Breaking News

ABC Reports Tentative Debt Ceiling Deal Reached Between GOP And Obama

This could very well be another red herring like the NYT article from two weeks ago that proved to be a dud, but for what it's worth according to ABC's Jonathan Karl, the White House and the GOP have just reached a tentative deal as follows...Obama's Final Loophole: The "Catastrophic Emergency" Clause?

Politico's Ben White has pointed out something interesting, namely that while the 14th Amendment may or may not be practical under the current situation (especially not without a full blown constitutional crisis), one potential loophole that Obama may have comes from none other than former president Bush, in the form of the Homeland Security Presidential Directive-20, one which deals with such trivia as "Catastrophic Emergency", "Continuity of Government", "Continuity of Operations", and lastly, and perhaps somewhat ironically, "Enduring Constitutional Government." Considering the amount of doom and gloom spun by the government is bigger than anything seen even under Hank Paulson, could this "crisis" be interpreted by the constitutional scholar as one that merits the invocation of Homeland Security privileges? Is America's maxing out its credit card comparable to a nuclear or terrorist attack on the continent? We may find out in less than 48 hours.Meanwhile The Global Economy...

While the biggest winner of the ongoing political melodrama is C-SPAN, whose ratings have likely never been higher, and the broad audience is logically largely distracted by the hourly lack of development out of the White House, what we do know is that QE2 has failed to generate any growth in the economy, with both Q2 and Q1 GDP crashing spectacularly to a point where post another revision Q1 will be the inflection point where America re-entered another recession. Furthermore, we have seen a stark example of the economic snake eating its tail, whereby the more than proportional increase in the price of commodities, courtesy of Bernanke's policies, has offset any potential incipient growth germs that may have been lingering in the economy in Q3 2010 through Q2 2011. Yet all of these are backward looking indicators. The question is what happens to the global economy going forward? For the answer we again turn to Sean Corrigan, who remarks on some very disturbing developments in the global macro arena, which when tied in to core tenets of the Austrian Business Cycle theory, indicate that the global soft landing may be a mirage, and that the downslope we are already in, may convert into a stall from which the global airborne Titanic does not recover.

On More QE and the Recession that won’t end

07/30/2011 - 17:51

07/30/2011 - 19:53

Obviously the GDP Number Was A Lot Worse Than Expected

by the overpaid geniuses on bubblevision TV and Wall Street. Most of them really missed the boat badly on this one. If a REAL inflation number was used to adjust nominal GDP into the number that was reported, I'd bet my last 1 oz. silver eagle that real GDP was negative by quite bit.Here's a couple of other real economy news reports that should explain just how weak the economy is and just how imminent QE3 is:

Container-Ship Plunge Signals U.S. Slowdown - Plunging rates for chartering container vessels that carry sneakers, furniture and flat-screen TVs may signal a U.S. consumer slowdown and losses for shipping lines in what is traditionally their busiest time of the year. LINK

Juniper Sends Grim Signal - Juniper Networks Inc. offered some new clues that the U.S. economy is stalling, warning of slowing sales growth that sent its stock plunging 21% in trading Wednesday. LINK

Merck to Cut Up to 13,000 Jobs - Merck is cutting costs, expanding in emerging markets and spending on research and development...LINK

Good to see that Merck is following the example set by Obama's jobs Czar - GE's Jeffrey Immelt - and cutting jobs here and shifting the workforce to emerging markets. I'm guessing this is Obama's implicit yet official jobs policy now.

And here is what a former Chinese central banker is now advising Chinese policy-makers: Yu Yongding Says China Needs to Hold Less Treasuries as Safety a ‘Mirage’ - “U.S. bonds are not safe, but people think they are safe,” Yu, a researcher at a Beijing institute under the Chinese Academy of Social Sciences, told reporters at a briefing in Mumbai, India, today. “That is a mirage.” LINK

It will be just wonderful if we get a new debt-limit deal - and we will. But who the hell is going to buy all the new Treasury bonds that have to issued if our largest financier - the Chinese - decide to stop being the monetary crack dealer for our abusively reckless Government? Are you? I'm not...

Anyone not moving most of their investible money into gold and silver right now is an idiot. I have 90% of my net worth in the physical metal and in mining stocks. Everyone needs to understand that the dollar is going a LOT lower. Knowing that, why on earth would you want to own anything denominated in dollars? And that includes any metals ETF other than PHYS and PSLV. Yes, technically mining stocks are dollar assets, but I anticipate that because their business is gold and silver, the price performance of mining stocks will far outpace the rate of decline in the dollar.

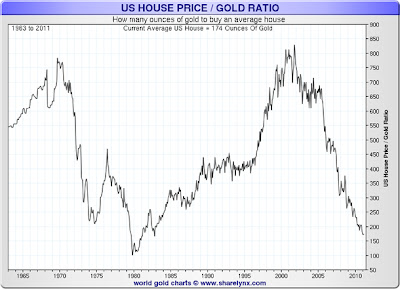

Here's a good illustration of my point, with a chart from Sharelynx that shows how the value of your house is declined when you price it in terms of gold:

(CLICK ON CHART TO ENLARGE)

Tip Jar.

Thank You

I'm PayPal Verified

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment