by Steve St. Angelo, SRS Rocco Report:

The global financial system is now getting out of control. While the

clowns on the financial networks continue to regurgitate the same

bullish propaganda, “that everything will be fine”, quite the opposite

is the case. The system is so broken and the leverage propping it up is

so extreme, the result will be the largest financial and economic

calamity the world has ever seen.

The global financial system is now getting out of control. While the

clowns on the financial networks continue to regurgitate the same

bullish propaganda, “that everything will be fine”, quite the opposite

is the case. The system is so broken and the leverage propping it up is

so extreme, the result will be the largest financial and economic

calamity the world has ever seen.

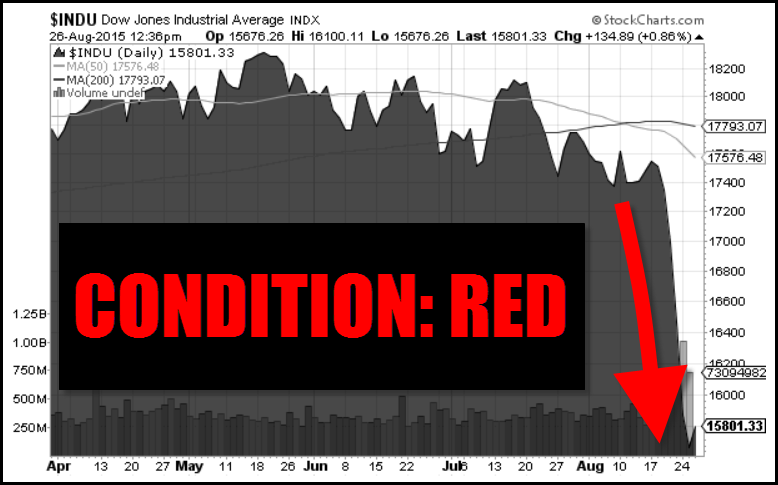

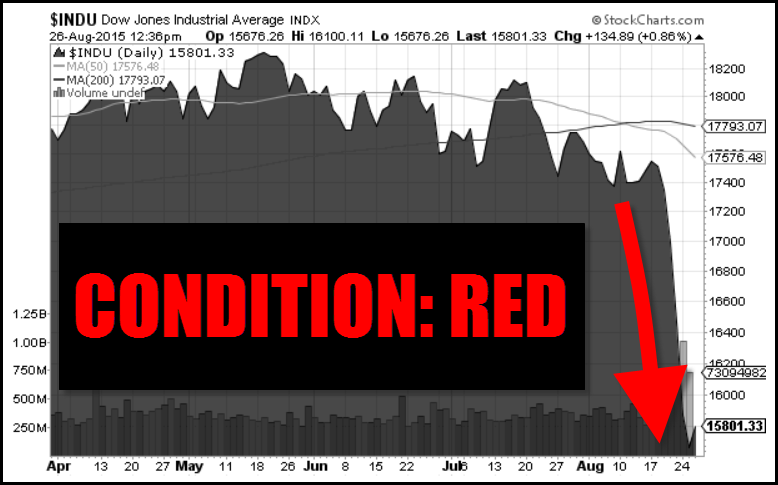

To get an idea just how broken the system has become, here is the Dow Jones chart of Monday’s trading activity from Zerohedge’s article Behold: Insanity:

Read More

The global financial system is now getting out of control. While the

clowns on the financial networks continue to regurgitate the same

bullish propaganda, “that everything will be fine”, quite the opposite

is the case. The system is so broken and the leverage propping it up is

so extreme, the result will be the largest financial and economic

calamity the world has ever seen.

The global financial system is now getting out of control. While the

clowns on the financial networks continue to regurgitate the same

bullish propaganda, “that everything will be fine”, quite the opposite

is the case. The system is so broken and the leverage propping it up is

so extreme, the result will be the largest financial and economic

calamity the world has ever seen.To get an idea just how broken the system has become, here is the Dow Jones chart of Monday’s trading activity from Zerohedge’s article Behold: Insanity:

Read More

Deflationary Collapse Ahead?

Submitted by Tyler Durden on 08/26/2015 - 20:30 Both the stock market and oil prices have been plunging. Is this “just another cycle,” or is it something much worse? We think it is something much worse...Dow Follows Biggest Crash Since Lehman With Third Biggest One Day Surge Ever As China Dumps Treasurys

Submitted by Tyler Durden on 08/26/2015 - 16:05

Presenting The Annotated Chinese Equity Bubble Timeline

Submitted by Tyler Durden on 08/26/2015 - 15:11 As the ashes of the China's scorched equity markets lay smoldering at the feet of the plunge protection national team which finally gave up on rescuing the market after CNY900 billion proved inadequate to arrest the slide, and on the heels of the PBoC’s latest effort to staunch the bleeding by resorting to yet more policy rate cuts, we bring you the full, annotated SHCOMP market and policy timeline courtesy of Bloomberg.

Why This Time Could Be Different

Submitted by Tyler Durden on 08/26/2015 - 15:33 From both and fundamental and technical viewpoint, there is mounting evidence that the current decline might just be sending a signal that there is more going on here than just an "overdue correction in a bull market." While it is too soon to know for sure, there seems to be little risk in being more conservative within portfolio allocations currently until the market environment clears. However, the proverbial "elephant" is margin debt.

What Would Happen If Everyone Joins China In Dumping Treasurys?

Submitted by Tyler Durden on 08/26/2015 - 18:10 On Tuesday evening, we quantified the staggering cost of China’s near daily open FX operations in support of the yuan. In short, the new currency regime has led the PBoC to dump more US paper in the past two weeks than it had YTD. In conclusion, we asked if anyone else was set to join China in liquidating US Treasurys at a never before seen pace. Here's the answer and what it means for the US economy and monetary policy going forward.

"Would You Finance Your Kicks?": Shoe-Backed Securities Are On The Way

Submitted by Tyler Durden on 08/26/2015 - 20:00 "Much like buying other pricey items such as cars, houses or jewelry, you’re now able to finance goods (borrow money) from a credit company as long as you agree to pay it all back, with interest. Partnering with AFFIRM, Flight Club kicks such as the ”Fragment” Air Jordan 1 is at $123.01 USD a month, while the Nike Air MAG is at $702.90 USD a month."

China & The Return Of The "Yellow Peril" - The Muddled Economics Of Scapegoating

Submitted by Tyler Durden on 08/26/2015 - 19:30 Too big to control, too volatile to be predictable, and too full of contradictions to achieve stability, China is a society that is on the edge of coming completely unglued. And so, appealing to the typical American conceit that nothing that ever happens to us is our own fault, scapegoating is a reflection of widespread economic ignorance. For the reality is that the policies of our own rulers limn those of the Chinese: pump-priming the currency, flooding the US economy with money, and creating massive bubbles is something they learned from us. And those policies are having the same effect here as they are having in China.

Americans Are "Fired Up" About First Commercially Available Flamethrowers

Submitted by Tyler Durden on 08/26/2015 - 19:00 Why does one need a handheld flamethrower, you ask? Here are some "ideas" from the Ion Productions' official XM42 website: 1) start your bonfire from across the yard, 2) kill the weeds between your cracks in style, 3) clearing snow/ice, 4) controlled burns/ground-clearing of foliage, 5) insect control.

What An Actual Leader Might Say

Submitted by Tyler Durden on 08/26/2015 - 18:35 In the current deluge of wannabe leaders clamoring for attention and trying to convince us that they are the boss who should be applying rules to us, it strikes me that all of them are looking backward and none are looking forward. So, since none of this crowd is going to venture anywhere outside of their hermetically sealed status quo, we’d like to offer an example of something a real leader might say...

Jim Grant Warns "The Fed Turned The Stock Market Into A 'Hall Of Mirrors'"

Submitted by Tyler Durden on 08/26/2015 - 17:45 The question we appear to be getting answered this week is, as Grant's Interest Rate Observer's Jim Grant so poetically explains, "how much of this paper moon market is real, and how much is governmental whipped cream?" In this brief but, as usual, perfectly to the point interview with Reason.com's Matt Welch, Grant asks (and answers), "are prices meant to be imposed from on high, or discovered by individuals acting spontaneously in markets?" noting that, while many readers here may know the answer, "they’re regrettably in the minority." The always entertaining Grant then goes on to discuss the underlying causes of the recent market turbulence, why we don’t really "have interest rates anymore."from Reason TV:

"I Fear For The Chinese Citizen"

Submitted by Tyler Durden on 08/26/2015 - 17:20 The idea of a change towards a domestic consumption-driven economy is being revealed as a woeful disaster. You can’t magically turn into a consumer-based economy by blowing bubbles first in property and then in stocks, and hope people’s profits in both will make them spend. Because the whole endeavor was based from the get-go on huge increases in debt, the just as predictable outcome is, and will be even much more, that people count their losses and spend much less in the local economy. While those with remaining spending power purchase property in the US, Britain, Australia. And go live there too, where they feel safe(r). I fear for the Chinese citizen. Not so much for Xi and Li. They will get what they deserve.

How The US Economy Underwent Half A Rate Hike In The Past Week Without The Fed's Permission

Submitted by Tyler Durden on 08/26/2015 - 17:01 In the past week, ever since the Fed's FOMC minutes which sent the S&P tumbling from 2100 to their lows in the overnight session, some 13% lower, the US economy underwent the functional equivalent of a 15 bps rate hike, or more than half the rate hike that the Fed has been so terrified to engage in for years.

Why Deez Nuts Is Actually Critically Important For The Future Of The Country

Submitted by Tyler Durden on 08/26/2015 - 16:30 One might argue that the success of 15-year-old Brady Olsen - aka Deez Nuts - from Wallingford, Iowa, embodies more than simply a successful lampooning of the American political system. There are legitimate reasons to view this development as the opening salvo in an upheaval of the way Americans elect presidents. Does this sound hyperbolic? Let me take it a step further: Deez Nuts is actually critically important for the future of the country... and here’s why...

Fiscally Irresponsible?

Submitted by Tyler Durden on 08/26/2015 - 15:53 "Can you believe how fiscally irresponsible 'those' other guys are?"

China Loses All Control: Arrests Journalist, Financial Executive Over Market Crash

Submitted by Tyler Durden on 08/26/2015 - 15:51 With China's equity bubble now squarely in the rearview and the stock market crash making headlines the world over, Beijing is out for blood in a desperate attempt to find a scapegoat for a market rout that has rattled the country to the core. In what is perhaps a worrying sign of things to come, overnight China arrested a journalist and a top investment banker for "spreading fake trading information" and "illegal trading", respectively.You decide...

by Ian Greenhalgh, Veterans Today:

Two weeks ago a devastating explosion took place in the port city of

Tianjin, China. Official reports claimed a chemical storage facility had

caught fire and exploded. Mobile phone footage taken by residents

showed an enormous blast and fireball.

Two weeks ago a devastating explosion took place in the port city of

Tianjin, China. Official reports claimed a chemical storage facility had

caught fire and exploded. Mobile phone footage taken by residents

showed an enormous blast and fireball.Within days, aerial photos revealed the stunning extent of the damage. A steaming black crater marks ground zero, while the apocalyptic surrounding landscape is charred and flattened. Rows of burnt-out cars and twisted shipping containers stretch into the distance on all sides.

The total burned area spans 20,000 square meters and continues to be dangerous—more explosions were reported by Chinese authorities on the 15th of August. Residents within a 3-mile radius have been relocated; at least 85 victims of the accident have been reported dead.

Read More

If you are confused as to why the price of silver was smashed under

$14/oz today you have no farther to look than the COMEX Silver contract

that expires tomorrow!

If you are confused as to why the price of silver was smashed under

$14/oz today you have no farther to look than the COMEX Silver contract

that expires tomorrow!Somebody…NEEDED to smash silver for that expiration and “somebody” did just that. So who is it? That’s easy!

Read More

from Dollar Collapse:

Back when society’s balance sheet was reasonably solid, the occasional

bear market was no big deal. A 20% drop in the average S&P 500

stock would scare investors and lead to slight declines in consumer

spending and government capital gains tax revenue, but the overall

economy would barely notice such a minor speed bump.

Back when society’s balance sheet was reasonably solid, the occasional

bear market was no big deal. A 20% drop in the average S&P 500

stock would scare investors and lead to slight declines in consumer

spending and government capital gains tax revenue, but the overall

economy would barely notice such a minor speed bump.

But that was then. Like a person with an impaired immune system, today’s developed world is so highly leveraged that a shock of any kind risks catastrophic complications. Which is why governments and central banks now meet every incipient crisis with quick infusions of newly-created cash and lower interest rates. We can’t risk letting markets be markets any more.

Read More

Back when society’s balance sheet was reasonably solid, the occasional

bear market was no big deal. A 20% drop in the average S&P 500

stock would scare investors and lead to slight declines in consumer

spending and government capital gains tax revenue, but the overall

economy would barely notice such a minor speed bump.

Back when society’s balance sheet was reasonably solid, the occasional

bear market was no big deal. A 20% drop in the average S&P 500

stock would scare investors and lead to slight declines in consumer

spending and government capital gains tax revenue, but the overall

economy would barely notice such a minor speed bump.But that was then. Like a person with an impaired immune system, today’s developed world is so highly leveraged that a shock of any kind risks catastrophic complications. Which is why governments and central banks now meet every incipient crisis with quick infusions of newly-created cash and lower interest rates. We can’t risk letting markets be markets any more.

Read More

from Natural News:

Natural mosquito repellants can be made from essentials oils at home.

Mosquito bites can lead to West Nile virus, malaria, and other health

conditions, however many commercial mosquito repellants contain toxic

ingredients such as DEET that can also be harmful. You can replace these

toxic ingredients with essentials oils to make inexpensive, natural

mosquito repellants.

Natural mosquito repellants can be made from essentials oils at home.

Mosquito bites can lead to West Nile virus, malaria, and other health

conditions, however many commercial mosquito repellants contain toxic

ingredients such as DEET that can also be harmful. You can replace these

toxic ingredients with essentials oils to make inexpensive, natural

mosquito repellants.

Toxic ingredients in mosquito repellents

DEET is one of the most commonly used ingredients in commercial insect repellants. DEET, which was first introduced in 1957, continues to be a popular mosquito repellant because its protection can last as long as 300 minutes, which other mosquito repellants last only 20.

Read More

Natural mosquito repellants can be made from essentials oils at home.

Mosquito bites can lead to West Nile virus, malaria, and other health

conditions, however many commercial mosquito repellants contain toxic

ingredients such as DEET that can also be harmful. You can replace these

toxic ingredients with essentials oils to make inexpensive, natural

mosquito repellants.

Natural mosquito repellants can be made from essentials oils at home.

Mosquito bites can lead to West Nile virus, malaria, and other health

conditions, however many commercial mosquito repellants contain toxic

ingredients such as DEET that can also be harmful. You can replace these

toxic ingredients with essentials oils to make inexpensive, natural

mosquito repellants.Toxic ingredients in mosquito repellents

DEET is one of the most commonly used ingredients in commercial insect repellants. DEET, which was first introduced in 1957, continues to be a popular mosquito repellant because its protection can last as long as 300 minutes, which other mosquito repellants last only 20.

Read More

from FinancialSurvivalNetwork.com:

Jeff Berwick of DollarVigilante.com joined us to discuss the Shemitah Year that is unfolding before us now…

Jeff Berwick of DollarVigilante.com joined us to discuss the Shemitah Year that is unfolding before us now…

Under Jewish Tradition, every 7th year is a Shemitah year. And every 7th Shemitah is a Jubilee Year.

There are so many events unfolding that it’s hard to keep track of them. From Jade Helm, to the UN’s 70th Anniversary, to the Papal Visit, and the world-wide stock market decline, things are starting to heat up.

Click Here to Listen

Jeff Berwick of DollarVigilante.com joined us to discuss the Shemitah Year that is unfolding before us now…

Jeff Berwick of DollarVigilante.com joined us to discuss the Shemitah Year that is unfolding before us now…Under Jewish Tradition, every 7th year is a Shemitah year. And every 7th Shemitah is a Jubilee Year.

There are so many events unfolding that it’s hard to keep track of them. From Jade Helm, to the UN’s 70th Anniversary, to the Papal Visit, and the world-wide stock market decline, things are starting to heat up.

Click Here to Listen

by Karl Denninger, Market-Ticker:

Be very ****ing careful.

Be very ****ing careful.

That’s the short version.

Timelines have become compressed to an unbelievable degree, and liquidity sucks. HFT is responsible for most of this, I suspect, but it portends very bad things in the near future for the markets — and ultimately for the overlevered economy and business as well.

Don’t let anyone tell you business has “de-levered.” That’s a lie. Non-financial corporations have record debt outstanding.

Read More

Be very ****ing careful.

Be very ****ing careful.That’s the short version.

Timelines have become compressed to an unbelievable degree, and liquidity sucks. HFT is responsible for most of this, I suspect, but it portends very bad things in the near future for the markets — and ultimately for the overlevered economy and business as well.

Don’t let anyone tell you business has “de-levered.” That’s a lie. Non-financial corporations have record debt outstanding.

Read More

from trendsjournal:

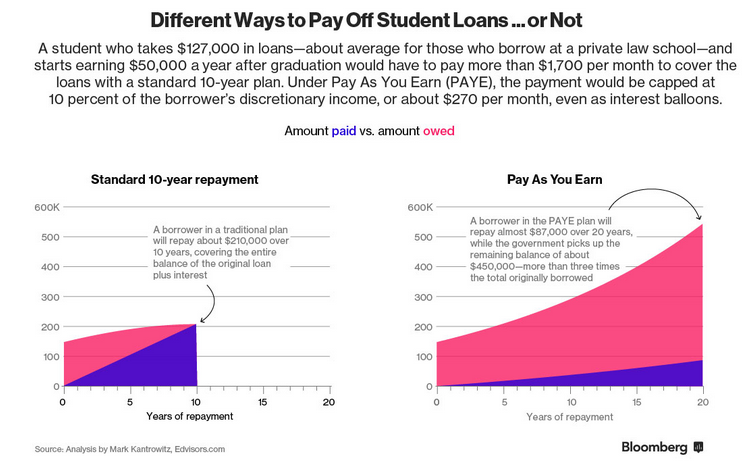

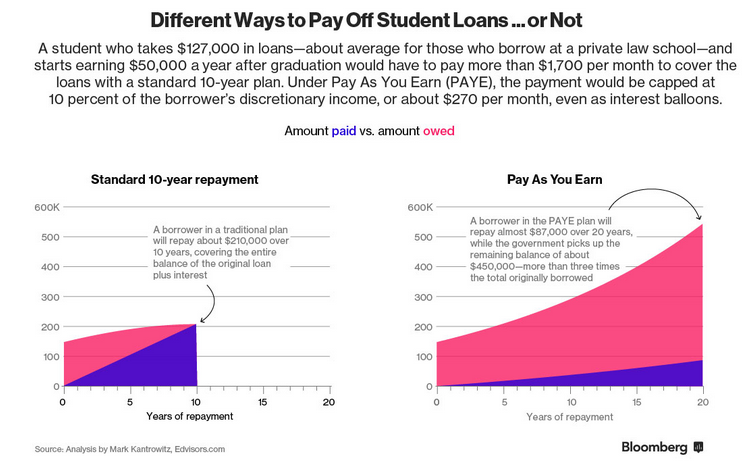

The college debt bubble grows.

from MyBudget360.com:

The student debt problem continues to spiral out of control as millions of young Americans enter the workforce only to be greeted by low paying jobs and the monthly bill for their college experience. For the most part studies show that college graduates do better than non-college graduates. Yet these studies fail to take into account the soaring cost of college today. These studies also mix in top performing schools with paper mill operations. There was a recent analysis showing that there are now 7 million college debtors who haven’t made a college payment in the last year. This is a staggering 17 percent of federally held student debt while many others are inching closer to the 360-day delinquency window. In other words, many people are simply not paying back their college debt. The amount of student debt is staggering coming in at over $1.36 trillion. The student debt bubble is symptomatic of the way our financial system is now operating and that is debt is piled upon debt and strung out over years to be paid back in hopes that inflation will pass the bill to future generations. The bill is getting harder to pass.

Read More

from MyBudget360.com:

The student debt problem continues to spiral out of control as millions of young Americans enter the workforce only to be greeted by low paying jobs and the monthly bill for their college experience. For the most part studies show that college graduates do better than non-college graduates. Yet these studies fail to take into account the soaring cost of college today. These studies also mix in top performing schools with paper mill operations. There was a recent analysis showing that there are now 7 million college debtors who haven’t made a college payment in the last year. This is a staggering 17 percent of federally held student debt while many others are inching closer to the 360-day delinquency window. In other words, many people are simply not paying back their college debt. The amount of student debt is staggering coming in at over $1.36 trillion. The student debt bubble is symptomatic of the way our financial system is now operating and that is debt is piled upon debt and strung out over years to be paid back in hopes that inflation will pass the bill to future generations. The bill is getting harder to pass.

Read More

by Dave Kranzler, Investment Research Dynamics:

We all woke this morning to the money honeys on financial propaganda

television, all of whom couldn’t hide their ear-to-ear toothy grin over

the Dow futures being up over 600 points. But after a big 350 point

opening gap up, and after trending largely sideways for most of the

trading day, the markets plunged to close well below yesterday’s closing

levels:

We all woke this morning to the money honeys on financial propaganda

television, all of whom couldn’t hide their ear-to-ear toothy grin over

the Dow futures being up over 600 points. But after a big 350 point

opening gap up, and after trending largely sideways for most of the

trading day, the markets plunged to close well below yesterday’s closing

levels:

Grins turned to frowns and confusion by the close of trading. What is even more stunning is the way the indices were bouncing around in the last 10 minutes of trading. The Dow went from down over 100 to almost green and then back down to its close at -204. It was shocking to watch, to say the least. I’ve never witnessed trading like this in over 30 years of active involvement in the financial markets. The Dow and the S&P 500 were bouncing around like an LSD-laced kangaroo on a pogo-stick. The NAZ was up over 14 points and in less than it minute it was down 10. I closed down 22, or .6% on the day.

Read More

We all woke this morning to the money honeys on financial propaganda

television, all of whom couldn’t hide their ear-to-ear toothy grin over

the Dow futures being up over 600 points. But after a big 350 point

opening gap up, and after trending largely sideways for most of the

trading day, the markets plunged to close well below yesterday’s closing

levels:

We all woke this morning to the money honeys on financial propaganda

television, all of whom couldn’t hide their ear-to-ear toothy grin over

the Dow futures being up over 600 points. But after a big 350 point

opening gap up, and after trending largely sideways for most of the

trading day, the markets plunged to close well below yesterday’s closing

levels:Grins turned to frowns and confusion by the close of trading. What is even more stunning is the way the indices were bouncing around in the last 10 minutes of trading. The Dow went from down over 100 to almost green and then back down to its close at -204. It was shocking to watch, to say the least. I’ve never witnessed trading like this in over 30 years of active involvement in the financial markets. The Dow and the S&P 500 were bouncing around like an LSD-laced kangaroo on a pogo-stick. The NAZ was up over 14 points and in less than it minute it was down 10. I closed down 22, or .6% on the day.

Read More

by Mac Slavo, SHTFPlan:

Ostensibly, and on the surface, they are trained to “help out” with things like natural disasters, floods and hurricanes.

Ostensibly, and on the surface, they are trained to “help out” with things like natural disasters, floods and hurricanes.

They are “ready” too for chemical, biological, radiological or nuclear hazards.

Slightly below the surface, these Fort Bragg Army engineers are also training — this time in Florida — to assist local authorities in the event of domestic disorder and potential chaos — prepared to quell civil unrest, riots, mass unrest or even the aftermath of terrorist attacks.

Scenarios which could all be really coming to America.

Read More

Ostensibly, and on the surface, they are trained to “help out” with things like natural disasters, floods and hurricanes.

Ostensibly, and on the surface, they are trained to “help out” with things like natural disasters, floods and hurricanes.They are “ready” too for chemical, biological, radiological or nuclear hazards.

Slightly below the surface, these Fort Bragg Army engineers are also training — this time in Florida — to assist local authorities in the event of domestic disorder and potential chaos — prepared to quell civil unrest, riots, mass unrest or even the aftermath of terrorist attacks.

Scenarios which could all be really coming to America.

Read More

At This Point The Stock Market Is Meaningless, The Economy Is Headed For A Collapse: Chris Martenson

from McAlvany Financial:

McAlvany Weekly Commentary 2015: David heads to China where financial crises accelerates, China dumps 180 billion in U.S. Treasuries & Income starved retirees forced to take risks they WILL regret.

McAlvany Weekly Commentary 2015: David heads to China where financial crises accelerates, China dumps 180 billion in U.S. Treasuries & Income starved retirees forced to take risks they WILL regret.

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment