Submitted by Tyler Durden on 08/19/2015 - 18:55

Submitted by Tyler Durden on 08/19/2015 - 18:55

When we see guys like Bernie Sanders get visibly angry at guys like Alan Greenspan it behooves all of us to go beyond the entertainment of it or some prima facie agreement and to truly understand why the anger is justified. If we were to all take the responsibility to understand the lifeblood of our American existence i.e. the economy, we will most certainly be moved to remove not only the policymakers but the system that together serve only those at the top of the economic food chain and at a cost to the rest of us. When we do we will be asking why in the hell is no one yelling at Janet Yellen??

After 6 Years Of QE, And A $4.5 Trillion Balance Sheet, St. Louis Fed Admits QE Was A Mistake

Submitted by Tyler Durden on 08/19/2015 - 15:30 "Evidence in support of Bernanke's view of the channels through which QE works is at best mixed. There is no work, to my knowledge, that establishes a link from QE to the ultimate goals of the Fed inflation and real economic activity. Indeed, casual evidence suggests that QE has been ineffective in increasing inflation."

10 Things Every Economist Should Know About The Gold Standard

Submitted by Tyler Durden on 08/19/2015 - 19:45 At the risk of sounding like a broken record we'd like to say a bit more about economists' tendency to get their monetary history wrong; in particular, the common myths about the gold standard. If there's one monetary history topic that tends to get handled especially sloppily by monetary economists, not to mention other sorts, this is it. Sure, the gold standard was hardly perfect, and gold bugs themselves sometimes make silly claims about their favorite former monetary standard. But these things don't excuse the errors many economists commit in their eagerness to find fault with that "barbarous relic." The point, in other words, isn't to make a pitch for gold. It's to make a pitch for something - anything - that's better than our present, lousy money.

Facing Public Fury, China Reveals Owners Of Tianjin Warehouse

Submitted by Tyler Durden on 08/19/2015 - 20:20 Facing a growing public backlash and seeking to deflect charges that the government is complicit in a massive coverup of a completely avoidable disaster that ultimately caused the deaths of more than 100 people, Beijing has compelled the Party-affiliated majority shareholders of Tianjin International Ruihai Logistics to admit their role in circumventing restrictions on the storage and handling of hazardous chemicals.

Presidential Candidate "Deez Nuts" Surges In Polls

Submitted by Tyler Durden on 08/19/2015 - 19:20 "Finally another declared independent candidate, Deez Nuts, polls at 9% in North Carolina to go along with his 8% in Minnesota and 7% in Iowa in our recent polling."

Echoes Of 1997: China Devaluation "Rekindles" Asian Crisis Memories, BofA Warns

Submitted by Tyler Durden on 08/19/2015 - 18:29 Even before the latest shot across the bow in the escalating global currency wars, EM FX was beset by falling commodity prices, stumbling Chinese demand, and a looming Fed hike. And while, as Barclays notes, "estimating the global effects China has via the exchange rate and growth remains a rough exercise," more than a few observers believe the effect may be to spark a Asian Financial Crisis redux. For their part, BofAML has endeavored to compare last week’s move to the 1994 renminbi devaluation, on the way to drawing comparisons between what happened in 1997 and what may unfold in the months ahead.

US Plans Dramatic Increase In Global Lethal & Surveillance Drone Flights By 2019

Submitted by Tyler Durden on 08/19/2015 - 18:05 As if in complete defiance of the extensive contention at home and abroad, the Pentagon announced plans this week to dramatically ramp up global drone operations over the next four years. Daily drone flights will increase by 50% during this time, and will include lethal air strikes and surveillance missions to deal with the increase in global hot spots and crises.

The Next Leg Of The Commodity Carnage: Attention Shifts To Traders - Glencore Crashes, Noble Default Risk Soars

Submitted by Tyler Durden on 08/19/2015 - 17:54 One month ago we asked: "Which will be first: Trafigura, Mercuria or Glencore." Today we got our answer.ClusterF'ed: Bonds & Bullion Pumped While Stocks & Dollar Dumped

Submitted by Tyler Durden on 08/19/2015 - 17:44

The "Best Way To Play The Chinese Credit-Commodity Crunch" Is About To Pay Off Big

Submitted by Tyler Durden on 08/19/2015 - 17:38 After trading at what we postulated was the rough floor for the CDS at 150 bps for over a year, in the past month Glencore CDS have exploded higher, and at last check was trading 315 bps wide, about 150 wider from the March 2014 levels with the likelihood of a major gap wider when the rating agencies downgrade the company from investment grade to junk, which in turn would trigger an unknown amount of cascading collateral calls and an accelerated liquidity depletion, which would then further hammer Glencore's bonds, and as a result, send its default risk, and CDS, surging.

Keeping The Bubble-Boom Going

Submitted by Tyler Durden on 08/19/2015 - 17:15 To keep the credit induced boom going,policy makers have convinced themselves that more credit and more money, provided at ever lower interest rates, are required. Why then, as The FOMC Minutes just showed, do the decision makers at the Fed want to increase rates? If Fed members follow up their words with deeds, they might soon learn that the ghosts they have been calling will indeed appear — and possibly won’t go away. The sooner the artificial boom comes to an end, the sooner the recession-depression sets in, which is the inevitable process of adjusting the economy and allowing an economically sound recovery to begin.Momo No Mo' - BofAML Warns Stocks "Close To A Tipping Point"

Submitted by Tyler Durden on 08/19/2015 - 16:50 Momentum traders - relying on the 'trend is your friend' theme - may have a rude awakening soon as momentum stocks trade at a stunning 50% premium to the market (vs an average 20%). As BofAML notes, high growth, high multiple names that have been leading the market over the past year are showing some signs suggest we are close to a tipping point. The growth-to-value spread is at its highest since the peak of the dotcom bubble in 2000 and, as Subramanian ominously notes, when momentum ends, it ends badly - with an average loss of 25% over the next 12 months.

All Bubbles Are Different

Submitted by Tyler Durden on 08/19/2015 - 16:25 Take a step back from the media, and Wall Street commentary, for a moment and make an honest assessment of the financial markets today. If our job is to "bet" when the "odds" of winning are in our favor, then exactly how "strong" is the fundamental hand you are currently betting on? This "time IS different" only from the standpoint that the variables are not exactly the same as they have been previously. Of course, they never are, and the result will be "...the same as it ever was."

A Postcard From Puerto Rico

Not what you were expecting...

The Path To Rate Normalization Will Not Come Without Pain

Submitted by Tyler Durden on 08/19/2015 - 15:40 Market pundits robotically suggest that the Fed should not raise rates because inflation is too low. Well, if zero rates and $4 trillion in asset purchases did not boost inflation, do they really believe that another few months at zero rates will do the trick? Some Fed researchers are actually asking whether policies have become counter-productive to their dual mandates. The path to rate normalization will not come without pain. On the contrary, there will be a difficult period, potentially even a damaging recession. Fed doves will likely feel vindicated. However, while a period of hardship is likely inevitable, purging both bad businesses and market speculation is vital for long-run economic health and will allow more productive businesses to evolve over time.

East Ukraine's Donetsk Republic Will Hold Referendum To Join Russia

Submitted by Tyler Durden on 08/19/2015 - 15:29 Having waited for over a year for the Ukraine civil war/conflict to be relegated to back page status, if that, Putin has finally given the green light, and as Xinhua reports, leaders of the self-proclaimed "Donetsk People's Republic" are planning to hold a referendum on seceding from Ukraine and joining Russia, the Donetsk-based Ostrov news agency reported Wednesday.

Copper Breaches $5000, Breaks Below 15-Year Trendline

Submitted by Tyler Durden on 08/19/2015 - 15:10 While the PBOC was literally everything in its power to keep the Shanghai Composite above its 200-day moving average as some sign of 'stability', it forgot about that other proxy of overall Chinese economic health: copper. And just as we warned previously, ever since the CCFD crackdown in 2012, copper has been tumbling and more crucially has just broken a 15-year trendline. The plunge in copper means almost one in five mines globally is losing money. When I asked Sen. Rand Paul (R-Ky.) last year about his views on

police demilitarization, reforming drug sentencing, and restoring voting

rights to non-violent felons, I posed this question:

When I asked Sen. Rand Paul (R-Ky.) last year about his views on

police demilitarization, reforming drug sentencing, and restoring voting

rights to non-violent felons, I posed this question:“Is your brand of republicanism the new civil rights movement?”

Paul replied, “You know, I think you can look at it that way.”

It was around that time when Paul emerged as a new star of the Republican Party. He was featured on the Time Magazine cover as the “Most Interesting Man in American Politics.”

Read More

by Peter Cooper, Arabian Money:

HSBC, the fourth-largest bank in the world, is predicting that the

price of gold will be up 10 per cent by the end of this year and finish

the year worth around $1,225 an ounce. Gold is down six per cent

year-to-date.

HSBC, the fourth-largest bank in the world, is predicting that the

price of gold will be up 10 per cent by the end of this year and finish

the year worth around $1,225 an ounce. Gold is down six per cent

year-to-date.The bank believes Goldman Sachs and other commentators are wrong to say gold will fall in price as interest rates go up. HSBC’s analysis of the data showed that the last four times that the Fed raised interest rates the gold price went up, not down.

Fed policy change? The Federal Reserve is widely expected to raise rates later this year for the first time since 2006, albeit the Chinese equity crash, devaluation and trade slowdown might well scupper that plan anyway.

Read More

from Bill Still:

from Global Research:

The Butterfly Prison

begins slowly, combining seemingly disconnected stories that are taking

place in poor neighborhoods of Australia. The stories are like tiny

vignettes; shy, modest, minimalistic but always significant and

beautifully told. A fear here, a bitter humiliation there, a dream of a

child interrupted by a police officer.

The Butterfly Prison

begins slowly, combining seemingly disconnected stories that are taking

place in poor neighborhoods of Australia. The stories are like tiny

vignettes; shy, modest, minimalistic but always significant and

beautifully told. A fear here, a bitter humiliation there, a dream of a

child interrupted by a police officer.

Then suddenly, the stories begin to interconnect, intertwine, and the novel gains speed. Real pain – deep and overwhelming – emerges. Profound hurts, bitterness and injuries are slapping the faces of the characters, and somehow, we are drawn in and begin suffering with them.

It is Australia that we don’t know; that we are not supposed to see. After some 40 pages I thought, “it feels little bit like Carpentaria”, but then, just a few pages later, it did not feel like anything else, it only felt and read like the “Butterfly Prison”.

Read More

The Butterfly Prison

begins slowly, combining seemingly disconnected stories that are taking

place in poor neighborhoods of Australia. The stories are like tiny

vignettes; shy, modest, minimalistic but always significant and

beautifully told. A fear here, a bitter humiliation there, a dream of a

child interrupted by a police officer.

The Butterfly Prison

begins slowly, combining seemingly disconnected stories that are taking

place in poor neighborhoods of Australia. The stories are like tiny

vignettes; shy, modest, minimalistic but always significant and

beautifully told. A fear here, a bitter humiliation there, a dream of a

child interrupted by a police officer.Then suddenly, the stories begin to interconnect, intertwine, and the novel gains speed. Real pain – deep and overwhelming – emerges. Profound hurts, bitterness and injuries are slapping the faces of the characters, and somehow, we are drawn in and begin suffering with them.

It is Australia that we don’t know; that we are not supposed to see. After some 40 pages I thought, “it feels little bit like Carpentaria”, but then, just a few pages later, it did not feel like anything else, it only felt and read like the “Butterfly Prison”.

Read More

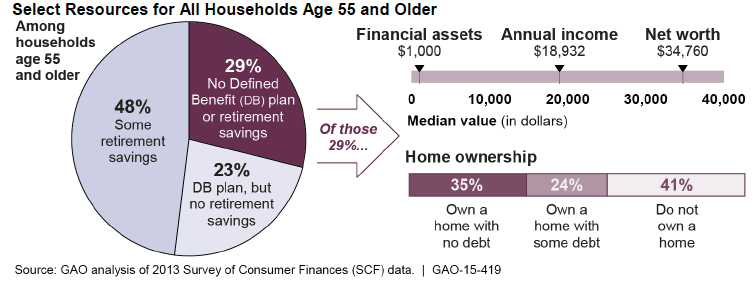

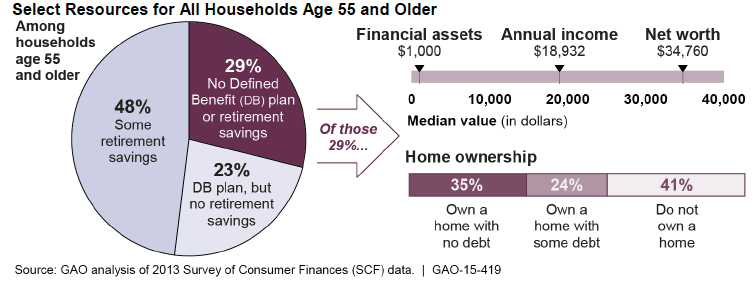

GAO report shows that half of Americans 55 and older have no retirement savings at all.

from MyBudget360.com:

Some of you might remember the glossy highly produced advertisements back in the early 1980s when Wall Street decided it was time to turn American retirement plans into casinos. The slow and agonizing death of the pension plan was supposed to be replaced by the beautiful and wonderful world of the 401(k) plan. Save for 30 years and in the end, you will be a millionaire just like your friends on Wall Street that sincerely care about your financial future. Of course since then, we have found out about junk bond scandals, mutual fund fees that make loan sharks look conservative, and of course the financial shenanigans of giving people toxic mortgages that were essentially ticking time bombs of destruction. This was the industry that was put in charge of helping you plan for your future. We are now a generation out from those slick ads and the results have been disastrous for most Americans. A recent analysis found that half of US households 55 and older have no money stashed away for retirement.

Read More

from MyBudget360.com:

Some of you might remember the glossy highly produced advertisements back in the early 1980s when Wall Street decided it was time to turn American retirement plans into casinos. The slow and agonizing death of the pension plan was supposed to be replaced by the beautiful and wonderful world of the 401(k) plan. Save for 30 years and in the end, you will be a millionaire just like your friends on Wall Street that sincerely care about your financial future. Of course since then, we have found out about junk bond scandals, mutual fund fees that make loan sharks look conservative, and of course the financial shenanigans of giving people toxic mortgages that were essentially ticking time bombs of destruction. This was the industry that was put in charge of helping you plan for your future. We are now a generation out from those slick ads and the results have been disastrous for most Americans. A recent analysis found that half of US households 55 and older have no money stashed away for retirement.

Read More

from KingWorldNews:

On the heels of continued chaos in key global markets, the top trends

forecaster in the world just warned King World News that the coming

trade wars may turn into world war.

On the heels of continued chaos in key global markets, the top trends

forecaster in the world just warned King World News that the coming

trade wars may turn into world war.

History is repeating itself. While the times are different and the names have changed, the underlying circumstances and basic fundamentals remains the same. The Crash of ’29, The Great Depression, plunging commodity prices, currency wars, trade wars, world war. Now, four score and six years later: The Panic of ’08, The Great Recession plunging commodity prices, currency wars….

Read More

On the heels of continued chaos in key global markets, the top trends

forecaster in the world just warned King World News that the coming

trade wars may turn into world war.

On the heels of continued chaos in key global markets, the top trends

forecaster in the world just warned King World News that the coming

trade wars may turn into world war.History is repeating itself. While the times are different and the names have changed, the underlying circumstances and basic fundamentals remains the same. The Crash of ’29, The Great Depression, plunging commodity prices, currency wars, trade wars, world war. Now, four score and six years later: The Panic of ’08, The Great Recession plunging commodity prices, currency wars….

Read More

by David Gutierrez, Natural News:

Dead and dying sea mammals continue to wash ashore at unusual and

alarming rates along the California coast. Scientists are stumped,

suggesting that the cause may be food shortages caused by abnormally

warm waters – but unsure of what has caused the ocean off the California

coast to warm so rapidly.

Dead and dying sea mammals continue to wash ashore at unusual and

alarming rates along the California coast. Scientists are stumped,

suggesting that the cause may be food shortages caused by abnormally

warm waters – but unsure of what has caused the ocean off the California

coast to warm so rapidly.

Meanwhile, the radioactive plume released into the Pacific Ocean following the Fukushima nuclear disaster draws ever closer to North America’s western coast. At the same time, radioactive material is still pouring into the sea from the Fukushima site. Could the ongoing radioactive poisoning of the Pacific and the dying of its marine mammals be related?

Read More

Dead and dying sea mammals continue to wash ashore at unusual and

alarming rates along the California coast. Scientists are stumped,

suggesting that the cause may be food shortages caused by abnormally

warm waters – but unsure of what has caused the ocean off the California

coast to warm so rapidly.

Dead and dying sea mammals continue to wash ashore at unusual and

alarming rates along the California coast. Scientists are stumped,

suggesting that the cause may be food shortages caused by abnormally

warm waters – but unsure of what has caused the ocean off the California

coast to warm so rapidly.Meanwhile, the radioactive plume released into the Pacific Ocean following the Fukushima nuclear disaster draws ever closer to North America’s western coast. At the same time, radioactive material is still pouring into the sea from the Fukushima site. Could the ongoing radioactive poisoning of the Pacific and the dying of its marine mammals be related?

Read More

from Off Grid Survival:

Bugging out can mean many different things to different people; in

general, when we speak of bugging out on this site we are talking about

having to make a quick getaway during times of crisis. That can be due

to a manmade or natural disaster that causes you to leave your immediate

area, or due to a long-term crisis situations which could make

returning home dangerous or impossible.

Bugging out can mean many different things to different people; in

general, when we speak of bugging out on this site we are talking about

having to make a quick getaway during times of crisis. That can be due

to a manmade or natural disaster that causes you to leave your immediate

area, or due to a long-term crisis situations which could make

returning home dangerous or impossible.

While the reasons for bugging out are many, it’s an action that should never be taken lightly, as it could carry significant risks to your safety and security.

Read More

Bugging out can mean many different things to different people; in

general, when we speak of bugging out on this site we are talking about

having to make a quick getaway during times of crisis. That can be due

to a manmade or natural disaster that causes you to leave your immediate

area, or due to a long-term crisis situations which could make

returning home dangerous or impossible.

Bugging out can mean many different things to different people; in

general, when we speak of bugging out on this site we are talking about

having to make a quick getaway during times of crisis. That can be due

to a manmade or natural disaster that causes you to leave your immediate

area, or due to a long-term crisis situations which could make

returning home dangerous or impossible.While the reasons for bugging out are many, it’s an action that should never be taken lightly, as it could carry significant risks to your safety and security.

Read More

from DAHBOO777:

filed under (unt

from The Victory Report:

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment