Israel's Key Energy Provider, Egypt, Cuts Off All Natural Gas Supplies

Two months ago, we warned that while the world had decided to blissfully move on from last year's topic #1,

the MENA revolutions, and specifically the massive power vacuum left

in their wake, things in the region were far from fixed. Quite the

contrary, and as we added back then "it is very likely that the

Mediterranean region, flanked on one side by the broke European

countries of Greece, Italy, Spain (and implicitly Portugal), and on the

other by the unstable powder keg of post-revolutionary Libya and Egypt,

will likely become quite active yet again. Only this time, in addition

to social and economic upheavals, a religious flavor may also be added

to the mix". Yet nobody cared as after a year of daily videos showing

Molotov Cocktails dropping like flies, people had simply gotten

habituated and needed some other source of excitement. Nobody cared also

when a week ago Art Cashin warned that the hidden geopolitcal risk is not Spain but Egypt.

Today, Egypt just reminded at least one country why perhaps caution

about the instability caused by having a military in charge of the most

populous Arabic country and the one boasting "the Canal", should have

been heeded after Egypt just announced that it is cutting off

its natural gas supplies to Israel, which just so happens relies on

Egypt for 40% of its energy needs.

Two months ago, we warned that while the world had decided to blissfully move on from last year's topic #1,

the MENA revolutions, and specifically the massive power vacuum left

in their wake, things in the region were far from fixed. Quite the

contrary, and as we added back then "it is very likely that the

Mediterranean region, flanked on one side by the broke European

countries of Greece, Italy, Spain (and implicitly Portugal), and on the

other by the unstable powder keg of post-revolutionary Libya and Egypt,

will likely become quite active yet again. Only this time, in addition

to social and economic upheavals, a religious flavor may also be added

to the mix". Yet nobody cared as after a year of daily videos showing

Molotov Cocktails dropping like flies, people had simply gotten

habituated and needed some other source of excitement. Nobody cared also

when a week ago Art Cashin warned that the hidden geopolitcal risk is not Spain but Egypt.

Today, Egypt just reminded at least one country why perhaps caution

about the instability caused by having a military in charge of the most

populous Arabic country and the one boasting "the Canal", should have

been heeded after Egypt just announced that it is cutting off

its natural gas supplies to Israel, which just so happens relies on

Egypt for 40% of its energy needs.The First French Official Results Are In

8 pm has just passed in France, and all the polls are now closed, which means official preliminary data is now allowed - the first results from IPSOS are in, and are as follows:- Francois Hollande: 28.4% - with victory virtually assured in the runoff round on May 6, it is now Hollande's election to lose. Could he? Yes - read here how Sarkozy can still catch up per DB.

- Nicholas Sarkozy: 25.5% - make the runoff round

- Marine Le Pen: 20.0% - extreme right: much better than expected as nationalism is back with a bang.

- Jean-Luc Melenchon: 11.7% - extreme left: best communist showing since 1981 yet weaker than expected.

- Francois Bayrou: 8.5%

- Eva Joly: 2.0%

Guest Post: SS Agents And Prostitutes- Another Case Of The Worst Rising To The Top

Hayek, while a brilliant mind, was not right on everything. He saw the welfare state is legitimate, a need for regulation into private industries such as education and food, and the necessity of the state in providing for individual and national defense. Yet even he was able to distinguish how political power attracts those who will use in the worst manner. The Secret Service agents who procured prostitutes may be relieved of their duty but it will only serve as a cautionary tale for the rest to keep their off-duty exploits better concealed in the future. The waste and graft will go on despite a pledge from Obama for a “rigorous” probe and his potential successor’s promise to “clean house.” These promises are just political theater used to conceal the playground like mentality which possesses the attitudes of all those who wield the guns of the state.

Here Is What The "Other" Financial Health Metrics Are Showing

For all those starry-eyed readers of Floyd Norris' New York Times

real-estate column this morning who have been out viewing new homes

this afternoon and already scratching together the down-payment with the

family's EBT cards, we have a little contextual reality checking.

Norris points to the factual reality that a broad ratio of all

financial obligations - both homeowners and renters - relative to

disposable income stands at an impressive-sounding lowest level since

1984, and uses this wondrous statistic, in its sublime

uniqueness, as an indication to suggest the consumer (and home-buyer we

assume) may be coming back as the household debt burden has been so

reduced from a record 14% of disposable income to a 'mere' 10.9% now

indicating just what good little deleveraging beings we Americans have

been. However, as Nomura noted so clearly this week, this statistic is just a small part of everything when we consider the balance sheet (and not just cash-flow) of the household,

'many homeowners are likely to take little comfort from the decline in

average debt service costs relative to incomes.' For millions of

homeowners whose property is now worth less than the debt used to

finance it, mortgage interest costs may be more usefully gauged relative to the equity they retain in their homes. For them, these monthly debt

service payments are necessary to retain their claim on an asset whose

value has fallen and might not recover, as the $3.7tn negative-equity

'gap' should remind us that the economic crisis of the past decade has

taught a new generation a painful lesson about the dangers of excessive

debt.

For all those starry-eyed readers of Floyd Norris' New York Times

real-estate column this morning who have been out viewing new homes

this afternoon and already scratching together the down-payment with the

family's EBT cards, we have a little contextual reality checking.

Norris points to the factual reality that a broad ratio of all

financial obligations - both homeowners and renters - relative to

disposable income stands at an impressive-sounding lowest level since

1984, and uses this wondrous statistic, in its sublime

uniqueness, as an indication to suggest the consumer (and home-buyer we

assume) may be coming back as the household debt burden has been so

reduced from a record 14% of disposable income to a 'mere' 10.9% now

indicating just what good little deleveraging beings we Americans have

been. However, as Nomura noted so clearly this week, this statistic is just a small part of everything when we consider the balance sheet (and not just cash-flow) of the household,

'many homeowners are likely to take little comfort from the decline in

average debt service costs relative to incomes.' For millions of

homeowners whose property is now worth less than the debt used to

finance it, mortgage interest costs may be more usefully gauged relative to the equity they retain in their homes. For them, these monthly debt

service payments are necessary to retain their claim on an asset whose

value has fallen and might not recover, as the $3.7tn negative-equity

'gap' should remind us that the economic crisis of the past decade has

taught a new generation a painful lesson about the dangers of excessive

debt.Flashback from 1975: “The NSA's Capability ... Could Enable It To Impose Total Tyranny, And There Would Be No Way To Fight Back

By SGT

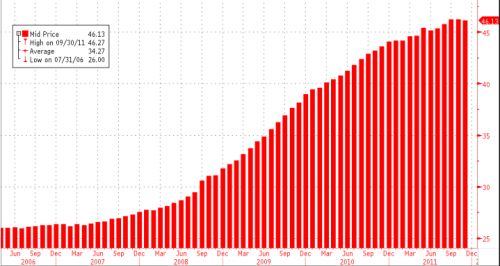

According to the Congressional Budget Office, the national debt will grow by more than $6 Trillion over the next decade.

In 2010, the United States accumulated over $3.5 billion in new debt each and every day. That’s more than $2 million per minute.

According to CNSnews, Obama and our criminally complicit Congress is still adding an average of $4.24 billion per day to the debt… by looking at the U.S. National Debt widget on the right side of SGTreport, you can see that based on these numbers the United States will surpass the $16 TRILLION debt mark within the next week or so…

There is no end to this madness in sight, just a mountain of endless debt.

Got physical?

The largest banks in Greece—National, Alpha, Eurobank, and Piraeus—reported

€28.2 billion in losses for the year 2011. Almost 13% of GDP! It

included the bond swap that had saddled private-sector bondholders with a

74% loss. But no worries. Rescue funds were already lined up at the

Hellenic Financial Stability Fund, which had received €25 billion in

bonds from the European Financial Stability Facility the day before—part

of the second bailout package of €130 billion that the Troika of the

ECB, IMF, and EU had orchestrated. The banks, not the Greeks themselves,

are getting bailed out. The big money is rolling in—and the ever wily

Greek political elite have figured it out. Read…. They’re Not Even Trying Anymore.

The largest banks in Greece—National, Alpha, Eurobank, and Piraeus—reported

€28.2 billion in losses for the year 2011. Almost 13% of GDP! It

included the bond swap that had saddled private-sector bondholders with a

74% loss. But no worries. Rescue funds were already lined up at the

Hellenic Financial Stability Fund, which had received €25 billion in

bonds from the European Financial Stability Facility the day before—part

of the second bailout package of €130 billion that the Troika of the

ECB, IMF, and EU had orchestrated. The banks, not the Greeks themselves,

are getting bailed out. The big money is rolling in—and the ever wily

Greek political elite have figured it out. Read…. They’re Not Even Trying Anymore.But “solidarity of the union has its limits,” said even soft-spoken Jens Weidmann, President of the Bundesbank on Saturday. “That’s why we linked the aid to conditions….”

A whole litany of them. And they have caused riots in the streets. But if they aren’t met, the bailout will stop. That’s the threat. A leaked report by European Commission President José Manuel Barroso includes a 15% cut in private sector wages and an overhaul of the system for collective bargaining—both of which will go over very well in Greece.

Read More @ TestosteronePit.com

As the French go to the polls today in the first round of choosing a new president, RT talks to Nicolas Dupont-Aignan, one of the candidates.

MyBudget360.com

A large part of our recovery is running on public relations trickery and smoke and mirrors debt machinery.

Let me explain what I mean by this since on the surface we have been

out of a recession since the summer of 2009. Government debt is soaring

and public debt in certain sectors is flying off the charts. Take for

example food stamp usage and student loan debt. These payments

typically rise during tough times as would be expected. So you would

conclude that being in year three of this so-called recovery that costs

for both of these sectors would be retreating. You would be absolutely

wrong in this Alice and Wonderland debt world.

The student debt market has become a predatory landmine for prospective

students and continues to grow like a wild fungus. Food stamp usage is

expected to be high deep into 2014. Can you call it a recovery by

using accounting magic that actually hides the continuing deterioration

of the middle class?

A large part of our recovery is running on public relations trickery and smoke and mirrors debt machinery.

Let me explain what I mean by this since on the surface we have been

out of a recession since the summer of 2009. Government debt is soaring

and public debt in certain sectors is flying off the charts. Take for

example food stamp usage and student loan debt. These payments

typically rise during tough times as would be expected. So you would

conclude that being in year three of this so-called recovery that costs

for both of these sectors would be retreating. You would be absolutely

wrong in this Alice and Wonderland debt world.

The student debt market has become a predatory landmine for prospective

students and continues to grow like a wild fungus. Food stamp usage is

expected to be high deep into 2014. Can you call it a recovery by

using accounting magic that actually hides the continuing deterioration

of the middle class?Read More @ MyBudget360.com

by James Turk, Gold Money:

Much has been learned from the ongoing financial debacle that has been

painfully rattling the world’s financial structure in recent years.

Foremost among these valuable lessons is the realization that all

financial assets have risks.

Much has been learned from the ongoing financial debacle that has been

painfully rattling the world’s financial structure in recent years.

Foremost among these valuable lessons is the realization that all

financial assets have risks.

Even the bonds of many sovereign nations are being called into question, and rightly so. Though often deemed to be “risk-less” because of a country’s ability to extract tax from its citizens, logic tells us that nothing in life is risk-free. This conclusion can also be reached by even a cursory reading of monetary history, or in a more meaningful and instructive way, just by closely observing financial events in recent years. Unquestionably, sovereign bonds have risks.

In fact, there are three of them. Each of these risks needs to be seriously considered and analysed before purchasing the bond of any sovereign nation.

Read More @ GoldMoney.com

Much has been learned from the ongoing financial debacle that has been

painfully rattling the world’s financial structure in recent years.

Foremost among these valuable lessons is the realization that all

financial assets have risks.

Much has been learned from the ongoing financial debacle that has been

painfully rattling the world’s financial structure in recent years.

Foremost among these valuable lessons is the realization that all

financial assets have risks.Even the bonds of many sovereign nations are being called into question, and rightly so. Though often deemed to be “risk-less” because of a country’s ability to extract tax from its citizens, logic tells us that nothing in life is risk-free. This conclusion can also be reached by even a cursory reading of monetary history, or in a more meaningful and instructive way, just by closely observing financial events in recent years. Unquestionably, sovereign bonds have risks.

In fact, there are three of them. Each of these risks needs to be seriously considered and analysed before purchasing the bond of any sovereign nation.

Read More @ GoldMoney.com

by Daisy Luther, Prison Planet:

Imagine being able to announce your intention to kill 900 million people.

Imagine being able to announce your intention to kill 900 million people.

This is pure psychopathy.

Psychopathy is defined

as “a personality disorder characterized by a pervasive pattern of

disregard for the rights of others and the rules of society. Psychopaths

have a total lack of empathy and remorse, and have very shallow

emotions. They are generally regarded as callous, selfish, dishonest,

arrogant, aggressive, impulsive, irresponsible, and hedonist.” Imagine being able to announce your intention to kill 900 million people.

Imagine being able to announce your intention to kill 900 million people.

Imagine devising a plan so cunning that people line up to be complicit in their own murders.

Imagine having the resources to put that plan into action and the

power to publically share your intention without any fear of

repercussions. This is pure psychopathy.

“The world today has 6.8 billion people… that’s headed up to about 9 billion. Now if we do a really great job on new vaccines, health care, reproductive health services, we could lower that by perhaps 10 or 15 percent.” – Bill Gates, 2010 TED Conference

Read More @ PrisonPlanet.com

[Ed. Note:

Ironically, the day after I wrote my RANT to USA Today for ignoring the

Ron Paul Revolution, reports hit the wires that a USA Today reporter

& editor are being targeted by Pentagon sock puppets. It just goes

to show that there ARE good people in all areas, and ANYONE who speaks

truth risks being the target of this fascist system.]

from AFP:

The newspaper USA Today said Friday an editor and reporter probing

Pentagon propaganda efforts have been targeted by an online

“misinformation campaign.”

The newspaper USA Today said Friday an editor and reporter probing

Pentagon propaganda efforts have been targeted by an online

“misinformation campaign.”

Fake Twitter and Facebook accounts have been created under the names of the reporter and editor with postings denigrating their professional reputations, according to the daily.

The timing of the online harassment coincided with stories by Pentagon correspondent Tom Vanden Brook, who has written about the military’s “information operations” program that spent large sums on marketing campaigns in Iraq and Afghanistan.

The program has faced criticism in and outside the Defense Department as “ineffective and poorly monitored,” the paper said.

The false online accounts, including a fake Wikipedia entry, started appearing only days after the reporter first contacted Pentagon contractors for the story, the newspaper wrote.

Read More @ News.Yahoo.com

Jim Sinclair’s Commentary

Harvey Organ: Get Physical Gold & Silver! Friday, April 20, 2012, 6:10 pm, by Adam Taggart

Harvey Organ has been analyzing the bullion markets closely for decades. The quality and accuracy of his work is respected enough to have earned him an invitation to testify before the CFTC on position limits for precious metals back in 2010.

And he minces no words: Gold and silver prices are suppressed. With extreme prejudice.

In this detailed interview, Harvey explains to Chris the mechanics of how he sees this manipulation occurring, why he predicts this fraudulent pricing scheme will collapse soon, and why it’s critical to be holding physical (vs. paper) bullion when it does.

The real suppression of the metals started in 1988. That’s when the leasing game started and was invented by J.P. Morgan.

These guys would go around to the mining companies and say, “Listen, I’m going to pay you for your gold in the ground and I will sell it. You just pay me as you bring it out.” So that was cheap financing to the miners. Barrick, the biggest mining company of them all, went in on this and it financed a lot of Nevada projects.

Once the leasing game came, the actual selling, the extra selling, suppressed the price. In the first five years, it started at maybe three hundred to four hundred tons. It didn’t start to get really bad until probably ’97-’98 with the Long Term Capital affair. And that’s when the leasing started to become around maybe 1,000 tons of gold. And it hasn’t stopped.

More…

Jim,

Thought you would be interested to know that the US House of "Representatives" has approved HR 2682, which appears to reconfirm that the end-user firms are exempt from margin and capital requirements on derivative contracts that they enter into. Interesting, don’t you think!

All the best,

Your CIGA in the mortgage finance industry

H.R. 2682: Business Risk Mitigation and Price Stabilization Act of 2011

Click here to view details on the bill…

Using Fear-Induced Churn To Build Tomorrow’s Profits CIGA Eric

Pessimism and fear reign as the gold stocks test previous resistance as support. Previous resistance was massive resistance zone of the 30-year consolidation broken in 2010. What do I think? I think long-term capital recognizes the importance of this breakout. 2012 retest, a period in which gold and gold stocks will have been pronounced dead numerous times, will be viewed no different than the retest of 1961-1962. Long-term capital will have used the fear-induced weakness and churn to build their positions for tomorrow’s profits.

S&P Gold (Formerly Precious Metals Mining)*

Hi Eric,

Do you have any thoughts on the breakdown in gold shares despite the resilient metals’ pricing? In my experience, the few institutions that have any exposure to gold stocks have generally held them as a "hedge". When things got dicey last year and gold spiked, these stocks rose moderately at best–that is to say, the "hedges" did not "work". Now that the economy is widely believed to be improving, why bother holding hedges that won’t pay off when they’re ‘supposed to’ is my guess as to the likely thought process of the fund managers obviously running for the exits on these things. What do you think?

Best, Michael

More…

Dear CIGAs,

Please click the link below to listen to this week’s metals wrap up from King World News, featuring our very own Trader Dan Norcini.

Click here to listen to the weekly metals wrap up…

Jim Sinclair’s Commentary

IMF doubles its lending firepower 20 April 2012 Last updated at 17:38 ET

The IMF says it has received firm commitments of more than $430bn.

The money is to help economies in trouble and includes just under £10bn ($15bn) from the UK in loans to the International Monetary Fund (IMF).

It is part of a global effort to bolster the fund’s lending capacity, which IMF managing director Christine Lagarde wanted to increase by $400bn.

The money doubles the fund’s firepower which threatened to become overwhelmed by the eurozone crisis.

Australia will contribute $7bn, Singapore $4bn and the Republic of Korea $15bn.

The IMF’s managing director, Christine Lagarde, said that some countries including Russia, India, China and Brazil had made private pledges but did not want to go public until they had discussed the pledges back home.

In a joint statement following the meeting in Washington, the IMF’s International Monetary and Financial Committee (IMFC) and the G20 finance ministers and Central Bank governors said: "There are firm commitments to increase resources made available to the IMF by over $400bn in addition to the quota increase under the 2010 reform."

"These resources will be available for the whole membership of the IMF, and not earmarked for any particular region."

The eurozone as a whole is contributing $200bn of the total and Japan is another major supplier of funds and is lending $60bn.

More…

Dear Jim,

I just finished reading Adam Fergusson’s “When Money Dies.” ( Weimar hyperinflation "When Money Dies" PDF file ) It walks you through the German Weimar Republic’s hyperinflationary period and aftermath. The similarities to our own situation in the USA are utterly amazing.

The book is rather difficult reading for many, not only because of the subject matter but also in its writing style. However, the epilogue summarizes the book simply and concisely. It’s worth the price of the book alone.

How Havenstein, president of the the Reichsbank (German Central Bank) denied that raising interest rates would moderate inflation. Instead, he believed higher rates would raise the cost of production, and hence prices. Furthermore, the cheap money he offered to ‘favored firms’ used this money to their best advantage – either by turning it into material assets or into a safer foreign exchange, or simply to speculate against the mark.

Lord D’Abernon (British Ambassador to Berlin) wrote in 1922 : Knowledge of currency laws – particularly Quantitative Theory (ring a bell?) – is incredibly absent in all German circles.”

Jim, let me tell you, your beliefs and warnings resonate powerfully in the summary. To quote Fergusson, “What really broke Germany was the constant taking of the soft political option in respect to money.” (Just like in the United States today, it’s easier to keep printing to keep the flock happy).

Also, “Stability came only when the abyss had been plumbed, when the credible mark could fall no more….” (Just like what you espouse, the eventual demise of the US Dollar). “For many, life became an obsessional search for Sachverte, things of ‘real’, constant value: Stinnes bought his factories, mines, newspapers. The meanest railway worker bought gewgaws (worthless, showy baubles and trinkets)."

Please have your readers take note of this book. You personify it! Thank you.

Yours in Gold,

CIGA Wolfgang Rech

I'm PayPal Verified

from AFP:

The newspaper USA Today said Friday an editor and reporter probing

Pentagon propaganda efforts have been targeted by an online

“misinformation campaign.”

The newspaper USA Today said Friday an editor and reporter probing

Pentagon propaganda efforts have been targeted by an online

“misinformation campaign.”Fake Twitter and Facebook accounts have been created under the names of the reporter and editor with postings denigrating their professional reputations, according to the daily.

The timing of the online harassment coincided with stories by Pentagon correspondent Tom Vanden Brook, who has written about the military’s “information operations” program that spent large sums on marketing campaigns in Iraq and Afghanistan.

The program has faced criticism in and outside the Defense Department as “ineffective and poorly monitored,” the paper said.

The false online accounts, including a fake Wikipedia entry, started appearing only days after the reporter first contacted Pentagon contractors for the story, the newspaper wrote.

Read More @ News.Yahoo.com

from The Daily Bell:

Huge’ water resource exists under Africa … Scientists say the

notoriously dry continent of Africa is sitting on a vast reservoir of

groundwater. They argue that the total volume of water in aquifers

underground is 100 times the amount found on the surface. The team have

produced the most detailed map yet of the scale and potential of this

hidden resource. Writing in the journal Environmental Research Letters,

they stress that large scale drilling might not be the best way of

increasing water supplies. Across Africa more than 300 million people

are said not to have access to safe drinking water. Demand for water is

set to grow markedly in coming decades due to population growth and the

need for irrigation to grow crops. – BBC

Huge’ water resource exists under Africa … Scientists say the

notoriously dry continent of Africa is sitting on a vast reservoir of

groundwater. They argue that the total volume of water in aquifers

underground is 100 times the amount found on the surface. The team have

produced the most detailed map yet of the scale and potential of this

hidden resource. Writing in the journal Environmental Research Letters,

they stress that large scale drilling might not be the best way of

increasing water supplies. Across Africa more than 300 million people

are said not to have access to safe drinking water. Demand for water is

set to grow markedly in coming decades due to population growth and the

need for irrigation to grow crops. – BBC

Dominant Social Theme: Water, water everywhere … it’s a miracle! Who would have thunk …

Free-Market Analysis: We’ve charted this elite meme for several years – water scarcity. The powers-that-be create fear-based scarcity promotions and then propose globalist solutions. Water scarcity is a big promotion for them – and this meme is a central one these days.

Right on schedule, it’s been determined that Africa has water after all. Of course, Western scientists had to make this determination.

Read More @ TheDailyBell.com

Huge’ water resource exists under Africa … Scientists say the

notoriously dry continent of Africa is sitting on a vast reservoir of

groundwater. They argue that the total volume of water in aquifers

underground is 100 times the amount found on the surface. The team have

produced the most detailed map yet of the scale and potential of this

hidden resource. Writing in the journal Environmental Research Letters,

they stress that large scale drilling might not be the best way of

increasing water supplies. Across Africa more than 300 million people

are said not to have access to safe drinking water. Demand for water is

set to grow markedly in coming decades due to population growth and the

need for irrigation to grow crops. – BBC

Huge’ water resource exists under Africa … Scientists say the

notoriously dry continent of Africa is sitting on a vast reservoir of

groundwater. They argue that the total volume of water in aquifers

underground is 100 times the amount found on the surface. The team have

produced the most detailed map yet of the scale and potential of this

hidden resource. Writing in the journal Environmental Research Letters,

they stress that large scale drilling might not be the best way of

increasing water supplies. Across Africa more than 300 million people

are said not to have access to safe drinking water. Demand for water is

set to grow markedly in coming decades due to population growth and the

need for irrigation to grow crops. – BBCDominant Social Theme: Water, water everywhere … it’s a miracle! Who would have thunk …

Free-Market Analysis: We’ve charted this elite meme for several years – water scarcity. The powers-that-be create fear-based scarcity promotions and then propose globalist solutions. Water scarcity is a big promotion for them – and this meme is a central one these days.

Right on schedule, it’s been determined that Africa has water after all. Of course, Western scientists had to make this determination.

Read More @ TheDailyBell.com

“Get

your facts straight first, then report to us. We’re busy here trying to

survive and help others transcend in a very real matrix-ruled world and

working our way around and beyond it. Don’t screw with us.” – Zen Gardner

from Zen Gardner :

They’re all doing it. From religious spewing to the political realm to phony financial prognostications and alternative community advantage-takers, inadvertently or not, it’s an easy sell that goes down smooth.

False hope sells.

Obama’s wrecking crew is the perfect example as they finish what the

last several Presidents started. Their bullshit “Hope and Change”

campaign was disgusting in its pandering to a teed-up America whose

anti-war-and-everything angst was deftly fanned into a bonfire by the

complicit media.

Obama’s wrecking crew is the perfect example as they finish what the

last several Presidents started. Their bullshit “Hope and Change”

campaign was disgusting in its pandering to a teed-up America whose

anti-war-and-everything angst was deftly fanned into a bonfire by the

complicit media.

Hence the emotional fawning over Obummer that was enough to make anyone half awake puke.

I’m more concerned about the alternative research community. I think it’s time to caution the sincere against these false hope snake oil salesmen that are bleeding the energy out of the goodhearted “wanting to believe something good” folks.

And that includes the Fulford-Wilcock preacher types and their cultish half-baked unsubstantiated claims of deliverance into a “new mafia” of all things.

No thanks.

Read More @ ZenGardner.com

from Zen Gardner :

They’re all doing it. From religious spewing to the political realm to phony financial prognostications and alternative community advantage-takers, inadvertently or not, it’s an easy sell that goes down smooth.

False hope sells.

Obama’s wrecking crew is the perfect example as they finish what the

last several Presidents started. Their bullshit “Hope and Change”

campaign was disgusting in its pandering to a teed-up America whose

anti-war-and-everything angst was deftly fanned into a bonfire by the

complicit media.

Obama’s wrecking crew is the perfect example as they finish what the

last several Presidents started. Their bullshit “Hope and Change”

campaign was disgusting in its pandering to a teed-up America whose

anti-war-and-everything angst was deftly fanned into a bonfire by the

complicit media.Hence the emotional fawning over Obummer that was enough to make anyone half awake puke.

I’m more concerned about the alternative research community. I think it’s time to caution the sincere against these false hope snake oil salesmen that are bleeding the energy out of the goodhearted “wanting to believe something good” folks.

And that includes the Fulford-Wilcock preacher types and their cultish half-baked unsubstantiated claims of deliverance into a “new mafia” of all things.

No thanks.

Read More @ ZenGardner.com

Americans are losing faith in the institutions that made this country great.

by Ron Fournier and Sophie Quinton, National Journal:

Johnny Whitmire shuts off his lawn mower and takes a long draw from a

water bottle. He sloshes the liquid from cheek to cheek and squirts it

between his work boots. He is sweating through his white T-shirt. His

jeans are dirty. His middle-aged back hurts like hell. But the calf-high

grass is cut, and the weeds are tamed at 1900 W. 10th St., a house that

Whitmire and his family once called home. “I’ve decided to keep the

place up,” he says, “because I hope to buy it back from the bank.”

Johnny Whitmire shuts off his lawn mower and takes a long draw from a

water bottle. He sloshes the liquid from cheek to cheek and squirts it

between his work boots. He is sweating through his white T-shirt. His

jeans are dirty. His middle-aged back hurts like hell. But the calf-high

grass is cut, and the weeds are tamed at 1900 W. 10th St., a house that

Whitmire and his family once called home. “I’ve decided to keep the

place up,” he says, “because I hope to buy it back from the bank.”

Whitmire tells a familiar story of how public and private institutions derailed an American’s dream: In 2000, he bought the $40,000 house with no money down and a $620 monthly mortgage. He made every payment. Then, in the fall of 2010, his partially disabled wife lost her state job. “Governor [Mitch] Daniels slashed the budget, and they looked for any excuse to squeeze people out,” Whitmire says. “We got lost in that shuffle—cut adrift.” The Whitmires couldn’t make their payments anymore.

Read More @ NationalJournal.com

by Ron Fournier and Sophie Quinton, National Journal:

Johnny Whitmire shuts off his lawn mower and takes a long draw from a

water bottle. He sloshes the liquid from cheek to cheek and squirts it

between his work boots. He is sweating through his white T-shirt. His

jeans are dirty. His middle-aged back hurts like hell. But the calf-high

grass is cut, and the weeds are tamed at 1900 W. 10th St., a house that

Whitmire and his family once called home. “I’ve decided to keep the

place up,” he says, “because I hope to buy it back from the bank.”

Johnny Whitmire shuts off his lawn mower and takes a long draw from a

water bottle. He sloshes the liquid from cheek to cheek and squirts it

between his work boots. He is sweating through his white T-shirt. His

jeans are dirty. His middle-aged back hurts like hell. But the calf-high

grass is cut, and the weeds are tamed at 1900 W. 10th St., a house that

Whitmire and his family once called home. “I’ve decided to keep the

place up,” he says, “because I hope to buy it back from the bank.”Whitmire tells a familiar story of how public and private institutions derailed an American’s dream: In 2000, he bought the $40,000 house with no money down and a $620 monthly mortgage. He made every payment. Then, in the fall of 2010, his partially disabled wife lost her state job. “Governor [Mitch] Daniels slashed the budget, and they looked for any excuse to squeeze people out,” Whitmire says. “We got lost in that shuffle—cut adrift.” The Whitmires couldn’t make their payments anymore.

Read More @ NationalJournal.com

by Simon Kennedy and Sandrine Rastello, Bloomberg :

European policy makers were urged to be tougher and more agile in their efforts to end two years of debt turmoil as the International Monetary Fund won more than $430 billion to safeguard the world economy.

European policy makers were urged to be tougher and more agile in their efforts to end two years of debt turmoil as the International Monetary Fund won more than $430 billion to safeguard the world economy.

IMF Managing Director Christine Lagarde’s push for a doubling in lending power paid off despite complaints from emerging markets wanting more say in how the fund is run and calls from some richer nations for aid to be more tightly controlled.

That left finance chiefs from the Group of 20 stressing that Europe must now justify the show of solidarity by doing even more to restore fiscal health, help banks and spur economic growth. Failure to do so could make it harder for countries such as Spain to secure aid if they falter and imperil a global recovery the G-20 labeled modest and subject to downside risks.

Read More @ Bloomberg.com

European policy makers were urged to be tougher and more agile in their efforts to end two years of debt turmoil as the International Monetary Fund won more than $430 billion to safeguard the world economy.

European policy makers were urged to be tougher and more agile in their efforts to end two years of debt turmoil as the International Monetary Fund won more than $430 billion to safeguard the world economy. IMF Managing Director Christine Lagarde’s push for a doubling in lending power paid off despite complaints from emerging markets wanting more say in how the fund is run and calls from some richer nations for aid to be more tightly controlled.

That left finance chiefs from the Group of 20 stressing that Europe must now justify the show of solidarity by doing even more to restore fiscal health, help banks and spur economic growth. Failure to do so could make it harder for countries such as Spain to secure aid if they falter and imperil a global recovery the G-20 labeled modest and subject to downside risks.

Read More @ Bloomberg.com

by Ethan A. Huff, Natural News:

Just because SOPA and PIPA, the infamous internet “kill switch” bills,

are largely dead does not mean the threat to internet free speech has

become any less serious. The Cyber Intelligence Sharing and Protection Act

(CISPA), also known as H.R. 3523, is the latest mutation of these

internet censorship and spying bills to hit the U.S. Congress — and

unless the American people speak up now to stop it, CISPA could lead to

far worse repercussions for online free speech than SOPA or PIPA ever

would have.

Just because SOPA and PIPA, the infamous internet “kill switch” bills,

are largely dead does not mean the threat to internet free speech has

become any less serious. The Cyber Intelligence Sharing and Protection Act

(CISPA), also known as H.R. 3523, is the latest mutation of these

internet censorship and spying bills to hit the U.S. Congress — and

unless the American people speak up now to stop it, CISPA could lead to

far worse repercussions for online free speech than SOPA or PIPA ever

would have.

CNET, the popular technology news website that was among many others who spoke up against SOPA and PIPA earlier in the year, is also one of many now sounding the alarm about CISPA, which was authored by Rep. Mike Rogers (R-Mich.) and Rep. Dutch Ruppersberger (D-Md.). Though the bill’s promoters are marketing it as being nothing like SOPA or PIPA, CISPA is exactly like those bills, except worse.

Read More @ NaturalNews.com

Just because SOPA and PIPA, the infamous internet “kill switch” bills,

are largely dead does not mean the threat to internet free speech has

become any less serious. The Cyber Intelligence Sharing and Protection Act

(CISPA), also known as H.R. 3523, is the latest mutation of these

internet censorship and spying bills to hit the U.S. Congress — and

unless the American people speak up now to stop it, CISPA could lead to

far worse repercussions for online free speech than SOPA or PIPA ever

would have.

Just because SOPA and PIPA, the infamous internet “kill switch” bills,

are largely dead does not mean the threat to internet free speech has

become any less serious. The Cyber Intelligence Sharing and Protection Act

(CISPA), also known as H.R. 3523, is the latest mutation of these

internet censorship and spying bills to hit the U.S. Congress — and

unless the American people speak up now to stop it, CISPA could lead to

far worse repercussions for online free speech than SOPA or PIPA ever

would have.CNET, the popular technology news website that was among many others who spoke up against SOPA and PIPA earlier in the year, is also one of many now sounding the alarm about CISPA, which was authored by Rep. Mike Rogers (R-Mich.) and Rep. Dutch Ruppersberger (D-Md.). Though the bill’s promoters are marketing it as being nothing like SOPA or PIPA, CISPA is exactly like those bills, except worse.

Read More @ NaturalNews.com

from KingWorldNews:

With investors concerned about the action in equity markets, as well

as gold and silver, today Michael Pento, of Pento Portfolio Strategies,

writes for King World News to warn that global stock markets will plunge

this summer. Pento had this to say about the situation: “I

would have thought that the decoupling myth between global economies

would have been completely discredited after the events of this past

credit crisis unfolded. Back in 2007 and early 2008, investors were

very slowly coming to the realization that the U.S. centered real estate

crisis was going to dramatically affect our domestic economy.”

With investors concerned about the action in equity markets, as well

as gold and silver, today Michael Pento, of Pento Portfolio Strategies,

writes for King World News to warn that global stock markets will plunge

this summer. Pento had this to say about the situation: “I

would have thought that the decoupling myth between global economies

would have been completely discredited after the events of this past

credit crisis unfolded. Back in 2007 and early 2008, investors were

very slowly coming to the realization that the U.S. centered real estate

crisis was going to dramatically affect our domestic economy.”

Michael Pento Continues @ KingWorldNews.com

Spain is Greece… Only Bigger and Worse

by Phoenix Capital Research, via ZeroHedge.com:

On the Surface, Spain’s debt woes have many things in common with those of Greece:

On the Surface, Spain’s debt woes have many things in common with those of Greece:

Spain is about to enter a full-scale Crisis.

A few facts about Spain

• Total Spanish banking loans are equal to 170% of Spanish GDP.

• Troubled loans at Spanish Banks just hit an 18-year high.

• Spanish Banks are drawing a record €316.3 billion from the ECB

(up from €169.2 billion in February).

Things have gotten so bad that Spanish citizens are pulling their money out of Spain en masse: €65 billion left the Spanish banking system in March 2011 alone.

Read More @ ZeroHedge.com

With investors concerned about the action in equity markets, as well

as gold and silver, today Michael Pento, of Pento Portfolio Strategies,

writes for King World News to warn that global stock markets will plunge

this summer. Pento had this to say about the situation: “I

would have thought that the decoupling myth between global economies

would have been completely discredited after the events of this past

credit crisis unfolded. Back in 2007 and early 2008, investors were

very slowly coming to the realization that the U.S. centered real estate

crisis was going to dramatically affect our domestic economy.”

With investors concerned about the action in equity markets, as well

as gold and silver, today Michael Pento, of Pento Portfolio Strategies,

writes for King World News to warn that global stock markets will plunge

this summer. Pento had this to say about the situation: “I

would have thought that the decoupling myth between global economies

would have been completely discredited after the events of this past

credit crisis unfolded. Back in 2007 and early 2008, investors were

very slowly coming to the realization that the U.S. centered real estate

crisis was going to dramatically affect our domestic economy.” Michael Pento Continues @ KingWorldNews.com

by Phoenix Capital Research, via ZeroHedge.com:

On the Surface, Spain’s debt woes have many things in common with those of Greece:

On the Surface, Spain’s debt woes have many things in common with those of Greece:Spain is about to enter a full-scale Crisis.

A few facts about Spain

• Total Spanish banking loans are equal to 170% of Spanish GDP.

• Troubled loans at Spanish Banks just hit an 18-year high.

• Spanish Banks are drawing a record €316.3 billion from the ECB

(up from €169.2 billion in February).

Things have gotten so bad that Spanish citizens are pulling their money out of Spain en masse: €65 billion left the Spanish banking system in March 2011 alone.

Read More @ ZeroHedge.com

Jim Sinclair’s Commentary

This is a scenario that you need to know about because it cannot be wholly discounted as a possibility.

Harvey Organ: Get Physical Gold & Silver! Friday, April 20, 2012, 6:10 pm, by Adam Taggart

Harvey Organ has been analyzing the bullion markets closely for decades. The quality and accuracy of his work is respected enough to have earned him an invitation to testify before the CFTC on position limits for precious metals back in 2010.

And he minces no words: Gold and silver prices are suppressed. With extreme prejudice.

In this detailed interview, Harvey explains to Chris the mechanics of how he sees this manipulation occurring, why he predicts this fraudulent pricing scheme will collapse soon, and why it’s critical to be holding physical (vs. paper) bullion when it does.

The real suppression of the metals started in 1988. That’s when the leasing game started and was invented by J.P. Morgan.

These guys would go around to the mining companies and say, “Listen, I’m going to pay you for your gold in the ground and I will sell it. You just pay me as you bring it out.” So that was cheap financing to the miners. Barrick, the biggest mining company of them all, went in on this and it financed a lot of Nevada projects.

Once the leasing game came, the actual selling, the extra selling, suppressed the price. In the first five years, it started at maybe three hundred to four hundred tons. It didn’t start to get really bad until probably ’97-’98 with the Long Term Capital affair. And that’s when the leasing started to become around maybe 1,000 tons of gold. And it hasn’t stopped.

More…

Jim,

Thought you would be interested to know that the US House of "Representatives" has approved HR 2682, which appears to reconfirm that the end-user firms are exempt from margin and capital requirements on derivative contracts that they enter into. Interesting, don’t you think!

All the best,

Your CIGA in the mortgage finance industry

H.R. 2682: Business Risk Mitigation and Price Stabilization Act of 2011

Click here to view details on the bill…

Using Fear-Induced Churn To Build Tomorrow’s Profits CIGA Eric

Pessimism and fear reign as the gold stocks test previous resistance as support. Previous resistance was massive resistance zone of the 30-year consolidation broken in 2010. What do I think? I think long-term capital recognizes the importance of this breakout. 2012 retest, a period in which gold and gold stocks will have been pronounced dead numerous times, will be viewed no different than the retest of 1961-1962. Long-term capital will have used the fear-induced weakness and churn to build their positions for tomorrow’s profits.

S&P Gold (Formerly Precious Metals Mining)*

Hi Eric,

Do you have any thoughts on the breakdown in gold shares despite the resilient metals’ pricing? In my experience, the few institutions that have any exposure to gold stocks have generally held them as a "hedge". When things got dicey last year and gold spiked, these stocks rose moderately at best–that is to say, the "hedges" did not "work". Now that the economy is widely believed to be improving, why bother holding hedges that won’t pay off when they’re ‘supposed to’ is my guess as to the likely thought process of the fund managers obviously running for the exits on these things. What do you think?

Best, Michael

More…

Dear CIGAs,

Please click the link below to listen to this week’s metals wrap up from King World News, featuring our very own Trader Dan Norcini.

Click here to listen to the weekly metals wrap up…

Jim Sinclair’s Commentary

Locked and loaded. QE to infinity, which is debt monetization on

steroids because you have no clue how terrible the wrath of the

collapsed 2008-2009 OTC WMD derivatives still are. The collapse of 2013 –

2015 will be a horror to behold. The mortal sin of the FASB is that it

remains deeply hidden from anyone’s view, being painted solvent by the

blessing of the gatekeepers of auditing, the supposed soul of truth and

transparency. Surely FASB will be damned as OTC WMD derivatives are not a

victimless crime.

IMF doubles its lending firepower 20 April 2012 Last updated at 17:38 ET

The IMF says it has received firm commitments of more than $430bn.

The money is to help economies in trouble and includes just under £10bn ($15bn) from the UK in loans to the International Monetary Fund (IMF).

It is part of a global effort to bolster the fund’s lending capacity, which IMF managing director Christine Lagarde wanted to increase by $400bn.

The money doubles the fund’s firepower which threatened to become overwhelmed by the eurozone crisis.

Australia will contribute $7bn, Singapore $4bn and the Republic of Korea $15bn.

The IMF’s managing director, Christine Lagarde, said that some countries including Russia, India, China and Brazil had made private pledges but did not want to go public until they had discussed the pledges back home.

In a joint statement following the meeting in Washington, the IMF’s International Monetary and Financial Committee (IMFC) and the G20 finance ministers and Central Bank governors said: "There are firm commitments to increase resources made available to the IMF by over $400bn in addition to the quota increase under the 2010 reform."

"These resources will be available for the whole membership of the IMF, and not earmarked for any particular region."

The eurozone as a whole is contributing $200bn of the total and Japan is another major supplier of funds and is lending $60bn.

More…

Dear Jim,

I just finished reading Adam Fergusson’s “When Money Dies.” ( Weimar hyperinflation "When Money Dies" PDF file ) It walks you through the German Weimar Republic’s hyperinflationary period and aftermath. The similarities to our own situation in the USA are utterly amazing.

The book is rather difficult reading for many, not only because of the subject matter but also in its writing style. However, the epilogue summarizes the book simply and concisely. It’s worth the price of the book alone.

How Havenstein, president of the the Reichsbank (German Central Bank) denied that raising interest rates would moderate inflation. Instead, he believed higher rates would raise the cost of production, and hence prices. Furthermore, the cheap money he offered to ‘favored firms’ used this money to their best advantage – either by turning it into material assets or into a safer foreign exchange, or simply to speculate against the mark.

Lord D’Abernon (British Ambassador to Berlin) wrote in 1922 : Knowledge of currency laws – particularly Quantitative Theory (ring a bell?) – is incredibly absent in all German circles.”

Jim, let me tell you, your beliefs and warnings resonate powerfully in the summary. To quote Fergusson, “What really broke Germany was the constant taking of the soft political option in respect to money.” (Just like in the United States today, it’s easier to keep printing to keep the flock happy).

Also, “Stability came only when the abyss had been plumbed, when the credible mark could fall no more….” (Just like what you espouse, the eventual demise of the US Dollar). “For many, life became an obsessional search for Sachverte, things of ‘real’, constant value: Stinnes bought his factories, mines, newspapers. The meanest railway worker bought gewgaws (worthless, showy baubles and trinkets)."

Please have your readers take note of this book. You personify it! Thank you.

Yours in Gold,

CIGA Wolfgang Rech

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment