Egan Jones Downgrades USA From AA+ To AA, Outlook Negative

A few weeks ago when discussing the imminent debt ceiling breach, and the progression of US debt/GDP into the 100%+ ballpark, we reminded readers that in February S&P said it could downgrade the US again in as soon as 6 months if there was no budget plan. Not only is there no budget plan, but the US is about to have its debt ceiling fiasco repeat all over as soon in as September. Which means another downgrade from S&P is imminent, and continuing the theme of deja vu 2011, the late summer is shaping up for a major market sell off. Minutes ago, Egan Jones just reminded us of all of this, after the only rating agency that matters, just downgraded the US from AA+ to AA, with a negative outlook.Mike Krieger Explains Central Planning for Dummies

What we need to understand is that we are in one of the most dangerous phases of this crisis at the moment. The priests of fiat are being attacked from all sides. People have awoken to the Fed and how criminal and deceitful this organization is and the existential threat it poses to economic freedom and hence human liberty. The arguments against the Fed are blistering and the only rebuttal the Fed has is to spout the same old nonsense like “we saved the world” or some trite derivative of this fallacy. The only thing they saved are untalented speculators from their bad bets. What the Fed has systematically done is literally transfer all of the bad debts and bets from the banks to the taxpayer. We are living this reality to this day. This fact is becoming increasingly understood throughout society, hence the emergence of the tea party and then last year’s Occupy Wall Street movement. So the thing I want my readers to really internalize is that the Fed and indeed TPTB generally are getting slaughtered in the intellectual arena and they know it. As a result, they feel cornered and will thus act increasingly aggressive to prove they are right and everyone else is wrong.Q1 Post Mortem Stunners: Full Year 2012 EPS Forecasts Are Down 2% YTD; Apple Represents 15% Of S&P Rise

With

the record first quarter in the books we perform a quick postmortem

and find some stunning things, the first of which is that the 12% YTD

growth in the S&P YTD has been entirely due to multiple expansion: consensus 2012 EPS has declined by 2% since the start of 2012.

Why multiple expansion? Because as Goldman (this would be "bad"

Goldman in the face of David Kostin, not "good" Goldman ala Peter

Oppenheimer who top ticked the market two weeks ago by telling everyone to get out of bonds and into stocks)

which still has a 1250 year end price target says "the ECB reduced

“tail risk” via the LTRO." Which means that as of today, the market is

officially overvalued: "Since December the forward P/E multiple has

expanded by 10% from 12.1x to 13.2x, above its 35-year average of 12.9x"

even as EPS estimates have actually declined by 2% since the beginning

of the year! It gets funnier when one accounts for the outsized impact

of just one company. Apple. "Apple continues to have a significant impact on sector- and index-level results. Info Tech contributed 399 bp of the S&P 500 12% YTD return, but AAPL alone accounted for 179 bp or 15% of the rise in S&P 500 during 1Q.

The company constitutes 22% of the Info Tech sector’s market cap and

generates 22% of its earnings. Consensus expects year/year EPS growth

in 1Q 2012 of 6% for S&P 500 and 12% for Info Tech, but excluding

AAPL these expectations fall to 4% for both Tech and the index. While

Information Technology was the only sector to see margin growth in 4Q

2011, margins declined without Apple. In 1Q 2012, Tech margins are

expected to grow by 16 bp YoY in total, but fall 33 bp without AAPL."

Finally as the chart below shows, 2012 forward EPS have been declining

ever since July, when they peaked just short of 114, and are now down to

just about 105. In other words: without Apple and the margin boosting

impact of the LTRO, the quarter (and really last two quarters) would

have been a disaster. As noted earlier (and to Spain's detriment) the

LTRO effect has now phased out. How long until the Apple mania meets the

same fate?

With

the record first quarter in the books we perform a quick postmortem

and find some stunning things, the first of which is that the 12% YTD

growth in the S&P YTD has been entirely due to multiple expansion: consensus 2012 EPS has declined by 2% since the start of 2012.

Why multiple expansion? Because as Goldman (this would be "bad"

Goldman in the face of David Kostin, not "good" Goldman ala Peter

Oppenheimer who top ticked the market two weeks ago by telling everyone to get out of bonds and into stocks)

which still has a 1250 year end price target says "the ECB reduced

“tail risk” via the LTRO." Which means that as of today, the market is

officially overvalued: "Since December the forward P/E multiple has

expanded by 10% from 12.1x to 13.2x, above its 35-year average of 12.9x"

even as EPS estimates have actually declined by 2% since the beginning

of the year! It gets funnier when one accounts for the outsized impact

of just one company. Apple. "Apple continues to have a significant impact on sector- and index-level results. Info Tech contributed 399 bp of the S&P 500 12% YTD return, but AAPL alone accounted for 179 bp or 15% of the rise in S&P 500 during 1Q.

The company constitutes 22% of the Info Tech sector’s market cap and

generates 22% of its earnings. Consensus expects year/year EPS growth

in 1Q 2012 of 6% for S&P 500 and 12% for Info Tech, but excluding

AAPL these expectations fall to 4% for both Tech and the index. While

Information Technology was the only sector to see margin growth in 4Q

2011, margins declined without Apple. In 1Q 2012, Tech margins are

expected to grow by 16 bp YoY in total, but fall 33 bp without AAPL."

Finally as the chart below shows, 2012 forward EPS have been declining

ever since July, when they peaked just short of 114, and are now down to

just about 105. In other words: without Apple and the margin boosting

impact of the LTRO, the quarter (and really last two quarters) would

have been a disaster. As noted earlier (and to Spain's detriment) the

LTRO effect has now phased out. How long until the Apple mania meets the

same fate? Europe in turmoil/Spanish 10 yr bond exceed 5.68%/Euro/Swiss Franc falls to 1.20/Gold and silver rebound

Harvey Organ at Harvey Organ's - The Daily Gold and Silver Report - 7 hours ago

Good

evening Ladies and Gentlemen:

Gold closed up by $15.80 to $1628.10 at comex closing time. Silver rose

by 70 cents to $31.72.

Today we saw a mini-crash of the Euro-Swiss Franc to below the floor

1.20 (E/CFH). Spanish bonds

yields rose to 5.68% with credit default swaps on this nation rising as

well. German and UK production both fell setting the stage for Europe to

bleed red ink. The

Gold Daily and Silver Weekly Charts - The Dr. Evil Strategy and Some Targets

Please consider making a small donation, to help cover some of the labor and costs to run this blog.

Thank You

I'm PayPal Verified

Thank You

Weekly Gold Chart

Trader Dan at Trader Dan's Market Views - 10 hours ago

Gold did not have a good week falling below chart support at the 50 week

moving average for only the second time since the bottom made way back in

late 2008/early 2009. As you can see, since then it had only violated this

important chart level once and that was the very last week of trading in

2011. You might recall that funds were then dumping longs, booking profits

before year end and moving out of commodities over fears of European

sovereign debt meltdowns.

The start of the new year brought with it expectations of increased

liquidity coming from Western Central Banks to deal with... more »

Look Out Below (make sure you watch the video below)

Dave in Denver at The Golden Truth - 10 hours ago

Just a quick one today. Contrary to the public backscratching campaign

over the supposed relative strength of the economy being conducted by the

media, the real economy data continues to belie the lies being propagated

by the financial journalists, Fed officials and politicians.

First, housing is tanking and now more proof to back up my thesis that

foreclosures this year will swamp the market and push prices down even more.

Bloomberg: *Home Prices Seen Dropping 10% in U.S. on Foreclosures:

Mortgages LINK*

Reuters: *Americans brace for next foreclosure wave LINK*

Zerohedge: LIN... more »

Are The BRICs Broken? Goldman And Roubini Disagree On China

While

most of the time, it seems, investing in Emerging (or Growth) market

countries is entirely focused on just that - the growth - with little

thought given to the lower probability but high impact event of a

growth shock. Goldman uses a variety of economic and corporate factors

to compile a Growth Vulnerability Score including excess credit growth,

high levels of short-term and/or external debt, and current account

deficits. Comparing growth expectations to this growth shock score

indicates the BRICs are now in very different places from a valuation

perspective. Brazil remains 'fair' while India looks notably 'expensive'

leaving China and Russia 'cheap'. It seems, in Goldman's opinion that markets are discounting large growth risks too much for China and Russia (and not enough for India). Finally, for all the Europeans, Turkey is richest of all, with a significant growth shock potential that is notably underpriced.

Goldman's China-is-cheap perspective disagrees with Nouriel Roubini's

well-below-consensus view of an initially soft landing leading to a hard landing for China as 2013 approaches as he notes the pain that commodity exporters feel in 2012 is only a taste of the bleeding yet to come in 2013.

While

most of the time, it seems, investing in Emerging (or Growth) market

countries is entirely focused on just that - the growth - with little

thought given to the lower probability but high impact event of a

growth shock. Goldman uses a variety of economic and corporate factors

to compile a Growth Vulnerability Score including excess credit growth,

high levels of short-term and/or external debt, and current account

deficits. Comparing growth expectations to this growth shock score

indicates the BRICs are now in very different places from a valuation

perspective. Brazil remains 'fair' while India looks notably 'expensive'

leaving China and Russia 'cheap'. It seems, in Goldman's opinion that markets are discounting large growth risks too much for China and Russia (and not enough for India). Finally, for all the Europeans, Turkey is richest of all, with a significant growth shock potential that is notably underpriced.

Goldman's China-is-cheap perspective disagrees with Nouriel Roubini's

well-below-consensus view of an initially soft landing leading to a hard landing for China as 2013 approaches as he notes the pain that commodity exporters feel in 2012 is only a taste of the bleeding yet to come in 2013.Blythe Masters On The Blogosphere, Silver Manipulation, Gold-Axed Clients And Doing The "Wrong" Thing

For

all those who have long been curious what the precious metals "queen"

thinks about allegations involving her and her fimr in gold and silver

manipulation, how JPMorgan is positioned in the precious metals market,

and how she views the fringe elements of media, as well as JPMorgan's

ethical limitations to engaging in 'wrong' behavior, the answers are all

here.

For

all those who have long been curious what the precious metals "queen"

thinks about allegations involving her and her fimr in gold and silver

manipulation, how JPMorgan is positioned in the precious metals market,

and how she views the fringe elements of media, as well as JPMorgan's

ethical limitations to engaging in 'wrong' behavior, the answers are all

here.Commodities Recover As AAPL Saves The Tech Sector

The only sector of the S&P 500 that was not red today (and for that matter the week) is Tech as AAPL managed another wonderful 1.45% rally today (up 5.6% on the week - it's best performance in 3 weeks and notably AAPL hasn't had a down week since 1/13 -0.6%). As SNL might say, "we need more parabola".

Volume was average (for equities and futures) today but bigger blocks

came through to sell into the close ahead of the long weekend and

tomorrow's early excitement. Financials once again struggled and along

with Energy are the worst of the week but it is the majors (in particular Morgan Stanley) that has been hammered this week as MS is -8.2% from Europe's close on Monday with the rest of the TBTFs down around 6% - finally catching up to credit's weakness. Equities closed down marginally but sold off in futures after the close

- back below VWAP - having dropped all the way to reconnect with IG and

HY credit's less ebullient perspective this week (before credit extended its losses to its widest in three months!). Treasuries managed

to entirely recover their post-FOMC spike closing near the low yields

of the day/week with the 7Y belly outperforming on the week down around

5bps (with 30Y -1bps on the week). Commodities halted their descent (much to the chagrin of media commentators it seems) as Oil outperformed

on the day (and into the green for the week) over $103. Gold and Silver

are still underperforming the USD's gains on the week (up 1.4%) led by

EUR and CHF weakness. FX chatter was dominated by the

spike-save in EURCHF (taking out Goldman's stops) and the mirror CAD

strength JPY weakness relative to the USD. It seems EURUSD has become

relevant again as it heads back towards 1.30 the figure (3 months lows).

VIX went briefly red around the European close and

broke 17% before closing marginally higher on the day as the term

structure steepened a little more once again.

The only sector of the S&P 500 that was not red today (and for that matter the week) is Tech as AAPL managed another wonderful 1.45% rally today (up 5.6% on the week - it's best performance in 3 weeks and notably AAPL hasn't had a down week since 1/13 -0.6%). As SNL might say, "we need more parabola".

Volume was average (for equities and futures) today but bigger blocks

came through to sell into the close ahead of the long weekend and

tomorrow's early excitement. Financials once again struggled and along

with Energy are the worst of the week but it is the majors (in particular Morgan Stanley) that has been hammered this week as MS is -8.2% from Europe's close on Monday with the rest of the TBTFs down around 6% - finally catching up to credit's weakness. Equities closed down marginally but sold off in futures after the close

- back below VWAP - having dropped all the way to reconnect with IG and

HY credit's less ebullient perspective this week (before credit extended its losses to its widest in three months!). Treasuries managed

to entirely recover their post-FOMC spike closing near the low yields

of the day/week with the 7Y belly outperforming on the week down around

5bps (with 30Y -1bps on the week). Commodities halted their descent (much to the chagrin of media commentators it seems) as Oil outperformed

on the day (and into the green for the week) over $103. Gold and Silver

are still underperforming the USD's gains on the week (up 1.4%) led by

EUR and CHF weakness. FX chatter was dominated by the

spike-save in EURCHF (taking out Goldman's stops) and the mirror CAD

strength JPY weakness relative to the USD. It seems EURUSD has become

relevant again as it heads back towards 1.30 the figure (3 months lows).

VIX went briefly red around the European close and

broke 17% before closing marginally higher on the day as the term

structure steepened a little more once again. JPMorgan Trader Accused Of "Breaking" CDS Index Market With Massive Prop Position

Earlier today we listened with bemused fascination as Blythe Masters explained to CNBC how JPMorgan's trading business is "about assisting clients in executing, managing, their risks and ensuring access to capital so they can make the kind of large long-term investments that are needed in the long run to expand the supply of commodities." You know - provide liquidity. Like the High Freaks. We were even ready to believe it, especially when Blythe conveniently added that JPM has a "matched book" meaning no net prop exposure, since the opposite would indicate breach of the Volcker Rule. ...And then we read this: "A JPMorgan Chase & Co. trader of derivatives linked to the financial health of corporations has amassed positions so large that he’s driving price moves in the multi-trillion dollar market, according to traders outside the firm." Say what? A JPMorgan trader has a prop (not flow, not client, not non-discretionary) position so big it is moving the entire market? And we are talking hundreds of billions of CDS notional. But... that would mean everything Blythe said is one big lie... It would also mean that JPMorgan is blatantly and without any regard for legislation, ignoring the Volcker rule, which arrived in the aftermath of Merrill Lynch doing precisely this with various CDO and credit indexes, and "moving the market" only to blow itself up and cost taxpayers billions when the bets all LTCMed. But wait, it gets better: "In some cases, [the trader] is believed to have “broken” the index -- Wall Street lingo for the market dysfunction that occurs when a price gap opens up between the index and its underlying constituents." So JPMorgan is now privately accused of "breaking" the CDS Index market, courtesy of its second to none economy of scale and fear no reprisal for any and all actions, and in the process causing untold losses to, you guessed it, its clients, but when it comes to allegations of massive manipulation in the precious metals market, why Blythe will tell you it is all about "assisting clients in executing, managing, their risks." Which client would that be - Lehman, or MFGlobal? Perhaps it is time for a follow up interview, Ms Masters to clarify some of these outstanding points?Net Worthless: People As Corporations

US Households haven't shaken their 'junk bond' credit rating,

given their poor income statement and balance sheet. Reversing Mitt

Romney's famous quote "corporations are people", Bank Of America remains

skeptical of this self-sustaining recovery - expecting second half

growth to slow significantly as businesses and households react to the

risk of a major fiscal shock (and in the short-term, momentum looks

unsustainable). From an income statement perspective, 'a paycheck just ain't what it used to be'

with food and energy prices rising and payroll growth (typically a good

proxy for income growth) is disappointingly timid leaving real

disposable income diverging weakly from a supposed job recovery. The

balance sheet perspective has been helped by the rise of the equity

market but the recovery in net worth in the last three years has barely outstripped income growth,

leaving the ratio deeply depressed. The upshot is that the recent

pick-up in consumption is not being fueled by income or wealth gains,

but mainly by drawing down savings. Many households remain deeply distressed and react to higher costs of living by drawing down savings further.

In sum, a true virtuous cycle still seems a long way off. As weather

effects fade and gas pain builds the data should soften. BofA expects

businesses to recognize the risks of the fiscal cliff first and pull

back on hiring. Then with weaker job growth and with the

growing awareness of the cliff, consumers will likely start delaying

some discretionary spending.

US Households haven't shaken their 'junk bond' credit rating,

given their poor income statement and balance sheet. Reversing Mitt

Romney's famous quote "corporations are people", Bank Of America remains

skeptical of this self-sustaining recovery - expecting second half

growth to slow significantly as businesses and households react to the

risk of a major fiscal shock (and in the short-term, momentum looks

unsustainable). From an income statement perspective, 'a paycheck just ain't what it used to be'

with food and energy prices rising and payroll growth (typically a good

proxy for income growth) is disappointingly timid leaving real

disposable income diverging weakly from a supposed job recovery. The

balance sheet perspective has been helped by the rise of the equity

market but the recovery in net worth in the last three years has barely outstripped income growth,

leaving the ratio deeply depressed. The upshot is that the recent

pick-up in consumption is not being fueled by income or wealth gains,

but mainly by drawing down savings. Many households remain deeply distressed and react to higher costs of living by drawing down savings further.

In sum, a true virtuous cycle still seems a long way off. As weather

effects fade and gas pain builds the data should soften. BofA expects

businesses to recognize the risks of the fiscal cliff first and pull

back on hiring. Then with weaker job growth and with the

growing awareness of the cliff, consumers will likely start delaying

some discretionary spending. Researchers at one of the world’s leading think tanks have developed a

computing model that predicts serious implications for our way of life

as a result of our incessant need to consume resources like oil, food,

and fresh water. According to a team of scientists at the Massachusetts

Institute of Technology, the breaking point will come no later than

2030, and when it does, we can expect a paradigm shift unlike any we

have seen before in human history – one that will not only collapse the

economies of the world, but will cause food and energy production to

decrease so significantly that it will lead to the deaths of hundreds

of millions of people in the process.

Researchers at one of the world’s leading think tanks have developed a

computing model that predicts serious implications for our way of life

as a result of our incessant need to consume resources like oil, food,

and fresh water. According to a team of scientists at the Massachusetts

Institute of Technology, the breaking point will come no later than

2030, and when it does, we can expect a paradigm shift unlike any we

have seen before in human history – one that will not only collapse the

economies of the world, but will cause food and energy production to

decrease so significantly that it will lead to the deaths of hundreds

of millions of people in the process.The recent study, completed on behalf of The Club of Rome, an organization which issued it’s own findings on ‘peak everything’ back in the 1970′s in a controversial environmental report dubbed The Limits to Growth (video), takes into account the relations between various global developments and produces computer simulations for alternative scenarios.

Read More @ SHTFPlan

by James Quinn, BeforeItsNews.com:

“Human history seems logical in afterthought but a mystery in

forethought. Writers of history have a way of describing interwar

societies as coursing from postwar to prewar as though people alive at

the time knew when that transition occurred.” – Strauss & Howe, “The

Fourth Turning”

“Human history seems logical in afterthought but a mystery in

forethought. Writers of history have a way of describing interwar

societies as coursing from postwar to prewar as though people alive at

the time knew when that transition occurred.” – Strauss & Howe, “The

Fourth Turning”

“Watching pompous politicians, egotistical economists, arrogant investment geniuses, clueless media pundits, and self- proclaimed experts on the Great Depression predict an economic recovery and a return to normalcy would be amusing if it wasn’t so pathetic. Their lack of historical perspective does a huge disservice to the American people, as their failure to grasp the cyclical nature of history results in a broad misunderstanding of the Crisis the country is facing. The ruling class and opinion leaders are dominated by linear thinkers that believe the world progresses in a straight line. Despite all evidence of history clearly moving through cycles that repeat every eighty to one hundred years (a long human life), the present generations are always surprised by these turnings in history. I can guarantee you this country will not truly experience an economic recovery or progress for another fifteen to twenty years. If you think the last four years have been bad, you ain’t seen nothing yet.

Read More @ BeforeItsNews.com.com

“Human history seems logical in afterthought but a mystery in

forethought. Writers of history have a way of describing interwar

societies as coursing from postwar to prewar as though people alive at

the time knew when that transition occurred.” – Strauss & Howe, “The

Fourth Turning”

“Human history seems logical in afterthought but a mystery in

forethought. Writers of history have a way of describing interwar

societies as coursing from postwar to prewar as though people alive at

the time knew when that transition occurred.” – Strauss & Howe, “The

Fourth Turning”“Watching pompous politicians, egotistical economists, arrogant investment geniuses, clueless media pundits, and self- proclaimed experts on the Great Depression predict an economic recovery and a return to normalcy would be amusing if it wasn’t so pathetic. Their lack of historical perspective does a huge disservice to the American people, as their failure to grasp the cyclical nature of history results in a broad misunderstanding of the Crisis the country is facing. The ruling class and opinion leaders are dominated by linear thinkers that believe the world progresses in a straight line. Despite all evidence of history clearly moving through cycles that repeat every eighty to one hundred years (a long human life), the present generations are always surprised by these turnings in history. I can guarantee you this country will not truly experience an economic recovery or progress for another fifteen to twenty years. If you think the last four years have been bad, you ain’t seen nothing yet.

Read More @ BeforeItsNews.com.com

from Gold Money:

For some, the news blurb put out by Bloomberg, “Jobless Claims in U.S. Decrease to Lowest Level in Four Years,” is enough to believe that the economy is improving. But as usual, looking at the details matters, this will be the third consecutive ‘miss’ of expectations, and the previous numbers are constantly being revised for the worse behind the backs of market watchers.

Besides, housing has finally confirmed its double dip, with prices

falling 4 months in a row, as foreclosures are beginning to be released

off of bank’s books. Despite the structural problems of 12%

unemployment and a bloat of new currency, there are more urgent matters.

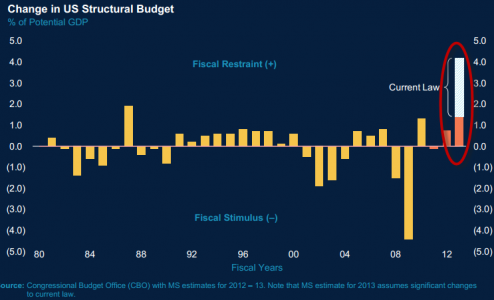

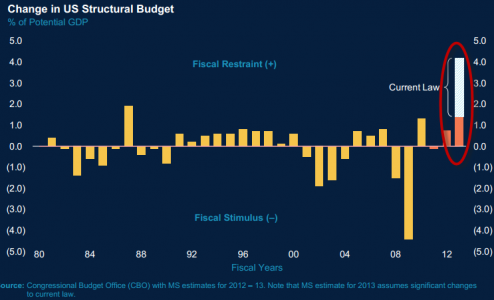

There are huge economic and political challenges to debt reduction, and

in fact, these upcoming issues are likely to be the largest fiscal drag

on the economy in the modern era.

Besides, housing has finally confirmed its double dip, with prices

falling 4 months in a row, as foreclosures are beginning to be released

off of bank’s books. Despite the structural problems of 12%

unemployment and a bloat of new currency, there are more urgent matters.

There are huge economic and political challenges to debt reduction, and

in fact, these upcoming issues are likely to be the largest fiscal drag

on the economy in the modern era.

Read More @ GoldMoney.com

For some, the news blurb put out by Bloomberg, “Jobless Claims in U.S. Decrease to Lowest Level in Four Years,” is enough to believe that the economy is improving. But as usual, looking at the details matters, this will be the third consecutive ‘miss’ of expectations, and the previous numbers are constantly being revised for the worse behind the backs of market watchers.

Besides, housing has finally confirmed its double dip, with prices

falling 4 months in a row, as foreclosures are beginning to be released

off of bank’s books. Despite the structural problems of 12%

unemployment and a bloat of new currency, there are more urgent matters.

There are huge economic and political challenges to debt reduction, and

in fact, these upcoming issues are likely to be the largest fiscal drag

on the economy in the modern era.

Besides, housing has finally confirmed its double dip, with prices

falling 4 months in a row, as foreclosures are beginning to be released

off of bank’s books. Despite the structural problems of 12%

unemployment and a bloat of new currency, there are more urgent matters.

There are huge economic and political challenges to debt reduction, and

in fact, these upcoming issues are likely to be the largest fiscal drag

on the economy in the modern era.Read More @ GoldMoney.com

from Wealth Cycles:

Eurozone Hue and Cry Will Help Justify More Fed Printing

Eurozone Hue and Cry Will Help Justify More Fed Printing

In a recent Bloomberg interview, “Premature Bundesbank calls for an ECB exit strategy have now triggered a new round of market wobbles, with a focus on Spain,” said Holger Schmieding, chief economist at Berenberg Bank in London. “The risk of a new irrational market panic remains serious.”

Spanish Prime Minister Mariano Rajoy warned that his country faces “extreme difficulty.” Spanish students mounting peaceful protests are pepper sprayed at their schools, just as occurred recently in California. Youth unemployment is similar between the two countries, hovering near 50%. Yes, half of young Spanish adults are unemployed, as they are in Greece as well.

The ECB has expanded its balance sheet by about 30% since Mario Draghi took the top banker position back in November, printing $1.3 trillion in less than six months.

Read More @ WealthCycles.com

Eurozone Hue and Cry Will Help Justify More Fed Printing

Eurozone Hue and Cry Will Help Justify More Fed PrintingIn a recent Bloomberg interview, “Premature Bundesbank calls for an ECB exit strategy have now triggered a new round of market wobbles, with a focus on Spain,” said Holger Schmieding, chief economist at Berenberg Bank in London. “The risk of a new irrational market panic remains serious.”

Spanish Prime Minister Mariano Rajoy warned that his country faces “extreme difficulty.” Spanish students mounting peaceful protests are pepper sprayed at their schools, just as occurred recently in California. Youth unemployment is similar between the two countries, hovering near 50%. Yes, half of young Spanish adults are unemployed, as they are in Greece as well.

The ECB has expanded its balance sheet by about 30% since Mario Draghi took the top banker position back in November, printing $1.3 trillion in less than six months.

Read More @ WealthCycles.com

Economic Hit Man John Perkins on the New Banana Republic and USA, Inc.

SBSS 18. Silver Confiscation

from TruthNeverTold :Dear Friends,

What we need is the second coming of a determined trader so convinced

of his/her opinion and feel for the market that taking on the gold

banks would seem like a divine calling.

The same stuff we see today went on in the great gold bull market of

the 1970s. Then I was a kid in my mid 30s with more guts than is usually

good for ones financial health.

I watched the gold dealer’s brokers, then of Phillips Brothers and J.

Aron, running the living hell out of the gold gang with the locals

jumping on the bandwagon the moment the dealers showed their selling

interest. I also saw the same quietly covering by the brokers for the

dealers taking back their sells after they had bullied the market lower,

exactly like the Goldmans and their pals do today.

The difference between today and then was there is no one with

cajones that are big and well financed enough to say enough and take

them on for mega profits. I learned from the dealers and used UBS and DB

to do my largest buying.

I fought them at key technical points only. The second time gold

tried to come up through the $400 level I was long 19,000 contracts. I

had run the locals every evening for two weeks making their shorting a

losing proposition.

Someone bought information from Bache and Company, my clearing agent,

to find out what cash I had. Down went gold through $400 with the gold

dealers selling.

I had to preserve my cash so I had to dump 9000 contracts. This dump

was not by a margin call as I never permitted that to occur. I called

myself well before the close.

All of sudden in comes DB at $380 buying with both hands and feet and

it was not me. I went out using my own floor traders to openly buy back

9000 at the market price and added an additional 5000 in Chicago.

Gold in that market never went under $400 again, but rather made it’s

great run to $887.50 with the formerly short gold dealers leading the

charge.

Believe me, you can run the gold banks if you have the courage,

knowledge, money and guts to take them on. You could flip their

algorithms against them, therein hanging them with their own rope.

What we need is Maximus, the financial gladiator, and gold would

break $3000 on the upside 90 days from the start of the reverse

strategy. The gold banks are far from omnipotent if you know how to play

their game on them.

Light the flame inherent in this market and the gold market will

bullishly run over central banks, the IMF and anyone that opposes it.

You will shift the gold banks to the long side as I did to get to over

valuation.

If you are out there and want to turn a billion into a few trillion

do I have a golden idea for you. It is all timing and intimidation.

Respectfully,

Jim

Jim

Dear CIGAs,

With many global investors still rattled by the price action of gold and silver, today King World News interviewed the “London Trader” to get his take on these markets. Here is what the source had to say: “Gold was trashed on Monday, while the Fed minutes essentially said nothing. When a central bank coordinates that kind of attack, it’s war, of course it’s war. This type of action is coordinated by Bernanke and the Fed and executed by the bullion banks. It’s actually laughable if anyone thinks that was a legitimate selloff, on what was, in reality, no news.”

The London Trader continues:

“No legitimate market participants were really selling. Sure there were some stops that were taken out, but it was the bullion banks that came in with their selling and this was what suddenly created the air pockets.

There is massive sovereign physical buying going on right now. Interestingly, the sovereign buying is being swamped by paper selling. Sovereign buyers are aggressively buying tonnage every day at these levels. You have to remember their goal is to pick up physical and get rid of dollars. Nothing has changed.

Interestingly, the Asian buyers have figured out the algorithms, like breaking an enemy’s code in war, and they are using the algorithmic trading to get the best prices each day for physical gold at these levels. The trading is just taking place at lower levels because these bullion banks and the Fed, which manage the price of gold, get overzealous in their price fixing.

But there will be a huge price to pay for their activity….

Click here to read the full interview on KingWorldNews.com…

Dear CIGAs,

Here is a short review for you before the weekend.

Street Name JANUARY 20, 2012

by: Jim Sinclair, jsmineset.com

“Investors should avoid margin accounts and instruct their broker dealer to not register stock certificates in street name.”

99.9% of brokerage account investors have no idea what is being done to them when their stock certificates are registered in “Street Name”. It allows their broker to lend their shares to short sellers, driving down the price of your investment. Additionally, this method allows the broker to “re-hypothecate” your assets and borrow money against your shares so they can speculate in the derivatives market.

“These hidden risks are the seeds of tomorrow’s ultimate collapse

of broker dealers which could dissipate the assets of customer accounts

as experienced in the MF Global fiasco.”

My Dear Friends,

Taking delivery of your share certificates and direct registration is to protect you from the MF syndrome.

The miscreants that permit shorting of gold shares are your gold

funds and gold index funds. If they would stop hurting us and themselves

to create income for themselves the market would turn a lot faster.

Regards,

Jim

Jim

Jim Sinclair’s Commentary

Recovery?

New round of mass layoffs in North America

By Barry Grey

31 March 2012

The US electronics retail chain Best Buy on Thursday announced it would close 50 stores this year and lay off 400 corporate and support workers as part of a plan to cut $800 million in costs and restructure its business. The Minnesota-based firm was one of a series of American and Canadian companies that announced major layoffs this week.

Best Buy announced the downsizing and cost-cutting plan on the same day it reported a $1.7 billion loss for its fourth quarter, which ended March 3. The company, which has 1,450 locations nationwide and 2,900 globally, is seeking to avoid the fate of its former rival Circuit City, which went out of business in 2009, wiping out tens of thousands of jobs.

Best Buy’s announcement follows last month’s announcement by the retail giant Sears Holdings of plans to sell off 1,250 of its Sears and K-Mart stores in a bid to raise $770 million, following a $2.4 billion quarterly loss. Sears did not give an estimate of job losses, but the scale of the downsizing suggests the elimination of between 10,000 and 20,000 positions.

The crisis of these retail giants is indicative of the deepening impact of economic slump and mass unemployment three-and-a half years after the Wall Street crash of September 2008. It underscores the fragile and marginal character of the jobs “recovery” of which President Barack Obama has boasted over the past several months. Obama is seeking to boost his reelection chances by presenting himself as a job creator.

While the official jobless rate has declined from 9.1 percent to 8.3 percent since last September and US payrolls have, according to the Labor Department, netted a total increase of 774,000 jobs over the past three months, there are still 5 million fewer private-sector jobs than at the official start of the recession in December 2007.

More…

Jim Sinclair’s Commentary

I am actually surprised it takes Washington that long.

Jim Sinclair’s Commentary

Recovery?

Americans brace for next foreclosure wave By Nick Carey

GARFIELD HEIGHTS, Ohio | Wed Apr 4, 2012 7:09pm EDT

(Reuters) – Half a decade into the deepest U.S. housing crisis since the 1930s, many Americans are hoping the crisis is finally nearing its end. House sales are picking up across most of the country, the plunge in prices is slowing and attempts by lenders to claim back properties from struggling borrowers dropped by more than a third in 2011, hitting a four-year low.

But a painful part two of the slump looks set to unfold: Many more U.S. homeowners face the prospect of losing their homes this year as banks pick up the pace of foreclosures.

"We are right back where we were two years ago. I would put money on 2012 being a bigger year for foreclosures than 2010," said Mark Seifert, executive director of Empowering & Strengthening Ohio’s People (ESOP), a counseling group with 10 offices in Ohio.

"Last year was an anomaly, and not in a good way," he said.

In 2011, the "robo-signing" scandal, in which foreclosure documents were signed without properly reviewing individual cases, prompted banks to hold back on new foreclosures pending a settlement.

Five major banks eventually struck that settlement with 49 U.S. states in February. Signs are growing the pace of foreclosures is picking up again, something housing experts predict will again weigh on home prices before any sustained recovery can occur.

More…

Jim Sinclair’s Commentary

If you are suspected of owing $50,000, not just if you owe?

Owe The IRS? Bill Would Suspend Passport Rights For Delinquent Taxpayers April 4, 2012 11:57 AM

LOS ANGELES (CBS) — A bill authored by a Southland lawmaker that could potentially allow the federal government to prevent any Americans who owe back taxes from traveling outside the U.S. is one step closer to becoming law.

Senate Bill 1813 was introduced back in November by Senator Barbara Boxer (D-Los Angeles) to “reauthorize Federal-aid highway and highway safety construction programs, and for other purposes” .

After clearing the Senate on a 74 – 22 vote on March 14, SB 1813 is now headed for a vote in the House of Representatives, where it’s expected to encounter stiffer opposition among the GOP majority.

In addition to authorizing appropriations for federal transportation and infrastructure programs, the “Moving Ahead for Progress in the 21st Century Act” or “MAP-21″ includes a provision that would allow for the “revocation or denial” of a passport for anyone with “certain unpaid taxes” or “tax delinquencies”.

Section 40304 of the legislation states that any individual who owes more than $50,000 to the Internal Revenue Service may be subject to “action with respect to denial, revocation, or limitation of a passport”.

More…

Jim,

Just a brief note.

In two weeks a major national paint vendor will institute their price increase. It is expected to be an increase of about 6% across the board. They are generally the leader of the pack with other companies following suit shortly thereafter. Prices have stagnated on some items after price

Continue reading Jim’s Mailbox

Just a brief note.

In two weeks a major national paint vendor will institute their price increase. It is expected to be an increase of about 6% across the board. They are generally the leader of the pack with other companies following suit shortly thereafter. Prices have stagnated on some items after price

Continue reading Jim’s Mailbox

Dear Extended Family,

Not one pro, not even Yra who is close to the establishment, believes that the action of all markets were a true price interpretation of the FOMC notes yesterday.

Today and yesterday was the product of five gold banks showing the market who in their opinion is boss. It was aimed

Continue reading In The News Today

I'm PayPal Verified

Not one pro, not even Yra who is close to the establishment, believes that the action of all markets were a true price interpretation of the FOMC notes yesterday.

Today and yesterday was the product of five gold banks showing the market who in their opinion is boss. It was aimed

Continue reading In The News Today

Please consider making a small donation, to help cover some of the labor and costs to run this blog.

Thank You

I'm PayPal Verified

Thank You

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment