from KingWorldNews:

On the heels of the Fed members commenting publicly, legendary trader

and investor, Jim Sinclair, told King World News that even though we

have already seen $17 trillion of money printing, we should expect

another $17 trillion going forward. KWN also asked Sinclair how he

knew, from the beginning, that there would be ‘QE to infinity,’ before

anyone else. But first, here is what Sinclair had to say about the

action in gold: “$1,650 is a comfortable number (for central

planners). Haven’t you seen the tremendous jawboning and market

intervention to hold gold in that range at $1,650? $1,764 and they lose

control. That begins the move which is exponential.”

On the heels of the Fed members commenting publicly, legendary trader

and investor, Jim Sinclair, told King World News that even though we

have already seen $17 trillion of money printing, we should expect

another $17 trillion going forward. KWN also asked Sinclair how he

knew, from the beginning, that there would be ‘QE to infinity,’ before

anyone else. But first, here is what Sinclair had to say about the

action in gold: “$1,650 is a comfortable number (for central

planners). Haven’t you seen the tremendous jawboning and market

intervention to hold gold in that range at $1,650? $1,764 and they lose

control. That begins the move which is exponential.”

Richard Russell continues @ KingWorldNews.com

On the heels of the Fed members commenting publicly, legendary trader

and investor, Jim Sinclair, told King World News that even though we

have already seen $17 trillion of money printing, we should expect

another $17 trillion going forward. KWN also asked Sinclair how he

knew, from the beginning, that there would be ‘QE to infinity,’ before

anyone else. But first, here is what Sinclair had to say about the

action in gold: “$1,650 is a comfortable number (for central

planners). Haven’t you seen the tremendous jawboning and market

intervention to hold gold in that range at $1,650? $1,764 and they lose

control. That begins the move which is exponential.”

On the heels of the Fed members commenting publicly, legendary trader

and investor, Jim Sinclair, told King World News that even though we

have already seen $17 trillion of money printing, we should expect

another $17 trillion going forward. KWN also asked Sinclair how he

knew, from the beginning, that there would be ‘QE to infinity,’ before

anyone else. But first, here is what Sinclair had to say about the

action in gold: “$1,650 is a comfortable number (for central

planners). Haven’t you seen the tremendous jawboning and market

intervention to hold gold in that range at $1,650? $1,764 and they lose

control. That begins the move which is exponential.”Richard Russell continues @ KingWorldNews.com

If you care about Americas future...you will donate...Now...

Ron Paul’s Urgent Plea To Supporters!

The Correction Has Got Underway

Admin at Marc Faber Blog - 6 minutes ago

The question is not whether this is a correction. The correction has got

underway. The technicals of the markets have deteriorated very badly over

the last two months. But the big question: is it the correction or is it

the beginning of a more serious downturn. - *in CNBC TV-18*

Related, SPDR S&P 500 Index ETF (SPY), iShares MSCI Emerging Markets Index

ETF (EEM)

*Marc Faber is an international investor known for his uncanny predictions

of the stock market and futures markets around the world.*

Agriculture: The Most Promising Payback

Admin at Jim Rogers Blog - 12 minutes ago

"The most promising payback in agriculture is to become a farmer." - *in MarketWatch* *Jim Rogers is an author, financial commentator and successful international investor. He has been frequently featured in Time, The New York Times, Barron’s, Forbes, Fortune, The Wall Street Journal, The Financial Times and is a regular guest on Bloomberg and CNBC.*

Today’s Items:

When Washington plans regime change, wars

are waged if other methods fail. Western-generated violence has

ravaged Syria; however, Assad remains in control. Next step, create a

black swan event and send in the Marines under the cover of peace.

After that, Iran.

Americans filing for jobless aid, at

380,000, increased to the highest level since January. In addition, the

number of Americans that are buying foreign crap is down since the

trade deficit shrank 12.4 percent to $46 billion in February. Wholesale

prices excluding food and energy costs rose 0.3 percent and this is

what the experts call a recovery?

Next…

China Developing Super Electromagnet Pulse Bomb To Use In War Against U.S.

http://www.examiner.com

China Developing Super Electromagnet Pulse Bomb To Use In War Against U.S.

http://www.examiner.com

The assassin’s mace is an EMP weapon that

China is developing against the U.S.. It can effectively send the U.S.

back to the dark ages within a second. The main goal of this weapon is

to use against aircraft carriers in any future conflict over Taiwan.

The April 5th interview by Blyth Masters

all but confirmed that their client was indeed the Federal Reserve. At

any rate, JP Morgan’s silver manipulation is no longer paying off… All

frauds eventually fail completely, and this one is being exposed. JP

Morgan is failing, and losing money on their scheme. Keep stacking!

St. Louis Federal Reserve President James

Bullard said that the unemployment rate will be 7.8 percent at the end

of 2012. Sure it will if you do not include all of those increasing

number of non-persons. Hell, we can even get the unemployment rate down

to zero using these manipulated growth model statistics. Even better…

We can add in those who wish they had a job and we will have negative

unemployment numbers.

Next…

Should Corrupt Bankers Face the Death Penalty?

http://azizonomics.com

http://ishtarsgate.wordpress.com

Should Corrupt Bankers Face the Death Penalty?

http://azizonomics.com

http://ishtarsgate.wordpress.com

Financial misdeeds ruin lives and

financial criminals in China are often executed. Sounds like more and

more people are looking for hot tar and feathers for bankers. No wonder

so many bankers are resigning; however, will that save their backsides?

Next…

Drinking Alcohol May Significantly Enhance Problem Solving Skills

http://medicaldaily.com

http://maisonbisson.com

Drinking Alcohol May Significantly Enhance Problem Solving Skills

http://medicaldaily.com

http://maisonbisson.com

Scientist found that men who drank

alcohol were able to solve brain teasers more faster and more correctly.

So, Boris Yeltsin, the drunk Russian President, who oversaw the

collapse of the Russian economy, must have been a genius.

Officials from the Treasury Department

said the deficit in March totaled $198.2 billion, a record for that

month. The Congressional Budget Office forecasts a deficit of $1.17

trillion for the entire 2012 budget year. Nothing like an election year

to ramp up government waste and spending folks.

If the worst happens, this interactive

map shows you places you will want to avoid, as well as places you can

go to get supplies.

(Ed note)...A great place to start is with our sponsors...

Steinhardt On The Fed's Failure And The End Of Wall Street As We Know It

The low interest rate 'logic' is not working

and "the economy can't gain any zest, can't gain any vigor" is how

Michael Steinhardt describes the crushing of 'widows and orphans' that

the Fed has embarked upon. In a Bloomberg TV interview, the WisdomTree

chairman notes the broad 'pall' over the equity markets (conjuring

images of a funereal procession down Trinity Street) pointing out that

there is no reason to be wildly bullish here. Citing Wall Street's lack of 'spirit',

he questions the entire raison d'etre of efficient capital transfer as

becoming secondary as he rather poignantly asks who has benefited from

Fed's policies "Certainly the banks. But ordinarily you'd say, well,

low interest rates benefit housing. It certainly hasn't benefited

housing." Reflecting on his performance as a hedge fund manager he

concludes that extraordinary performance is sadly not necessary anymore

as the money flowing into hedge funds means people do exceptionally well for themselves despite diminished performance.

While finding equities broadly unappealing, and suggesting talk of QE3

should cease, he notes there are pockets he would invest in but ends

by noting that "Bonds are no place to be".

The low interest rate 'logic' is not working

and "the economy can't gain any zest, can't gain any vigor" is how

Michael Steinhardt describes the crushing of 'widows and orphans' that

the Fed has embarked upon. In a Bloomberg TV interview, the WisdomTree

chairman notes the broad 'pall' over the equity markets (conjuring

images of a funereal procession down Trinity Street) pointing out that

there is no reason to be wildly bullish here. Citing Wall Street's lack of 'spirit',

he questions the entire raison d'etre of efficient capital transfer as

becoming secondary as he rather poignantly asks who has benefited from

Fed's policies "Certainly the banks. But ordinarily you'd say, well,

low interest rates benefit housing. It certainly hasn't benefited

housing." Reflecting on his performance as a hedge fund manager he

concludes that extraordinary performance is sadly not necessary anymore

as the money flowing into hedge funds means people do exceptionally well for themselves despite diminished performance.

While finding equities broadly unappealing, and suggesting talk of QE3

should cease, he notes there are pockets he would invest in but ends

by noting that "Bonds are no place to be".Does Obama Pay Less Taxes Than His Secretary?

Courtesy of the class division SWAT team, we already know all too well that Buffett had a lower tax rate than this secretary. We however have a question: according to just released data, the Obama's paid $789,674 in taxes in 2011...- OBAMAS PAID 20.5% IN TAXES ON $789,674 IN 2011

Art Cashin On Friday The 13th And Wall Street

Art Cashin goes through the history of Friday the 13th on Wall Street, and tells us it has a slight upward bias, being "up 55% to 60% of the time." Just don't tell that to Europe today, and especially Spain and Italian banks, both of which are getting monkeyhammered at this moment.Spain CDS On Track For Record Close

UPDATE: Break out your Spain CDS 500bps Hats! All-time record wides.

Spanish CDS, at 493bps, have just pushed above their previous record wide closing levels (though remain a few bps below their record intraday wides at 499bps from 11/17/11). The Spanish bond market, which we have numerous times indicated does not reflect the economic realities since it is so dominated by LTRO-buying and government reach-arounds, remain 45bps off their record wide spreads to Bunds. BBVA (430bps) and Santander (415bps) are also close to their record wides back in late November as their stock prices plummet.

Spain CDS Notional Update

UMichigan Confidence Drops For The First Time Since August 2011, Below Expectations - Drop Not Big Enough

As predicted earlier, UMich had no choice but to miss, because in centrally planned Bizarro markets only weak economic data leads to a rise in risk. Sure enough, with expectations of 76.2, the same as the March print, Consumer Confidence posted only its first decline since August, while missing expectations, printing at 75.7. And while a miss on its own would have led to a surge in stocks as NEW QE WOULD BE IMMINENT ANY SECOND NOW, the miss was less than the whisper number of 73.2 predicted, and as such this was merely one month of coincident data propaganda flushed down the drain. Also not helping things is that the Expectations index printed at 72.5, up from 69.8 and the highest since September 2009. With hope still so high it is hardly likely that the Fed will go ahead and appease everyone. Hope first has to be brutalized before Bernanke comes in to save the day and make the Fed appear like the 401(k)night in shining armor.

Why JPM's "Chief Investment Office" Is The World's Largest Prop Trading Desk: Fact And Fiction

"What Bernanke is to the Treasury market, Iksil is to the derivatives market"How The ECB Is Turning Spain Into Greece

As Spanish CDS surge and bonds shrug off the very recent gloss of a 'successful' Italian debt auction, the sad reality we pointed out this morning

is the increasing dependence between Spanish banks, the sovereign's

ability to borrow, and the ECB. As ING rates strategist Padhraic Garvey

notes this morning, the bulk of the LTRO2 proceeds were taken down by Italian (26%) and Spanish (36% of the total)

and the latter is even more dramatic given the considerably smaller

size of Spanish banking assets relative to Italy. The hollowing out of

the Spanish banking system, via encumbrance (ECB liquidity now

accounts for 8.6% of all Spanish banking assets), is a very high number -

on par with Greek, Irish, and Portuguese levels around 10%

where their systems are now fully dependent on the ECB for the viability

of their banks. His bottom line, Spain is not looking good here and

while plenty of chatter focuses on the ECB's ability to use its

SMP (whose longer-term effectiveness is reduced due to scale at

EUR214bn representing just 3% of Eurozone GDP), consider what

happened in Greece! The ECB did not take a Greek haircut and so the

greater the amount of Greek debt the ECB bought, the greater the

eventual haircut the private sector was forced to take. By definition, every Spanish bond that the ECB buys in its SMP program increases the default risk that private sector holders are left with.

As Spanish CDS surge and bonds shrug off the very recent gloss of a 'successful' Italian debt auction, the sad reality we pointed out this morning

is the increasing dependence between Spanish banks, the sovereign's

ability to borrow, and the ECB. As ING rates strategist Padhraic Garvey

notes this morning, the bulk of the LTRO2 proceeds were taken down by Italian (26%) and Spanish (36% of the total)

and the latter is even more dramatic given the considerably smaller

size of Spanish banking assets relative to Italy. The hollowing out of

the Spanish banking system, via encumbrance (ECB liquidity now

accounts for 8.6% of all Spanish banking assets), is a very high number -

on par with Greek, Irish, and Portuguese levels around 10%

where their systems are now fully dependent on the ECB for the viability

of their banks. His bottom line, Spain is not looking good here and

while plenty of chatter focuses on the ECB's ability to use its

SMP (whose longer-term effectiveness is reduced due to scale at

EUR214bn representing just 3% of Eurozone GDP), consider what

happened in Greece! The ECB did not take a Greek haircut and so the

greater the amount of Greek debt the ECB bought, the greater the

eventual haircut the private sector was forced to take. By definition, every Spanish bond that the ECB buys in its SMP program increases the default risk that private sector holders are left with.March Inflation Rises 0.3%, As Expected, And A Primer On CPI For Energy

No surprises in today's release of US CPI, which unlike China's still searing inflation (which is the PBoC's way to check to Bernanke on more easing) came just as expected at 0.3% headline and 0.2% core, or 2.7% Y/Y. From the release: "The indexes for food, energy, and all items less food and energy all increased in March. The gasoline index continued to rise, more than offsetting a decline in the household energy index and leading to a 0.9 percent increase in the energy index. The food index rose 0.2 percent as the index for meats, poultry, fish, and eggs increased notably. The index for all items less food and energy rose 0.2 percent in March after increasing 0.1 percent in February. Most of the major components increased in March, with the indexes for shelter and used cars and trucks accounting for about half the total increase for all items less food and energy. The indexes for medical care, apparel, recreation, new vehicles, and airline fares increased as well, while the indexes for tobacco and household furnishings and operations were among the few to decline in March." The items rising the most in March sequentially: fuel oil at 2.7%, gasoline at 1.7% and apparel at 1.3%. The only decliner was electricity at -0.8%, courtesy of nat gas plunging. With a record hot summer approaching, this is a good thing.

Gold To Repeat April, May And Q2 / Q3 2011 Gains In 2012?

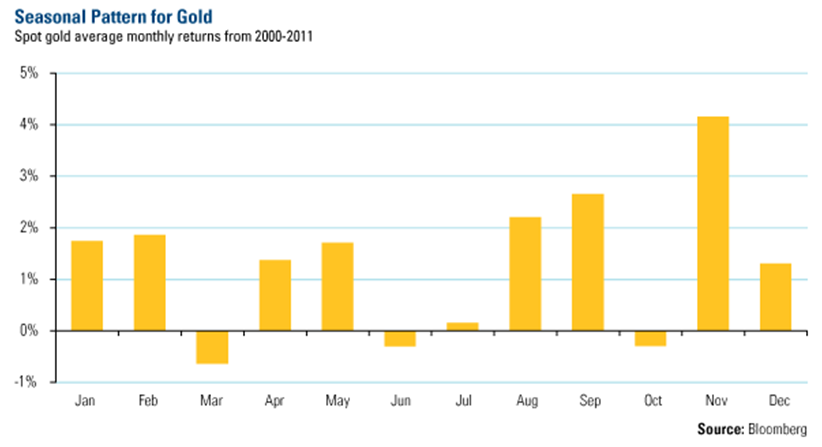

Gold bullion remains supported, mostly due to a pickup in physical Indian and Chinese gold demand this week. There are expectations of sustained Indian consumption next week in the lead up to the Akshaya Tritiya festival later this month. Western physical buying remains unusually anaemic - for now. In recent years, April and May have been positive months for gold in terms of returns (see table above). April has returned 1.4% per annum in the course of the current bull market since 2000. May has returned 1.75% per annum in the course of the current bull market since 2000. Interestingly, the last month of Q1 and Q2, March and June, have been negative in terms of returns. March in particular has seen the poorest returns for any month in the last 11 years with average falls of 0.6%. Therefore the very poor performance of gold in March 2012 (-6.4%) may represent another buying opportunity as it did last year (see chart below) and in previous years.

Daily US Opening News And Market Re-Cap: April 13

Risk-aversion is noted in the European markets with all major European bourses trading lower heading into the US open. Participants remain particularly sensitive to Spain following a release from the ECB showing that Spanish bank’s net borrowing from the ECB hit a new record high at EUR 227.6bln in March against EUR 152.4bln in February. Further pressure on the equity markets was observed following the overnight release of a below-expected Chinese GDP reading, coming in at 8.1% against a consensus estimate of 8.4%. As such, markets have witnessed a flight to safety, with Bund futures up over 40 ticks on the day. In the energy complex, WTI and Brent futures are also trading lower, as the disappointing Chinese GDP data dampens future oil demand, however a failed rocket launch from North Korea may have capped the losses.JPM Earnings Beat Courtesy Of $0.28 Benefit From Loan Loss Reserves Despite First Increase In Nonperforming Loans In Years

Earlier today JPMorgan announced results that were better than expected, with revenue of $27.4 billion on expectations of $24.1 billion, and EPS of $1.31 or $5.0 billion, on expectations of $1.17. As previously noted, the bank increased its dividend to $0.30/share, and has authorized a $15 billion new repurchase, which however will likely not be a sizable factor, as JPM has already said with the stock price at the current level buybacks are not accretive. As for the EPS beat, as usual the one-time items swamped everything else, of which the primary one, reduction in loan loss reserves which is the traditional way for the bank to pump up the bottom line, accounting for $1.8 billion or $0.28/share. We are curious how Jamie Dimon will justify this accelerating release even as the firm's Nonperforming loans increased for the first time in years from $10 billion to $10.6 billion: just the TBTF put or something else? Other amusing "one-time" items were the $1.1 billion ($0.17/share) from the WaMu bankruptcy settlement as well as a $0.9 billion loss ($0.14/share) loss from DVA this time hurting the bank as JPM's CDS tightened in Q1. Also curious was a substantial $2.5 billion expense for additional litigation reserves, which is certainly not a one-time item now that every bank is suing JPM and is merely a catch up for Dimon to where he should have been reserved. That, or something else - just what is JPM seeing that others are not (hint: ask Bank of America). This number will continue rising. So net of the real one-time items, EPS was less than a $1.00.Spain CDS Surges Just Shy Of Record As Spanish Bank ECB Borrowings Go Parabolic

On Easter Friday we presented the parabolic egg that Italy laid in March in the form of Italian bank borrowings from the ECB, which had surged by a record €75 billion to €270 billion from €195 in one month. Of course, since the US market was closed and everyone was preoccupied with the ugly NFP report, nobody paid much attention. Today, however, everyone is paying attention as Italy's counterpart in the unsalvageable periphery - Spain, just posted its monthly consolidated Eurosystem borrowings update for March. And if last week's Italian data was the Easter egg, today's parabola is the Friday the 13th funny, because Spain bank borrowings from the ECB in March soared by... €75 billion, or precisely the same amount as Italy, to €227.6 billion, the highest ever, and a 50% increase over the €152 billion in February. The result: Spain CDS touching 491 bps according to CMA, just 2 bps shy of the November all time wides. Other securities impacted: 10 Year Spanish yield + 10 bps to 5.92%, and a spread over bunds now well into the 400 bps, or 418 bps to be precise. Italy is also catching the contagious bug, with its own 10 year starting to grind wider yet again, now at 5.47%. We have the feeling as more wake up this morning, that this latest glaring confirmation that the PIIGS banks now exist solely courtesy of the ECB, will not be liked by many.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment