by Henry Blodget, Business Insider:

Investor Marc Faber is still warning about the horrible future that awaits us.

Investor Marc Faber is still warning about the horrible future that awaits us.

Specifically, he says that the world’s wealthy will soon see half their wealth destroyed.

Faber’s smart, of course, so he’s not laying bets on exactly how it will be destroyed. He’s also not picking a particular time frame:

“Somewhere down the line we will have a massive wealth destruction that usually happens either through very high inflation or through social unrest or through war or a credit market collapse,” he told CNBC (via the Wall Street Journal).

The remarkable thing here is that this actually isn’t a bold a prediction. In fact, for monetary wealth NOT To be destroyed, we’d have to have a major shift in the world economy.

Read More @ BusinessInsider.com

Last week, when we commented on

the amusing spread between the Chinese PMI as measured by HSBC on one

hand (plunging) and the official number (soaring), we had one very

simple explanation for this divergence: "the Schrödinger paradox - where

the economy was doing better and worse at the same time - which was

experienced for the past three months in the US (and is now finished

with the economy rolling over), has shifted to Shanghai, where it is now

the PBOC's turn to baffle all with bullshit. Why? One simple reason:

despite what everyone believes, China still has residual and quite

strong pockets of inflation. So while the world may be expecting an RRR,

or even interest rate, cut any second now (just as China surprised

everyone literally house before the November the global FX swap line

expansion by the Fed in November 2011), the PBOC is just not sure it can afford the spike in inflation, or even perception thereof."

It appears we were correct, following the just released Chinese CPI

number, which in March printed at a far greater than expected 3.6%, on

expectations of a 3.4% print, and well above the February 3.2%.

Last week, when we commented on

the amusing spread between the Chinese PMI as measured by HSBC on one

hand (plunging) and the official number (soaring), we had one very

simple explanation for this divergence: "the Schrödinger paradox - where

the economy was doing better and worse at the same time - which was

experienced for the past three months in the US (and is now finished

with the economy rolling over), has shifted to Shanghai, where it is now

the PBOC's turn to baffle all with bullshit. Why? One simple reason:

despite what everyone believes, China still has residual and quite

strong pockets of inflation. So while the world may be expecting an RRR,

or even interest rate, cut any second now (just as China surprised

everyone literally house before the November the global FX swap line

expansion by the Fed in November 2011), the PBOC is just not sure it can afford the spike in inflation, or even perception thereof."

It appears we were correct, following the just released Chinese CPI

number, which in March printed at a far greater than expected 3.6%, on

expectations of a 3.4% print, and well above the February 3.2%.

And so the latest Goldman recommendation to muppets is now officially a dud.

As reported earlier, the Indian gold buying strike is

now over, and just as we predicted, gold futures are off to the races

right out of the gate, with the yellow metal surging $10 just as the

electronic market broke for trading, touching $1647, about $30 higher

compared to the liquidation rout from three days ago (has anyone seen Gartman

today?). Unfortunately, while Indian purchases of gold are sure to

provide a bid under the metal, their appetite for stocks appears to not

have risen, and as a result, ES is continuing Friday's downdraft lower,

with the E-Mini touching on 1372 in the first minutes of trading.

Finally, with Brian Sack no longer there to facilitate the overnight

ramp higher, this just may be one of those overnight futures sessions

where we do not see a miraculous melt up on absolutely nothing.

As reported earlier, the Indian gold buying strike is

now over, and just as we predicted, gold futures are off to the races

right out of the gate, with the yellow metal surging $10 just as the

electronic market broke for trading, touching $1647, about $30 higher

compared to the liquidation rout from three days ago (has anyone seen Gartman

today?). Unfortunately, while Indian purchases of gold are sure to

provide a bid under the metal, their appetite for stocks appears to not

have risen, and as a result, ES is continuing Friday's downdraft lower,

with the E-Mini touching on 1372 in the first minutes of trading.

Finally, with Brian Sack no longer there to facilitate the overnight

ramp higher, this just may be one of those overnight futures sessions

where we do not see a miraculous melt up on absolutely nothing.

Now

that the time has come to expect Greek March economic data, which will

show an acceleration in the total financial collapse of a society

which is merely used as an intermediary to bail out insolvent European

banks, something that virtually everyone takes for granted, together

with a third bailout package sometime in the late summer, we can focus

on the more entertaining developments out of the country that has become

a symbol of all that is broken in Europe. Such as this story from Greek Protothema that

one can now hire a cop for as little as €30/hour. €20 more gives one

the option of chosing between the Athenian version of Erik Estrada,

together with bike and ambiguous sexual tendencies, or a K-9 option.

Finally, for those who are in need of urgent transport from point A to

point B in total security, the Greek police choppers can be had for as

little as €1500 an hour. In other words, one can own a 24/7 full-time

militia of 20 policemen for as little as €14,400 a month. Naturally, the

Greek PD has stooped so low because it simply has no money, and in its

attempt to protect and serve, it has to do a little paid

moonlighting on the side. As to what happens when all the wealthy robber

barrons and tax evaders in Greek society end up owning all the

officers in circulation, leaving the rest of the country defenseless,

well, we are confident the local underworld elements will be more than

happy to find out just what the consequences of that particular outcome

will be. But at least Greece is still in the euro. And that's all that

matters.

Now

that the time has come to expect Greek March economic data, which will

show an acceleration in the total financial collapse of a society

which is merely used as an intermediary to bail out insolvent European

banks, something that virtually everyone takes for granted, together

with a third bailout package sometime in the late summer, we can focus

on the more entertaining developments out of the country that has become

a symbol of all that is broken in Europe. Such as this story from Greek Protothema that

one can now hire a cop for as little as €30/hour. €20 more gives one

the option of chosing between the Athenian version of Erik Estrada,

together with bike and ambiguous sexual tendencies, or a K-9 option.

Finally, for those who are in need of urgent transport from point A to

point B in total security, the Greek police choppers can be had for as

little as €1500 an hour. In other words, one can own a 24/7 full-time

militia of 20 policemen for as little as €14,400 a month. Naturally, the

Greek PD has stooped so low because it simply has no money, and in its

attempt to protect and serve, it has to do a little paid

moonlighting on the side. As to what happens when all the wealthy robber

barrons and tax evaders in Greek society end up owning all the

officers in circulation, leaving the rest of the country defenseless,

well, we are confident the local underworld elements will be more than

happy to find out just what the consequences of that particular outcome

will be. But at least Greece is still in the euro. And that's all that

matters.

Investor Marc Faber is still warning about the horrible future that awaits us.

Investor Marc Faber is still warning about the horrible future that awaits us.Specifically, he says that the world’s wealthy will soon see half their wealth destroyed.

Faber’s smart, of course, so he’s not laying bets on exactly how it will be destroyed. He’s also not picking a particular time frame:

“Somewhere down the line we will have a massive wealth destruction that usually happens either through very high inflation or through social unrest or through war or a credit market collapse,” he told CNBC (via the Wall Street Journal).

The remarkable thing here is that this actually isn’t a bold a prediction. In fact, for monetary wealth NOT To be destroyed, we’d have to have a major shift in the world economy.

Read More @ BusinessInsider.com

IceCap Asset Management March Perspectives: "I Need A Job"

Since most people live in the real World, this concept of cyclical versus structural falls on deaf ears. However, it’s actually a very important concept for you to understand and it could even save you a few bucks in your portfolio. Cyclical simply means the regular ebbs and flows of a market. Think of your daily commute to work (if you have a job) – some days are longer, some are shorter but in general they are quite predictable. Structural refers to the underlying foundation and how it supports the system. For example, what happens if suddenly in the middle of the night the bridge everyone uses collapses. Suddenly your commute has become a lot more complicated and will remain complicated for a long time. In the real World, 6 million people had their bridge collapse and lost their jobs. Yet, in Mr. Bernanke’s World this cyclical inconvenience could easily be fixed simply by cutting interest rates to 0%, spending billions on “shovel ready” projects, and cutting taxes. Sadly, a funny thing didn’t happen - the usual boomerang (or cyclical) rebound in new jobs has not occurred, and for some strange reason the collapsed bridge hasn’t been replaced either. The high levels of employment reached during the 2004-2007 period were achieved on the backs of the housing and debt bubbles. During that time, economic growth was boosted by 400% as a result of people taking equity out of their homes (mortgage equity withdrawal). Considering no one has any equity left in their homes to withdraw, economic growth and the jobs that come with it are going to have to find another adrenalin shot. If you know the next big thing – feel free to share it, the World needs it.PBOC To Defer To Fed On Easing After Inflation Comes In Hotter Than Expected

Last week, when we commented on

the amusing spread between the Chinese PMI as measured by HSBC on one

hand (plunging) and the official number (soaring), we had one very

simple explanation for this divergence: "the Schrödinger paradox - where

the economy was doing better and worse at the same time - which was

experienced for the past three months in the US (and is now finished

with the economy rolling over), has shifted to Shanghai, where it is now

the PBOC's turn to baffle all with bullshit. Why? One simple reason:

despite what everyone believes, China still has residual and quite

strong pockets of inflation. So while the world may be expecting an RRR,

or even interest rate, cut any second now (just as China surprised

everyone literally house before the November the global FX swap line

expansion by the Fed in November 2011), the PBOC is just not sure it can afford the spike in inflation, or even perception thereof."

It appears we were correct, following the just released Chinese CPI

number, which in March printed at a far greater than expected 3.6%, on

expectations of a 3.4% print, and well above the February 3.2%.

Last week, when we commented on

the amusing spread between the Chinese PMI as measured by HSBC on one

hand (plunging) and the official number (soaring), we had one very

simple explanation for this divergence: "the Schrödinger paradox - where

the economy was doing better and worse at the same time - which was

experienced for the past three months in the US (and is now finished

with the economy rolling over), has shifted to Shanghai, where it is now

the PBOC's turn to baffle all with bullshit. Why? One simple reason:

despite what everyone believes, China still has residual and quite

strong pockets of inflation. So while the world may be expecting an RRR,

or even interest rate, cut any second now (just as China surprised

everyone literally house before the November the global FX swap line

expansion by the Fed in November 2011), the PBOC is just not sure it can afford the spike in inflation, or even perception thereof."

It appears we were correct, following the just released Chinese CPI

number, which in March printed at a far greater than expected 3.6%, on

expectations of a 3.4% print, and well above the February 3.2%.Goldman Closes Long Russell 2000 Recommendation At A Loss

And so the latest Goldman recommendation to muppets is now officially a dud.

Gold Surges As Indian Jeweller Strike Ends, Equity Futures Slide

As reported earlier, the Indian gold buying strike is

now over, and just as we predicted, gold futures are off to the races

right out of the gate, with the yellow metal surging $10 just as the

electronic market broke for trading, touching $1647, about $30 higher

compared to the liquidation rout from three days ago (has anyone seen Gartman

today?). Unfortunately, while Indian purchases of gold are sure to

provide a bid under the metal, their appetite for stocks appears to not

have risen, and as a result, ES is continuing Friday's downdraft lower,

with the E-Mini touching on 1372 in the first minutes of trading.

Finally, with Brian Sack no longer there to facilitate the overnight

ramp higher, this just may be one of those overnight futures sessions

where we do not see a miraculous melt up on absolutely nothing.

As reported earlier, the Indian gold buying strike is

now over, and just as we predicted, gold futures are off to the races

right out of the gate, with the yellow metal surging $10 just as the

electronic market broke for trading, touching $1647, about $30 higher

compared to the liquidation rout from three days ago (has anyone seen Gartman

today?). Unfortunately, while Indian purchases of gold are sure to

provide a bid under the metal, their appetite for stocks appears to not

have risen, and as a result, ES is continuing Friday's downdraft lower,

with the E-Mini touching on 1372 in the first minutes of trading.

Finally, with Brian Sack no longer there to facilitate the overnight

ramp higher, this just may be one of those overnight futures sessions

where we do not see a miraculous melt up on absolutely nothing.Greece Launches Rent-A-Cop To Fill Empty Public Servant Coffers

Now

that the time has come to expect Greek March economic data, which will

show an acceleration in the total financial collapse of a society

which is merely used as an intermediary to bail out insolvent European

banks, something that virtually everyone takes for granted, together

with a third bailout package sometime in the late summer, we can focus

on the more entertaining developments out of the country that has become

a symbol of all that is broken in Europe. Such as this story from Greek Protothema that

one can now hire a cop for as little as €30/hour. €20 more gives one

the option of chosing between the Athenian version of Erik Estrada,

together with bike and ambiguous sexual tendencies, or a K-9 option.

Finally, for those who are in need of urgent transport from point A to

point B in total security, the Greek police choppers can be had for as

little as €1500 an hour. In other words, one can own a 24/7 full-time

militia of 20 policemen for as little as €14,400 a month. Naturally, the

Greek PD has stooped so low because it simply has no money, and in its

attempt to protect and serve, it has to do a little paid

moonlighting on the side. As to what happens when all the wealthy robber

barrons and tax evaders in Greek society end up owning all the

officers in circulation, leaving the rest of the country defenseless,

well, we are confident the local underworld elements will be more than

happy to find out just what the consequences of that particular outcome

will be. But at least Greece is still in the euro. And that's all that

matters.

Now

that the time has come to expect Greek March economic data, which will

show an acceleration in the total financial collapse of a society

which is merely used as an intermediary to bail out insolvent European

banks, something that virtually everyone takes for granted, together

with a third bailout package sometime in the late summer, we can focus

on the more entertaining developments out of the country that has become

a symbol of all that is broken in Europe. Such as this story from Greek Protothema that

one can now hire a cop for as little as €30/hour. €20 more gives one

the option of chosing between the Athenian version of Erik Estrada,

together with bike and ambiguous sexual tendencies, or a K-9 option.

Finally, for those who are in need of urgent transport from point A to

point B in total security, the Greek police choppers can be had for as

little as €1500 an hour. In other words, one can own a 24/7 full-time

militia of 20 policemen for as little as €14,400 a month. Naturally, the

Greek PD has stooped so low because it simply has no money, and in its

attempt to protect and serve, it has to do a little paid

moonlighting on the side. As to what happens when all the wealthy robber

barrons and tax evaders in Greek society end up owning all the

officers in circulation, leaving the rest of the country defenseless,

well, we are confident the local underworld elements will be more than

happy to find out just what the consequences of that particular outcome

will be. But at least Greece is still in the euro. And that's all that

matters.

from TheBigPictureRT :

Kevin Kamps, Beyond Nuclear, joins Thom Hartmann. California beware! A radioactive wave is headed toward the West Coast of the United States courtesy of the Fukushima nuclear disaster? So with nuclear power still wreaking havoc on the environment – why are the Japanese about to flip on more of their nuclear reactors?

Kevin Kamps, Beyond Nuclear, joins Thom Hartmann. California beware! A radioactive wave is headed toward the West Coast of the United States courtesy of the Fukushima nuclear disaster? So with nuclear power still wreaking havoc on the environment – why are the Japanese about to flip on more of their nuclear reactors?

by Joe Weisenthal , Business Insider:

Were you annoyed by the “whining” in Jamie Dimon’s annual letter to shareholders?

Were you annoyed by the “whining” in Jamie Dimon’s annual letter to shareholders?

Go download and read the shareholder letter from M&T bank CEO Robert Wilmers. Breakingviews calls it the “must-read missive of the season.”

Why? Because rather than whine about government regulation, Wilmers takes it to the banks themselves, and blasts the industry for destroying its own reputation.

The basic gist is that at one point banks were respected industries that facilitated economic progress. In the quest for growth and trading revenue at any cost, the industry became parasitical, ultimately causing the crisis.

Here are some key parts. On the decline of the bankers’ reputation:

…A 2011 Gallup survey found that only a quarter of the American public expressed confidence in the integrity of bankers. We have reached a point at which not only do public demonstrations specifically target the financial industry but when a leading national newspaper would opine that regulation which might lower bank profits would be “a boon to the broader economy.” What’s worse is that such a view is far from entirely illogical, even if it fails to distinguish between Wall Street banks who, in my view, were central to the financial crisis and continue to distort our economy, and Main Street banks who were often victims of the crisis and are eager, under the right conditions, to extend credit to businesses that need it.

Read More @ BusinessInsider.com

Were you annoyed by the “whining” in Jamie Dimon’s annual letter to shareholders?

Were you annoyed by the “whining” in Jamie Dimon’s annual letter to shareholders?Go download and read the shareholder letter from M&T bank CEO Robert Wilmers. Breakingviews calls it the “must-read missive of the season.”

Why? Because rather than whine about government regulation, Wilmers takes it to the banks themselves, and blasts the industry for destroying its own reputation.

The basic gist is that at one point banks were respected industries that facilitated economic progress. In the quest for growth and trading revenue at any cost, the industry became parasitical, ultimately causing the crisis.

Here are some key parts. On the decline of the bankers’ reputation:

…A 2011 Gallup survey found that only a quarter of the American public expressed confidence in the integrity of bankers. We have reached a point at which not only do public demonstrations specifically target the financial industry but when a leading national newspaper would opine that regulation which might lower bank profits would be “a boon to the broader economy.” What’s worse is that such a view is far from entirely illogical, even if it fails to distinguish between Wall Street banks who, in my view, were central to the financial crisis and continue to distort our economy, and Main Street banks who were often victims of the crisis and are eager, under the right conditions, to extend credit to businesses that need it.

Read More @ BusinessInsider.com

by Madison Ruppert, Activist Post

Many people thought that the Stop Online Piracy Act (SOPA) was going to be dead for good after it was protested by millions of Internet users and some of the Web’s largest entities like Google, Wikipedia, Reddit and more.

Many people thought that the Stop Online Piracy Act (SOPA) was going to be dead for good after it was protested by millions of Internet users and some of the Web’s largest entities like Google, Wikipedia, Reddit and more.

Unfortunately, Chris Dodd, the Chairman and CEO of the Motion Picture Association of America (MPAA) and formerly a long-time Senator and Congressman, wants to bring it back and once again threaten everything that the Internet was built upon.

When asked if there were negotiations currently going on surrounding a revival of SOPA, Dodd said that he was “confident that’s the case.”

However, he wants to keep this out of the public eye and away from the scrutiny it deserves. “I’m not going to go into more detail because, obviously, if I do, it becomes counterproductive,” Dodd said.

Read More @ Activist Post

Many people thought that the Stop Online Piracy Act (SOPA) was going to be dead for good after it was protested by millions of Internet users and some of the Web’s largest entities like Google, Wikipedia, Reddit and more.

Many people thought that the Stop Online Piracy Act (SOPA) was going to be dead for good after it was protested by millions of Internet users and some of the Web’s largest entities like Google, Wikipedia, Reddit and more.Unfortunately, Chris Dodd, the Chairman and CEO of the Motion Picture Association of America (MPAA) and formerly a long-time Senator and Congressman, wants to bring it back and once again threaten everything that the Internet was built upon.

When asked if there were negotiations currently going on surrounding a revival of SOPA, Dodd said that he was “confident that’s the case.”

However, he wants to keep this out of the public eye and away from the scrutiny it deserves. “I’m not going to go into more detail because, obviously, if I do, it becomes counterproductive,” Dodd said.

Read More @ Activist Post

by Ellen Brown, Global Research:

It is well known that Philadelphia was the birthplace of the U.S.

Constitution and American democracy. Less well known is that it was

also the birthplace of public banking in America. The Philadelphia

Quakers originated a banking model involving government-issued money

lent to farmers. The profits returned to the government and the people

in a sustainable feedback loop that nourished and supported the local

economy.

It is well known that Philadelphia was the birthplace of the U.S.

Constitution and American democracy. Less well known is that it was

also the birthplace of public banking in America. The Philadelphia

Quakers originated a banking model involving government-issued money

lent to farmers. The profits returned to the government and the people

in a sustainable feedback loop that nourished and supported the local

economy.

It is well known that Philadelphia was the birthplace of the U.S.

Constitution and American democracy. Less well known is that it was

also the birthplace of public banking in America. The Philadelphia

Quakers originated a banking model involving government-issued money

lent to farmers. The profits returned to the government and the people

in a sustainable feedback loop that nourished and supported the local

economy.

It is well known that Philadelphia was the birthplace of the U.S.

Constitution and American democracy. Less well known is that it was

also the birthplace of public banking in America. The Philadelphia

Quakers originated a banking model involving government-issued money

lent to farmers. The profits returned to the government and the people

in a sustainable feedback loop that nourished and supported the local

economy.

Both landmark events will be commemorated in upcoming gatherings in Philadelphia. On April 7th, during Occupy Philly’s celebration of its six month anniversary on the mall in front of Independence Hall, the Occupy Philly General Assembly

reached consensus in support of the National Gathering Working

Group proposal to hold an Occupy National Gathering at the same location

from June 30 to July 4, 2012. The endorsement included a commitment by

Occupy Philly to provide the resources necessary to make the first

Occupy national gathering in history a resounding success. The stage

was thus set for what could be a revolutionary event located at the

historic birthplace of the First American Revolution.

Read More @ GlobalResearch.ca

[Ed. Note:

In lieu of ending these unconstitutional wars or getting our active

military the help they really need, the Pentagon is more than happy to

keep these folks hopped up on SRI's. It's the modern day version of

Huxley's Soma.]

by Kim Murphy, Los Angeles Times:

U.S. Air Force pilot Patrick Burke‘s

day started in the cockpit of a B-1 bomber near the Persian Gulf and

proceeded across nine time zones as he ferried the aircraft home to

South Dakota.

U.S. Air Force pilot Patrick Burke‘s

day started in the cockpit of a B-1 bomber near the Persian Gulf and

proceeded across nine time zones as he ferried the aircraft home to

South Dakota.

Every four hours during the 19-hour flight, Burke swallowed a tablet of Dexedrine, the prescribed amphetamine known as “go pills.” After landing, he went out for dinner and drinks with a fellow crewman. They were driving back to Ellsworth Air Force Base when Burke began striking his friend in the head.

“Jack Bauer told me this was going to happen — you guys are trying to kidnap me!” he yelled, as if he were a character in the TV show “24.”

When the woman giving them a lift pulled the car over, Burke leaped on her and wrestled her to the ground. “Me and my platoon are looking for terrorists,” he told her before grabbing her keys, driving away and crashing into a guardrail.

Read More @ LATimes.com

by Kim Murphy, Los Angeles Times:

U.S. Air Force pilot Patrick Burke‘s

day started in the cockpit of a B-1 bomber near the Persian Gulf and

proceeded across nine time zones as he ferried the aircraft home to

South Dakota.

U.S. Air Force pilot Patrick Burke‘s

day started in the cockpit of a B-1 bomber near the Persian Gulf and

proceeded across nine time zones as he ferried the aircraft home to

South Dakota.Every four hours during the 19-hour flight, Burke swallowed a tablet of Dexedrine, the prescribed amphetamine known as “go pills.” After landing, he went out for dinner and drinks with a fellow crewman. They were driving back to Ellsworth Air Force Base when Burke began striking his friend in the head.

“Jack Bauer told me this was going to happen — you guys are trying to kidnap me!” he yelled, as if he were a character in the TV show “24.”

When the woman giving them a lift pulled the car over, Burke leaped on her and wrestled her to the ground. “Me and my platoon are looking for terrorists,” he told her before grabbing her keys, driving away and crashing into a guardrail.

Read More @ LATimes.com

Ron Paul – The Invisible Candidate

from MyBudget360.com:

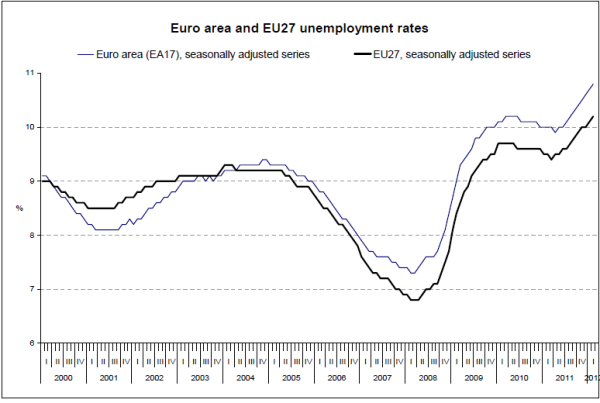

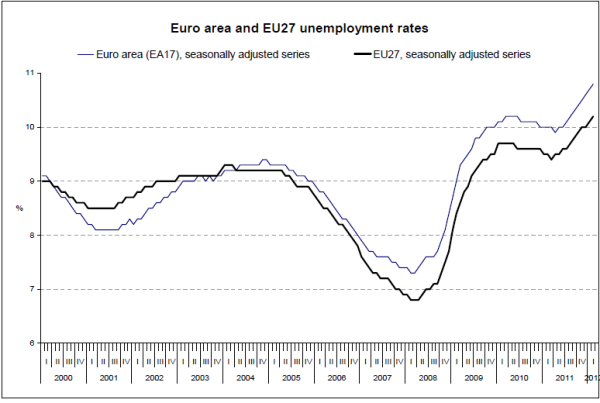

The biggest market in the world is the European Union and debt problems are still rippling through the global markets.

It is apparent with the financial crisis that the global markets are

tied together by large banks and interconnected trade. A problem in the

largest market should be unsettling and the unemployment rate in the

European Union is now at a 15 year high. The global debt problem

was never really solved but papered over with extensions and banking

trickery. The US has dealt with much of the debt issues by suspending

major accounting rules and stuffing bad loans into the Federal Reserve

like a Christmas stocking. The European Union is facing some

challenges ahead and all eyes will be watching given the impact of

contagion impacts. Greece was only a tiny sliver of the debt issues

compared to the major debt restructuring that will be necessary for a

large economy like Spain.

The biggest market in the world is the European Union and debt problems are still rippling through the global markets.

It is apparent with the financial crisis that the global markets are

tied together by large banks and interconnected trade. A problem in the

largest market should be unsettling and the unemployment rate in the

European Union is now at a 15 year high. The global debt problem

was never really solved but papered over with extensions and banking

trickery. The US has dealt with much of the debt issues by suspending

major accounting rules and stuffing bad loans into the Federal Reserve

like a Christmas stocking. The European Union is facing some

challenges ahead and all eyes will be watching given the impact of

contagion impacts. Greece was only a tiny sliver of the debt issues

compared to the major debt restructuring that will be necessary for a

large economy like Spain.

Read More @ MyBudget360.com

The biggest market in the world is the European Union and debt problems are still rippling through the global markets.

It is apparent with the financial crisis that the global markets are

tied together by large banks and interconnected trade. A problem in the

largest market should be unsettling and the unemployment rate in the

European Union is now at a 15 year high. The global debt problem

was never really solved but papered over with extensions and banking

trickery. The US has dealt with much of the debt issues by suspending

major accounting rules and stuffing bad loans into the Federal Reserve

like a Christmas stocking. The European Union is facing some

challenges ahead and all eyes will be watching given the impact of

contagion impacts. Greece was only a tiny sliver of the debt issues

compared to the major debt restructuring that will be necessary for a

large economy like Spain.

The biggest market in the world is the European Union and debt problems are still rippling through the global markets.

It is apparent with the financial crisis that the global markets are

tied together by large banks and interconnected trade. A problem in the

largest market should be unsettling and the unemployment rate in the

European Union is now at a 15 year high. The global debt problem

was never really solved but papered over with extensions and banking

trickery. The US has dealt with much of the debt issues by suspending

major accounting rules and stuffing bad loans into the Federal Reserve

like a Christmas stocking. The European Union is facing some

challenges ahead and all eyes will be watching given the impact of

contagion impacts. Greece was only a tiny sliver of the debt issues

compared to the major debt restructuring that will be necessary for a

large economy like Spain.Read More @ MyBudget360.com

by C. Powell, GATA.org:

Dear Friend of GATA and Gold:

Dear Friend of GATA and Gold:

Our friend J.T. writes:

“I’m sure you know by now, probably from all the e-mails and comments you’ve received from GATA members and other ‘gold bug’ types, that many if not most of us are so ‘up to here’ with all the information about gold market manipulation that at some level we don’t even want to hear it anymore.

“We believe it. We know it. We’ve watched it for years. It’s part of our DNA by now.

“But many if not most of us are way more than ready for you or someone else to start the new project of what to do about it.

“I no longer find much information about the manipulation to be of use. I can watch the manipulation myself. I don’t need to be told anymore. I want to know what else we can do. What else is anyone else doing?

“We know that the U.S. Commodity Futures Trading Commission and the Securities and Exchange Commission won’t do anything. Congress won’t do anything. So who will?

Read More @ GATA.org

Dear Friend of GATA and Gold:

Dear Friend of GATA and Gold:Our friend J.T. writes:

“I’m sure you know by now, probably from all the e-mails and comments you’ve received from GATA members and other ‘gold bug’ types, that many if not most of us are so ‘up to here’ with all the information about gold market manipulation that at some level we don’t even want to hear it anymore.

“We believe it. We know it. We’ve watched it for years. It’s part of our DNA by now.

“But many if not most of us are way more than ready for you or someone else to start the new project of what to do about it.

“I no longer find much information about the manipulation to be of use. I can watch the manipulation myself. I don’t need to be told anymore. I want to know what else we can do. What else is anyone else doing?

“We know that the U.S. Commodity Futures Trading Commission and the Securities and Exchange Commission won’t do anything. Congress won’t do anything. So who will?

Read More @ GATA.org

by Bob Chapman, The International Forecaster via GoldSeek.com:

We’ve all heard the old adage about adding insult to injury but the IMF

has turned it into an art form. The new IMF Director, Christine

Lagarde, came to Washington this week begging for yet more billions so

the fund can continue propping up insolvent European banks and wrapping

developing countries around the globe in debt chains. Lagarde is on a

political junket with the aim of raising an additional $500 billion for

the IMF, money that will be used for future Eurozone bailouts and other

financial crises, or so they say. The speech was delivered 64 years to

the day after Truman’s signing of the Marshall Plan (coincidence,

surely) as she asked the American taxpayers to search their hearts, take

one for the team and dig deep to help foot the bill for Europe. Except

this is not 1948 and Europe is not recovering from the Nazis. It’s 2012

and the Eurozone is falling apart at the seams because it was a failed

concept from the beginning. The cracks in the Euro have been showing for

years, despite the best efforts of the Goldman Sachs gang to paper over

the debt swap deal that helped Greece lie its way into the Eurozone and

helped Goldman earn 12 percent of its entire trading and investment

revenue in 2001 on a single day. Lagarde didn’t mention this in her

speech, but she did assure the crowd that at the IMF “your money is used

prudently.”

We’ve all heard the old adage about adding insult to injury but the IMF

has turned it into an art form. The new IMF Director, Christine

Lagarde, came to Washington this week begging for yet more billions so

the fund can continue propping up insolvent European banks and wrapping

developing countries around the globe in debt chains. Lagarde is on a

political junket with the aim of raising an additional $500 billion for

the IMF, money that will be used for future Eurozone bailouts and other

financial crises, or so they say. The speech was delivered 64 years to

the day after Truman’s signing of the Marshall Plan (coincidence,

surely) as she asked the American taxpayers to search their hearts, take

one for the team and dig deep to help foot the bill for Europe. Except

this is not 1948 and Europe is not recovering from the Nazis. It’s 2012

and the Eurozone is falling apart at the seams because it was a failed

concept from the beginning. The cracks in the Euro have been showing for

years, despite the best efforts of the Goldman Sachs gang to paper over

the debt swap deal that helped Greece lie its way into the Eurozone and

helped Goldman earn 12 percent of its entire trading and investment

revenue in 2001 on a single day. Lagarde didn’t mention this in her

speech, but she did assure the crowd that at the IMF “your money is used

prudently.”

Read More @ GoldSeek.com

I'm PayPal Verified

We’ve all heard the old adage about adding insult to injury but the IMF

has turned it into an art form. The new IMF Director, Christine

Lagarde, came to Washington this week begging for yet more billions so

the fund can continue propping up insolvent European banks and wrapping

developing countries around the globe in debt chains. Lagarde is on a

political junket with the aim of raising an additional $500 billion for

the IMF, money that will be used for future Eurozone bailouts and other

financial crises, or so they say. The speech was delivered 64 years to

the day after Truman’s signing of the Marshall Plan (coincidence,

surely) as she asked the American taxpayers to search their hearts, take

one for the team and dig deep to help foot the bill for Europe. Except

this is not 1948 and Europe is not recovering from the Nazis. It’s 2012

and the Eurozone is falling apart at the seams because it was a failed

concept from the beginning. The cracks in the Euro have been showing for

years, despite the best efforts of the Goldman Sachs gang to paper over

the debt swap deal that helped Greece lie its way into the Eurozone and

helped Goldman earn 12 percent of its entire trading and investment

revenue in 2001 on a single day. Lagarde didn’t mention this in her

speech, but she did assure the crowd that at the IMF “your money is used

prudently.”

We’ve all heard the old adage about adding insult to injury but the IMF

has turned it into an art form. The new IMF Director, Christine

Lagarde, came to Washington this week begging for yet more billions so

the fund can continue propping up insolvent European banks and wrapping

developing countries around the globe in debt chains. Lagarde is on a

political junket with the aim of raising an additional $500 billion for

the IMF, money that will be used for future Eurozone bailouts and other

financial crises, or so they say. The speech was delivered 64 years to

the day after Truman’s signing of the Marshall Plan (coincidence,

surely) as she asked the American taxpayers to search their hearts, take

one for the team and dig deep to help foot the bill for Europe. Except

this is not 1948 and Europe is not recovering from the Nazis. It’s 2012

and the Eurozone is falling apart at the seams because it was a failed

concept from the beginning. The cracks in the Euro have been showing for

years, despite the best efforts of the Goldman Sachs gang to paper over

the debt swap deal that helped Greece lie its way into the Eurozone and

helped Goldman earn 12 percent of its entire trading and investment

revenue in 2001 on a single day. Lagarde didn’t mention this in her

speech, but she did assure the crowd that at the IMF “your money is used

prudently.”Read More @ GoldSeek.com

Total donations so far this year... $10.00 Thank You James H.

Please consider making a small donation, to help cover some of the labor and costs to run this blog.

Thank You

I'm PayPal Verified

Thank You

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment