Dear CIGAs,

Eric King of www.KingWorldNews.com has been kind enough to interview me once again on the actions in the gold market and how it has turned after hitting the low two weeks ago.

Click here to listen to the full interview on KingWorldNews.com…

The following is courtesy of KingWorldNews.com:

Today legendary trader and investor Jim Sinclair told King World News the gold market has turned into a coiled spring that will be extraordinarily explosive on the upside. Sinclair also said that central banks have been aggressively accumulating gold because it is going to part of the monetary solution. But first, here is what Sinclair had to say about the gold market: “The attempt to keep (the gold market) from moving higher, creates, by nature, a spring, a coil as it were in markets. If the spirit of the gold market could have been broken, it certainly would have been broken down at the $1,500 level. This thing is turning into a spring, into a coil, and when it goes it’s going to be something to behold on the upside. Both in the shares and in gold itself.”

Jim Sinclair continues:

“When you feel the worst, when you get to the point where you say, ‘I can’t take it anymore,’ toughen up. Everything that you are doing you are doing for good, right and logical reasons.

Markets are not necessarily illogical. They can’t hold the negative trend against the fundamentals, as long as they have, without great change coming, almost a transformation. It will take place in the gold shares and it will take place at a much higher price….

Click here to continue reading on KingWorldNews.com…

Jim Sinclair’s Commentary

The question is where will the Federal Government get the money.

The answer is QE to infinity.

Untouchable Pensions in California May Be Put to the Test By MARY WILLIAMS WALSH

Published: March 16, 2012

When the city manager of troubled Stockton, Calif., had to tell city council members why it was on track to become the biggest American city yet to go bankrupt, it took hours to get through the list.

There was the free health care for retirees, the unpaid parking tickets, the revenue bonds without enough revenue to pay them. On it went, a grim drumbeat of practically every fiscal malady imaginable, except an obvious one: municipal pensions. Stockton is spending some $30 million a year to pay for them, but it has less than 70 cents set aside for every dollar of benefits its workers expect.

Some public pension experts think they know why pensions were not on the city manager’s list. They see the hidden hand of California’s giant state pension system, known as Calpers, which administers hundreds of billions of dollars in retirement obligations for municipalities across the state.

Calpers does not want cities like Stockton going back on their promises, and it argues that the state Constitution bars any reduction in pensions — and not just for people who have already retired. State law also forbids cuts in the pensions that today’s public workers expect to earn in the future, Calpers says, even in cases of severe fiscal distress. Workers at companies have no comparable protection.

Stockton is in the midst of a mediation process with its creditors that will determine by the end of June whether it will file for Chapter 9 bankruptcy, which would allow the city to negotiate reductions in its debt in court.

More…

Jim Sinclair’s Commentary

The answer is simple. The balance sheets of financial institutions

are comic books due to the FASB ruling that they can valuate these OTC

derivatives at whatever they wish.

Wall Street owns Washington. Where is the mystery?

Why Are the Fed and SEC Keeping Wall Street’s Secrets? By William D. Cohan Apr 1, 2012 6:01 PM ET

Getting what should be public information about major Wall Street firms can be maddeningly difficult.

Bloomberg News discovered this in its ultimately successful effort to get information on the $1.2 trillion in “secret loans” the Fed doled out during the financial crisis. And I’ve had no small experience of it myself.

As I started each of my three books — about Lazard Freres, Bear Stearns and Goldman Sachs Group Inc. (GS) — I submitted Freedom of Information Act requests to the appropriate government agencies (the Securities Exchange Commission, the State Department and the Federal Reserve) to obtain whatever documents, memos and e-mails they had about these companies and their senior executives.

I was hoping to find, among other nuggets, details of enforcement actions, or settlements that were reached where the firms “neither admitted nor denied” guilt, or other documentary evidence of the coziness that has for too long existed between Wall Street and Washington.

Sadly, getting this information in anything like a timely basis — say, before my books were finished and published — has been nearly impossible. At first, when I asked the SEC about documents related to Lazard’s role in the Hartford-Mediobanca scandal starting in 1968 and ending in 1981, the agency told me it could not release the information. When I reminded the FOIA administrator that the SEC had already released the information, years before, to another journalist, the agency dug up the 40 boxes of unindexed, unorganized documents and invited me to a warehouse in Pennsylvania to take a look. After an hour or so, the clerk asked me if I was done with my review. (Eventually, I persuaded the SEC to ship the boxes — at my expense — to its office in Manhattan, where I spent months poring over them.)

More…

Jim Sinclair’s Commentary

I think he is right.

Did Gold Stocks Bottom Last Week? Source: Jordan Roy-Byrne, The Daily Gold (4/1/12)

"Considering the extreme negative sentiment and our technical work, we believe the market made an important long-term low last week."

The gold stocks have frustrated investors for several reasons. First, the sector has had a general inability to keep pace with gold and that struggle has been particularly incensing over the last year in which gold has gained. Second, the substantial rebound in the equity market has provided no lift. We know that the gold stocks can be vulnerable when gold falls and when the stock market is plunging. Yet, the gold stocks did not respond as expected despite the reverse favorable conditions in the past year. In the words of a friend, these stocks couldn’t advance if a rocket ship landed up their ass! It is time to bail, right? Wrong! Considering the extreme negative sentiment and our technical work, we believe the market made an important long-term low last week.

First, let’s look at the large caps, which have really struggled over the past six months. Sure, the HUI broke to new 52-week lows but the market has been so oversold for so long that this breakdown didn’t initiate downside follow through. Veteran observers of the sector know that there are numerous false breakouts and breakdowns. Over the past two weeks, the HUI has formed bullish hammers, which is a sign of a reversal. More convincing is the fact that the market bottomed at the 38% retracement. Finally, consider the 40-month moving average. It provided key support at the 2007 bottom, resistance in 2008 and early 2009 and then support in early 2010.

![clip_image001[6] clip_image001[6]](http://www.jsmineset.com/wp-content/uploads/2012/04/clip_image0016_thumb.jpg)

More…

Jim Sinclair’s Commentary

You can be sure that the Brics will create their own SWIFT system. Not to would be downright stupid.

Robert Zoellick calls for Brics bank

The outgoing president of the World Bank has backed the creation of a Brics bank – warning not to do so would be a “mistake of historic proportions”. By Jamie Dunkley

10:55AM BST 02 Apr 2012

Robert Zoellick said the World Bank would support a Brics bank, an idea formally proposed at a summit in New Delhi last week. The World Bank has previously backed the creation of the Islamic Development Bank and the Opec Fund to build financing and analytical capabilities.

If Brics nations “decide they want another financing vehicle – fine. Let’s figure out how to work with it … I’m enough of an economist that I’m not a monopolist,” Mr Zoellick told The Financial Times.

“India wants the money. China wants to be seen as a good partner and may want to internationalise the renminbi … Brazil wants to be associated with the concept and maybe it can connect [its own] Development Bank.”

The idea was discussed at the meeting between Manmohan Singh, the Indian prime minister, and leaders Hu Jintao of China, Dilma Rousseff of Brazil, Dmitry Medvedev of Russia and Jacob Zuma of South Africa.

Mr Zoellick said the desire by India, China, Brazil and Russia for a new financing vehicle was a reminder of what could happen if the World Bank reduced its engagement with middle-income countries in preference for poorer nations.

More…

World's Largest Solar Plant, With Second Largest Ever Department of Energy Loan Guarantee, Files For Bankruptcy

Solyndra

was just the appetizer. Earlier today, in what will come as a surprise

only to members of the administration, the company which proudly held

the rights to the world's largest solar power project, the hilariously

named Solar Trust of America ("STA"),

filed for bankruptcy. And while one could say that the company's epic

collapse is more a function of alternative energy politics in Germany,

where its 70% parent Solar Millennium AG filed for bankruptcy last

December, what is relevant is that last April STA was

the proud recipient of a $2.1 billion conditional loan from the

Department of Energy, incidentally the second largest loan ever handed out

by the DOE's Stephen Chu. That amount was supposed to fund the

expansion of the company's 1000 MW Blythe Solar Power Project in

Riverside, California. From the funding press release, "This project

construction is expected to create over 1,000 direct jobs in Southern

California, 7,500 indirect jobs in related industries throughout the

United States, and more than 200 long-term operational jobs at the

facility itself. It will play a key role in stimulating the American economy,”

said Uwe T. Schmidt, Chairman and CEO of Solar Trust of America and

Executive Chairman of project development subsidiary Solar Millennium,

LLC." Instead, what Solar Trust will do is create lots of billable hours

for bankruptcy attorneys (at $1,000/hour), and a good old equity

extraction for the $22 million DIP lender, which just happens to be

NextEra Energy Resources, LLC, another "alternative energy" company which last year received a $935 million loan courtesy of the very same (and now $2.1 billion poorer) Department of Energy,

which is also a subsidiary of public NextEra Energy (NEE), in the

process ultimately resulting in yet another transfer of taxpayer cash to

NEE's private shareholders.

Solyndra

was just the appetizer. Earlier today, in what will come as a surprise

only to members of the administration, the company which proudly held

the rights to the world's largest solar power project, the hilariously

named Solar Trust of America ("STA"),

filed for bankruptcy. And while one could say that the company's epic

collapse is more a function of alternative energy politics in Germany,

where its 70% parent Solar Millennium AG filed for bankruptcy last

December, what is relevant is that last April STA was

the proud recipient of a $2.1 billion conditional loan from the

Department of Energy, incidentally the second largest loan ever handed out

by the DOE's Stephen Chu. That amount was supposed to fund the

expansion of the company's 1000 MW Blythe Solar Power Project in

Riverside, California. From the funding press release, "This project

construction is expected to create over 1,000 direct jobs in Southern

California, 7,500 indirect jobs in related industries throughout the

United States, and more than 200 long-term operational jobs at the

facility itself. It will play a key role in stimulating the American economy,”

said Uwe T. Schmidt, Chairman and CEO of Solar Trust of America and

Executive Chairman of project development subsidiary Solar Millennium,

LLC." Instead, what Solar Trust will do is create lots of billable hours

for bankruptcy attorneys (at $1,000/hour), and a good old equity

extraction for the $22 million DIP lender, which just happens to be

NextEra Energy Resources, LLC, another "alternative energy" company which last year received a $935 million loan courtesy of the very same (and now $2.1 billion poorer) Department of Energy,

which is also a subsidiary of public NextEra Energy (NEE), in the

process ultimately resulting in yet another transfer of taxpayer cash to

NEE's private shareholders.America's Future, Interrupted

The ghost of America's future pays us a visit, telling us all we need to know in five simple charts.

The ghost of America's future pays us a visit, telling us all we need to know in five simple charts.Gold Chart

Trader Dan at Trader Dan's Market Views - 4 hours ago

Gold managed to claw its way back above important technical resistance near

the $1680 level in today's trade and is thus far holding above that number,

albeit just barely. The market needs to push away from $1680 with some

conviction and demonstrate that it can attract enough buyers at this level

to take it firmly up and then through $1700. If it can do that, we have a

solid shot at the $1720 level.

If it fails to sustain its footing above $1680, it will fall back within

the recent trading range that it has been carving out with the bottom down

near $1650 - $1640.

By the way, the... more »

Europe trading this morning/ Europe trying to create new firewall/English law Greek bonds/Gold and silver rise

Harvey Organ at Harvey Organ's - The Daily Gold and Silver Report - 7 hours ago

Good evening Ladies and Gentlemen: Gold closed down today up to the tune of $7.20 by comex closing time. Silver had a stellar day rising by $.61 on the day to $33.08. During the weekend, the Europeans were preparing another firewall no doubt to try and rescue Portugal and Spain as they are well aware that contagion is upon us. Also we learned today that we had 11 billion euros worth of

Open Letter To The Bernank

Dear Ben:You have publicly gone on record with some off-the-wall assertions about the gold standard. What made you think you could get away with it? Your best strategy would have been to ignore gold. Although I concede that with the endgame of the regime of irredeemable paper money near, you might not be able to pretend that people aren’t talking and thinking about gold. You can’t win, Ben. In this letter I will address your claims and explain your errors so that the whole world can see them, even if you cannot.

The Cliff Notes

As it now stands, the US economy faces a “fiscal cliff” in early 2013 – meaningful Government spending cuts AND tax increases at the household level. Nothing like a double whammy, now is there? Unquestionably this is one of the reasons why the Fed has pledged to leave short-term interest rates low for some time. So what happens if nothing is changed and both tax increases and spending cuts are allowed to materialize? Although it’s an approximation, the deadly combo could shave 1.5% plus from US GDP next year. Estimates from the Congressional Budget Office are for a more meaningful contractionary impact. And that’s before the ultimate global economic fallout influence of Europe and China slowing. But there is a larger and very important issue beyond this, although the “cliff” is something investors will not ignore and could be very meaningful to forward economic and financial market outcomes, especially given the relative complacent market mood of the moment.

[Ed. Note: Part One]

from The Burning Platform:

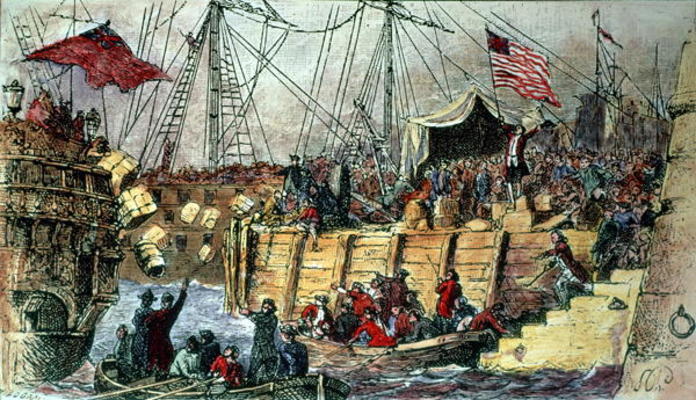

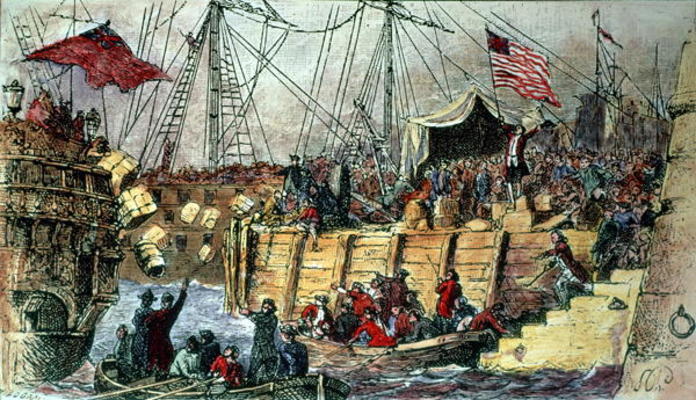

The

actions of the governing elite have provoked the darkening mood

creeping across the land. The rise of the Tea Party in 2009 was fueled

by anger over the bank bailouts, out of control federal spending and

ever increasing taxes. The anger spilled over into town hall meetings,

as Congressmen felt the wrath of public dissatisfaction. The fury

propelled Tea Party Republicans to being elected in large numbers in

2010. But the movement was hijacked by the Republican establishment and

defanged. As 2011 progressed, with Wall Street continuing to pillage the

American middle class, the Occupy Movement spread to cities across

America and around the world. The movement, led by Millenials, claims

that mega-corporations and Wall Street manipulate the world in an

unbalanced way that disproportionately benefits a super wealthy minority

and is undermining democracy. They have shone a light upon the fact the

1% has used their wealth and power to plunder the national treasury,

while impoverishing the 99%. The audacity of the 1% was on display for

all to see when former Goldman Sachs CEO and former U.S. Senator Jon

Corzine absconded with $1.2 billion of his customers’ money and

continues to hide it in the vaults of his fellow robber baron Jamie

Dimon at J.P. Morgan. To this day, no one has been jailed for this heist

or any of the thousands of other crimes committed by the Wall Street

titans. These psychopaths will not be satisfied until nothing remains of

our country but a barren desert.

The

actions of the governing elite have provoked the darkening mood

creeping across the land. The rise of the Tea Party in 2009 was fueled

by anger over the bank bailouts, out of control federal spending and

ever increasing taxes. The anger spilled over into town hall meetings,

as Congressmen felt the wrath of public dissatisfaction. The fury

propelled Tea Party Republicans to being elected in large numbers in

2010. But the movement was hijacked by the Republican establishment and

defanged. As 2011 progressed, with Wall Street continuing to pillage the

American middle class, the Occupy Movement spread to cities across

America and around the world. The movement, led by Millenials, claims

that mega-corporations and Wall Street manipulate the world in an

unbalanced way that disproportionately benefits a super wealthy minority

and is undermining democracy. They have shone a light upon the fact the

1% has used their wealth and power to plunder the national treasury,

while impoverishing the 99%. The audacity of the 1% was on display for

all to see when former Goldman Sachs CEO and former U.S. Senator Jon

Corzine absconded with $1.2 billion of his customers’ money and

continues to hide it in the vaults of his fellow robber baron Jamie

Dimon at J.P. Morgan. To this day, no one has been jailed for this heist

or any of the thousands of other crimes committed by the Wall Street

titans. These psychopaths will not be satisfied until nothing remains of

our country but a barren desert.

Read More @ TheBurningPlatform.com

from The Burning Platform:

The

actions of the governing elite have provoked the darkening mood

creeping across the land. The rise of the Tea Party in 2009 was fueled

by anger over the bank bailouts, out of control federal spending and

ever increasing taxes. The anger spilled over into town hall meetings,

as Congressmen felt the wrath of public dissatisfaction. The fury

propelled Tea Party Republicans to being elected in large numbers in

2010. But the movement was hijacked by the Republican establishment and

defanged. As 2011 progressed, with Wall Street continuing to pillage the

American middle class, the Occupy Movement spread to cities across

America and around the world. The movement, led by Millenials, claims

that mega-corporations and Wall Street manipulate the world in an

unbalanced way that disproportionately benefits a super wealthy minority

and is undermining democracy. They have shone a light upon the fact the

1% has used their wealth and power to plunder the national treasury,

while impoverishing the 99%. The audacity of the 1% was on display for

all to see when former Goldman Sachs CEO and former U.S. Senator Jon

Corzine absconded with $1.2 billion of his customers’ money and

continues to hide it in the vaults of his fellow robber baron Jamie

Dimon at J.P. Morgan. To this day, no one has been jailed for this heist

or any of the thousands of other crimes committed by the Wall Street

titans. These psychopaths will not be satisfied until nothing remains of

our country but a barren desert.

The

actions of the governing elite have provoked the darkening mood

creeping across the land. The rise of the Tea Party in 2009 was fueled

by anger over the bank bailouts, out of control federal spending and

ever increasing taxes. The anger spilled over into town hall meetings,

as Congressmen felt the wrath of public dissatisfaction. The fury

propelled Tea Party Republicans to being elected in large numbers in

2010. But the movement was hijacked by the Republican establishment and

defanged. As 2011 progressed, with Wall Street continuing to pillage the

American middle class, the Occupy Movement spread to cities across

America and around the world. The movement, led by Millenials, claims

that mega-corporations and Wall Street manipulate the world in an

unbalanced way that disproportionately benefits a super wealthy minority

and is undermining democracy. They have shone a light upon the fact the

1% has used their wealth and power to plunder the national treasury,

while impoverishing the 99%. The audacity of the 1% was on display for

all to see when former Goldman Sachs CEO and former U.S. Senator Jon

Corzine absconded with $1.2 billion of his customers’ money and

continues to hide it in the vaults of his fellow robber baron Jamie

Dimon at J.P. Morgan. To this day, no one has been jailed for this heist

or any of the thousands of other crimes committed by the Wall Street

titans. These psychopaths will not be satisfied until nothing remains of

our country but a barren desert.Read More @ TheBurningPlatform.com

from CapitalAccount:

The S&P 500 stock index has had its best yearly start vis-à-vis gold in over a decade, and bond traders see a rebound for treasuries after the most tumultuous quarter since 2010. Meanwhile, Greenspan going to bat for his old right-hand at the Federal Reserve, Ben Bernanke, for all the criticism he has taken in recent months, in particular for criticism he has received by the republican primary candidates. But what does all this say about the direction of the us economy. Should we be optimistic or pessimistic, and what to make the dollar? After all, the performance of treasuries, as well as that of gold, is directly related to the value of the dollar.

The S&P 500 stock index has had its best yearly start vis-à-vis gold in over a decade, and bond traders see a rebound for treasuries after the most tumultuous quarter since 2010. Meanwhile, Greenspan going to bat for his old right-hand at the Federal Reserve, Ben Bernanke, for all the criticism he has taken in recent months, in particular for criticism he has received by the republican primary candidates. But what does all this say about the direction of the us economy. Should we be optimistic or pessimistic, and what to make the dollar? After all, the performance of treasuries, as well as that of gold, is directly related to the value of the dollar.

by Dr. Ron Paul, Paul.House.gov:

Last week the Supreme Court heard arguments concerning the

constitutionality of the Obamacare law, focusing on the mandate

requiring every American to buy health insurance or pay fines enforced

by the IRS. Hopefully the Court will strike down this abomination, but

we must recognize that the federal judiciary has an abysmal record when

it comes to protecting liberty. It’s doubtful the entire law will be

struck down. Regardless, the political left will continue its drive

toward a single-payer, government run health care system.

Last week the Supreme Court heard arguments concerning the

constitutionality of the Obamacare law, focusing on the mandate

requiring every American to buy health insurance or pay fines enforced

by the IRS. Hopefully the Court will strike down this abomination, but

we must recognize that the federal judiciary has an abysmal record when

it comes to protecting liberty. It’s doubtful the entire law will be

struck down. Regardless, the political left will continue its drive

toward a single-payer, government run health care system.

The insurance mandate clearly exceeds the federal government’s powers under the interstate commerce clause found in Article I, Section 8 of the Constitution. This is patently obvious: the power to “regulate” commerce cannot include the power to compel commerce! Those who claim otherwise simply ignore the plain meaning of the Constitution because they don’t want to limit federal power in any way.

Read More @ Paul.House.gov

Last week the Supreme Court heard arguments concerning the

constitutionality of the Obamacare law, focusing on the mandate

requiring every American to buy health insurance or pay fines enforced

by the IRS. Hopefully the Court will strike down this abomination, but

we must recognize that the federal judiciary has an abysmal record when

it comes to protecting liberty. It’s doubtful the entire law will be

struck down. Regardless, the political left will continue its drive

toward a single-payer, government run health care system.

Last week the Supreme Court heard arguments concerning the

constitutionality of the Obamacare law, focusing on the mandate

requiring every American to buy health insurance or pay fines enforced

by the IRS. Hopefully the Court will strike down this abomination, but

we must recognize that the federal judiciary has an abysmal record when

it comes to protecting liberty. It’s doubtful the entire law will be

struck down. Regardless, the political left will continue its drive

toward a single-payer, government run health care system.The insurance mandate clearly exceeds the federal government’s powers under the interstate commerce clause found in Article I, Section 8 of the Constitution. This is patently obvious: the power to “regulate” commerce cannot include the power to compel commerce! Those who claim otherwise simply ignore the plain meaning of the Constitution because they don’t want to limit federal power in any way.

Read More @ Paul.House.gov

by Greg Hunter, USA Watchdog:

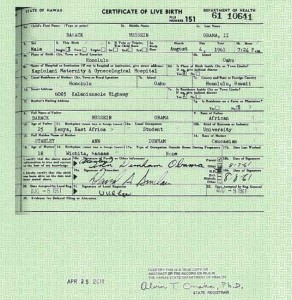

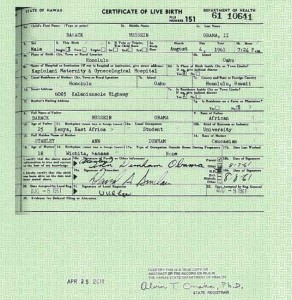

About a month ago, renowned Arizona Sheriff Joe Arpaio made an astounding claim in a public press conference, “A

six month long investigation conducted by my cold case posse has lead

me to believe there is probable cause to believe that President Barack

Obama’s long-form birth certificate released by the White House on April

27, 2011, is a computer-generated forgery,” said Arpaio. The Maricopa County Sheriff claimed President Obama’s Hawaiian selective-service card was, also, “most likely a forgery.” (Click

here for the complete press release from the Maricopa County Arizona

Sheriff’s office. This includes 6 videos explaining the Obama birth

certificate investigation.)

About a month ago, renowned Arizona Sheriff Joe Arpaio made an astounding claim in a public press conference, “A

six month long investigation conducted by my cold case posse has lead

me to believe there is probable cause to believe that President Barack

Obama’s long-form birth certificate released by the White House on April

27, 2011, is a computer-generated forgery,” said Arpaio. The Maricopa County Sheriff claimed President Obama’s Hawaiian selective-service card was, also, “most likely a forgery.” (Click

here for the complete press release from the Maricopa County Arizona

Sheriff’s office. This includes 6 videos explaining the Obama birth

certificate investigation.)

From what I can tell, every single mainstream media (MSM) outlet covered this press conference. CBS, NBC, ABC, FOX, CNN, Wall Street Journal, New York Times and many more all covered this story at the very beginning of March. Then, poof—the coverage stopped.

Read More @ USAWatchdog.com

About a month ago, renowned Arizona Sheriff Joe Arpaio made an astounding claim in a public press conference, “A

six month long investigation conducted by my cold case posse has lead

me to believe there is probable cause to believe that President Barack

Obama’s long-form birth certificate released by the White House on April

27, 2011, is a computer-generated forgery,” said Arpaio. The Maricopa County Sheriff claimed President Obama’s Hawaiian selective-service card was, also, “most likely a forgery.” (Click

here for the complete press release from the Maricopa County Arizona

Sheriff’s office. This includes 6 videos explaining the Obama birth

certificate investigation.)

About a month ago, renowned Arizona Sheriff Joe Arpaio made an astounding claim in a public press conference, “A

six month long investigation conducted by my cold case posse has lead

me to believe there is probable cause to believe that President Barack

Obama’s long-form birth certificate released by the White House on April

27, 2011, is a computer-generated forgery,” said Arpaio. The Maricopa County Sheriff claimed President Obama’s Hawaiian selective-service card was, also, “most likely a forgery.” (Click

here for the complete press release from the Maricopa County Arizona

Sheriff’s office. This includes 6 videos explaining the Obama birth

certificate investigation.) From what I can tell, every single mainstream media (MSM) outlet covered this press conference. CBS, NBC, ABC, FOX, CNN, Wall Street Journal, New York Times and many more all covered this story at the very beginning of March. Then, poof—the coverage stopped.

Read More @ USAWatchdog.com

by John Galt:

In the nation of Greece, poverty and misery rules the day as the

ideals of Eurosocialism when implemented to completion take hold. The

attempt to create a hybrid version of capitalism with Marxist overtones

has never been successful and there is no reason to believe that success

is just around the corner as a desperate population begins to realize

the failure of the globalists which have sold the nation out to

participate in an international currency system which offers no benefits

nor sovereignty to the citizenry.

In the nation of Greece, poverty and misery rules the day as the

ideals of Eurosocialism when implemented to completion take hold. The

attempt to create a hybrid version of capitalism with Marxist overtones

has never been successful and there is no reason to believe that success

is just around the corner as a desperate population begins to realize

the failure of the globalists which have sold the nation out to

participate in an international currency system which offers no benefits

nor sovereignty to the citizenry.

The believers of the great European Union system and the unified currency are ignoring the reality of their decisions however and the consequences that have filtered down to a formerly bustling middle class and now destitute lower class. The citizens of Greece made their own bed by buying and voting for the enhanced debt laden lifestyle provided by cheap, easy money and trusting bankers to manage the nation’s financial affairs. However, in the town of Perama to the West of Athens, the impact of the European system and sacrificing the country’s sovereignty are hitting home at an unimaginable level.

Read More @ JohnGaltFLA.com

The

middle class is being systematically wiped out of existence in the

United States today. America is a nation with a very tiny elite that is

rapidly becoming increasingly wealthy while everyone else is becoming

poorer. So why is this happening? Well, it is actually very simple. Our

institutions are designed to concentrate wealth in the hands of a very

limited number of people. Throughout human history, almost all societies

that have had a big centralized government have also had a very high

concentration of wealth in the hands of the elite. Throughout human

history, almost all societies that have allowed big business or big

corporations to dominate the economy have also had a very high

concentration of wealth in the hands of the elite. Well, the United

States has allowed both big government and big corporations to grow

wildly out of control. Those were huge mistakes. Our founding fathers

attempted to establish a nation where the federal government would be

greatly limited and where corporations would be greatly restricted.

Unfortunately, we have turned our backs on those principles and now we

are paying the price.

The

middle class is being systematically wiped out of existence in the

United States today. America is a nation with a very tiny elite that is

rapidly becoming increasingly wealthy while everyone else is becoming

poorer. So why is this happening? Well, it is actually very simple. Our

institutions are designed to concentrate wealth in the hands of a very

limited number of people. Throughout human history, almost all societies

that have had a big centralized government have also had a very high

concentration of wealth in the hands of the elite. Throughout human

history, almost all societies that have allowed big business or big

corporations to dominate the economy have also had a very high

concentration of wealth in the hands of the elite. Well, the United

States has allowed both big government and big corporations to grow

wildly out of control. Those were huge mistakes. Our founding fathers

attempted to establish a nation where the federal government would be

greatly limited and where corporations would be greatly restricted.

Unfortunately, we have turned our backs on those principles and now we

are paying the price.

Read More @ EndoftheAmericanDream.com

In the nation of Greece, poverty and misery rules the day as the

ideals of Eurosocialism when implemented to completion take hold. The

attempt to create a hybrid version of capitalism with Marxist overtones

has never been successful and there is no reason to believe that success

is just around the corner as a desperate population begins to realize

the failure of the globalists which have sold the nation out to

participate in an international currency system which offers no benefits

nor sovereignty to the citizenry.

In the nation of Greece, poverty and misery rules the day as the

ideals of Eurosocialism when implemented to completion take hold. The

attempt to create a hybrid version of capitalism with Marxist overtones

has never been successful and there is no reason to believe that success

is just around the corner as a desperate population begins to realize

the failure of the globalists which have sold the nation out to

participate in an international currency system which offers no benefits

nor sovereignty to the citizenry.The believers of the great European Union system and the unified currency are ignoring the reality of their decisions however and the consequences that have filtered down to a formerly bustling middle class and now destitute lower class. The citizens of Greece made their own bed by buying and voting for the enhanced debt laden lifestyle provided by cheap, easy money and trusting bankers to manage the nation’s financial affairs. However, in the town of Perama to the West of Athens, the impact of the European system and sacrificing the country’s sovereignty are hitting home at an unimaginable level.

Read More @ JohnGaltFLA.com

from The American Dream:

The

middle class is being systematically wiped out of existence in the

United States today. America is a nation with a very tiny elite that is

rapidly becoming increasingly wealthy while everyone else is becoming

poorer. So why is this happening? Well, it is actually very simple. Our

institutions are designed to concentrate wealth in the hands of a very

limited number of people. Throughout human history, almost all societies

that have had a big centralized government have also had a very high

concentration of wealth in the hands of the elite. Throughout human

history, almost all societies that have allowed big business or big

corporations to dominate the economy have also had a very high

concentration of wealth in the hands of the elite. Well, the United

States has allowed both big government and big corporations to grow

wildly out of control. Those were huge mistakes. Our founding fathers

attempted to establish a nation where the federal government would be

greatly limited and where corporations would be greatly restricted.

Unfortunately, we have turned our backs on those principles and now we

are paying the price.

The

middle class is being systematically wiped out of existence in the

United States today. America is a nation with a very tiny elite that is

rapidly becoming increasingly wealthy while everyone else is becoming

poorer. So why is this happening? Well, it is actually very simple. Our

institutions are designed to concentrate wealth in the hands of a very

limited number of people. Throughout human history, almost all societies

that have had a big centralized government have also had a very high

concentration of wealth in the hands of the elite. Throughout human

history, almost all societies that have allowed big business or big

corporations to dominate the economy have also had a very high

concentration of wealth in the hands of the elite. Well, the United

States has allowed both big government and big corporations to grow

wildly out of control. Those were huge mistakes. Our founding fathers

attempted to establish a nation where the federal government would be

greatly limited and where corporations would be greatly restricted.

Unfortunately, we have turned our backs on those principles and now we

are paying the price.Read More @ EndoftheAmericanDream.com

[Ed. Note: Wow. That endorsement didn't take long. But why?]

from Silver Doctors:

Outgoing World Bank President Robert Zoellick has stated that the World Bank would support a BRICS bank. It appears that using the SWIFT system as a weapon against Iran has MAJORLY backfired. The result will see the dollar lose its reserve currency status much sooner than it otherwise might have.

Robert Zoellick said the World Bank would support a Brics bank, an idea formally proposed at a summit in New Delhi last week. The World Bank has previously backed the creation of the Islamic Development Bank and the Opec Fund to build financing and analytical capabilities.

from Silver Doctors:

Outgoing World Bank President Robert Zoellick has stated that the World Bank would support a BRICS bank. It appears that using the SWIFT system as a weapon against Iran has MAJORLY backfired. The result will see the dollar lose its reserve currency status much sooner than it otherwise might have.

Robert Zoellick said the World Bank would support a Brics bank, an idea formally proposed at a summit in New Delhi last week. The World Bank has previously backed the creation of the Islamic Development Bank and the Opec Fund to build financing and analytical capabilities.

If Brics nations “decide they want another financing vehicle – fine. Let’s figure out how to work with it … I’m enough of an economist that I’m not a monopolist,” Mr Zoellick told The Financial Times.Read More @ Silver Doctors

“India wants the money. China wants to be seen as a good partner and may want to internationalise the renminbi … Brazil wants to be associated with the concept and maybe it can connect [its own] Development Bank.”

The U.S. government says it must govern Internet technology more closely to protect against cyberattacks.

by Tom Simonite, Technology Review:

The U.S. Department of Defense may have funded the research that led to

the Internet, but freewheeling innovation created the patchwork of

privately owned technology that makes up the Internet today. Now the

U.S. government is trying to wrest back some control, as it adjusts to

an era when cyberattacks on U.S. corporations and government agencies

are common.

The U.S. Department of Defense may have funded the research that led to

the Internet, but freewheeling innovation created the patchwork of

privately owned technology that makes up the Internet today. Now the

U.S. government is trying to wrest back some control, as it adjusts to

an era when cyberattacks on U.S. corporations and government agencies

are common.

At the RSA computer security conference yesterday, representatives of the White House, U.S. Department of Defense, and National Security Agency said that safeguarding U.S. interests required them to take a more active role in governing what has been a purely commercial, civilian resource. But some experts are concerned that the growing influence of defense and military organizations on the operation and future development of the Internet will compromise the freedom that has made it a success.

Read More @ TechnologyReview.com

I'm PayPal Verified

by Tom Simonite, Technology Review:

The U.S. Department of Defense may have funded the research that led to

the Internet, but freewheeling innovation created the patchwork of

privately owned technology that makes up the Internet today. Now the

U.S. government is trying to wrest back some control, as it adjusts to

an era when cyberattacks on U.S. corporations and government agencies

are common.

The U.S. Department of Defense may have funded the research that led to

the Internet, but freewheeling innovation created the patchwork of

privately owned technology that makes up the Internet today. Now the

U.S. government is trying to wrest back some control, as it adjusts to

an era when cyberattacks on U.S. corporations and government agencies

are common.At the RSA computer security conference yesterday, representatives of the White House, U.S. Department of Defense, and National Security Agency said that safeguarding U.S. interests required them to take a more active role in governing what has been a purely commercial, civilian resource. But some experts are concerned that the growing influence of defense and military organizations on the operation and future development of the Internet will compromise the freedom that has made it a success.

Read More @ TechnologyReview.com

by Avalon & Shepard Ambellas, The Intel Hub:

Who would believe that in the year 2012 one would have to ask if the U.S. Military would fire on American Citizen’s?

The question of troop involvement in a possible upcoming Martial Law scenario that is being predicted is no imaginary possibility – nor is it a ‘conspiracy theory’.

Other tough questions are being discussed such as, “Will the U.S. government confiscate Gold and Silver in an economic collapse?” and “Will there be a round-up of American Citizens to be put into FEMA Camps?”

Many believe that the United Nations will be given authority to step in to keep the peace in any civil unrest or economic collapse. This is a strong possibility.

Readers should be familiar with the term ‘Hidden In Plain Sight’. How this applies to the United Nations is simple.

Read More @ TheIntelHub.com

Who would believe that in the year 2012 one would have to ask if the U.S. Military would fire on American Citizen’s?

The question of troop involvement in a possible upcoming Martial Law scenario that is being predicted is no imaginary possibility – nor is it a ‘conspiracy theory’.

Other tough questions are being discussed such as, “Will the U.S. government confiscate Gold and Silver in an economic collapse?” and “Will there be a round-up of American Citizens to be put into FEMA Camps?”

Many believe that the United Nations will be given authority to step in to keep the peace in any civil unrest or economic collapse. This is a strong possibility.

Readers should be familiar with the term ‘Hidden In Plain Sight’. How this applies to the United Nations is simple.

Read More @ TheIntelHub.com

From King World News:

“The

attempt to keep (the gold market) from moving higher, creates, by

nature, a spring, a coil as it were in markets. If the spirit of the

gold market could have been broken, it certainly would have been broken

down at the $1,500 level. This thing is turning into a spring, into a

coil, and when it goes it’s going to be something to behold on the

upside. Both in the shares and in gold itself.”

“The

attempt to keep (the gold market) from moving higher, creates, by

nature, a spring, a coil as it were in markets. If the spirit of the

gold market could have been broken, it certainly would have been broken

down at the $1,500 level. This thing is turning into a spring, into a

coil, and when it goes it’s going to be something to behold on the

upside. Both in the shares and in gold itself.”

Jim Sinclair continues: Read More @ KingWorldNews.com

from Azizonomics:

from Azizonomics:

If I was a mathematical economist — and I have very, very good reason not to be — I would try to create a formal model for what I call antiprosperity.

What is antiprosperity? It is a strange effect. I hypothesise thus: as nations (and to a lesser extent, people) become more prosperous, they tend toward greater fragility. In other words, fat times create weakness. This is not a universal law, because there are some exceptions. It is more of a tendency. The children of the strong, the hard-working or the wealthy often grow up lazy and stupid and conceited. People who keep winning don’t learn about their weaknesses, and without being aware of their weaknesses their weaknesses can fester and develop into glaring cracks.

Read More @ Azizonomics

“The

attempt to keep (the gold market) from moving higher, creates, by

nature, a spring, a coil as it were in markets. If the spirit of the

gold market could have been broken, it certainly would have been broken

down at the $1,500 level. This thing is turning into a spring, into a

coil, and when it goes it’s going to be something to behold on the

upside. Both in the shares and in gold itself.”

“The

attempt to keep (the gold market) from moving higher, creates, by

nature, a spring, a coil as it were in markets. If the spirit of the

gold market could have been broken, it certainly would have been broken

down at the $1,500 level. This thing is turning into a spring, into a

coil, and when it goes it’s going to be something to behold on the

upside. Both in the shares and in gold itself.”Jim Sinclair continues: Read More @ KingWorldNews.com

from Azizonomics:

from Azizonomics:If I was a mathematical economist — and I have very, very good reason not to be — I would try to create a formal model for what I call antiprosperity.

What is antiprosperity? It is a strange effect. I hypothesise thus: as nations (and to a lesser extent, people) become more prosperous, they tend toward greater fragility. In other words, fat times create weakness. This is not a universal law, because there are some exceptions. It is more of a tendency. The children of the strong, the hard-working or the wealthy often grow up lazy and stupid and conceited. People who keep winning don’t learn about their weaknesses, and without being aware of their weaknesses their weaknesses can fester and develop into glaring cracks.

Read More @ Azizonomics

Our sponsors were chosen to help you prepare for the coming global financial collapse...If you wait until TSHTF (the shi! hits the fan) it will be too late...

Please consider making a small donation, to help cover some of the labor and costs to run this blog.

Thank You

I'm PayPal Verified

Thank You

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment