Steve Wynn Annihilates Barack Obama: "This Administration Is The Greatest Wet Blanket To Business And Job Creation In My Lifetime"

During the just completed Wynn earnings calls we

witnessed what is without doubt the most blistering and scathing

critique of Obama's administration to date by anybody in the public

domain. To wit:"I believe in Las Vegas, I think its best days

are ahead of it, but I'm afraid to do anything in the current political

environment in the United States...I'm saying it bluntly that this

administration is the greatest wet blanket to business and progress and

job creation in my lifetime... And those of us who have business

opportunities and the capital to do it, are going to sit in fear of the

President...The guy keeps making speeches about redistribution, and

maybe's ought to do something to businesses that don't invest, they're

holding too much money. You know, we haven't heard that kind of money

except from pure socialists....And until he's gone, everybody is going

to be sitting on their thumbs.

Developed World Default Risk In Race To Top After German, UK CDS Surge By 50% In Two Weeks

Many associate exploding CDS as a feature of backward third world countries, or, as they are better known these days, PIIGS. It may thus come as a surprise to most that the default risk of not only the US, which we reported had recently hid a multi year high, but especially Germany and the UK have surged by well over 50% in the past month. In fact, Germany, by most objective evaluations, an economy that is far more resilient and productive than America's, has in the past 3 days seen its CDS surge to a level 10 basis points wide of the US. And if not the actual economy, what then? Why such monstrosities as Deutsche Bank and Commerzbank, which as reported previously have caused many to doubt are as viable as the stress tests represents, and whose combined asset bases are well over the total GDP of Germany. As the for the UK, after trading at around 55 bps for months, the spread has jumped to nearly 80 bps. So as Sigma X indicated earlier that it may now be time to shift attention to the UK, have the vigilantes already succeeded in penetrating all the way to the very core of the Eurozone? Or, courtesy of ISDA's criminal abdication of its responsibilities by pre-determining that no development in the future of Greece would be an event of default, perhaps the only natural response now is to buy protection on those names which have not blown out to ridiculous (read 600 bps or wider) spreads. Which, however, is very bad news for the Eurozone core, as going forward investors will simply hedge peripheral cash risk with core synthetic: a process which will result in the eventual wipe out of both instruments. But that's precisely what happens when the CDS administrator and "regulator" decides to play ball with the central planners instead of the siding with market participants: unintended escalating consequences galore.

ilene

07/18/2011 - 21:49

Charting 60 Years Of Defense Spending, And Why The Mean Reversion Will Cost Millions Of Jobs

Moody's is out with a comprehensive chart of defense spending since 1946 which shows that while over the years the average yearly amount spent on defense by the US government has been around $400 billion, in the past decade this amount has surged to an all time high of just under $750 billion. And while one can debate the reasons for why America spends 20% of annual revenues on military (and debate even more why this number has continued to surge under a Nobel Peace Prize winning president), one thing is rather certain: this number will decline in the coming months and years as Washington has no choice but to cut the defense budget. And while this will likely be a multi-year process, it will have substantial implications for not only the defense companies identified, but for their respectively supply-chains, resulting in hundreds of thousands and possibly millions of layoffs over the next decade as government-sourced revenue plummets and yet another layer of overhead will have to be trimmed.

Stub Quote Ban Apparently Just As Powerless As The SEC

Remember when back in November the SEC banned stub quotes, which the worthless regulators from the SEC even had the gall to blame the flash crash on, yet whose elimination was supposed to return investor confidence in the stock market and practically ensure that there would be no future HFT-induced manipulation or mini (tall, or venti) flash crashes every agan? Well... it's baaaack.

Guest Post: Doing The Global Currency Shuffle

In mainstream financial circles, the concept of a

global currency is often spoken of only with an air of caution. It is

approached always in hypothetical terms. It is whispered of as some far

off dream; a socio-economic moon landing in the far reaches of fiscal

space. Perhaps in 2015, or 2020, or maybe 2050, but certainly never just

over the horizon, or right around the corner posing as an innocuous

trade asset created over 40 years ago and used only on rare occasions.

Unfortunately, the development of a centralized global security

representing the creation of a supranational economic body is much

closer than many would care to admit…

Goldman's FX Team Generates 40% Annualized Loss For Clients Per Its Latest Disastrous Recommendation

And another humiliating notch on Goldman's "client facing" FX team's bedpost... And another win for the firm's prop desk.

As David Cameron Resignation Odds Surge From 100/1 To 8/1 In Hours, Is UK Default (And Contagion) Risk Set To Follow?

What started off as a simple, if very much

illegal, information gathering protocol (and yes, NOTW is most certainly

not the only organization that hacked voice mails), and has since

escalated to an epic shakedown of one of the world's most legendary

media companies in which Murdoch himself now appears on the verge of

leaving the company, appears set to ultimately result in a historic

parliamentary collapse, with the Prime Minister of the UK David Cameron

seen as the ultimate fallguy. As English booking agency reports, "David

Cameron's odds of leaving the Cabinet have been slashed by Ladbrokes. The

bookies have taken a steady stream of bets on the PM leaving office

with the odds dropping from 100/1 to 20/1 and now 8/1 in a matter of

hours." In other words anyone who bet that the shuttering of

the NOTW was merely the first step in the News Corp. scandal and that it

would reach as high as the pinnacle of UK leadership, has made a return

well over 10 times in the past several days. And yet, as the Economist

chimes in with a late night piece, the departure of Cameron at this

point is far from certain. Which is arguably a far worse state of

affairs: if there is anything the markets hate, it is uncertainty. If

Cameron was sure to stay or go, it would have no impact on the UK's

economy and financial markets. As it stands, and with Murdochgate

getting worse by the minute, we would not be surprised to see UK CDS

follow the US and Germany to multi-year highs, as the UK now openly

becomes yet another target for the bond vigilantes who relish precisely

this kind of uncertain inbetweenness.

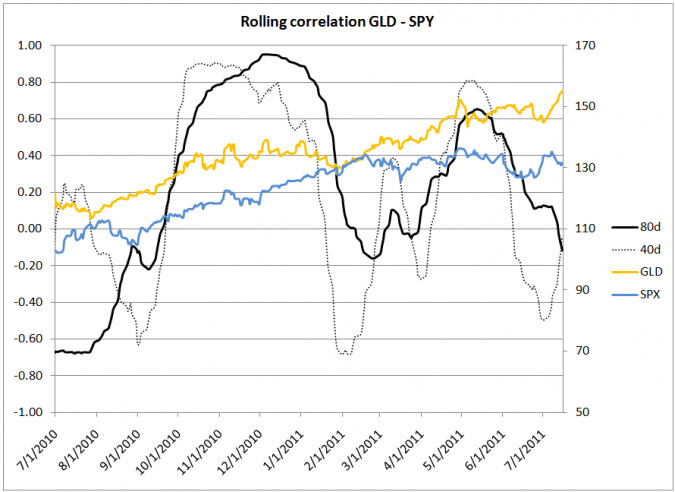

Guest Post: Gold And Stocks Love Inflation, Right?

In theory, stock prices react positively to inflation. You can explain that with the balance sheet effect: while debt remains same in nominal terms, assets gain in value (with the difference showing up in the equity position via net profit). Gold should also benefit from inflation as the supply of precious metals is limited – hence they will go up in price if money supply increases. Taken together we should assume that gold and stocks are positively correlated (if one moves up, the other one does the same)...

Developing: Rupert Murdoch Considers Stepping Down As Head Of News Corp., COO Chasey Carey To Replace Him

Some breaking news out of Bloomberg TV which has

just announed that Rupert Murdoch may step down as CEO of News Corp.

contingent on his perfomance before parliament tomorrow, and that News

Corp COO Chase Carey is being considered as his replacement.

LulzSec Is Back After Hacking The Front Page Of The Sun, Redirecting To Story About Rupert Murdoch's Death

It was only a few short weeks ago that we

reported that the hacker group LulzSec which among others hacked the

FBI, Sony, and who knows how many other security agencies, has decided

to shut down. That didn't last long. As of a few minutes ago, The Sun's

front page redirects to a makeshift website called New-Times.co.uk which

carries a headline story titled "Media Moguls Body Discovered" which

reports that "Rupert Murdoch, the controversial media mogul, has

reportedly been found dead in his garden, police announce." Readers can

experience the hack for themselves by going to thesun.co.uk.

Naturally, that this is like poking a stick in an already angry

hornet's nest goes without mention. As for the masses, we expect the

distraction should be quite welcome.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment