Submitted by Tyler Durden on 08/04/2015 - 15:30 Despite its history of gains, and 5,000 years of tradition behind it, gold is rapidly becoming one of the most widely despised assets. But before we pronounce it dead and write the final gold eulogy, however, let’s consider the following...

from Jesse’s Café Américain:

As you can see from the first chart below, the number of potential

claims per deliverable ounce on the Comex has risen to a record high of

121 to 1.

As you can see from the first chart below, the number of potential

claims per deliverable ounce on the Comex has risen to a record high of

121 to 1.

That can be corrected by higher prices for bullion that will prompt more legitimate sellers of actual bullion to take their stored gold and put it in the ‘registered’ for delivery category.

Or the trading desks of the banks and funds can continue to pummel the price with paper short selling, in the hopes of knocking down the open interest and the longs.

Read More

As you can see from the first chart below, the number of potential

claims per deliverable ounce on the Comex has risen to a record high of

121 to 1.

As you can see from the first chart below, the number of potential

claims per deliverable ounce on the Comex has risen to a record high of

121 to 1.That can be corrected by higher prices for bullion that will prompt more legitimate sellers of actual bullion to take their stored gold and put it in the ‘registered’ for delivery category.

Or the trading desks of the banks and funds can continue to pummel the price with paper short selling, in the hopes of knocking down the open interest and the longs.

Read More

by Bill Bonner, Daily Reckoning:

PARIS – Today, help comes from an unexpected direction – Alan Greenspan!

PARIS – Today, help comes from an unexpected direction – Alan Greenspan!

After so many years of mumbly-dumbly gobbledygook and credit-pumping folderol (much of the blame for the credit crisis of 2008 can be sent to his inbox), we had forgotten about Greenspan’s earlier oeuvre.

Yes… before he became a public servant he might have passed for an honest man.

And his 1966 essay “Gold and Economic Freedom” is a classic. It helps explain how this credit bubble finally ends.

Read More

PARIS – Today, help comes from an unexpected direction – Alan Greenspan!

PARIS – Today, help comes from an unexpected direction – Alan Greenspan!After so many years of mumbly-dumbly gobbledygook and credit-pumping folderol (much of the blame for the credit crisis of 2008 can be sent to his inbox), we had forgotten about Greenspan’s earlier oeuvre.

Yes… before he became a public servant he might have passed for an honest man.

And his 1966 essay “Gold and Economic Freedom” is a classic. It helps explain how this credit bubble finally ends.

Read More

by Don DiPaola, Investment Research Dynamics:

There is a feeling shared by many investors that something is not

quite right in the financial world today. They do not know or understand

exactly what is going on but the recovery that is supposed to be

happening is not showing any visible signs of that being the case. Their

neighbors are losing their jobs. Food costs and daily living expenses

are going up even though there is supposed to be no inflation. The world

is becoming a dangerous place. Countries are going into default. States

and counties are under financial duress, pensions are underfunded.

There is a feeling shared by many investors that something is not

quite right in the financial world today. They do not know or understand

exactly what is going on but the recovery that is supposed to be

happening is not showing any visible signs of that being the case. Their

neighbors are losing their jobs. Food costs and daily living expenses

are going up even though there is supposed to be no inflation. The world

is becoming a dangerous place. Countries are going into default. States

and counties are under financial duress, pensions are underfunded.

Read More

Read More

Fed Lunacy Is To Blame For The Coming Crash

Submitted by Tyler Durden on 08/04/2015 - 21:15 From our perspective, the fundamental reason for economic stagnation and growing income disparity is straightforward: Our current set of economic policies supports and encourages a low level equilibrium by encouraging debt-financed consumption and discouraging saving and productive investment. We permit an insular group of professors and bankers to fling trillions of dollars about like Frisbees in the simplistic, misguided, and repeatedly destructive attempt to buy prosperity by maximally distorting the financial markets.

Windows 10 OS – the ultimate Big Brother?

Windows 10 OS – the ultimate Big Brother?Of the 14+ million people who have recently installed Microsoft’s new Windows 10, there haven’t been many complaints until now. The system is said to run more efficiently, but apparently someone only recently read the tome of a service agreement. Let’s just say that Windows 10 goes above and beyond good service and makes sure that you are being a good citizen. Who is the one really getting the upgrade, here?

Yes, it is implicitly stated that whoever installs the program is agreeing to be watched and that Windows 10 can and will aid and abet law enforcement and other government agencies – should it deem that you are doing something illegal.

Read More @ ActivistPost.com

The Dodd-Frank financial reform legislation just celebrated its fifth anniversary on July 21 and the gaping holes it left in the promise to protect our Nation from another systemic financial crash are becoming clearer every day. No other agency has done more to highlight these growing risks than the Office of Financial Research (OFR), created under Dodd-Frank as a unit of the U.S. Treasury. In its most recent report, it provides the stunning news that private hedge funds in the U.S. now control one-third of all assets under management in the financial services industry – a stunning $4.1 trillion when leverage is included.

In February of this year, OFR released a jaw-dropping report showing dangerous levels of systemic and interconnected risk among some of the same Wall Street players that held pivotal roles in the crash of 2008. The report found that five Wall Street banks had high contagion index values — Citigroup, JPMorgan, Morgan Stanley, Bank of America, and Goldman Sachs.

Read More @ WallStreetonParade.com

Inflation Nation: College Textbook Prices Soar 1000% Since 1977

Submitted by Tyler Durden on 08/04/2015 - 20:40 Wondering why the drop-out rate from college is so high? One reason could be that a stunning 65% of students avoided buying textbooks due to the cost. As NBCNews reports, textbook prices have risen over three times the rate of inflation from January 1977 to June 2015, a 1,041 percent increase - dwarfing the government's official CPI data. Just as government-subsidized healthcare has 'enabled' dramatic rises in the costs of drugs so government-subsidized education has sparked hyperinflation-esque pricing in college textbooksPeter Schiff: What If "They" Are Wrong (Again)?

Submitted by Tyler Durden on 08/04/2015 - 20:05 What if the assumptions about a U.S. economic recovery and Fed rate hikes were wrong? Could observers be mistaken now about the trajectory of the Dollar vs. the Euro as they were back in 2000? Confidence is the only thing that really undergirds modern fiat currencies. But confidence can be very ephemeral...disappearing as quickly as it arrives. The U.S. Dollar benefits from confidence that the Euro currency may just be unworkable, that the U.S. economy will continue to improve, and that the Fed will raise rates throughout the remainder of 2015 and into 2016. If these expectations are unfulfilled, there could be a Euro reversal.

"You're Gonna Need a Bigger Boat" - Does Size Matter When It Comes To The Debt Markets

Submitted by Tyler Durden on 08/04/2015 - 19:33 The reality might just be that the collective "we," and quite possibly sooner than we think, really will need a bigger boat. That is, as it pertains to the global debt markets, which have swollen past the $200 trillion mark this year rendering the great white featured in Jaws which can be equated with past debt markets as defenseless and small as a small, striped Nemo by comparison. The question for the ages will be whether size really does matter when it comes to the debt markets...

Russia Ready To Send Paratroopers To Syria

Submitted by Tyler Durden on 08/04/2015 - 19:26 The Russian Airborne Troops are ready to assist Syria in countering terrorists, if such a task is set by Russia’s leaders, commander of the Airborne Troops Colonel-General Vladimir Shamanov told reporters on Tuesday.

TEPCO Officials To Be Tried for Role In Fukushima Meltdown

Submitted by Tyler Durden on 08/04/2015 - 19:10 A Japanese citizens’ judicial committee has overruled government prosecutors and forced them to bring three former executives of the Tokyo Electric Power Co. (TEPCO) to trial on charges of criminal negligence for their inability to prevent the 2011 nuclear disaster at the Fukushima Daiichi nuclear power plant.

Twin Trillion-Dollar Bubbles Prompt Dramatic Rise In Non-Mortgage Debt

Submitted by Tyler Durden on 08/04/2015 - 18:45 America's twin trillion-dollar bubbles - auto loans and student debt - are taking their toll on household finances as "mortgage holders today are carrying more non-mortgage debt than at any point in the past 10 years, with an average of $25,000 per borrower."Chart Of The Day - Americans Are Not Happy

Submitted by Tyler Durden on 08/04/2015 - 18:20 ...despite record stock prices and non-stop propaganda, fewer and fewer people are believing the hype.

Why Turkey's "ISIS-Free Zone" Is The Most Ridiculous US Foreign Policy Outcome In History

Submitted by Tyler Durden on 08/04/2015 - 17:55 The truly incredible thing about US foreign policy outcomes is that there are seemingly no limits on how absurd they can be. Indeed, Washington’s uncanny ability to paint itself into policy corners and create the most thoroughly flummoxing geopolitical quagmires in the history of statecraft knows absolutely no bounds.

Politicians Seek Short-Term Advantages By Lecturing Capitalists About The Long Term

Submitted by Tyler Durden on 08/04/2015 - 17:30 Political attacks on short-termism, and reforms to fix it, are beyond confused. They ignore financial market participants’ clear incentives to take future effects into account. They are clueless about what provides evidence of short-termism. There is little to Clinton’s criticism and alleged solutions beyond misunderstanding and misrepresentation. We should recognize, with Henry Hazlitt, that “today is already the tomorrow which the bad economist yesterday urged us to ignore,” and that expanding government’s power to do more of the same is not in Americans’ interests.

Creditors May Have To Hire Pirates To Seize Oil Ship From "Deadbeat" Ex-Billionaire

Submitted by Tyler Durden on 08/04/2015 - 17:00 "The costs of executing the collateral are very high unless creditors send pirates from Algeria to go and get the vessel."

Goldman Is Confused: If The Economy Is Recovering, Then How Is This Possible

Submitted by Tyler Durden on 08/04/2015 - 16:40 "The share of young people living with their parents--which rose sharply during the recession and its aftermath--finally began to decline in 2014. But over the last six months, this decline seems to have stalled. We find that the share of young people living with their parents has increased relative to pre-recession rates for all labor force status groups, not just the unemployed and underemployed." - Goldman SachsAAPLocalypse & Lockhart-nado Spoil Stock Party; Dollar & Bond Yields Surge

Submitted by Tyler Durden on 08/04/2015 - 16:08

…and hardly anyone even noticed

…and hardly anyone even noticedWhile everyone was freaking out over a lion, the Obama White House just declared war on Syria and hardly anyone even noticed.

Read More @ Infowars.com

by Julie Fidler, Natural Society:

Scientists and environmentalists are concerned that a new technique for

generated “supercharged” genetically modified organisms (GMOs) could be misused and trigger a health emergency or natural disaster.

Scientists and environmentalists are concerned that a new technique for

generated “supercharged” genetically modified organisms (GMOs) could be misused and trigger a health emergency or natural disaster.

The “gene drive” technology allows GMOs to spread rapidly in the wild. The fear is that these organisms could fall into the wrong hands or accidentally spark a catastrophe. The technology is being touted as a way to revolutionize medicine and agriculture, and supporters say it could, in theory, halt the spread of mosquito-borne diseases like malaria and yellow fever, and eliminate crop pests and invasive species like rats and can toads. [1]

Read More @ NaturalSociety.com

Scientists and environmentalists are concerned that a new technique for

generated “supercharged” genetically modified organisms (GMOs) could be misused and trigger a health emergency or natural disaster.

Scientists and environmentalists are concerned that a new technique for

generated “supercharged” genetically modified organisms (GMOs) could be misused and trigger a health emergency or natural disaster.The “gene drive” technology allows GMOs to spread rapidly in the wild. The fear is that these organisms could fall into the wrong hands or accidentally spark a catastrophe. The technology is being touted as a way to revolutionize medicine and agriculture, and supporters say it could, in theory, halt the spread of mosquito-borne diseases like malaria and yellow fever, and eliminate crop pests and invasive species like rats and can toads. [1]

Read More @ NaturalSociety.com

from Stefan Molyneux:

Is the United States economy recovering – or are we being lied to by the mainstream establishment? Why has Gold recently hit a five year low despite long term predictions of it’s rise in value? Are the government statistics on inflation accurate? What does the future hold for the US Dollar? Why has the Dollar strengthened and how will this play out in the long term? What does Peter Schiff think about Donald Trump and his recent success in the Republican presidential primary?

Also Includes: China economic situation, the Shanghai Stock Exchange Composite Index collapse, Puerto Rico debt default, gold repatriation, physical vs. paper gold holdings, the student debt bubble, the new real estate bubble, more quantitative easing, interest rates and what happens if you raise the minimum wage to $70,000 per year.

Is the United States economy recovering – or are we being lied to by the mainstream establishment? Why has Gold recently hit a five year low despite long term predictions of it’s rise in value? Are the government statistics on inflation accurate? What does the future hold for the US Dollar? Why has the Dollar strengthened and how will this play out in the long term? What does Peter Schiff think about Donald Trump and his recent success in the Republican presidential primary?

Also Includes: China economic situation, the Shanghai Stock Exchange Composite Index collapse, Puerto Rico debt default, gold repatriation, physical vs. paper gold holdings, the student debt bubble, the new real estate bubble, more quantitative easing, interest rates and what happens if you raise the minimum wage to $70,000 per year.

by John Whitehead, Rutherford:

We’re living in two worlds, you and I.

There’s the world we see (or are made to see) and then there’s the one we sense (and occasionally catch a glimpse of), the latter of which is a far cry from the propaganda-driven reality manufactured by the government and its corporate sponsors, including the media.

Indeed, what most Americans perceive as life in America—privileged, progressive and free—is a far cry from reality, where economic inequality is growing, real agendas and real power are buried beneath layers of Orwellian doublespeak and corporate obfuscation, and “freedom,” such that it is, is meted out in small, legalistic doses by militarized police armed to the teeth.

Read More

We’re living in two worlds, you and I.

There’s the world we see (or are made to see) and then there’s the one we sense (and occasionally catch a glimpse of), the latter of which is a far cry from the propaganda-driven reality manufactured by the government and its corporate sponsors, including the media.

Indeed, what most Americans perceive as life in America—privileged, progressive and free—is a far cry from reality, where economic inequality is growing, real agendas and real power are buried beneath layers of Orwellian doublespeak and corporate obfuscation, and “freedom,” such that it is, is meted out in small, legalistic doses by militarized police armed to the teeth.

Read More

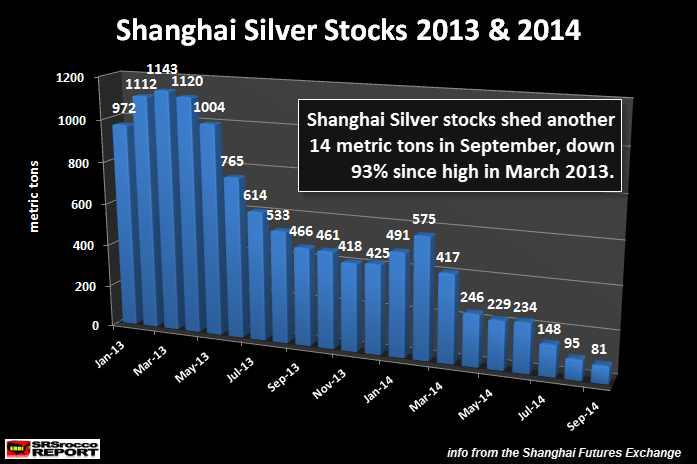

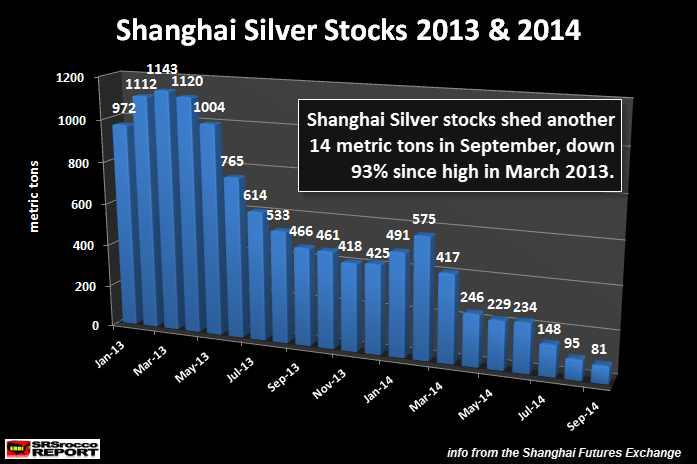

by Steve St. Angelo, SRS Rocco Report:

There seems to be more evidence indicating the beginning stages of a global run on silver. How so? Well, ever since the middle of June, something significantly changed in the silver market. Physical silver investment demand skyrocketed. Why June? This was at the time Greece was voting on whether or not to remain in the European Union.

Since the middle of June, investment demand for silver has increased considerably. Matter-a-fact, the U.S. Mint suspended sales of the Silver Eagle for two weeks starting on July 12th. When Silver Eagle sales resumed on July 27th, over 2.5 million were sold over the next two days.

Read More

There seems to be more evidence indicating the beginning stages of a global run on silver. How so? Well, ever since the middle of June, something significantly changed in the silver market. Physical silver investment demand skyrocketed. Why June? This was at the time Greece was voting on whether or not to remain in the European Union.

Since the middle of June, investment demand for silver has increased considerably. Matter-a-fact, the U.S. Mint suspended sales of the Silver Eagle for two weeks starting on July 12th. When Silver Eagle sales resumed on July 27th, over 2.5 million were sold over the next two days.

Read More

from Gold Silver Worlds:

If there are words to characterize the precious metals markets for

July, it would be “divergences” and “shortages.” There was heavy selling

in the leveraged futures market and extraordinary buying demand and

shortages in physical coins, rounds, and bars.

If there are words to characterize the precious metals markets for

July, it would be “divergences” and “shortages.” There was heavy selling

in the leveraged futures market and extraordinary buying demand and

shortages in physical coins, rounds, and bars.

Despite turmoil surrounding Greece and a huge sell-off in Chinese equities, traders dumped wheelbarrow loads of paper gold and silver. The expected safe-haven buying was concentrated entirely in physical bullion. Spot prices fell relentlessly during the month.

This divergence has been reported recently. But some surprising new data has come to light…

Read More

If there are words to characterize the precious metals markets for

July, it would be “divergences” and “shortages.” There was heavy selling

in the leveraged futures market and extraordinary buying demand and

shortages in physical coins, rounds, and bars.

If there are words to characterize the precious metals markets for

July, it would be “divergences” and “shortages.” There was heavy selling

in the leveraged futures market and extraordinary buying demand and

shortages in physical coins, rounds, and bars.Despite turmoil surrounding Greece and a huge sell-off in Chinese equities, traders dumped wheelbarrow loads of paper gold and silver. The expected safe-haven buying was concentrated entirely in physical bullion. Spot prices fell relentlessly during the month.

This divergence has been reported recently. But some surprising new data has come to light…

Read More

from USA Today:

Greek stock markets suffered a second straight day of losses Tuesday as Greek banking stocks once again fell by around 30%, the daily limit.

The Athens Stock Exchange in Greece dropped 1.2% to 659.94 after being down as much as 4.9% earlier. That comes on top of the 16% drop on Monday.

WALL STREET: Stocks lower as Dow faces 4th straight day of losses

Global stocks were uneven as other European stock markets were mixed. Germany’s DAX rose 0.1%, France’s CAC 40 dropped 0.2% and Britain’s FTSE 100 was flat.

Read More

Greek stock markets suffered a second straight day of losses Tuesday as Greek banking stocks once again fell by around 30%, the daily limit.

The Athens Stock Exchange in Greece dropped 1.2% to 659.94 after being down as much as 4.9% earlier. That comes on top of the 16% drop on Monday.

WALL STREET: Stocks lower as Dow faces 4th straight day of losses

Global stocks were uneven as other European stock markets were mixed. Germany’s DAX rose 0.1%, France’s CAC 40 dropped 0.2% and Britain’s FTSE 100 was flat.

Read More

from X22Report Spotlight:

from Western Journalism:

Claiming that “no challenge poses a greater threat to our future” than

climate change and how to lessen its supposed impact on the planet,

President Obama today laid out his administration’s newest plan to

greatly reduce carbon emissions. The so-called “Clean Power Plan” is

seen by many Republicans and energy industry analysts as a business and

jobs killer as well as a looming threat to the finances of Americans who

would likely see the cost of electricity and other everyday necessities

go up substantially if the plan is enacted.

Claiming that “no challenge poses a greater threat to our future” than

climate change and how to lessen its supposed impact on the planet,

President Obama today laid out his administration’s newest plan to

greatly reduce carbon emissions. The so-called “Clean Power Plan” is

seen by many Republicans and energy industry analysts as a business and

jobs killer as well as a looming threat to the finances of Americans who

would likely see the cost of electricity and other everyday necessities

go up substantially if the plan is enacted.

According to coverage in USA Today of Obama’s news conference in which he advanced what many critics see as his war on coal, “While Obama laid out a stark vision of what could happen if not [sic] actions are taken, the next president will have a say on how — and if — Obama’s proposed emission reductions are enforced.”

Read More

Claiming that “no challenge poses a greater threat to our future” than

climate change and how to lessen its supposed impact on the planet,

President Obama today laid out his administration’s newest plan to

greatly reduce carbon emissions. The so-called “Clean Power Plan” is

seen by many Republicans and energy industry analysts as a business and

jobs killer as well as a looming threat to the finances of Americans who

would likely see the cost of electricity and other everyday necessities

go up substantially if the plan is enacted.

Claiming that “no challenge poses a greater threat to our future” than

climate change and how to lessen its supposed impact on the planet,

President Obama today laid out his administration’s newest plan to

greatly reduce carbon emissions. The so-called “Clean Power Plan” is

seen by many Republicans and energy industry analysts as a business and

jobs killer as well as a looming threat to the finances of Americans who

would likely see the cost of electricity and other everyday necessities

go up substantially if the plan is enacted.According to coverage in USA Today of Obama’s news conference in which he advanced what many critics see as his war on coal, “While Obama laid out a stark vision of what could happen if not [sic] actions are taken, the next president will have a say on how — and if — Obama’s proposed emission reductions are enforced.”

Read More

filed under (unt

from Bill Still:

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment