There’s no question that the world economy has been shaky at best since the crash of 2008. Yet, politicians, central banks, et al., have, since then, regularly announced that “things are picking up.” One year, we hear an announcement of “green shoots.” The next year, we hear an announcement of “shovel-ready jobs.” And yet, year after year, we witness the continued economic slump. Few dare call it a depression, but, if a depression can be defined as “a period of time in which most people’s standard of living drops significantly,” a depression it is.

by Andy Hoffman, Miles Franklin:

This morning, the Financial Times – the UK’s more straight-laced (read: boring) version of America’s relentlessly pro-Central bank, propaganda-spewing Wall Street Journal

– claimed China’s government has “abandoned large scale purposes” as a

means of supporting its collapsing stock market. To which, I ask the

same ‘pink elephant in the room’ question; i.e., how the hell would they

know what the Chinese government is doing? I mean, it’s not like they tell us. And moreover, whatever they do report – as in the UK, the U.S., and everywhere – is a flat out lie these days. Like China, for example, in still reporting a 6.8% GDP growth, when in fact it’smassively declining.

Not to mention, the fact that Central banks such as the PBOC – as a

rule – execute far more “monetary policy” covertly than overtly; such

as, for example, the Fed opaque overseas “swap agreements” and plain old

covert Treasury and mortgage-backed bond buying.

This morning, the Financial Times – the UK’s more straight-laced (read: boring) version of America’s relentlessly pro-Central bank, propaganda-spewing Wall Street Journal

– claimed China’s government has “abandoned large scale purposes” as a

means of supporting its collapsing stock market. To which, I ask the

same ‘pink elephant in the room’ question; i.e., how the hell would they

know what the Chinese government is doing? I mean, it’s not like they tell us. And moreover, whatever they do report – as in the UK, the U.S., and everywhere – is a flat out lie these days. Like China, for example, in still reporting a 6.8% GDP growth, when in fact it’smassively declining.

Not to mention, the fact that Central banks such as the PBOC – as a

rule – execute far more “monetary policy” covertly than overtly; such

as, for example, the Fed opaque overseas “swap agreements” and plain old

covert Treasury and mortgage-backed bond buying.

Read More…

This morning, the Financial Times – the UK’s more straight-laced (read: boring) version of America’s relentlessly pro-Central bank, propaganda-spewing Wall Street Journal

– claimed China’s government has “abandoned large scale purposes” as a

means of supporting its collapsing stock market. To which, I ask the

same ‘pink elephant in the room’ question; i.e., how the hell would they

know what the Chinese government is doing? I mean, it’s not like they tell us. And moreover, whatever they do report – as in the UK, the U.S., and everywhere – is a flat out lie these days. Like China, for example, in still reporting a 6.8% GDP growth, when in fact it’smassively declining.

Not to mention, the fact that Central banks such as the PBOC – as a

rule – execute far more “monetary policy” covertly than overtly; such

as, for example, the Fed opaque overseas “swap agreements” and plain old

covert Treasury and mortgage-backed bond buying.

This morning, the Financial Times – the UK’s more straight-laced (read: boring) version of America’s relentlessly pro-Central bank, propaganda-spewing Wall Street Journal

– claimed China’s government has “abandoned large scale purposes” as a

means of supporting its collapsing stock market. To which, I ask the

same ‘pink elephant in the room’ question; i.e., how the hell would they

know what the Chinese government is doing? I mean, it’s not like they tell us. And moreover, whatever they do report – as in the UK, the U.S., and everywhere – is a flat out lie these days. Like China, for example, in still reporting a 6.8% GDP growth, when in fact it’smassively declining.

Not to mention, the fact that Central banks such as the PBOC – as a

rule – execute far more “monetary policy” covertly than overtly; such

as, for example, the Fed opaque overseas “swap agreements” and plain old

covert Treasury and mortgage-backed bond buying.Read More…

The leverage in all markets suggests a “holiday” will occur because the unwinding cannot be orderly

by Bill Holter, SGT Report:

“Something” happened three weeks ago.

While we cannot be sure “what” exactly happened, we can speculate. We

have many dots and lots of data points to help us but first it needs to

be pointed out, even if wrong in conclusion …just the knowledge alone

that “something changed” is enough. If you know something has changed,

you can take clues and look at various markets for inflection points.

Currently, most markets are stretched to various limits. Whether it be

zero bound credit markets, equities, real estate, commodities or gold

and silver, all values had reached extreme highs or lows.

“Something” happened three weeks ago.

While we cannot be sure “what” exactly happened, we can speculate. We

have many dots and lots of data points to help us but first it needs to

be pointed out, even if wrong in conclusion …just the knowledge alone

that “something changed” is enough. If you know something has changed,

you can take clues and look at various markets for inflection points.

Currently, most markets are stretched to various limits. Whether it be

zero bound credit markets, equities, real estate, commodities or gold

and silver, all values had reached extreme highs or lows.

Something changed three weeks ago and a series of events began. It all started with China announcing 600 additional tons of gold. This was followed by the IMF rebuff of China, the three yuan devaluations and three “coincidental” explosions. Then equity markets around the world (which were already weak) began to violently unravel and finally spilled over to the U.S.. This tested the PPT’s limits (which were apparently $23 billion last week).

Read More

by Bill Holter, SGT Report:

“Something” happened three weeks ago.

While we cannot be sure “what” exactly happened, we can speculate. We

have many dots and lots of data points to help us but first it needs to

be pointed out, even if wrong in conclusion …just the knowledge alone

that “something changed” is enough. If you know something has changed,

you can take clues and look at various markets for inflection points.

Currently, most markets are stretched to various limits. Whether it be

zero bound credit markets, equities, real estate, commodities or gold

and silver, all values had reached extreme highs or lows.

“Something” happened three weeks ago.

While we cannot be sure “what” exactly happened, we can speculate. We

have many dots and lots of data points to help us but first it needs to

be pointed out, even if wrong in conclusion …just the knowledge alone

that “something changed” is enough. If you know something has changed,

you can take clues and look at various markets for inflection points.

Currently, most markets are stretched to various limits. Whether it be

zero bound credit markets, equities, real estate, commodities or gold

and silver, all values had reached extreme highs or lows. Something changed three weeks ago and a series of events began. It all started with China announcing 600 additional tons of gold. This was followed by the IMF rebuff of China, the three yuan devaluations and three “coincidental” explosions. Then equity markets around the world (which were already weak) began to violently unravel and finally spilled over to the U.S.. This tested the PPT’s limits (which were apparently $23 billion last week).

Read More

Russian Military Forces Arrive In Syria, Set Forward Operating Base Near Damascus

Submitted by Tyler Durden on 08/31/2015 - 21:49 According to Western diplomats, a Russian expeditionary force has already arrived in Syria and set up camp in an Assad-controlled airbase. The base is said to be in area surrounding Damascus, and will serve, for all intents and purposes, as a Russian forward operating base. In the coming weeks thousands of Russian military personnel are set to touch down in Syria, including advisors, instructors, logistics personnel, technical personnel, members of the aerial protection division, and the pilots who will operate the aircraft.

China Strengthens Yuan Most Since Nov 2014 After PMI Hits 3-Year Low, PBOC Offers "Hope" As A Strategy For Stocks

Submitted by Tyler Durden on 08/31/2015 - 21:21 Having exposed the culprit for all of its economic and market woes, China is likely going to have problems explaining why its economic plague is still spreading (with South Korean exports collapsing and Japanese Capex growth slowing) and China's official manufacturing PMI slipped into contraction for the first time in 6 months (to 3 year lows). Amid the face-saving clean-air of Parade Week, the appearance of awesomeness must prevail and following the worst quarter since Lehman, stocks are indicated lower despite having received some 'help' into last night's close. PBOC proxies push 'hope' as a strategy for stock stability (even as US markets and oil are re-collapsing) as margin debt drops to an 8-month low - still double YoY though. PBOC fixes Yuan 0.22% stronger- the biggest jump since Nov 2014 - as it injects another CNY150bn via 7-day rev.repo.

from KingWorldNews:

The exchange value of gold and FIAT-money is not stable. It would

change over time, depending on the growth in the supply of gold, the

change in the demand to hold cash balances, and the growth in goods and

services on the market. However, given its much lower as well as easily

foreseeable annual supply growth rate, it would be far more stable than

paper currencies.

The exchange value of gold and FIAT-money is not stable. It would

change over time, depending on the growth in the supply of gold, the

change in the demand to hold cash balances, and the growth in goods and

services on the market. However, given its much lower as well as easily

foreseeable annual supply growth rate, it would be far more stable than

paper currencies.

Ludwig von Mises always argued that money is a good like any other. It differentiates itself by one important characteristic: Money is the generally accepted medium of exchange, because it is the most marketable good. According to Mises, money’s function as a medium of exchange is thus the central one, while its store of value and unit of account functions are merely subordinate functions (they are derived from, or implied by the central function). This also implies that a rising money supply must lower the exchange value of money.1

Read More

The exchange value of gold and FIAT-money is not stable. It would

change over time, depending on the growth in the supply of gold, the

change in the demand to hold cash balances, and the growth in goods and

services on the market. However, given its much lower as well as easily

foreseeable annual supply growth rate, it would be far more stable than

paper currencies.

The exchange value of gold and FIAT-money is not stable. It would

change over time, depending on the growth in the supply of gold, the

change in the demand to hold cash balances, and the growth in goods and

services on the market. However, given its much lower as well as easily

foreseeable annual supply growth rate, it would be far more stable than

paper currencies.Ludwig von Mises always argued that money is a good like any other. It differentiates itself by one important characteristic: Money is the generally accepted medium of exchange, because it is the most marketable good. According to Mises, money’s function as a medium of exchange is thus the central one, while its store of value and unit of account functions are merely subordinate functions (they are derived from, or implied by the central function). This also implies that a rising money supply must lower the exchange value of money.1

Read More

Is This Man Responsible For China's Stock Market Crash?

Submitted by Tyler Durden on 08/31/2015 - 21:05 Meet Wang Xiaolu, the journalist detained by Chinese authorities is being held responsible for the “chaos” in China’s stock market.

"It's The Gun's Fault!!"

Submitted by Tyler Durden on 08/31/2015 - 20:50 Presented with no comment...

The Age Of Voodoo Finance

Submitted by Tyler Durden on 08/31/2015 - 20:40The Jackson Hole gathering may end up providing at least some clarification, but not even close to the manner in which everyone seems intent on inferring. With Janet Yellen’s notable absence, there isn’t the same sort of celebrity about what would have been the media hanging upon every word; that is, after all, what the Federal Reserve has become, not an organ of stability or even expertise but a public relations effort aimed squarely at trying to convince everyone possible that it is. Given the unique circumstances at the moment, the real issue is not whether they might raise rates but just how much systemic misdirection has already been revealed even to the least attentive of people.

Exposed: The New American Way Of Life

Dow Futures Plunge 200 Points As Oil Drops 4% Ahead Of China PMI

Submitted by Tyler Durden on 08/31/2015 - 20:24 Just when you thought it was safe to listen to the stability-preaching talking heads, crude futures are sliding and US equity futures are tumbling as Asia opens. Worse still XIV (VIX inverse ETF) has tumbled to fresh lows with a 24 handle in the after-hours market, suggesting more downside for stocks. With all eyes on China PMIs - though, there is little need for a weak PMI to be present for China to unleash moar measures, and a strong PMI will be scoffed at - it seems, the end-of-month rip-fest is fading fast...

Brazil Throws In Towel On Budget; Citi Compares Fiscal Outlook To "Bloody Terror Film"

Submitted by Tyler Durden on 08/31/2015 - 20:15 "In the meantime, in our (un)beloved country, there is something scarier than Freddy Krueger: our growth / fiscal outlook." A 2015 study

has shown that children exposed to pesticides used to grow GM soy

suffer serious genetic damage. Does this mean that our children will

suffer the same fate as those unfortunate enough to live near GM soy

fields in Argentina?

A 2015 study

has shown that children exposed to pesticides used to grow GM soy

suffer serious genetic damage. Does this mean that our children will

suffer the same fate as those unfortunate enough to live near GM soy

fields in Argentina?Researchers from the National University of Río Cuarto, Cordoba (UNRC) compared children who lived close to a GM-soy growing area in Argentina to children who lived in another city in Cordoba that was not adjacent to GM soy fields.

Read More

Unusually Massive Protests Erupt in Japan Against Forthcoming "War Legislation"

Submitted by Tyler Durden on 08/31/2015 - 19:50 In case you aren’t up to speed on your Japanese history, the nation’s post WWII Constitution prohibits military action unless it’s in self-defense. Clearly a sensible approach, which is why the current Japanese government, led by the demonstrably insane and incompetent Prime Minister Shinzo Abe, wants to get rid of it. Not only will this action increase the likelihood of World War III in the Far East, but it’s another important example of a government acting against the will of the people. Democracy is dead. Globally. If we fail to bring it back, history will see us as one of the most inept and spineless generations in history.

How China Cornered The Fed With Its "Worst Case" Capital Outflow Countdown

Submitted by Tyler Durden on 08/31/2015 - 19:24 China has just cornered the Fed: not just diplomatically, as observed when China's PBOC clearly demanded that Yellen's Fed not start a rate hiking cycle, but also mechanistically, as can be seen by the acute and sudden selloff across all asset classes in the past 3 weeks. Now Yellen has about 365 days or so to find a solution, one which works not only for the US, but also does not leave China a smoldering rubble of three concurrently burst bubbles. Good luck.

China Rocked By Another Massive Chemical Explosion

Submitted by Tyler Durden on 08/31/2015 - 19:12 Seriously, what the f##k is going on over there?*BLAST SEEN IN CHEM. IND. ZONE IN SHANDONG, CHINA: PEOPLES DAILY

This is the second explosion in Shandong, which both follow the huge and deadly explosion in Tianjin.

Monday Humor: Go 'West' Young Men

Submitted by Tyler Durden on 08/31/2015 - 19:00 First Trump, now this...!?Stocks Suffer Biggest Monthly Drop In Five Years As Oil Spikes Most Since 1990

Submitted by Tyler Durden on 08/31/2015 - 18:50

Recession Odds Surge To 47%, Highest Since 2011

Submitted by Tyler Durden on 08/31/2015 - 17:59 Assuming that after being wrong for 7 years about everything, economists are actually right about the market still having some discounting abilities left, what then is the market telegraphing? The answer, according to the Bank of America: the biggest surge in recessionary odds since 2011, which over the past few days have nearly hit a 50% probability of an economic slowdown.

If The Fed Is Always Wrong, How Can Its Policies Ever Be Right?

Submitted by Tyler Durden on 08/31/2015 - 17:30 One of the most curiously persistent surrealisms of Washington, DC is the reflexive deference given the Federal Reserve System. The Washington elite tends to accord more infallibility to the Fed than do Catholics the Pope.

When Every Option In The Financial System Is Grounded In Absurdity, It's Time To Look Elsewhere

Submitted by Tyler Durden on 08/31/2015 - 16:36 The fundamentals for the US dollar are terrible, but people keep dumping money into it like trained monkeys simply because nothing else in financial markets makes any sense. This perception of 'safety' is based on a complete myth - every credible fundamental suggests that the dollar is dangerously overvalued; but if not the US dollar, then which currency is the safe haven? The euro is garbage, the Chinese are fighting a depression, Japan is a disaster. And that’s precisely the point. When every option in the financial system is grounded in absurdity, the only solution is to start looking for safety outside of it.

Economics 102: WalMart Cuts Worker Hours After Hiking Minimum Wages

Submitted by Tyler Durden on 08/31/2015 - 16:20 Don’t look now, but undergrad economics is rearing its ugly again at Wal-Mart as the retailer cuts workers’ hours in a desperate attempt to offset more than a billion in wage hikes.

Guest Post: Stanley Fischer Speaks - More Drivel From A Dangerous Academic Fool

Submitted by Tyler Durden on 08/31/2015 - 15:51 With every passing week that money markets rates remain pinned to the zero bound by the Fed, the magnitude of the financial catastrophe hurtling toward main street America intensifies. When the next financial bubble crashes it can only be hoped that this time the people will grab their torches and pitchforks. Stanley Fischer ought to be among the first tarred and feathered for the calamity that he has so arrogantly helped enable.

Citi Slams Today's Historic Oil Surge: "Another False Start, Time To Fade The Rally"

Submitted by Tyler Durden on 08/31/2015 - 15:31 Moments ago Citi's Edward Morse who, together with Goldman, has been bearish on oil for a good part of the past year, just slammed today's crude breakout and doubled down on his double-dead cat skepticism, when he released a report titled "Another False Start…Time to Fade the Rally" whose punchline is that "Citi foresees that WTI and Brent prices should post another fresh leg lower—perhaps making new 2015 lows—before year-end." To be able to follow the twists and turns in the Greek drama, we need

to remember that after the 2008 crisis, the Troika of creditors (the

ECB, the IMF and the European Commission) imposed external economic

governance on Greece, calling it “assistance” and “escape from default”.

The Troika was not saving Greece, but the money of Greek government

bond holders – German, French and American banks – by cutting social

expenditure and selling state-owned property (first and foremost to

Germans).

To be able to follow the twists and turns in the Greek drama, we need

to remember that after the 2008 crisis, the Troika of creditors (the

ECB, the IMF and the European Commission) imposed external economic

governance on Greece, calling it “assistance” and “escape from default”.

The Troika was not saving Greece, but the money of Greek government

bond holders – German, French and American banks – by cutting social

expenditure and selling state-owned property (first and foremost to

Germans).Under these conditions, the victory of the Coalition of the Radical Left (Syriza) in the early parliamentary elections in January 2015 was greeted by the majority of Greek society as deliverance and its young leader, Alexis Tsipras, was all but regarded as the Messiah. His statements matched those of a saviour as well: “Greece has turned a page. The Greek people have written history. The Troika is in the past and we have put an end to austerity forever… We will change the EU from within.” So said Tsipras seven months ago. On that night, 25 January 2015, it felt to the Greeks as if anything was possible…

Read More

by Tim Brown, Freedom Outpost:

Senator John McCain (R-AZ) not only got his nickname “Songbird” for alleged treasonous activity while in Vietnam (though he has been hailed by many as a hero), but has taken completely unconstitutional stand and has engaged in treasonous activities in recent years with America’s Islamic enemies, even going so far as to say he helped to fund and arm the now infamous Islamic State. Now, a grassroots movement has formed and will descend on Arizona this week to demand the Arizona senator be held accountable for his actions.

The launch date for Operation Detain McCain will begin on September 1. Click here to read the full itinerary.

Read More

Senator John McCain (R-AZ) not only got his nickname “Songbird” for alleged treasonous activity while in Vietnam (though he has been hailed by many as a hero), but has taken completely unconstitutional stand and has engaged in treasonous activities in recent years with America’s Islamic enemies, even going so far as to say he helped to fund and arm the now infamous Islamic State. Now, a grassroots movement has formed and will descend on Arizona this week to demand the Arizona senator be held accountable for his actions.

The launch date for Operation Detain McCain will begin on September 1. Click here to read the full itinerary.

Read More

from The Burning Platform:

Last week ended with the cackling hens on CNBC and the spokesmodels on

Bloomberg bloviating about the temporary pothole on the road to riches.

They assured their few thousand remaining viewers the 11% plunge in the

stock market was caused by China and the communist government’s direct

intervention in their stock market, arrest of a brokerage CEO, and

threat to prosecute sellers surely cured what ails their market. The Fed

and their Plunge Protection Team co-conspirators reversed the free

fall, manipulating derivatives and creating a short seller covering

rally back to previous week levels. The moneyed interests are desperate

to retain the appearance of normality and stability, as their debt

saturated system teeters on the verge of collapse.

Last week ended with the cackling hens on CNBC and the spokesmodels on

Bloomberg bloviating about the temporary pothole on the road to riches.

They assured their few thousand remaining viewers the 11% plunge in the

stock market was caused by China and the communist government’s direct

intervention in their stock market, arrest of a brokerage CEO, and

threat to prosecute sellers surely cured what ails their market. The Fed

and their Plunge Protection Team co-conspirators reversed the free

fall, manipulating derivatives and creating a short seller covering

rally back to previous week levels. The moneyed interests are desperate

to retain the appearance of normality and stability, as their debt

saturated system teeters on the verge of collapse.

Read More

Last week ended with the cackling hens on CNBC and the spokesmodels on

Bloomberg bloviating about the temporary pothole on the road to riches.

They assured their few thousand remaining viewers the 11% plunge in the

stock market was caused by China and the communist government’s direct

intervention in their stock market, arrest of a brokerage CEO, and

threat to prosecute sellers surely cured what ails their market. The Fed

and their Plunge Protection Team co-conspirators reversed the free

fall, manipulating derivatives and creating a short seller covering

rally back to previous week levels. The moneyed interests are desperate

to retain the appearance of normality and stability, as their debt

saturated system teeters on the verge of collapse.

Last week ended with the cackling hens on CNBC and the spokesmodels on

Bloomberg bloviating about the temporary pothole on the road to riches.

They assured their few thousand remaining viewers the 11% plunge in the

stock market was caused by China and the communist government’s direct

intervention in their stock market, arrest of a brokerage CEO, and

threat to prosecute sellers surely cured what ails their market. The Fed

and their Plunge Protection Team co-conspirators reversed the free

fall, manipulating derivatives and creating a short seller covering

rally back to previous week levels. The moneyed interests are desperate

to retain the appearance of normality and stability, as their debt

saturated system teeters on the verge of collapse.Read More

from Paul Craig Roberts:

IJudiciary Branch Has Self-Abolished

IJudiciary Branch Has Self-Abolished

The US no longer has a judiciary. This former branch of government has transitioned into an enabler of executive branch fascism.

Privacy is a civil liberty protected by the US Constitution. The Constitution relies on courts to enforce its prohibitions against intrusive government, but if the executive branch claims (no proof required) “national security,” courts kiss the Constitution good-bye.

Federal judges are chosen by the executive branch. The senate can refuse to confirm, but that is rare. The executive branch chooses judges who are friendly to executive power.

Read More

IJudiciary Branch Has Self-Abolished

IJudiciary Branch Has Self-AbolishedThe US no longer has a judiciary. This former branch of government has transitioned into an enabler of executive branch fascism.

Privacy is a civil liberty protected by the US Constitution. The Constitution relies on courts to enforce its prohibitions against intrusive government, but if the executive branch claims (no proof required) “national security,” courts kiss the Constitution good-bye.

Federal judges are chosen by the executive branch. The senate can refuse to confirm, but that is rare. The executive branch chooses judges who are friendly to executive power.

Read More

from DAHBOO77:

from Global Research:

This

document is meant for all those interested in the lead up and current

events surrounding the war in Syria and the creation of the Islamic

State (ISIS).

This

document is meant for all those interested in the lead up and current

events surrounding the war in Syria and the creation of the Islamic

State (ISIS).

Below is a timeline ranging from 1992-2015 with related articles to the war in Syria, ISIS and geopolitical events that tie them all together. Purposely the author of this document provides No commentary.

You will notice that each citation is met with origin of the article, date published and key quotations. Also, the author attempted to find sources that many “Westerners” would consider “mainstream”, with the exception of a few. Lastly, at the end of the timeline, one can find longer articles and videos that the reader can dive into if interested.

Read More

This

document is meant for all those interested in the lead up and current

events surrounding the war in Syria and the creation of the Islamic

State (ISIS).

This

document is meant for all those interested in the lead up and current

events surrounding the war in Syria and the creation of the Islamic

State (ISIS).Below is a timeline ranging from 1992-2015 with related articles to the war in Syria, ISIS and geopolitical events that tie them all together. Purposely the author of this document provides No commentary.

You will notice that each citation is met with origin of the article, date published and key quotations. Also, the author attempted to find sources that many “Westerners” would consider “mainstream”, with the exception of a few. Lastly, at the end of the timeline, one can find longer articles and videos that the reader can dive into if interested.

Read More

from Truth Never Told:

from Jesse’s Café Américain:

< Most people are sick and tired of the system as it is now. And they

are once again attempting to reject the status quo, having been badly

disappointed by Obama and the Congress. And this gives rise to popular

movements and even third parties.

Most people are sick and tired of the system as it is now. And they

are once again attempting to reject the status quo, having been badly

disappointed by Obama and the Congress. And this gives rise to popular

movements and even third parties.

The biggest problem with popular movements is that they either tend to be co-opted by the most powerful in the status quo and used badly, misdirected and deceived, as in the case of the Tea Party, or diffused by too many factions and lack of prioritization resulting in a lack of effective cohesion, as in the case of the Occupy Movement.

And so we have the ascendancy of the Wall Street wing of the Democratic Party, and the Koch Brothers wing of the Republicans.

Read More

<

Most people are sick and tired of the system as it is now. And they

are once again attempting to reject the status quo, having been badly

disappointed by Obama and the Congress. And this gives rise to popular

movements and even third parties.

Most people are sick and tired of the system as it is now. And they

are once again attempting to reject the status quo, having been badly

disappointed by Obama and the Congress. And this gives rise to popular

movements and even third parties.The biggest problem with popular movements is that they either tend to be co-opted by the most powerful in the status quo and used badly, misdirected and deceived, as in the case of the Tea Party, or diffused by too many factions and lack of prioritization resulting in a lack of effective cohesion, as in the case of the Occupy Movement.

And so we have the ascendancy of the Wall Street wing of the Democratic Party, and the Koch Brothers wing of the Republicans.

Read More

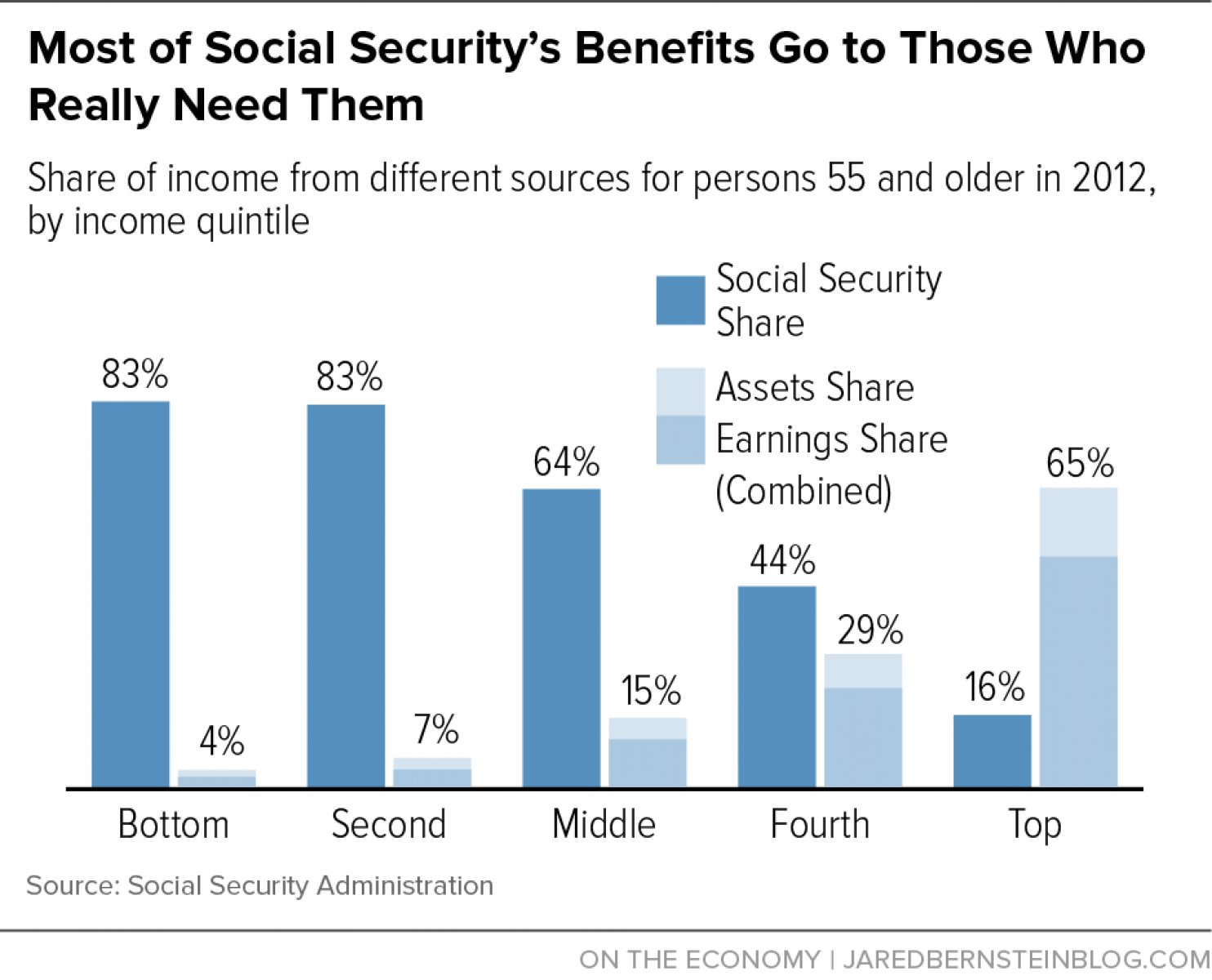

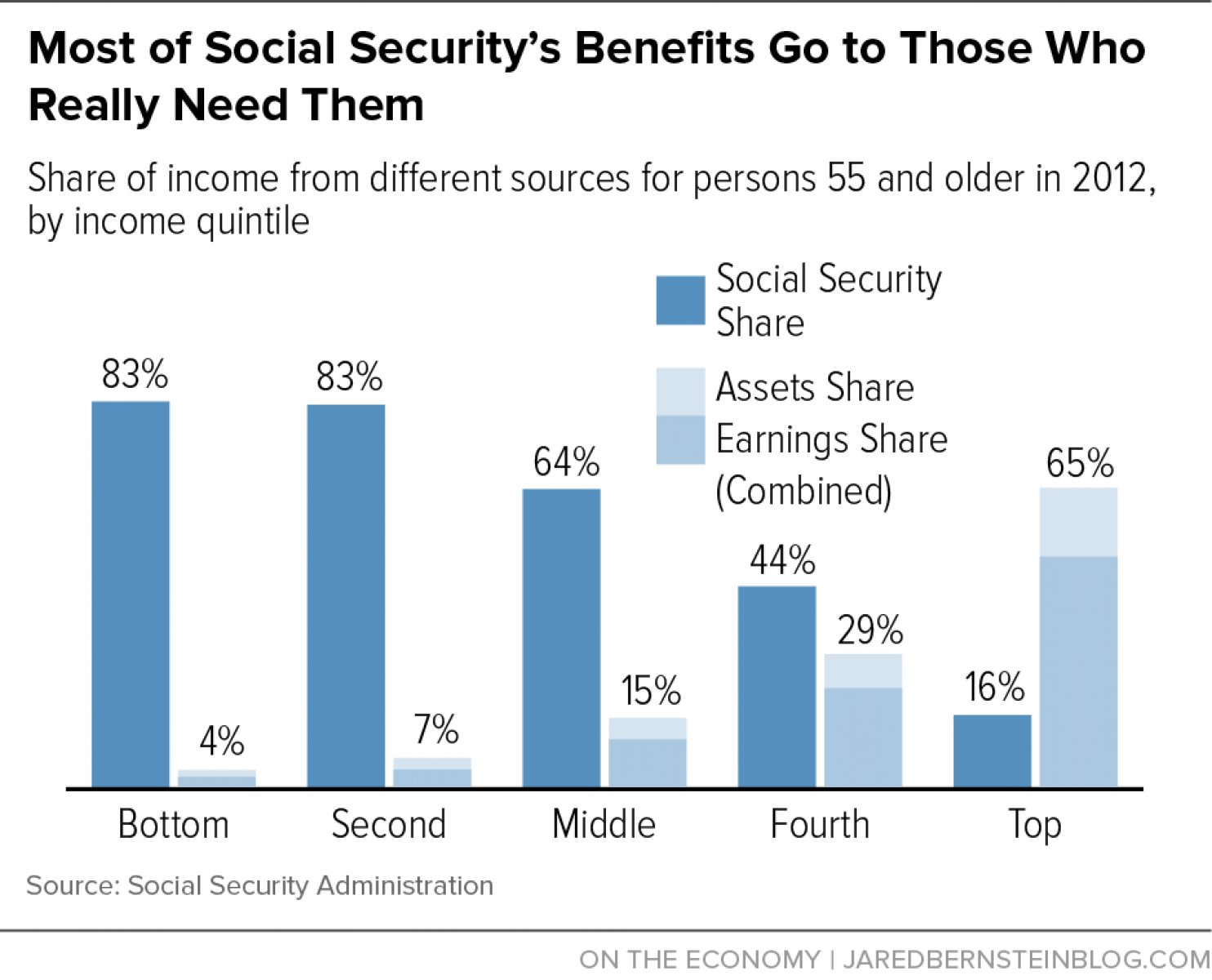

Most retirees heavily depend on Social Security for their retirement income.

from MyBudget360.com:

It is great that people overall are living longer but adding years to your life can get costly. Retirement can be a long time. For some, retirement can last as long as their working career. With a pension people didn’t have to worry about longevity as if this was a bad thing. Yet pensions are rare in our current low wage environment. Social Security has become the backbone of income for millions of retirees. Numbers can be daunting but as I dug deep into the Social Security figures, we now have more than 64 million Americans receiving some form of Social Security. In other words, 1 out of 5 Americans is receiving funds from a system that heavily relies on those actually working. The challenge is now emerging where many young Americans are being pushed into low wage jobs while older Americans scrimp by on their monthly benefit payment. Things work until they don’t and math eventually catches up.

Read More

from MyBudget360.com:

It is great that people overall are living longer but adding years to your life can get costly. Retirement can be a long time. For some, retirement can last as long as their working career. With a pension people didn’t have to worry about longevity as if this was a bad thing. Yet pensions are rare in our current low wage environment. Social Security has become the backbone of income for millions of retirees. Numbers can be daunting but as I dug deep into the Social Security figures, we now have more than 64 million Americans receiving some form of Social Security. In other words, 1 out of 5 Americans is receiving funds from a system that heavily relies on those actually working. The challenge is now emerging where many young Americans are being pushed into low wage jobs while older Americans scrimp by on their monthly benefit payment. Things work until they don’t and math eventually catches up.

Read More

/

A longtime friend/colleague of mine sent me a note tonight in which he

said he thought something significant might be coming to light about

gold in the next week or two. There’s certainly some unusual behavior

on the Comex, with Goldman taking delivery of 98,300 ounces last week

(2.8 tonnes), the amount of gold cleared on the LBMA at the a.m. fix

spiked up from an average of about 100,000 ozs per day to over 150,000

ounces, the Shanghai Gold Exchange saw the 4th largest withdrawal of

gold in its history and the premiums on both physical gold and silver

rose considerably.

A longtime friend/colleague of mine sent me a note tonight in which he

said he thought something significant might be coming to light about

gold in the next week or two. There’s certainly some unusual behavior

on the Comex, with Goldman taking delivery of 98,300 ounces last week

(2.8 tonnes), the amount of gold cleared on the LBMA at the a.m. fix

spiked up from an average of about 100,000 ozs per day to over 150,000

ounces, the Shanghai Gold Exchange saw the 4th largest withdrawal of

gold in its history and the premiums on both physical gold and silver

rose considerably. Dementia and other neurological brain diseases are striking people

younger and younger, according to a new study conducted by researchers

from Bournemouth University in England and published in the journal

Surgical Neurology International. These diseases have reached levels

that are “almost epidemic,” the researchers said, and they reached them

so quickly that environmental factors must be largely to blame.

Dementia and other neurological brain diseases are striking people

younger and younger, according to a new study conducted by researchers

from Bournemouth University in England and published in the journal

Surgical Neurology International. These diseases have reached levels

that are “almost epidemic,” the researchers said, and they reached them

so quickly that environmental factors must be largely to blame. Free speech has officially failed.

Free speech has officially failed. “All

truth passed through three stages: First it is ridiculed. Second it is

violently opposed. Third it is accepted as being self evident”.

“All

truth passed through three stages: First it is ridiculed. Second it is

violently opposed. Third it is accepted as being self evident”. Good news: The number of Americans using food stamps in 2014 declined

slightly from the previous year. So why does the 2015 Index of Culture

and Opportunity say this indicator is headed in the “wrong direction”?

Good news: The number of Americans using food stamps in 2014 declined

slightly from the previous year. So why does the 2015 Index of Culture

and Opportunity say this indicator is headed in the “wrong direction”?![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)