Submitted by Tyler Durden on 08/05/2015 - 18:35 Will there be a financial collapse in the United States before the end of 2015? An increasing number of respected financial experts are now warning that we are right on the verge of another great economic crisis.

from KingWorldNews:

Today King World News is featuring a piece by a man whose recently

released masterpiece has been praised around the world, and also

recognized as some of the most unique work in the gold market. Below is

the latest exclusive KWN piece by Ronald-Peter Stoeferle of Incrementum

AG out of Liechtenstein.

Today King World News is featuring a piece by a man whose recently

released masterpiece has been praised around the world, and also

recognized as some of the most unique work in the gold market. Below is

the latest exclusive KWN piece by Ronald-Peter Stoeferle of Incrementum

AG out of Liechtenstein.

What Is Seen And What Is Not Seen: The Fatal Consequences Of The Zero Interest Rate Policy

Three hundred years ago, Newton formulated his third law, also called the principle of action-reaction. It states: “Forces always appear in pairs. When one body A exerts a force on a second body B (action), the second body B simultaneously exerts a force equal in magnitude and opposite in direction on the first body A (reaction).”

Read More

Today King World News is featuring a piece by a man whose recently

released masterpiece has been praised around the world, and also

recognized as some of the most unique work in the gold market. Below is

the latest exclusive KWN piece by Ronald-Peter Stoeferle of Incrementum

AG out of Liechtenstein.

Today King World News is featuring a piece by a man whose recently

released masterpiece has been praised around the world, and also

recognized as some of the most unique work in the gold market. Below is

the latest exclusive KWN piece by Ronald-Peter Stoeferle of Incrementum

AG out of Liechtenstein.What Is Seen And What Is Not Seen: The Fatal Consequences Of The Zero Interest Rate Policy

Three hundred years ago, Newton formulated his third law, also called the principle of action-reaction. It states: “Forces always appear in pairs. When one body A exerts a force on a second body B (action), the second body B simultaneously exerts a force equal in magnitude and opposite in direction on the first body A (reaction).”

Read More

Hedge Fund Horrors: First Einhorn Has Worst Month Since 2008, Now Paulson Getting Redeemed

Submitted by Tyler Durden on 08/05/2015 - 16:21 "The wealth management arm of Bank of America Merrill Lynch is liquidating its clients’ money from one of Paulson & Company’s funds and has put another fund under "heightened review,'" NY Times reports. As it turns out, this was not the year to be long Greece and Puerto Rico. The question is often asked: “What can we do?” Here is a prescription

for peace and prosperity. We will begin with prosperity, because

prosperity can contribute to peace. Sometimes governments begin wars in

order to distract from unpromising economic prospects, and internal

political stability can also be dependent on prosperity.

The question is often asked: “What can we do?” Here is a prescription

for peace and prosperity. We will begin with prosperity, because

prosperity can contribute to peace. Sometimes governments begin wars in

order to distract from unpromising economic prospects, and internal

political stability can also be dependent on prosperity.The Road to Prosperity

For the United States to return to a prosperous road, the middle class must be restored and the ladders of upward mobility put back in place. The middle class served domestic political stability by being a buffer between rich and poor. Ladders of upward mobility are a relief valve that permit determined folk to rise from poverty to success. Rising incomes throughout society provide the consumer demand that drives an economy. This is the way the US economy worked in the post-WWII period.

Dr. Roberts continues @ KingWorldNews.com

"I Sure Am Glad There's No Inflation"

Submitted by Tyler Durden on 08/05/2015 - 14:50 I sure am glad there's no inflation, because these "stable prices" the Federal Reserve keeps jaw-jacking about are putting us in a world of hurt.China's Plunge Protection "National Team" Bought 900 Billion In Stocks, Goldman Calculates

Stock Buybacks Set To Soar After SEC Forces Companies To Compare CEO And Worker Pay

Submitted by Tyler Durden on 08/05/2015 - 14:38 In an attempt to publicly shame CEOs into lowering their pay, or boost the compensation they pay their employees (because the forces of labor supply and demand apparently no longer work) moments ago, in a 3-2 vote, the SEC approved a rule Wednesday requiring companies to reveal the pay gap between the chief executive officer and their typical worker. The problem: this latest attempt at wealth redistribution will backfire massively, lead to even higher comp for executives, while assuring an even faster collapse for the US middle class.

China Responds To US Declaration Of Cyber War

Submitted by Tyler Durden on 08/05/2015 - 20:10 "The United States is on the brink of making another grave mistake under the name of protecting cyber security... If it stubbornly implements retaliatory measures against China in cyber space, it will be known for being a cyber bully and will have to shoulder responsibility for escalating confrontation and disrupting the peaceful order in the cyber space."

from The Burning Platform:

On April 10, 2006, Mexican authorities searched through a DC-9 jet at

the airport in Ciudad del Carmen. They found more than five tons of

cocaine… valued at more than $100 million.

On April 10, 2006, Mexican authorities searched through a DC-9 jet at

the airport in Ciudad del Carmen. They found more than five tons of

cocaine… valued at more than $100 million.

If you’re like many Americans, you’re not surprised by a story like this. Not a year goes by without a few big media stories about Mexican drug cartels.

However, you probably will be very surprised to learn who aided and abetted the drug operation: it was US banking giant Wachovia.

After an investigation that took years, Wells Fargo, which now owns Wachovia, paid a $160 million fine to settle the case. “Wachovia’s blatant disregard for our banking laws gave international cocaine cartels a virtual carte blanche to finance their operations,” said federal prosecutor Jeffrey Sloman.

Read More

On April 10, 2006, Mexican authorities searched through a DC-9 jet at

the airport in Ciudad del Carmen. They found more than five tons of

cocaine… valued at more than $100 million.

On April 10, 2006, Mexican authorities searched through a DC-9 jet at

the airport in Ciudad del Carmen. They found more than five tons of

cocaine… valued at more than $100 million.If you’re like many Americans, you’re not surprised by a story like this. Not a year goes by without a few big media stories about Mexican drug cartels.

However, you probably will be very surprised to learn who aided and abetted the drug operation: it was US banking giant Wachovia.

After an investigation that took years, Wells Fargo, which now owns Wachovia, paid a $160 million fine to settle the case. “Wachovia’s blatant disregard for our banking laws gave international cocaine cartels a virtual carte blanche to finance their operations,” said federal prosecutor Jeffrey Sloman.

Read More

from Economic Noise:

And now it begins –the long-awaited financial collapse! The domino

effect is not underway yet, but a preview of what is coming can be

visualized. Detroit, Greece and Puerto Rico are harbingers of what faces

many, if not most, political jurisdictions. Common to all is political

legerdemain, lying and promises made that never could be fulfilled. All

that differs is the degree of harm already inflicted and a

jurisdiction’s ability to hold out.

And now it begins –the long-awaited financial collapse! The domino

effect is not underway yet, but a preview of what is coming can be

visualized. Detroit, Greece and Puerto Rico are harbingers of what faces

many, if not most, political jurisdictions. Common to all is political

legerdemain, lying and promises made that never could be fulfilled. All

that differs is the degree of harm already inflicted and a

jurisdiction’s ability to hold out.

Economics and mathematics are required to determine the downward spiral that most government entities have boxed themselves into. Economics tells us why there is not, nor will there be, a recovery. Mathematics tells us the hole is now so deep that there is no way out without massive defaults on debts and promises. Throw a bit of public-choice theory in and it all seems inevitable.

Read More

And now it begins –the long-awaited financial collapse! The domino

effect is not underway yet, but a preview of what is coming can be

visualized. Detroit, Greece and Puerto Rico are harbingers of what faces

many, if not most, political jurisdictions. Common to all is political

legerdemain, lying and promises made that never could be fulfilled. All

that differs is the degree of harm already inflicted and a

jurisdiction’s ability to hold out.

And now it begins –the long-awaited financial collapse! The domino

effect is not underway yet, but a preview of what is coming can be

visualized. Detroit, Greece and Puerto Rico are harbingers of what faces

many, if not most, political jurisdictions. Common to all is political

legerdemain, lying and promises made that never could be fulfilled. All

that differs is the degree of harm already inflicted and a

jurisdiction’s ability to hold out.Economics and mathematics are required to determine the downward spiral that most government entities have boxed themselves into. Economics tells us why there is not, nor will there be, a recovery. Mathematics tells us the hole is now so deep that there is no way out without massive defaults on debts and promises. Throw a bit of public-choice theory in and it all seems inevitable.

Read More

"Debt Is A Fickle Witch"

Submitted by Tyler Durden on 08/05/2015 - 19:20 Debt is a fickle witch. When left to its own devices, which it has been for nearly seven years with interest rates at the zero bound, it tends to get into trouble. Unchecked credit initially seeps, and eventually finds itself fracked, into the dark, dank nooks and crannies of the fixed income markets whose infrastructures and borrowers are ill-suited to handle the capacity. Consider the two flashiest badges of wealth in America - cars and homes...

Iran Refuses UN Inspector Access To Scientists, Caught Trying To "Clean Up" Suspected Nuclear Site

Submitted by Tyler Durden on 08/05/2015 - 19:00 Surprise! In what must be the most predictable geopolitical event in recent days, WSJ reports that Iran has refused to let United Nations inspectors interview key scientists and military officers to investigate allegations Tehran maintained a covert nuclear-weapons program.

For Commodities, It's 2008 All Over Again

Submitted by Tyler Durden on 08/05/2015 - 18:55 18 of the 22 components in the Bloomberg Commodity Index have dropped at least 20% from recent closing highs, meeting the common definition of a bear market. As Bloomberg details, that’s the same number as at the end of October 2008, when deepening financial turmoil sent global markets into a swoon.Six Warning Signs That The Economy Is In Trouble

Submitted by Tyler Durden on 08/05/2015 - 18:07 The best time to prepare for trouble... is before trouble arrives.

The best time to prepare for trouble... is before trouble arrives.

Scotiabank Warns "The Fed Is Cornered And There Are Visible Market Stresses Everywhere"

Submitted by Tyler Durden on 08/05/2015 - 17:45 The Fed’s zero interest rate policy has provided a subsidy to investors for the past 7 years. The lure of easy profits from cheap money was wildly attractive and readily accepted by investors. The Fed “put” gave investors great confidence that they could outperform their exceptionally low cost of capital. These implicit promises by central banks encouraged trillions of dollars into ‘carry trades’ and various forms of market speculation. Complacent investors maintain these trades, despite the Fed’s warning of a looming reduction in the subsidy, and despite a balance sheet expected to shrink in 2016. It has been a risk-chasing ‘game of chicken’ that is coming to an end. Changing conditions have skewed risk/reward to the downside. This is particularly true because financial assets prices are exceptionally expensive...There are warning signs and visible market stresses beyond those mentioned yesterday.Mapping The Global War On Terror

The Swiss National Bank Bought Another 500,000 AAPL Shares Just Before 10% Correction

Submitted by Tyler Durden on 08/05/2015 - 17:09 We were amused to learn that in the quarter in which AAPL stock almost hit a new all time high, the Swiss Central Bank, which reported a record $20 billion loss in the second quarter, and a record $52 billion in the first half, added another 500,000 AAPL shares, bringing its new grand total to a whopping 9.4 million shares, equivalent to $1.2 billion as of June 30 (well below that now following the recent 10% correction).The Damage Is Done... Something Will Have To Give

Submitted by Tyler Durden on 08/05/2015 - 16:45 It wasn’t until the Americans were free to issue unlimited amounts of ‘dollars’ that these claims lost their soundness in a rambunctious belief in the never-ending global supremacy of US manufacturing. Now the damage is done. The gross misallocations that have plagued the world economy for well over four decades cannot be corrected without a cataclysmic event that will dramatically change living standards as the US realign their manufacturing and service sectors. But it cannot continue indefinitely either. Something will have to give.Tesla Tumbles On Margins Miss & Deliveries Downgrade - The Quarter In Three Charts

Submitted by Tyler Durden on 08/05/2015 - 16:34

Mickey Mouse Market Pops-n-Drops As Crude Carnage Follows VIXtermination

Submitted by Tyler Durden on 08/05/2015 - 16:04

filed under (unt

Mission Impossible-er

Submitted by Tyler Durden on 08/05/2015 - 15:55 Hillarinochio strikes again as The FBI unleashes a probe into her email server...

It Really Is Different This Time: It's Worse

Submitted by Tyler Durden on 08/05/2015 - 15:40 Another talking-head myth destroyed: there has never, ever, been a higher percentage of IPOs that are are unprofitable! It really is different this time, it's worse.

The Roots Of Iraq's Looming Financial Crisis

Submitted by Tyler Durden on 08/05/2015 - 15:25 Low oil prices and the battle against Islamic State (IS) are pushing Iraq toward a financial crisis. Only fundamental reforms, especially decentralization of power, can resolve the challenges facing Iraq today.

The Dow Curse Strikes Again: AAPL Tumbles, AT&T Jumps After Index Switch

Submitted by Tyler Durden on 08/05/2015 - 15:10 In the weeks before AAPL's adition to The Dow, the stock soared over 13% (for no good reason). In the almost 4 months since - after some sideways trading - AAPL shares have plunged. The announcement on March 6th, that AAPL would be included in The Dow on March 19th marked the end of exuberance and has now turned into a "no brainer" trade as the curse of The Dow strikes again. Ironically AT&T - which was replaced by Apple - has surged since its removal from the venerable index.

The Overly-Optimistic Economic Factor No One Is Talking About

Submitted by Tyler Durden on 08/05/2015 - 15:03 In historical context, this uninterrupted inventory accumulation is by any count extreme (the last time it was this high, scaled by real GDP, was just prior to the Asian flu in early 1998). This is a major problem for future growth, one that has been building for more than a year which is why the constant mainstream references to the great recovery are so very unhelpful. Anyone inclined to believe in the fantasy only makes this process more drawn out and, in the end, susceptible to that much greater of a downside to restore productive balance. In short, we already have the outlines of recession with the full weight of recession processes yet to be released.

Trump Warns The Fed "Is Creating A Bubble That Could Explode"

Submitted by Tyler Durden on 08/05/2015 - 14:17 Paul Volcker's "policy and demeanor were very solid," explains Donald Trump in a brief Bloomberg TV interview, pointing out that the inflation-taming former Fed head is a role model for the type of central banker he would pick. While admitting he "has always done well in a low rate environment," Trumps slammed the current Fed's ZIRP for "creating a bubble.. and the bubble could explode." Trump had - as usual - plenty to say on topics from Ex-Im Bank (against it as not "free enterprise"), to campaign financing (favoring full transparency of money in politics) careful to brag - jabbing at The Kochs - that "I don't need anybody else's money."

Housing 2006 Redux - Mortgage Fraud And Speculation Come Roaring Back

Submitted by Tyler Durden on 08/05/2015 - 13:59 Pervasive “occupancy fraud in lending” – purposely misidentifying “investment” properties as “second/vacation” for the purpose of obtaining prime, “owner-occupied”, low-down payment mortgages vs expensive “investment” property loans — is back in a big way and driving housing demand, based on NAR’s “2015 Investment and Vacation Home Buyers Survey”. It comes on the heels of a multi-year cycle of increasingly “bad” appraisals – a widespread problem — by the Appraisal Management Companies (AMC) that in Bubble 2.0 are similarly conflicted, as independent residential appraisers were during Bubble 1.0 . Both appraisal and occupancy fraud are primary features to a speculative, house-price bubble. This is an identical replay of 2005 to 2007 that nobody recognizes, expects, or is even looking for, which will present an opportunity at some point.

Varoufakis Tells All: Tsipras Was "Dispirited" With "No" Vote, Referendum Was Meant As "Exit Strategy"

Submitted by Tyler Durden on 08/05/2015 - 13:40 "I could tell [Tsipras] was dispirited. It was a major victory, one that I believe he actually savoured, deep down, but one he couldn’t handle. He knew that the cabinet couldn’t handle it. It was clear that there were elements in the government putting pressure on him. Already, within hours, he had been pressured by major figures in the government, effectively to turn the no into a yes, to capitulate."

Japan's Dire Message To Yellen: "Don't Raise Rates Soon"

Submitted by Tyler Durden on 08/05/2015 - 21:00 There are so many parallels between the current period since 2007 in the U.S. (The Great Recession), the period since 1990 in Japan (Japan’s 2+ lost decades), and the period after 1929 in the US (The Great Depression) because they are all periods of a ‘balance-sheet recession’ (or similarly, ‘secular stagnation'; that it is next to impossible to dismiss the comparison. Using this, there is an important lesson for the Fed to consider now in weighing whether to raise rates.

Cash-Strapped Saudi Arabia Hopes To Continue War Against Shale With Fed's Blessing

Submitted by Tyler Durden on 08/05/2015 - 20:35 In an irony of ironies, Saudi Arabia is set to take advantage of the very same forgiving capital markets that have served to keep its US competition in business as persistently low oil prices and two armed conflicts look set to strain the Kingdom's finances.

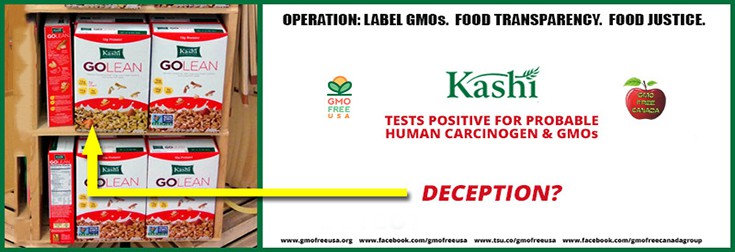

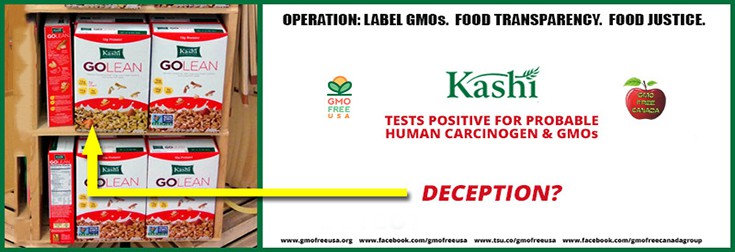

Contains 6x the levels found in Froot Loops

by Christina Sarich, Natural Society:

An independent lab has found that Kashi’s ‘healthy’ GoLean Original

breakfast cereal (owned by Kellogg’s) is loaded with the herbicide

chemical glyphosate. What’s more, it actually contains 6x the amount of

glyphosate previously found in Kellogg’s’ Froot Loops cereal.

An independent lab has found that Kashi’s ‘healthy’ GoLean Original

breakfast cereal (owned by Kellogg’s) is loaded with the herbicide

chemical glyphosate. What’s more, it actually contains 6x the amount of

glyphosate previously found in Kellogg’s’ Froot Loops cereal.

The Kashi brand has been in trouble before. The company has faced multiple class action lawsuits when consumers accused Kellogg’s of misleading them with “natural” labels despite their cereals containing things like pyridoxine hydrochloride, calcium pantothenate, and hexane-processed soy oil.

Now, GMOFreeUSA.org is reporting that a box of Kashi Go Lean Original Cereal, which was not verified by the GMO Free Project, was sent to a lab to be tested for probably-carcinogenic glyphosate – the main ingredient in Monsanto’s best-selling Round Up.

Read More @ NaturalSociety.com

by Christina Sarich, Natural Society:

An independent lab has found that Kashi’s ‘healthy’ GoLean Original

breakfast cereal (owned by Kellogg’s) is loaded with the herbicide

chemical glyphosate. What’s more, it actually contains 6x the amount of

glyphosate previously found in Kellogg’s’ Froot Loops cereal.

An independent lab has found that Kashi’s ‘healthy’ GoLean Original

breakfast cereal (owned by Kellogg’s) is loaded with the herbicide

chemical glyphosate. What’s more, it actually contains 6x the amount of

glyphosate previously found in Kellogg’s’ Froot Loops cereal.The Kashi brand has been in trouble before. The company has faced multiple class action lawsuits when consumers accused Kellogg’s of misleading them with “natural” labels despite their cereals containing things like pyridoxine hydrochloride, calcium pantothenate, and hexane-processed soy oil.

Now, GMOFreeUSA.org is reporting that a box of Kashi Go Lean Original Cereal, which was not verified by the GMO Free Project, was sent to a lab to be tested for probably-carcinogenic glyphosate – the main ingredient in Monsanto’s best-selling Round Up.

Read More @ NaturalSociety.com

by Darryl Robert Schoon, GoldSeek:

..there

was an element of hypocrisy..being leveled at Greece by France and

Germany. It’s hypocritical to ignore the fact that a not insignificant

amount was spent on buying [expensive] weapon systems from EU members

Germany and France. – Helena Smith, TheGuardian, April 19, 2012

..there

was an element of hypocrisy..being leveled at Greece by France and

Germany. It’s hypocritical to ignore the fact that a not insignificant

amount was spent on buying [expensive] weapon systems from EU members

Germany and France. – Helena Smith, TheGuardian, April 19, 2012

EU bankers have framed the Greek crisis as that of a spendthrift nation whose profligate pensions are the primary reason for its bankruptcy. There’s another reason, however, i.e. Greece’s bloated military budget—a budget which primarily benefits its EU and NATO allies.

As a proportion of GDP, now-bankrupt Greece spends twice as much as any other EU member on defense. On June 15, 2015, The Financial Times noted: One of the oddities of Greece’s bailout programme has been that, despite five years of punishing austerity, its military budget remains amongst the highest in the EU…as of 2013 Greece was still spending more as a percentage of gross domestic product than any other NATO ally save the US or Britain…

Read More

..there

was an element of hypocrisy..being leveled at Greece by France and

Germany. It’s hypocritical to ignore the fact that a not insignificant

amount was spent on buying [expensive] weapon systems from EU members

Germany and France. – Helena Smith, TheGuardian, April 19, 2012

..there

was an element of hypocrisy..being leveled at Greece by France and

Germany. It’s hypocritical to ignore the fact that a not insignificant

amount was spent on buying [expensive] weapon systems from EU members

Germany and France. – Helena Smith, TheGuardian, April 19, 2012EU bankers have framed the Greek crisis as that of a spendthrift nation whose profligate pensions are the primary reason for its bankruptcy. There’s another reason, however, i.e. Greece’s bloated military budget—a budget which primarily benefits its EU and NATO allies.

As a proportion of GDP, now-bankrupt Greece spends twice as much as any other EU member on defense. On June 15, 2015, The Financial Times noted: One of the oddities of Greece’s bailout programme has been that, despite five years of punishing austerity, its military budget remains amongst the highest in the EU…as of 2013 Greece was still spending more as a percentage of gross domestic product than any other NATO ally save the US or Britain…

Read More

from FauzInfoVids:

The first of a four-part investigation into a world of greed and recklessness that led to financial collapse. In the first episode of Meltdown, we hear about four men who brought down the global economy: a billionaire mortgage-seller who fooled millions; a high-rolling banker with a fatal weakness; a ferocious Wall Street predator; and the power behind the throne.

The crash of September 2008 brought the largest bankruptcies in world history, pushing more than 30 million people into unemployment and bringing many countries to the edge of insolvency. Wall Street turned back the clock to 1929.

But how did it all go so wrong?

hat tip TheDailySheeple.com

The first of a four-part investigation into a world of greed and recklessness that led to financial collapse. In the first episode of Meltdown, we hear about four men who brought down the global economy: a billionaire mortgage-seller who fooled millions; a high-rolling banker with a fatal weakness; a ferocious Wall Street predator; and the power behind the throne.

The crash of September 2008 brought the largest bankruptcies in world history, pushing more than 30 million people into unemployment and bringing many countries to the edge of insolvency. Wall Street turned back the clock to 1929.

But how did it all go so wrong?

hat tip TheDailySheeple.com

by L.J. Devon, Natural News:

Major progress is being made at Campbell Soup Company. The leading

soup manufacturer has announced they will be introducing a new line of

organic products to appeal to rising tide of health conscious consumers.

Notably, the company also has plans to remove an artificial additive

called monosodium glutamate (MSG). This synthetic, salt form of an amino

acid was first isolated from a Japanese sea weed called kombuin after

World War II. It is commonly used by food manufacturers today to addict

consumers’ brains to common food products.

Major progress is being made at Campbell Soup Company. The leading

soup manufacturer has announced they will be introducing a new line of

organic products to appeal to rising tide of health conscious consumers.

Notably, the company also has plans to remove an artificial additive

called monosodium glutamate (MSG). This synthetic, salt form of an amino

acid was first isolated from a Japanese sea weed called kombuin after

World War II. It is commonly used by food manufacturers today to addict

consumers’ brains to common food products.

As an excitotoxin, MSG signals the brain to produce excess dopamine, making the person feel good about the food product they are eating. This tricky flavor-enhancing technique is one of the reasons why consumers become addicted to certain processed foods and eat them over and over again.

Read More

Major progress is being made at Campbell Soup Company. The leading

soup manufacturer has announced they will be introducing a new line of

organic products to appeal to rising tide of health conscious consumers.

Notably, the company also has plans to remove an artificial additive

called monosodium glutamate (MSG). This synthetic, salt form of an amino

acid was first isolated from a Japanese sea weed called kombuin after

World War II. It is commonly used by food manufacturers today to addict

consumers’ brains to common food products.

Major progress is being made at Campbell Soup Company. The leading

soup manufacturer has announced they will be introducing a new line of

organic products to appeal to rising tide of health conscious consumers.

Notably, the company also has plans to remove an artificial additive

called monosodium glutamate (MSG). This synthetic, salt form of an amino

acid was first isolated from a Japanese sea weed called kombuin after

World War II. It is commonly used by food manufacturers today to addict

consumers’ brains to common food products.As an excitotoxin, MSG signals the brain to produce excess dopamine, making the person feel good about the food product they are eating. This tricky flavor-enhancing technique is one of the reasons why consumers become addicted to certain processed foods and eat them over and over again.

Read More

by Tony Sagami, Mauldin Economics:

On July 14, I wrote about the danger developing in the transportation sector, and things are looking even worse today. Here’s what I mean:

Look Out Below #1: Royal Dutch Shell reported its quarterly results last week—$3.4 billion, down from $5.1 billion for the same quarter a year ago—and warned that “today’s oil price downturn could last for several years.”

In anticipation of tough times, Shell slashed its 2015 capital expenditure budget by 20% and is going to lay off 6,500 high-paying jobs (not Burger King-type jobs) this year.

Look Out Below #2: UPS is a very good barometer of the consumer end of our economy: It’s the largest component of the Dow Jones Transportation Average both by sales and market valuation.

Read More

On July 14, I wrote about the danger developing in the transportation sector, and things are looking even worse today. Here’s what I mean:

Look Out Below #1: Royal Dutch Shell reported its quarterly results last week—$3.4 billion, down from $5.1 billion for the same quarter a year ago—and warned that “today’s oil price downturn could last for several years.”

In anticipation of tough times, Shell slashed its 2015 capital expenditure budget by 20% and is going to lay off 6,500 high-paying jobs (not Burger King-type jobs) this year.

Look Out Below #2: UPS is a very good barometer of the consumer end of our economy: It’s the largest component of the Dow Jones Transportation Average both by sales and market valuation.

Read More

from The Daily Coin:

One

of my sources says the silver is the most explosive they’ve ever seen

it in terms of what is coming down the pike. To get it in size is

extremely difficult and they expect it to disappear sometime this fall

where you just can’t get it – and they’re adamant about it.

One

of my sources says the silver is the most explosive they’ve ever seen

it in terms of what is coming down the pike. To get it in size is

extremely difficult and they expect it to disappear sometime this fall

where you just can’t get it – and they’re adamant about it.

– Bill Murphy, Shadow of Truth

It’s been four-plus years now since the gold and silver markets have been subjected to the complete criminal control of the western Central Banks and their agent bullion banks.

Read More

One

of my sources says the silver is the most explosive they’ve ever seen

it in terms of what is coming down the pike. To get it in size is

extremely difficult and they expect it to disappear sometime this fall

where you just can’t get it – and they’re adamant about it.

One

of my sources says the silver is the most explosive they’ve ever seen

it in terms of what is coming down the pike. To get it in size is

extremely difficult and they expect it to disappear sometime this fall

where you just can’t get it – and they’re adamant about it.– Bill Murphy, Shadow of Truth

It’s been four-plus years now since the gold and silver markets have been subjected to the complete criminal control of the western Central Banks and their agent bullion banks.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment