mariano Rajoy has admitted, as global traders continued

to punish the nation’s stocks and bonds. Mr Rajoy said it was “not

possible to rescue Spain” but insisted his country did not need a

Greek-style international bail-out anyway …Christine Lagarde, the boss

of the International Monetary Fund

(IMF), also warned that Europe’s rescue mechanisms were not enough to

restore confidence to global markets but said the IMF could provide a

“global firewall”. Speaking in Washington on Thursday, Ms Lagarde, who

is seeking to raise $500bn (£313.4bn) in extra funds for the IMF from

the G20, warned risks to the global economy “remain high; the situation

fragile”. “We need a broader approach – and a stronger global firewall –

if we are to push back this crisis. The IMF can help. But to be as

effective as possible, we need to increase our resources.” – UK

TelegraphDominant Social Theme: What is needed is a global currency.

Free-Market Analysis: We’ve long since come to the conclusion that the EU‘s sovereign crisis is a manufactured one. This article supports such a conclusion, in our view.

Read More @ TheDailyBell.com

by Bruce Judson, New Deal 2.0:

Unequal

enforcement of the law will distort and destroy any capitalist society,

and we may be witnessing just such a downward spiral in the financial

sector.

Unequal

enforcement of the law will distort and destroy any capitalist society,

and we may be witnessing just such a downward spiral in the financial

sector.

Capitalism is not an abstract idea. It is an economic system with a distinct set of underlying principles that must exist in order for the system to work. One of these principles is equal justice. In its absence, parties will stop entering into transactions that create overall wealth for our society. Justice must be blind so that both parties — whether weak or powerful — can assume that an agreement between them will be equally enforced by the courts.

There is a second, perhaps even more fundamental, reason that equal justice is essential for capitalism to work. When unequal justice prevails, the party that does not need to follow the law has a distinct competitive advantage.

Read More @ Newdeal20.org

Unequal

enforcement of the law will distort and destroy any capitalist society,

and we may be witnessing just such a downward spiral in the financial

sector.

Unequal

enforcement of the law will distort and destroy any capitalist society,

and we may be witnessing just such a downward spiral in the financial

sector.Capitalism is not an abstract idea. It is an economic system with a distinct set of underlying principles that must exist in order for the system to work. One of these principles is equal justice. In its absence, parties will stop entering into transactions that create overall wealth for our society. Justice must be blind so that both parties — whether weak or powerful — can assume that an agreement between them will be equally enforced by the courts.

There is a second, perhaps even more fundamental, reason that equal justice is essential for capitalism to work. When unequal justice prevails, the party that does not need to follow the law has a distinct competitive advantage.

Read More @ Newdeal20.org

by Mike Shedlock, Global Economic Analysis:

Things are going so “well” in Spain that the Government banned cash payments in excess of 2,500 euros

Things are going so “well” in Spain that the Government banned cash payments in excess of 2,500 euros

I calmly predict that black market transactions in Spain will soar as soon as Spain is stupid enough to hike the VAT.

Sadly, such stupidity is just around the corner as noted in Slow Road to Hell: Spain Entertains VAT Hike

Real Anti-Fraud Plan

Once again I am stumbling for a precise translation but I happen to agree with this sentiment (emphasis mine) as translated by Google from the lead article.

The general coordinator of IU Rajoy called on a real anti-fraud plan, with more resources to the tax office, and has taken the opportunity to ask the president that when you announce cuts of 10,000 million euros “do it in Parliament.

Read More @ GlobalEconomicAnalysis.blogspot.com

Things are going so “well” in Spain that the Government banned cash payments in excess of 2,500 euros

Things are going so “well” in Spain that the Government banned cash payments in excess of 2,500 eurosI calmly predict that black market transactions in Spain will soar as soon as Spain is stupid enough to hike the VAT.

Sadly, such stupidity is just around the corner as noted in Slow Road to Hell: Spain Entertains VAT Hike

Real Anti-Fraud Plan

Once again I am stumbling for a precise translation but I happen to agree with this sentiment (emphasis mine) as translated by Google from the lead article.

The general coordinator of IU Rajoy called on a real anti-fraud plan, with more resources to the tax office, and has taken the opportunity to ask the president that when you announce cuts of 10,000 million euros “do it in Parliament.

Read More @ GlobalEconomicAnalysis.blogspot.com

by Ron Hera, Financial Sense:

The history of the U.S. dollar is closely linked to U.S. involvement in a series of wars. The Bretton Woods Accord and the resulting world reserve currency status of the U.S. dollar were both byproducts of World War II (1939-1945). The Korean War (1950-1953) was followed six years later by the Vietnam War (1959-1975) which led to the end of the Bretton Woods system. Unfettered by the constraint of gold backing after 1971, the U.S. dollar became a weapon in the Cold War (1945–1991) between the U.S. and the former Union of Soviet Socialist Republics (U.S.S.R.). Each war corresponded with an increase in the U.S. money supply. The Gulf War (1990-1991) was followed by wars in Afghanistan, beginning in 2001, and in Iraq, beginning in 2003, and, simultaneously, by the U.S.-led War on Terror that began in 2001. Like the wars that came before them, the recent staccato of U.S. wars is correlated with increases in the U.S. money supply. The Iraq war, for example, is estimated to have cost as much as $4 trillion.

Read More @ FinancialSense.com

The history of the U.S. dollar is closely linked to U.S. involvement in a series of wars. The Bretton Woods Accord and the resulting world reserve currency status of the U.S. dollar were both byproducts of World War II (1939-1945). The Korean War (1950-1953) was followed six years later by the Vietnam War (1959-1975) which led to the end of the Bretton Woods system. Unfettered by the constraint of gold backing after 1971, the U.S. dollar became a weapon in the Cold War (1945–1991) between the U.S. and the former Union of Soviet Socialist Republics (U.S.S.R.). Each war corresponded with an increase in the U.S. money supply. The Gulf War (1990-1991) was followed by wars in Afghanistan, beginning in 2001, and in Iraq, beginning in 2003, and, simultaneously, by the U.S.-led War on Terror that began in 2001. Like the wars that came before them, the recent staccato of U.S. wars is correlated with increases in the U.S. money supply. The Iraq war, for example, is estimated to have cost as much as $4 trillion.

Read More @ FinancialSense.com

by Charles Goyette, SHTFPlan:

Perhaps it’s like shouting an alarm, unheard above the engine noise of two trains on a collision course. Or, screaming helplessly as a car slips its brakes and rolls toward a toddler playing at the bottom of the driveway.

It is gruesome imagery and I apologize for invoking it. But if anything, it may be inadequate to the prospect before us.

One only has to ask, “What is heading our way?”

Headline:

The Department Of Homeland Security Is Buying 450 Million New Bullets

And don’t kid yourself; they’re not for target practice. It’s .40 caliber ammunition, hollow point rounds that promise “optimum penetration for terminal performance.” The department also has a bid out for up to 175 million rounds of .223 caliber ammunition.

This isn’t the flipping army, you know. This is an internal national police force, a department that didn’t even exist 10 years ago.

Read More @ SHTFPlan

Perhaps it’s like shouting an alarm, unheard above the engine noise of two trains on a collision course. Or, screaming helplessly as a car slips its brakes and rolls toward a toddler playing at the bottom of the driveway.

It is gruesome imagery and I apologize for invoking it. But if anything, it may be inadequate to the prospect before us.

One only has to ask, “What is heading our way?”

Headline:

The Department Of Homeland Security Is Buying 450 Million New Bullets

And don’t kid yourself; they’re not for target practice. It’s .40 caliber ammunition, hollow point rounds that promise “optimum penetration for terminal performance.” The department also has a bid out for up to 175 million rounds of .223 caliber ammunition.

This isn’t the flipping army, you know. This is an internal national police force, a department that didn’t even exist 10 years ago.

Read More @ SHTFPlan

from The Daily Bell:

Author

John Robbins, Other Progressives Denounce ‘Thrive’ … The Santa

Cruz-based author is joined by Deepak Chopra and others in a statement

distancing themselves from the film … Robbins says filmmaker Foster

Gamble, a friend of his, is “naive” about the political consequences of

his new film ‘Thrive.’ Last fall, the acclaimed environmentalist and

nutrition guru John Robbins was invited to the home of his friends

Foster and Kimberly Carter Gamble, near Santa Cruz, to view the Gambles’

just-completed film, Thrive. Robbins, who makes a brief appearance in

the film, says he was “overwhelmed” by what he saw. “There were parts I

liked, but there were other parts that I just detested,” he recalls. “I

didn’t want to be rude—we were there with our families—so I just didn’t

say anything.” – SantaCruz.com

Author

John Robbins, Other Progressives Denounce ‘Thrive’ … The Santa

Cruz-based author is joined by Deepak Chopra and others in a statement

distancing themselves from the film … Robbins says filmmaker Foster

Gamble, a friend of his, is “naive” about the political consequences of

his new film ‘Thrive.’ Last fall, the acclaimed environmentalist and

nutrition guru John Robbins was invited to the home of his friends

Foster and Kimberly Carter Gamble, near Santa Cruz, to view the Gambles’

just-completed film, Thrive. Robbins, who makes a brief appearance in

the film, says he was “overwhelmed” by what he saw. “There were parts I

liked, but there were other parts that I just detested,” he recalls. “I

didn’t want to be rude—we were there with our families—so I just didn’t

say anything.” – SantaCruz.com

Dominant Social Theme: “Thrive” is a movie by, of and for kooks.

Free-Market Analysis: As we suspected, the counterattacks have begun. We questioned “Thrive” and its composition from the beginning, but liked it more once we saw it. We interviewed the movie’s maker, who certainly seems sincere about it, and at the time we suggested we shouldn’t have jumped to certain conclusions.

Read More @ TheDailyBell.com

Author

John Robbins, Other Progressives Denounce ‘Thrive’ … The Santa

Cruz-based author is joined by Deepak Chopra and others in a statement

distancing themselves from the film … Robbins says filmmaker Foster

Gamble, a friend of his, is “naive” about the political consequences of

his new film ‘Thrive.’ Last fall, the acclaimed environmentalist and

nutrition guru John Robbins was invited to the home of his friends

Foster and Kimberly Carter Gamble, near Santa Cruz, to view the Gambles’

just-completed film, Thrive. Robbins, who makes a brief appearance in

the film, says he was “overwhelmed” by what he saw. “There were parts I

liked, but there were other parts that I just detested,” he recalls. “I

didn’t want to be rude—we were there with our families—so I just didn’t

say anything.” – SantaCruz.com

Author

John Robbins, Other Progressives Denounce ‘Thrive’ … The Santa

Cruz-based author is joined by Deepak Chopra and others in a statement

distancing themselves from the film … Robbins says filmmaker Foster

Gamble, a friend of his, is “naive” about the political consequences of

his new film ‘Thrive.’ Last fall, the acclaimed environmentalist and

nutrition guru John Robbins was invited to the home of his friends

Foster and Kimberly Carter Gamble, near Santa Cruz, to view the Gambles’

just-completed film, Thrive. Robbins, who makes a brief appearance in

the film, says he was “overwhelmed” by what he saw. “There were parts I

liked, but there were other parts that I just detested,” he recalls. “I

didn’t want to be rude—we were there with our families—so I just didn’t

say anything.” – SantaCruz.comDominant Social Theme: “Thrive” is a movie by, of and for kooks.

Free-Market Analysis: As we suspected, the counterattacks have begun. We questioned “Thrive” and its composition from the beginning, but liked it more once we saw it. We interviewed the movie’s maker, who certainly seems sincere about it, and at the time we suggested we shouldn’t have jumped to certain conclusions.

Read More @ TheDailyBell.com

[Ed. Note: Here's my interview with Tekoa in which he shares this same life-changing story.]

by Tekoa da Silva, Dollar Vigilante:

In 2006 I was woken up and pulled out of bed at 3:00 a.m. It must have

been a Sunday or a Monday morning, I can’t remember. My bedroom door

burst open with a loud voice yelling at me to get out of bed. When I

opened my eyes, all I saw was a flashlight beaming in my face. I was

taken out of my bedroom, and into my kitchen by a person in black

SWAT-looking like gear. This stranger had a machine gun and was telling

me what to do and where to go in my own home.

In 2006 I was woken up and pulled out of bed at 3:00 a.m. It must have

been a Sunday or a Monday morning, I can’t remember. My bedroom door

burst open with a loud voice yelling at me to get out of bed. When I

opened my eyes, all I saw was a flashlight beaming in my face. I was

taken out of my bedroom, and into my kitchen by a person in black

SWAT-looking like gear. This stranger had a machine gun and was telling

me what to do and where to go in my own home.

When I entered my kitchen, I walked into a crowd of easily fifteen police and “ICE” officers hanging out and strutting around my living room and kitchen, and in the living room lay the prize, my father, a small older man in his late fifties at the time, bound, handcuffed, and held by three officers twice his size.

Read More @ DollarVigilante.com

by Tekoa da Silva, Dollar Vigilante:

In 2006 I was woken up and pulled out of bed at 3:00 a.m. It must have

been a Sunday or a Monday morning, I can’t remember. My bedroom door

burst open with a loud voice yelling at me to get out of bed. When I

opened my eyes, all I saw was a flashlight beaming in my face. I was

taken out of my bedroom, and into my kitchen by a person in black

SWAT-looking like gear. This stranger had a machine gun and was telling

me what to do and where to go in my own home.

In 2006 I was woken up and pulled out of bed at 3:00 a.m. It must have

been a Sunday or a Monday morning, I can’t remember. My bedroom door

burst open with a loud voice yelling at me to get out of bed. When I

opened my eyes, all I saw was a flashlight beaming in my face. I was

taken out of my bedroom, and into my kitchen by a person in black

SWAT-looking like gear. This stranger had a machine gun and was telling

me what to do and where to go in my own home.When I entered my kitchen, I walked into a crowd of easily fifteen police and “ICE” officers hanging out and strutting around my living room and kitchen, and in the living room lay the prize, my father, a small older man in his late fifties at the time, bound, handcuffed, and held by three officers twice his size.

Read More @ DollarVigilante.com

from Azizonomics:

Central planning — like war

— never changes. It has always been a powerful and effective way of

achieving an explicit objective (e.g. building a bridge, or a road), but

one that has has always come with detrimental side-effects. And the

more central planners try to minimise the side-effects, the more

side-effects appear. And so the whack-a-mole goes on.

Central planning — like war

— never changes. It has always been a powerful and effective way of

achieving an explicit objective (e.g. building a bridge, or a road), but

one that has has always come with detrimental side-effects. And the

more central planners try to minimise the side-effects, the more

side-effects appear. And so the whack-a-mole goes on.

This was true in the days of Rome, too.

From Dennis Gartman:

“Rome had its socialist interlude under Diocletian. Faced with increasing poverty and restlessness among the masses, and with the imminent danger of barbarian invasion, he issued in A.D. 301 an edictum de pretiis, which denounced monopolists for keeping goods from the market to raise prices, and set maximum prices and wages for all important articles and services. Extensive public works were undertaken to put the unemployed to work, and food was distributed gratis, or at reduced prices, to the poor. The government – which already owned most mines, quarries, and salt deposits – brought nearly all major industries and guilds under detailed control. “In every large town,” we are told, “the state became a powerful employer, standing head and shoulders above the private industrialists, who were in any case crushed by taxation…”

Read More @ Azizonomics.com

My Dear Friends,

Jim Sinclair’s Commentary

Tax refunds being used to pay for bankruptcy filings By Christine Dugas, USA TODAY

Some Americans spend their tax refunds on high-tech gadgets and long-awaited vacations. Others use the cash to file for bankruptcy.

More than 200,000 money-strapped households will use their tax refunds this year to pay for bankruptcy filing and legal fees, says a new study by the National Bureau of Economic Research.

The NBER research confirms what bankruptcy lawyers have long known: At the first part of the year, when Americans receive their tax refunds, there almost always is a spike in personal bankruptcy filings.

But that has been especially true since the cost of bankruptcy soared after U.S. bankruptcy laws changed in 2005. And many more families have been forced to delay filing until they can afford to pay the fees, the NBER study says.

"If people are expecting a big refund, they go as fast as they can to a tax preparer," says Henry Sommer, a bankruptcy lawyer in Philadelphia. "They need the money so they can afford to file for bankruptcy."

More…

Hi Jim,

How are you?

To your best judgment, will we reach 650 on the HUI this year?

Regards,

CIGA Tonko

Dear Tonko,

Jim Sinclair’s Commentary

As the US dollar finds significant substitutions for international contract settlement, it takes the following self explanatory form. Courtesy of CIGA Matt.

Central planning — like war

— never changes. It has always been a powerful and effective way of

achieving an explicit objective (e.g. building a bridge, or a road), but

one that has has always come with detrimental side-effects. And the

more central planners try to minimise the side-effects, the more

side-effects appear. And so the whack-a-mole goes on.

Central planning — like war

— never changes. It has always been a powerful and effective way of

achieving an explicit objective (e.g. building a bridge, or a road), but

one that has has always come with detrimental side-effects. And the

more central planners try to minimise the side-effects, the more

side-effects appear. And so the whack-a-mole goes on.This was true in the days of Rome, too.

From Dennis Gartman:

“Rome had its socialist interlude under Diocletian. Faced with increasing poverty and restlessness among the masses, and with the imminent danger of barbarian invasion, he issued in A.D. 301 an edictum de pretiis, which denounced monopolists for keeping goods from the market to raise prices, and set maximum prices and wages for all important articles and services. Extensive public works were undertaken to put the unemployed to work, and food was distributed gratis, or at reduced prices, to the poor. The government – which already owned most mines, quarries, and salt deposits – brought nearly all major industries and guilds under detailed control. “In every large town,” we are told, “the state became a powerful employer, standing head and shoulders above the private industrialists, who were in any case crushed by taxation…”

Read More @ Azizonomics.com

My Dear Friends,

This week nine board members of the US Federal reserve spoke on the

subject of QE, some of them more than one time. MSM has interpreted

their message as saying we have QE ready to go but we do not necessarily

see it as required.

Consumer Confidence has sundered and all the China bashers are going

wild over the possibility that China growth might drop to 5% to 7%. MSM

is again hammering the euro. The net result is downside pressure on gold

and equities because it is liquidity that floats those boats.

QE to infinity is infinite debt monetization. That is cosmos level

liquidity. The sum total of all this MSM news today, truly understood,

is that QE to infinity is guaranteed in both the US and in Euroland. It

is more certain than death and taxes. Because of this it is better to

buy breaks in general equities to trade than sell short equities for

investment, and to hold your gold insurance. The manipulators love a day

like this because the long side is the side that the gold banks will be

on when they makes the most money in the shortest time as they did in

1980.

Long your gold they scared out of your hands by total BS on days like today.

Regards,

Jim

Jim

QE to infinity is as sure as death and taxes here and in Euroland.

Tax refunds being used to pay for bankruptcy filings By Christine Dugas, USA TODAY

Some Americans spend their tax refunds on high-tech gadgets and long-awaited vacations. Others use the cash to file for bankruptcy.

More than 200,000 money-strapped households will use their tax refunds this year to pay for bankruptcy filing and legal fees, says a new study by the National Bureau of Economic Research.

The NBER research confirms what bankruptcy lawyers have long known: At the first part of the year, when Americans receive their tax refunds, there almost always is a spike in personal bankruptcy filings.

But that has been especially true since the cost of bankruptcy soared after U.S. bankruptcy laws changed in 2005. And many more families have been forced to delay filing until they can afford to pay the fees, the NBER study says.

"If people are expecting a big refund, they go as fast as they can to a tax preparer," says Henry Sommer, a bankruptcy lawyer in Philadelphia. "They need the money so they can afford to file for bankruptcy."

More…

Hi Jim,

How are you?

To your best judgment, will we reach 650 on the HUI this year?

Regards,

CIGA Tonko

Dear Tonko,

The HUI is the main target of gold share manipulators. Each share must be looked at as a separate entity.

By manipulating the major index you automatically manipulate the field plus it is much cheaper to do your dirty work.

Regards,

Jim

Jim

Jim Sinclair’s Commentary

As the US dollar finds significant substitutions for international contract settlement, it takes the following self explanatory form. Courtesy of CIGA Matt.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment